Decentralized Finance, or DeFi, is changing the financial industry by providing unprecedented accessibility, security, and transparency. However, it’s challenging to figure out the DeFi area because it’s risky, complicated, and always changing. You require professional advice if you want to start a DeFi project, optimize your smart contracts, or guarantee regulatory compliance.

Top DeFi consulting firms can help with that. They assist companies and startups in creating DeFi solutions that are safe, scalable, and compliant. These professionals ensure your project is set up for success, with everything from tokenomics design to liquidity tactics and smart contract audits.

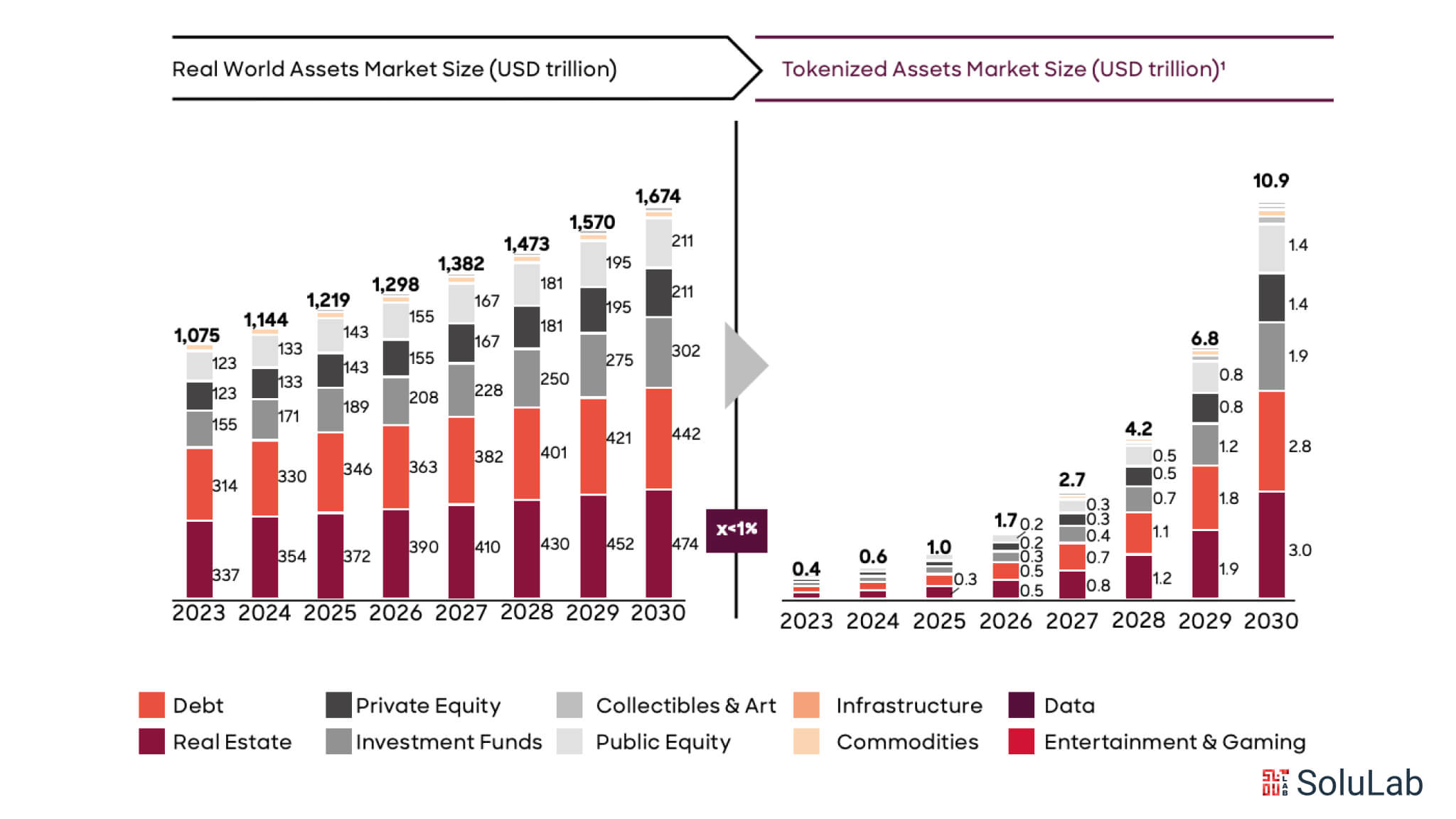

| The DeFi industry is expected to reach an annual growth rate of 9.07%, projecting revenues of $37.04 billion by 2028. |

This blog will explore the top 10 DeFi consulting companies in 2026 that can help you successfully utilize blockchain technology.

What do Defi Consulting Firms do?

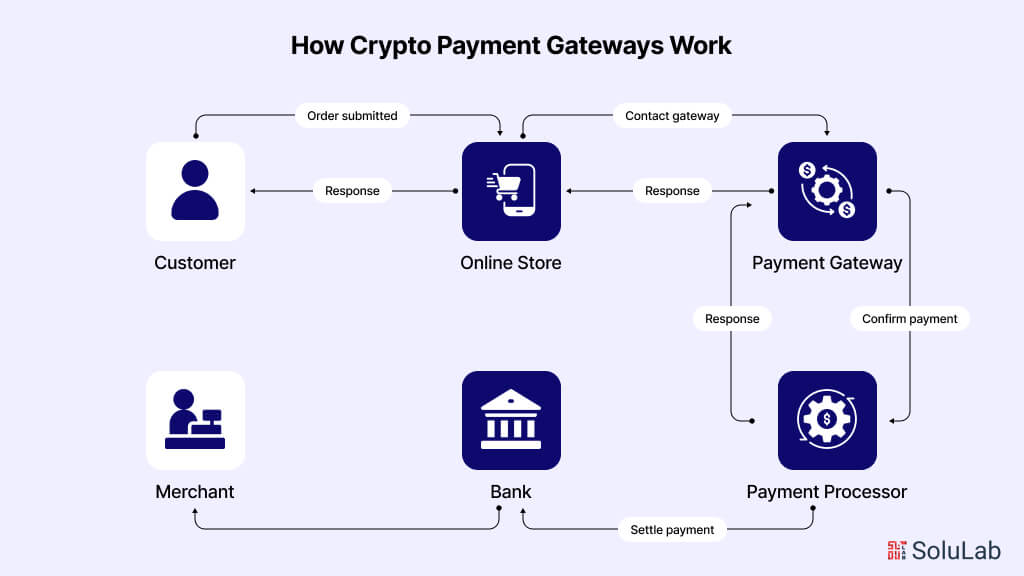

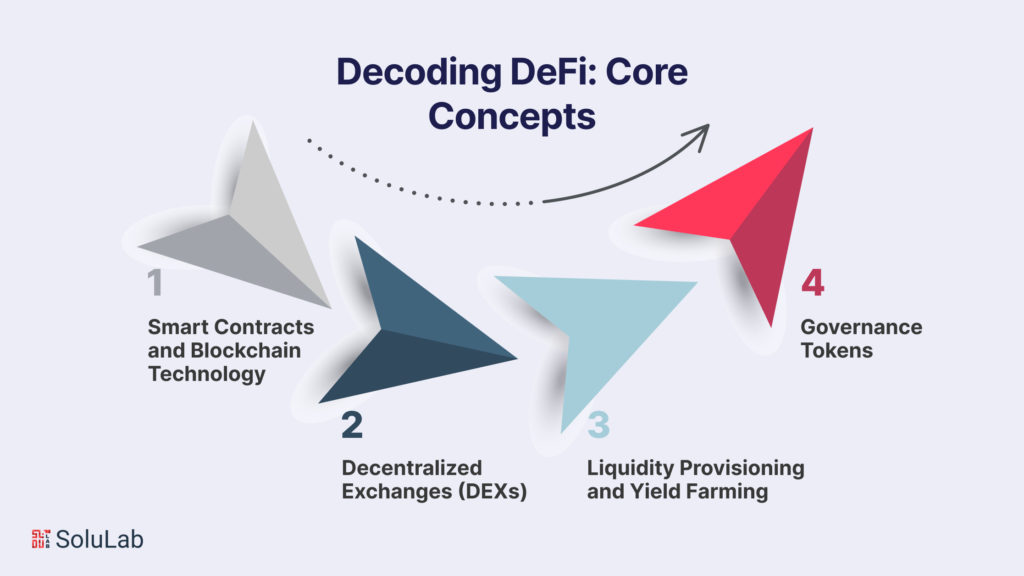

Businesses and individuals can benefit from the assistance of DeFi consulting services in negotiating the complexity of decentralized finance. However, you probably want to know exactly what they do. Fundamentally, DeFi consulting companies offer knowledgeable counsel and direction on how to effectively enter the decentralized finance market. They assist customers in the design, development, and deployment of DeFi solutions, such as lending platforms, yield farming techniques, liquidity pools, and decentralized exchanges (DEXs).

Whether introducing a new DeFi product or incorporating DeFi protocols into already-existing services, companies may steer clear of hazards and guarantee uninterrupted service. The necessity for DeFi consulting services is more important than ever since it has been reported that DeFi hacks and vulnerabilities cost over $3 billion in 2022.

Top 10 DeFi Consulting Firms in 2026

Given the established standards for a premier DeFi consulting firm, here are the most well-liked DeFi consulting firms of 2026 that will meet all of your current and future DeFi consulting requirements:

1. SoluLab

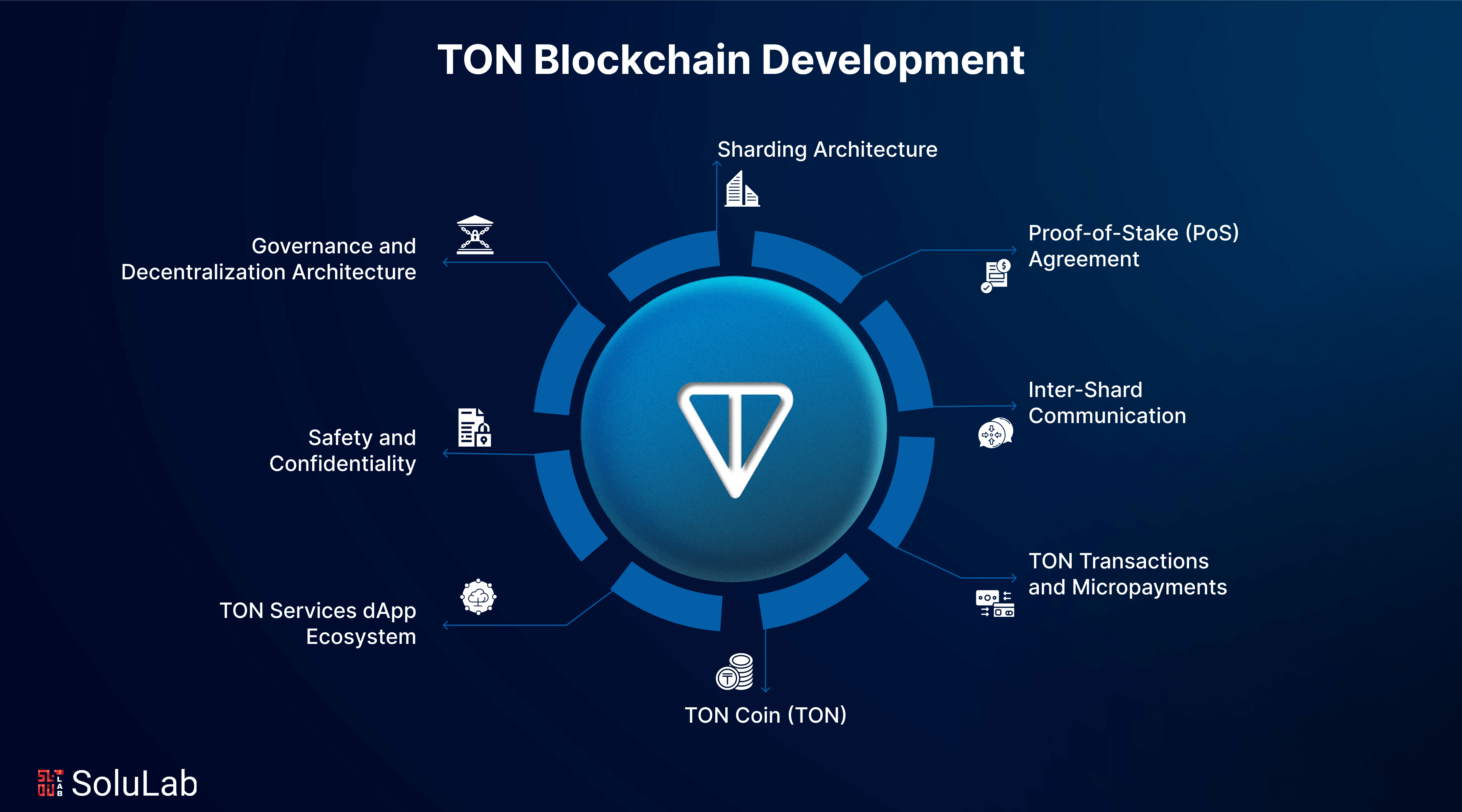

SoluLab, a top-tier DeFi development and consulting company, designs and builds decentralized financial platforms powered by blockchain technology. They offer exceptional decentralized finance development services, including DeFi token creation, cryptocurrency solutions, crypto exchanges, and smart contract development.

With extensive expertise in DeFi solutions, they focus on delivering secure, scalable, and custom-tailored platforms to meet your unique business requirements.

$25 – $49

50 – 249

Blockchain

India

2. Unicsoft

Based in California, Unicsoft is a blockchain development business that offers both direct blockchain solutions and custom software development. In addition, they have a record of more than 200 successfully finished DeFi wallet projects and specializes in providing DeFi consulting to a wide variety of clients.

$50 – $99

100 – 150

Blockchain / Software Development

India

3. Suffescom

Since 2013, Suffescom Solutions has been a friendly guide in the world of DeFi. With a passionate team of over 300 blockchain experts, they bring 50+ projects to life worldwide. They create tailored DeFi solutions like secure and transparent lending and investing platforms.

With deep knowledge across blockchain platforms, Suffescom helps businesses dive into decentralized finance with utmost ease, making them a go-to partner for innovation.

20$ – 25$

251 – 500

Blockchain

USA

4. Synodus

Synodus is a Vietnam-based DeFi consulting company that helps businesses build and scale decentralized finance solutions. They offer end-to-end services, including blockchain development, smart contract audits, and DeFi app design.

Known for their deep expertise in Web3 technologies, Synodus supports startups and enterprises in launching secure, scalable, and user-friendly DeFi platforms.

$25 – $49

250 – 300

Software Development

Vietnam

5. 4IRE

4IRE is a leading DeFi consulting company based in Canada, specializing in blockchain development, fintech solutions, and DeFi strategy. They offer services like smart contract development, DeFi app design, and tokenomics consulting. With deep expertise in Web3, 4IRE helps startups and enterprises launch secure, scalable, and innovative decentralized finance platforms.

$25 – $49

50 – 249

Blockchain Development

Canada

6. Antier Solutions

Antier Solutions is a leading DeFi consulting company that helps businesses launch decentralized finance platforms. Based in India, they offer end-to-end DeFi development services like smart contract creation, staking platforms, and liquidity solutions.

With deep blockchain expertise, Antier empowers startups and enterprises to build secure, scalable, and future-ready DeFi ecosystems.

$25 – $40

100 – 200

Blockchain

India

7. Debut Infotech

One of the leading DeFi development and consulting firms, Debut Infotech, was established in 2011 and specializes in designing and delivering DeFi solutions that can effectively and efficiently satisfy all company needs.

By combining technology with a deep understanding of market trends, Debut Infotech empowers its clients to stay ahead in the evolving DeFi landscape, providing robust solutions for long-term success.

$25 – $40

100 – 200

Blockchain

USA

8. Mattelio

Mattelio, a top software development company founded in California in 2014, has forged fruitful alliances with IT behemoths like Google Cloud, Siemens, and others in the areas of developing cryptocurrency wallets and providing knowledgeable DeFi consultancy.

With a commitment to delivering solutions, the company bridges the gap between traditional finance and decentralized systems, empowering organizations to harness the full potential of blockchain technology and drive sustainable growth.

$30 – $50

100 – 150

Software Development

USA

9. Innowise Group

The leading DeFi consulting firm, Innowise Group, provides end-to-end blockchain solutions. Smart contracts, wallets, DApps, and decentralized finance platforms are their areas of expertise. Innowise assists companies in entering the DeFi market with confidence and effectiveness, from concept to launch, with an intense focus on security, scalability, and customized development.

$50 – $99

300 – 400

Blockchain / IT Consulting

Poland

10. ConsenSys

Joseph Lubin, a co-founder of Ethereum, established ConsenSys in 2014. ConsenSys has a strong foundation in Ethereum development and a focus on DeFi advising, which helps in the creation of effective DeFi solutions for a wide range of clients.

Its focus on DeFi advising ensures that clients receive strategic guidance and robust frameworks to navigate the rapidly evolving blockchain landscape. With a commitment to innovation, ConsenSys continues to play a pivotal role in shaping the future of decentralized technologies.

$30 – $70

50 – 100

AI / Blockchain / DeFi

USA

Common Mistakes to Avoid While Choosing a DeFi Consulting Company

With so many DeFi consulting firms available, picking just one might be challenging. To facilitate your choice, here are some mistakes you should avoid:

1. Not prioritizing experience and expertise: Dealing with inexperienced developers may result in project failure, poor software quality, or delays. You can lose time and money if they are unable to handle complicated blockchain operations. Here is how you can prevent this:

- Examine their IT stack and portfolio.

- Find out how they manage deadlines, project scaling, and their development process.

- Examine customer evaluations to learn about their dependability and working style.

- Make sure the group has suitable work experience and blockchain credentials.

2. Choosing cost over quality: While going with the least expensive choice may save money up front, it may result in security vulnerabilities, poorer performance, and more expensive fixes down the road. Here are some ways to prevent this:

- Prioritize value over price by taking into account the long-term advantages of superior labor.

- Make sure they have strong testing and security procedures in place to assess their quality assurance procedures.

Read Our Blog: Top 10 DeFi Development Companies

3. Not defining clear goals and requirements: Confusion and misalignment with your development team may result from failing to specify the precise functionality you need and the kind of DeFi platform you wish to create (such as lending, staking, or liquidity pools). This can lead to delays and additional expenses if the final product doesn’t live up to your expectations or needs. Here are some ways to prevent this:

- Spend some time outlining the features you would like to see in your platform.

- Clearly state the essential characteristics so that the development team is on board.

4. Ignoring future updates: You risk having a product that is unable to adapt to changes in the market or user demands if you don’t plan for app updates. Here is how you can prevent this:

- Collaborate with a group that creates scalable applications and provides strategies for ongoing maintenance and upgrades.

- To maintain the competitiveness of your product, make sure they have long-term maintenance and update programs.

Conclusion

The success of your DeFi project depends critically on your choice of DeFi consulting company. Working with a reputable and experienced organization that has the necessary technical know-how and experience to build a platform that is safe, reliable, and easy to use is crucial.

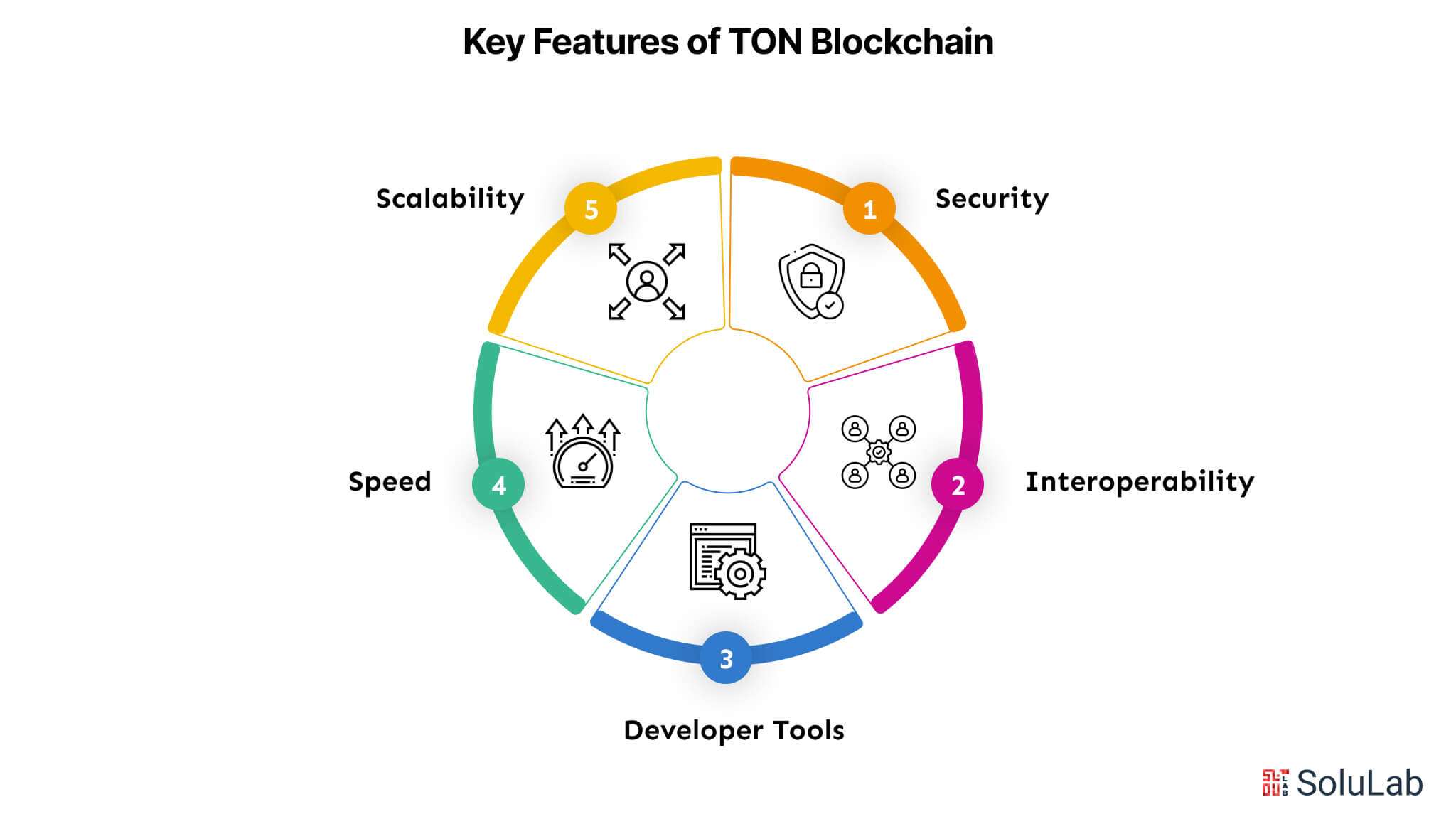

The DeFi consultancy industry is expected to grow significantly in the future. Businesses that keep ahead of the curve by implementing state-of-the-art technologies and creative solutions will set the standard while adjusting to new developments like improved blockchain interoperability, AI and machine learning integration, and the emergence of regulatory frameworks.

SoluLab is a leading DeFi consulting company with a team of experts ready to address your business queries and provide tailored solutions. Reach out to us today!

FAQs

1. What is the future of DeFi Consulting?

With improvements in regulations and blockchain technology, the future of DeFi consultancy appears bright. Businesses will prioritize interoperability, AI integration, and improved security. Remaining flexible and forward-thinking will be essential for success in this changing industry.

2. What services do DeFi consulting firms typically offer?

They usually provide smart contract development, DeFi protocol design, tokenomics consulting, wallet integration, blockchain development, and security audits.

3. How do I choose the right DeFi consulting company?

Look for firms with strong portfolios, positive client reviews, experience in your desired blockchain platform (like Ethereum or Solana), and transparent pricing.

4. Are DeFi consulting services expensive?

Costs vary widely based on the complexity of your project. Hourly rates typically range from $25 to $150+, depending on the company’s location and expertise.

5. Can DeFi consultants help with fundraising or token launches?

Yes, many offer end-to-end support, including tokenomics, whitepaper creation, and guidance for IDOs, ICOs, or token sales.

![Top 5 Enterprise Blockchain Platforms to Consider [2026]](https://www.solulab.com/wp-content/uploads/2025/04/Top-Enterprise-Blockchain-Platforms.png)