Memes have gained attention in the Bitcoin space as entertaining, community-driven initiatives that frequently gain traction due to social media buzz and cultural allusions. Memes have demonstrated the ability to draw attention, create sizeable groups, and occasionally produce substantial value as demonstrated by Dogecoin and Shiba Inu. However, how can one make their meme currency? Using tools such as meme coin generator, the process is easier than you might imagine.

From the blockchain technology aspects of token production to marketing newly created meme coins within a congested market, this blog will help you with everything you need to know about what is a meme coin, how to create a meme coin, and how much would it cost to create a meme coin and how can you get your meme coin monetized.

What is a Meme Coin?

Meme coins are a kind of cryptocurrency that mostly exists as a joke. They are not intended to address any technological or financial issues, in contrast to “serious” digital assets like Bitcoin or Ethereum. Their capacity to capitalize on viral trends and online memes to become well-known is what makes them valuable.

They can go viral in a matter of hours, riding on little more than an increase in community interaction, and they are typically quite inexpensive, creating a low barrier of entry. Even novice traders find them accessible and unthreatening due to their humorous and eccentric style.

As was the case with Dogecoin, the first cryptocurrency inspired by the Shiba Inu meme, these features allow these digital tokens to persist and remain relevant even years after the original meme that inspired them fades into history.

What’s the Logic Behind It?

A distinct kind of cryptocurrency, meme coins are fueled by comedy, online culture, and community involvement. You can create a meme Coin for amusement and community building, in contrast to typical cryptocurrencies, which may have specialized applications or technological underpinnings. To draw in a loyal fan base, they usually base their names and logos on well-known memes, fictional characters, or online trends. Several important reasons help explain the logic behind meme coins are as follows:

1. Cultural Influence

The Meme Coin Development Company is thoroughly immersed in internet culture when looking at meme coins. Users can easily relate to them because very many of them contain recognizable characters or themes that many people can connect with. For instance, PEPE frogs and Shiba Inu faces of Dogecoin have gained popularity in the cryptocurrency market: encouraging holders’ togetherness.

2. Community Involvement

Meme coin development communities carry more power and influence which in turn affects their success. Often, these coins create vivid discussion forums in which users feel inclined and necessary to participate by sharing jokes, memes, and trading tips. Because of the great use of coins like these in the market for P2P lending, the effects on and generation of the community element when it comes to influencing the prices are fairly evident.

3. Speculative Investment

Instead of being considered comparatively stable investments, many investors turn meme coins into short-term risky media. Speculators interested in futures to make quick gains are fascinated by sudden large price movements often triggered by social media frenzy. This paves the way for manipulative whim which may fuel a given price either up or down to extremes again owing to speculative nature.

4. Fair Play Process

Meme coins are stated to be the new filter, which can be a consensus method known as the “Fair Play” algo, and is based on fair sharing and openness to the community. This strategy is distinct from conventional currencies tied to complex economic structures or large investors, which have complicated the problem of defining cryptocurrencies.

What Role Does Meme Coin Play in Ecosystem Growth?

According to experts, Dogecoin’s 2013 introduction coincided with the emergence of meme coins. Dogecoin the first cryptocurrency created mainly for enjoyment rather than profit, was first developed as a lighthearted joke and later grew out of online comedy and virtual trends. Despite its humorous beginnings, dogecoin attracted a lot of attention and developed a strong community, as evidenced by its recognizable Shiba Inu logo. Dogecoin one of the Best meme coins in 2024 went from a joke to an important participant in the cryptocurrency industry when its market valuation jumped above $85 billion.

There are special features that characterize memes and place them in a class of their own when it comes to currency. They derive their strengths from performativity in aspects of community and culture, more often encouraged by the social media platforms where fans share trade and memes. Such defi ecosystem popularity may lead to speculative purposes with the desire to profit in a short period from changes in prices based on emotions or endorsements.

Also, in the meme currency industry, a new consensus process called “Fair Play” has been identified. This strategy differs from the received approach inherent in typical cryptocurrencies, which can be impacted by institutional investors, for example, focusing on the openness of society and equitable Stake distribution between community members. Secondary audiences, the communities that emerge and coalesce at these coins give out extra content and raise their public engagement even more, interests, and investments.

Due to the psychology that drives adoption within an investment community via entertaining and engaging dealing with community and pop culture memes, meme coins are critical elements of a broader crypto financial system. They are perceived as principal actors in the emergent setting of electronic currencies because of their ability to engage the public, which has very significant market growth opportunities.

How to Buy a Meme Coin?

When purchasing a meme coin like Memecoin (MEME) in a buying platform like Binance, here are organized procedures as per Top Meme Coin Development Companies that will make the buying process as smooth as possible:

Step 1: Register for an account

To create your meme coin in cryptocurrency, the first thing to do is to open an account on Binance which is one of the world’s most popular cryptocurrency trading platforms, and this is free to do. In other words, registering can be done on the website of Binance, or in the Binance app. Your mobile number and email address must be filled in during the registration process from beginning to end. During registration, you need to show your Identification documents as per the regulatory requirements since they have set down some standards that one has to provide Identification.

Step 2: Select Your Mode of Payment

After registration and confirmation, you will have to decide on what you want to do to buy Memecoin. Binance has several ways to pay:

The easiest method for a new person to use is credit or debit cards are easy to use. Both Visa and MasterCard are recognized on Binance, so you may purchase Memecoin instantaneously.

- Bank Transfer: Fiat money can be transferred between respective bank accounts and the Binance account. Nevertheless, you can use the money to buy Memecoin once it comes up on the market.

- Third-Party Payment Services: According to your country, Binance might accept various third-party payment services.

Step 3: Complete the Purchase

Go to the ‘Buy Crypto’ page after selecting your payment type. The amount of Memecoin to be purchased here is totally within fractional ownership. Although thinking in terms of purchasing a stablecoin like USDT could provide better compatibility for investing in other altcoins, it is suggested to consider getting one first.

Memecoin Safety Tips:

Following a successful Memecoin purchase, you have several storage options:

- Wallet: If you hold any Memecoin, you may store it in your Binance account wallet. It makes sense for daily trading or staking, that is for sure.

- Personal Crypto Wallet: You might want to shift your meme coin to a personal digital currency wallet for extra security, this shields your assets from exchange-related dangers.

- Decentralized Exchanges: Meme coins can be traded on decentralized exchanges if that’s your preference.

How to Create a Meme Coin?

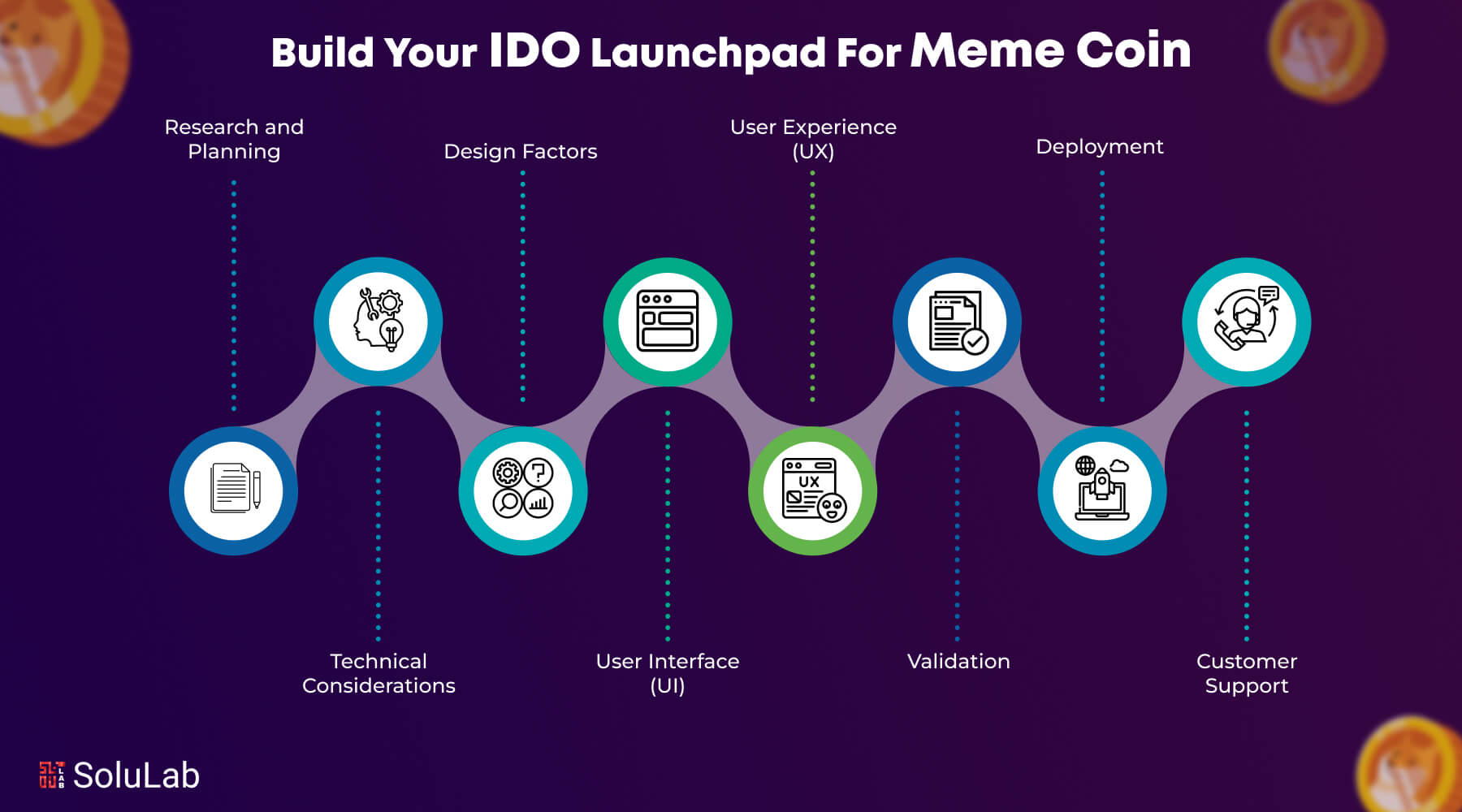

Given the rise in popularity of meme cryptocurrencies in recent years, developing a meme currency can be a fascinating endeavor. By guiding you through the necessary stages to create your meme currency. This is your step-by-step guide on how to make a meme coin:

Step 1: Purpose

Before getting into the technical requirements of how to make meme coin you should first establish the topic or goal of your coin. Keep this in mind:

- What culture reference or meme is the coin going to represent?

- Will the coin be useful or would it be just community-engaging?

- Who is your intended audience?

Dogecoin, for example, is based on the famous doge meme which depicts Shiba Inu with a cosmin sans text. Each coin is supposed to have an entertaining and memorable theme that speaks to your target demographic.

Step 2: Choose the Right Blockchain

There is the subject of the selection of the most appropriate blockchain for the meme coin. Popular choices include:

- Ethereum: It was Criticised that while some denominations are strong in terms of smart contract functionality, EOS is more famous for it.

- Binance Smart Chain: Offers faster transaction speed as well as low charges compared to other types of transactions.

- Launch Meme Coin on Solana: Launch Meme Coin on Solana Indeed, familiar to many customers for offering low costs and yet high capacity.

Depending on the usefulness of your project, compare the advantages and disadvantages of each platform, relying upon criteria such as transaction costs, expansion potentialities, and developers’ support.

Step 3: Set a wallet

Since you would trade in meme coins and for all practical purposes you will interact with the blockchain you’ll need a cryptocurrency wallet you can set up a brand-new wallet for this very task or you could also simply use one that you have on hand In fact, you shall need this wallet for topping off the team and holding down the first checks of your meme coins.

Step 4: Meme Coin Creation With Meme Coin Generator

Several key elements are involved in building the parameters for your meme coin:

- Name: Select an exceptional and easily identifiable nickname.

- Logo: Design an impressive emblem that would symbolize the concept of your meme. Design an impressive emblem with a logo maker that would symbolize the concept of your meme.

- Total supply: This means very minimal consideration is given to the number of tokens that are going to be issued in the market.

- Meme coin tokenomics: Declare how tokens will be distributed for community rewards, development, and marketing.

Step 5: Write a Smart Contract

The heart and soul of any meme coin lies in its smart contract, which is what regulates its laws as well as its operations. Giving priority to this stage is key to minimizing the chances of exploitable weaknesses. You can leverage AI code generation tools to streamline smart contract development or, for more complex needs, hire professional developers or reputable firms that carry out blockchain development.

Step 6: Audit Smart Contract

Audit your smart contract in detail and in a critical manner before implementing this meme coin on the blockchain in question. This stage will help in the identification of any errors that might be in the code or any weakness that exists. In order to assess the capabilities of your token in practice, use testnets such as Binance testnet or Ropsten testnet for Ethereum.

Step 7: Use Your Coin for Memes

If you are satisfied with the smart contract’s security and usefulness, it is time to launch a meme coin you are developing on the blockchain of choice. Ensure that you comply with all the requirements to Deploy Solana Smart Contracts so that users can use it when it is launched.

Step 8: Creating a Distribution Strategy

A well-thought-out tokenomics model is very important and it will determine the profitability of your meme coin. First, you need to check the number of tokens that will be made available. Explain how developers, investors, and the community will obtain the tokens. Consider mechanisms such as staking awards or liquidity pools to encourage user participation.

Step 9: Create a Network

Around your meme coin, it is necessary to create a lively network. Use effective marketing tips to bring in potential consumers. Consider using forums, social networks, and advertising to help in creating visibility. People also become more involved in your project as their activity and interaction get regularly updated.

Step 10: Make Your Coin Available for Trading on Exchanges

List the cryptocurrency on exchanges so that you can sell through trading your meme coin. From the beginning of the trading period, there must be enough liquidity in trade. Still, to do this without getting into legal problems in the course of performing this work, legal norms also have a place here.

Read Also: Shitcoins vs Real Tokens

Essential Steps After Launching a Meme Coin

Creating and launching a meme coin is just the beginning. To ensure its success, trust, and long-term value, it’s important to take the following steps after development.

1. Smart Contract Auditing Ensures Security and Trust

Before going live, your meme coin’s smart contract should be audited by a trusted third-party firm. This helps detect and fix vulnerabilities, build investor confidence, and avoid costly issues or reputational damage later.

Pro Tip: Choose well-known audit platforms like CertiK or Hacken for added credibility.

2. Legal and Regulatory Compliance is Crucial

Crypto regulations vary by country and change often. Making sure your meme coin follows all legal requirements helps you avoid fines, access top exchanges, and build legitimacy.

Steps to Follow: Consult a crypto legal expert, follow tax and AML laws, and clearly state disclaimers on your website.

3. Listing on Exchanges Makes Your Meme Coin Tradeable

Once your coin is secure and compliant, the next step is visibility and liquidity. You can do this by listing your coin on:

- Decentralized Exchanges (DEXs) such as Uniswap or PancakeSwap using liquidity pools

- Centralized Exchanges (CEXs) like Binance or KuCoin, may require higher compliance and listing fees

Creating Liquidity Pools: Provide initial liquidity in trading pairs like MEME/ETH, offer incentives for liquidity providers, and monitor liquidity to avoid price swings.

4. Build Transparency and Keep Your Community Engaged

To keep users and grow your community, share updates regularly, use tracking tools like CoinGecko or CoinMarketCap, and run engaging activities like staking, giveaways, or NFT collaborations.

What Gets a Meme Coin Monetized?

But the bigger question is how meme coins work. There are a few ways in which meme currency can be largely monetized based on the exceptional branding and engagement of the community. The easiest of the ways to earn from a meme coin are the transaction fees and these are the most widely used strategies. Utilizing a charges technique every time users sell your meme coin or any other transaction is done, then it means that you will always make money out of your site whenever there are users.

As the user base increases, such a defi protocol, already common across many cryptocurrencies can be highly effective for generating a consistent source of revenue. In case your meme currency becomes in high demand, you may wish to sell t-shirts or other souvenirs or even hype the name. For this, it may be sufficient to make circuits, caps, or any other Daesh with the face or theme of your meme coin at the back. Further, you can license other companies to use your mark and generate other income streams too.

Strengthening the resolve of holders to stick with their coins rather than sell them helps to promote price and stability whilst creating an active user base. Another alluring monetization strategy is yield farming, in which consumers offer liquidity in return for benefits. Meme currency monetization calls for ingenuity and careful preparation. You can generate several revenue streams that raise the amount of your meme coin and cultivate a loyal user base by adding transaction fees, utilizing gaming applications, investing in merchandising potential, interacting with the community, and putting in place staking mechanisms.

Do I Need Programming Skills To Create A Meme Coin?

Advanced programming experience is not necessary to create a meme coin for free, however, it can be helpful to have some technical understanding. You must comprehend smart contract programming if you intend to launch your meme coin on an established blockchain platform, such as Ethereum. Ethereum smart contracts are primarily written in Solidity, therefore, some knowledge of the language is beneficial.

Additionally, some platforms and tools let you launch your meme coin without needing to know a lot about programming. For instance, you can use token generators or token creation platforms that provide an intuitive user interface to make setting up and implementing your meme coin easier.

But bear in mind that a meme coin’s success frequently depends on elements other than its technical qualities, such as marketing, community involvement, and the coin’s unique meme. Your chances of developing a successful meme currency can be greatly increased by collaborating with people or a respectable meme coin development company that possesses a combination of technical and marketing know-how.

Is It Legal To Start Your Own Meme Coin?

Like any other cryptocurrency or token, the legality of creating a meme coin depends on several variables as well as the regulatory environment in your country. There are significant differences in cryptocurrency laws between countries; some have clear foundations, while others might not have any information at all. Now that you’ve learned how to make a meme coin, here are a few broad things to think about:

1. Adherence to the law: Adhering to the legal requirements of the jurisdiction in which you intend to conduct business is crucial. Understanding securities laws, following anti-money laundering (AML) guidelines, and meeting know-your-customer (KYC) standards are all part of this.

2. Securities Regulations: The production and distribution of tokens may occasionally be governed by securities laws. Your meme coin can have extra legal restrictions if it is set up as a security or investment.

3. Consumer Protection: Protecting consumers from fraud and making sure investments are transparent may be top priorities for authorities. It’s crucial to be explicit about the characteristics of your meme coin and the dangers it poses.

4. AML and KYC Compliance: To counter illicit activities like money laundering and terrorist financing, many jurisdictions mandate that cryptocurrency projects use AML and KYC protocols.

5. Tax Implications: It’s critical to comprehend the tax ramifications of developing and trading your meme coin because the tax treatment of cryptocurrency transactions can differ.

6. Regulatory Environment: Be aware that the laws governing cryptocurrencies are always changing. Various nations’ regulatory bodies are attempting to adjust to the difficulties presented by the Bitcoin industry.

How Much Does it Cost to Create a Meme Coin?

The cost of developing a meme coin might vary depending on numerous things, such as the platform you decide to launch your meme coin on, such as Ethereum or Binance. The intricacy of the tokenomics and features determines how your meme coin’s smart contract is developed, an advanced feature may raise overall costs.

Generally speaking, creating a meme coin may cost you around $5,000-$60,000. Even the functionality, complexity, and manpower requirements of your project such as those for blockchain developers and business developers, may also have a significant impact on this cost.

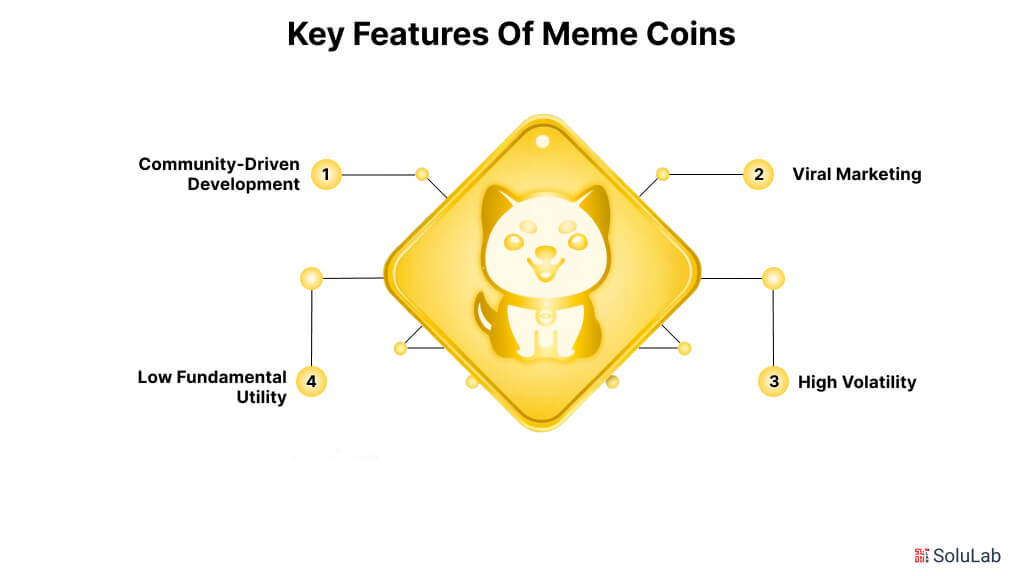

Key Features of Meme Coins

Due to such significant characteristics and organizational framework, memes have gained a lot of attention in the cryptocurrency market. The following four characteristics characterize meme coins:

- Community-Driven Development: For meme coins to grow there should be participation from the community. This is because it is the supporters of the currency, who help in decision-making regarding marketing strategies, development profiles, and even aspects of branding such as the name and symbol of the coin in this case. The presented community-focused approach makes its development stimulates loyalty among users and the use of the corresponding platform in their activity, which contributes to raising awareness of the coin across the multiple Internet-based resources.

- Viral Marketing: Memes rely on social media as well as humor to advertise themselves. Often, they originated from some popular culture references or an internet meme that would grab the user’s attention with a story. Members of my community often share memes and information that increases the circulation of the coin, and thus people adopt it at a faster rate. This can be seen with their success base being largely viral.

- High Volatility: The price of meme coins fluctuates significantly often within a short period due mainly to popularity pitches by influencers, trending hashtags, as well as sentiment analysis. Memes are also a double-edged sword for traders and are interesting for the same reason – as a possibility to invest because they are highly speculative, and that means that the price can flit up and down significantly.

- Low Fundamental Utility: Looking at its definition, meme coins, in contrast to more proliferated cryptos, many of which are little beyond jokes, often do not have explicit utility, and are not built on enhanced technologies. Unlike social use, which is essential in day-to-day undertakings, they allow the development of entertainment and community participation. To have some other use than for speculation some meme currencies are now adding some form of staking or integrating with decentralized finance (DeFi) services.

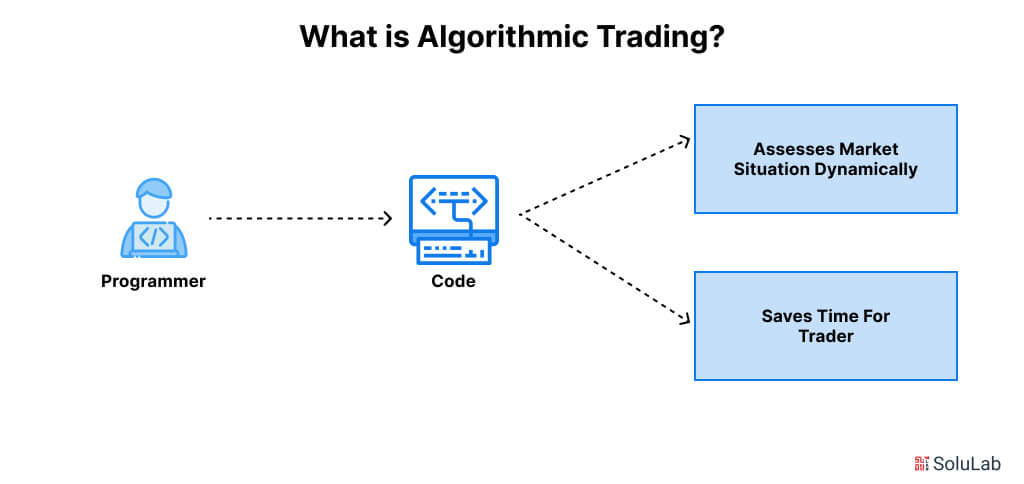

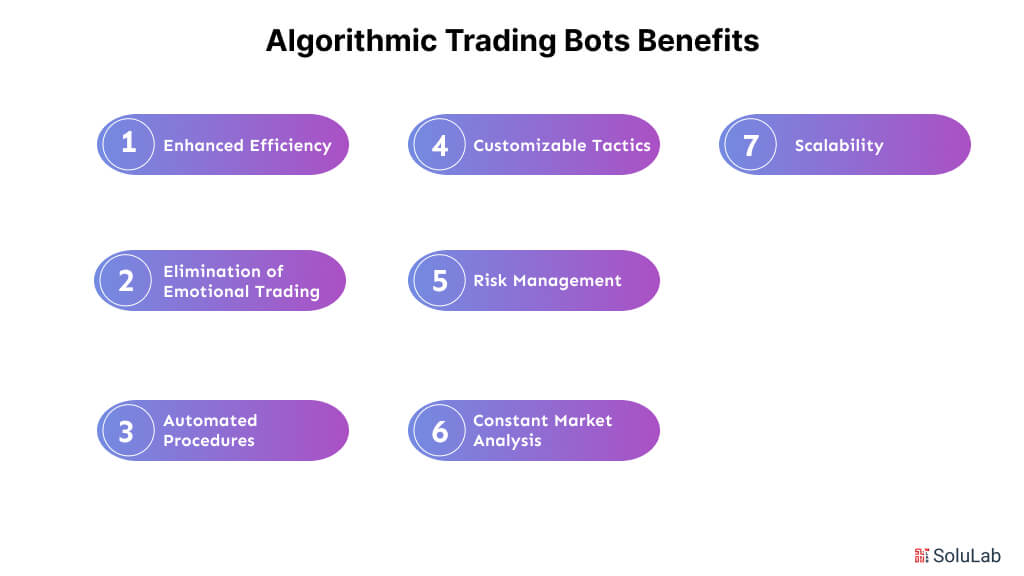

How Can SoluLab Bring Modern Technology Into Your Trading Businesses?

The emergence of meme coins is an intriguing example of how comedy, community involvement, and cryptocurrency creativity may come together. These digital assets, present special chances for enjoyment and financial benefit and have captivated the interest of both investors and fans. Knowing the factors that influence meme coins will assist prospective developers and investors in successfully navigating this industry as it continues to change.

Token World is a creation of SoluLab for this purpose. It aims to build a premier cryptocurrency launchpad that connects blockchain projects with financiers who want to find and work with reliable businesses. The design is intended to facilitate investors’ access to a selected range of projects and project promoters’ advertisement of their projects. Token World aims to enhance the efficiency of the entire blockchain ecosystem through better project launches and investment processes that are more transparent, secure, and user-friendly. If you are considering entering the world of meme coins or creating your own business, you can get well-defined, clear directions and expertise from professionals like Solulab to assist you in your business endeavors.

Solulab’s inventive approaches will help you bring your vision to life whether it is creating a meme coin or developing a launchpad.

FAQs

1. Are meme coins profitable?

Although working with meme coins might yield significant gains, it can also cause significant losses. They are mostly built on fad assets and do not have any inherent value or fundamental utility, which might cause a quick decline to the original value.

2. Which is the top meme coin?

More than simply a meme coin, BFTD Coin is a complete ecosystem made to interact with and compensate its users. Significant milestones have already been reached by its presale, which sold over 16 billion coins.

3. What is an AI meme coin?

AI meme coins are surprisingly responsible for the current elation of AI in the crypto world. Tokens that are related to memes and integrate AI through the use of AI agents or AI-driven utility are known as AI meme coins used to dominate the meme coin mindshare.

4. Is there are future for meme coins?

The most well-known coin in meme coin Doge is no longer a sleeping dog and has risen 188% in the last 30 days and an incredible 340% this year. This shows that meme coins are the future.

5. How is SoluLab automating services in blockchain technology?

SoluLab, a blockchain development company is making automation happen for blockchain technology with the use of smart contracts and various other solutions, they also offer custom blockchain solutions for different business needs.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]