Gone are the days when banking meant long queues, paper-heavy processes, and one-size-fits-all services. Today’s customers demand speed, personalization, and smart solutions—and banks are turning to Artificial Intelligence (AI) to deliver just that.

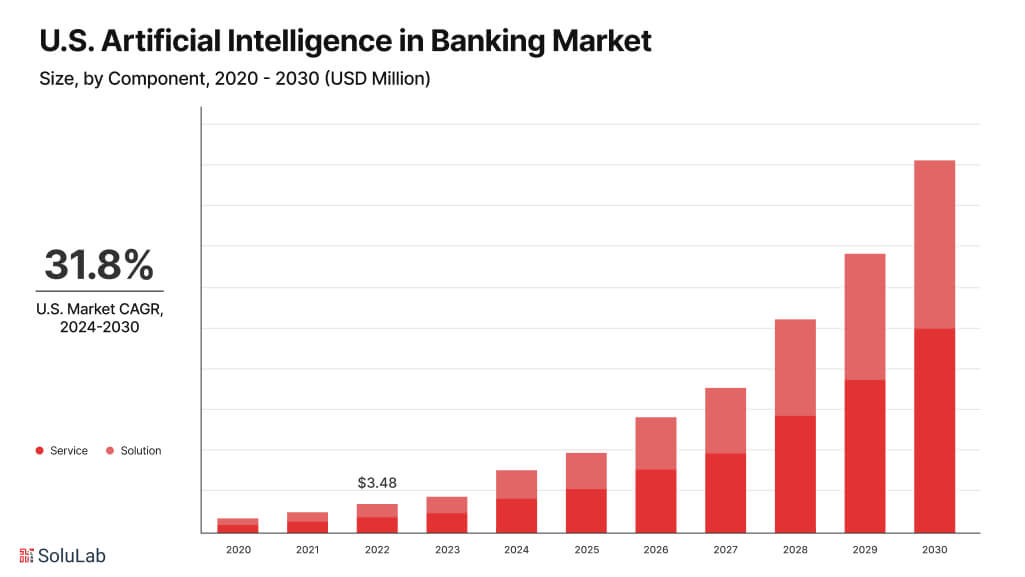

The banking sector’s AI and generative AI spending was estimated at 31.3 billion U.S. dollars in 2024. With a CAGR of 27%, it is forecast to exceed 81 billion U.S. dollars by 2028.

From detecting fraud in real time to offering tailored financial advice, AI is reshaping the very foundation of banking. It’s not just a tech trend—it’s a strategic necessity. In this blog, we’ll uncover why AI has become a must-have tool for modern banks aiming to stay relevant, competitive, and future-ready. Let’s get started!

How Generative AI is Modifying Traditional Banking?

Generative AI is reshaping traditional banking by introducing intelligent automation, personalized services, and enhanced decision-making capabilities. Unlike traditional systems, generative AI can create new content, simulate scenarios, and generate insights based on vast data, empowering banks to operate smarter and faster.

1. Improved Business Relationships

Generative AI in banking is transforming customer interactions. Banks are building and deploying AI chatbots like JPMorgan’s “COCO” to enable 24/7 support and efficiently process frequently asked questions.

2. Fraud Prevention and Identification

Generative AI in banking fraud detection strengthens efforts to avoid fraud. With the help of synthetic data, banks can train their GenAI models more successfully in recognizing anomalous patterns indicative of fraudulent activity.

3. Risk Assessment

Generative AI in banking can simulate a variety of economic scenarios to better assess potential risks. Not only that, but generative AI in bfsi will also help in ascertaining robust techniques of risk management by helping in stress testing of portfolios.

4. Personalized Financial Advice

Now, AI-powered financial advisors are emerging and are used to deliver customized investment advice based on the risk tolerance and financial goals of the user. So, Generative AI can further enhance this by creating personalized financial strategies.

5. Smarter Marketing and Sales

By generating insights from customer data, artificial intelligence in the UAE helps banks create targeted marketing campaigns and personalized sales strategies, increasing engagement and conversion rates.

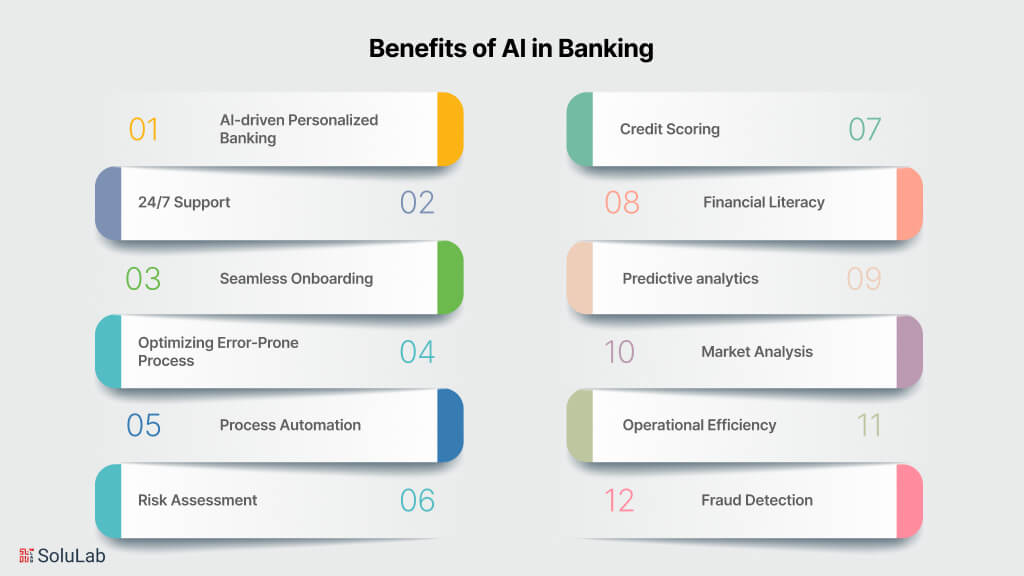

Benefits of AI in Banking

Considering the various benefits of AI in banking, it is rapidly altering the nature of the financial sector. The significant advantages are as follows:

1. AI-driven personalized banking: Use cases of AI agents will be able to provide customized financial services and products according to the analysis of the data of the clients. For example, AI-driven recommendation systems will provide investment advice in resonance with the financial goals and risk tolerance of a person.

2. 24/7 Support: AI-driven chatbots can support clients uninterruptedly by answering their queries and problems for quick solutions, thus improving customer satisfaction and brand loyalty.

3. Seamless Onboarding: The application of AI in banking will reduce friction and enhance customer experience through identity and document verification automation, thus making customers.

4. Optimizing Error-Prone Process: AI in banking ensures the reduction of manual errors and enhances accuracy ultimately improving customer service.

5. Process Automation: Artificial intelligence in banking can be utilized for processing tasks that free the human worker to take up other strategic roles, which include data entry, loan processing, and compliance checks.

6. Risk Assessment: AI analyses consumer data, market patterns, and economic indicators to gauge risk with high precision and efficiency. It helps protect the assets of banks and makes them very informed in decisions.

7. Credit Scoring: If AI and banks consider other sources of data, they would come up with inclusive credit-scoring models that would extend credit availability to marginalized communities.

8. Financial Literacy: The chatbots powered by AI can advise and counsel clients about money matters in a way that will let them make prudent financial decisions.

9. Predictive analytics: Using past data, AI in banks can build forecasts of the future and hence enable banks to avail of opportunities and make data-driven decisions.

10. Market Analysis: AI evaluates the consumption patterns of customers and market trends, identifying new market niches and allowing focused ad campaigns to be formulated.

11. Operational Efficiency: Artificial intelligence in banks reduces operational expenditure of banks to a large extent by automating operations and making procedures seamless.

12. Fraud Detection: Artificial intelligence in banking systems reads massive volumes of transaction data and highlights suspicious activities quickly enough to prevent loss of financial value.

Check Out Our Blog: Generative AI in Payments

What Banks Should Know Before Investing in AI Integration?

Banks wishing to incorporate AI tech technologies and techniques into their operations. Should keep in mind the following steps:

- Describing Bank’s Policy Profile: Since each bank is unique, its leaders must decide for themselves what risks and how to use AI. Banks should adopt AI while keeping in mind that it necessitates robust security measures to mitigate any possible threats.

- Set Use Cases: AI implementations need to be connected to certain business scenarios that have quantified effects and support organizational objectives. Personalise, investing plans, fraud prevention, creditworthiness scoring, and chatbots that interact with customers are a few examples of specialized use cases.

- Select Reliable AI Platform: To make sure a business has everything that it requires to thrive, the majority of enterprise AI techniques call for the implementation of several AI models. As a result, banks must decide whether to utilize in-house models, open-source models, or both.

- Adopt Hybrid Cloud Architecture: AI for banks to prioritize software resource management and fix any inefficiencies in their current technology. For real-time, Digital banking, bank, skin and resilience, and response Ness by utilizing a hybrid cloud architecture that allows them to order it between public and private clouds.

What does the Future of Banking look like with AI?

The future of banking is being rewritten by Artificial Intelligence, promising smarter, faster, and more personalized financial services. As AI technology advances, banks will evolve from traditional institutions into highly agile, customer-centric digital hubs.

1. Hyper-Personalized Experiences:

AI will enable banks to understand customers deeply—analyzing spending habits, financial goals, and risk preferences—to deliver tailored advice, products, and offers in real time.

2. Fully Automated Operations:

Routine tasks like loan approvals, compliance checks, and customer onboarding will become almost entirely automated, speeding up processes while reducing errors and costs.

3. Predictive and Proactive Services:

AI-powered predictive analytics will allow banks to anticipate customer needs and potential financial risks, offering proactive solutions such as early fraud alerts or customized investment plans.

4. Seamless Omnichannel Banking:

AI will unify interactions across mobile apps, websites, call centers, and even voice assistants, providing a smooth and consistent banking experience anytime, anywhere.

5. Expansion of Financial Inclusion:

UAE artificial intelligence strategy can lower costs and simplify access, making banking services available to underserved populations globally, driving financial inclusion like never before.

In short, AI will transform banking into an intuitive, efficient, and secure ecosystem, empowering customers and institutions alike to thrive in a digital-first world.

SoluLab Transforms Banking and Finance with Gen AI

Challenge

The banking industry struggles with meeting rising customer expectations, streamlining manual processes, managing risks, adapting to evolving regulations, and protecting data from increasing cyber threats.

Solution

SoluLab used Gen AI to automate tasks, deliver personalized customer experiences, and improve cybersecurity, helping banks operate more efficiently.

Impact

- 3x increase in customer satisfaction with personalized services.

- 70% faster processes, cutting operational costs.

- 98% fewer cyber threats, ensuring data safety.

Wrap Up

The future of banking is undeniably powered by Generative AI, revealing unprecedented opportunities for personalization, efficiency, and security. As financial institutions race to innovate, partnering with a trusted technology leader like SoluLab can make all the difference.

With deep expertise in AI development solutions, SoluLab helps banks seamlessly integrate generative AI technologies that transform customer experiences, optimize operations, and ensure regulatory compliance. Not just that, you can even hire an AI developer to help you leverage artificial intelligence in Dubai to improve customer engagement and smoothen operations for better business growth.

Ready to elevate your banking services with leading-edge AI? Connect with SoluLab today and take the first step toward a smarter, more agile financial future!

FAQs

1. How can AI improve the customer experience for banking?

Artificial Intelligence would significantly improve the customer experience through the inclusion of chatbots because Artificial Intelligence banks are aware of the behavior and liking of customers, and they can provide customized financial products and services to customers.

2. How is security affected by the use of AI in banking?

Banks should formulate stringent safety measures that can ensure their clients’ private information is not hacked. This includes guidelines on data privacy, encryption methods, and frequent security checks.

3. In what ways can AI help to reduce costs for banks?

It can cut down costs for banks due to the automation of the repetitive processes involved, fraud prevention, and increasing operational effectiveness. Much savings can be made through the streamlining of procedures and eliminating errors.

4. What is Hybrid AI for Banking?

Hybrid AI in banking is the integration of both machine learning and human intelligence to enhance decision-making. By leveraging the combined capabilities in banking, Hybrid AI can optimize customer service, risk management, and operational efficiency.

5. How can AI be used in banks with the support of SoluLab?

SoluLab offers end-to-end AI solutions for the banking sector. We specialize in chatbot development with AI, fraud detection programs, and predictive analytics models. Feel free to reach out to us to learn more about how SoluLab can help you transform your bank with AI.