Bitcoin became the initial cryptocurrency on the market. Nowadays, there are numerous cryptocurrencies and several million cryptocurrency owners.

The cryptocurrency industry is expected to have 107.30 million individuals by 2025, with a user retention rate of 7.41% in 2024 and increasing to 7.35% by 2025. This market’s average earnings per user is estimated to reach $61.5 in 2024.

Most people’s initial step in cryptocurrency trading is to select a trustworthy crypto exchange that will provide a safe, reliable platform for their transactions. Several exchanges are privately owned and run, and clever entrepreneurs are capitalizing on possibilities in the crypto sector to launch their own exchanges.

If you’re considering entering this booming market, knowing how to build a crypto exchange is the first step toward success. Creating a seamless, secure, and user-friendly platform requires careful planning, the right technology, and a deep understanding of market needs.

Whether you’re looking to build a cryptocurrency exchange website from scratch or use a white-label solution, this guide will walk you through the essential steps to get started and grow your crypto exchange business.

What is a Cryptocurrency Exchange & How Does It Work?

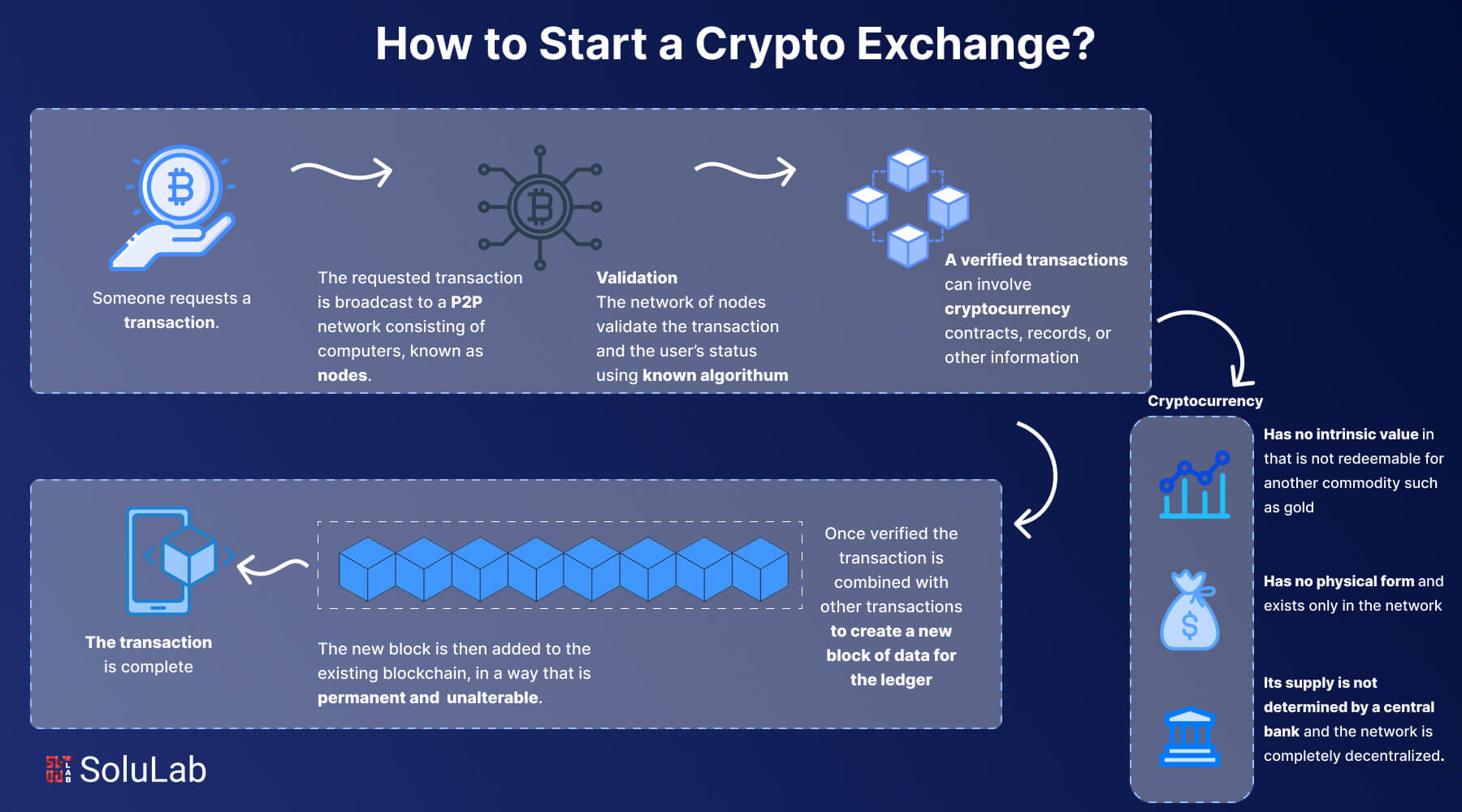

A cryptocurrency exchange is a platform where cryptocurrency holders can exchange their digital assets for other forms of assets. These exchanges serve as intermediaries for individuals seeking to buy or sell cryptocurrencies.

Once users create an account on a cryptocurrency exchange, they can trade a variety of cryptocurrencies such as Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), and many more.

There are two types of exchanges:

1. Fiat-to-crypto exchanges: This allows users to trade traditional currencies for cryptocurrencies and vice versa.

2. Crypto-to-crypto exchanges: It enables users to exchange one cryptocurrency for another.

Popular crypto exchanges include Binance, Coinbase, FTX, Kraken, and KuCoin.

Each exchange varies in terms of the number of supported cryptocurrencies and the services they offer. Some platforms restrict users from transferring cryptocurrency to external wallets, while others allow users full control over moving their assets.

If you are interested in entering the cryptocurrency space, you could even start your cryptocurrency exchange, providing a valuable service for users in this growing industry.

The image below provides a visual representation of how cryptocurrency exchanges function.

Why Create a Cryptocurrency Exchange?

Cryptocurrency is a multibillion-dollar, quickly developing industry. The present moment might be an excellent opportunity to enter the sector and capitalize on it. Because numbers speak louder than words, let’s look at some intriguing industry data.

- The worldwide cryptocurrency market capitalization is now $2.28 trillion, up 0.94% in the previous 24 hours and 105.19% from a year ago. As of now, Bitcoin’s (BTC) market capitalization is $1.25 trillion, reflecting a 54.92% domination.

- Binance was among the world’s major cryptocurrency exchangers in 2025, with a daily trading volume of $19.38 billion.

- With an average daily volume of trade of $11.05, Binance is the second most popular exchange, followed by FutureX Pro, which has a $4.33 billion trading volume.

- Binance recorded 2.27 trillion in sales in 2024, which is a 37.3% increase thus far this year.

- More than 560 million people worldwide owned or utilized cryptocurrencies in 2025.

- The size of the global blockchain technology market increased at a compound annual growth rate (CAGR) of 52.8% from 2024 to 2032, from USD 27.84 billion to USD 825.93 billion.

The market for cryptocurrencies is still expanding and shows no signs of slowing down anytime soon. For this reason, a lot of companies are considering developing cryptocurrency exchanges in an attempt to become the next Binance or Coinbase.

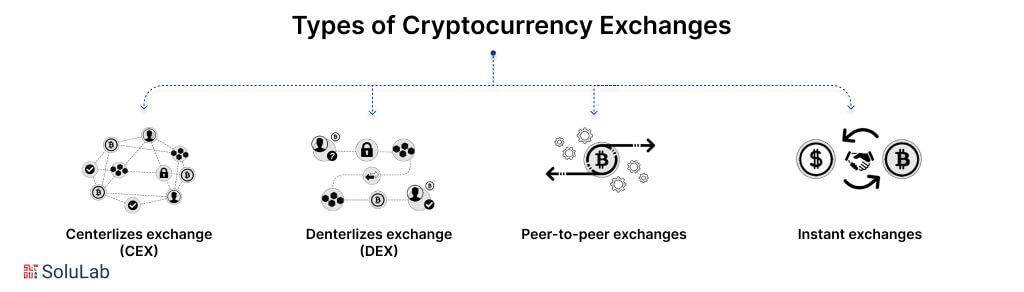

Types of Cryptocurrency Exchanges

There are four main types of cryptocurrency exchanges:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Peer-to-Peer (P2P) Exchanges

- Instant Exchanges

Each type comes with its own set of advantages and disadvantages. Below, we’ll dive deeper into each type to help you better understand how to start your cryptocurrency exchange.

1. Centralized Exchanges (CEX)

Centralized exchanges act as intermediaries between buyers and sellers, making them the most popular type of cryptocurrency exchange. These exchanges are also known as custodian exchanges because they store customers’ digital assets. Users can trade cryptocurrencies for other crypto assets or fiat currencies.

As intermediaries, centralized exchanges charge a trading fee ranging from 0.1% to 8%, offering a secure platform for users to store and trade cryptocurrencies. Some of the most popular centralized exchanges include Coinbase, Binance, and Kraken.

Advantages:

- User-friendly

- Feature-rich with multiple trading options

- Can handle millions of transactions per second

Disadvantages:

- Weaker security against hacks

- Users must keep their assets on the platform

- Trading fees can go as high as 8% (which is unfavorable for users but profitable for exchange operators)

If you’re considering entering the market, you can launch a cryptocurrency exchange of this type, as it remains the most widely used model.

2. Decentralized Exchanges (DEX)

Decentralized exchanges (DEXs) are non-custodial, meaning they don’t store user funds. Instead, transactions occur directly between users’ wallets via the blockchain, without the involvement of a third-party entity.

Although less popular than CEXs, DEXs provide lower trading volumes and liquidity. Some well-known DEX platforms are PancakeSwap, Binance DEX, and Uniswap.

Advantages:

- Quick registration and verification for new users

- Low fees (up to 0.25%), beneficial for users but less profitable for exchange operators

- Users retain control of their assets, reducing the risk of losing funds

Disadvantages:

- No third-party oversight

- Difficulties with chargebacks via PayPal or bank cards

- Users must wait for counterparties to be ready for transactions

When choosing a model, starting a DEX can be a good choice if you want to offer users more control over their assets.

3. Peer-to-Peer (P2P) Crypto Exchanges

P2P exchanges operate similarly to DEXs, providing the necessary infrastructure for users to trade directly with each other. However, unlike DEXs, P2P exchanges use an escrow service to ensure transactions are completed as agreed.

Best P2P crypto exchanges are especially popular in regions where crypto exchanges are banned, like parts of Africa. Examples include LocalBitcoins and Paxful.

Advantages:

- Beginner-friendly, offering only buy and sell options

- Buyers do not incur fees for deposits, exchanges, or withdrawals

- Seller ratings ensure greater safety

Disadvantages:

- Trades can take longer to process

- Possibility of sending funds to the wrong user

- Disputing transactions is difficult

If you opt to start your cryptocurrency exchange of this type, you can monetize it by charging a percentage of every completed transaction.

4. Instant Exchanges

Instant exchanges are swap services that allow users to quickly exchange one cryptocurrency for another. Unlike custodial platforms, instant exchanges don’t store customer funds, making the transaction process faster.

Some well-known instant exchanges are Letsexchange, Changelly, FixedFloat, and SwapZone.

Advantages:

- Fastest transaction speeds

- Support for large-volume trades

- No responsibility for managing stored assets

Disadvantages:

- Refunds can be complicated

- More complex to navigate for beginners

By using white-label crypto exchange solutions, you can quickly build an instant exchange and offer users a fast and efficient service.

As you can see, there are various types of cryptocurrency exchanges. Whether you choose to start your cryptocurrency exchange or launch a cryptocurrency exchange using white-label crypto exchange solutions, each model offers unique opportunities to meet the needs of a growing market.

How to Start a Cryptocurrency Exchange?

For those looking to start a cryptocurrency exchange business, there are two main paths to consider for decentralized crypto exchanges: using a white-label crypto exchange solution or building a crypto exchange from scratch.

A. White Label Cryptocurrency Exchange Development Solution

White-label crypto exchange solutions provide all the essential components needed to build a cryptocurrency exchange website. These include a trading engine, user interface, liquidity integration, wallet, and admin panel. Essentially, it offers a pre-built framework to help you get your exchange up and running quickly.

Advantages of using a white-label solution:

- Faster time to market: You can launch your exchange much more quickly compared to developing everything from scratch.

- Lower cryptocurrency exchange development cost: This option is generally more cost-effective as it avoids the need for custom development.

- Immediate access to basic features: The platform comes with essential functionalities pre-configured, enabling you to start the business sooner.

Disadvantages of using a white-label solution:

- Dependence on a third-party provider: Your exchange will rely on the provider, and if they stop supporting the software, your platform could be affected.

- Limited customization options: Since the solution is pre-built, you have limited flexibility in tailoring features to your exact needs.

- Challenges with scaling: Scaling your platform to accommodate future growth may be difficult.

- Potential security risks: Using third-party software can introduce vulnerabilities, increasing the risk of security issues.

Although white-label solutions offer a quick and cost-effective route to start a cryptocurrency exchange business, they come with potential risks related to long-term reliability and scalability.

B. Custom Cryptocurrency Exchange Development

Developing a cryptocurrency exchange from the ground up allows you to create every component of the platform, such as the trading engine, wallet, admin panel, and user interface.

Advantages of custom development:

- No third-party reliance: You have full control over every aspect of the platform without depending on external providers.

- Unlimited customization possibilities: You can tailor your exchange to meet specific needs and preferences, from the design to the features.

- Scalability: You can build the platform to grow with your business, ensuring it can handle increasing transaction volumes.

- Unique UX/UI design: Custom development allows you to create a unique user experience that stands out from competitors.

Disadvantages of custom development:

- Longer time to market: Building everything from scratch will take more time than using a ready-made solution.

- Higher development costs: Custom development is generally more expensive due to the complexity and resources required.

While custom development takes longer and is more costly, it offers the best way to start a crypto exchange if you’re looking for complete control, scalability, and the ability to build a platform tailored to your unique business vision.

A Step-by-Step Guide on How to Start a Cryptocurrency Exchange

To create a cryptocurrency exchange, follow these essential steps to successfully build and launch your platform.

Step 1: Choose Which Countries to Operate In

When planning your crypto exchange development, consider where you want to operate. Starting in your own country is a good option, as it’s easier to understand local regulations regarding cryptocurrency exchanges. You can then plan to expand into other countries as your cryptocurrency exchange business plan progresses. Expanding globally involves adhering to local laws, supporting multiple fiat currencies, and partnering with different banks. Starting in several countries at once is possible if you have the financial resources and time.

Step 2: Define Your Target Audience

Once you’ve chosen where your platform will operate, the next step is to define your target audience. Knowing your customers is crucial for your success. Research the market, explore cryptocurrency forums, and social media groups where crypto traders engage. Find out what features they expect from a crypto exchange development project and what gaps exist in the current market. This could help you cater to users looking for features like interest-earning options or access to rare altcoins.

Step 3: Adhere to Legal Requirements & Obtain a Crypto Trading License

Understanding and following legal regulations is a critical step before you create a crypto exchange platform. Each country has its own set of laws surrounding cryptocurrencies and exchange operations. Hire a legal team to help navigate these rules. If a crypto trading license is required in your target country, make sure to secure it before proceeding with the development.

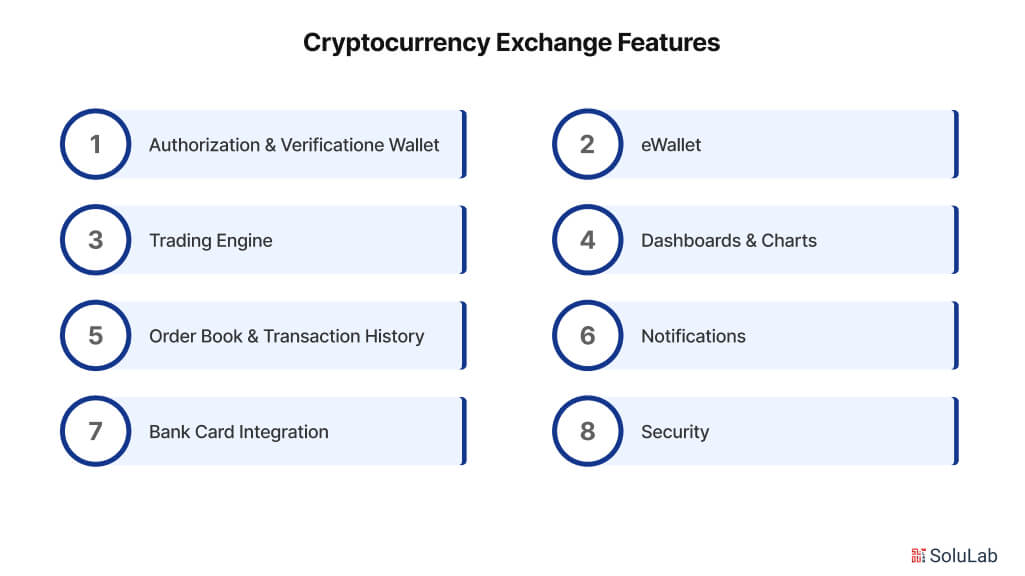

Step 4: Choose Cryptocurrency Exchange Features

Before you begin your cryptocurrency exchange development, decide on the features you want to include in your platform. A clear feature list ensures you won’t miss any critical functionalities later on. Some must-have features include:

- Authorization & Verification: Implement secure login methods such as Single Sign-On (SSO), Multi-Factor Authentication (MFA), and biometric authentication to ensure transparency and security.

- eWallet: If you’re building a centralized exchange, provide users with a built-in eWallet to store, manage, and convert cryptocurrency into fiat.

- Trading Engine: This is the core of any exchange, handling all operations from matching orders to processing real-time prices.

- Dashboards & Charts: Offer users visual tools to track price histories and real-time cryptocurrency rates.

- Order Book & Transaction History: These features allow users to view open orders and track completed transactions.

- Notifications: Set up customizable push notifications to keep users informed about key updates like price changes or new listings.

- Bank Card Integration: For crypto-to-fiat services, ensure your platform supports credit card transactions.

- Security: Implement robust security protocols, including encryption, secure authentication, and regular audits, to protect your platform from cyber threats.

These features form the foundation of a strong cryptocurrency exchange business plan.

Step 5: Find a Cryptocurrency Exchange Development Company

If you lack the technical skills to build a top decentralized crypto exchange or a centralized one, you’ll need to hire a development company. Platforms like Clutch and GoodFirms can help you find reputable companies with experience in cryptocurrency exchange projects. Look for vendors with strong portfolios, positive reviews, and expertise in the cryptocurrency field. Don’t be tempted to go with the cheapest option; it may result in poor quality and higher long-term costs.

Step 6: Design a Cryptocurrency Exchange Platform

Design is crucial when you create a cryptocurrency exchange. Your platform needs to be user-friendly to attract both experienced traders and beginners. Focus on clear navigation, smooth onboarding processes, and easy-to-understand interfaces. A good design ensures users can quickly understand how to use the platform, minimizing friction and confusion.

Step 7: Start Cryptocurrency Exchange Development

The crypto exchange development process involves choosing the right architecture, technology stack, and APIs. When considering platform architecture, you can choose between monolithic, microservices, and distributed systems. A microservices architecture provides better scalability, while a distributed architecture is ideal for cloud-based platforms with high user volumes.

For the technology stack, popular programming languages include Swift, Kotlin, Java for mobile, and Java, PHP, and Laravel for web platforms. Databases like MongoDB and MySQL are commonly used, while cloud services such as AWS and Google Cloud Platform provide the infrastructure. Integrate APIs like Binance API, CoinBase API, and Coin Market Cap API for essential crypto market data.

Step 8: Launch & Promote Your Cryptocurrency Exchange

After you launch a cryptocurrency exchange, the next phase is promoting it. Begin your marketing efforts early by building a community on social media platforms like Twitter and Reddit. You can also partner with influencers to raise awareness about your exchange. Collaboration with crypto-related services and communities, as well as media outreach, can further establish your brand. To retain users, ensure your platform provides high security, transparency, a wide selection of coins, and excellent customer support.

By gathering user feedback, you’ll continuously improve the platform and address the needs of your target audience. Whether you’re launching a centralized or decentralized exchange, delivering a high-quality product with reliable features is key to success in the cryptocurrency industry.

Following these steps will guide you through how to start a decentralized exchange or a centralized platform, enabling you to launch a secure, user-friendly, and scalable cryptocurrency exchange.

How Much Does it Cost to Start a Crypto Exchange?

The average cost to launch a cryptocurrency exchange typically ranges from $130,000 to $200,000. The development timeline usually spans between 6 to 9 months, depending on the complexity and scope of the project.

Several factors influence the final cost and timeline, such as the type of platform you are building, the features you want to implement, the number of APIs and integrations, and so on. Below is a breakdown of how various stages impact the overall cost of building a decentralized crypto exchange or a centralized one:

| Stage | Cost |

| Design | $5,000 – $10,000 |

| Development | $40,000 – $50,000 |

| API Integration | $50,000 – $80,000 |

| Blockchain | $10,000 – $15,000 |

| Testing | $25,000 – $30,000 |

| Total Cost | $130,000 – $185,000 |

The figures above provide an approximate estimate. The actual cost will depend on the specific requirements of your project. To get a more detailed estimate, reach out to professionals for a tailored cost breakdown.

If you’re looking to build a cryptocurrency exchange website, whether it’s a centralized or decentralized crypto exchange, you’ll need a solid cryptocurrency exchange business plan. The plan should outline every feature, integration, and API necessary to build your platform.

For those wondering how much it costs to start a crypto exchange, a major factor is whether you’re using white-label crypto exchange solutions or custom development. A white-label crypto exchange solution can offer a quicker and more cost-effective way to get started, while custom development offers more flexibility.

Knowing the best way to start a crypto exchange involves carefully planning your platform’s design, architecture, and feature set. Whether you choose to start a cryptocurrency exchange business from scratch or opt for how to start a decentralized exchange, having clear goals and a detailed strategy is essential to success.

How SoluLab Can Help Start a Crypto Exchange?

At SoluLab, we specialize in helping businesses start a cryptocurrency exchange with a tailored approach to meet your specific needs. Whether you’re looking to build a decentralized crypto exchange or a centralized platform, our team of experts guides you through the entire development process. We offer comprehensive services, from initial concept development and platform design to API integrations, blockchain setup, and security protocols. With our vast experience in crypto exchange development, we ensure your platform is scalable, secure, and ready to meet the demands of the evolving cryptocurrency market.

SoluLab a P2P crypto exchange development company recently launched a crypto borrowing and lending platform, Borrowland, transforming the traditional lending landscape with blockchain technology. The accounting platform with crypto assets allows users to easily borrow, lend, swap, deposit, and transfer crypto assets while earning daily interest. By integrating third-party solutions like Persona for instant KYC verification and BitGo for secure transactions, SoluLab also implemented features to reduce gas fees, automate interest transactions, and introduce a referral system to expand the user base. With innovative solutions like currency swapping and loan liquidation safeguards, Borrowland delivers a seamless, secure, and efficient user experience.

At SoluLab, we provide both white-label crypto exchange solutions and custom development options to cater to different business models. By choosing SoluLab, you benefit from our expertise in cutting-edge blockchain technology, fast time-to-market, and robust platform architecture. Ready to take the next step and launch a cryptocurrency exchange? Contact us today to discuss your project and let us help you bring your vision to life.

FAQs

1. What are the basic steps to start a crypto exchange?

To start a crypto exchange, you need to choose your target countries, define your audience, secure a crypto trading license, decide on the platform features, hire a development company, and design and launch your platform.

2. How much does it cost to start a crypto exchange?

The cost typically ranges from $130,000 to $200,000, depending on platform features, integrations, and security needs. Development can take 6 to 9 months.

3. Should I choose a white-label crypto exchange solution or custom development?

White-label solutions offer faster, cheaper setups but with limited customization. Custom development takes longer and costs more but gives you complete control over features and scalability.

4. How do I ensure the security of my crypto exchange platform?

Implement encryption, multi-factor authentication, and regular audits. Use trusted third-party security providers like BitGo and consider using cold storage for added asset protection.

5. What are the key features to include in a crypto exchange?

Essential features include secure user authentication, a built-in eWallet, a trading engine, real-time dashboards, order books, and notifications. Consider adding credit card support and referral programs to enhance user experience.