The financial industry is undergoing a radical transformation with the advent of Decentralized Finance, commonly known as DeFi. This groundbreaking shift eliminates conventional intermediaries, ushering in an era of peer-to-peer transactions, lending, and trading. At the forefront of this revolution is DeFi Asset Management, a rapidly evolving field that plays a pivotal role in optimizing and securing assets within the decentralized finance space. This blog delves into the intricacies of DeFi Asset Management, exploring its growth, fundamental principles, challenges, and promising trends that are reshaping the financial landscape. Join us on a journey to unravel the dynamics of managing assets in the decentralized future of finance.

So, let’s get started!

What is Asset Management in DeFi?

Asset management in DeFi refers to the strategic oversight and optimization of digital assets within the decentralized ecosystem. In the world of DeFi, users can engage in various financial activities, such as lending, borrowing, and trading, without relying on traditional intermediaries like banks. Asset management in DeFi involves actively managing and allocating these digital assets to maximize returns while minimizing risks. Users leverage smart contracts and decentralized protocols to automate and execute investment strategies, ensuring transparency, security, and efficiency in the management process.

Decentralized finance platforms often provide users with tools like decentralized exchanges (DEXs), liquidity pools, and yield farming protocols, enabling them to optimize their asset allocation strategies. Asset managers in DeFi may employ algorithms and automated strategies to rebalance portfolios based on market conditions and opportunities.

This dynamic and automated approach distinguishes DeFi asset management from traditional finance, offering users greater control over their assets and financial strategies in a permissionless and trustless environment. As the DeFi space continues to evolve, asset management plays a crucial role in empowering users to navigate the decentralized financial landscape and unlock the full potential of their digital assets.

The Evolution of DeFi and Its Impact on Asset Management

The allure of DeFi captured the interest of asset management professionals and investors as early as 2019. The DeFi landscape introduced novel elements such as protocols, derivatives, composability, decentralized exchanges, and Security Tokens, creating a fertile ground for innovative solutions in asset management.

These components, when amalgamated, laid the groundwork for the adoption of DeFi asset management. Traditional finance predominantly revolves around life goals, risk profiles, and income considerations for investment decisions. This often results in a manual and burdensome process, lacking standardization and leading to diverse investment portfolios among similar clients.

In recent years, the financial sector witnessed the rise of automated advisors like Betterment, Personal Capital, and Wealthfront, along with self-investing platforms such as Robinhood. This shift empowered investors, moving towards dominance by index funds and algorithms in the investment and asset management landscape. The convergence of these trends, coupled with the advantages presented by DeFi, spurred the growth of asset management within decentralized finance.

Before DeFi’s emergence, crypto trading was heralded as the next alternative to conventional financial systems. With the increasing usage of Ethereum and the advent of ERC20 tokens, decentralized exchanges emerged as a response to the drawbacks associated with centralized counterparts.

Beyond decentralized exchanges, the demand for hedging, margin trading, borrowing, and lending became pronounced. Users also sought incentive mechanisms tied to staking and liquidity. Consequently, DeFi evolved into a highly competitive space, offering a diverse range of financial instruments and setting the stage for the integration of asset management into the decentralized realm.

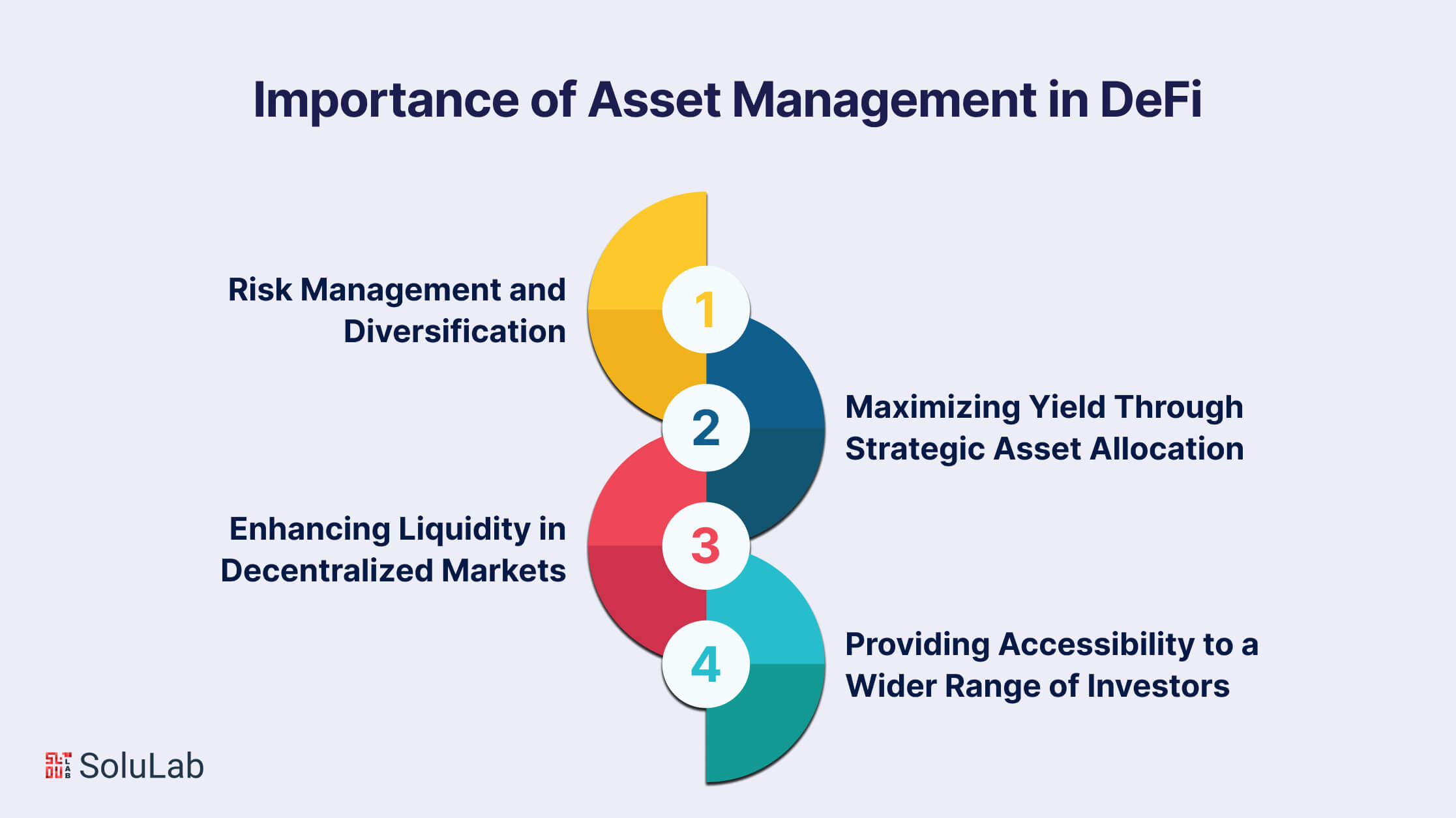

Importance of Asset Management in DeFi

The importance of managing assets in the realm of decentralized finance (DeFi) cannot be overstated. In DeFi, efficient asset management is a pivotal aspect that empowers users to navigate the decentralized financial landscape with precision and purpose. Unlike traditional finance, where centralized entities often dictate financial strategies, DeFi places the control firmly in the hands of users. Asset management in DeFi ensures that digital assets are strategically allocated and actively optimized, maximizing returns while mitigating risks. This dynamic approach is facilitated by the use of smart contracts and decentralized protocols, providing users with transparency, security, and unprecedented autonomy over their financial assets. As the DeFi ecosystem continues to evolve, the role of asset management becomes increasingly crucial, enabling users to unlock the full potential of their digital assets in a trustless and permissionless environment.

A. Risk Management and Diversification

In the dynamic landscape of decentralized finance (DeFi), risk management stands out as a paramount consideration. Asset management in DeFi allows users to strategically diversify their holdings, mitigating exposure to individual asset risks. By spreading investments across a spectrum of assets, users can reduce the impact of unforeseen market fluctuations and specific token vulnerabilities. This approach enhances the resilience of portfolios, providing a safety net against the inherent uncertainties within the crypto space.

B. Maximizing Yield Through Strategic Asset Allocation

DeFi asset management opens the door to optimizing yield generation through meticulous asset allocation. Investors can strategically allocate their assets across various decentralized protocols, taking advantage of different lending, borrowing, and liquidity mining opportunities. By actively managing their DeFi portfolio management composition, users can adapt to changing market conditions, capitalize on emerging trends, and ultimately maximize their returns. This dynamic approach contrasts with traditional finance, offering a unique avenue for yield optimization in the decentralized realm.

C. Enhancing Liquidity in Decentralized Markets

One of the cornerstones of DeFi asset management is its role in enhancing liquidity within decentralized markets. By actively participating in liquidity pools and decentralized exchanges, asset managers contribute to the overall liquidity of tokens. This not only facilitates smoother trading experiences for users but also plays a vital role in reducing slippage and improving price stability. The proactive management of assets thus becomes a catalyst for fostering vibrant and efficient decentralized markets.

D. Providing Accessibility to a Wider Range of Investors

DeFi asset management champions financial inclusion by providing accessibility to a broader spectrum of investors. Unlike traditional finance, which often imposes barriers such as geographical restrictions and minimum investment thresholds, DeFi platforms are inherently open and accessible. Through decentralized asset management, individuals worldwide can engage in various financial activities, regardless of their location or the size of their investment. This democratization of financial services aligns with the core principles of DeFi, fostering a more inclusive and globally connected financial ecosystem.

As DeFi continues to evolve, the significance of asset management in these key areas becomes increasingly evident, shaping a new paradigm for decentralized financial services.

Different Types of Assets Managed in DeFi

DeFi (Decentralized Finance) platforms support a wide variety of assets, enabling users to engage in decentralized financial activities. Here are the different types of assets managed in DeFi:

1. Cryptocurrencies

- Bitcoin (BTC): While Bitcoin is primarily a store of value, some DeFi platforms allow users to collateralize their BTC to access decentralized lending and borrowing services.

- Ethereum (ETH): The native cryptocurrency of the Ethereum blockchain is widely used within DeFi protocols as a means of collateral, transaction fees, and staking.

2. Stablecoins

- USDC, USDT, DAI: Stablecoins pegged to fiat currencies (e.g., USD) provide stability and are commonly used in lending, borrowing, and trading within DeFi due to their low volatility.

3. Wrapped Assets

- Wrapped Bitcoin (WBTC): An ERC-20 token representing Bitcoin on the Ethereum blockchain, allowing users to bring Bitcoin liquidity into DeFi platforms.

- Wrapped Ethereum (WETH): Similar to WBTC, WETH is an ERC-20 version of Ethereum, facilitating its use in various DeFi protocols.

4. Synthetic Assets

- Synthetic USD (sUSD): These are tokens representing the value of traditional assets like fiat currencies, commodities, or indices, allowing users to gain exposure to these assets without directly holding them.

5. Tokenized Securities

- Security Tokens: Tokenized versions of traditional financial instruments like stocks, bonds, and real estate can be managed on DeFi platforms, providing fractional ownership and liquidity.

6. LP (Liquidity Provider) Tokens

- Uniswap LP Tokens, SushiSwap LP Tokens: Users providing liquidity to decentralized exchanges receive LP tokens, representing their share of the liquidity pool and earning fees.

7. Governance Tokens

- COMP, UNI, YFI: These tokens are used to govern and vote on decisions within DeFi protocols. Holders often participate in decision-making processes related to the platform’s development and changes.

8. NFTs (Non-Fungible Tokens)

- CryptoKitties, Decentraland Parcels: While primarily associated with digital art and virtual real estate, NFTs can also represent ownership of unique assets and be utilized within DeFi applications.

9. Derivatives

- Options, Futures, and Perpetual Swaps: DeFi platforms offer derivative instruments that enable users to hedge risks, speculate on price movements, and manage exposure to various assets.

10. Interest-Bearing Tokens

- cTokens (Compound), aTokens (Aave): Users can earn interest by depositing assets into lending platforms, receiving interest-bearing tokens in return that represent their share of the pool.

Understanding and managing these diverse assets within the DeFi ecosystem allows users to tailor their investment strategies, diversify portfolios, and participate in a range of financial activities in a decentralized manner.

Popular DeFi Asset Management Platforms

The surge of interest in decentralized finance has given rise to a multitude of platforms catering to DeFi asset management. Among these, platforms such as Yearn Finance, Aave, and Compound have gained prominence. Yearn Finance, founded by Andre Cronje, stands out for its automated yield farming strategies, optimizing returns for users across various DeFi protocols. Aave and Compound, on the other hand, are decentralized lending platforms that enable users to lend and borrow assets seamlessly while earning interest. These platforms represent just a fraction of the diverse DeFi ecosystem, each contributing unique features to the landscape of decentralized asset management.

Overview of Leading DeFi Asset Management Platforms

1. Yearn Finance

- Automated Yield Farming: Yearn Finance automates yield farming strategies across different DeFi protocols, providing users with a hassle-free approach to optimizing their returns.

- Vaults and Strategies: Users can deposit funds into specialized vaults managed by Yearn, each employing distinct strategies to maximize yield while minimizing risk.

2. Aave

- Decentralized Lending: Aave facilitates decentralized lending, allowing users to lend and borrow a variety of assets without the need for traditional intermediaries.

- Flash Loans: Aave pioneered flash loans, enabling users to borrow and repay funds within the same transaction, fostering efficient and innovative DeFi activities.

3. Compound

- Algorithmic Lending and Borrowing: Compound operates as an algorithmic money market protocol, dynamically adjusting interest rates based on the supply and demand of assets.

- Governance Token (COMP): Users actively participate in the governance of the Compound through the COMP token, influencing protocol upgrades and changes.

Key Features and Functionalities Offered by These Platforms

- Automated Strategies: DeFi asset management platforms often employ automated strategies to optimize yield farming, ensuring that users can capitalize on the most lucrative opportunities in the ever-changing DeFi landscape.

- Decentralized Lending and Borrowing: Platforms like Aave and Compound provide decentralized lending and borrowing services, eliminating the need for traditional intermediaries and fostering a more inclusive financial ecosystem.

- Governance Tokens: Many DeFi platforms issue governance tokens, allowing users to participate in decision-making processes and influence the direction of the platform’s development.

- Innovative Financial Instruments: DeFi asset management platforms introduce innovative financial instruments such as flash loans, providing users with new ways to engage in lending, borrowing, and other financial activities.

These key features collectively contribute to the attractiveness and functionality of DeFi asset management platforms, shaping the landscape of decentralized finance.

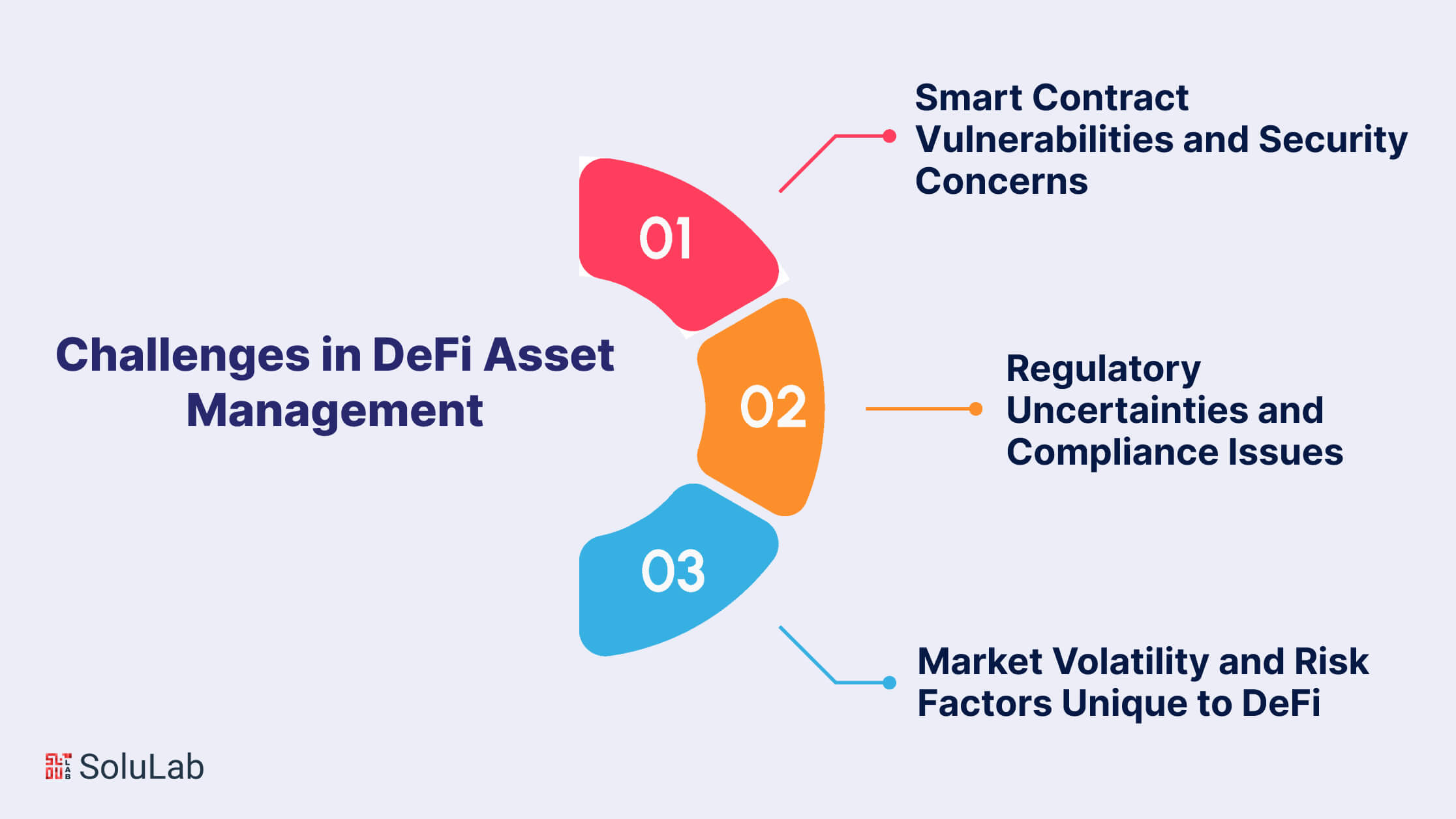

Challenges in DeFi Asset Management

While the DeFi asset management protocol presents exciting opportunities, it also confronts several challenges that demand careful consideration. One of the foremost concerns is the susceptibility to smart contract vulnerabilities and security issues within the decentralized ecosystem. Smart contracts, integral to asset management in DeFi, can be exposed to exploits and vulnerabilities, risking the safety of users’ funds. Additionally, the regulatory landscape surrounding DeFi remains uncertain, with compliance issues posing potential hurdles for the widespread adoption of decentralized asset management solutions. Moreover, the inherent market volatility and unique risk factors within DeFi further underscore the need for robust risk management strategies in the realm of asset management.

-

Smart Contract Vulnerabilities and Security Concerns

Asset management in DeFi heavily relies on smart contracts, which, while enabling automated and trustless transactions, are not immune to vulnerabilities. Smart contract exploits, hacks, and coding errors have resulted in substantial financial losses for users. Ensuring the security and auditability of smart contracts is imperative to safeguard user funds and maintain the trust of participants in DeFi asset management platforms.

-

Regulatory Uncertainties and Compliance Issues

The decentralized nature of DeFi asset management platforms challenges traditional regulatory frameworks, leading to uncertainties and compliance issues. Regulatory bodies worldwide are grappling with the classification and oversight of DeFi protocols, creating a complex environment for asset managers. Navigating these uncertainties and staying compliant with evolving regulations are critical aspects for the sustainable growth and acceptance of asset management in the decentralized financial landscape.

-

Market Volatility and Risk Factors Unique to DeFi

The DeFi space is characterized by rapid innovation, but it also comes with unique risk factors, including extreme market volatility. The values of tokens and assets within DeFi protocols can experience sharp fluctuations, impacting the overall performance of asset management strategies. Risk management becomes crucial in mitigating the impact of market volatility, requiring continuous monitoring, adaptation, and the development of strategies tailored to the distinctive challenges posed by the decentralized financial ecosystem.

Risks and Mitigations in DeFi Asset Management

Navigating the dynamic landscape of DeFi asset management entails addressing various risks inherent to the decentralized ecosystem. Identifying and mitigating these risks is essential for safeguarding user funds and ensuring the long-term viability of decentralized financial solutions.

-

Identifying Potential Risks in DeFi Asset Management

In DeFi asset management, potential risks include smart contract vulnerabilities, protocol exploits, liquidity crises, and regulatory uncertainties. Smart contract vulnerabilities may expose funds to security breaches, while unexpected exploits can lead to financial losses. Liquidity crises, triggered by sudden market movements, can affect the overall stability of DeFi protocols. Moreover, evolving regulatory landscapes add complexity, with compliance issues potentially disrupting the seamless functioning of decentralized asset management platforms.

-

Strategies and Tools for Risk Mitigation

To mitigate these risks, robust security measures are paramount. Auditing smart contracts, employing formal verification methods, and implementing bug bounty programs contribute to the identification and rectification of vulnerabilities. Risk diversification, both in terms of assets and protocols, helps distribute potential losses. Furthermore, the use of decentralized insurance protocols and the creation of contingency funds can act as financial safeguards. Employing advanced monitoring tools and integrating secure oracles also enhances the resilience of DeFi asset management systems.

-

Importance of Due Diligence in Selecting DeFi Asset Management Platforms

Conducting thorough due diligence is a critical step for users and investors when selecting DeFi asset management platforms. Analyzing the track record of platforms, understanding their governance models, and evaluating the security measures in place are essential aspects of due diligence. Users should prioritize platforms that have undergone comprehensive security audits, have transparent governance structures, and implement risk management practices. Staying informed about the regulatory landscape and the platform’s compliance measures further adds to the due diligence process, ensuring a prudent approach to decentralized asset management.

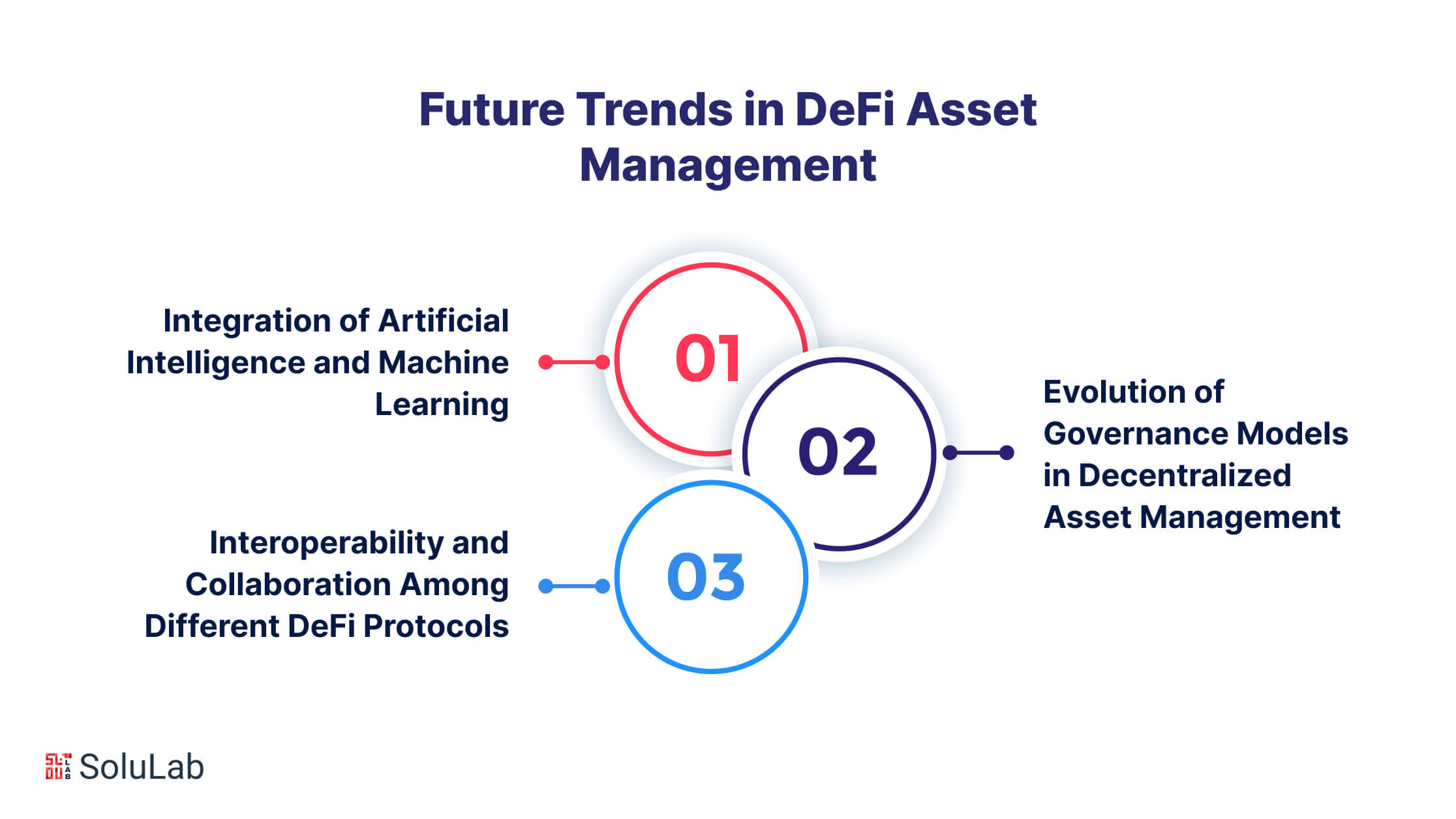

Future Trends in DeFi Asset Management

The future of DeFi asset management holds exciting possibilities as the ecosystem continues to evolve. One prominent trend is the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) into asset management strategies. These technologies have the potential to enhance decision-making processes, optimize DeFi portfolio management allocations, and adapt dynamically to changing market conditions. Additionally, the evolution of governance models in decentralized asset management is expected to shape the future landscape, empowering users with more direct participation in protocol governance and decision-making. Interoperability and collaboration among different DeFi protocols are poised to become instrumental, fostering a cohesive and interconnected financial ecosystem that can provide users with a seamless and holistic approach to asset management.

-

Integration of Artificial Intelligence and Machine Learning

The integration of AI and ML into DeFi asset tokenization management is anticipated to revolutionize the way portfolios are managed and optimized. Machine learning algorithms can analyze vast amounts of data, identify patterns, and make predictions, enabling more informed investment decisions. Smart contract execution and risk management can benefit from AI-driven automation, offering users sophisticated tools for managing their assets in a decentralized environment. As these technologies mature, they are likely to play a pivotal role in enhancing the efficiency and performance of DeFi asset management strategies.

-

Evolution of Governance Models in Decentralized Asset Management

The future of decentralized DeFi asset management protocol will witness the continued evolution of governance models, emphasizing increased decentralization and community involvement. Governance tokens will play a central role, enabling users to participate in decision-making processes related to protocol upgrades, changes, and the overall direction of the platform. This trend fosters a more democratic and inclusive approach to managing assets, aligning with the decentralized ethos of the broader DeFi ecosystem.

-

Interoperability and Collaboration Among Different DeFi Protocols

Interoperability is set to become a cornerstone of DeFi asset tokenization, allowing seamless collaboration between different protocols. Users will have the flexibility to move assets and liquidity across diverse platforms, unlocking new opportunities and creating a more interconnected financial ecosystem. Collaboration can lead to the creation of composite financial products, further expanding the range of possibilities for decentralized asset management. As interoperability standards mature, users can expect a more integrated and user-friendly experience when navigating the diverse landscape of DeFi protocols.

Final Words

In conclusion, the DeFi asset management landscape represents a transformative force in the financial realm, marked by rapid growth and technological innovation. As the sector matures, challenges such as smart contract vulnerabilities and regulatory uncertainties must be addressed alongside emerging trends. The integration of artificial intelligence, the evolution of governance models, and enhanced interoperability are poised to define the future of decentralized asset management, promising users a more sophisticated and inclusive financial experience.

For those navigating the complexities of DeFi asset management, SoluLab offers tailored DeFi Development solutions at the forefront of blockchain technology. From secure smart contracts to comprehensive audits and the integration of advanced technologies like AI, SoluLab is your partner for a secure and efficient decentralized financial journey. Explore the possibilities with SoluLab – your gateway to the future of decentralized asset management. Contact us today!

FAQs

1. What is DeFi asset management, and how does it differ from traditional asset management?

DeFi asset management refers to the decentralized management of assets using blockchain-based protocols and smart contracts. Unlike traditional asset management, which relies on centralized entities, DeFi asset management leverages decentralized finance platforms, providing users with direct control over their assets without the need for intermediaries.

2. What are the key benefits of engaging in DeFi asset management?

Engaging in DeFi asset management offers several benefits, including enhanced liquidity, diversified investment opportunities, and increased accessibility. Users can maximize yield through strategic asset allocation, participate in decentralized lending and borrowing, and enjoy a more inclusive and borderless financial ecosystem.

3. How does decentral asset management address risk factors unique to the DeFi space?

Decentralized Asset Management incorporates risk mitigation strategies such as smart contract audits, risk diversification, and the use of decentralized insurance protocols. These measures help address smart contract vulnerabilities, market volatility, and other unique risk factors associated with managing assets in the decentralized financial landscape.

4. Can AI and machine learning play a role in DeFi asset management?

Yes, the integration of AI and machine learning is a future trend in DeFi asset management. These technologies can optimize portfolio management, automate decision-making processes, and enhance risk management strategies, providing users with more sophisticated tools for managing their assets in a decentralized environment.

5. How can SoluLab assist in bringing the benefits of DeFi asset management, and what services do they offer?

SoluLab specializes in blockchain technology and offers a range of services to support the benefits of DeFi asset management. From developing secure smart contracts to comprehensive audits, integrating AI technologies, and providing tailored solutions, SoluLab stands as a reliable partner for those navigating the complexities of decentralized financial management.