Investing in real estate has traditionally been expensive. Limited access, slow transactions, and cumbersome paperwork make it hard for investors to participate. Many investors miss out on opportunities because buying entire properties is costly, compliance processes are complex, and managing multiple properties is tedious.

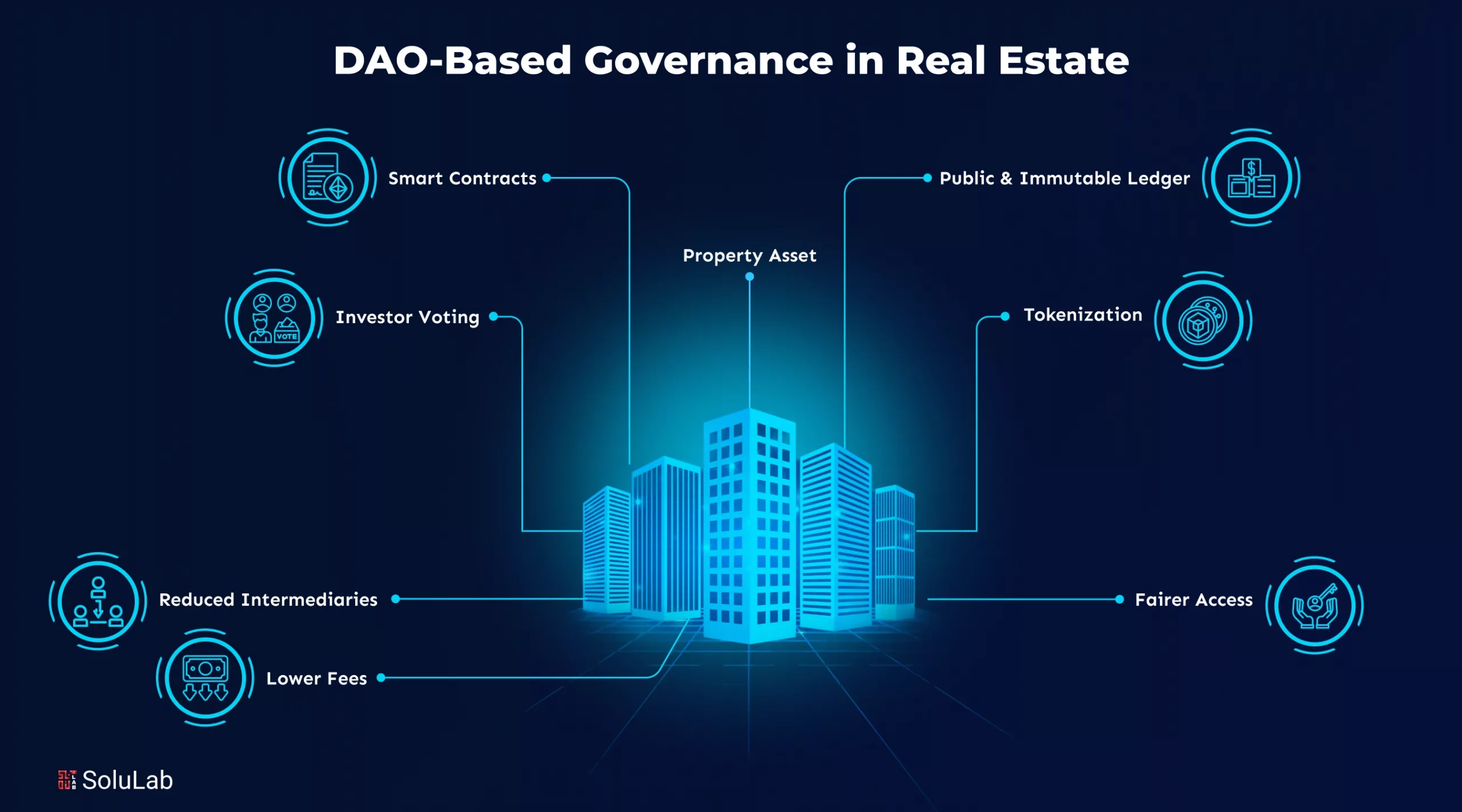

Decentralized governance, powered by DAOs (Decentralized Autonomous Organizations), is changing it. Through fractional ownership property tokens, investors can own portions of real estate without requiring a large capital investment.

Smart contracts automate processes, enforce compliance in real estate, and provide transparent records. In this blog, we’ll explore everything you need to know about decentralized governance in real estate.

What Is Decentralized Governance in Real Estate?

Decentralized governance in real estate refers to a system where decisions about property management, investment, and ownership are made collectively by stakeholders using blockchain technology, rather than being controlled by a single central authority, such as a developer, government, or corporate board.

The global real estate tokenization market is expected to reach $11.80 billion by 2031, growing at a 19.9% CAGR.

Here’s how it works:

- Blockchain-Based Voting: Property owners or investors get digital tokens that represent their stake. These tokens let them vote on key matters like maintenance, rent adjustments, or selling assets.

- Transparent Rules: All decisions and transactions are recorded on a blockchain, ensuring transparency and reducing corruption or manipulation.

- Community-Driven Decisions: Instead of a few top executives making calls, everyone with a stake gets a say, making governance fairer and more democratic.

- Smart Contracts: These are self-executing agreements that automate actions (such as rent distribution or profit sharing) once specific conditions are met, eliminating the need for middlemen and reducing delays.

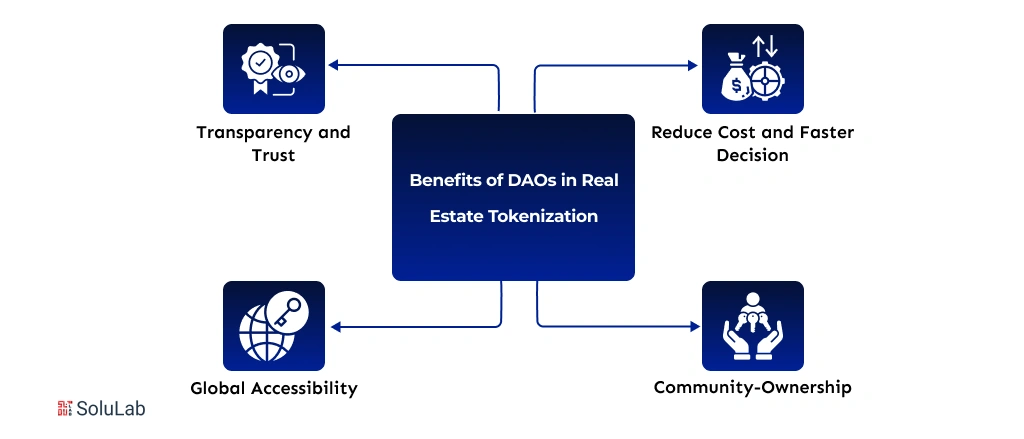

Benefits of Using DAOs in Tokenized Properties

Decentralized Autonomous Organizations (DAOs) are changing the workings of tokenized properties. They introduce fairness, speed, and inclusivity to real estate ownership by a blockchain-based governance system and a community-driven decision-making process.

1. Transparency and Trust: All activities and actions of a DAO are stored in the blockchain, which guarantees complete transparency. This ensures that any covert agendas are removed, investors gain confidence, and all players can confirm what is being done immediately without using intermediaries.

2. Global Accessibility: DAOs also erase geographical boundaries because any person in the world can invest in or operate tokenized properties. This marketability enhances participation, brings liquidity, and expands real estate investment opportunities to both small and large investors.

3. Reduce Cost and Faster Decision: DAOs reduce administrative expenses by eliminating the middlemen, such as brokers and managers. Automated smart contracts facilitate the approvals and voting process to enable property owners and investors to make timely and informed decisions, with little human intervention.

4. Community-Ownership: DAOs facilitate a feeling of ownership. All the token owners are democratically involved in making decisions such as the maintenance, rental policies, or sales, thus establishing a strong, active, and aligned community of investors.

Technological Foundations of DAO-Real Estate Integration

By improving efficiency, security, and transparency, DAOs’ application of blockchain to the real estate sector is changing the sector.

1. Blockchain: The Foundation of Security and Transparency

Blockchain solutions ensure transparency and lower the risk of fraud by recording all transactions in an immutable ledger. By doing away with the necessity for a central authority, this decentralized approach promotes participant trust.

2. Automating Real Estate Transactions with Smart Contracts

Self-executing agreements with their terms encoded directly into the code are known as smart contracts. They automate real estate procedures like escrow services, rental agreements, and property transfers. This automation decreases errors, expedites transactions, and eliminates the need for middlemen.

3. Tokenization: Facilitating Ownership in Fractions

Tokenization enables fractional ownership by transforming real estate assets into digital tokens. This strategy improves market liquidity and decreases the entry hurdle for investors. With a cumulative annual growth rate (CAGR) of 21%, the worldwide real estate tokenization market is expected to increase from $3.5 billion in 2024 to $19.4 billion by 2033.

How to Build a DAO-Integrated Real Estate Platform?

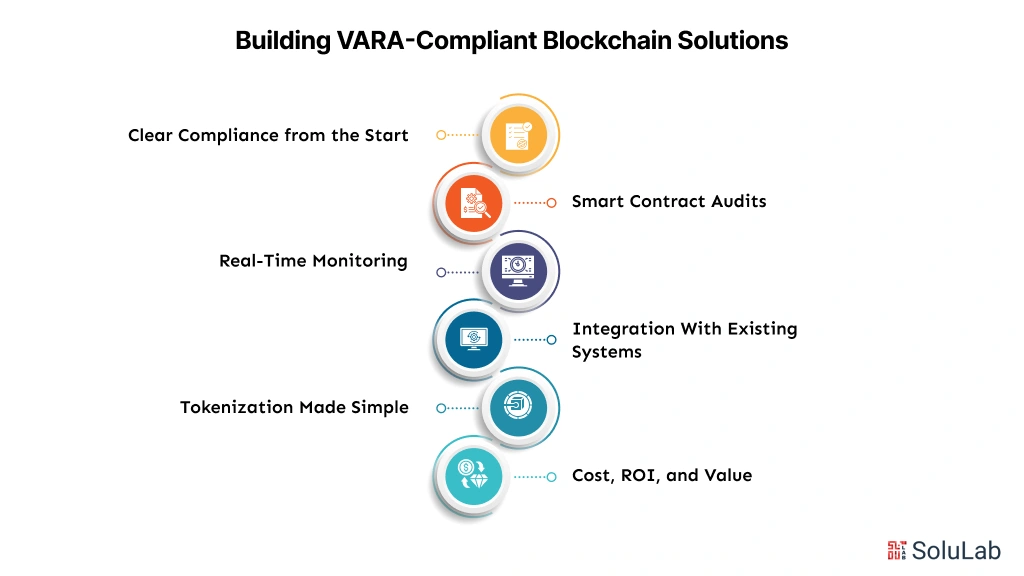

Building a DAO-integrated real estate platform requires blockchain transparency with community-driven decision-making. It allows property investors and stakeholders to collaborate, vote, and earn through decentralized governance and tokenized assets.

1. Define the Purpose and Governance Model

Start by outlining the platform’s vision, whether it’s property investment, management, or fractional ownership. Then, decide on governance rules for how decisions are proposed, voted on, and executed through smart contracts.

2. Choose a Suitable Blockchain

Select a blockchain like Ethereum, Polygon, or Solana for scalability, security, and low transaction fees. The chosen network should support DAO tools, smart contracts, and token standards like ERC-20 or ERC-721.

3. Develop Smart Contracts

Smart contracts automate critical processes in real estate tokenization, ownership transfers, voting, and profit distribution. Ensure they’re audited for security to prevent vulnerabilities or unauthorized access to community or investor funds.

4. Tokenize Real Estate Assets

Convert property value into digital tokens representing fractional ownership. This lets multiple investors own shares of a property, improving liquidity, accessibility, and participation in the real estate market.

5. Integrate DAO Framework Tools

Use DAO platforms like Aragon, DAOstack, or Colony for member onboarding, proposal creation, and voting. These tools simplify governance, transparency, and collaboration between property owners and investors.

6. Build a User-Friendly Platform

Design an intuitive interface that lets users buy, sell, and vote easily. Integrate dashboards to track assets, governance updates, and earnings by making real estate investment simple and transparent.

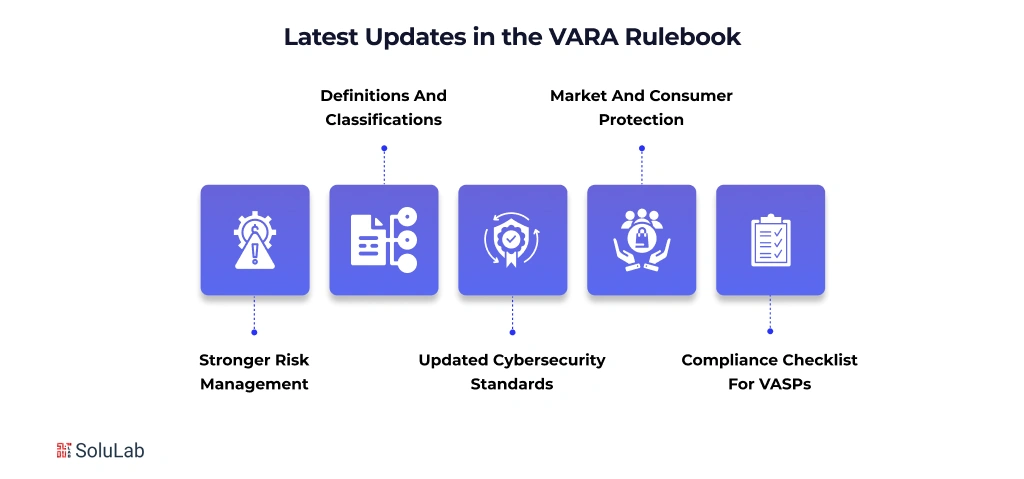

7. Ensure Regulatory Compliance

Adhere to property laws, KYC/AML regulations, and token issuance norms. Work with legal experts to ensure your DAO functions within local and international real estate regulations.

8. Launch and Onboard the Community

Host an initial offering or community drive to attract early investors. Educate them about DAO participation, voting rights, and profit-sharing models to build trust and engagement.

9. Establish Continuous Governance and Maintenance

Keep improving DAO operations through member feedback, governance upgrades, and transparent reporting. Regular audits and active participation maintain platform credibility and long-term sustainability.

Real-World Examples of DAOs in Real Estate

DAOs and blockchain tokenization are enabling fractional ownership, global investor access, legal entity structures, and governance rights over property, changing how people buy, own, and profit from real assets.

RealT

RealT is a platform that tokenizes real, income-producing U.S. residential properties into digital tokens (RealTokens), allowing people worldwide to own fractions of property and receive rental income.

Lofty AI

Lofty AI is another fractional real estate investing platform using blockchain that lets investors buy tokens representing portions of single properties, and participate in governance via DAO-LLCs.

Propy (PRO)

Propy is more focused on using blockchain to transform how real estate transactions are done: titles, escrow, deeds, registry, with smart contracts to reduce friction, delays, and intermediaries. It has components of governance via tokens, though its DAO features are more nascent compared to fully fractional ownership DAOs.

Future of DAO-Based Governance in Real Estate

- Fractional Ownership & Tokenization: Assets in real estate are divided into digital tokens, allowing a large number of buyers to have small portions. This minimizes the levels of minimum investments and allows the liquidity and diversification of various properties.

- International Accessibility and Low Barriers: DAOs enable investors who have varying geographies to get involved, even with minimal capital. Geographic, socioeconomic, and financial obstacles are eliminated and exposing real estate investment to a significantly larger number of individuals.

- Smart Contracts & Automation: DAOs, with the help of smart contracts, automate rent collection, maintenance, profit distribution, and agreement enforcement. This reduces the use of middlemen and administrative wastage.

- Integration of Legal Recognition and Real-World Assets: To be scaled, jurisdictions have to legally acknowledge the existence of DAOs that exist and operate physical property. In the meantime, additional real-world assets are being managed by means of DAOs, which forces regulatory changes.

- Better Transparency and Trust: Every transaction, vote, and ownership is recorded on blockchains virtually forever and can be accessed by interested parties. Such auditability minimizes the risk of fraud and creates confidence between investors and participants.

Conclusion

The rise of real estate DAOs is improving how properties are owned, managed, and invested in. By using DAOs in real estate tokenization, investors gain fractional ownership, improved transparency, and automated governance through smart contracts.

These reduce barriers to entry, enhance liquidity, and management processes, making real estate more accessible globally. As demand grows, real estate tokenization services are evolving to provide legal compliance, secure transactions, and efficient administration for tokenized properties.

SoluLab, a DAO development company, can help investors and businesses leverage Real estate DAOs for efficient governance and transparency. Contact us today to discuss further!

FAQs

1. Can small investors participate in DAO-based real estate?

Yes. Fractional ownership allows smaller investors to join via tokens, making high-value properties accessible without significant capital.

2. What is crypto-backed real estate investment?

A Crypto Backed Real Estate Investment lets investors use digital currencies to buy property tokens, combining crypto markets with tangible real estate returns.

3. How can I start investing in a real estate DAO?

Contact a Tokenization development company to tokenize property, issue governance tokens, and onboard investors for collective decision-making.

4. Why should businesses consider DAO governance for real estate?

DAO-Based Governance in Real Estate enables businesses to pool resources, make data-driven decisions, reduce overhead, and participate in innovative tokenized property projects.

5. Are DAO real estate platforms legally recognized?

Some jurisdictions allow DAOs through legal wrappers or LLCs. Regulatory frameworks vary, so compliance is crucial for DAO operations.

![Top 10 Digital Identity Wallet Development Companies [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Digital-Identity-Wallet-Development-Companies.webp)

![Asset Tokenization Regulations for Australia: Every Business Must Know [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Asset-Tokenization-Regulations-for-Australia.webp)