The fintech industry is realizing how blockchain technology can revolutionize revenue generation, enhance end-user experience, streamline delivery, increase efficiency, and lower operational risk.

Like any other tech-related business, fintech is still in its early stages of development. These days, a number of brand-new finance applications appear every day, providing improved and innovative methods for handling and processing payments.

The majority of the blockchain market is made up of fintech, and for good reason. By the end of 2028, the blockchain in fintech market analysis is projected to be valued at $36.04 billion. A new financial system called Decentralized Finance (DeFi) is built on blockchain technology and lessens the power of banks over money and financial services. The way we receive, send, store, and handle money will likewise change over the next several decades as a result of digital ledgers.

This article examines how blockchain in fintech is changing the financial industry for both people and enterprises. We’ll also demonstrate how blockchain-based solutions may streamline procedures and address problems unique to a certain sector.

Understanding Blockchain in Fintech Industry

Blockchain, a decentralized ledger for P2P transactions, has been a staple in finance for over a decade. DeFi, an outcome of blockchain integration, revolutionizes financial operations, enhancing accessibility, transparency, and security. It enables direct asset exchanges sans intermediaries.

DeFi encompasses technologies enabling decentralized financial transactions on blockchain networks, enhancing accessibility, transparency, and security by merging fintech with blockchain. Moreover, it enables direct asset exchanges between entities, eliminating the necessity of intermediaries.

With a projected valuation of $10.02 billion in 2022, the worldwide technology of blockchain in the fintech market is expected to expand at a compound annual growth rate of 87.7% until 2030. Simultaneously, the DeFi market, valued at $13.61 billion in 2022, is anticipated to grow at a 46% CAGR through that same year.

Furthermore, in 2021, venture investors nearly tripled their investment in fintech businesses, investing over $133 billion.

Thus, it is evident that financial institutions favor distributed ledger technology. Let’s examine how it can fill up the holes in conventional financial services to comprehend why.

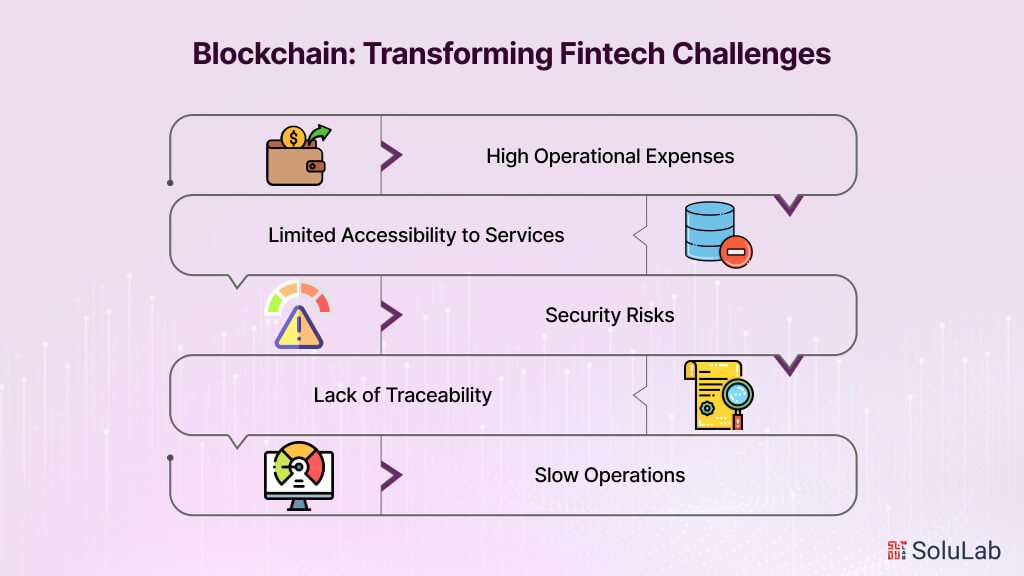

Blockchain’s Potential to Solve Fintech Industry Challenges

In the fintech sector, mismanagement is frequently the cause of issues including missed deadlines, protracted fundraising rounds, and rising losses. The financial sector faces the following list of issues that blockchain technology can help with:

-

High Operational Expenses

Blockchain has the potential to lower transaction expenses in the financial sector. Even a simple credit card transaction includes many partners in a typical system: the retailer, bank, and credit card network. For its services, each organization charges a fee.

Due to the larger network of financial institutions involved, this issue is exacerbated for foreign exchanges and cross-border transfers. For a single transfer, a client can be charged for conversion, intermediary, correspondent as well as receiving bank fees for a single transfer. Blockchain removes intermediaries from financial activities via peer-to-peer transactions and decentralized protocols, leading to quicker processing and reduced transaction costs for both fintech firms and their customers.

-

Limited Accessibility to Services

In some circumstances, access to fintech services may be restricted. When a person is traveling, they might face limitations in accessing an app due to technological constraints or regulatory restrictions imposed by the company. Additionally, a business may lack physical branches or remote support staff.

Blockchain technology enables fintech enterprises to operate independently of traditional banking systems. Clients can engage in activities from any location using decentralized applications, cryptocurrencies, and smart contracts. In essence, financial services become globally accessible at all times.

-

Security Risks

Ensuring data security and safeguarding consumer privacy is a major priority in the financial sector. Security risks can arise both externally, like fraud and cyberattacks, and internally, such as inadequate access controls, employee lack of awareness about cybersecurity, and rushed implementation of cloud computing without proper security measures.

Three essential features of blockchain lower fraud and cybersecurity risks:

- Decentralization: Since blockchain lacks a single point of failure, it is a decentralized system that is more resilient to security lapses. Each transaction undergoes verification and encryption by a network of nodes.

- Encryption: Data is sent between members in blockchain networks using hashing and cryptographic methods Subsequently, the encrypted transactions are appended to the blocks throughout the network.

- Immutability: To validate transactions, nodes collaborate inside a blockchain ledger. The requirement for multiple nodes to reach consensus before altering a single action enhances the data’s resilience against tampering.

Fintech businesses may strengthen their security posture and lower the risk of cyberattacks by implementing blockchain. When compared to other industries, the financial industry is still the most susceptible to cybercrime. Fintech developers are very concerned about protecting sensitive data and digital assets, as seen by the 2,527 incidents that have been reported in 2021.

-

Lack of Traceability

FinTech blockchain companies encounter traceability challenges within traditional banking systems. Basic procedures often involve numerous intermediaries, complicating tracking and verification processes.

Moreover, the high level of centralization in conventional systems hampers transparency and elevates the risk of manipulation. Blockchain technology provides unparalleled traceability through a distributed, decentralized ledger accessible to the public. Advanced algorithms and consensus mechanisms verify and record all transactions. Consequently, auditors can easily validate fintech activities, and consumers can review each transaction on the network.

-

Slow Operations

In classic fintech systems, settlement timeframes might vary from a few hours to several days. This is because there are several middlemen and clearinghouses involved, as well as the requirement for human processing.

Blockchain has a quick design. It saves businesses time by streamlining authorization and verification processes, which in turn speeds up settlement. It also minimizes the time required to process transactions and validate payments.

Faster and less costly financial transactions are advantageous to customers. Banks are also able to process payments very instantaneously, saving money by not having to maintain as many departments or costly infrastructure.

Applications of Blockchain in Fintech Industry

The ideal approach for looking at and understanding the impact of FinTech blockchain is to concentrate on the major economic sectors. So let’s look into blockchain applications in fintech.

1. Banking and Peer-to-Peer Payments: Traditional banking systems often suffer from inefficiencies and high costs, especially in the areas of clearing and settlement. Blockchain technology introduces decentralized systems that streamline transactions through consensus algorithms, resulting in faster processing times and reduced costs. By eliminating intermediaries and bureaucracy, blockchain enhances the efficiency and transparency of peer-to-peer payments. Additionally, blockchain mitigates security concerns and reduces fraud in payment systems, making transactions more secure and trustworthy.

2. Trading and Trade Finance: Trade finance has historically relied on paper-based processes and lengthy settlement periods, leading to delays and increased risks. Blockchain technology revolutionizes trade finance by digitizing and automating transactions, reducing the need for manual paperwork, and speeding up settlement processes. Through smart contracts and distributed ledgers, blockchain enhances the accuracy and transparency of trade transactions, thereby minimizing risks and improving overall efficiency in trade finance.

3. Crypto Lending: Crypto lending introduces a novel approach to borrowing and lending, leveraging cryptocurrencies as collateral for loans. Borrowers can use their crypto assets to obtain fiat or stablecoin loans, while lenders provide the necessary funds at pre-agreed interest rates. This arrangement offers flexibility and liquidity to both borrowers and lenders, creating new opportunities for capital deployment and investment in the financial sector.

4. Regulatory Compliance: Regulatory compliance is a critical aspect of the financial industry, requiring strict adherence to legal and regulatory requirements. Blockchain technology facilitates compliance by providing a tamper-proof and transparent record of transactions, reducing the need for extensive verification processes. By ensuring the integrity and immutability of financial records, blockchain simplifies regulatory reporting and auditing, leading to increased efficiency and trust in the financial system.

5. Digital Identity: Identity theft and fraudulent accounts are significant challenges in the digital age, necessitating robust identity verification mechanisms. Blockchain offers a decentralized and secure digital identity system, allowing individuals to manage and share their identity data securely. Through cryptographic techniques and distributed consensus, blockchain enables secure authentication and verification of identities, reducing the risk of fraud and enhancing trust in digital transactions.

6. Auditing: Auditing processes in traditional financial systems can be complex and time-consuming, often requiring extensive manual verification. Blockchain simplifies auditing by providing a transparent and immutable ledger of transactions, making it easier to track and verify financial data. By automating the recording and updating of records, blockchain streamlines the auditing process, reducing costs and improving accuracy.

7. New Crowdfunding Models: Blockchain introduces innovative crowdfunding models such as Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs), revolutionizing the way startups and projects raise capital. These models leverage blockchain technology to offer transparency, accessibility, and efficiency in fundraising, enabling investors to participate in projects from anywhere in the world. By democratizing access to investment opportunities, blockchain crowdfunding models unlock new avenues for capital formation and economic growth.

In essence, blockchain technology is reshaping the fintech industry by enhancing efficiency, transparency, and security across various sectors, while also enabling innovative new business models and opportunities for growth.

What are the Benefits of Blockchain in the Fintech Industry?

Blockchain has made it possible for corporate networks to be open, safe, and inclusive. This has allowed for faster, more customized, and less expensive digital security to be granted. The application of blockchain technology in finance has developed over the past several years, exhibiting the following advantages:

-

Transparency

Blockchain technology uses mutualization, shared procedures, and protocols to provide a single source of growth for all network members. Faster processing increases client experience while preserving data integrity.

-

Security

The use of blockchain in finance has made it feasible to create secure application code that is intended to be impervious to tampering by malevolent parties and third parties, making it nearly hard to alter or hack.

-

Trust

It is simpler for different stakeholders in a corporate network to handle data cooperation, create agreements, and maintain an immutable and transparent ledger. A distributed ledger technology called blockchain is used to securely record, manage, store, and send transactions across a wide range of industries.

-

Confidentiality

Blockchain in finance enables the business network to share data selectively by providing industry-leading technologies for data privacy across the various software stack levels. This preserves privacy and secrecy while enhancing openness and confidence.

Related: Smart Contracts in DeFi

-

Programmability

It facilitates the development and operation of smart contracts, which are tamper-proof, deterministic software that automate corporate processes for improved programmability, efficiency, and confidence.

-

Superior Efficiency and Scalability

In the financial industry, blockchain is made up of private and hybrid networks that are designed to handle hundreds of transactions per second. It provides enterprises with exceptional resilience and worldwide reach by completely supporting interoperability across public and private change.

Blockchain Use Cases in Fintech Industry

Blockchain technology in fintech is revolutionizing the financial industry by offering innovative solutions to longstanding challenges. Below are some key use cases demonstrating the transformative potential of blockchain in various aspects of financial services.

- Cross-Border Payments and Remittances: The use of blockchain in fintech facilitates faster and more cost-effective cross-border payments and remittances. Blockchain technology enables direct peer-to-peer transfers without the need for intermediaries, reducing transaction fees and processing times significantly. Ripple, for instance, utilizes blockchain for real-time gross settlement systems, currency exchange, and remittance networks.

- Smart Contracts for Financial Agreements: Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are a key use of the FinTech blockchain. These contracts automatically enforce and execute the terms of agreements without the need for intermediaries, reducing the risk of fraud and streamlining processes in areas such as lending, insurance, and trade finance.

- Asset Tokenization: Blockchain technology enables the tokenization of assets, transforming physical or illiquid assets into digital tokens that can be easily traded and transferred on blockchain networks. This use of blockchain in fintech opens up new investment opportunities and enhances liquidity in markets such as real estate, art, and securities.

- Identity Verification and KYC Processes: Blockchain-based identity verification solutions offer a secure and efficient way to verify the identity of individuals and businesses. By storing encrypted identity data on a decentralized ledger, blockchain enhances security and reduces the risk of identity theft and fraud. This use of blockchain in fintech streamlines KYC (Know Your Customer) and AML (Anti-Money Laundering) processes for financial institutions.

- Supply Chain Finance: Blockchain technology can be used to improve transparency and efficiency in supply chain finance by providing a decentralized and immutable record of transactions and product provenance. By tracking the movement of goods and verifying the authenticity of products, blockchain enhances trust and reduces the risk of fraud in supply chain finance.

- Decentralized Finance (DeFi) Platforms: DeFi platforms leverage blockchain technology to offer decentralized financial services such as lending, borrowing, trading, and asset management. These platforms operate without intermediaries, allowing users to access financial services directly from their digital wallets. DeFi represents a growing use of blockchain in fintech, offering greater accessibility, transparency, and innovation in the financial sector.

- Fraud Detection and Prevention: Blockchain can be used to improve fraud detection and prevention in the FinTech blockchain by providing a secure and immutable record of transactions. By analyzing patterns and anomalies in transaction data stored on the blockchain, machine learning algorithms can identify potential fraudulent activities and alert financial institutions in real time.

Future of Blockchain in Fintech Market

The usage of blockchain technology in finance is growing, as is the conversation regarding blockchain’s future in this industry. The market for blockchain-based financial technology is anticipated to grow at a compound annual growth rate of 75.2% to reach a worth of USD 6700.63 million by 2024.

FinTech blockchain apps are going to disrupt the sector like never before. In the future, this specific platform will not only help banks but also non-banking financial services like asset and wealth management.

Financial institutions of all sizes should look for advice on how to incorporate and use this advanced technology into their business plans so they may set their own standards for improved customer satisfaction, cost savings, and efficiency throughout the value chain.

Conclusion

Although blockchain technology in the finance sector has the potential to completely change the way we manage money, the field is still in its infancy. Blockchain’s greater security and transparency are already helping fintech businesses, but there are still obstacles to be solved.

Scalability is among the first. The inability of current blockchain technology to manage massive data quantities is a key barrier to its acceptance in the financial industry. Development is also being hampered by regulatory concerns and interoperability problems (between blockchain networks and current financial systems). It is early to conclude that blockchain is revolutionizing the financial sector due to these and other obstacles. Although the technology has a lot of potential in the banking industry, further development is required before it is suitable for general use. We’ll probably witness more astounding application cases as technology advances and solves issues like regulation and scalability.

As a well-known blockchain development company, we at SoluLab understand how critical it is to stay current with the finance industry’s constantly shifting market. Are you eager to learn more about the fascinating new fields of blockchain, smart contracts, and DeFi? Get in touch with us for fintech software development services, technical skills, or professional guidance.

FAQs

1. How does blockchain improve security in fintech?

Blockchain enhances security in fintech by utilizing cryptographic techniques to create tamper-proof and immutable records of transactions. Each transaction is encrypted and linked to previous transactions, making it virtually impossible to alter or manipulate the data. This ensures transparency and trust in financial transactions, reducing the risk of fraud and unauthorized access.

2. Can blockchain streamline cross-border payments?

Yes, blockchain technology has the potential to revolutionize cross-border payments by eliminating intermediaries and reducing transaction times and costs. Through decentralized networks, blockchain enables direct peer-to-peer transfers of funds, bypassing traditional banking systems and their associated fees. This streamlines the process of international money transfers, making it faster, cheaper, and more efficient.

3. How does blockchain facilitate transparent and efficient lending?

Blockchain enables transparent and efficient lending through smart contracts, self-executing contracts with predefined terms written in code. These contracts automate the lending process, from loan origination to repayment, eliminating the need for intermediaries and reducing the risk of fraud. Additionally, Defi lending platforms offer greater transparency and accessibility, opening up new opportunities for borrowers and lenders.

4. How can blockchain improve regulatory compliance in fintech?

Blockchain enhances regulatory compliance in fintech by providing a transparent and immutable record of transactions. Regulators can access this decentralized ledger to verify compliance with legal and regulatory requirements, reducing the need for extensive audits and documentation. Additionally, blockchain’s cryptographic features ensure the integrity and authenticity of financial data, enhancing trust and confidence in regulatory reporting and compliance efforts.

5. What role does SoluLab play in blockchain innovation for fintech?

SoluLab is a leading blockchain development company that specializes in creating custom blockchain solutions for fintech firms. With expertise in blockchain technology and fintech domain knowledge, SoluLab helps businesses leverage blockchain to streamline operations, enhance security, and drive innovation in financial services. From smart contracts to decentralized finance (DeFi) platforms, SoluLab empowers fintech companies to harness the full potential of blockchain technology.