Bio threats such as infectious diseases, laboratory accidents, and bioterrorism are hazardous to international health and safety. The common problems faced by traditional biosecurity systems are slow detection, inaccurate manual processing, and delayed responses.

However, with advanced analytics, automation, and data processing, AI biosecurity solutions can identify anomalies, predict outbreaks, and help manage threats faster. AI-enhanced bio-security systems detected intrusion/contamination risks with ~85% precision; disease-prediction success surpassed ~80%.

In this blog, we’ll explore the

- role of AI in biosecurity,

- how AI helps prevent bioterrorism

- real-world examples, its future, and more.

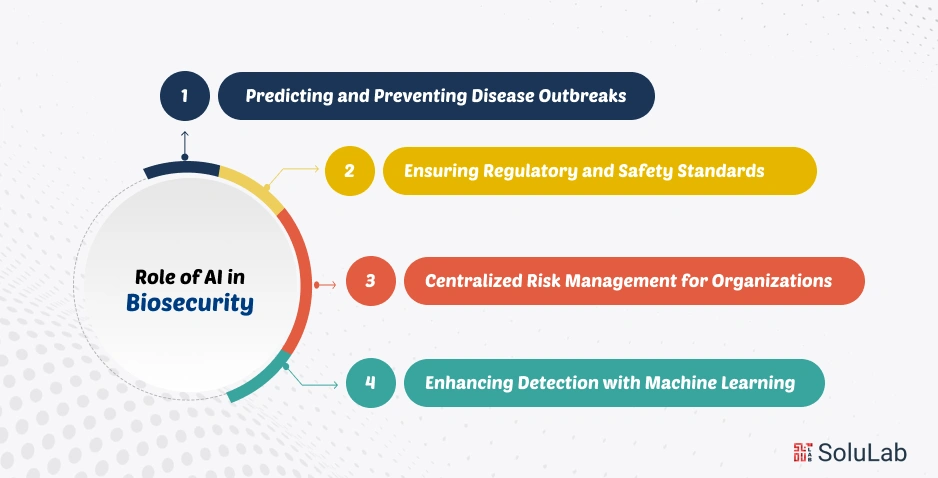

Role of AI in Biosecurity

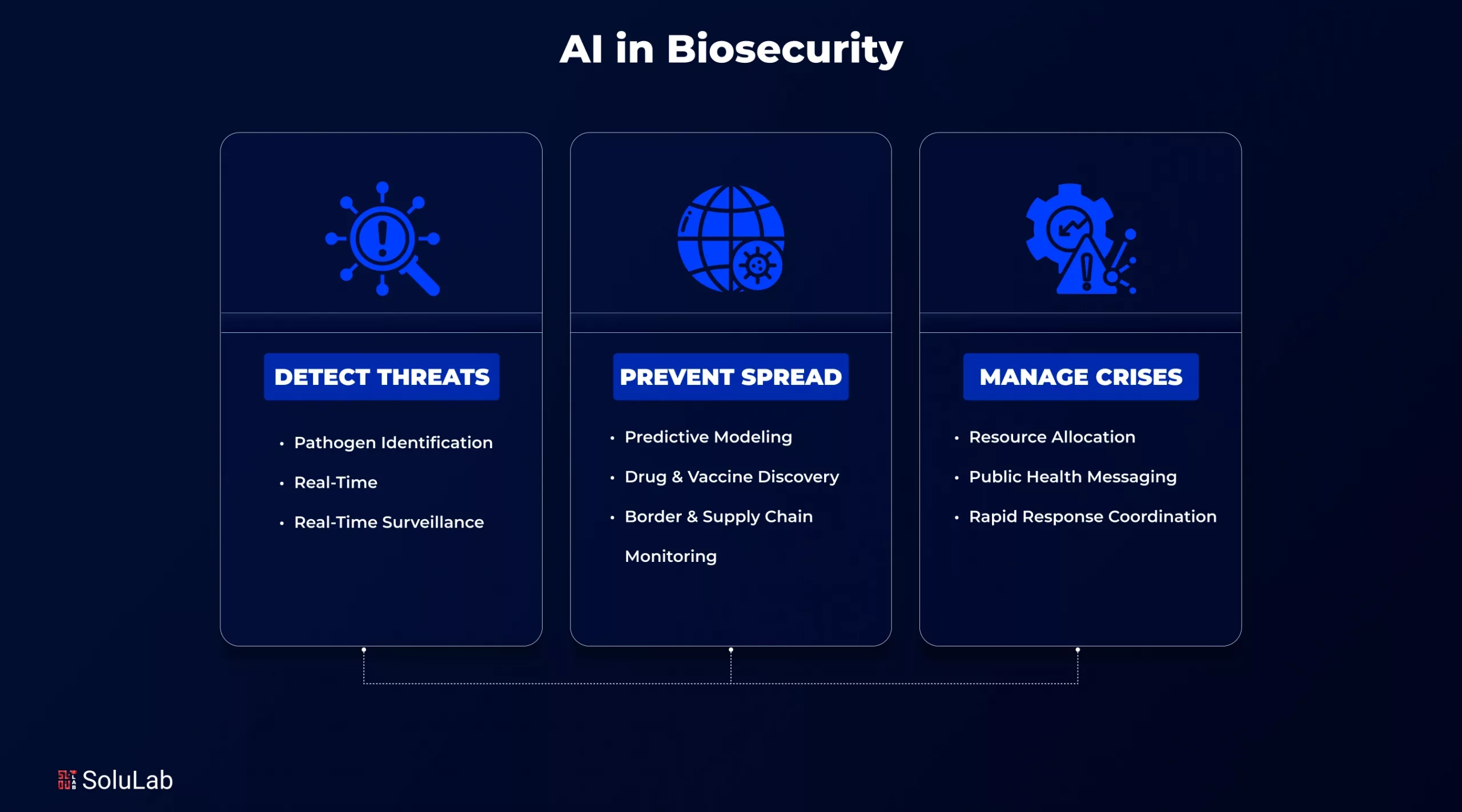

Artificial Intelligence is changing how we protect human, animal, and environmental health. From early threat detection to risk management, AI-driven innovations are reshaping the future of global biosecurity systems.

1. Predicting and Preventing Disease Outbreaks: With AI in healthcare solutions, health agencies can analyze massive datasets to predict outbreaks before they spread. These AI-powered biosecurity tools identify infection patterns, enabling faster containment and proactive response to emerging biological threats.

2. Ensuring Regulatory and Safety Standards: Biosecurity compliance AI tools help organizations automatically monitor and meet safety regulations. They assist in detecting AI content related to policy gaps, managing documentation, and ensuring that labs or enterprises follow required biosecurity protocols without manual errors.

3. Centralized Risk Management for Organizations: An enterprise biosecurity platform AI integrates multiple safety functions, disease tracking, data management, and emergency response into one system. This helps institutions improve coordination and make quick, data-driven biosecurity decisions.

4. Enhancing Detection with Machine Learning: A machine learning biosecurity system continuously learns from new data to identify unusual patterns, detect biological threats, and improve decision-making accuracy, making biosecurity faster, smarter, and more reliable.

Top Benefits of AI-Powered Biosecurity Systems

Artificial Intelligence (AI) is transforming the field of biosecurity by improving how we detect, monitor, and respond to biological threats, ensuring faster, smarter, and more efficient protection systems globally.

- Faster Threat Detection and Response Time: AI-powered tools can quickly analyze large biological datasets to detect unusual patterns or potential threats. This enables early warning alerts and rapid containment actions, reducing the spread of infectious diseases or bioterror risks.

- Improved Accuracy: AI enhances accuracy by minimizing human error in identifying biohazards. Through real-time data analysis, it supports better predictions, informed decision-making, and precise identification of pathogens and emerging biological threats.

- Cost-Effective Monitoring and Risk Management: Using AI automates repetitive monitoring tasks, cutting down on labor and operational expenses. With integrated device security, it also provides continuous, protected surveillance, helping governments and organizations manage risks more efficiently while saving both time and resources.

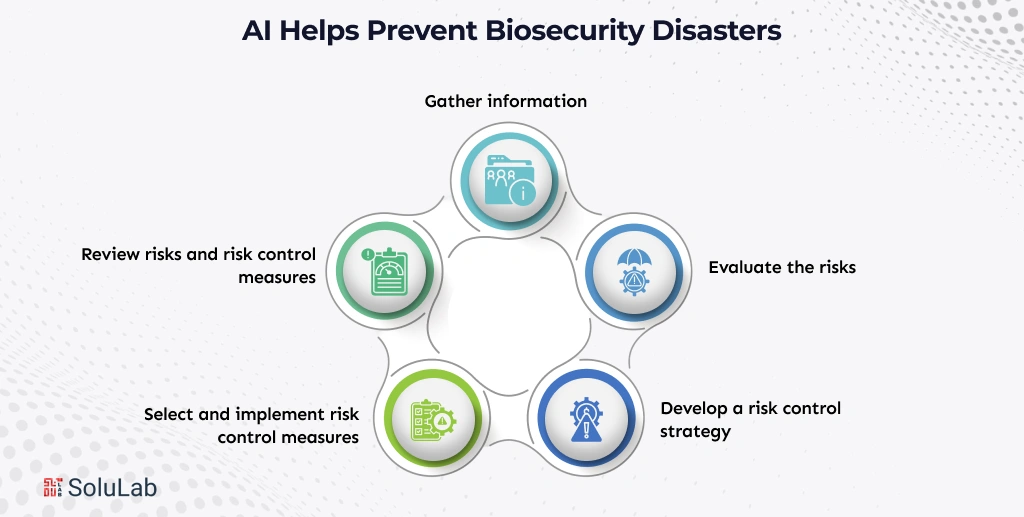

How Can AI Help Prevent Biosecurity Disasters?

AI models are transforming biosecurity by offering faster detection, smarter analysis, and automated responses. It helps identify potential threats early, prevent disease outbreaks, and strengthen global health defense systems.

1. Early Detection and Prediction of Disease

AI analyzes massive health and environmental data to spot unusual patterns that may signal an outbreak. Predictive analytics models forecast potential disease spread, enabling authorities to take timely preventive measures.

2. Pathogen Surveillance and Analysis

AI tools can rapidly analyze pathogen genomes, identify mutations, and predict their behavior. This helps scientists track infectious agents in real time and develop effective vaccines or countermeasures faster.

3. Automation in Biohazard Detection

AI-driven robots and sensors can detect hazardous biological materials automatically. This reduces human exposure, speeds up containment, and ensures safer and more efficient biohazard management.

4. Laboratory and Research Safety with AI

AI monitors lab equipment, chemical reactions, and biosafety protocols in real time. It alerts researchers about potential safety risks, helping maintain secure lab environments and prevent accidents.

5. AI in Wildlife and Agricultural Biosecurity

AI helps track animal health and crop conditions using drones, sensors, and image analysis. Early detection of infections or pests prevents large-scale agricultural losses and protects food security.

Real-World Examples of AI in Biosecurity

AI-powered tools are changing biosecurity by enabling faster detection, monitoring, and response to identify threats, showing AI use cases that span agriculture, public health, and defense.

1. Pest and invasive species detection in agriculture

In Australia, authorities deployed a mobile app using image recognition to identify the invasive stink bug species at ports and borders. This is a clear example of a biological threat detection service AI being used for border-biosecurity work.

2. Monitoring of Hives for Varroa Mites Pests

In Australia, a system of AI-enabled “sentry hives” monitors honey-bee health and detects the varroa mite threat at borders. Here, the AI applications integrate camera data and analytics to provide early warning of pest incursions, protecting an important ecological and agricultural sector.

3. AI in Defense and Biosecurity

AI in the defense sector plays a vital role in identifying bioweapon threats and securing national borders. It helps defense agencies analyze biological samples and develop rapid-response measures against potential bio-attacks.

The Future of AI in Biosecurity

AI is shaping the future of biosecurity by making disease detection faster, monitoring systems smarter, and global responses more coordinated. It’s revolutionizing how we prevent, predict, and manage biological risks.

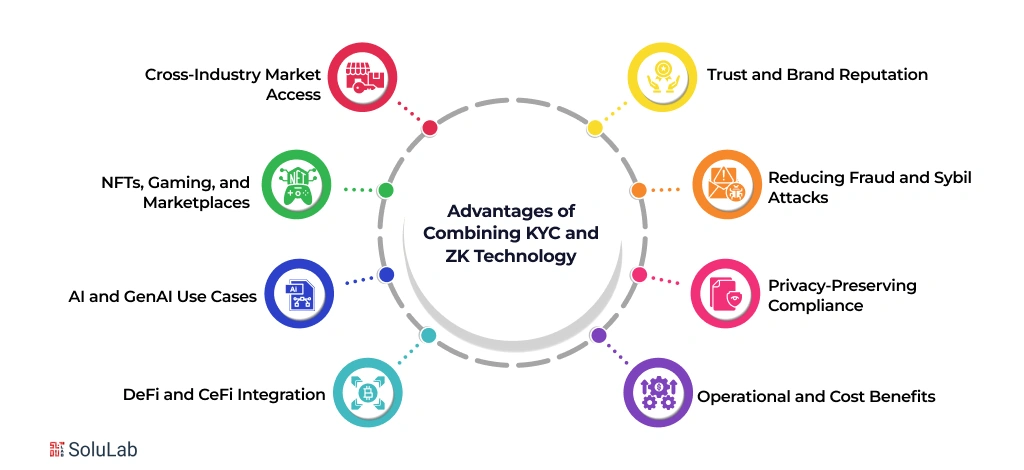

1. Integration with Blockchain and IoT for Secure Monitoring: Combining AI in Blockchain and IoT ensures transparent, tamper-proof, and real-time tracking of biological data. This integration improves accuracy, enhances accountability, and strengthens security in monitoring global bio-threats effectively.

2. Predictive Modeling for Future Bio-Threats: AI-driven predictive models analyze huge datasets to identify early signs of potential outbreaks. Recognizing risk patterns enables authorities to act before threats escalate, thereby reducing damage and saving countless lives.

3. Policy and Collaboration for Safer AI Deployment: To ensure the ethical and safe use of AI, governments, scientists, and organizations must collaborate on developing strong policies and global frameworks. This ensures AI benefits biosecurity without risking misuse or data privacy.

Conclusion

AI helps save time and lives by making data-driven decisions faster since early disease surveillance is possible, and automated threat identification can be facilitated. With AI consulting solutions, organizations and governments can now strengthen disease surveillance, enhance lab safety, and ensure rapid response to biological risks.

Its predictive features allow detecting possible outbreaks before they rise, and machine learning also contributes to being more precise in response and the distribution of resources. The alignment of technology, policy, and science will be important as countries enhance their biological threat detection service with AI.

SoluLab, a top AI development company in USA, can help your business build smart solutions that detect, prevent, and manage biological threats efficiently. Get in touch with us today!

FAQs

1. What role does machine learning play in biosecurity?

Machine learning models continuously learn from new data to improve prediction accuracy, making biosecurity systems smarter and more reliable over time.

2. How are AI-based biological design tools used in biosecurity?

These tools help scientists safely design vaccines and analyze pathogen genomes while ensuring bioethical standards and preventing misuse in research.

3. How does AI help in public health monitoring?

AI models track symptoms, test results, and online search patterns to detect possible disease clusters and alert health agencies in real time.

4. Can AI replace human experts in biosecurity?

No, AI complements human expertise by providing data-driven insights; experts still make critical ethical and strategic decisions.

5. What are AI-powered synthetic biology tools?

These tools use AI to engineer biological systems responsibly, helping develop treatments, biofuels, or safe microorganisms while monitoring potential misuse risks.