Stablecoin Development Company

As a #1 stablecoin development company, SoluLab builds custom fiat-pegged and algorithmic tokens that protect your ecosystem from market turbulence, whether you're running a DeFi platform, payment gateway, or fintech app.

250+ Developers

150+ Projects Delivered

50+ Custom Stablecoin Solutions

10+ Years of Experience

Get Market-Ready with Customized Stablecoin

Development Services

We assist businesses in having everything under one roof by providing a broad range of stablecoin development solutions and services. A synopsis of our services is provided below.

Stablecoin Consulting Services

Our stablecoin development consultants improve your understanding of the potential of your blockchain startup based on stablecoins. With a focus on commercial and technical strategies, market analytics, development, and delivery methods, our blockchain professionals draft the project's roadmap.

Payment and AML/KYC Services

To increase the variety of payment choices that stablecoin offerings may offer, our best stablecoin team now offers payment services to our clients. Checking investor profiles is made possible by our integration of AML/KYC services.

Stablecoin Promotion and Marketing Services

Our stablecoin development services also encompass promotion and marketing strategies. We start by crafting a detailed whitepaper for your stablecoin project, followed by executing pre-launch marketing campaigns. Post-launch, we continue to offer stablecoin marketing services across various channels to raise awareness among potential investors.

Token Integration and Wallet Development

As a leading stablecoin development company, we provide seamless integration services to incorporate your stablecoin into existing platforms, such as wallets, exchanges, or decentralized applications (dApps). Our team of skilled stablecoin developers can create custom wallets or integrate your stablecoin with widely used crypto wallets, enhancing both user experience and accessibility.

Security and Audit Services

Security is a top priority in our stablecoin development service. We conduct thorough security audits to uncover any vulnerabilities and reinforce the stablecoin’s defenses against potential threats. This process is crucial in reducing risks and safeguarding users' funds, ensuring the stablecoin's integrity.

Asset-Backed Token Development

Develop asset-backed tokens that mirror the value of their underlying real-world assets. Whether it's real estate, shares, diamonds, or any other commodity, asset-backed tokens are favored by users for their optimal stability, making them a popular choice within the stablecoins list.

Token Distribution Platform Development

Traditional stablecoins often fail because they stagnate after launch. Our token distribution platform development service focuses on globally marketing your stablecoin through your exclusive ICO, MLM, or STO platforms, ensuring it stands out in the stablecoins list.

Whitepaper Creation

Our subject matter experts deliver precise and detailed technical whitepaper writing services. Our team of experienced professionals crafts a technical whitepaper that effectively demonstrates how your proposed project could revolutionize the industry by addressing numerous real-world applications.

Community Management

Our dedicated support staff provides efficient client support services through ticket systems, live chat, and crypto forums. We offer 24/7 assistance to ensure that investors' queries and concerns are promptly addressed, ensuring smooth communication within the stablecoins list community.

Still Exploring the Best Way to Build Your Stablecoin?

Our experts will walk you through the best architecture, use case fit, and compliance strategies to maximize your project's success. No obligation — just clear advice tailored to your goals from our stablecoin development consultants.

Stablecoin Solutions We Specialize In

At our stablecoin development company, we specialize in creating a diverse range of stablecoins, each tailored to meet specific needs and market demands. Here’s an overview of the different types of stablecoins we develop

Fiat Currency-Backed Stablecoins

Fiat currency-backed stablecoins are pegged to traditional fiat currencies like the US Dollar, Euro, or other national currencies. For every stablecoin issued, an equivalent amount of fiat currency is held in reserve by a trusted custodian. This type of stablecoin provides a direct link to the stability of traditional financial systems, making it a popular choice for users seeking a reliable store of value and medium of exchange.

Cryptocurrency-Backed Stablecoins

Cryptocurrency-backed stablecoins are collateralized by other cryptocurrencies, such as Bitcoin or Ethereum. These stablecoins often require over-collateralization to account for the volatility of the backing assets. Smart contracts automate the issuance and redemption process, ensuring that the stablecoin remains stable despite fluctuations in the value of the underlying cryptocurrency.

Commodity-Backed Stablecoins

Commodity-backed stablecoins are pegged to tangible assets like gold, silver, oil, or other commodities. Each stablecoin represents ownership of a specific quantity of the commodity, offering users a stable and inflation-resistant digital asset. These stablecoins appeal to those looking to invest in real-world assets while benefiting from the flexibility and security of blockchain technology.

Non-Collateralized Stablecoins

Non-collateralized stablecoins, also known as algorithmic stablecoins, do not rely on any external assets for backing. Instead, they use complex algorithms and smart contracts to automatically adjust the supply of the stablecoin in response to changes in demand. By expanding or contracting the supply, these stablecoins maintain their value, offering a decentralized and autonomous alternative to collateral-backed stablecoins.

Asset-Backed Stablecoins

Asset-backed stablecoins are tied to a broad range of underlying assets, including real estate, shares, or other financial instruments. Each stablecoin represents ownership of a portion of the asset, providing investors with a secure and transparent way to trade and store value. These stablecoins are favored for their ability to tokenize and democratize access to valuable assets.

Algorithmic Stablecoins

Algorithmic stablecoins operate without collateral by using algorithms to manage their supply dynamically. These algorithms adjust the number of tokens in circulation based on market demand to stabilize the coin’s price. Algorithmic stablecoins offer an innovative solution to maintaining stability without relying on external reserves, making them a unique and scalable option in the stablecoin ecosystem.

Have a Stablecoin Concept But Don’t Know Where to Start?

Our team guides you through every stage — from token design and smart contract development to KYC/AML and backend integration. We turn your concept into a live, secure, and compliant stablecoin ready for mass adoption.

Our Stablecoin Development Services Customized for Every Industry

As a prominent stablecoin development service company, we understand that every industry has unique needs and challenges. Our team of asset-backed stablecoin development experts is equipped to deliver tailored solutions that meet the specific demands of various sectors. Here’s how we cater to different industries

Finance and Banking

We develop stablecoins that enable faster, more secure, and cost-effective cross-border payments, making traditional banking processes more efficient.

E-Commerce and Retail

Our development services include integrating stablecoins into online payment gateways, allowing businesses to expand their payment options.

Real Estate

We develop stablecoins that represent ownership of real estate, enabling fractional ownership and making real estate investments more accessible.

Supply Chain and Logistics

Our stablecoin solutions can be used to facilitate transactions between stakeholders, improving efficiency and transparency in supply chain management.

Healthcare

Our stablecoins can be used to manage payments for services, track the purchase of medical supplies, and facilitate cross-border transactions.

Gaming and Entertainment

We create stablecoins that can be integrated into gaming platforms, offering players a secure and consistent digital currency to enhance their gaming experience.

Powerful Benefits of Investing in Stablecoin Development

Stablecoin development offers numerous advantages for your business, as highlighted below

Stability

Stablecoins provide much-needed stability in the otherwise volatile cryptocurrency market. By anchoring their value to a specific asset or a collection of assets, stablecoins are designed to minimize price swings and offer users a dependable medium of exchange.

Transparency

Built on blockchain technology, stablecoins ensure complete transparency and immutability in transaction records. These records are available for real-time auditing, offering enhanced visibility and fostering greater trust among users, investors, and regulators.

Security

Leveraging the power of blockchain, stablecoins ensure secure transactions. They benefit from strong encryption and decentralized consensus mechanisms, which significantly enhance security, making stablecoins a safe choice for digital transactions.

Global Accessibility

Stablecoins enable users to conduct transactions globally with ease. By removing the obstacles posed by traditional banking systems, stablecoins facilitate swift and borderless transactions, making them an ideal solution for cross-border payments and remittances.

Liquidity

Highly liquid by nature, stablecoins allow businesses to raise funds in a safe and stable manner for their projects. If prices rise, additional tokens can be minted to maintain stability, ensuring that liquidity is preserved.

Financial Inclusion

Stablecoins play a crucial role in bridging the gap between the unbanked and traditional financial systems. They provide a stable and accessible digital currency, offering financial services to individuals who lack access to conventional banking facilities.

Build a Stablecoin That Scales Globally with Experts

Avoid the trial-and-error approach. With proven stablecoin frameworks, powerful APIs, and institutional-grade infrastructure, we ensure your stablecoin is ready for mainstream usage and future innovations like cross-chain swaps and DeFi staking.

How Businesses Utilize Stablecoin Development for Real Results?

Stablecoins are increasingly becoming a cornerstone in the digital economy, offering stability, security, and efficiency across various industries. Here are some of the compelling use cases where stablecoins are making a significant impact

Cross-Border Payments

Stablecoins enable fast, low-cost international transactions by bypassing traditional banking systems. They facilitate instant transfers with minimal fees, making them ideal for cross-border payments and remittances, especially in regions with limited access to financial services.

Decentralized Finance (DeFi)

In the DeFi space, stablecoins are essential for lending, borrowing, and trading without the volatility of other cryptocurrencies. They provide a stable medium of exchange, serve as collateral for loans, and are used in yield farming, staking, and other DeFi activities, ensuring users can engage in financial services with predictable value.

E-Commerce and Online Payments

Stablecoins are being adopted by online retailers and service providers as a reliable payment method. They offer lower transaction fees, faster settlement times, and protection against cryptocurrency price swings, making them a preferred option for merchants and customers alike.

Tokenized Assets

Stablecoins can represent ownership of real-world assets like real estate, commodities, or equities on the blockchain. This tokenization of assets makes them easier to trade and manage, providing greater liquidity and enabling fractional ownership, which opens up investment opportunities to a broader audience.

Payroll and Employee Compensation

Companies are increasingly using stablecoins to pay their employees, especially in international contexts. This allows for quick, cost-effective payments that are not subject to the exchange rate fluctuations of traditional fiat currencies, providing employees with stable and accessible compensation.

Crowdfunding and ICOs

Stablecoins are becoming a popular choice for fundraising in Initial Coin Offerings (ICOs) and crowdfunding campaigns. Their stable value attracts investors who want to avoid the risks associated with volatile cryptocurrencies, ensuring that the funds raised are protected from market fluctuations.

Remittances

Stablecoins offer an efficient solution for sending remittances, allowing people to transfer money across borders quickly and cheaply. The use of stablecoins in remittances eliminates the need for traditional financial intermediaries, reducing transaction costs and delivery times.

Supply Chain Management

Stablecoins streamline payments in supply chains, allowing businesses to settle transactions with suppliers, manufacturers, and distributors more efficiently. By using stablecoins, companies can reduce payment processing times, lower transaction costs, and improve transparency across the supply chain.

Hedging Against Volatility

Investors and businesses use stablecoins to protect their assets from cryptocurrency market volatility. By converting their holdings into stablecoins during periods of uncertainty, they can preserve the value of their investments without needing to exit the cryptocurrency market entirely.

Tired of Payment Delays & High Fees? Build a Stablecoin Solution That Works.

From cross-border payments to e-commerce transactions, stablecoins reduce friction, speed up settlements, and cut costs. We develop tailored solutions that help your business go borderless, cashless, and future-ready.

Our Stablecoin Development Projects

At SoluLab, we've had the privilege of working on a range of groundbreaking stablecoin projects that highlight our expertise in blockchain technology and financial innovation. Here are some of our notable projects

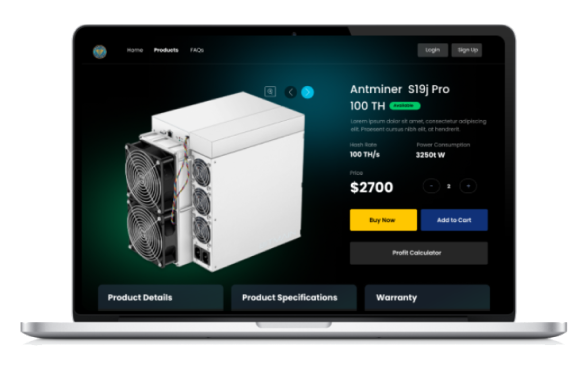

Crypto Mining

-Crypto in Mining

It is a specialized crypto mining platform where interested users can come and join to either buy a miner for crypto mining or use the miners available to start operations. SoluLab's team helped build the platform with all the necessary features to offer a superior user experience and make the platform appropriately functional.

NFTY

- Crypto in NFTs

It is a specialized NFT protocol that plays a significant role in helping different NFT exchanges to appropriately determine the quality of items for sale and at the same time, rightly categorize them. SoluLab helped create the NFT protocol, the NFTY token, and a stablecoin backed by the USD, where the token acts as the vital reputation layer for all transactions of NFTs.

DLCC

- Crypto Exchange in Asset Borrowing/Lending

DLCC is to transform the future of regulated crypto and digital asset lending. SoluLab built a decentralized blockchain-based solution for the financial area, including a crypto wallet and crypto exchange solution, which makes borrowing and lending assets hassle-free. Our team also handled regulatory compliance issues and made digital asset financing straightforward.

Milestones That Define Our Stablecoin Development Excellence

Achieving success in stablecoin development requires a well-structured approach that ensures each project is delivered with precision, security, and innovation. At SoluLab, every stage of the stablecoin development process ensures that we meet our clients' unique needs while adhering to the highest industry standards.

Have an Idea? We’ll Help You Validate and Launch It—Fast.

Not sure which type of stablecoin is right for your business? Our consultants will help you evaluate your use case, choose the best collateral model, and deploy a secure, scalable solution.

Why Choose SoluLab As Your Stablecoin

Development Company?

Selecting the right partner for your stablecoin development project is crucial to ensuring its success. You need a company that not only understands the technology but also the intricacies of your industry. Here’s why SoluLab stands out as the preferred choice

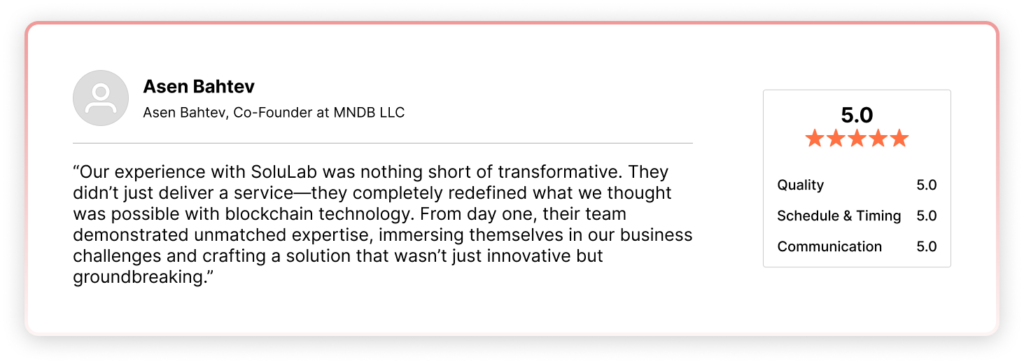

What Our Clients Have to Say for Us

Frequently Asked Questions

Stablecoins are a type of cryptocurrency designed to maintain a stable value by pegging their worth to a reserve of assets such as fiat currencies or commodities. Unlike volatile cryptocurrencies like Bitcoin, stablecoins aim to offer stability in value, making them ideal for transactions, savings, and as a medium of exchange in the digital economy.

A stablecoin is a digital asset that is pegged to a stable value, typically linked to a fiat currency such as the US Dollar, or backed by other assets like gold or real estate. This pegged value helps minimize price fluctuations, providing users with a predictable value, which is essential for various financial applications.

Stablecoins come in several types. Fiat currency-backed stablecoins are pegged to traditional currencies like the US Dollar or Euro. Cryptocurrency-backed stablecoins use other cryptocurrencies as collateral. Commodity-backed stablecoins are secured by physical assets such as gold or real estate. Non-collateralized stablecoins rely on algorithms to stabilize the price without backing assets, while algorithmic stablecoins use automated mechanisms and smart contracts to manage stability.

Examples of popular stablecoins include Tether (USDT), which is pegged to the US Dollar, and USD Coin (USDC), another stablecoin backed by the US Dollar. Dai (DAI) is a decentralized stablecoin backed by various cryptocurrencies. TrueUSD (TUSD) is fully backed by US Dollars and audited, while Paxos Standard (PAX) is a stablecoin fully backed by US Dollars and regulated.

Stablecoin technology typically involves pegging the stablecoin’s value to a reserve of assets. Fiat-backed stablecoins hold reserves of fiat currency in a bank to maintain their value. Cryptocurrency-backed stablecoins use cryptocurrencies as collateral in smart contracts to ensure stability. Commodity-backed stablecoins are secured by physical assets stored in vaults. Algorithmic stablecoins employ algorithms to adjust the supply of the stablecoin to keep its value stable.

Stablecoins provide several advantages, including stability in value, which reduces the impact of market volatility. They offer transparency as transactions are recorded on a blockchain, ensuring a clear and immutable record. Security is enhanced through blockchain technology and encryption. Stablecoins also facilitate global transactions by removing traditional banking barriers and offer high liquidity, making them suitable for various financial activities.

Stablecoins differ from traditional cryptocurrencies like Bitcoin or Ethereum in that they are designed to maintain a consistent value rather than experiencing high volatility. This stability is achieved by pegging them to stable assets or using algorithms to regulate their supply, which makes stablecoins more suitable for everyday transactions and financial stability.

The best stablecoin for your business depends on your specific needs and use case. Factors to consider include the type of asset backing, regulatory compliance, liquidity, and integration capabilities. For instance, if your business requires a fiat-backed stablecoin, options like Tether (USDT) or USD Coin (USDC) may be appropriate. For decentralized finance (DeFi) applications, Dai (DAI) might be a better fit..

SoluLab provides a full range of stablecoin development services, including consultation, design, development, integration, and post-launch support. Our team’s expertise covers various stablecoin types and applications, allowing us to tailor solutions to your specific needs. Whether you require a fiat-backed stablecoin or an algorithmic one, we deliver robust and secure stablecoin solutions aligned with your business objectives.

Tell Us About Your Project

Latest Blogs

Top 10 Stablecoin Development Companies in the USA to Work With

Looking for the best stablecoin development company in the USA?...

Read MoreWhat Are Algorithmic Stablecoins In DeFi? A Beginner’s Guide

Discover how algorithmic stablecoins are changing DeFi with smart supply...

Read MoreWhat Are Yield-Bearing Stablecoins?

Discover how yield-bearing stablecoins offer passive income with stability. Explore...

Read More