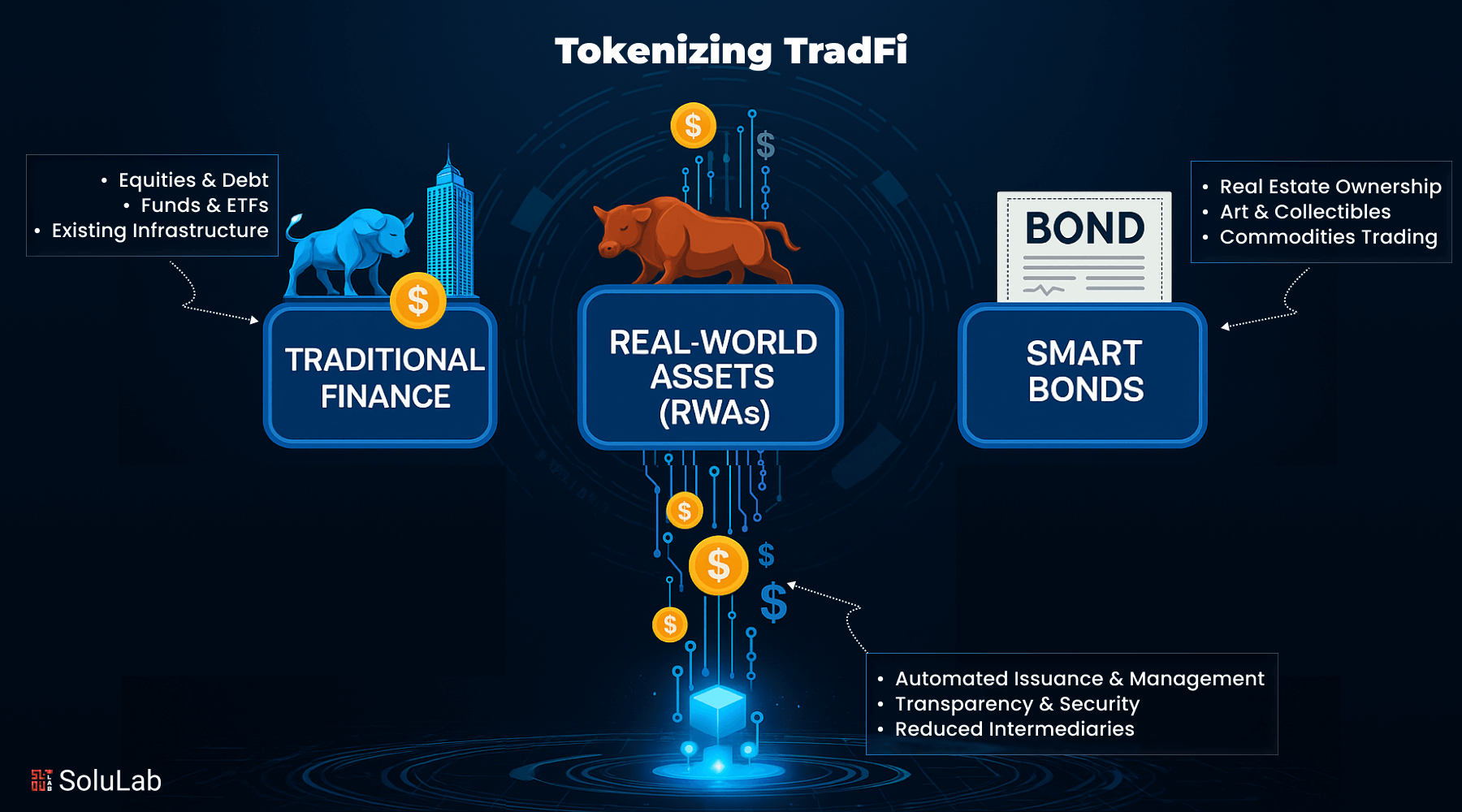

You might have heard how startups build innovative platforms at low cost. Businesses are now focusing on making their system smarter, faster, and more transparent to save expenses. This is where blockchain technology plays a key role. Blockchain for enterprises supports cutting suppliers’ onboarding time to ensure instant payouts.

Mike Cagney, Co-founder of Figure, said, “Blockchain represents the democratization of financial services, offering retail investors one of the largest allocations ever seen in an IPO.”

Not only that, but businesses are enhancing it to ensure user data security, customer trust, and regulatory compliance. With this automatic smart technology, enterprises saved millions. Let’s get into some major use cases that can reshape your business.

Why Enterprises Need Blockchain Development?

Blockchain for enterprise builds trust and transparency. Every stakeholder can access the same verified data without disputes. It enhances your customer security and helps protect against fraud and technical breaches. Some convincing reasons to invest in blockchain are:

1. Blockchain for digital identity streamlines verification. Users control their credentials while reducing compliance delays.

2. Smart contracts automate processes. Enterprises save time, reduce errors, and eliminate unnecessary intermediaries.

3. Supply chain tracking improves accountability. Companies trace goods in real time, ensuring authenticity and reducing counterfeits.

4. Blockchain reduces costs significantly. Enterprises cut transaction, auditing, and reconciliation expenses.

5. Faster settlements boost efficiency. Payments, cross-border transfers, and vendor payouts are complete in near real time.

6. Blockchain innovation ensures future readiness. Businesses stay competitive as industries shift to Web3 and tokenization.

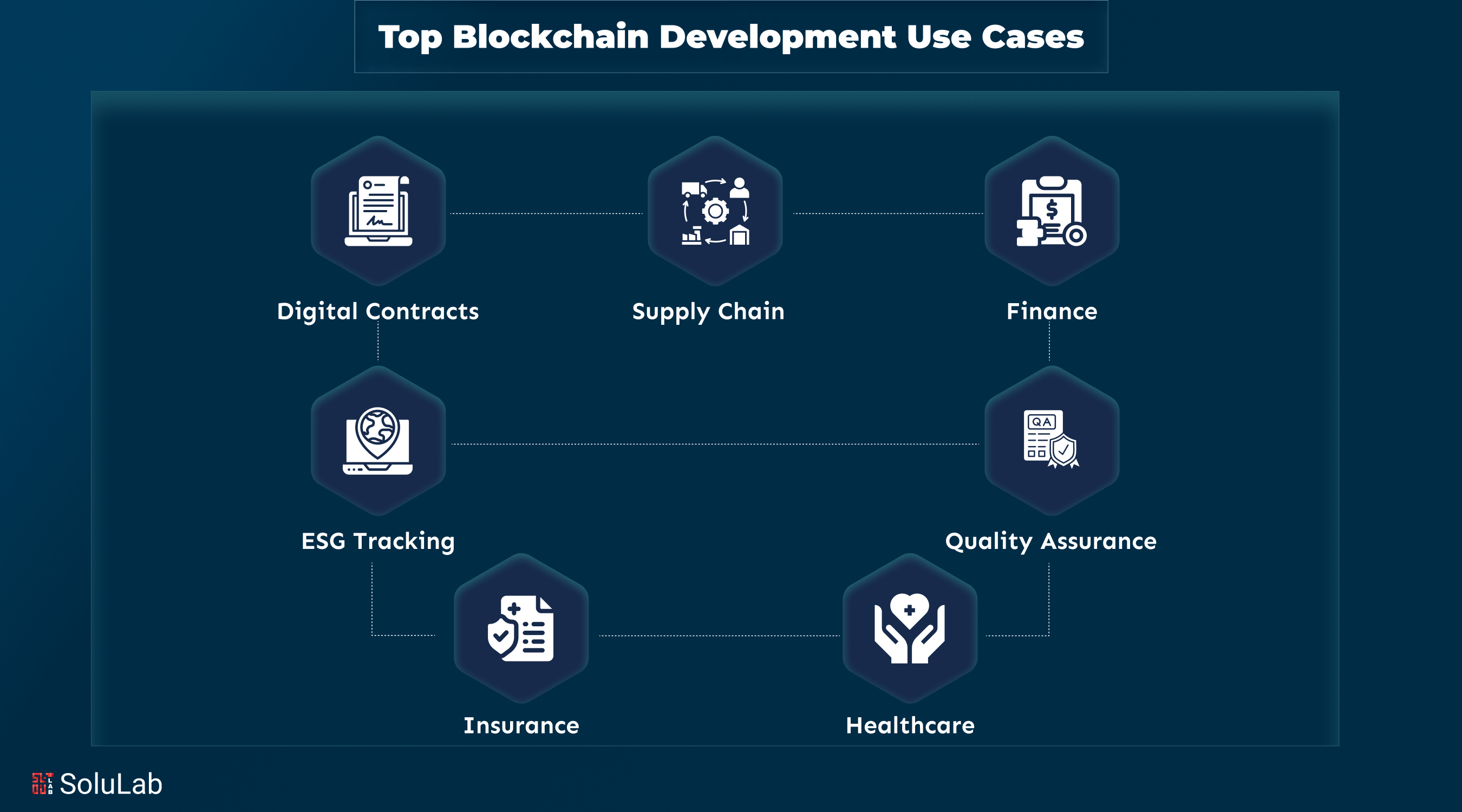

Top 7 Blockchain Development Use Cases

Now that you have a clear idea of how blockchain helps your business, let’s get to know some case studies that took the businesses to new heights.

1. Digital Contracts and Transactions Using Blockchain

In the following two case studies, the companies automated the contracts by leveraging blockchain. By doing this, they not only saved time but also improved the efficiency and reduced the manual delay. Let’s check each one in detail.

-

Hitachi

Hitachi was managing contracts with around 2000 companies. Their traditional paper-based system slowed down procurement and invited errors. To overcome this, Hitachi adopted a blockchain-based paperless procurement system using Hyperledger Fabric. This new system digitized contract approvals and document sharing with suppliers.

Blockchain ensured documents were tamper-proof and traceable. As a result, Hitachi could handle at least one contract per company monthly with greater efficiency and less risk of fraud. The blockchain for enterprise system helped reduce manual delays and secured sensitive procurement data, saving both time and operational costs.

-

BlockTower Credit

Capital markets have begun leveraging blockchain for faster settlements and improved access to capital. BlockTower Capital partnered with Centrifuge to modernize credit securitization using blockchain. The move cut costs by 97% and improved transparency.

Blockchain applications enable near-instant trade settlement, removing the need for third-party intermediaries. Traditional assets like stocks and bonds can be tokenized, allowing fractional ownership. This increases liquidity and lowers capital entry barriers, saving institutions millions in operational inefficiencies and errors.

2. Blockchain made Supplier Management and Compliance Easy

As countries introduce new rules and regulations to protect user details, businesses must adapt to them. Let’s examine how companies manage these changes and how they minimize the cost of updates.

-

Trust Your Supplier

Trust Your Supplier, developed in partnership with IBM, simplifies supplier onboarding and verification using blockchain. Traditionally, verifying supplier credentials took weeks and involved repetitive checks. Using blockchain, data is verified once by trusted sources like Dun & Bradstreet or EcoVadis.

Then, a digital “supplier passport” is created and shared securely across business networks. This blockchain for business solution cut onboarding time by over 70% and slashed data verification costs by 50%. Blockchain’s transparency also improved regulatory compliance and risk management across global supply chains.

-

Walmart

In global commerce, tracking a product’s origin and movement is crucial for safety and ethics. Blockchain allows each supply chain participant to log verified data in real-time. For example, Walmart and IBM’s Food Trust blockchain solution traces food items from farm to shelf.

This ensures product freshness, reduces food waste, and speeds up recalls during contamination events. Consumers and regulators gain access to reliable data on sourcing, handling, and transit, all verifiable on the blockchain. Such blockchain technology in financial services saves millions in quality control and fraud prevention.

3. Trade Finance and Commerce Process Simplified

As blockchain technology grows, world trade is writing new chapters in the economy. Here is how companies handle transactions without delay and errors, which reduces the transactional costs.

-

Marco Polo Network

International trade often involves complex paperwork and delayed payments. To solve this, Marco Polo Network introduced a blockchain platform for trade finance. It connects buyers, sellers, and banks through a shared ledger, integrating with ERP systems. Smart contracts ensure that payment is automatically released once delivery is confirmed. This removed the need for letters of credit and reduced manual errors. It shortened settlement time, reduced bank fees, and improved trust in global transactions.

-

Barclays PLC

Traditional letters of credit can take weeks and involve multiple layers of verification. For the first time in 2016, Barclays PLC automated this using smart contracts programmed with trade terms. Once conditions are met, payments are released without human intervention. This automation reduces fraud risk and eliminates the need for constant follow-ups. Enterprises using blockchain in trade finance report improved cash flow and reduced transaction costs.

4. Blockchain Enhanced ESG Tracking

With the green certification and carbon credits, companies are gaining external financial support. Let’s see how this actually works.

-

Renault

Renault must comply with over 6,000 safety and quality standards across its operations. Tracking components from multiple suppliers was complex and error-prone. To solve this, Renault and IBM built a blockchain-based compliance platform. This solution ensures traceability of every part from suppliers to assembly lines.

It helps meet internal and external compliance requirements without duplication. Renault reduced non-compliance expenses by 50% and plans to expand blockchain use for tracking carbon footprints and recycling efforts.

-

Brooklyn Microgrid

Blockchain also plays a role in clean energy and sustainability. Projects like the Brooklyn Microgrid enable peer-to-peer energy trading without intermediaries. Participants sell excess solar energy to neighbors through a blockchain ledger. This creates a transparent, local energy market and boosts renewable energy adoption. Blockchain also tracks carbon emissions and green certifications, helping organizations meet ESG goals with verified data.

5. Raw Material and Product Quality Verified Through Blockchain Technology

Nowadays, industries use technology to reduce manual labor and reduce their costs.

-

Ford

Ford aimed to ensure the ethical sourcing of cobalt used in electric vehicle batteries. They partnered with IBM and RCS Global to build a blockchain tracking system. The system recorded the cobalt’s journey from certified mines through logistics to factories. IoT sensors and supplier declarations verified authenticity and compliance at each stage. This gave Ford end-to-end visibility into its sourcing, reducing ESG risks and improving transparency for stakeholders.

-

Nestlé

After China’s 2008 milk scandal, parents were cautious about baby food safety. Nestlé introduced NAN A2 infant formula with full blockchain traceability in China. Customers scanned QR codes to view the product’s origin, ingredients, and packaging details. All data was stored on a public blockchain, accessible via mobile apps. This move helped Nestlé gain significant consumer trust and grow its market share in infant nutrition.

6. Insurance Claims and Fraud Reduced Rapidly

Blockchain technology in the insurance industry is improving customer satisfaction levels without any delays. Here is how companies use smart contracts to gain users’ trust.

-

AXA Fizzy

AXA tackled slow and frustrating flight delay claims with a product called Fizzy. It used blockchain smart contracts and flight data oracles to detect delays automatically. If a flight was delayed over two hours, a smart contract triggered an automatic payout. No paperwork or claim filing was needed. This innovation improved customer satisfaction and reduced administrative overhead for AXA.

-

Etherisc

Etherisc created blockchain-based insurance for events like crop failure or flight delays in Kenya. Smart contracts automated payouts when conditions were met using third-party data. For instance, if weather data confirmed a drought, a payout was made instantly. This reduced fraud, sped up claim settlements, and brought insurance access to underserved communities.

7. Identity, Health, and Legal Records Secured

Blockchain is evolving into the next stage as industries use it in every application. From private to government, everyone is adopting blockchain technology to make things easy. Enterprises are also adopting it and innovating new ideologies to enhance their system and reduce expenses.

-

OpenLaw

OpenLaw uses blockchain to create smart legal agreements. Lawyers and clients use templates with embedded code for execution. These smart contracts handle actions like payments and asset transfers once triggered. This reduces manual revisions and offers an auditable legal record on-chain. It saves time, lowers legal costs, and increases contract reliability. This makes it one of the top blockchain applications and use cases in business.

-

IPwe

IPwe collaborated with IBM to build a blockchain-based IP marketplace. They tokenized over 80% of the world’s patents for transparent tracking. Businesses now display, value, and trade IP more efficiently. This unlocks investment opportunities and ensures fair licensing practices.

-

American Hospital Association

Healthcare providers store patient data on blockchain for better security and access control. The American Hospital Association also mentioned how Blockchain is changing clinical operations. With this, patients decide who can access their records. Doctors’ credentials are also verified and stored on-chain. This reduces fraud and ensures licensed professionals deliver care. Data integrity is preserved with a full audit trail.

-

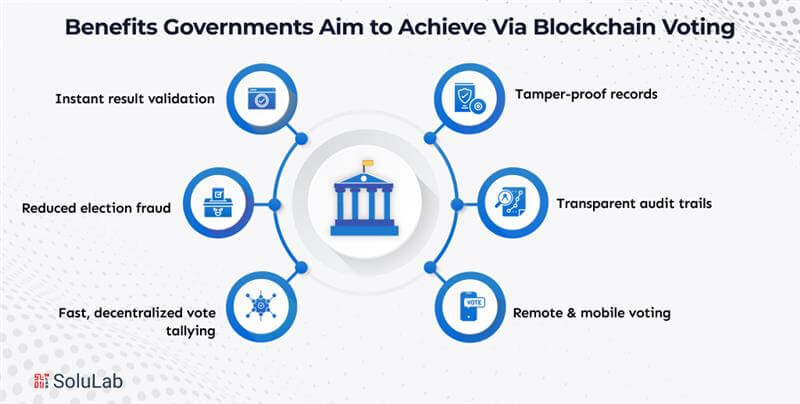

Governments

Public sector bodies now use blockchain to manage land records, identity documents, and licenses. States like Illinois and Delaware have launched blockchain pilots. This ensures tamper-proof public records and secure citizen data. Governments benefit from higher transparency and reduced administrative costs.

Conclusion

As per the above case studies and use cases, blockchain proves its worth in the technology world. If you are also thinking of adopting blockchain technology, then Solulab, the top blockchain consulting company, is here to assist you.

We at Solulab provide hands-on guidance, helping you design and implement large-scale blockchain systems. Our blockchain consultants assist businesses in implementing this innovative technology effectively. This makes you stay ahead of the competition.

Contact us today for secure, reliable, and efficient blockchain adoption.

FAQs

1. How exactly does blockchain help companies save money?

Blockchain removes middlemen, automates contracts, and prevents fraud. It reduces paperwork, human errors, and processing time, saving millions in administrative costs, compliance issues, and delayed payments across global operations.

2. Is blockchain only useful for big companies like Hitachi or Ford?

Not at all. While large companies adopted it first, small and mid-sized businesses now use blockchain for supply tracking, digital identity, or automated contracts, especially with today’s easier-to-access blockchain platforms.

3. How can SoluLab help enterprises adopt blockchain solutions for procurement and trade finance?

At SoluLab, we design secure, efficient blockchain solutions that help you reduce costs, automate contracts, and boost trust across procurement and trade finance.

4. How does blockchain improve product safety for consumers?

It tracks every step in the supply chain, from farm to shelf. That means consumers can scan a code and instantly see where, when, and how a product was made, with total transparency.

5. Could I ever use blockchain to track my coffee beans or shoes?

Yes, really! Some companies already let you trace your coffee or sneakers back to the farm or factory. Blockchain lets everyday people see the full story behind what they buy.