Artificial intelligence (AI) is becoming a vital component of our daily lives, which was previously considered technology. With their capabilities of increasing efficiency at work, AI-powered personal assistants transform technological development within our individual lives by attending to our entertainment, health, and well-being requirements. Google Assistants, Alexa, and Siri are the top examples of voice-activated assistants easily incorporated into our daily routines from the minute we get up until we go to bed. They can deliver timely weather updates, recommend the best routes for avoiding getting stuck in traffic, and provide company to people who are feeling lonely.

Globally, 4.2 billion digital voice assistants were used in 2020; now, according to Statista, there will be around 8.4 billion digital voice assistants worldwide in 2024.

Virtual AI assistants are changing the way we think about help and support in our everyday lives, not just about organizing duties. More than merely a desire is required to launch a personal virtual assistant firm; you also need a deep grasp of human needs, an unshakeable commitment, and an uncompromising drive for creativity. It involves developing solutions that are not only beneficial but also radically transformational. Think of it as providing customized solutions to make each client feel extremely appreciated and supported.

What are On-Device Personal Assistants?

On-device personal assistants, sometimes also known as intelligent personal assistants, are complex software programs created to help users with a range of tasks using artificial intelligence (AI) and natural language processing (NLP). These assistants include Google Assistant, Amazon Alexa, and Apple’s Siri; they are built into gadgets like wearables, smart speakers, and smartphones and allow users to communicate with them via text input or voice commands. Here are the key features of device-based AI assistants:

- Natural Language Understanding: This capability allows for more intuitive interactions by understanding and interpreting user commands and queries in natural language.

- Generative Capabilities: The assistant can deliver appropriately suited and personalized information by dynamically generating human-like responses.

- Context Awareness: This is maintaining contextual awareness across several exchanges, allowing for more thoughtful and pertinent answers based on current discussions.

- Task Automation: It is the execution of a range of tasks, from straightforward commands to more intricate and situation-specific actions, in response to user requests.

- Conversational Flow: Improving the flow of a discussion by comprehending the context, staying coherent, and avoiding rambling or repetitive answers helps create a more organic contact experience.

The Need for Personal Assistants

Significant investments in modern conventional AI are made by big tech firms such as Google, Apple, Amazon, and Microsoft. Intelligent assistants have become increasingly popular over the past ten years. A culture of inquiry and invention has been fostered by the widespread trend of technological change that many businesses have experienced in recent years, which is reflected in the development surge. Businesses are increasingly examining their operations and investigating how data might improve efficiency and results become more widely available.

AI agents can now comprehend and react to user interactions with more context and nuance because of the combination of strong algorithms and large datasets. People’s interactions with technology are changing, and these assistants may now be easily incorporated into many aspects of daily life. Here are the reasons that caused the rise and need for autonomous voice assistants:

1. Technological Investment

The development of advanced AI application solutions with the ability to process and understand natural language has been accelerated by the substantial financial investment made by tech titans. As a result of this investment, personal assistants are now more responsive and intelligent.

2. Cultural Shift

Over the last ten years, corporate culture has changed to embrace digital solutions. Businesses are now more inclined to challenge conventional wisdom and look into novel approaches for using data to boost productivity.

3. Improved Client Interaction

Voice-activated assistants are made to communicate with users in a way that is more akin to that of a human. They can carry out difficult jobs, like locating appropriate locations for events or coming up with original answers to problems at work, simulating group collaboration sessions.

4. Personalization

These assistants can provide insightful suggestions based on each user’s tastes and requirements as they gain knowledge from user interactions. They are comparable to employing offline personal assistants who are aware of one’s goals and way of life because of this degree of customization.

5. Daily Life Integration

A move toward a more automated lifestyle is shown by the smooth incorporation of On-Device AI capabilities. By streamlining intricate procedures, these aides improve user experience in addition to increasing productivity.

Top 5 Leading Personal Assistants

The top five AI-Powered Personal Assistants are listed below, each having special features and functionalities that improve the user experience:

-

Apple Siri

Built into Apple products, Siri provides iOS and MacOS users with voice-activated support. Among the many things it can do is make calls, send messages, and create reminders. Additionally, Siri easily connects with Apple’s ecosystem, giving consumers access to customized recommendations according to usage habits and the ability to operate smart home gadgets through HomeKit.

-

Google Assistant

This multi-platform and Android-enabled tool is excellent at managing tasks and retrieving information. It can be used to manage schedules, navigate directions, and check the weather, among other tasks. It is especially effective because it comprehends context, for example, it can offer follow-up responses depending on earlier queries. Google Assistant is a flexible tool for daily chores because it can operate compatible devices and integrate with smart homes.

-

Amazon Alexa

Known for its vast skill set and smart home features, Alexa can be found on Amazon Echo along with other Alexa-enabled devices. Alexa can be used to play music, manage smart home appliances, and access countless third-party skills that increase its capabilities. Alexa is a popular option for home automation because of its speech recognition feature, which enables hands-free interaction.

-

Microsoft Cortana

Initially included in Windows devices, it offers voice-activated support with an emphasis on productivity tools. Despite Microsoft’s shift in focus away from consumer-focused apps, Cortana is still useful in business settings since it helps users organize meetings, manage projects, and interact with Microsoft Office.

-

Samsung Bixby

This feature, which is available on Samsung gadgets and smartphones, provides voice commands and user-specific recommendations. From capturing pictures to controlling device settings, it is made to help with several activities. The distinctive aspect of Bixby is its capacity for contextual understanding through visual recognition.

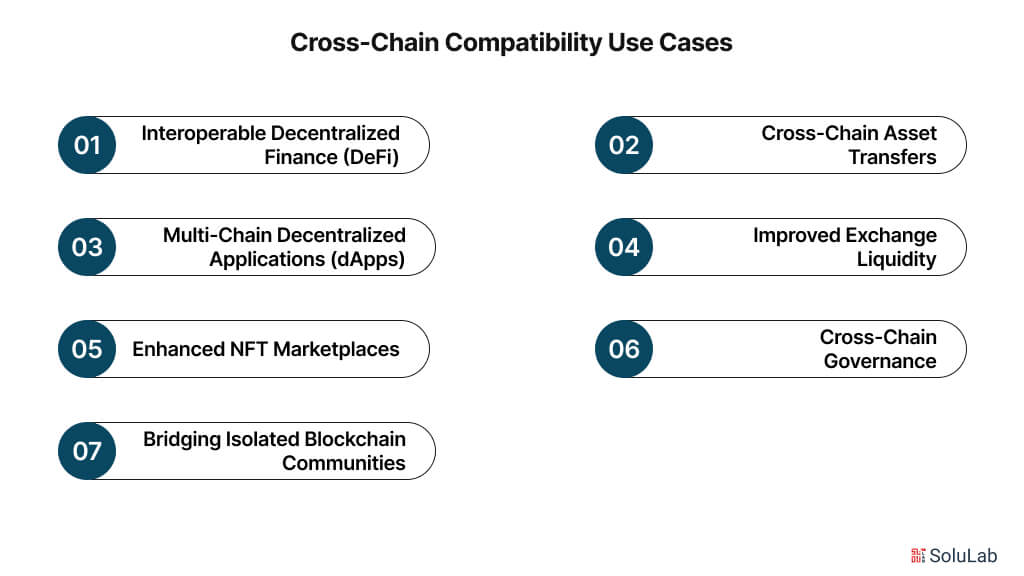

Industries Using Personal Assistants

Both at home and workplace, these personal assistants have limitless AI use cases and applications. The following examples demonstrate the wide range of use cases:

1. Medical Care

Generative AI Chatbots are helping medical assistants make more accurate and efficient decisions by producing comprehensive patient summaries according to electronic health records. Individualized medical advice and medication schedule reminders can be given to patients. For example, by setting up appointments, responding to frequently asked questions by patients, and supplying vital health information. They improve the effectiveness of healthcare by increasing patient participation, automating duties, and ensuring timely vaccine reminders.

2. Education

Generative AI digital assistants can function as virtual instructors in the educational dynamics, creating interactive, customized learning resources based on the needs of each student. By automating administrative duties like scheduling and assignment grading, these assistants can also help teachers by freeing up more time for direct student interaction and educational tactics.

3. Customer Support

AI-Powered Chatbots in customer service are capable of handling a variety of queries and offering prompt, precise answers to often requested questions. By ensuring a smooth information transfer and elevating complicated problems to human agents, these assistants can increase customer satisfaction overall and free up human agents to handle more complex consumer needs.

4. Manufacturing

By creating proactive upkeep schedules for machines, autonomous personal assistants can optimize production processes in the manufacturing sector, decreasing downtime and increasing operational efficiency. By offering data-driven insights and real-time simulations, they can also help engineers build and improve product prototypes. For example. Without taking their focus away from their tasks, employees can utilize speech AI to raise safety concerns, manage maintenance schedules, or seek real-time inventory updates.

Related: Generative AI in Manufacturing

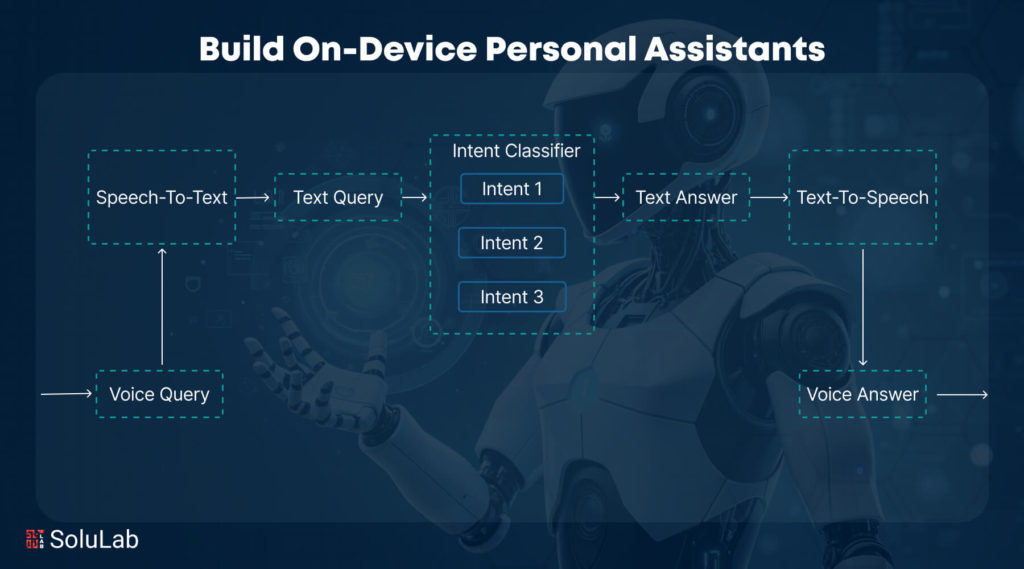

How to Build an On-Device Personal Assistant App?

The development of an AI-Powered Personal Assistant App entails several crucial procedures to guarantee its efficiency and usability. Here is your step-by-step guide on how to build an AI-powered personal assistant app:

Step 1: Writing User Narratives

Creating user stories, which give information about the services people anticipate from the virtual assistant, is the first stage. Written from the viewpoint of the end user, these narratives are informal summaries of software functionality. A user’s story’s main objective is to explain how a particular function will benefit the client. User stories, which are usually brief, describe the desired goals without going into specifics; these can be established after the development team has a consensus.

Step 2: Choosing A Programming Language

Selecting a programming language comes after the user narratives have been established. Python is frequently suggested because of its many machine learning and artificial intelligence libraries, which make it a good option for creating AI models. Python can be used by developers to build their models, and if necessary, another programming language can be used to implement them.

Step 3: Selecting Appropriate Technology Stack

The tech stack is determined by your finalized app specs, including the optional cloud platform for handling data, scalability, etc. the development platform on which your AI personal assistant app development will operate, and AI and ML tools.

Step 4: Gathering and Preparing Data

Collect high-quality data about the features of your app, such as user interaction data, NLP tracking data, and audio recordings for speech recognition. Your AI model can be enhanced with the help of this data. Label and annotate your data if necessary so that the machine learning algorithm can be trained.

Step 5: Developing and Training AI Model

Develop the fundamental AI features of your smartphone AI assistant by including machine learning, speed recognition, and natural language processing (NLP) techniques in the AI assistant’s programming. Use the prepared data to train your model, then let it comprehend user requests, react appropriately, and pick up knowledge from user interactions.

Step 6: Testing of the App

Using the chosen development framework, create the application front end with an emphasis on seamless AI functional integration. Examine the assistant thoroughly for security flaws, usability, performance, and functioning on a range of hardware and operating systems.

Step 7: Implementation

Last but not least, it is time to release your application on the Play or App Store. Keep an eye on your app and update it frequently to enhance features, address issues, and adjust to new user demands and technical developments. You may find AI-Powered Personal Assistant apps for your company with these steps.

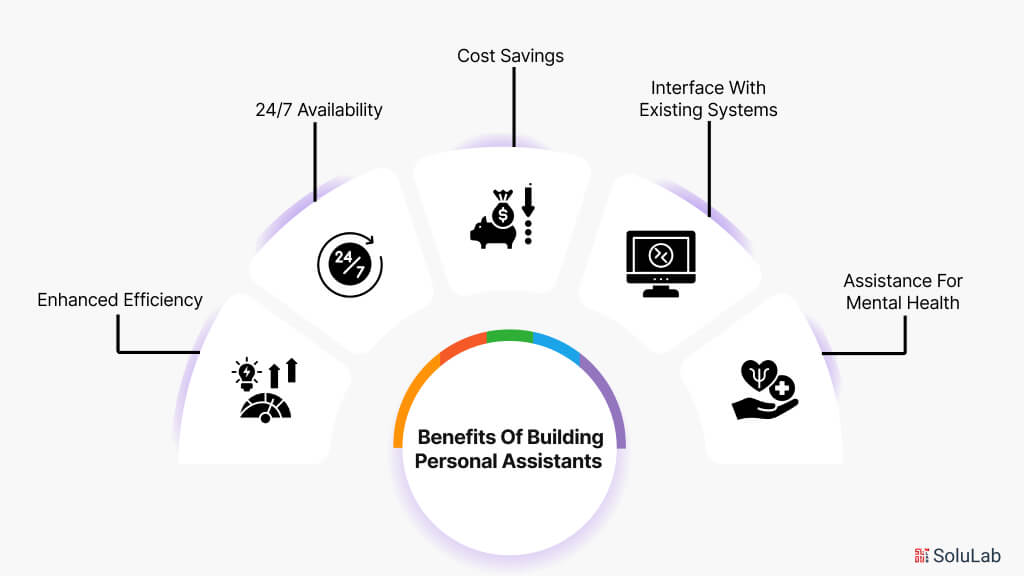

Benefits of Building Personal Assistants

There are several advantages to hiring personal assistants in a variety of industries. Here are the main benefits of building personal assistants:

-

Enhanced Efficiency

Virtual assistants automate repetitive processes like calendar management and appointment scheduling. Employee’s workload is lessened, freeing up to concentrate on more difficult tasks which boosts output.

-

24/7 Availability

Virtual assistants, in contrast to actual employees, can work around the clock and offer users prompt support wherever they need it. In the customer service sector, where prompt services can greatly increase user happiness, this is especially advantageous.

-

Cost Savings

Businesses can save labor expenses by automating processes that would normally need human involvement. There is no need for huge customer personnel because personal assistants can easily handle many requests at once.

-

Interface With Existing Systems

A lot of personnel assistants can easily link with pre-existing tools and software, such as project management software or CRM systems. Centralizing information and eliminating the requirement of manual data, this improved workflow efficiency.

-

Assistance for Mental Health

By offering coping mechanisms and resources, virtual assistants can aid in closing gaps in service accessibility. They can help people get information or make appointments without requiring face-to-face visits.

Future of Virtual Assistants in Improving Experiences?

Virtual assistants have a wide range of applications and are expected to improve services in many industries worldwide. We can predict several important trends that will influence the future of technology as it develops further.

Transparent data handling regulations are one important trend. The chatbot development company will probably put in place more transparent policies that tell users exactly how their data is gathered, processed, and shared in light of growing privacy concerns. This openness encourages confidence and gives people the ability to make wise choices. It will surely start the trend of improved emotional intelligence. It is anticipated that advanced emotional detection features will be incorporated into future virtual assistants, enabling them to better comprehend and react to user’s emotions.

Furthermore, virtual assistants will be essential in gathering and evaluating user data as companies depend more and more on data-driven insights. By using this data, businesses can better satisfy the demands of their clients by improving their offers and services. To sum up, virtual assistants have enormous potential to improve services in a variety of industries in the future by increasing customer involvement.

Can SoluLab Help in Building a Virtual Assistant Experience?

SoluLab an AI chatbot development company is in an excellent position to bring change in the virtual assistant market across several different sectors. SoluLab can build virtual assistants to enhance users’ experiences and reduce the time taken on processes by deploying newer technologies. For example, you might say that due to the COVID-19 epidemic, the mental health of different categories of the population deteriorated; a non-profit organization aimed at improving the results of mental health care recognized the need for relevant services that are as close as possible. To solve this urgent problem, the organization developed an online chatbot in collaboration with SoluLab where people could access mental health services. This serves as a real-time help function, which, when clicked, provides consumers with information about mental health. Thanks to AI, the chatbot can answer frequently asked questions regarding mental health issues, the services they offer, and various treatment options.

Contact SoluLab today to talk with us about how we may help you design a virtual assistant service that meets your specific needs and enhances your services tremendously. It will be great to brainstorm great ideas that will enable us to work hard and be happy!

FAQs

1. What is the price of an AI personal assistant?

Technically, personal virtual assistants are developed as per the needs and preferences of the owner or clients for whom it is being created. The appropriate cost of developing an AI personal assistant is around $40,000-$100,000.

2. Is there any AI assistant available for free?

One of the most proclaimed and effective AI assistants that is still free to use is Google Assistant. Its capabilities have been extended in 2024 to include improved natural talks by recalling context from earlier exchanges.

3. Does ChatGPT count as an AI assistant?

The AI language model ChatGPT was created by OpenAI. Although Microsoft’s Copilot also uses OpenAI, it was earlier designed with a less conversational AI transformer model in mind.

4. Is it safe to speak with an AI assistant openly?

You have no control over when and where your personal information is being used when it is shared with an AI chatbot. AI chatbots save the shared data on servers, which are susceptible to breaches or hacker attempts.

5. Does SoluLab promise to deliver an improved experience with AI chatbots?

Indeed, SoluLab claims that by boosting customer service, efficiency, and engagement, AI chatbots will improve user experience. In the end, their solutions seek to increase client satisfaction and loyalty by offering prompt and precise responses.

![How to Create A Crypto Trading Bot [7 easy Steps]](https://www.solulab.com/wp-content/uploads/2024/10/Crypto-Trading-Bot.jpg)