Aman Bank

Generative AI powered Mobile Banking Solution

AmanBank

Generative AI-Powered Mobile Banking Platform

Banking and Finance

Services Provided

Mobile Apps

Development

Generative AI-powered Chatbot Development

Voice AI Agent

Development

Client Vision

The Client, Amanbank from Libya has 18+ years of expertise in banking with a 35% market share and 300 Million Libyan Dinars in Capital. Amanbank has around 7,50,000 customer base in Libya. They aimed to create a mobile banking application that would be more than just a digital extension of their existing services and provide a seamless and secure banking experience to its customers ensuring security and accessibility. Their goal was to offer a secure, user-friendly platform that could handle the complex needs of modern banking while providing a seamless and efficient user experience. By integrating AI-powered chatbots and Voice AI agents, they aimed to enhance customer engagement, streamline operations, and provide personalized financial solutions. This vision was driven by the need to stay competitive in a rapidly evolving digital landscape and to meet the rising expectations of tech-savvy customers.

Business Overview & Requirement

Amanbank is a prominent player in the Libyan banking sector, recognized for its commitment to innovative digital solutions. Amanbank is a significant player in the Libyan banking sector, offering a wide range of financial services to individuals, businesses, and governmental entities with almost 18 years of expertise. Recognizing the growing trend towards mobile banking, the client aimed to develop a comprehensive mobile application that would:

Enhanced Customer Support

Chatbot Development

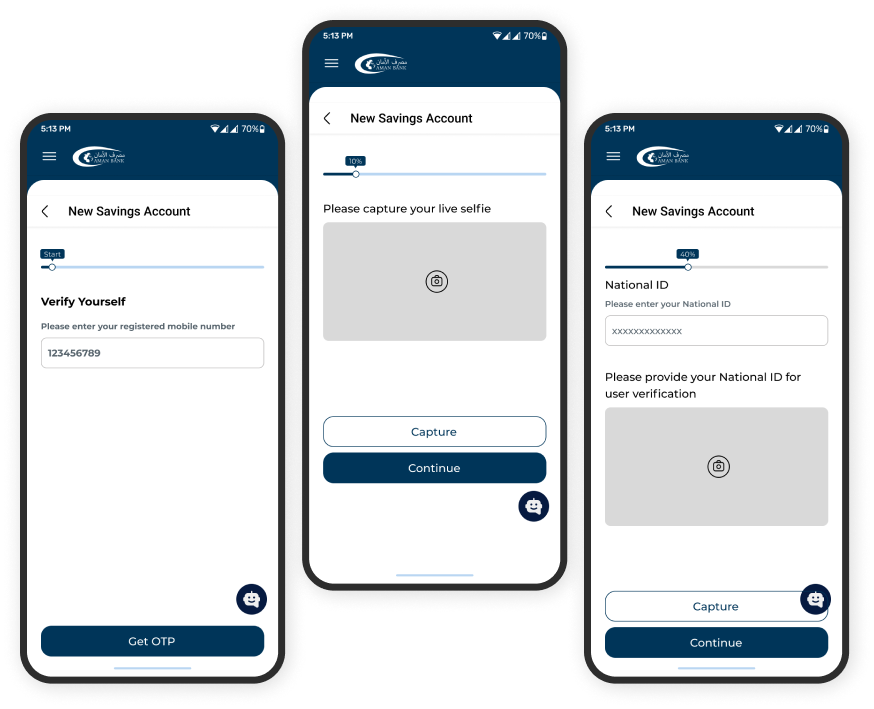

The client needed a solution to provide 24/7 customer support, reducing wait times and ensuring immediate responses to common inquiries. The goal was to develop AI-powered chatbots capable of handling a wide range of customer queries and providing 24/7 assistance with functionalities like Account Details, Recent Transactions, Money transfers, Card management, Bill payments, and Account Statements, thereby enhancing customer satisfaction and engagement..

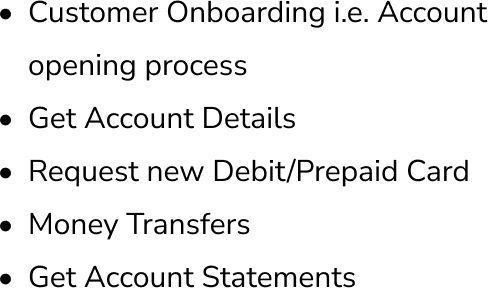

Voice AI Assistant

To offer an additional layer of convenience, the client sought to implement a Voice AI assistant. This assistant would enable customers to interact with the bank using natural language voice commands, providing a hands-free, intuitive banking experience, and guiding customers through various banking services available.

Customer Onboarding

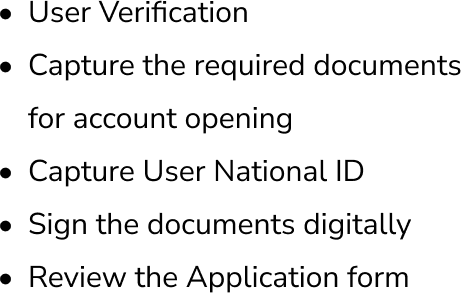

AI-Powered Onboarding

The client required an efficient and user-friendly onboarding process for new customers. By using chatbots and voice AI, the onboarding process could be automated and streamlined, making it faster and more convenient for users. This included digital KYC (Know Your Customer) procedures, customer verification, document identification using the OCR model, Signing the documents digitally, and automated account setup.

Operational Efficiency

Automation of Routine Tasks

By automating routine customer service tasks through chatbots and voice AI, the client aimed to free up human agents to focus on more complex issues, thereby improving overall operational efficiency. This included handling frequently asked questions, assisting with transactions, and providing real-time support.

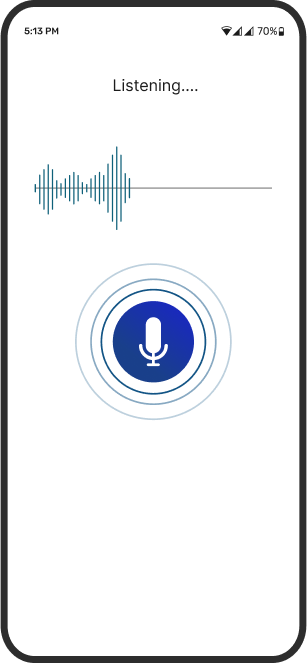

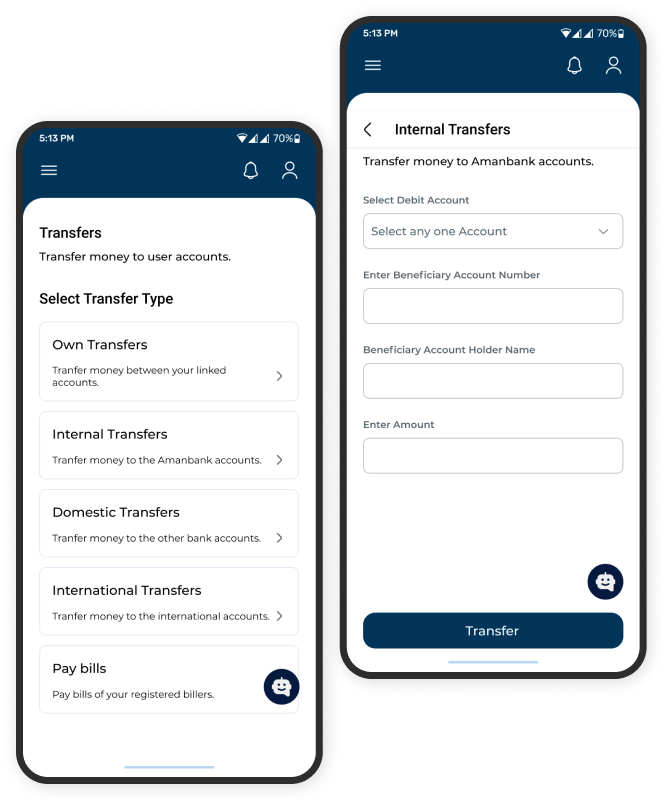

Digital Banking Services

Wide range of Banking Services

The client wanted to expand its digital footprint by offering a comprehensive range of services through the mobile app, including Account Management, Card management, Money Transfers, Bill payments, Account Statements, and Security settings for the app.

Challenges

Amanbank has an existing mobile app with a less intuitive and interactive platform. Amanbank as a prominent player in the banking sector, approached for developing a comprehensive and intuitive mobile banking application. The development process came with several challenges and these challenges need to be addressed to ensure the app meets the high standards:

Inefficient Onboarding Processes: The customer onboarding process was lengthy and complex, involving multiple steps and manual verification. This resulted in delays, customer frustration, and a higher dropout rate during the onboarding process. Streamlining onboarding was essential to improve customer acquisition and satisfaction.

Limited Support Hours: Traditional customer support was limited to specific hours, leaving customers without assistance during off-hours. This lack of availability was particularly problematic for customers in different time zones and those with urgent needs outside regular business hours.

Inconsistent Customer Service: The quality of customer service varied significantly depending on the time of day and the specific support agent handling the request. This inconsistency was leading to customer dissatisfaction and eroding trust in the bank's ability to provide reliable support.

High Customer Support Volume: The bank's customer support teams were overwhelmed by the volume of inquiries and service requests. This led to long wait times and a decrease in customer satisfaction. The need for 24/7 support further strained resources, making it difficult to provide timely and efficient assistance.

High-Quality Service: Meeting the high expectations of our customers for seamless, efficient, and secure digital banking services is a constant challenge.

Solutions

By approaching SoluLab, Amanbank looked up to develop an intuitive and interactive banking platform. SoluLab implemented a range of targeted solutions to address the pressing challenges and meet the evolving demands of their customers, developing an AI-powered chatbot for mobile banking applications provides a revolutionary solution to increase accessibility, streamline customer interactions, and offer intuitive banking services for all users, including those with feature phones or limited technical skills.

Generative AI Powered Chatbot

24/7 Customer Support

By incorporating Chatbots, the bank ensures that customer support is available round-the-clock. The development process involves designing robust backend systems capable of handling continuous interactions without downtime. These chatbots could handle a wide range of customer inquiries and transactions, ensuring immediate and consistent service at any time of day or night.

Natural Language Processing (NLP)

Developing a chatbot with cutting-edge NLP capabilities enables it to understand and respond to user queries conversationally. This involves training the AI on vast datasets to recognize various speech patterns, accents, and dialects, ensuring accurate comprehension and response generation..

Multi-Language Support

Incorporating multi-language support in the chatbot involves developing language models for multiple languages and dialects. This allows the chatbot to cater to a diverse user base, breaking down language barriers and ensuring inclusivity. It includes tailoring the chatbot to understand and respond in the local languages of the target user groups, providing a personalized and comfortable user experience.

Personalized Interactions

Leveraging AI and machine learning, the chatbot is developed to analyze user data and interactions to offer personalized responses. This involves creating algorithms that learn from past interactions to predict user needs and provide relevant recommendations.

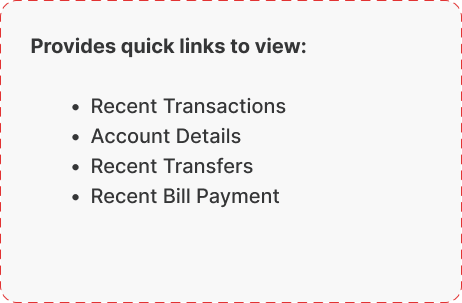

Digital Banking Services

The chatbot manages banking transactions, automating digital KYC and account setup, and handling account details, transactions, money transfers, card requests, and account statements. It ensures a seamless user experience by providing efficient and comprehensive support for various banking needs.

Voice AI Assitant

Hands-Free Banking

The Voice AI assistant allows customers to perform banking tasks using natural language voice commands, providing a convenient and hands-free experience. This was particularly beneficial for users who preferred voice interactions or had limited access to traditional input methods.

Routine Task Automation

Similar to the chatbots, the Voice AI assistant automated routine banking tasks such as balance inquiries, transaction history, fund transfers, and bill payments. This automation reduced the workload on human agents and improved operational efficiency.

Real-Time Support

The Voice AI assistant provided real-time support for customer inquiries and issues, reducing wait times and enhancing the overall customer experience.

Proactive Notifications and Alerts

The Voice AI assistant can notify customers about important events such as low balance warnings, upcoming bill payments, and suspicious activities. This proactive approach helps customers stay informed and take timely action.

Ease of Use

Voice AI agents enable users to interact with banking services using natural language, making it intuitive and accessible for non-tech savvy users, including those with feature phones, elderly users, and individuals with disabilities. They allow tasks like checking balances and transferring money to be performed through simple voice commands, bypassing complex menus and touch interfaces.

Real-Time Statistics and Impact

Improved Customer Satisfaction

The development and implementation of AI-powered chatbots and Voice AI assistants resulted in a significant improvement in customer satisfaction. The bank reported a 30% increase in positive customer feedback and a 40% reduction in average response times.

Onboarding Efficiency

The streamlined onboarding process reduced the average onboarding time by 60%, leading to a faster and more efficient customer acquisition process.

Operational Efficiency

The automation of routine tasks led to a 50% reduction in the workload of human customer support agents, allowing them to focus on more complex and high-value customer issues. This improved overall operational efficiency and reduced costs.

Customer Engagement

The AI solutions' personalized interactions and multi-language support enhanced customer engagement. The bank saw a 25% increase in customer interaction rates and a 20% increase in adopting digital banking services.

Results Achieved

The implementation of AI-powered chatbots and Voice AI assistants in the bank's mobile banking application led to significant improvements across various aspects of customer service, operational efficiency, and overall user experience. The results achieved were measurable and impactful, showcasing the benefits of integrating advanced AI technologies into the banking sector.

Increased Customer Engagement

The AI-driven chatbots and Voice AI assistants provided personalized responses and recommendations based on individual customer profiles and behaviors. This personalization led to a 25% increase in customer interaction rates and higher engagement with the bank's services.

Offering support in multiple languages broke down language barriers and made the banking services more accessible to a diverse customer base. This inclusivity resulted in a 20% increase in the adoption of digital banking services.

Enhanced Customer Satisfaction

The chatbots and Voice AI assistants provided round-the-clock support, ensuring that customers could receive assistance at any time. This led to a significant increase in customer satisfaction, as reflected in a 30% rise in positive feedback and customer ratings.

The AI systems handled routine inquiries and tasks instantly, reducing the average response time by 40%. Customers appreciated the immediate responses and quick resolutions to their issues, enhancing their overall experience with the bank.

Hands-free and Convenient Banking

The introduction of the Voice AI assistant provided a hands-free, convenient banking experience for customers. By using natural language voice commands, customers could perform a wide range of banking tasks, such as checking balances, transferring funds, and paying bills, without needing to navigate through the app manually.

The intuitive and user-friendly design of the Voice AI assistant led to a high adoption rate among customers, particularly those who preferred voice interactions or had limited access to traditional input methods.

Improved Operational Efficiency

The automation of routine customer service tasks by chatbots and Voice AI assistants resulted in a 50% reduction in the workload of human support agents. This allowed the agents to focus on more complex and high-value customer interactions, improving service quality and efficiency.

By reducing the need for a large customer support team and minimizing operational expenses, the bank achieved significant cost savings. The AI-powered solutions proved to be a cost-effective alternative to traditional support methods.

Streamlined Digital Banking Services

The AI-powered chatbots and Voice AI assistants automated and streamlined the customer onboarding process, including digital KYC and account setup. This reduced the average onboarding time by 60%, making it faster and more convenient for new customers to join the bank.

The AI-powered chatbots and Voice AI assistants ensure a seamless experience while performing banking services, Getting Account Details, View Recent Transactions, Get Card Details, Transfer Money (Own Transfer, Internal Transfer, Domestic Transfers, International Transfers), Request New Debit/Prepaid Card, Reload Prepaid Card, Link Prepaid card to bank account, Card Less withdrawal Request, Request Account Statements for linked account. This reduced the average time by performing the banking services faster and more convenient for customers.

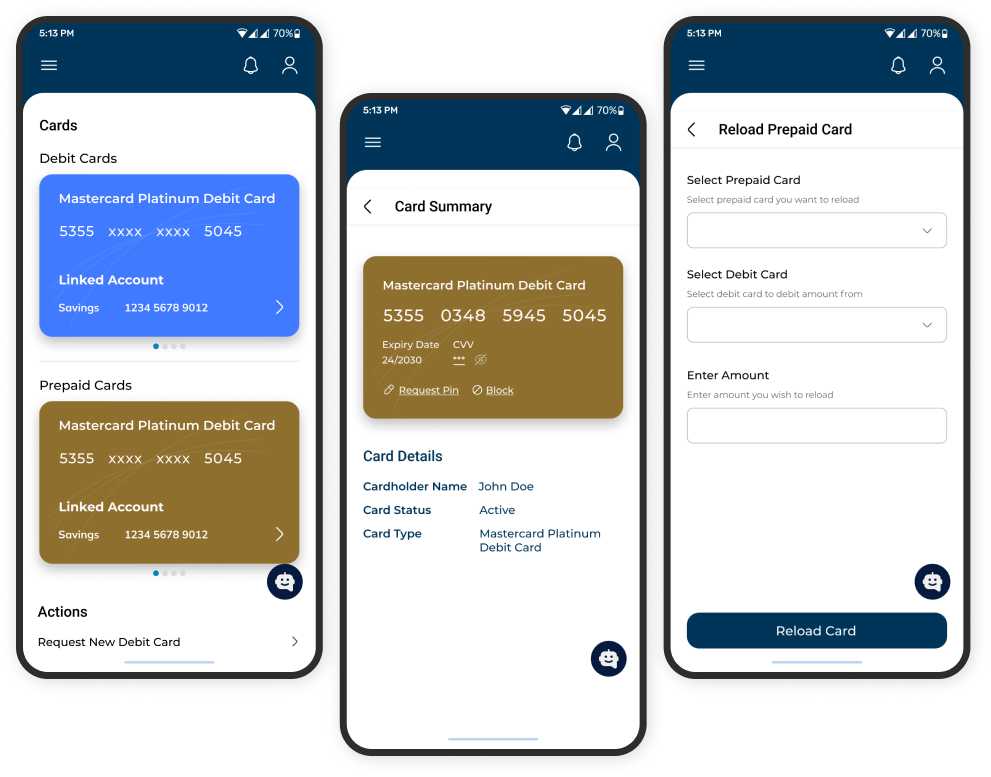

Mobile App redevelopment

Chatbot Assistant

Dashboard

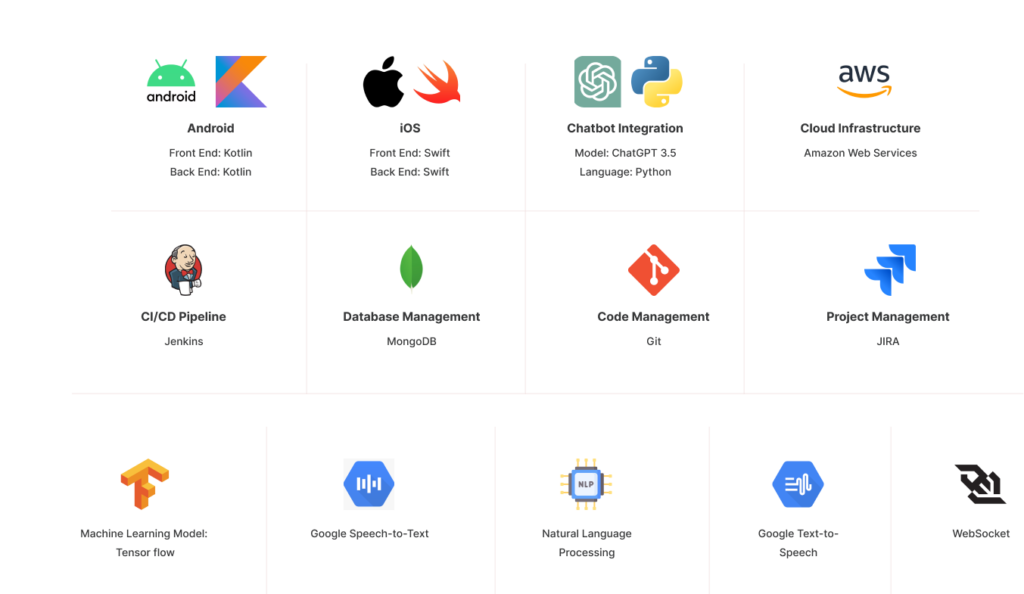

Tech Stack

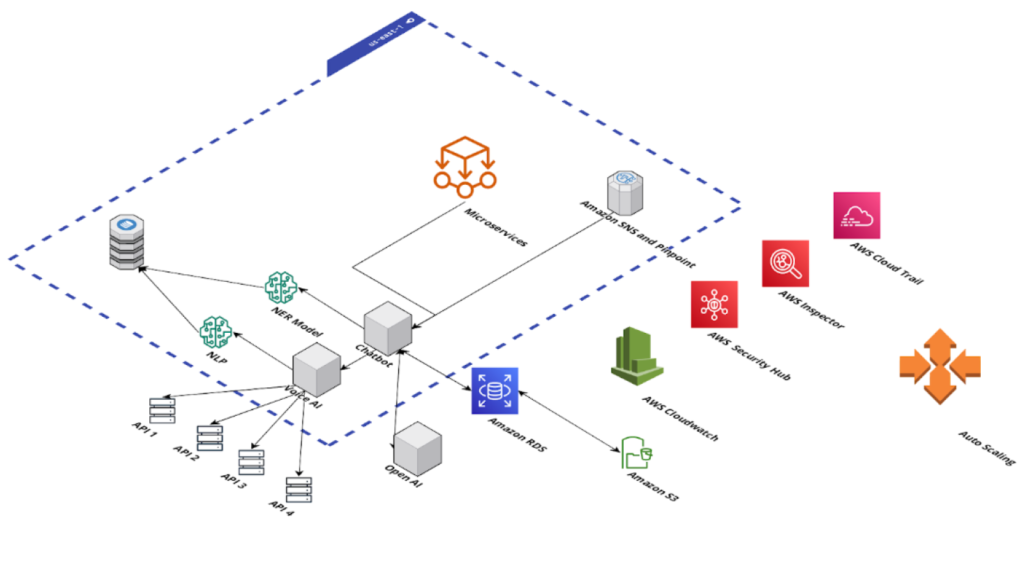

SoluLab used the below technologies across the application to ensure the app's functionality, performance, security, and scalability:

Solution Architecture

Key Features

Based on the requirements of Amanbank, SoluLab focused on the following features which are again considered to be the

key features of mobile banking application:

Customer Onboarding

Chatbot Assistant

Voice AI Agents

Money Transfers

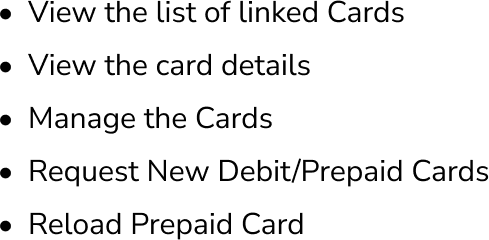

Card Management