Web3 has gone beyond just buzzword status; it continues to grow into the future internet. As users seek faster, secure, and streamlined methods for managing their digital assets, Sui wallets are quickly gaining the top position in the Web3 era.

| According to recent research, SUI has a market valuation of about $7.2 billion, a 24-hour trading volume of $900.25 million, and a price that varies about $2.25 as of March 2025. |

Sui-based wallets are demonstrating that they are not only tools; they serve as the launchpad for the future of Web3, facilitating smooth DeFi access and one-click NFT transactions. This kind of strength results in more seamless, cost-effective, and responsive experiences for actual users. Let us explore the factors that make them a top option for today’s digital innovators.

What are Sui Wallets?

The Sui wallet is a cryptocurrency wallet that has been specifically engineered for use with the Sui blockchain. It is employed for the storage, management, and trading of Sui tokens and NFTs. In order to grant consumers access to the apps and other features of the Sui network, the Sui wallet can be incorporated into a variety of dApps.

Sui wallet includes three critical types of data:

- Public Key or Wallet Address

An alphanumeric sequence known as a wallet address is employed by third parties to transfer cryptocurrencies to your Sui wallet. Additionally, wallet addresses are employed by individuals to transmit currencies to one another, much like addresses are employed by humans to transmit parcels.

- Passphrase

The passphrase is a security key or password that consists of 12 English characters. The recovery of wallet operations necessitates the use of a passphrase logon.

- Private Key

Also, an alphanumeric sequence is utilized to establish a connection to the account, known as a private key. This can be likened to the personal identification number (PIN) of a bank account.

The Wallet Extension

For a Sui developer, wallet extensions are essential tools. They provide the simulation of on-chain transactions, evaluate dApp workflows in real-time, and incorporate smart contract capabilities into frontend apps. These Sui extensions often include integrated development modes, compatibility with specialized networks (such as testnets), and standardized APIs for transaction signing and transmission.

Developers may swiftly iterate, debug, and launch user-oriented Web3 applications on the Sui network by using wallet extensions. As the usage of Sui-based applications increases, wallet extensions provide a seamless connection between end-users and the decentralized finance ecosystem, offering both security and convenience in a single, elegant plugin.

How Sui Wallet Addresses Work and Why They Matter?

A Sui wallet address is a distinctive identifier on the Sui blockchain that enables the secure transfer, receipt, and management of digital assets. It is a potent instrument that is based on Sui’s object-centric design, allowing for more efficient and rapid interactions with the Web3 ecosystem. It is not merely an account number. By selecting the best Sui wallet, this address will be certain to work securely and seamlessly for a variety of purposes, including DeFi transactions and NFT trading.

Key Points Regarding Sui Wallet Address:

-

Unique Identity

Secure interaction with dApps, tokens, and smart contracts is enabled by the association of each Sui wallet address with your crypto identity.

-

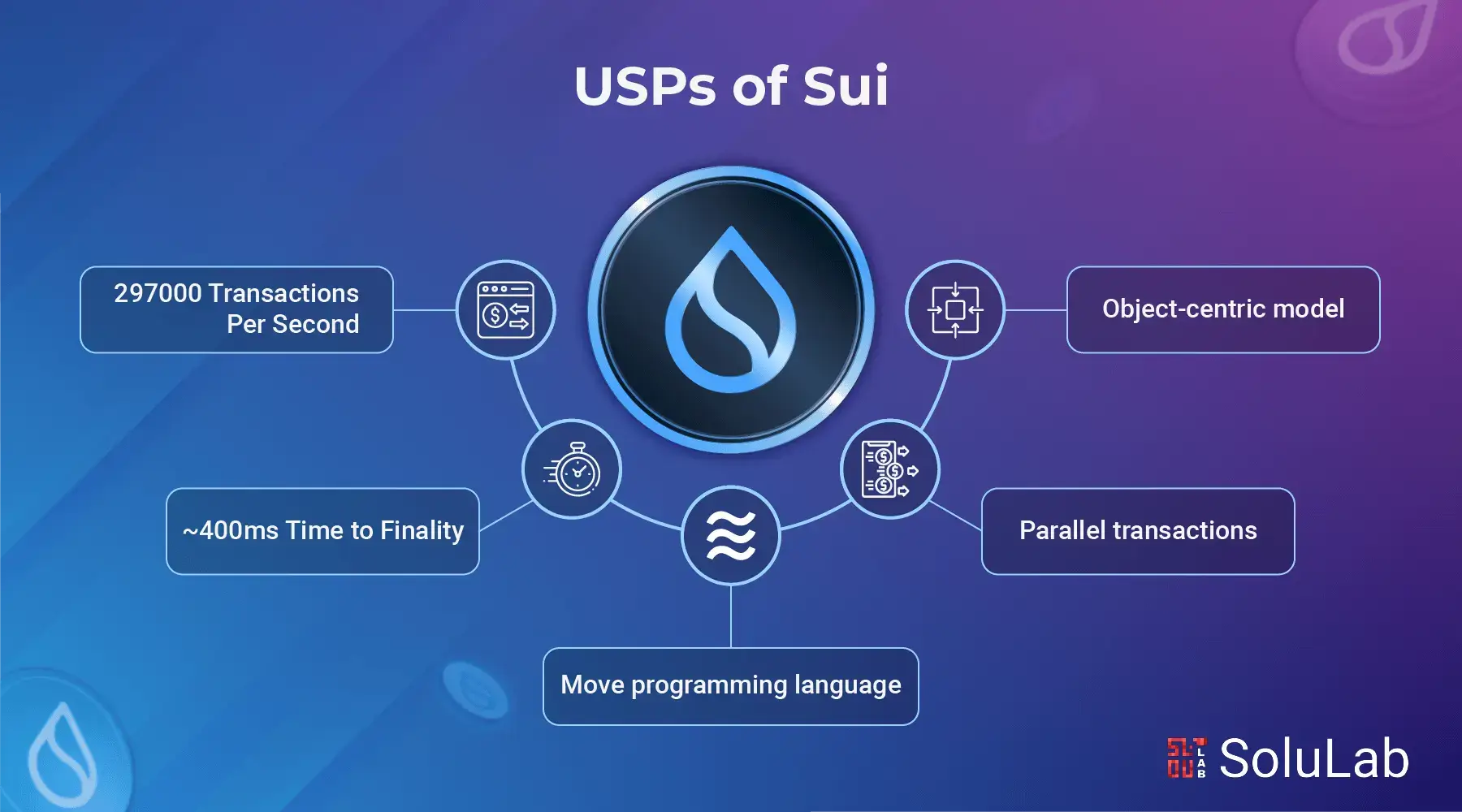

Object-Centric Structure

The Sui crypto wallet is distinguished from conventional account-based wallets by its support for Sui’s distinctive object-based architecture, which enhances scalability and monitoring.

-

Fast and Low-Cost Transactions

The blockchain’s high transaction per second (TPS) capabilities are leveraged to facilitate the rapid and cost-effective processing of transactions from Sui wallet addresses.

-

Secure Key Management

The Sui wallet app provides your address and securely administers your private keys, which are typically backed up using biometric security or seed phrases.

-

Full Ecosystem Compatibility

Your IP address is capable of connecting to all Sui-based platforms, such as games, DeFi protocols, and NFT marketplaces.

-

Easy Onboarding and Usage

The Sui wallet app and Ethos are among the most popular wallets as they simplify the process of creating and managing addresses without any technical difficulties.

A Sui wallet address is not merely a destination; it is your entryway to a Web3 universe that is constantly changing. Selecting the appropriate wallet assures that your experience is secure, seamless, and future-proof.

Read Our Blog Post: Custodial vs. Non-Custodial Wallets

Why Sui Wallet is Gaining Traction From Web3 Users?

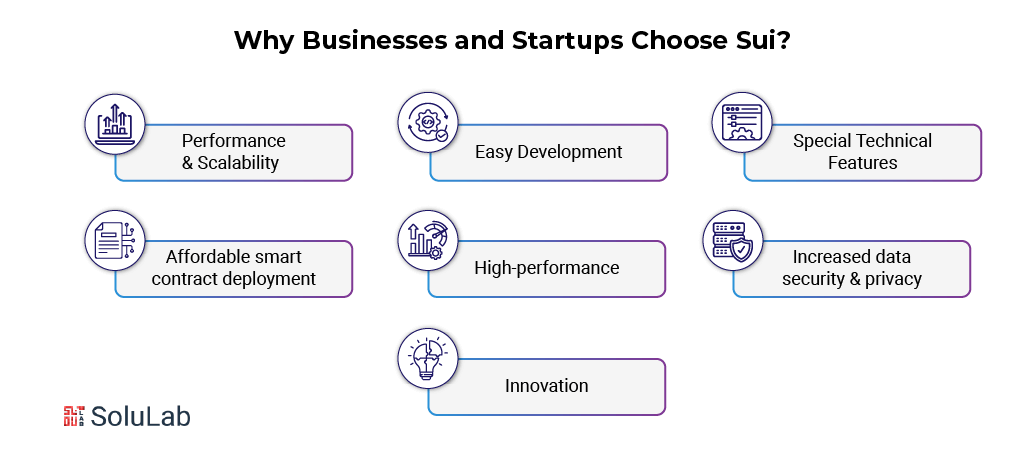

The Sui Wallet is engineered to provide a smooth, safe, and scalable user experience, particularly designed for the high-performance Sui blockchain. Regardless of whether you are a developer, investor, or new cryptocurrency user, the wallet encompasses robust features that facilitate the seamless management of your digital assets. With the expansion of the ecosystem, Sui Wallet is increasingly acknowledged as the premier wallet for Sui users seeking to engage with DeFi, NFTs, and various Web3 apps.

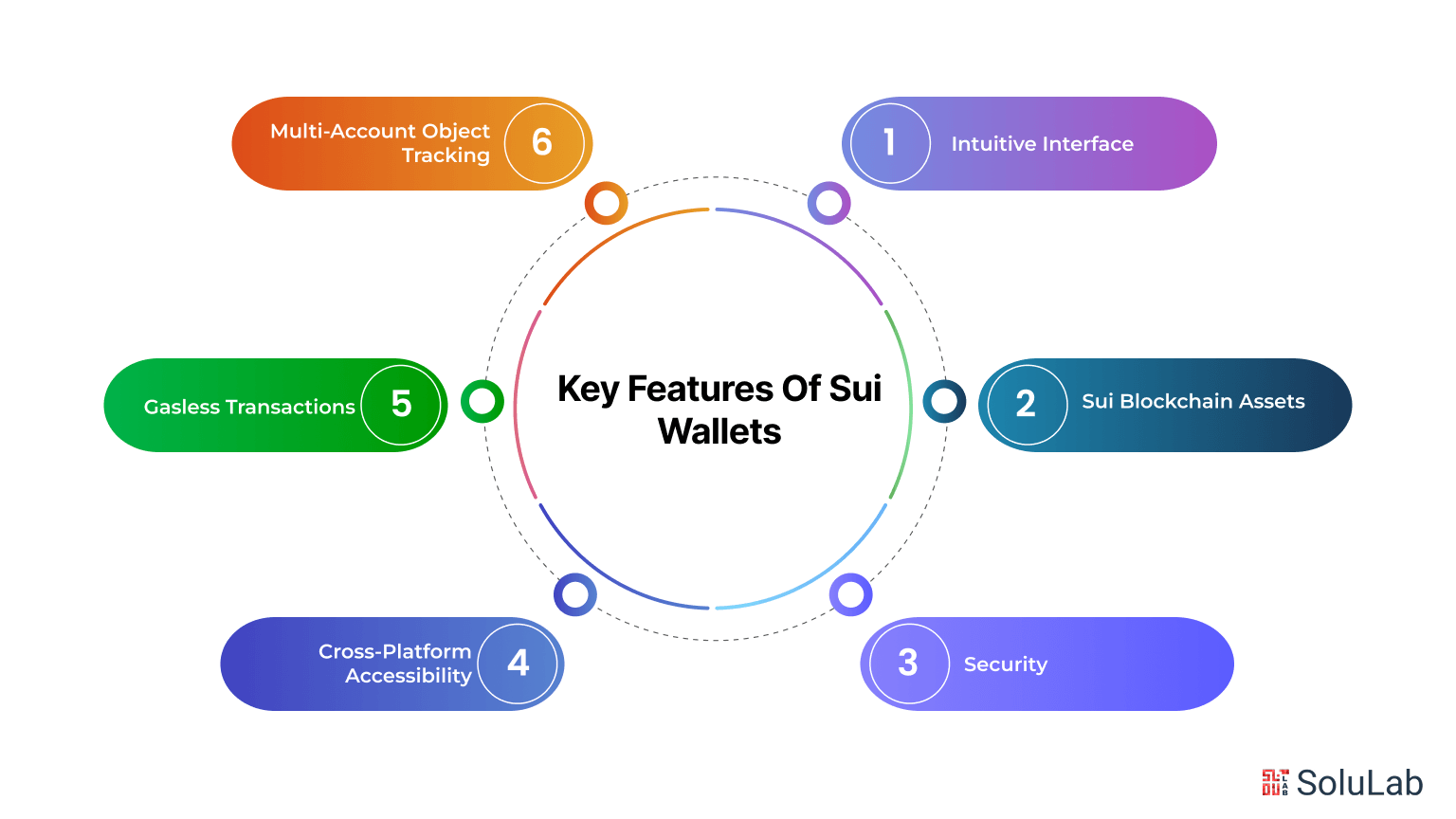

Here are some of the key features of Sui Wallet:

1. Intuitive Interface

Sui Wallet provides a streamlined and user-friendly interface, facilitating navigation and token management for both beginners and experienced users.

2. Sui Blockchain Assets

The wallet, designed exclusively for the Sui network, enables users to handle SUI tokens and Sui-based NFTs directly, eliminating the necessity for third-party bridges or conversions.

3. Security

Private keys are retained locally and safeguarded using encryption. The recovery of seed phrases and the potential use of biometric logins provide additional security measures.

4. Cross-Platform Accessibility

Accessible as both a browser extension and a Sui Wallet mobile application, customers can manage their assets seamlessly across devices.

5. Gasless Transactions

Future improvements intend to alleviate user friction by incorporating support for sponsored or gasless transactions, a crucial advancement for mainstream adoption.

6. Multi-Account Object Tracking

Due to Sui’s object-oriented nature, the wallet can effectively monitor distinct NFTs, tokens, and other digital entities linked to each account.

Sui Wallet, a safe, lightweight, and adaptable tool, is continually advancing as the best wallet for Sui, providing users with all necessary functionalities to engage comprehensively in the Sui ecosystem, both on desktop and mobile platforms.

Best Practices for Your Sui Wallet Security

Creating a Sui wallet provides a public and private key, with the private key serving as the master key for accessing and controlling your cash. Ensuring security is crucial for safeguarding your tokens and digital assets housed in your Sui crypto wallet. Here are some essential security guidelines for your Sui wallet:

-

Don’t Share Your Private Key

The public key may be disseminated without restriction, but the private key must be kept secret. It is utilized to authenticate your identity, endorse transactions, and safeguard possession of your assets.

-

Be Alert Against Scams

No authentic service, including the Sui wallet mobile application, will ever request your private key. Remain vigilant against phishing efforts or fraudulent pop-ups.

-

Utilize Cold Storage

Safeguard your private keys offline—utilize a hardware wallet or an encrypted USB drive or securely document them on paper. This mitigates the danger of Internet breaches.

-

Create Secure Backups

Preserve backup copies of your keys in several secure locations. Additionally, you may keep a QR code version for expedited access; nevertheless, ensure that you utilize only reputable applications for its generation.

-

Multi-Factor Authentication (2FA)

Enhance your wallet security by activating two-factor authentication whenever possible, or utilize hardware devices such as YubiKeys for further safeguarding.

-

Safeguard Your Devices

Utilize reputable antivirus software, implement robust passwords, and consistently update your computers to safeguard against malware.

-

Review and Test Consistently

Regularly evaluate your wallet backups and security configuration. For substantial transactions, initially transmit a nominal test amount to verify precision.

-

Multi-Signature Wallets

Sui facilitates multi-signature functionality for shared wallets or treasuries, preventing any individual from independently transferring cash.

-

Effective Security Practices

Configure your wallet for automatic locking, refrain from utilizing identical keys across many devices, and avoid public Wi-Fi when handling your wallet.

Adhering to these practices will safeguard your private keys and funds, ensuring a seamless, secure, and stress-free experience with the Sui blockchain development wallet.

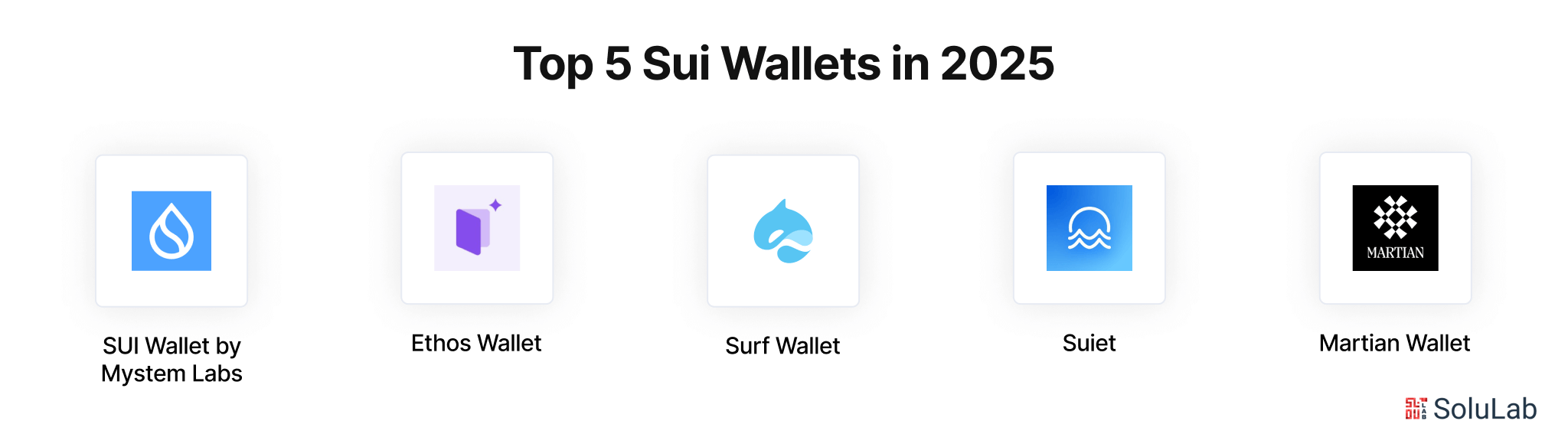

Top 5 Sui Wallets to Watch Out for in 2025

The Sui ecosystem provides a varied selection of engaging and functional Web3 applications. To commence using these programs, a wallet is required. A wallet enables the execution of several functions, including the purchase, sale, transmission, and reception of digital assets, such as SUI, NFTs, and other tokens inside the ecosystem.

As Sui’s Mainnet debut approaches its one-year anniversary, several wallets have gained popularity within the Sui ecosystem. So, here are the top 5 Sui Wallets to look out for in 2025:

1. Sui Wallet by Mysten Labs

This official wallet, created by the team responsible for the Sui blockchain, is frequently regarded as the best wallet for Sui. It offers seamless interaction with all Sui-based decentralized applications, safe storage for private keys, and an intuitive user interface that accommodates both novice and experienced users.

2. Ethos Wallet

Ethos is gaining popularity because of its streamlined mobile and web applications, which have integrated NFT support and features suitable for decentralized finance. Renowned for its simplicity and rapid onboarding, it is favored by consumers seeking a safe and lightweight Sui wallet experience.

3. Surf Wallet

An alternative centered on privacy for people that value anonymity and control. Surf Wallet provides top multi-wallet, compatibility with testnets for Sui blockchain development, and adjustable transaction parameters for advanced users.

4. Suiet

Suiet is a streamlined wallet designed for efficiency. It provides browser extension capabilities, including object tracking, token management, and an intuitive interface that attracts both Web3 newcomers and developers.

5. Martian Wallet

Initially developed for Aptos, Martian has now extended its support to Sui in beta. Its multichain functionalities render it optimal for people overseeing assets across many ecosystems, while maintaining providing fundamental facilities for Sui token storage and transfers.

The Key Takeaway

In 2025, Sui wallets will become an essential tool for Web3 users due to their unparalleled simplicity, security, and speed. Featuring intuitive user interfaces, native support for Sui tokens, and easy integration with decentralized applications, top-tier Sui wallets let users actively engage in the decentralized economy.

We help businesses in developing robust applications on the Sui blockchain here at SoluLab. As a leading Sui blockchain development company, we recently developed The Mobyii mobile wallet app, designed to simplify digital payments including the utility bills payment, making deposits and withdrawals effortlessly, and carry out cashless shopping.

Ready to build the next great wallet or dApp on Sui? Get in touch with SoluLab to bring your vision to life. Let’s Talk!

FAQs

1. Can I connect my Sui wallet to multiple dApps simultaneously?

Yes, most Sui wallets like Ethos and Sui Wallet by Mysten Labs allow multi-dApp connections. You can switch between or stay connected to various platforms within the same session, streamlining your Web3 experience.

2. What happens if I lose access to my Sui wallet mobile app?

If you lose access, you can recover your wallet using the original seed phrase (also known as the recovery phrase). That’s why securely backing up your seed phrase offline is critical for restoring access on a new device.

3. Do Sui wallets support token swaps within the wallet interface?

Some Sui wallets are beginning to support native token swaps through integrated DeFi protocols. However, this depends on the wallet—more advanced wallets may include this feature, while simpler ones may redirect users to third-party dApps.

4. Are Sui wallets suitable for developers and testers?

Absolutely. Many wallets support Sui testnets, making them great tools for developers. Wallets like Surf and Suiet are especially popular in Sui blockchain development environments due to testnet compatibility and flexible network settings.

5. How do I know if a Sui wallet is trustworthy?

Look for open-source wallets with strong community support, frequent updates, and backing by reputable teams (like Mysten Labs). Check for secure key storage, permissions transparency, and whether the wallet has undergone third-party audits.