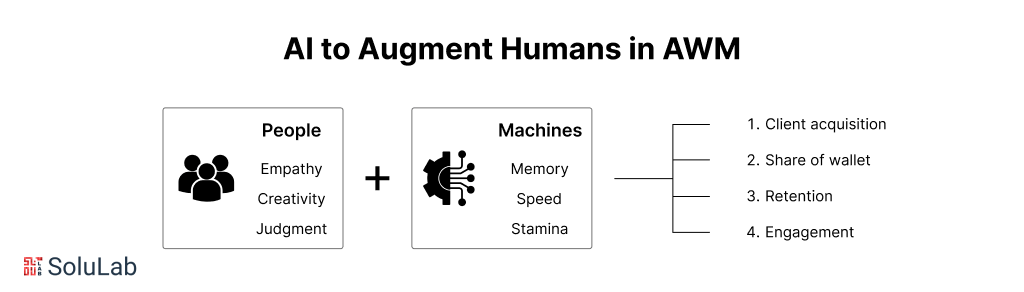

Artificial Intelligence has major implications for a wide range of businesses, particularly financial services. Although most clients would rather speak with a human advisor, AI has a clear place in wealth management. 6 out of 10 finance professionals want to check out AI. If you want to expand, you should consider how artificial intelligence technology may fit into your strategy.

AI in wealth management represents a significant shift in the delivery and optimization of financial services. Many wealth management organizations currently use AI in some capacity, and according to recent studies, 62% of business and technology experts at wealth management companies want to boost expenditure on new technologies in the coming year. Consider having a financial adviser who can handle large volumes of information quickly, respond to changing market circumstances in real time, and make individualized investment recommendations based on your financial objectives and risk tolerance.

AI enables asset managers and customers to streamline operations, increase transparency, and provide new degrees of personalization. AI is changing the way wealth is managed and increased, whether it’s through automated customer onboarding, adjusting investment portfolios, or detecting tax-saving options. The goal is not to replace human advisers but to make them more successful, productive, and responsive. The banking sector is quickly utilizing AI to provide data-driven, more straightforward, and affordable wealth management solutions.

In this blog, we will look into the major aspects of artificial intelligence in wealth management, shining light on how it is altering the sector, the benefits it provides to investors and wealth managers, and the many use cases for AI.

What is Wealth Management?

Wealth management is an important aspect of financial services that assists people in properly managing their resources and provides professional guidance. This comprehensive strategy includes financial, tax, estate, and legal advice. A wealth manager serves as a single point of contact, collaborating with accountants, estate planners, and tax experts to develop a complete wealth strategy that is personalized to your specific requirements and objectives. This tailored and holistic strategy optimizes and protects your financial well-being, helping you to make educated decisions and plan for your future.

The Importance of Artificial Intelligence in Wealth Management

Artificial intelligence in wealth management empowers financial advisors to make data-driven investment decisions and swiftly respond to market shifts. AI-powered predictive analytics helps identify promising investment opportunities while efficiently managing risks. Wealth management AI also improves risk assessment, guaranteeing that investment plans are tailored to meet the financial objectives and tastes of every customer. By utilizing AI to analyze client data, wealth managers can deliver personalized advice that supports wealth growth and long-term success.

PwC forecasts suggest that robo-advisors will manage $5.9 trillion in assets by 2027, more than doubling the $2.5 trillion managed in 2022. Personalized indexing is gaining popularity, especially among investors seeking tax optimization or focusing on ESG (Environmental, Social, and Governance) criteria, factor-based strategies, and algorithmic portfolio construction.

In the institutional investment sector, around 40% of investors plan to allocate funds to custom indexing products, while nearly 50% of asset managers are preparing to introduce individualized indexing solutions into their portfolios.

According to PwC’s predictions, assets under management (AUM) for direct indexing will more than triple by 2027, reaching $1.47 trillion, about 1% of total AUM. Additionally, active exchange-traded funds (ETFs) are expected to surge from $4.6 billion to $1.1 trillion, representing 7.5% of the global ETF market by 2027.

Comparison Between Traditional Wealth Management and AI-Based Wealth Management

The following provides a thorough comparison of AI-based wealth management with conventional wealth management:

| Aspect | Traditional Wealth Management | AI-Based Wealth Management |

| Client Onboarding | Manual and time-consuming, with clients required to provide extensive paperwork and undergo complex verification. | Automated and streamlined onboarding, with AI verifying documents, conducting anti-money laundering checks, and assessing risk profiles efficiently. |

| Portfolio Creation | Mostly manual, relying on research and human skills. | AI-powered portfolio construction and optimization using algorithms and data analysis. |

| Advisory Services | Relies heavily on financial advisors for client interactions and advice. | AI simplifies advisory services by providing data-driven insights and personalized recommendations, often at a lower cost. |

| Transparency | Transparency differs and frequently depends on advisor communication. | AI guarantees consistent transparency by providing lucid charge structures and product details. |

| Portfolio Rebalancing | Financial advisors manually rebalance portfolios based on their assessments. | AI-powered portfolio rebalancing uses algorithms and real-time market data for more frequent and accurate adjustments. |

| Risk Management | Supervised by human consultants with differing specializations. | AI uses advanced predictive analytics and algorithms to assess and manage risk more effectively. |

| Efficiency | Processes are often slow, manual, and prone to human errors. | AI enhances efficiency by automating routine tasks and providing rapid data analysis. |

| Personalization | Personalization is based on the advisor’s expertise and client engagement. | AI enables deeper personalization by analyzing large data sets to tailor recommendations and strategies. |

| Costs | Traditional wealth management is often more expensive due to manual labor and operational overhead. | AI-based wealth management typically reduces costs and offers services with a lower fee structure. |

How AI for Wealth Management Works?

AI for wealth management revolutionizes the way financial advisors and institutions manage portfolios, assess risks, and deliver personalized services to clients. By integrating advanced algorithms and data analysis, AI enhances decision-making and operational efficiency in various aspects of wealth management.

Here’s how AI and wealth management interact:

-

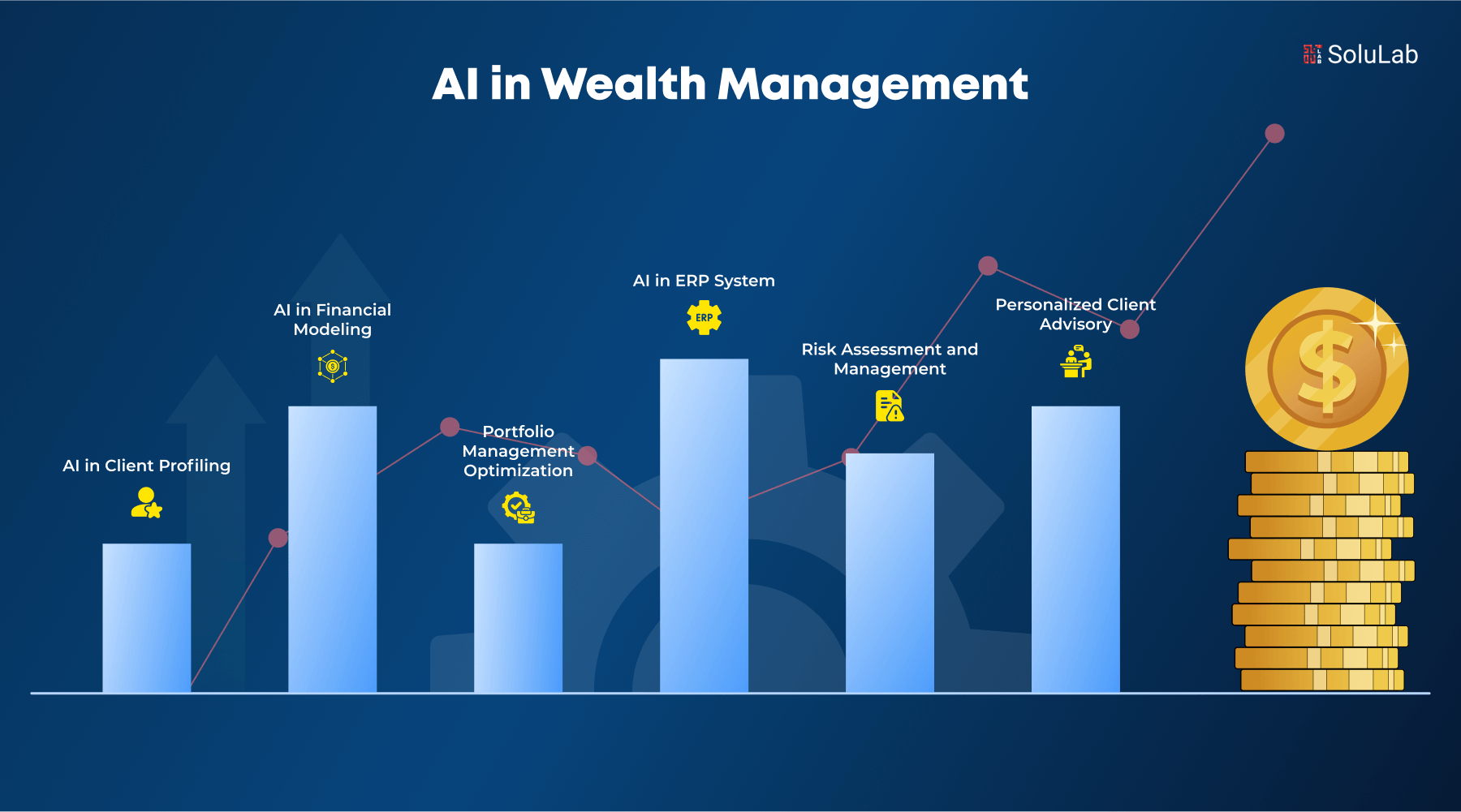

AI in Client Profiling

The use of AI in wealth management starts with analyzing vast amounts of data to create detailed client profiles. AI algorithms evaluate client behavior, preferences, and financial goals to tailor investment strategies that align with their risk tolerance and long-term objectives.

-

AI in Financial Modeling

AI plays a crucial role in financial modeling by predicting market trends and investment opportunities. Through machine learning, AI in financial modeling can analyze historical data and market indicators to create highly accurate financial models, improving investment forecasting and portfolio management.

-

Portfolio Management Optimization

AI in wealth management automates portfolio management by continuously monitoring market conditions and adjusting portfolios based on real-time data. This dynamic approach ensures that portfolios are optimized to respond to market fluctuations, improving overall performance and mitigating risk.

-

AI in ERP System for Wealth Management Firms

The integration of AI in ERP systems allows wealth management firms to streamline operations. AI-driven ERP systems handle data management, compliance, and reporting efficiently, allowing financial advisors to focus more on strategic decision-making and client engagement.

-

Risk Assessment and Management

AI for wealth management uses predictive analytics to assess risks more effectively. AI can evaluate various financial scenarios, market volatility, and external factors, helping wealth managers implement more informed risk management strategies to safeguard client assets.

-

Personalized Client Advisory

One of the significant uses of AI in wealth management is providing personalized advisory services. AI analyzes client data to generate customized investment advice and strategies, offering a more tailored approach compared to traditional advisory models.

By incorporating AI, wealth management firms can significantly enhance their service offerings, delivering faster, more accurate, and personalized solutions to their clients.

AI Use Cases in Wealth Management

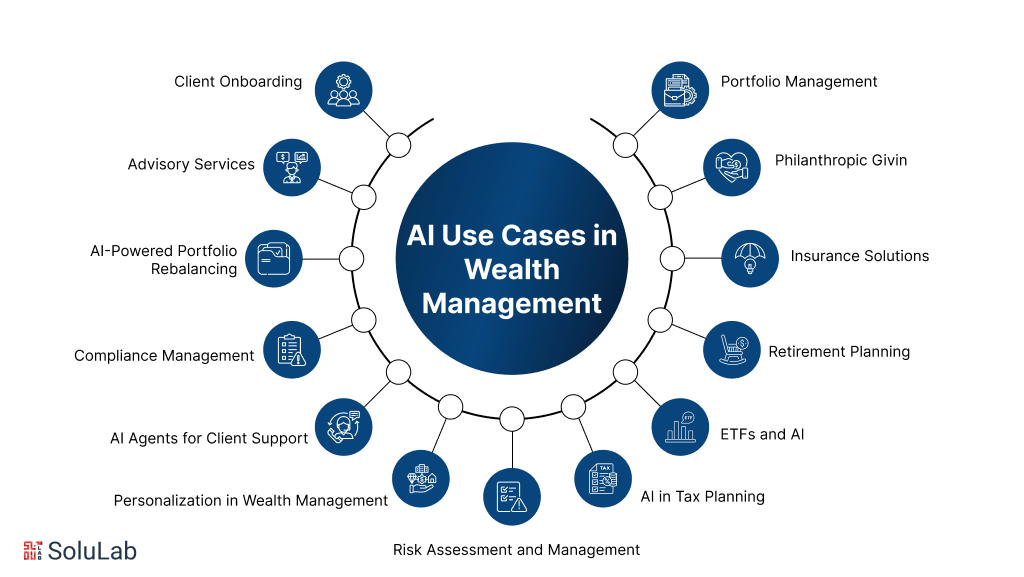

AI is transforming the wealth management industry by streamlining processes, enhancing client experiences, and delivering personalized, data-driven financial strategies. Here’s a breakdown of how AI applications in wealth management are revolutionizing the industry:

1. Streamlining Client Onboarding: AI is automating essential tasks in the client onboarding process, such as initial communications, document verification, and anti-money laundering checks. With AI, investment firms can verify documents more swiftly, ensuring accuracy and faster onboarding times. This automation improves productivity for wealth management consulting firms, granting quicker access to crucial client data.

For example, Deutsche Bank Wealth Management leverages an AI-powered KYC Solution, utilizing multi-language processing and natural language processing (NLP) to verify user identities. This system collects background information, assesses risks, and compiles detailed profiles of current and potential clients.

2. Simplified Advisory Services: AI applications in wealth management have greatly simplified advisory services. By automating routine tasks, AI frees up wealth managers to focus on strategic investment decisions. AI systems analyze economic conditions and client data to offer tailored investment packages, allowing for more informed decision-making. This enhanced efficiency leads to higher client satisfaction and retention rates.

3. Investment Portfolio Management: AI in wealth management examples include using machine learning to analyze vast datasets, identify patterns, and optimize investment strategies. AI-powered tools can adjust portfolios in real time based on market fluctuations, maximizing returns and minimizing risk. These systems also customize investment strategies according to individual investor goals and risk tolerance, delivering personalized solutions.

4. AI-Powered Portfolio Rebalancing: Market factors can greatly influence portfolio performance, and manual analysis is often complex. An AI consulting company offers portfolio management tools that generate real-time insights, enabling financial advisors to rebalance portfolios more efficiently. This ensures that client investments stay optimized and aligned with their financial goals.

5. Robo-Advisors: Robo-advisors are an excellent AI in wealth management examples. These automated financial advisor applications use algorithms to provide personalized investment advice. Robo-advisors assess client preferences, goals, and risk tolerance to create tailored portfolios. They also monitor market conditions continuously and adjust portfolios as needed to optimize investment strategies. As a result, robo-advisors are cost-effective, accessible, and user-friendly, appealing to a wide range of investors.

6. AI Agents for Client Support: AI agents, such as AI-powered chatbots, enhance client service by providing 24/7 assistance. These bots can respond to routine queries about account balances, transaction history, and appointments, offering human-like interactions through natural language processing. By analyzing client inquiries, AI systems can identify trends and preferences, allowing wealth managers to offer a more personalized and data-driven service.

7. Compliance Management: Compliance is a critical area where AI excels in wealth management. AI technologies automate tasks such as KYC checks, anti-money laundering (AML) screening, and transaction monitoring. These AI applications efficiently manage large datasets, ensuring compliance with financial regulations and reducing the risk of regulatory breaches. Real-time compliance checks help wealth management firms maintain high levels of trust and security.

8. Personalization in Wealth Management: AI enhances personalization by using data analytics to provide customized financial strategies. Small language models (SLMs) analyze client behaviors, market trends, and historical financial data to tailor investment recommendations. These AI-driven solutions continuously monitor and adjust portfolios based on evolving client needs, providing a more adaptive and precise wealth management approach.

9. Risk Assessment and Management: AI enhances risk management by using predictive analytics to assess market volatility and emerging trends. By analyzing client profiles and predicting life events like health changes or career shifts, AI helps wealth managers offer personalized risk assessments and adjust investment strategies accordingly. This proactive approach ensures clients’ financial security.

10. AI in Tax Planning: AI streamlines tax planning by identifying tax-saving opportunities and optimizing deductions. AI-powered systems monitor tax regulations and adapt strategies to comply with changing laws. These systems also suggest tax-efficient investment options, including strategies like tax-loss harvesting, helping wealth managers minimize tax liabilities while maximizing after-tax returns.

11. ETFs and AI: AI plays a significant role in managing Exchange-Traded Funds (ETFs) within wealth management. AI algorithms select the most suitable ETFs based on client goals, market conditions, and risk tolerance. These systems continuously monitor portfolios to ensure they remain aligned with the client’s financial objectives, providing personalized ETF investment strategies that optimize returns.

12. Retirement Planning: AI tools assist in retirement planning by analyzing financial data and investment portfolios to create personalized plans. AI models factor in variables like inflation, market volatility, and life expectancy, offering wealth managers a way to simulate various scenarios and assess risks to retirement funds. This ensures clients receive precise, adaptive retirement strategies.

13. Insurance Solutions: AI applications in wealth management extend to insurance, where AI-driven tools assess and tailor coverage to meet client needs. AI optimizes premium payments and claims processing, while continuously adjusting insurance portfolios in line with the client’s changing financial goals.

14. Philanthropic Giving: AI-driven algorithms help wealth managers assess the risks and benefits of various philanthropic strategies. AI can model different donation scenarios, allowing clients to make well-informed decisions that align with their financial security and personal values.

AI in wealth management is revolutionizing traditional processes by enhancing efficiency, improving compliance, and delivering personalized solutions. AI development companies with wealth management technologies will be better equipped to optimize services and deliver superior value to their clients.

Advantages of Artificial Intelligence in Wealth Management

Here are some of the advantages of using artificial intelligence in wealth management:

-

Enhanced Decision-Making

Artificial intelligence in wealth management enables professionals to make well-informed, data-driven investment choices. AI-powered insights and recommendations lead to more accurate decisions, helping maximize returns while minimizing risks for clients. By leveraging AI’s analytical capabilities, wealth managers can significantly improve the quality and precision of their strategies.

-

Increased Operational Efficiency

AI automates routine tasks like document processing and client communication, allowing wealth managers to focus on more strategic activities. This operational efficiency streamlines wealth management processes, helping optimize investment portfolios and achieve better outcomes for clients. Additionally, automation allows firms to operate more smoothly, cutting down on manual effort and errors.

-

Personalized Investment Strategies

Multimodal models and AI algorithms create customized investment strategies tailored to individual client goals and risk profiles. This personalization enhances the wealth management experience by offering strategies that align closely with each client’s financial objectives. As a result, wealth managers can provide more targeted and effective solutions that resonate with specific client needs.

-

Improved Risk Management

AI applications in wealth management play a crucial role in risk assessment and mitigation. By continuously monitoring market data and identifying potential risks, AI tools enable wealth managers to better protect client portfolios. This proactive approach helps minimize the likelihood of financial loss and creates a safer environment for wealth growth.

-

Cost Reduction

The use of AI leads to cost savings by automating processes and improving operational efficiency. This allows wealth management firms to reduce expenses, making services more affordable for clients. Lower operational costs can translate into reduced fees for clients, making high-quality wealth management more accessible.

-

Round-the-Clock Client Support

AI-driven chatbots and virtual assistants provide 24/7 support, ensuring clients have access to real-time assistance whenever needed. This continuous service improves client satisfaction by addressing inquiries and concerns outside traditional business hours, making wealth management services more responsive and convenient.

-

Tax Optimization

AI helps clients optimize their investment strategies to minimize tax liabilities. AI tools can analyze the tax implications of investment decisions, enabling clients to maximize their after-tax returns. This level of precision in tax optimization contributes to improved financial health and greater long-term portfolio value.

-

Diversification Strategies

AI aids wealth managers in identifying diverse investment opportunities across various asset classes. By promoting portfolio diversification, AI reduces the overall risk for clients. This approach balances risk and reward, ensuring that wealth management strategies remain resilient in the face of market fluctuations.

By integrating artificial intelligence into wealth management, firms can enhance decision-making, streamline operations, and offer highly personalized and cost-effective services, ultimately delivering greater value to their clients.

AI Trends in Wealth Management

The integration of artificial intelligence in wealth management is transforming the industry, with several emerging trends reshaping how wealth managers deliver value to clients.

-

Rise of Small Language Models (SLMs)

While large language models like GPT-4 have gained attention, the use of small language models (SLMs) is growing in wealth management due to their ability to provide specialized, concise insights. These models are efficient in processing specific tasks, such as generating personalized investment reports, answering client queries, and analyzing niche data sets. SLMs offer faster performance and require fewer resources, making them an attractive option for wealth management firms looking to integrate AI without significant infrastructure changes.

-

AI-Powered Robo-Advisors

Robo-advisors, powered by AI, continue to gain popularity in wealth management. These digital platforms use machine learning algorithms to create and manage client portfolios automatically. The increased sophistication of AI models, including multimodal models, allows robo-advisors to analyze various data types—such as financial statements, market trends, and even social sentiment—providing more comprehensive and personalized investment strategies for users. This trend is making wealth management services more accessible, especially for younger, tech-savvy investors.

-

Predictive Analytics for Market Trends

AI’s ability to predict market trends is becoming a vital tool in wealth management. By analyzing vast amounts of historical and real-time data, AI models help wealth managers anticipate market movements and adjust strategies accordingly. These predictive analytics improve decision-making processes, allowing wealth managers to offer timely advice and maximize portfolio performance for their clients.

-

AI-Driven Risk Assessment

Risk management remains a key focus area in wealth management, and AI is playing an increasingly critical role. With its ability to continuously scan markets and detect anomalies, AI enhances the ability to forecast and mitigate risks. Advanced algorithms can now identify early warning signals and potential financial downturns, helping wealth managers make informed decisions that protect client assets.

-

Hyper-Personalization

One of the most promising trends in AI is the move toward hyper-personalization. By leveraging Small Language Models and AI algorithms, wealth managers can offer clients highly customized financial strategies. These tools take into account a range of factors, including individual risk tolerance, life goals, and market conditions, to deliver tailored investment advice. Hyper-personalization ensures that each client’s financial journey is unique and closely aligned with their personal objectives.

-

Automation and Workflow Optimization

AI is being used to automate not only investment decisions but also operational tasks within wealth management firms. From automating client onboarding to generating reports and handling compliance, AI helps streamline workflows. This frees up wealth managers to focus on higher-value tasks such as strategic planning and client relationship management.

As AI trends like small language models and multimodal data analysis continue to evolve, wealth management firms are positioned to offer more efficient, personalized, and insightful services, enhancing the client experience and improving investment outcomes.

Future of AI in Wealth Management

The future of artificial intelligence in wealth management holds immense potential, as emerging AI technologies and approaches continue to transform how wealth managers operate and serve their clients. AI is set to become an even more integral part of the industry, driving innovation and efficiency.

1. Collaboration with AI Consulting Companies

As AI adoption grows, wealth management firms are increasingly turning to AI consulting companies to help navigate the complexities of AI integration. These consulting firms offer strategic guidance on implementing AI-driven solutions, from automating portfolio management to leveraging advanced analytics for better decision-making. By working with AI consultants, wealth managers can stay ahead of technological trends, ensuring that they adopt the most effective and cutting-edge tools to meet client needs. This collaboration will likely intensify as the demand for personalized and automated wealth management solutions rises.

2. AI for Predictive Financial Planning

In the future, AI will play a pivotal role in predictive financial planning. By analyzing historical data, economic trends, and even behavioral patterns, AI models will provide clients with more accurate financial forecasts and investment strategies tailored to their goals. This shift towards AI-powered predictions will allow wealth managers to offer proactive, data-driven advice that adapts to changing market conditions, maximizing returns while mitigating risks.

3. Integration of Explainable AI

The rise of Explainable AI (XAI) will be critical for the future of wealth management. Clients and advisors alike will demand more transparency in AI-driven decisions, especially when it comes to managing large investments. Explainable AI will allow wealth managers to understand and justify the rationale behind specific AI-generated recommendations, enhancing client trust and regulatory compliance. As AI continues to take on more decision-making responsibilities, having clear explanations for its actions will become essential in client communication.

4. AI-Driven ESG Investing

Environmental, social, and governance (ESG) investing is another area where AI will significantly impact wealth management. AI can sift through large datasets, such as corporate sustainability reports, CSRD reporting requirements, and market data, to identify companies that align with clients’ ESG criteria. This trend will enable wealth managers to cater to the growing demand for socially responsible investing, helping clients build portfolios that reflect their ethical values while still delivering strong financial performance.

5. AI-Enhanced Client Experience

In the near future, AI will further enhance the client experience by offering hyper-personalization at an unprecedented scale. With AI algorithms able to analyze client preferences, behavior, and financial goals, wealth managers will deliver more customized investment solutions that evolve in real time. AI will also enhance client engagement through intelligent chatbots and virtual assistants, providing seamless 24/7 support and real-time investment updates.

As AI consulting companies continue to guide wealth managers in adopting innovative AI solutions, the industry is poised for a future where AI plays a central role in decision-making, client interaction, and investment strategy development. Wealth management firms that embrace this future stand to offer more personalized, efficient, and value-driven services to their clients.

How SoluLab Helps for AI in Wealth Management?

As a leading AI development company, SoluLab specializes in delivering advanced AI-driven solutions tailored to the wealth management industry. We help firms harness the power of artificial intelligence to streamline operations, optimize portfolio management, and enhance client experiences. Our team of experts excels in developing AI systems that automate repetitive tasks, deliver data-driven insights, and provide personalized investment strategies that align with each client’s financial goals. By leveraging AI, we enable wealth managers to make more informed decisions, reduce risks, and increase the overall efficiency of their services.

At SoluLab, we offer businesses the opportunity to hire AI developers with deep industry expertise who can design and deploy customized AI solutions that transform wealth management processes. Whether it’s implementing AI for predictive financial analysis, risk assessment, or client engagement, our skilled developers work closely with firms to create advanced solutions that deliver measurable results. With our AI-powered systems, wealth managers can offer more personalized, efficient, and competitive services.

FAQs

1. How is AI transforming wealth management?

AI is revolutionizing wealth management by automating routine tasks, offering data-driven insights, and enhancing personalization in investment strategies. It helps wealth managers streamline processes like client onboarding, portfolio management, risk assessment, and tax planning. By leveraging AI technologies, wealth management firms can provide more efficient, cost-effective, and personalized services, ultimately improving client satisfaction and investment outcomes.

2. What are the key benefits of using AI in wealth management?

AI provides several benefits in wealth management, including improved decision-making through data-driven insights, enhanced efficiency by automating tasks, personalized investment strategies tailored to client goals, and effective risk management. Additionally, AI enables cost savings by reducing operational expenses and allows wealth managers to deliver more responsive, 24/7 client support through AI-powered chatbots and virtual assistants.

3. Can AI help with investment portfolio management?

Yes, AI plays a crucial role in investment portfolio management by analyzing large datasets, identifying patterns, and generating insights to inform investment strategies. AI-driven algorithms continuously monitor market conditions and adjust portfolios in real-time to optimize returns and minimize risks. It also enables wealth managers to personalize portfolios based on each client’s financial goals and risk tolerance.

4. How do AI-powered robo-advisors work in wealth management?

AI-powered robo-advisors are digital platforms that offer automated, algorithm-based investment advice to clients. They assess client preferences, financial goals, and risk tolerance, creating personalized investment portfolios. Robo-advisors continuously monitor market conditions and make real-time adjustments to optimize investment strategies. These AI-based tools are cost-effective, accessible, and provide tailored wealth management services with minimal human intervention.

5. How can SoluLab help wealth management firms implement AI solutions?

SoluLab, as an AI development company, helps wealth management firms implement AI-driven solutions that enhance their operations and client services. By enabling firms to hire AI developers with industry expertise, we build customized AI systems for tasks like financial modeling, risk assessment, portfolio management, and customer engagement. SoluLab’s solutions help wealth management firms streamline processes, improve decision-making, and offer personalized, data-driven services to clients.