An Initial Coin Offering (ICO) is a novel fundraising mechanism employed by businesses in the cryptocurrency industry. It involves issuing a new cryptocurrency token and selling it to investors during a specified period. Similar to how Coinbase, a crypto-fiat based company, recently launched its Initial Public Offering (IPO) by offering shares of its company in exchange for funds that can be used for various projects and capital requirements. In the crypto world, a token or coin issued through an ICO is also referred to as an ICO. Token creators can sell a predetermined quantity of digital tokens at a fixed price to distribute the token in the market and raise capital for their project or personal needs.

Types of ICOs

There are two types of ICO:

1. Private ICOs:

- Limited participation, only a select group of investors are allowed.

- Participants tend to be large institutions and wealthy individuals due to high minimum investment amounts.

- Companies choose this option when they need significant funding and target specific, high-value investors.

2. Public ICOs:

- Open to everyone, targeting the general public.

- Regulatory concerns have made private ICOs more attractive for companies.

- Lower investment amounts to attract a wider range of participants.

- Companies aim to raise funds from a large number of contributors.

Working of ICO

An ICO (Initial Coin Offering) is a process that demands a profound understanding of the underlying technology. The fundamental concept behind an ICO is to secure capital for the company from investors. To raise funds through an ICO, the project organizer must first define its structure. There are typically three common structures for an ICO:

1. Static Supply and Static Price: The number of tokens and their price remain constant in this model.

2. Static Supply and Dynamic Price: The price of the token is determined by the amount of funds raised during the ICO, while the supply of the token remains fixed.

3. Dynamic Supply and Static Price: The supply of the token is determined by the amount of funds raised during the ICO, while the price of the token remains fixed.

The Following Are The Steps Explaining The Working Of ICO:

1. Investment Targets:

- Upon launching an ICO, a company establishes a value for its currency and seeks individuals interested in acquiring that value.

- Identifying the target audience, the company creates relevant materials to attract potential investors.

2. Token Creation:

- After identifying the target audience, the company initiates the creation of tokens.

- These tokens are tradable and distinct from cryptocurrencies.

- Tokens do not confer equity ownership in the company but rather provide holders with a stake in the company’s success.

- Tokens are created on existing blockchain platforms, eliminating the need for the company to develop code from scratch.

3. Promotion Campaign:

- The company launches promotional campaigns to raise awareness about its ICO among potential customers.

- These promotions are primarily conducted online, as some platforms prohibit the promotion of ICOs on their platforms.

- Despite these restrictions, there are numerous potential platforms willing to run promotional campaigns for ICOs.

4. Initial Offering:

- Tokens are offered to investors through several funding rounds.

- The company can utilize the proceeds from the ICO to launch new products or services, while investors can use the received tokens to access and benefit from those offerings.

The startup begins the Initial Coin Offering (ICO) process by setting up the blockchain and establishing protocols and rules. Then, the company specifies the purpose of the ICO launch. After that, the creators take the final step of checking to ensure the smooth operation of the ICOs at the time of launch. The creators will sign up with an exchange, where active or upcoming ICOs can be found. The process is similar to an Initial Public Offering (IPO) listing but with less paperwork for the company.

ICO vs IPO

When investing in an Initial Public Offering (IPO), one gains voting rights proportional to the number of shares owned. This allows shareholders to influence company decisions. However, investing in an IPO requires thorough research and due diligence, as the success of the project is uncertain. IPOs are regulated by government agencies and established companies can only raise IPOs with stable bank accounts, business records, and proper legal formats. Lawyers and banks are usually involved in IPOs.

In contrast, Initial Coin Offerings (ICOs) do not require a finished product, leading to increased risk. However, some ICOs do have working and testable products, which should be considered when investing. Unlike IPOs, ICOs are not regulated, making it easier for developers to take the money and run away, creating a “rug pool” scam. Any startup or new entity can launch an ICO, as it only requires a new idea and does not follow a specific legal format. Programmers and the internet are usually involved in ICOs.

IPO

- Initial Public Offering (IPO) involves opening a bank account for security purposes.

- IPOs are a conventional method for private companies to raise funds under government supervision.

- IPOs are subject to strict regulations imposed by the regulatory bodies of the respective countries.

- An IPO provides security in the form of shares, representing the ownership rights of the investor.

- IPOs require a substantial amount of time to obtain funds from a company, as they involve extensive due diligence processes.

ICO

- Initial Coin Offering (ICO), a new form of fundraising, requires an account with an exchange or a wallet to apply for offerings.

- ICOs are characterized by low regulations and low to moderate transparency, with the exception of security tokens.

- Cryptocurrency utility tokens are issued during ICOs, except in cases where security tokens are taken as equity.

- Cryptocurrency tokens can be issued quickly, while security tokens typically take longer to issue due to regulatory requirements.

Related: ICO Vs IPO: What’s the Difference?

How to Create ICO?

The steps to create an ICO are:

1. Whitepaper:

- A statistical explanation of the coin’s purpose and how it differs from others.

- Includes information such as marketing plans, problem-solving capabilities, unique features, development fees, developer wallets, future plans, and long-term goals.

2. Marketing:

- Challenging due to past influencer scams and rug pulls associated with ICOs.

- Involves attracting investors to understand the coin’s purpose and secure funding.

- Popular advertising methods include targeted advertising on crypto platforms, joining relevant groups, and promoting through influencers.

3. Selling on Platforms:

- Platforms allow for the collection of pre-sale funds and subsequent distribution of coins to investors.

- Investors trust third-party platforms rather than solely relying on the coin’s developers.

- Simplifies the coin launch process.

ICO Regulations

To enhance the capitalization of the cryptocurrency market, the regulation of the ICO space is essential. The Russian Association of Crypto-Currency and Blockchain (RACB) has taken the initiative to establish uniform standards for companies participating in ICOs. Currently, the lack of uniform standards and the absence of new institutions to delineate the relationship between cryptocurrencies and their economic role and significance pose challenges. However, governments in the future are expected to create favorable conditions for ICOs, fostering innovative activity, diversified business development, and increased income generation.

Advantages of ICO

- Liquidity: Lack of funds is a frequent obstacle for individuals seeking investment opportunities. ICOs provide significant liquidity to investors, eliminating many limitations imposed by traditional funding sources.

- Decentralization: Most ICOs allow investors to transfer funds at the time of purchase, ensuring that many individuals can contribute at any time. Early investment is advantageous as it allows contributors to pay less and avoid premiums.

- Ease of Funding: ICOs offer a straightforward method for fundraising. Anyone from anywhere in the world can participate in the investment process, simplifying fundraising and allowing projects to acquire the necessary funds.

- Online Marketing: ICO tokens are marketed online, reaching a wide audience. Potential buyers can learn about ICOs through the organization’s website, forums, and other platforms.

- Positive Impact: The ICO model promotes the development of decentralized applications, as these applications require numerous users. When an organization launches a public ICO for decentralized applications, it encourages adoption and growth.

- Quick Fund Availability: Companies can raise funds without extensive paperwork. This process is rapid, enabling funds to be made available quickly, which is crucial for building a company’s infrastructure at an early stage.

- Traceability: All ICO transactions are conducted online and can be easily traced, allowing potential investors to conduct thorough research. Plans for the coming months and year are transparently visible.

- High Liquidity: ICO tokens have high liquidity, meaning they can be bought and sold easily. Their digital nature eliminates the need for physical exchange, and investors can monitor their investments closely.

- High Returns: Some ICOs offer high returns, as they begin with a low initial value that increases over time. These potential returns make ICOs attractive to investors.

Disadvantages Of ICO

Concerns Surrounding Initial Coin Offerings (ICOs):

1. Due Diligence:

- Lack of formal ICO audit processes.

- Flaws in white papers may remain undetected until substantial investments have been made.

- Some organizations include clauses requiring contributors to accept project abandonment risks.

2. Volatility:

- Rapid fluctuations in token prices within seconds.

- High price volatility poses risks for investors and may impact their portfolios.

- The competitive nature of ICOs in the market can lead to unpredictable price changes, making them more volatile compared to other investment options.

3. Unlawful Activity:

- Growing concerns about the potential use of ICOs to finance terrorist organizations or criminal activities.

- Cryptography’s hash functions conceal the identities of parties involved, making it easier for unlawful activities to occur.

4. Conflict of Interest:

- Founders’ lack of personal financial risk in ICO transactions creates a conflict of interest.

- Allocating tokens to founders without lock-up periods misaligns incentives.

5. ICO Scams:

- Investors often invest in ICOs with the expectation of quick and high returns.

- While some successful ICOs have delivered high returns, investors often overlook ICO scams, leading to financial losses.

- Scammers take advantage of the lack of paperwork and ease of fundraising in ICOs, targeting unsuspecting investors.

6. Lack of Clarity:

- Unclear regulations regarding the treatment of profits from ICOs in various jurisdictions.

- Ambiguity in tax accounting and tax treatment of ICOs.

Examples

- Ethereum: Launched in 2014, Ethereum raised $18 million in just 42 days with an initial token price of $0.31. It remains the most valuable cryptocurrency ecosystem, providing technology for building distributed applications through smart contracts.

- Tezos: Despite raising $232 million in its ICO in July 2017, this project faced numerous delays in token distributions. As a result, it wasn’t able to achieve its desired outcome.

- EOS: EOS launched in 2017 with an initial token price of $0.925. This blockchain raised $185 million in just five days. It positions itself as an alternative to the Ethereum network.

- NEO: NEO initially came into existence between 2015 and 2016 with an initial token price of $0.032. This ICO yielded substantial returns in 2016, largely attributed to the support and confidence it garnered from high-profile entities.

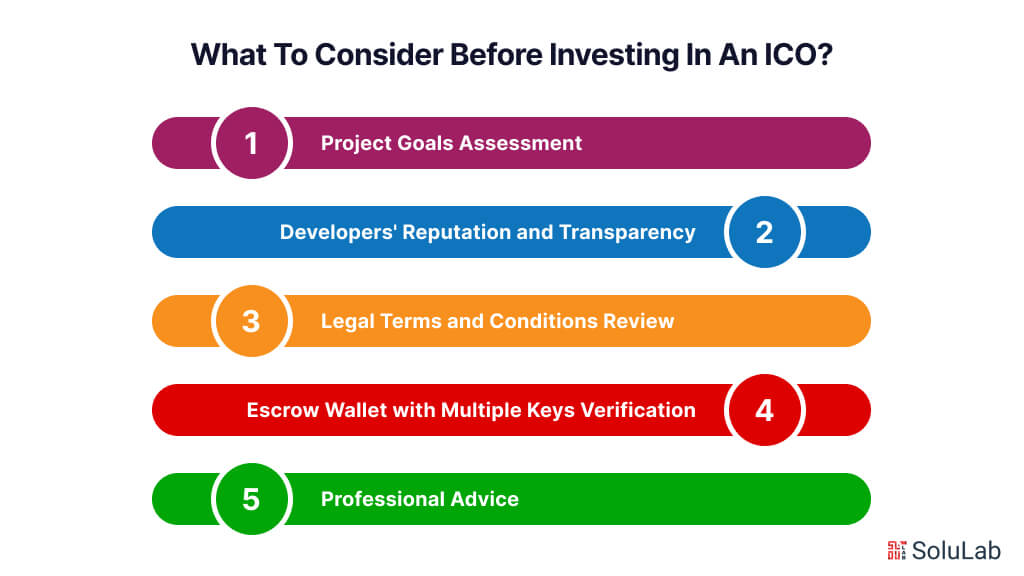

What To Consider Before Investing In An ICO?

To protect your financial interests, exercising caution when assessing an Initial Coin Offering (ICO) is imperative. Here are some key factors to consider to avoid the risk of monetary loss:

1. Project Goals Assessment:

- Scrutinize the project’s goals and objectives for realism and achievability.

- Beware of unrealistic promises and timelines that might indicate over-ambition.

- Legitimate projects will have well-defined and practical goals aligned with their resources and expertise.

2. Developers’ Reputation and Transparency:

- Research the developers behind the ICO for a proven track record in the cryptocurrency industry.

- Examine their reputation for transparency and openness.

- Look for red flags such as past failures or questionable dealings.

3. Legal Terms and Conditions Review:

- Thoroughly review the ICO’s legal terms and conditions for clarity, comprehensiveness, and legal compliance.

- Pay close attention to clauses related to token distribution, refunds, and dispute resolution.

- Consider seeking legal counsel to understand your rights and obligations as an investor.

4. Escrow Wallet with Multiple Keys Verification:

- Confirm that the funds raised during the ICO are stored in an escrow wallet with multiple keys.

- This setup ensures that no single entity has control over the funds, reducing the risk of misappropriation or fraud.

- The escrow wallet should be managed by a reputable third-party custodian.

5. Professional Advice:

- Enlist the help of cryptocurrency experts, such as financial advisors or analysts specializing in ICOs, to gain valuable insights and guidance.

- These experts can evaluate the project’s potential, assess the risks involved, and assist you in making informed investment decisions.

To mitigate the risk of investing in deceptive or unsustainable Initial Coin Offerings (ICOs), investors should adhere to a strategic approach. While the cryptocurrency market’s volatility presents inherent risks, even for promising projects, prudent investors can minimize potential losses by conducting thorough research, exercising caution, and investing only disposable funds.

The Difference Between Coin And Token

In the cryptocurrency realm, coins and tokens, though often used interchangeably, possess distinct meanings. Coins, exemplified by Bitcoin, Ether, Ripple, and Litecoin, are cryptocurrencies built on their own decentralized blockchain networks. These coins serve specific purposes, such as a store of value or a medium of exchange. In contrast, tokens utilize existing blockchain networks as their foundation. Each project has its own interpretation of tokens, as exemplified by the ERC20 standard on the Ethereum blockchain. The fundamental difference between coins and tokens lies in their underlying structure: coins operate on their own dedicated blockchains, while tokens leverage pre-existing ones. Typically, coins and tokens are listed on separate cryptocurrency exchanges. Grasping this distinction is essential for navigating the world of cryptocurrency effectively.

Conclusion

In conclusion, understanding the intricacies of an Initial Coin Offering (ICO) is crucial for navigating the rapidly evolving world of cryptocurrency. Whether you’re asking “What is an Initial Coin Offering?” or looking at specific initial coin offering examples, the key aspects such as ICO vs IPO, how to create ICO, and the various types of ICOs are essential knowledge. With numerous ICO listings available, it’s important to discern which projects are worthwhile. ICO development plays a pivotal role in shaping the success of these ventures. Companies like SoluLab are at the forefront of this field, offering expert guidance and innovative solutions for your coin initial offering needs. Explore our comprehensive ICO initial coin offering list to stay informed and make educated decisions in this dynamic market.

FAQs

1. What is a Initial Coin Offering (ICO)?

An Initial Coin Offering (ICO) is a fundraising method used by startups to raise capital by issuing digital tokens in exchange for cryptocurrencies like Bitcoin or Ethereum.

2. How does an ICO work?

An ICO works by allowing investors to purchase newly issued tokens from a project in its early stages. These tokens can represent various utilities or assets within the project’s ecosystem and can often be traded on various crypto exchanges.

3. What are some initial coin offering examples?

Examples of successful initial coin offerings include Ethereum, which raised millions in its ICO, and Filecoin, which became one of the largest ICOs in history by raising over $250 million.

4. What is the difference between ICO vs IPO?

An ICO (Initial Coin Offering) is used to raise funds for cryptocurrency projects by issuing digital tokens, whereas an IPO (Initial Public Offering) is the process of offering shares of a private corporation to the public in the stock market.

5. How to create an ICO?

To create an ICO, you need a well-defined project, a whitepaper outlining the project’s goals, a legal framework, a strong development team, a marketing strategy, and a platform for issuing and managing tokens.

6. What are the types of ICOs?

The types of ICOs include Public ICOs, open to the general public, and Private ICOs, restricted to a select group of investors. Each type has its own benefits and regulatory considerations.

7. Where can I find an ICO initial coin offering list?

ICO listings can be found on various platforms and websites dedicated to tracking upcoming and ongoing ICOs. These lists provide information on project details, funding goals, and timelines.

8. What role does ICO development play?

ICO development involves creating the technological infrastructure, legal framework, and marketing strategy necessary to successfully launch and manage an ICO. Companies like SoluLab specialize in providing comprehensive ICO development services.