The financial services sector is changing due to artificial intelligence (AI). It is used everywhere, from improving customer experiences to changing processes and generating substantial cost savings.

The AI market in finance is expected to grow at a remarkable 30.6% compound annual growth rate (CAGR) from its 2024 valuation of $38.36 billion to $190.33 billion by 2030. This rapid adoption highlights the crucial role AI plays in transforming the financial services industry.

In this blog, we’ll explore how artificial intelligence is giving the financial industry a competitive edge. The Current State of AI Implementation in Finance.

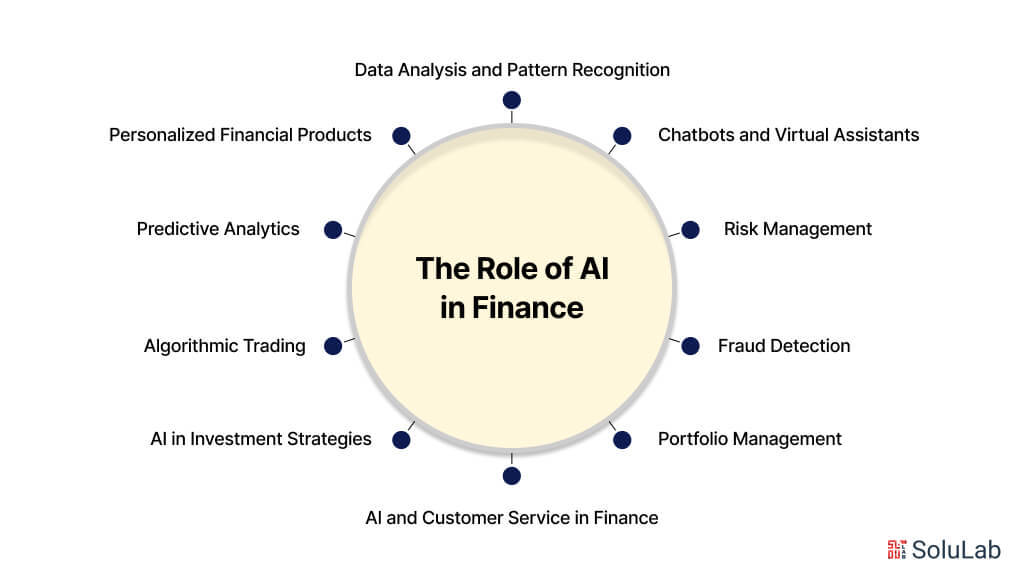

The Role of Artificial Intelligence in Finance

AI in finance is reshaping how financial services are delivered, making them more efficient, accurate, and customer-centric. The integration of AI in financial services allows institutions to handle large datasets, which are essential for making informed decisions. The following are some of the key areas where AI is making a significant impact:

-

Data Analysis and Pattern Recognition

AI systems can process and analyze enormous volumes of financial data far more quickly and accurately than humans. Machine learning algorithms, a core component of AI, are particularly adept at recognizing complex patterns in data. These patterns can provide valuable insights into market trends, customer behavior, and potential risks. By using AI, financial institutions can gain a deeper understanding of the market dynamics and make more informed investment decisions.

-

Predictive Analytics

Predictive analytics is another powerful application of AI in finance. By analyzing historical data, AI algorithms can forecast future market movements, helping investors and financial managers to anticipate changes and adjust their strategies accordingly. This capability is especially useful in high-frequency trading, where split-second decisions can lead to significant gains or losses.

-

Risk Management

Effective risk management is crucial in the financial sector, and AI is enhancing this aspect significantly. AI-powered risk assessment tools can evaluate vast amounts of data to identify potential risks and vulnerabilities. These tools can detect subtle signs of financial instability or fraudulent activities that may not be apparent to human analysts. By providing early warnings, AI helps institutions mitigate risks and protect their assets.

-

Fraud Detection

AI is instrumental in detecting and preventing fraud in financial transactions. Machine learning algorithms can evaluate transaction trends and detect abnormalities that might suggest fraudulent activity. Natural language processing (NLP) can also be used to analyze textual data from emails, social media, and other sources to detect potential fraud schemes. By implementing AI-driven fraud detection systems, financial institutions can significantly reduce the incidence of fraud and enhance the security of their operations.

-

AI and Customer Service in Finance

Customer service is a critical area where AI is making a substantial impact. Financial institutions are using AI to provide more personalized and responsive customer service.

Read Also: AI in Australian Fintech Industry

-

Chatbots and Virtual Assistants

Chatbots and virtual assistants driven by AI are becoming more prevalent in the financial industry. These tools can handle a wide range of customer queries, from account balances to transaction details, providing instant responses and freeing up human agents to handle more complex issues. Advanced chatbots can also offer personalized financial advice based on the customer’s transaction history and financial goals.

-

Personalized Financial Products

AI allows financial companies to provide individualized financial goods and services. By analyzing customer data, AI can identify individual needs and preferences, allowing institutions to tailor their offerings accordingly. For example, AI can recommend specific investment products, loan options, or insurance policies that best match a customer’s financial situation and goals.

Read Blog: Top 10 AI Development Companies in Finance

-

AI in Investment Strategies

Investment strategies are also being transformed by AI. The ability of AI to process and analyze large datasets allows for more sophisticated and effective investment strategies. Here are some ways AI is optimizing investment decisions:

-

Algorithmic Trading

Algorithmic trading, often known as automated trading, utilizes artificial intelligence algorithms to carry out transactions at ideal moments. These algorithms can analyze market data in real time and execute trades within milliseconds, taking advantage of market opportunities that human traders might miss. This high-speed trading can lead to significant profit gains while minimizing risks.

-

Portfolio Management

AI is also improving portfolio management by continuously monitoring market conditions and adjusting investment portfolios accordingly. Machine learning models can optimize asset allocation to maximize returns and minimize risks. By using AI, portfolio managers can make more informed decisions and achieve better investment outcomes for their clients.

Why Are Fintech Companies Using AI?

Fintech organizations are using Artificial Intelligence (AI) for a variety of reasons. Here are some tangible ways that Artificial Intelligence development services could assist firms in the financial sector:

1. Data Analysis and Decision Making

AI can move vast volumes of data faster and more efficiently than humans. This is significant because fintech organizations sometimes have to make judgments based on rapidly changing and evolving data.

2. Improved Customer Experience

AI enables fintech development businesses to adapt their services for each consumer by knowing their individual wants and preferences. As a result, AI in fintech businesses may offer a more personalized experience, which is expected to increase client happiness and loyalty.

3. Establish a Competitive Edge

The use of artificial intelligence in the financial services industry might help your company stay ahead of the competition. As more firms join the finance market, those who can utilize AI to create a competitive advantage will most likely win in the long term.

4. Fraud Detection and Security

Artificial intelligence systems aid in the detection of fraudulent behavior patterns in real-time. It improves security and mitigates financial hazards. Machine learning algorithms, in conjunction with artificial intelligence, examine massive amounts of data to detect abnormalities and flag questionable transactions.

5. Scalability and Innovation

AI drives technological innovation by allowing fintech businesses to rapidly create and deploy new services. By utilizing AI-driven insights, your company may remain ahead of the competition and respond to changing market needs.

6. Lower Expenses

Artificial intelligence (AI) for financial operations lowers costs in a number of ways, including by automating tedious jobs and identifying and stopping fraud. For instance, banks utilize chatbots driven by AI to answer customer support questions, freeing up human staff to work on more difficult jobs.

Related: Generative AI in Customer Service

7. Making Additional Services Available

Financial institutions may develop and produce new goods, services, and customer solutions with the use of AI. AI has aided banks in creating Robo-advisory systems, for instance, which utilize algorithms to assist customers in managing their finances.

5 Ways AI Will Change the Investment World

Artificial intelligence (AI) will transform the investment landscape by introducing a range of advanced tools and capabilities. Here are seven ways AI will revolutionize the world of investing:

-

Advanced Analytics

AI finance tools excel at analyzing historical data and market trends, providing more accurate predictions of future price movements for stocks, bonds, and other assets. By identifying patterns that were previously undetectable, AI enables investors to make more informed decisions, anticipate market fluctuations, and ultimately enhance their profitability while minimizing losses.

Related: AI Agents in Healthcare

-

Enhanced Risk Assessment and Management

Artificial intelligence in fintech allows investors to evaluate the risks associated with various investment options more accurately. By analyzing factors such as volatility, liquidity, and asset correlation, AI helps investors make safer and smarter choices. This improved risk assessment ensures better-informed investment decisions and enhances overall portfolio management.

-

Personalized Investment Recommendations

AI platforms utilize machine learning techniques to offer personalized investment recommendations based on individual goals, preferences, and risk tolerance. By considering factors like age, income, and investment objectives, these AI-driven systems tailor suggestions to meet unique investment needs, providing a more customized and effective investment strategy.

-

Behavioral Analysis

AI systems can analyze investors’ behavioral patterns and sentiments from various sources, including financial reports. By understanding these sentiments, AI helps investors avoid emotional decision-making and maintain discipline during market fluctuations. This behavioral analysis contributes to more rational and strategic investment decisions.

-

Real-time Market Monitoring

AI in investing enables continuous monitoring of market data and news in real-time, something humans cannot achieve on their own. AI tools can swiftly identify relevant information and significant events, alerting investors immediately. This real-time market monitoring allows investors to react promptly to market shifts and adjust their strategies as needed.

What is ML in Finance?

Machine Learning (ML) in finance refers to the use of algorithms and statistical models that enable computer systems to learn from historical financial data and make predictions or decisions without being explicitly programmed. In simple terms, it helps financial institutions analyze large datasets, identify patterns, and automate tasks.

For example, banks use ML for credit scoring, fraud detection, algorithmic trading, and customer service chatbots. In investment management, ML models help in predicting stock prices, optimizing portfolios, and managing risk. What makes ML powerful in finance is its ability to continuously improve as more data becomes available, making financial operations faster, smarter, and more accurate.

Leading Industries Using AI Technology

Because of its disruptive potential, artificial intelligence in fintech is widely used across a variety of sectors. Below is a list of a few of these industries:

- Healthcare: AI assists physicians in diagnosing patients, finding malignant cells, and creating individualized treatment strategies.

Read Blog: Artificial Intelligence in Healthcare

- Retail Sector: AI-driven chatbots assist with product recommendations, product sales and cross-selling, and customer service.

- Banking and Finance Sector: Artificial Intelligence for fintech is utilized by banking solution companies for fraud detection, investment advice, and loan approval procedures.

- Automotive: AI is utilized in the automotive industry for enhanced driver assistance systems, driverless cars, and infotainment systems.

- Tourism: Artificial intelligence plays an important part in travel planning by recommending tourist sites based on customer interests and discovering new places.

Real-World Use Cases of AI in Finance

Here are 5 real-world use cases of AI in finance that financial leaders can learn from:

1. JPMorgan Chase – Contract Review Automation (COiN)

JPMorgan uses its AI tool COiN (Contract Intelligence) to review legal documents and extract important data. It processes 12,000+ agreements in seconds, saving over 360,000 hours of legal work annually.

2. HDFC Bank – AI-powered Chatbot “Eva”

HDFC uses Eva, an AI chatbot developed by Senseforth, to handle over 5 million queries from customers, delivering instant responses and reducing the load on customer service teams.

3. ICICI Bank – AI for Fraud Detection

ICICI uses AI and machine learning models to monitor millions of transactions. Their system flags anomalies, helping reduce financial fraud and unauthorized activity.

4. Mastercard – AI for Cybersecurity & Fraud Prevention

Mastercard uses AI algorithms to analyze transaction data and detect fraudulent behavior in milliseconds. This real-time detection helps minimize fraud and protect cardholders globally.

5. Upstox – AI for Stock Recommendations

Indian brokerage Upstox uses AI-driven analytics to give users stock suggestions based on historical data, trends, and sentiment analysis, making investing easier for retail customers.

Future of AI in Finance

The future of AI in finance is bringing rapid changes to the industry. The BFSI sector is using Agentic AI, which enables systems to autonomously interpret scenarios and initiate real-time actions, enhancing customer engagement and operational efficiency. Globally, institutions like JPMorgan Chase are investing heavily in AI, with applications ranging from fraud detection to personalized wealth management.

However, the integration of AI also raises concerns about job displacement. Anthropic’s CEO warns that AI could eliminate up to 50% of entry-level white-collar jobs within the next five years. Conversely, entrepreneurs like Mark Cuban argue that AI will create new roles, emphasizing the need for strategic implementation.

As AI continues to grow, financial leaders must balance innovation with ethical considerations, ensuring transparency and fairness in AI-driven decisions.

The Bottom Line

From risk management to fraud detection and smarter decision-making, AI is changing how the industry operates. The key? Embrace it strategically. Start small, scale wisely, and always keep data ethics in mind.

This isn’t about replacing people—it’s about empowering them with better tools. So, whether you’re revamping workflows or exploring predictive analytics, now’s the time to lead with innovation. By integrating AI-powered chatbots and Voice AI agents in banking, SoluLab aimed to enhance customer engagement, streamline operations, and provide personalized financial solutions in its recent project named Aman Bank.

SoluLab, an AI development company, with its team of experts, can help you create models for algorithmic trading, fraud detection, risk management, and personalized financial services.

FAQs

1. Can AI help detect financial fraud?

Yes, AI can detect unusual patterns and flag suspicious transactions faster than traditional methods. It continuously learns from new data, making fraud detection smarter and more accurate over time.

2. How does AI improve risk management in the financial sector?

AI improves risk management by analyzing large volumes of data to identify potential risks and predict future risk scenarios. AI models can assess credit risk by evaluating borrower data and transaction patterns, detect market risks through real-time analysis of market conditions, and prevent fraud by identifying unusual transaction patterns. These capabilities enable financial institutions to develop more effective risk mitigation strategies and reduce potential losses.

3. How can financial leaders align AI strategies with business goals?

Start by identifying pain points AI can solve, like reducing costs, improving compliance, or enhancing customer experience. Then, choose AI solutions that directly support those business outcomes.

4. How can financial institutions ensure compliance with regulations using AI?

Financial institutions can use AI to automate the monitoring and reporting processes required for regulatory compliance. AI systems analyze transactions and documents to identify compliance issues, generate necessary reports for regulatory authorities, and ensure adherence to anti-money laundering (AML) regulations. This reduces the risk of regulatory penalties and enhances the institution’s ability to comply with ever-evolving regulatory requirements.

5. How does SoluLab help financial institutions leverage AI?

SoluLab helps financial institutions leverage AI by developing custom AI solutions tailored to the unique challenges of the finance industry. Our expertise includes creating advanced AI models for algorithmic trading, fraud detection, risk management, and personalized financial services. By partnering with SoluLab, financial institutions can access innovative AI tools that enhance their operations, improve decision-making, and offer superior customer experiences. Contact SoluLab today to learn how we can help you harness the power of AI for smarter investments and risk management.