As a means of offering financial services outside of the conventional banking system, decentralized finance is quickly gaining appeal. Decentralized Finance (DeFi) is a new world being shaped by the financial industry’s use of blockchain technology and the growth of decentralized financial services. This environment is defined by cheap transaction costs, secure transactions, worldwide accessibility to financial services, and the most recent DeFi developments dominating the industry.

Although there are a number of possible advantages to decentralized finance (DeFi), it’s crucial to be aware of the hazards before committing to anything. We will thus lead you through the fundamentals of decentralized finance, covering what it is, how it operates, and some of the main challenges you must be aware of before beginning, through our DeFi guide on decentralized finance development for businesses.

So, let’s get started!

What is DeFi?

You must be wondering about what is decentralized finance or DeFi, in short. A financial system based on public blockchains is known as decentralized finance or DeFi. Open finance is made up of blockchain-based smart contracts, dApps (decentralized apps), digital assets, and protocols.

Most people are aware that Ethereum and Bitcoin are cryptocurrencies, but not many are aware that they are also open-source, large networks that let users create programs that facilitate financial transactions without the participation of centralized organizations.

Users may now engage with the Ethereum blockchain in a multitude of new ways that were previously impossible thanks to the advent of decentralized finance. Users may trade digital assets without utilizing a centralized exchange, receive interest on their cryptocurrency holdings, lend or borrow Ethereum-based assets, and more by using DeFi.

Offering consumers an alternative to the sometimes opaque and unreachable existing financial institutions is the goal of bringing about decentralized finance. DeFi aims to create a more inclusive financial system that benefits all users by improving the accessibility and usability of financial services.

What is DeFi Wallet?

A DeFi (Decentralized Finance) Wallet is a type of cryptocurrency wallet specifically designed to interact with decentralized finance applications and protocols.

In traditional finance, banks and financial institutions act as intermediaries to facilitate transactions and manage assets. DeFi aims to replace these intermediaries with decentralized protocols and smart contracts running on blockchain networks like Ethereum. DeFi applications include lending, borrowing, trading, yield farming, and more.

A Crypto DeFi Wallet allows users to securely store, send, and receive various cryptocurrencies and tokens, while also providing access to decentralized applications (DApps) and protocols within the DeFi ecosystem. These wallets typically offer features such as integration with decentralized exchanges (DEXs), staking, yield farming, and participation in liquidity pools.

Some popular DeFi Wallets include MetaMask, Trust Wallet, Coinbase Wallet, and Argent, among others. These wallets often provide users with greater control over their funds and financial activities, as well as opportunities to earn interest and rewards through various DeFi protocols.

How Does DeFi Work?

Financial services can be accessed through decentralized finance, eliminating the need for centralized middlemen. On the Ethereum blockchain, it makes use of smart contracts to facilitate peer-to-peer communication. A financial system requires two primary elements in order to function properly: the infrastructure required for operation and the currency required for operation.

- Infrastructure: Writing decentralized applications is possible on Ethereum, a DeFi platform. Smart contracts, which define a set of requirements or guidelines by which an agreement can be established, can be created using Ethereum. A smart contract cannot be changed after it has been deployed.

- Currency: Currency: A coin that can be used to communicate with every protocol available is required to build a safe, dependable decentralized finance system. Typically, DeFi’s currency is the DAI stablecoin. A decentralized stablecoin that is correlated with the US dollar is called DAI.

Comparing Decentralized and Traditional Finance

There are certain intrinsic decentralized distinctions between Decentralized Finance (DeFi) and fintech, even if DeFi is only an enhanced form of the finance system with the same fundamental functioning, which is lying in receiving and transferring money. that establishes blockchain app development services as a significant financial trend for the years 2021–2022, and beyond. So let’s continue to learn about the distinctions.

- Institutions and staff do not oversee the operations of DeFi. In the DeFi context, smart contracts or coded algorithms do this function. DeFi apps operate automatically after a smart contract is put onto the blockchain; in traditional finance, financial processes are managed by middlemen like banks.

- The ability of DeFi to use code transparency is one of the key characteristics that sets it apart from conventional banking applications. This gives everyone the ability to audit, which fosters user trust as everyone can comprehend the operation of the contract. Furthermore, because the transactions are pseudonymous, privacy concerns are never raised. However, since intermediaries oversee the monetary processes in conventional finance, security lapses are possible.

- Another kind of blockchain application employed in the DeFi environment is called dApps development, and it is intended to function worldwide right from the start. The DeFi networks and services are accessible to everyone, regardless of where they live.In contrast, financial institutions’ services are limited to their local areas in the case of the traditional financial system. For example, you are limited to opening a bank account inside the nation in which the bank is located.

- Applications for decentralized finance can be created and used by everyone. In contrast to modern finance, consumers engage with smart contracts directly via DeFi cryptocurrency wallets; there are no accounts or gatekeepers involved.

- The various DeFi products are combined to create the latest decentralized financial applications. For instance, new products may be created by combining prediction markets, stablecoins, and decentralized exchanges. On the other hand, each application in the old financial system is made specifically for a particular function.

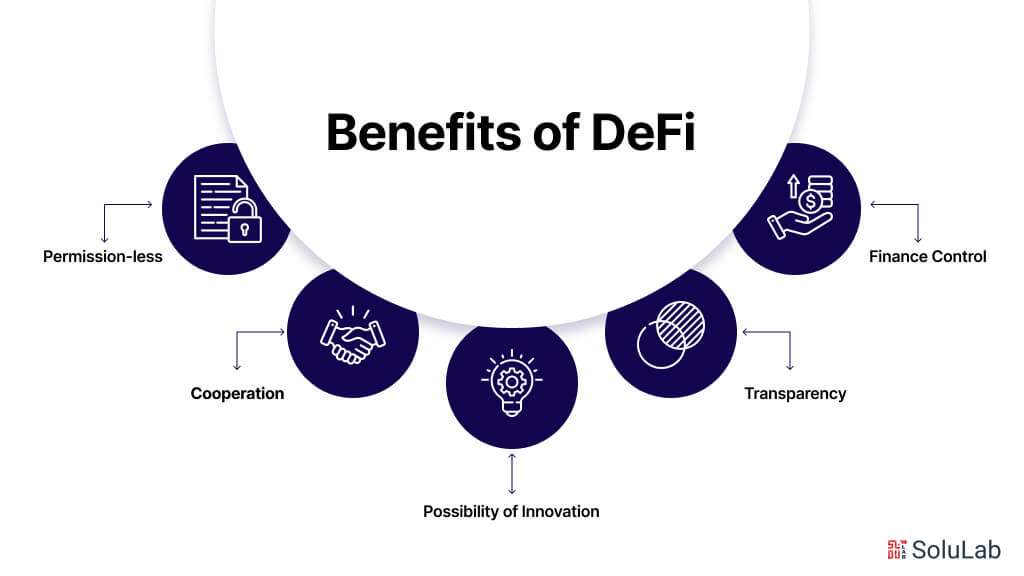

Benefits of DeFi

Conventional banks are costly to operate and primarily administrative in nature. The lengthy transaction procedure has resulted in the exclusion of many people from the financial system due to its strict regulations. DeFi arrived to resolve a great deal of these problems. Here are a few of the primary benefits of DeFi:

-

Permission-less

Permissionlessness is one of the primary benefits of decentralized finance (DeFi). This implies that no one needs permission from a centralized authority in order to use DeFi applications and services. DeFi’s openness and accessibility—which let anybody with an internet connection join the vibrant ecosystem—are some of its key selling points.

Furthermore, because permission-less DeFi solutions are not susceptible to single points of failure, they are frequently safer than their centralized equivalents. They are therefore perfect for conducting financial transactions and holding value. Thus, one of the main draws for anyone interested in entering the decentralized financial space is the permissionless aspect of DeFi.

Related: Permissionless Blockchain

-

Cooperation

Developers may freely build upon established protocols, alter user interfaces, and include third-party apps with decentralized accounts. This kind of versatility is why DeFi conventions are sometimes referred to as “Money Legos.” It is possible to create new decentralized money apps by combining several DeFi products.

Stablecoins, for example, may be combined with decentralized trades and prediction markets to create an entirely new and far more advanced DeFi financial market in terms of scale and centers.

-

Transparency

DeFi facilitates a higher level of transparency and accessibility. Every activity is open to the public as the majority of DeFi protocols are built on the blockchain, a public ledger. Transactions are visible to all parties; but, unlike traditional banks, no individual is personally linked to these records.

All things looked at, the accounts merely post numerical addresses and are pseudo-anonymous. The majority of DeFi products are open source, thus users with programming knowledge may also examine or expand upon the source code. Because of local area connections, open-source programs are more secure and of higher quality than proprietary software.

-

Finance Control

Financial organizations have extensive control over how customers may utilize their money when they use traditional banking. If they believe there is fraudulent behavior, they have the authority to restrict the kinds of transactions that users may complete and to prevent access to their accounts.

On the other hand, people have greater control over their personal funds using decentralized financial solutions. Users may choose which assets to interact with and manage their own assets, for instance. This makes it harder for someone to take their money and enables them to conduct transactions directly with the parties involved. Decentralized finance, as a consequence, lets consumers avoid fraud and has greater control over their personal funds.

-

Possibility of Innovation

The DeFi ecosystem offers legitimate opportunities for innovation and the development of DeFi goods and services. DeFi is an open protocol that can be very helpful in creating financial solutions for a new era. Because it supports Ethereum and enables innovators to create new decentralized financial apps, the DeFi is becoming more and more significant.

Let’s continue to learn how to utilize DeFi and its practical uses now that you have an understanding of its benefits.

How is DeFi Used?

Before you begin utilizing DeFi, there are a few things you should be aware of.

-

Retrieve Your Wallet

You will require an Ethereum-compatible digital wallet in order to use DeFi. Users may safely keep thousands of NFTs and other cryptocurrencies in the wallet.

-

Purchase Related DeFi Cryptocurrency

You must buy a decentralized finance cryptocurrency asset, like ether, that is native to the Ethereum blockchain in order to communicate with DeFi. Considering your risk tolerance and investing objectives, pick the best option for you.

-

Link Your Digital Wallet to the Decentralized Marketplace

You may begin trading on a decentralized exchange as soon as you have a digital wallet and enough cryptocurrency for decentralized financing.

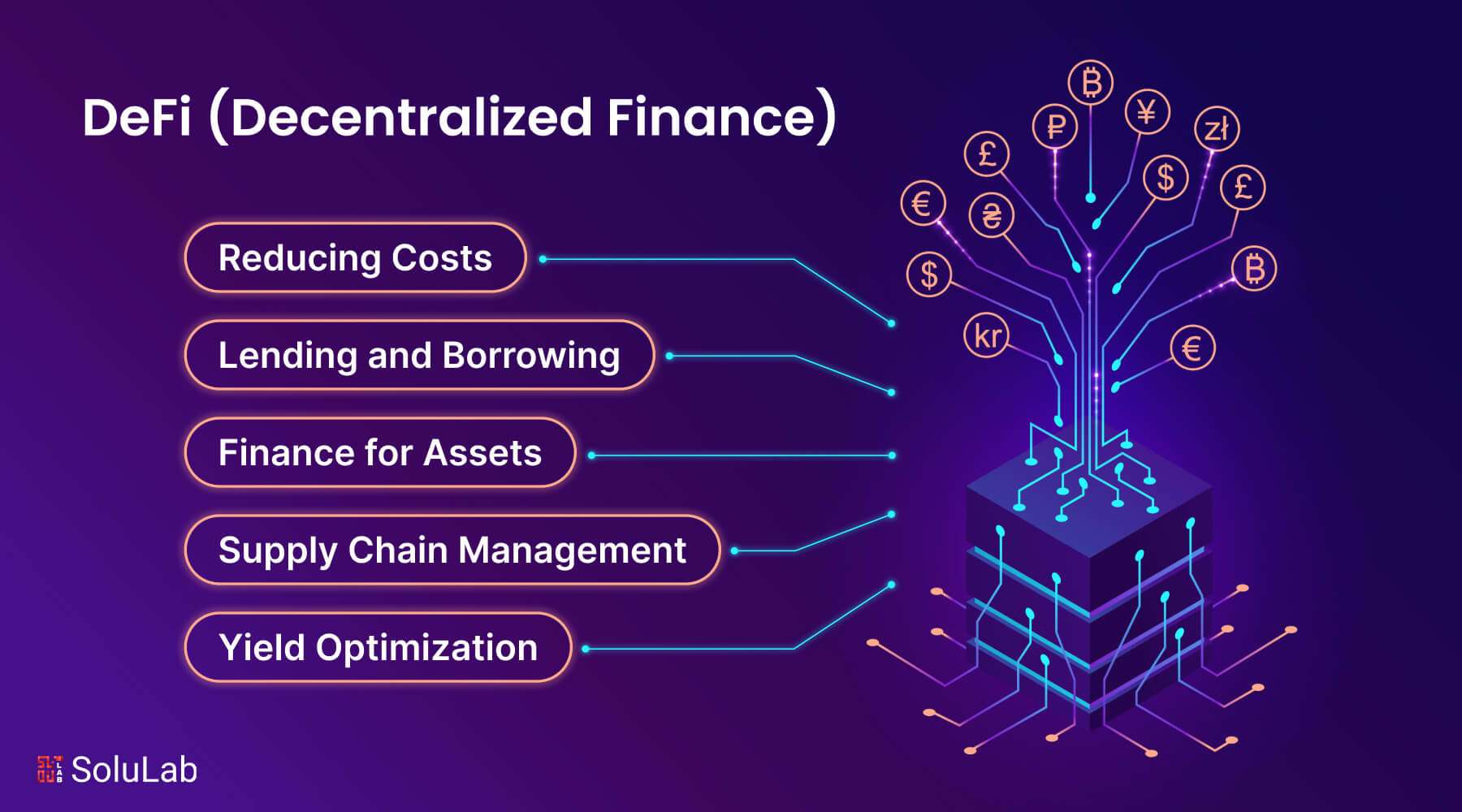

Use Cases of DeFi in Real-World

Every unbanked person on the planet might have their life completely changed by the increasing use of DeFi platforms and procedures. A few significant real-world use cases for DeFi are covered in this section.

-

Reducing Costs

The costs that international workers must pay on the remittance market front, where they transmit billions of dollars to their relatives overseas, are exorbitant. There is a chance that these expenses can be reduced by over 50% thanks to the developments in decentralized finance services. In addition to raising worker productivity, this promotes economic expansion.

-

Lending and Borrowing

The other difficult area that may be resolved by focusing on DeFi’s benefits is loans. Because of their poor credit history or absence of credit scores, the unbanked are now unable to obtain loans. By bringing lenders and borrowers together, the DeFi platforms do away with the need for credit checks.

-

Finance for Assets

An extensive network that combines DeFi protocols and financial instruments has been established by the DeFi ecosystem, ranging from portals for lending and borrowing to stablecoins and tokenized BTC. DeFi developers have opened up a world of fresh opportunities for asset-decentralized finance and risk management by using irreversible smart contracts on Ethereum.

DeFi protocols have provided new means to obtain liquidity without relying on centralized exchanges, such as flash loans that are paid in a single transaction and the ability to collateralize loans using DeFi coins or digital assets.

-

Supply Chain Management

The term “DeFi” describes the transition from conventional, centralized financial institutions to peer-to-peer lending made possible by decentralized Ethereum blockchain systems. The supply chain management sector is already starting to see the effects of this paradigm-shifting movement, which presents a plethora of opportunities for improving inefficiencies and creating new channels for decentralized financing and untrustworthy collaboration.

By eliminating errors and adding transparency, blockchain technology is only preparing to handle more advanced DeFi platform use cases.

-

Yield Optimization

Applications for DeFi can be used to aggregate, stake, and maximize yields from interest-bearing investments, automating the process. Data analytics and optimization approaches are used in the process of yield optimization. In order to obtain the greatest rates on cryptocurrency transactions, computational approaches are applied in DeFi yield optimization.

Yield farming is another name for yield optimization. A smart contracts in DeFi manages the process of reinvesting your cryptocurrency winnings to help you get optimal returns through yield optimization.

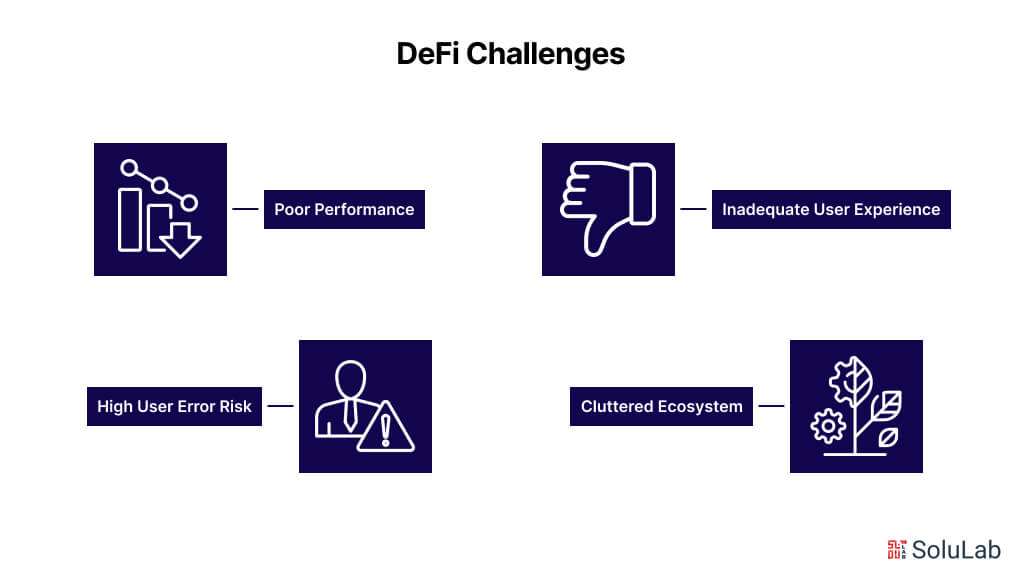

What Challenges Does DeFi Encounter?

Despite the fact that decentralized finance is a relatively new field that is always changing, there are certain drawbacks to DeFi.

- Poor Performance: The fundamental slowness of blockchain-based applications compared to their centralized counterparts has an impact on them. The designers of DeFi programs must take these limitations into account and then optimize their work.

- High User Error Risk: DeFi programs give the user more accountability by removing the middlemen. For many people, this might be a drawback. When products are implemented on top of immutable blockchains, designing them to reduce the possibility of user mistakes presents a difficult task.

- Inadequate User Experience: Currently, the user must put in more effort in order to use DeFi applications. In order for DeFi apps to become an essential part of the global financial system, they must provide a compelling reason for consumers to switch from the conventional system.

- Cluttered Ecosystem: It might be challenging to locate the application that best suits a certain use case, thus users need to be able to recognize the best possibilities. Not only is it challenging to develop apps, but it’s also challenging to consider how such applications will integrate into the broader DeFi ecosystem.

What is the Future for DeFi Systems?

The newest digital product in an industry that has existed since the dawn of time is cryptocurrency. We are about to see the complete rebuilding of every financial service we currently utilize under the fiat scheme within the DeFi and open finance ecosystem.

Collateral is a key component of the initial generation of DeFi applications, which means that in order to borrow more DeFi cryptocurrency, you must first acquire a DeFi platform coin and then put it up as collateral.

The most recent versions of DeFi applications are also already causing a great deal of innovation in the insurance industry. Many of the DeFi loans that are made today are overcollateralized (the large asset cushion maintained in the reserve gives the loans an inherent sense of safety).

DeFi cryptocurrency wallets development have also shown signs of being the hub for all activity involving digital assets. Think of it as a dashboard that displays your assets as well as the amount that is restricted by various open finance protocols, such as loans, insurance policies, and pools.

Additionally, a move toward decentralized decision-making and governance is evident. DeFi emphasizes the word “decentralized,” however the projects now have master keys that enable DeFi platform development suppliers to disable dapps in order to prevent instances of malicious code or to facilitate upgrades. On the other hand, the DeFi community is searching for methods to allow stakeholders to cast votes on choices, opening up a far larger set of DeFi use cases.

Something new is occurring in the open financial system front: cryptocurrencies are creating money online and providing people methods to generate money on dapps. This is in response to all the rumors and proof of concepts around new DeFi possibilities that are being created and built. Every disruptive launch challenges our understanding of how money functions.

As observers, we find it fascinating that everyone with programming skills has the potential to shape the future of decentralized banking and money.

The Bottom Line

Fintechs may get a competitive edge and open up new avenues for financial service delivery by implementing DeFi technology.

Fintechs may now provide their clients with more effective, transparent, and easily accessible solutions thanks to their use of DeFi. Fintech companies may offer cutting-edge financial services, automate procedures, cut expenses, and do away with middlemen by utilizing blockchain technology and smart contracts.

As a leading DeFi development company, SoluLab offers comprehensive solutions tailored to meet the diverse needs of clients seeking to leverage the potential of decentralized finance. With expertise in blockchain technology, smart contracts, and decentralized applications, SoluLab empowers businesses to build, deploy, and scale innovative DeFi solutions. Whether it’s creating decentralized exchanges, liquidity pools, lending platforms, or yield farming protocols, our team of experienced developers ensures the delivery of secure, scalable, and interoperable solutions. Partner with SoluLab to revolutionize your financial services with DeFi. Contact us today to discuss your project requirements and embark on a journey towards decentralized finance excellence.

FAQs

1. What is DeFi (Decentralized Finance)?

DeFi, or Decentralized Finance, is the abbreviation for a group of blockchain-based financial services and apps. Unlike traditional finance, which relies on intermediaries like banks, DeFi aims to create an open and permissionless financial system, allowing individuals worldwide to access financial services without the need for intermediaries. These services include lending, borrowing, trading, asset management, and more, all executed through smart contracts on decentralized platforms.

2. How does DeFi differ from traditional finance?

DeFi differs from traditional finance in several key ways. Firstly, it operates on decentralized platforms, eliminating the need for intermediaries like banks. Secondly, DeFi applications are typically accessible to anyone with an internet connection, promoting financial inclusion. Additionally, DeFi protocols often offer greater transparency, security, and composability, enabling users to seamlessly interact with multiple applications and protocols.

3. What are the risks associated with DeFi?

While DeFi presents exciting opportunities, it also comes with risks that users should be aware of. These risks include smart contract vulnerabilities, impermanent loss in liquidity provision, market volatility, regulatory uncertainty, and the potential for hacks or exploits on decentralized platforms. It’s essential for users to conduct thorough research, understand the risks involved, and exercise caution when participating in DeFi activities.

4. How can I get started with DeFi?

To get started with DeFi, you’ll need a few basic tools and resources. First, you’ll need a cryptocurrency wallet that supports DeFi tokens, such as MetaMask or Trust Wallet. Next, familiarize yourself with decentralized exchanges (DEXs) like Uniswap or SushiSwap, where you can trade tokens directly from your wallet. You can also explore DeFi lending platforms like Compound or Aave to earn interest on your crypto assets. Remember to start with small amounts and gradually increase your involvement as you become more comfortable with the DeFi ecosystem.

5. How can SoluLab help with DeFi development?

SoluLab is a trusted DeFi development company with expertise in blockchain technology, smart contracts, and decentralized applications. Whether you’re looking to build a decentralized exchange, lending platform, yield farming protocol, or any other DeFi solution, SoluLab can provide comprehensive development services tailored to your specific requirements. With a team of dedicated developers and a proven track record of delivering high-quality projects, SoluLab is your ideal partner for navigating the complexities of decentralized finance. Contact us today to discuss your DeFi project and take the first step toward financial innovation.