Buying U.S. Treasuries has traditionally been seen as a secure investment; yet, it has not been easy or accessible to many individuals. The conversion of government bonds into digital tokens is initiating a transformation. Reports indicate that the market value has surpassed $3 billion, reflecting a substantial increase compared to previous years. This surge underscores the increasing confidence in blockchain-based financial instruments and their potential to revolutionize conventional investing avenues.

The long-term forecast is even more remarkable. Projections suggest that the market might surpass $9.5 billion by 2030, growing at an annual pace of 24.4%. This expansion is driven by the increasing need for transparent, successful, and accessible investment platforms.

What is the cause of this increase? And why are so many focusing on building platforms around tokenized U.S. Treasuries? Let’s break down the reasons and opportunities driving this shift in this blog.

What are Tokenized U.S Treasuries?

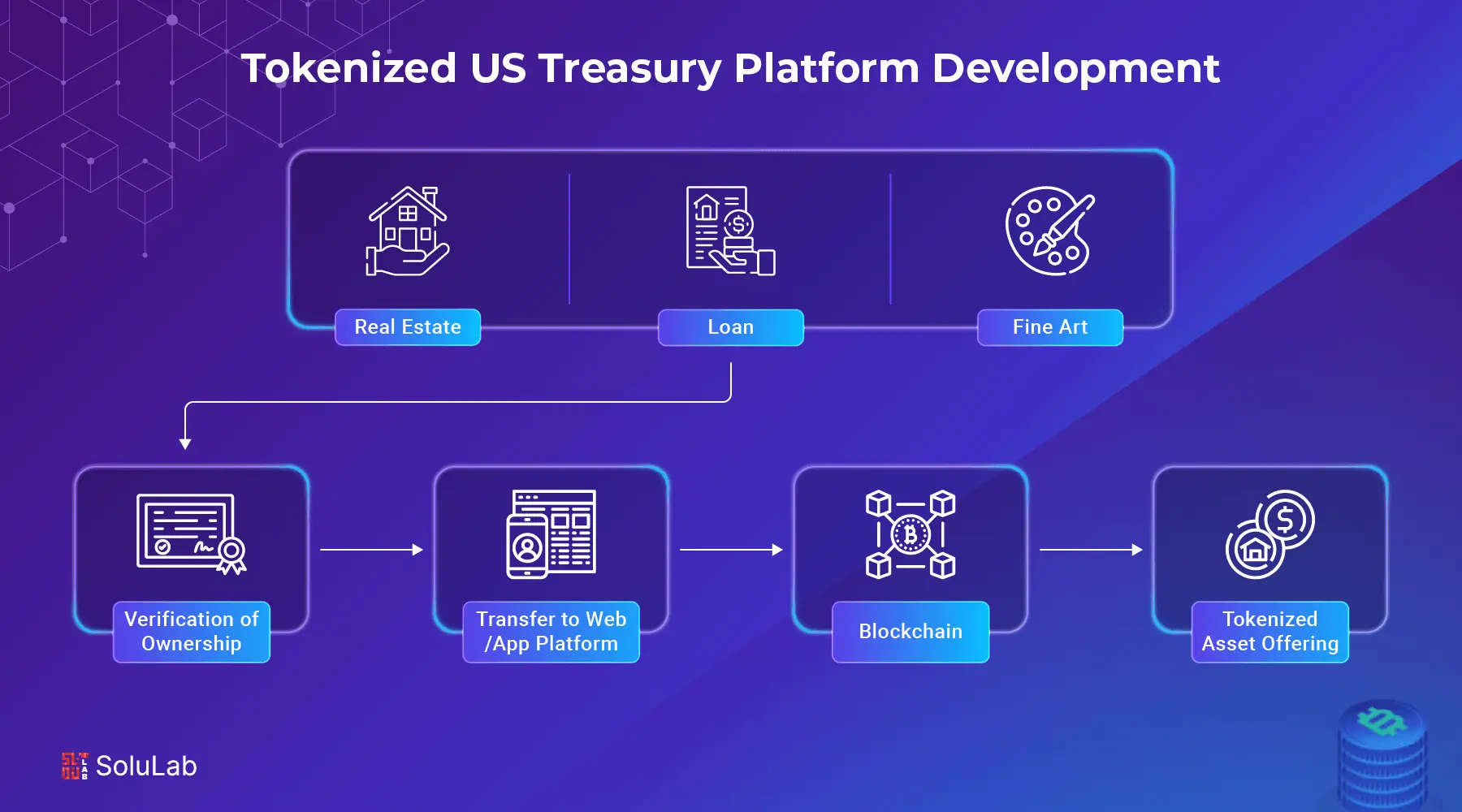

For many years, U.S. Treasuries were seen to be among the safest spots to invest your money. They’re backed by the full faith and credit of the U.S. government, and they offer consistent returns. Tokenized treasury bonds are conventional government bonds converted into digital tokens via blockchain technology. Tokenized U.S. Treasuries convert the reliability of government bonds into a digital format, enhancing usability, expediting transactions, and increasing accessibility.

One can purchase these bonds directly on a digital platform. What does that mean? It means you still get the same stability and interest payments that come with regular U.S. Treasuries, but with more flexibility. You can own smaller portions, trade them 24/7, and see real-time updates, something the traditional bond market doesn’t offer. Tokenized treasury bonds enable global investors to engage in U.S. debt markets without the necessity of middlemen or long settlement durations.

Why Investors Must Tokenize Their Treasury Bills?

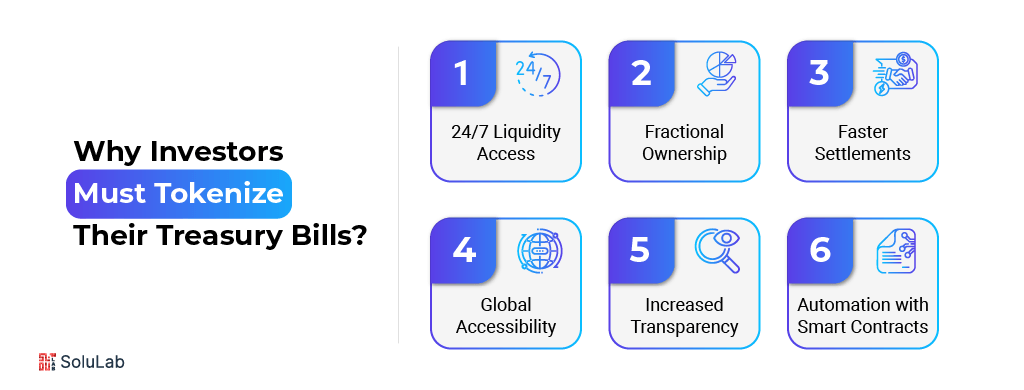

For decades, treasury bills have been a go-to for investors seeking low-risk returns and stability. But the process of buying, managing, and trading them has always come with friction, slow settlements, limited market hours, and geographical barriers. But with tokenized treasuries, investors now have the opportunity to bring these traditionally rigid instruments into a faster, more flexible digital environment.

Tokenizing treasury bills isn’t just a tech trend, it’s a practical step towards having better access, efficiency, and control in fixed-income investing. Here’s why more investors are making the shift:

- 24/7 Liquidity Access: Tokenized treasuries can be traded anytime, removing the usual constraints of banking hours and market closures. Investors can move in and out of positions at their convenience, not when the market dictates.

- Fractional Ownership: Instead of needing large sums to invest, tokenization allows for the purchase of small fractions of a Treasury bill. This opens the door for retail investors and democratizes access to one of the safest asset classes in the world.

- Faster Settlements: Traditional T-bill transactions can take days to clear. With tokenized treasuries, settlements can happen in minutes or even seconds, reducing counterparty risk and freeing up capital faster.

- Global Accessibility: Global investors can now obtain U.S. Treasury products without the necessity of a U.S.-based broker or bank. They require only a digital wallet and a compatible platform.

- Increased Transparency: All transactions about tokenized treasury bills are documented on a blockchain, ensuring complete traceability and minimizing the risk of mismanagement or fraud.

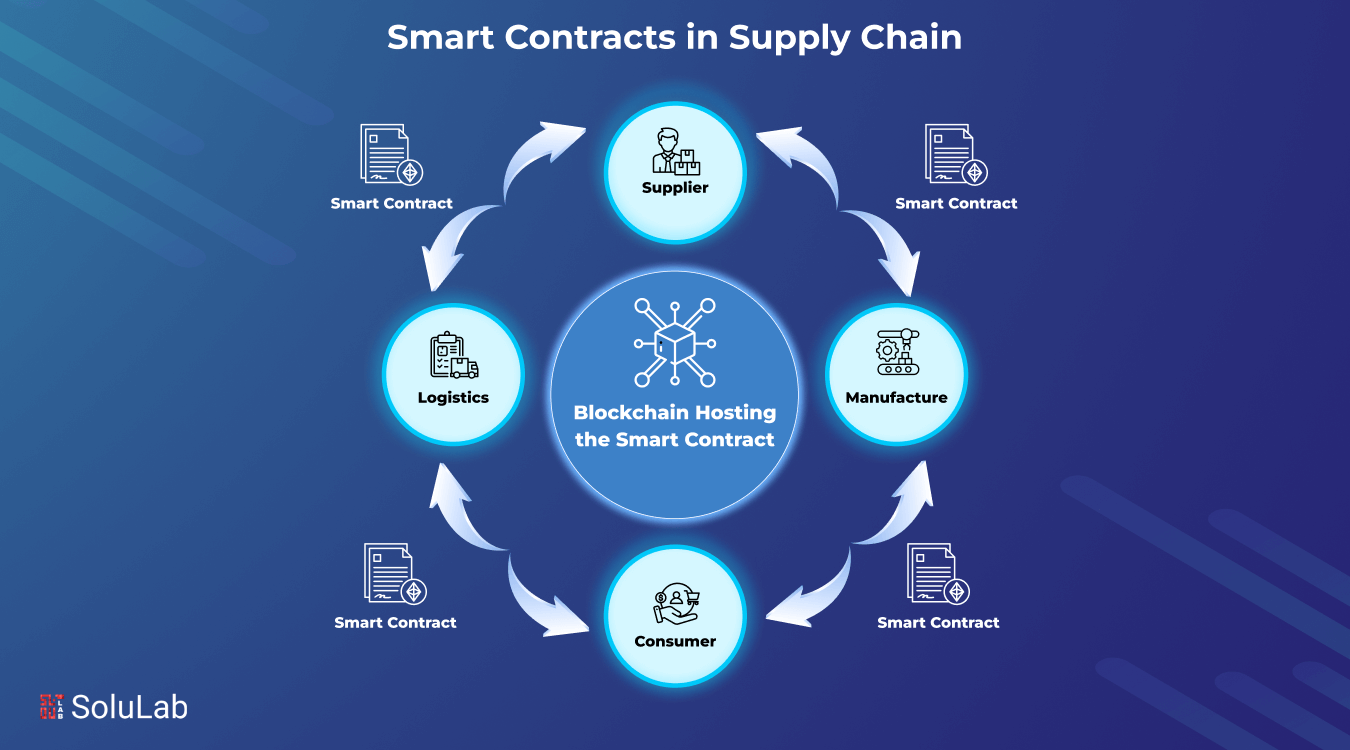

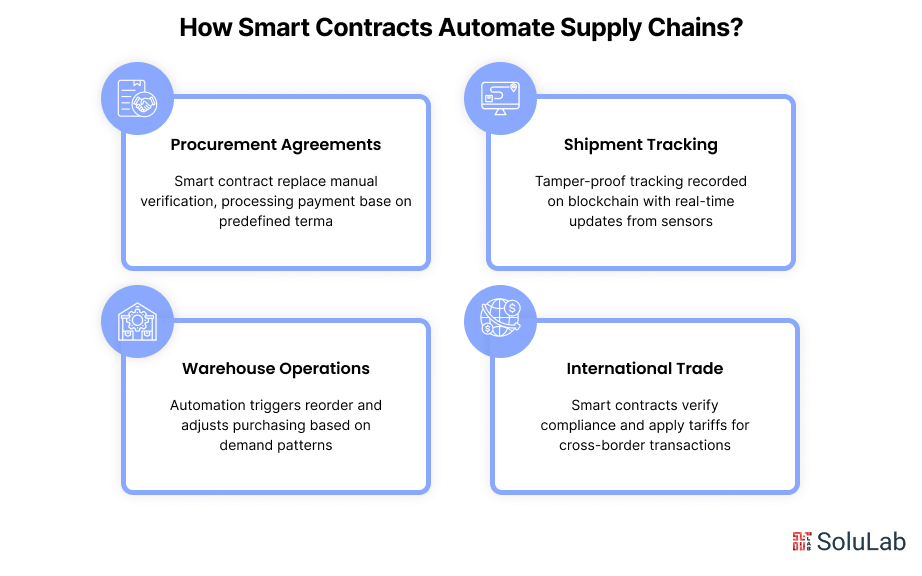

- Automation with Smart Contracts: Interest payments, maturity redemptions, and other functions can be automated through smart contracts, simplifying management and reducing human error.

Market Opportunity for Tokenized Treasury Platforms

Tokenized treasuries are becoming a viable and smart option for contemporary investors as the global financial system gradually adopts digital transformation. Investors may obtain the same degree of security and steady returns by turning traditional treasury notes into blockchain-based assets, all without the limitations and operational inefficiencies of traditional marketplaces.

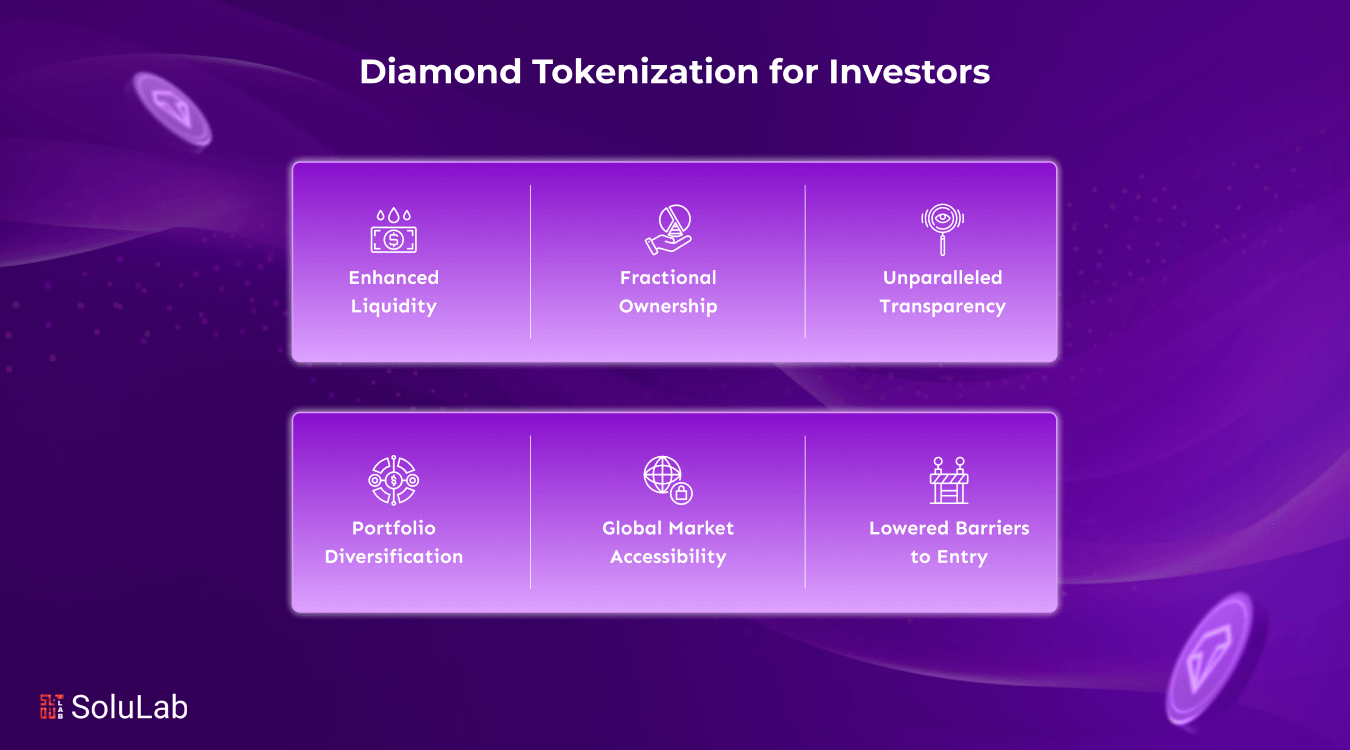

1. Enhanced Liquidity

Because tokenized Treasury bills are easier to trade, frequently in real-time, they allow for more responsive investment strategies and faster rebalancing.

2. Fractional Investment Opportunities

Large capital expenditures are no longer necessary for investors since tokenization permits fractional ownership, allowing for wider involvement.

3. Quicker Settlement Periods

Tokenized treasury transactions may settle in minutes as opposed to days, which lowers counterparty risk and expedites cash flow.

4. Access to International Markets

Qualified investors from all around the world may now interact with U.S. debt securities thanks to tokenized platforms, which eliminate conventional regulatory and geographic barriers.

5. Transparency and Trackability

An immutable ledger records all transfers and ownership changes, improving auditability and lowering the possibility of fraud or mistake.

6. Interest Payment Automation

Back-office processes may be made simpler by using smart contracts to manage interest payments and maturity redemptions automatically.

Benefits of Building a Tokenized US Treasury Platform

As interest in digital finance increases, platforms offering direct access to tokenized US treasury bills are creating new ways for investors to engage with one of the most trusted financial instruments in the world.

Building a tokenized US treasury platform development solution opens the door to a smarter, more accessible form of investing. It bridges traditional finance with blockchain technology, offering practical advantages for both investors and platform operators.

Here’s what makes this opportunity worth considering:

- Broader Investor Access: Traditionally, investing in treasury bills required large capital and specific financial channels. Now, through tokenization, people anywhere in the world can invest in tokenized U.S. Treasury bills with just a few dollars, no banks or brokers needed.

- Faster Settlement: Blockchain allows for near-instant settlement, eliminating the days-long delays in traditional financial systems. This means better liquidity and less capital locked up in transit.

- Around-the-Clock Availability: Unlike traditional markets, which close on weekends and holidays, tokenized platforms operate 24/7, making it easier for users across different time zones to access and trade whenever they want.

- Lower Barriers for Entry: Tokenization breaks down large treasury instruments into smaller digital assets, removing the minimum investment thresholds and opening the door for retail participation.

- Automation and Efficiency: Smart contracts can handle processes like onboarding, compliance, interest distribution, and reporting, reducing the need for manual oversight and slashing administrative costs.

- Improved Transparency and Trust: Every transaction on the platform is recorded on-chain and viewable in real time. This helps users feel more confident in where their money is going and how it’s being handled.

- Diversification Made Easy: With fractional ownership, investors can now hold small portions of multiple treasury instruments, a strategy that was far more difficult (and expensive) before.

- Scalability for Growth: As interest grows in digital bonds, platforms built now will be in a strong position to scale quickly. Early adopters can capture market share and establish credibility before the space becomes crowded.

- New Business Models: A tokenized treasury platform isn’t just a service, it’s a revenue-generating product. Transaction fees, custody, premium features, and financial advisory layers can all contribute to long-term monetization.

Use Cases for Tokenized Treasury Platforms

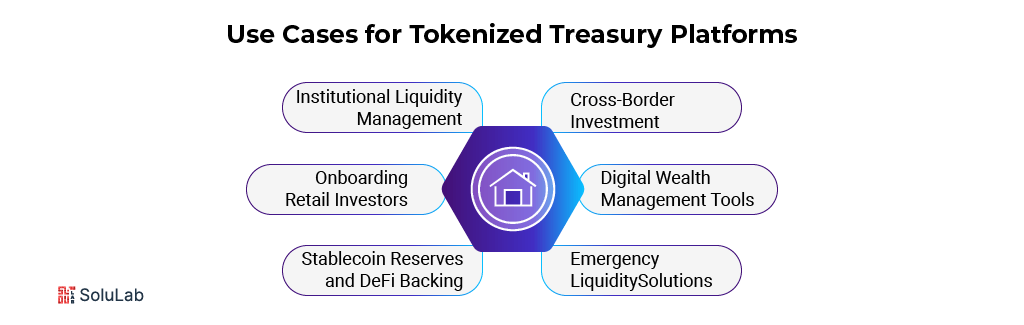

The practical applications of tokenized treasury platforms are growing rapidly, and they’re not just limited to crypto-savvy investors. These platforms are filling real gaps in the financial system, offering smarter access to low-risk, interest-bearing instruments in a way that was previously reserved for banks and large institutions.

By leveraging the tokenization of assets, treasury platforms are reimagining how fixed-income products are issued, managed, and traded. Below are several meaningful ways these platforms are already being used across industries and investor profiles:

1. Institutional Liquidity Management

Corporations and fintech firms can hold tokenized treasury bonds as part of their treasury management strategy. This gives them an easy way to earn yield on idle cash without locking it up in traditional long-term instruments. Plus, the blockchain layer adds transparency and makes auditing far more efficient.

2. Onboarding Retail Investors

With tokenization, even small investors can now access U.S. treasury bonds in bite-sized digital units. Platforms allow users to purchase and trade government bonds just like crypto or stocks, making stable, low-risk assets more accessible than ever before.

3. Stablecoin Reserves and DeFi Backing

Stablecoin issuers and DeFi protocols are starting to back their tokens with tokenized treasuries instead of volatile crypto assets. This strengthens the peg, increases user trust, and creates a stronger bridge between traditional finance and decentralized ecosystems.

4. Cross-Border Investment

For international investors who struggle with access to U.S. financial products due to local restrictions or lack of infrastructure, tokenized treasury platforms offer a more direct, borderless solution. With just a wallet and internet connection, investors can diversify into U.S. bonds with minimal friction.

5. Digital Wealth Management Tools

Wealth managers and robo-advisors can now integrate tokenized treasuries into client portfolios, offering exposure to low-risk assets in a digital-native way. These tools are especially attractive to younger investors looking for yield, simplicity, and full visibility.

6. Emergency Liquidity Solutions

In volatile markets, having the ability to tokenize and liquidate treasury holdings quickly can be a lifeline. Tokenized platforms provide that flexibility; investors can exit positions at any time, with instant settlement and no third-party delays.

Read Also: Why Dubai, London & New York Lead in Real Estate Tokenization?

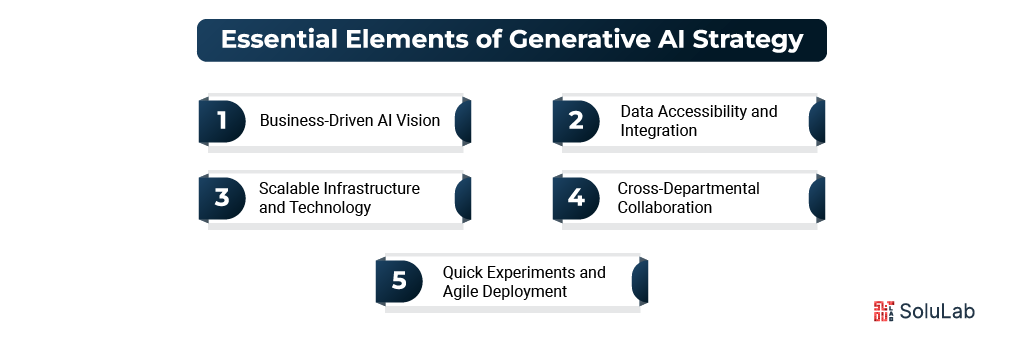

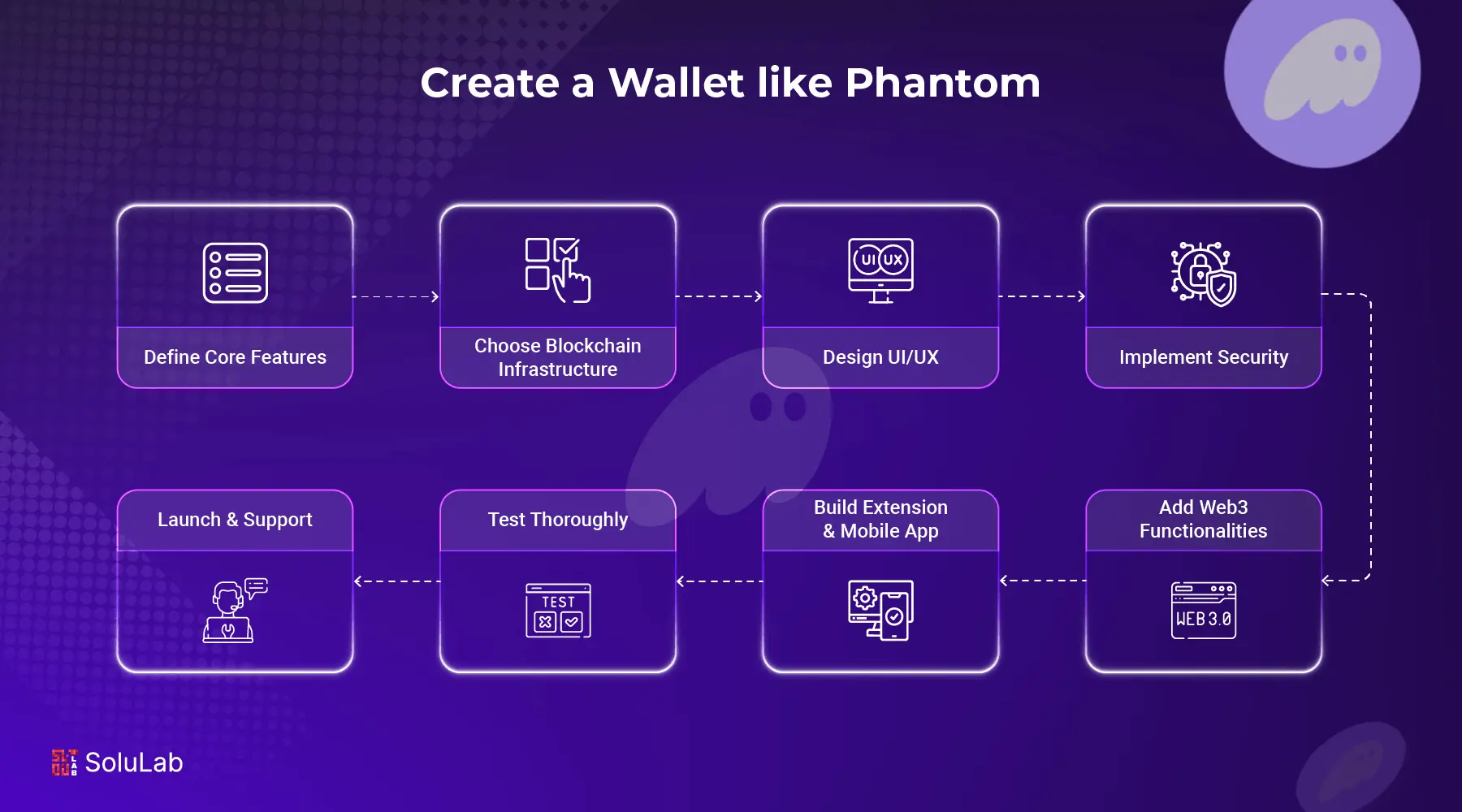

Key Requirements for a U.S. Tokenized Treasury Bill Platform

Building a platform for tokenized treasury bills isn’t just about digitizing bonds—it’s about getting the core financial, technical, and legal pieces right from the start. These platforms need to work seamlessly, stay compliant, and make asset ownership as secure and transparent as possible.

Here are some of the essential requirements that must be addressed:

- Regulatory Compliance

The platform must align with U.S. securities laws and financial regulations. This includes Know Your Customer (KYC), Anti-Money Laundering (AML), and tax reporting features to ensure investor safety and legal clarity. - Secure Asset Custody

Since the platform deals with real value, it must have reliable custody solutions to safeguard both digital tokens and the underlying treasuries. This includes wallet security, private key management, and multi-signature protections. - Smart Contract Reliability

The automation behind asset tokenization must be rock solid. Smart contracts should be audited and error-free, ensuring that token issuance, interest payments, and redemptions are handled accurately and fairly. - User Access & Fractional Ownership

Investors should be able to buy small portions of treasury bills easily—removing traditional barriers. This democratizes fixed-income investing and helps widen the investor base globally. - Real-Time Reporting and Transparency

Clear dashboards, instant transaction histories, and up-to-date yield information should all be part of the experience. Transparency builds trust and drives adoption. - Scalable Infrastructure

The backend must handle thousands of transactions securely, even during peak loads. This ensures the platform stays fast and responsive as user demand grows.

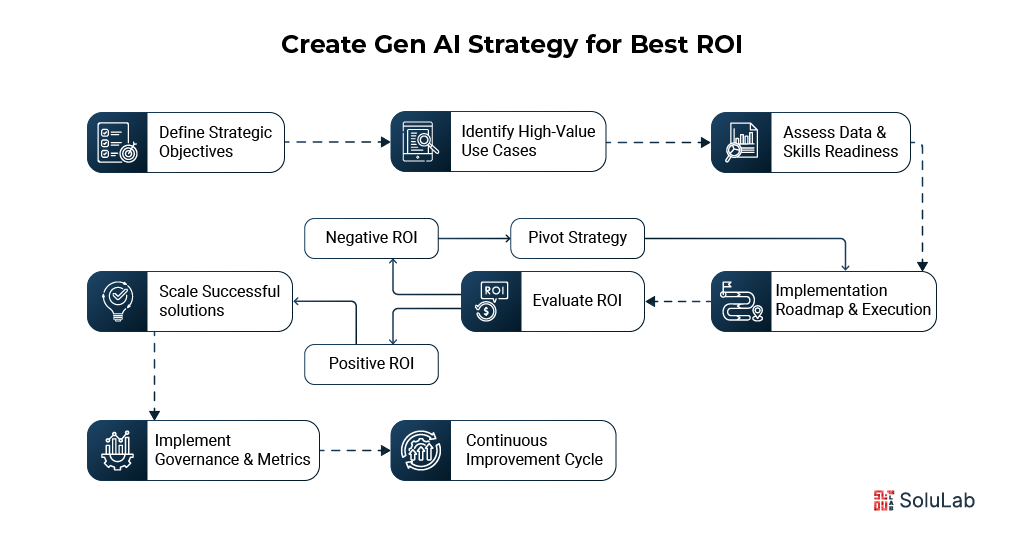

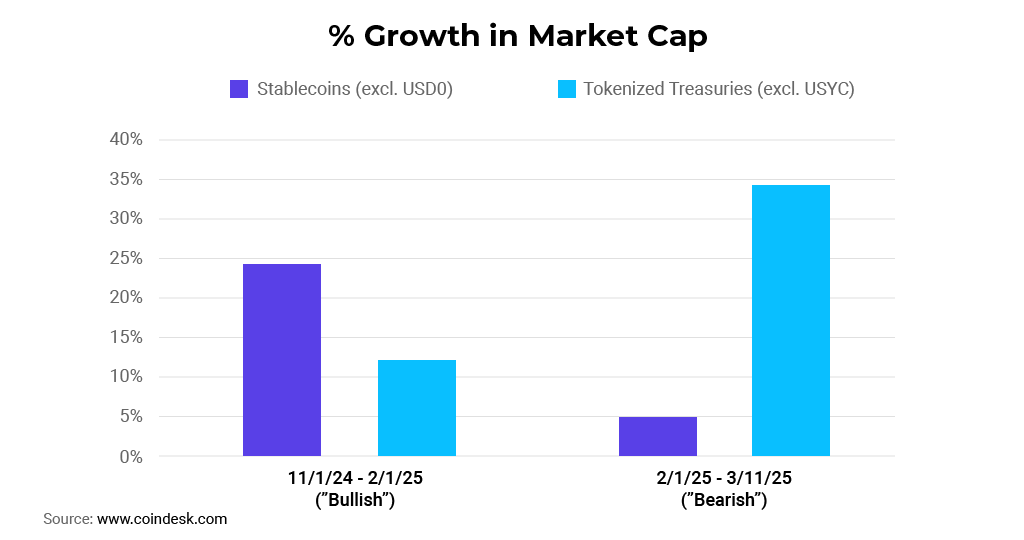

Why Now is the Right Time to Invest?

Timing matters in finance, and today’s market conditions make this a particularly strategic moment to invest in tokenized assets. Interest rates have found stability, and the broader investment community is actively seeking low-risk, yield-generating options that go beyond traditional products. Tokenized treasury bills are stepping in to meet that demand.

We’re also in the middle of a digital shift in how assets are bought and sold. A few years ago, the idea of owning digital real estate or trading on NFT marketplace platforms seemed far-fetched. Now, tokenized assets are quietly becoming part of mainstream financial strategies. The infrastructure has matured, user trust is building, and regulatory frameworks are becoming clearer, making it safer and easier to enter the space.

There’s also growing interest from younger investors who value transparency, accessibility, and financial control. Tokenized treasuries allow them to participate in the U.S. bond market with ease, something that used to be limited to institutions or high-net-worth individuals.

Conclusion

Tokenized U.S. Treasury platforms are gaining real traction as investors look for secure, efficient ways to access traditional financial products through modern technology. With rising interest in low-risk, blockchain-based investments, tokenized treasury bills are emerging as a practical solution that blends trust with innovation.

SoluLab has been at the forefront of this space, helping businesses bring tokenized platforms to life. As a trusted asset tokenization development company, we recently worked on a project called Token World, a crypto launchpad built to connect new blockchain ventures with investors. The platform provides an easy way for project creators to list their offerings and for investors to find high-potential opportunities, all in one streamlined experience.

Whether you’re a fintech startup, an investment firm, or a visionary entrepreneur, the time to act is now. With the right strategy and a trusted development partner, building a tokenized treasury platform can put you ahead in the next generation of financial innovation.

FAQs

1. What makes tokenized U.S. Treasuries different from traditional government bonds?

While traditional government bonds are usually bought through brokers or large financial institutions, tokenized U.S. Treasuries are digital versions that can be purchased and traded on blockchain platforms. They offer the same safety and yield but come with added benefits like easier access, lower minimum investment, and real-time ownership tracking.

2. Do I need to be tech-savvy to invest in tokenized treasury bills?

Not at all. Many platforms are designed to be user-friendly, even for those with little or no experience in blockchain or crypto. If you can use an online trading app or e-wallet, you can likely handle tokenized treasury investments with ease.

3. Is my investment in tokenized treasuries legally protected?

If the platform offering tokenized treasuries follows proper regulatory guidelines and offers fully-backed assets, your investment should be just as secure as holding a traditional bond. That said, it’s important to choose platforms that are licensed, transparent, and provide clear legal documentation.

4. How do tokenized treasuries generate returns?

Just like regular U.S. Treasury bills, tokenized versions pay interest over time. The returns usually come from the yield on the underlying government bond. What’s different is that with tokenization, you may receive those interest payments more frequently and directly to your digital wallet.

5. Can tokenized U.S. treasuries be traded like crypto?

Yes, one of the advantages of tokenization is liquidity. You can often trade tokenized treasury bills on secondary markets, similar to how cryptocurrencies are exchanged. However, availability depends on the platform’s features and regulatory setup.