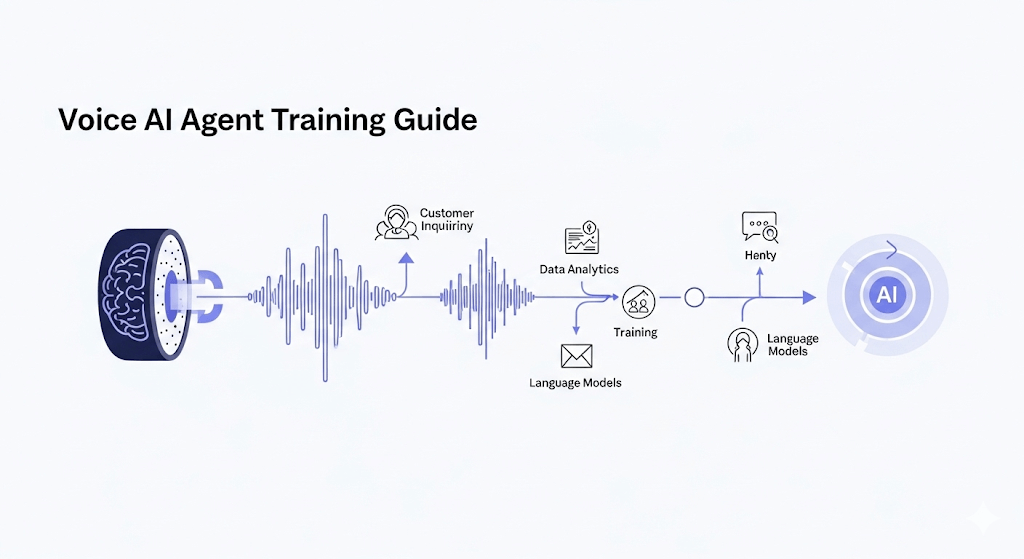

So, how do you train a voice AI agent on a voice AI platform? The idea might sound tricky, but it can be explained in a very simple way. Think of it as teaching someone a new language or showing a tourist how to get around a new city. You break it into steps, keep things clear, and make sure there’s practice along the way. This guide walks through the whole process, from planning to testing, with examples that feel easy to follow.

Knowing What a Voice AI Platform Does

A voice AI platform is software that helps create and train digital agents that can talk with people. Instead of only pressing buttons or typing messages, customers can simply speak. The agent listens, understands, and gives answers in real time. It can work in call centres, sales, or even customer service for small businesses.

The main goal is to make conversations smoother. But just like teaching someone how to read a map, the agent needs training before it can handle real customers. That’s why setup and guidance matter so much.

Starting With Clear Goals

Before you train an agent, you need to decide what you want it to do. Do you want it to answer basic questions, handle bookings, or maybe support sales calls? Having a clear goal is like knowing which city you are visiting. Without that, you could get lost.

For example, if you run a hotel, the agent might need to answer questions about check-in times or room availability. If you run a store, the agent might help with order updates or return policies. Each case will have its own plan.

Getting the Basics Ready

When you travel, you make sure you have tickets, clothes, and money. For training an AI agent, you also prepare. You need good data, examples of customer conversations, and scripts. The platform uses this information to learn.

Start with simple phrases. Customers may say “I need help with my order” or “What are your hours?” Teaching these basics first makes the agent stronger. Later, you can move on to more complex cases.

How Training Usually Works

Training a voice AI agent is like practice runs before the real trip. You speak to the agent, test responses, and correct mistakes. Over time, it becomes better.

Most platforms give you dashboards where you can enter phrases, set replies, and even test the voice output. Some also connect with CRM systems so the agent has customer details ready. That makes conversations more personal and saves time.

Choosing the Right Voice AI Platform

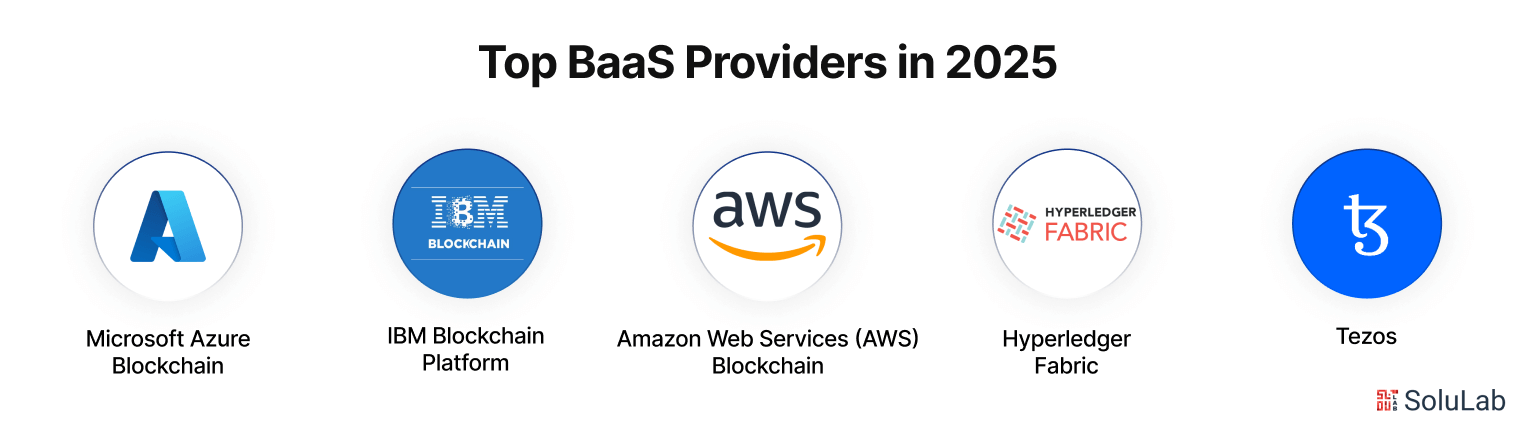

There are many platforms you can use. Plura AI, Retell.ai, and Vapi.ai are some common names. They all offer features like voice agents, CRM integration, and support for SMS or chat. The best choice depends on your goals and budget.

Plura AI is one of several platforms that offer a full suite of tools. It may support customer engagement and operational efficiency by bringing calling, SMS, and CRM together. Retell.ai focuses on flexible integration, while Vapi.ai has strong voice automation tools. Looking at them side by side helps you see what fits your business best.

Why Plura Stands Out

Even though there are many options, Plura often stands out because it combines calling, SMS, and CRM in one place. That means you don’t have to juggle multiple tools. It’s an AI contact center platform that also supports AI calling and SMS automation.

It’s not about being the only option. Instead, it’s about being one of the platforms that try to make operations smoother. That can be useful if your team wants everything in one setup.

Preparing Your Team

When you travel, you don’t just pack your own bag—you also remind others what to bring. The same goes here. Your staff should know how the agent works. They should understand that AI is here to help, not replace.

Hold short sessions to explain the software. Show them how it answers calls, how it pulls details from the CRM, and when they need to step in. The more comfortable they are, the smoother the rollout will be.

Running Pilot Tests

No one books a long vacation without trying short trips first. Pilot tests let you see how the AI agent performs. Start small, maybe with one department or a limited set of calls. Listen to recordings, check the reports, and look at customer feedback.

You may notice that some phrases confuse the AI. Adjust those scripts. You may also find that some customers prefer speaking to a human for certain issues. In that case, you set up quick transfers so they don’t wait long.

Watching the Results

Training doesn’t stop after the first round. You keep checking. Reports can show you call length, drop rate, or how many issues are solved without human help. If the numbers improve, you know the training is working.

If not, you make small changes. Add more training phrases, adjust responses, or improve the voice tone. Over time, the agent becomes more natural. It’s like how a tourist learns more about a city each time they visit.

Handling Common Challenges

There are always bumps along the way. Sometimes the AI misunderstands accents. Sometimes background noise makes things harder. These can be fixed with better data and tuning.

Costs can also be a challenge. Some platforms charge per user, others by minutes or calls. Planning your budget early helps avoid surprises. Training staff also takes time, but it pays off once everyone is confident.

Tips for a Smooth Rollout

Start with simple tasks. Let the agent answer common questions first. Add complex ones later. This builds confidence for both staff and customers.

Also, keep testing in different conditions. Calls in winter, calls at busy times, and calls in quieter hours can all sound different. The more varied the training, the stronger the agent becomes.

Wrapping Up the Journey

So, how do you train a voice AI agent with a voice AI platform? You start with clear goals, prepare your data, and choose a platform that fits your needs. You run small tests, train the AI, and check results often.

Platforms like Plura AI, Retell.ai, and Vapi.ai all bring useful tools. Plura stands out as one of the platforms that bundle many features together. It may support customer engagement and efficiency when connected with CRM and SMS automation.

In the end, training a voice AI agent is less about machines and more about planning, practice, and patience. Just like a trip, the journey gets easier the more you prepare.