Tired of traditional banking systems wasting your time and money? Decentralized Finance (DeFi) is rewriting the rules of how we handle money. With no middlemen, global accessibility, and open-source protocols, DeFi is changing everything from lending and borrowing to insurance and asset management.

Now, you can take a loan without a bank, earn passive income by staking crypto, or trade assets 24/7, all from your smartphone. Innovations like decentralized identification systems, cross-chain integrations, and AI-powered investing are appearing as DeFi keeps expanding.

The global DeFi market is projected to grow at a CAGR of ~49%, reaching $351.8 bn by 2031. In this blog, we’ll explore why Defi is growing, how it works, and future trends. Let’s get started.

Why is DeFi’s popularity rising now?

DeFi is gaining popularity as it eliminates the limitations associated with traditional financial systems. It has attracted customers by offering noticeably higher lending and borrowing interest rates than traditional banks, and it can reach people who would not typically meet the bank’s qualifying criteria.

Furthermore, DeFi of every blockchain transaction. Overall, DeFi’s attractiveness comes from its increased inclusion, lack of restriction, and high return potential, all of which have fueled its explosive expansion.

Core Pillars of DeFi: What Investors Should Know?

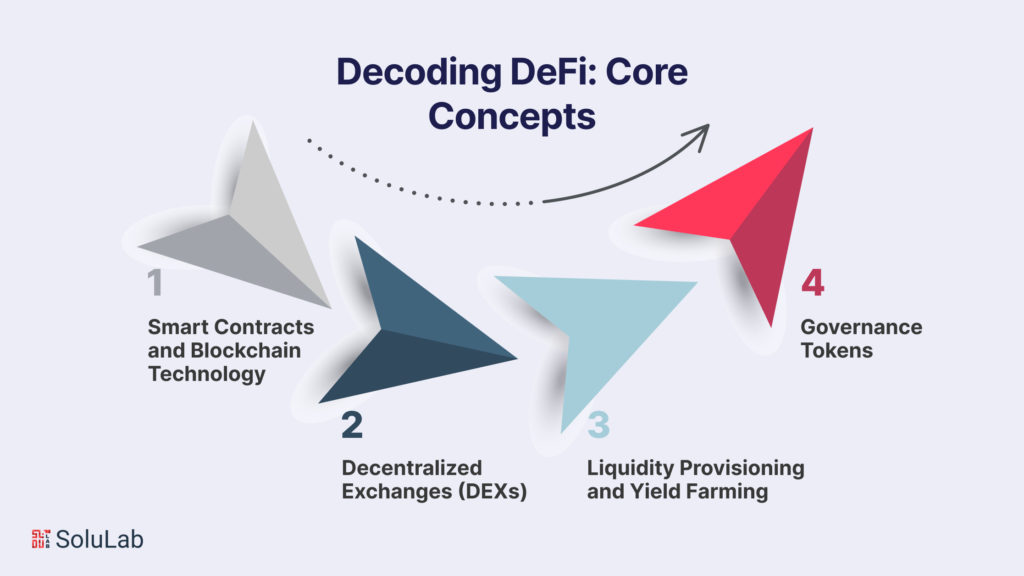

To truly grasp the trends and developments within the DeFi landscape, it’s essential to understand the fundamental concepts that underpin this financial revolution. DeFi isn’t just a buzzword; it’s a complex and innovative ecosystem built on a foundation of blockchain technology. In this section, we’ll decode the core concepts that are central to DeFi’s operation.

-

Smart Contracts and Blockchain Technology

At the heart of DeFi are smart contracts, self-executing agreements with the terms and conditions directly encoded into computer programs. These contracts automate financial processes, ensuring that transactions occur when predefined conditions are met. Ethereum, a blockchain platforms designed to support smart contracts, has been the epicenter of DeFi’s growth. Smart contracts have replaced the need for intermediaries, executing tasks like lending, borrowing, and trading without the involvement of traditional banks or financial institutions.

Blockchain technology, on the other hand, provides the decentralized and immutable ledger on which DeFi solutions operates. Transactions and data are stored across a network of computers, ensuring transparency and security. This foundation of blockchain ensures that DeFi transactions are trustless, meaning they can occur without the need for trust between parties.

-

Decentralized Exchanges (DEXs)

Decentralized exchanges are a key component of the DeFi ecosystem. These platforms enable users to trade cryptocurrencies directly with one another, without the need for a centralized intermediary. DEXs operate through smart contracts, facilitating peer-to-peer trading while allowing users to maintain control of their funds. This approach significantly reduces counterparty risk and enhances the security of transactions.

-

Liquidity Provisioning and Yield Farming

Liquidity provisioning is the practice of providing assets to decentralized exchanges, enabling other users to trade them. In return, liquidity providers earn fees and rewards. Yield farming, a popular DeFi practice, involves optimizing the use of these assets to maximize returns. Users can earn interest, lending fees, and governance tokens by participating in liquidity provision and yield farming protocols.

-

Governance Tokens

Governance tokens are tokens that provide users with decision-making power within a DeFi ecosystem. Holders of these tokens can vote on proposed changes, upgrades, and alterations to the protocol. This democratic approach to governance empowers the community to have a say in the development and management of DeFi lending platforms.

Understanding these core concepts is crucial for anyone looking to navigate the DeFi trends effectively. They serve as the building blocks for the multitude of financial services and applications that DeFi has to offer. As we move forward in this blog, we will explore the trends and innovations emerging within DeFi and how they relate to these core concepts.

Top DeFi Trends to Look for in 2025

Decentralized Finance (DeFi) is evolving fast in 2025, redefining how we borrow, lend, trade, and earn. Here are the top DeFi trends shaping the future of finance this year:

1. Real-World Asset Tokenization: DeFi is bridging with the real world by tokenizing assets like real estate, gold, and bonds. This brings more liquidity to traditional markets and opens up fractional ownership for global investors.

2. Mobile-First DeFi Apps: With DeFi gaining traction in emerging markets like India, mobile-first platforms are on the rise. These apps offer smoother UX and simpler onboarding for users without a desktop or technical know-how.

3. DeFi Regulation Frameworks: Governments are moving from banning to regulating DeFi. Countries like the U.S., the UK, and India are exploring compliance tools, ensuring investor protection without stifling innovation.

4. AI-Powered DeFi Bots: AI is being integrated into DeFi protocols to help with risk management, automated trading, and lending decisions, making platforms smarter and safer for users.

5. Insurance & Risk Mitigation: More DeFi platforms are offering built-in insurance options against smart contract failures or hacks. This builds user trust and promotes long-term adoption.

6. Cross-Chain Interoperability: Movement of assets across blockchains is improving thanks to interoperability protocols. Users no longer need to worry about being locked into one chain.

7. Stablecoin Innovation: Beyond USDT and USDC, 2025 is seeing a rise in algorithmic and CBDC-backed stablecoins, enhancing payment efficiency and reducing volatility risks in DeFi ecosystems.

Future of DeFi: How Will It Evolve Beyond 2025?

The future of DeFi holds immense promise and potential for reshaping the global financial landscape. As we look ahead, several key factors and developments are likely to play a significant role in shaping the future of decentralized finance.

-

Scalability and Layer 2 Solutions

One of the most pressing challenges facing DeFi is scalability. Ethereum, the primary platform for DeFi projects, has struggled with high gas fees and network congestion. To overcome these limitations, Layer 2 solutions such as Optimistic Rollups and zk-Rollups are being implemented. These solutions aim to enhance the scalability of Ethereum and other blockchain networks, making DeFi more accessible and cost-effective for users.

-

DeFi in Traditional Finance

DeFi is no longer operating in isolation. It is increasingly intersecting with traditional DeFi and the future of finance. Traditional financial institutions are recognizing the potential benefits of DeFi, including reduced operational costs, enhanced transparency, and improved access to financial services. We can expect to see more partnerships, integrations, and collaborations between DeFi projects and traditional financial entities in the future.

-

AI-Powered DeFi Solutions

The integration of artificial intelligence into DeFi platforms will transform how investors interact with decentralized protocols. AI algorithms will help users analyze risk, forecast returns, automate portfolio strategies, and detect suspicious activity in real time. Think of it as having a smart DeFi assistant that constantly scans data, market sentiment, and yield opportunities, enabling users to make faster, data-driven decisions without deep technical expertise.

-

Rise of Decentralized Identity (DID)

As regulation and compliance become critical for DeFi’s mainstream adoption, Decentralized Identity (DID) systems are emerging as a key enabler. DID allows users to verify their identity without handing over control of personal data to centralized entities. With verifiable credentials stored on-chain, users can access compliant DeFi services while retaining privacy and autonomy. This shift will be essential for unlocking secure, user-owned financial identities that can seamlessly interact across platforms and blockchains.

-

Use Cases Beyond Lending and Trading

While lending and trading have been the primary use cases in DeFi, the ecosystem is diversifying. New DeFi Solutions applications are emerging, including decentralized insurance, prediction markets, and decentralized identity solutions. These innovations extend the scope of DeFi, offering users a broader array of financial services that were once the domain of centralized institutions.

-

Risks and Security Considerations

With the rapid expansion of the DeFi ecosystem, the risk landscape is evolving. Security remains a paramount concern. Smart contract vulnerabilities, hacks, and scams are real threats. Users and projects must remain vigilant and prioritize security. The development of decentralized insurance and risk management solutions within DeFi is a step toward mitigating these risks.

Conclusion

With more people exploring decentralized platforms, smarter tools powered by AI, and better ways to stay secure. It’s becoming a real alternative to traditional banking. From easier access to loans to faster cross-border payments, everything’s getting more user-friendly and transparent.

And as DeFi blends with regular finance, we’re heading toward a future where you control your money fully and freely. With rapid adoption and innovation, many experts believe that DeFi could be the future of financial services.

SoluLab, a top DeFi development company in the USA, can help you integrate decentralized finance into your business. Contact us today to discuss further!

FAQs

1. Why should investors care about DeFi trends in 2025?

In 2025, DeFi is evolving rapidly with trends like real-world asset tokenization, AI-powered DeFi, and institutional-grade platforms. For investors, staying updated on these trends is crucial to spotting new opportunities and understanding where the next wave of returns could come from in the decentralized ecosystem.

2. How can I invest in DeFi protocols in 2025?

Investors can participate in DeFi by staking, lending, yield farming, or buying DeFi tokens from decentralized exchanges (DEXs). Many platforms also offer liquidity pools or structured DeFi products. It’s essential to understand how each protocol works and monitor its TVL (Total Value Locked), audits, and community reputation.

3. What role does AI play in DeFi in 2025?

AI is increasingly integrated into DeFi platforms in 2025 to automate trading, enhance risk assessment, predict yield opportunities, and detect fraud. Smart DeFi dashboards and robo-advisors are helping both retail and institutional investors make more informed decisions based on real-time data.

4. Are stablecoins still relevant in DeFi in 2025?

Absolutely. Stablecoins remain the backbone of DeFi transactions, providing a stable unit of account in volatile markets. In 2025, there’s a shift toward fully transparent, regulated, or overcollateralized stablecoins to reduce systemic risks. They’re widely used in lending, liquidity pools, payments, and savings protocols.

5. How can beginners start investing in DeFi in 2025?

Beginners should start by learning the basics of blockchain, crypto wallets, and DeFi platforms. Use secure wallets like MetaMask or hardware options, and begin with popular platforms like Aave, Uniswap, or Curve. Start small, explore tutorials, and consider platforms that offer beginner-friendly interfaces with guided steps.