Blockchain Development for Mortgage

Mortgage hyperledger blockchain development allow you to pay your loans, debts and insurance payments digitally. Smart contract development for mortgage allow your business and users to communicate with each other conveniently in real-time. Using blockchain you can perform an efficient cost/benefit analysis.

Let’s connect

Why Prefer Blockchain Development for Mortgage?

Blockchain increases the efficiency of searching for loan and increasing your credit limit. It improves the process of qualification check and speed-ups the approval process as well as the underwriting process. Blockchain drives the efficiency of leasing mortgage loans and control contract administration with transparency. Requesting for mortgage applications and loans is quicker, documentations and exchange are easier with visibility to disclosure with appropriate personnel. Blockchain also helps to set up a due diligence committee to quickly review applications. Most of all, blockchain reduces the mortgage processing fee by without comprising the value added to the credit or loans approved. Assets and title exchanges can be accomplished at better prices without any intermediary intervention. The overall process of transferring and tracking ownership between buyers and sellers is easier than ever. One can assess requests made and validate the buyers offers with private keys to sign agreements With blockchain your mortgage business can get the ability to create your own competition as you can directly connect with users and set a price with mutual consensus. Huge savings can be made by accurately recording transactions, sharing data to eliminate tampering of a paper trail to reduce human error and stop fraud.

Processing of Blockchain in Mortgage Industry

Types of Blockchain

Our Services for Blockchain in Mortgage

-

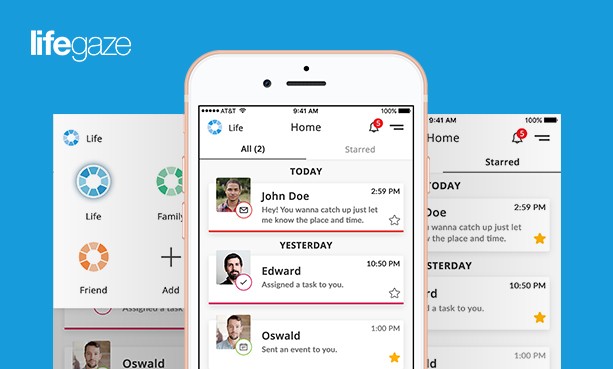

Create reports instantly, upload them in real-time to send payments to mortgage lenders, appraisers and receive/send statements online

-

Evaluate buyers, sellers by calculating credit scores by accessing their payment/transaction history provided by credit bureaus

-

Automatically retrieve loan, tax payments from buyers and get notified in real-time regarding loan applications

-

Access different data related to different necessary parties in real-time and share them using public/private key

-

Digitize your account information and improve your chances of getting approved loans with customized credit periods

-

Creating single point of environment to engage brokers, key suppliers, asset surveyors and agents

Why You Should Hire SoluLab for Blockchain in Mortgage

Technology and Tools We Use

Ethereum

Enables developers to build and deploy decentralized applications

Hyperledger

A shared ledger that utilizes cryptography and supports smart contracts

Solidity

A statically-typed programming language designed for developing smart contracts

Truffle

Act as a developer environment and testing framework for blockchain technology

R3 Corda

Open source blockchain designed specifically to meet the demands of modern day businesses

Ripple

Provides one frictionless experience for sending and receiving money globally

Quorum

Platform that addresses specific challenges to blockchain technology adoption within the financial industry and beyond

IOTA

Open-source distributed ledger built to power the Machine Economy through fee-less micro-transactions and data integrity

FAQs

We at SoluLab make use of distributed ledger technology or DLT and smart contracts for the purpose of implementing blockchain for mortgages. It would be great to let us know your specific requirements, and we can work accordingly.

You should choose SoluLab for blockchain development in the mortgage industry because of the following.

- SoluLab has an outstanding of highly proficient blockchain developers

- Hands-on experience with blockchain development for the mortgage industry

- Our team is up-to-date with the latest tools, technologies, and trends in the industry

- Affordable pricing structure

- Quick turnaround time

The major benefits of blockchain development for the mortgage industry are listed below.

- Readily speed up the transaction time

- Make settlement more rapid and hassle-free

- More accurate keeping of records

- Buyers’ cost is lowered

- Verification of the chain of title becomes easier

- Implementation of smart contracts

Blockchain technology can be used for mortgages to give them a complete makeover. It can increase the efficiency of the whole process, making it easier and more convenient for all the parties involved. With the help of blockchain mortgages, the data or information needed to assess as well as approve the loan application would be stored in a highly secure manner on a network where these ledgers would be automatically updated and that too in real-time.

Work speaks louder than words

What our client says

Based on what I’ve seen from our beta tests, the site is quite stable.

They manifested our concepts and were quite responsive.

They’re very agile and able to use the technology you need to solve the problem, not the other way around.

Our recent posts

How are AI Agents Redefining Sales and Marketing

Explore how AI agents are reshaping sales and marketing. Increase efficiency, personalize campaigns, and drive ROI. Embrace the power of AI for business growth.

How Can AI Agents Enhance the Hospitality Industry?

Discover how AI agents enhance the hospitality industry by improving guest experiences, boosting efficiency, and increasing profitability.

Agentic RAG: What It Is, Its Types, Applications And Implementation

Large Language Models (LLMs) have revolutionized our interaction with information. However, their dependence on internal [...]