Conversations about the blockchain usually revolve around cryptocurrencies and other crypto assets. In fact, that’s probably what drew you into the Web3 and blockchain space. That was also the major use case that businesses cared about for a long time. That has changed. Over the last few years, mid- and large-scale enterprises have flooded into the blockchain space to gain a competitive edge by using blockchain technology to boost efficiency, transparency, and profitability. These are live, operational deployments that are solving problems in major industries. This guide will explore how and why businesses leverage blockchain in areas outside finance.

Understanding the Blockchain

You probably already have a rough idea of what the blockchain is. Simply put, it is a digital book of records shared across thousands of computers instead of sitting in one central computer. Every entry into said book is linked to the one before it, locked in with cryptography, and once it’s in, it can’t be erased or altered (without leaving a trace).

That description shows the four central pillars/features of the blockchain:

- Decentralization: No single person controls the system; power is spread across participants.

- Immutability: Once information is recorded, it can’t be tampered with.

- Transparency: Participants can see and verify transactions.

- Security: Cryptography ensures data integrity and protects against fraud.

These features directly address the problems people often complain about when it comes to traditional systems and organizations: opacity, bureaucracy, and dependence on intermediaries. This is why blockchain and blockchain technologies have become popular in almost every business vertical.

The Most Popular Use Case

When discussing blockchain, the conversation almost always circles back to finance. For good reason: blockchains power cryptocurrencies, digital payments, and decentralized finance (DeFi), all of which are at the heart of the current shake-up in the global financial system. So, it makes sense if you, like many others, think that’s all blockchain is about. After all, people and businesses have heavily bought into the crypto wave, with major companies like PayPal, Microsoft, AT&T, Apple, and Tesla (among thousands of others) now accepting Bitcoin as of 2025.

It’s that momentum that keeps the markets alive. That’s why traders and investors continue to analyze blockchain-driven markets daily on platforms like TradingView, where every price move reflects the strength of the infrastructure behind it. They also track when major enterprises buy into new positions.

Still, blockchain’s potential doesn’t end with finance. It’s already finding real traction in industries you might not immediately associate with crypto:

- Healthcare: securing patient records and enabling seamless, tamper-proof data sharing.

- Supply Chain: tracking goods from origin to shelf with complete transparency.

- Regulatory Compliance: automating record-keeping to meet strict legal requirements.

- Process Automation: cutting out manual bottlenecks through smart contracts.

Blockchain as an Enterprise-Level Tool

Much of the conversation has centered on public blockchains, the backbone of most cryptocurrencies and decentralized assets. They’re undoubtedly powerful but not built with enterprise-scale needs in mind. Businesses operating at scale need something more private, scalable, and tightly controlled. That’s where enterprise blockchain comes in.

Let’s look at how this enterprise blockchain is being used and why its implementation is critical.

1. Supply Chain Transparency

Global (and even domestic) supply chains are notoriously complex and grossly inefficient. Counterfeiting, fraud, and lack of visibility are constants. When you add recurring geopolitical conflicts, post-pandemic disruptions, and recent tariffs, you realise that supply chains have become a massive cost burden for business owners and regulators alike.

So, how does blockchain help?

- Creates a shared, tamper-proof record of product movement.

- Enables traceability from origin to shelf.

- Boosts consumer and partner trust.

Here’s how some of the world’s most prominent organizations are already putting this into action:

- De Beers (yes, the diamond company) has registered nearly three million diamonds on its Tracr blockchain platform since 2022 to verify their origin and ethical sourcing.

- Merck, Walmart, FDA, IBM, and KPMG piloted blockchain solutions to comply with the Drug Supply Chain Security Act (DSCSA) 2023. The outcome? Improved traceability, faster recalls, and enhanced data privacy between stakeholders are all critical for patient safety and regulatory trust.

2. Compliance and Regulatory Alignment

Regulatory demands on enterprises are constantly changing, from data governance to sustainability and anti-counterfeiting laws. Traditional compliance methods, however, are often slow, manual, and error-prone. Blockchain offers several ways to flip the script by making compliance faster, more reliable, and easier to prove.

How blockchain helps:

- Tamper-proof records: Once data is written to a blockchain, it can’t be changed without leaving a trace. This ensures audit trails are reliable and regulators can trust the integrity of the records.

- Real-time tracking: Transactions, contracts, or shipments can be logged instantly, reducing the lag between events and reporting. This is especially critical in industries like finance, healthcare, or logistics.

- Transparency for regulators: Instead of digging through endless paperwork or spreadsheets, regulators can access blockchain records directly (with permissions), streamlining audits and inspections.

- Automated reporting: Smart contracts can automatically generate and share compliance reports when conditions are met, cutting down manual work and minimizing human error.

- Cross-border consistency: Different jurisdictions often require different proof of compliance in global trade. A shared blockchain record creates a consistent source of truth across countries.

3. Smart Contracts and Automation

Manual contracts and approvals slow businesses down. In large enterprises, every agreement has to pass through never-ending lists of departments, legal, finance, and compliance, before execution. That translates to delays, higher costs, and room for human error. Multiply that across global supply chains, procurement systems, and vendor relationships, and the costly mistakes become inevitable.

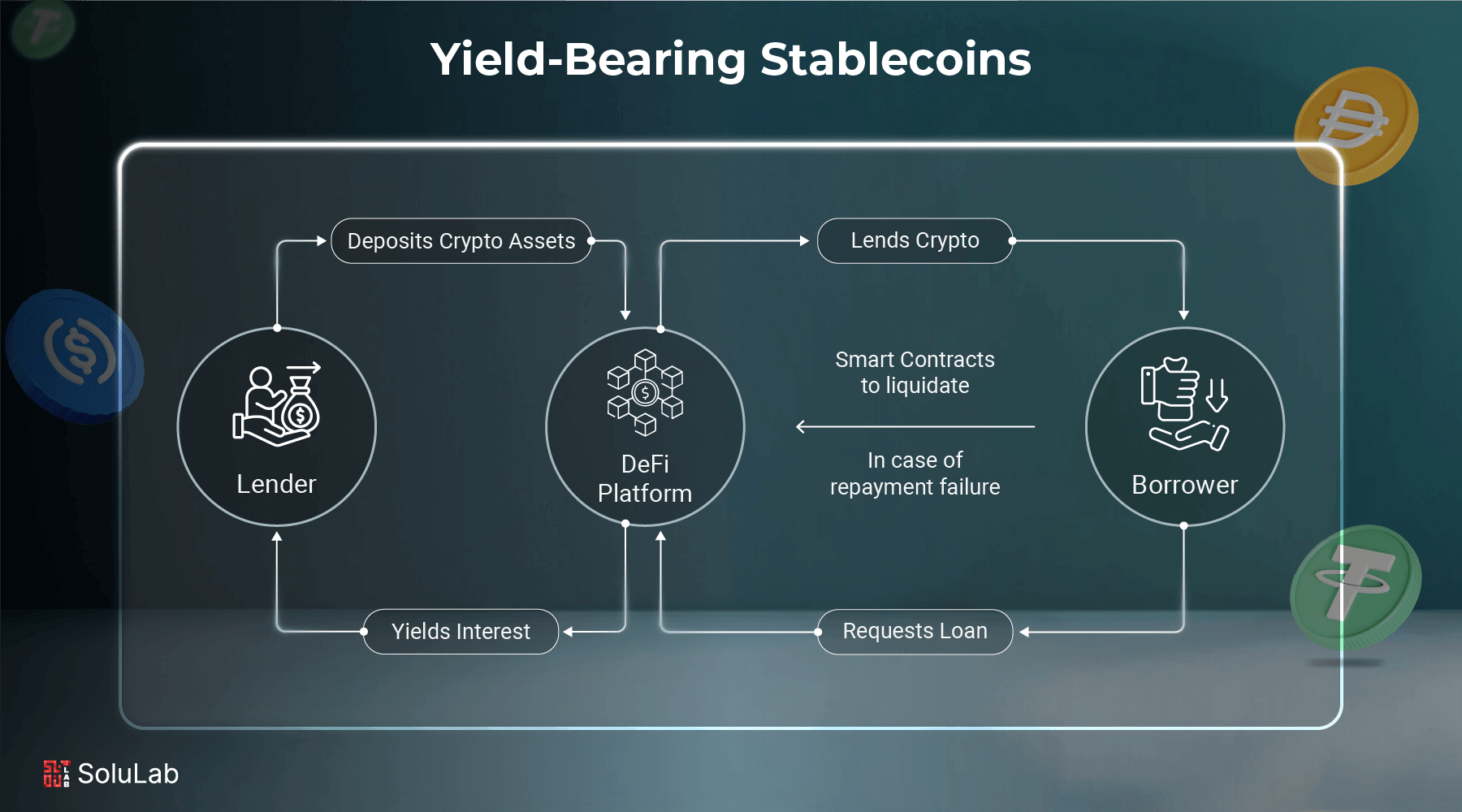

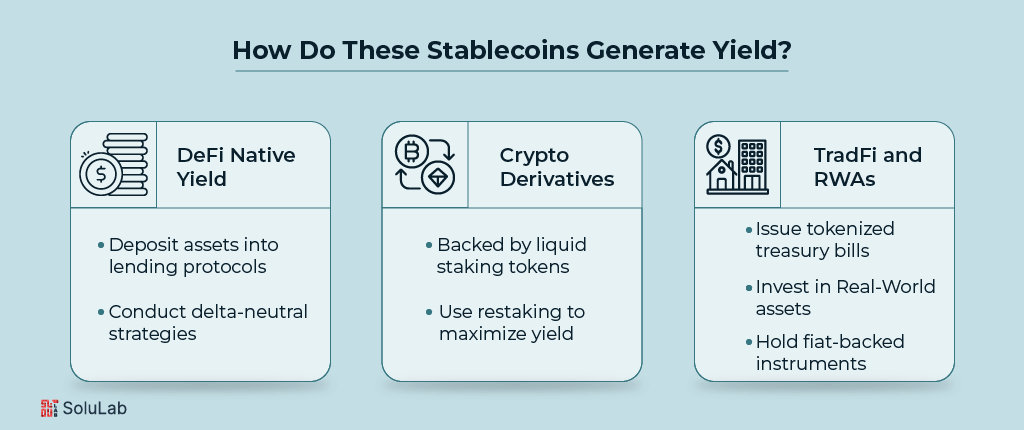

Enter smart contracts. Think of them as programs living on the blockchain that kick into action when agreed-upon conditions are met. They eliminate the need for a middleman or someone to push a button.

Here’s what they bring to the table:

- They cut out intermediaries and manual steps.

- They reduce errors by executing exactly as coded.

- They speed up B2B transactions, logistics, and procurement by running automatically in real time.

Smart contracts eliminate bottlenecks and minimize disputes by embedding rules directly into code. For enterprises, this translates into faster deal cycles, fewer administrative costs, and stronger trust between partners.

Blockchain Isn’t Just About Money Anymore

What started with Bitcoin has grown into something businesses can’t afford to ignore. Blockchain now powers supply chains, compliance, automation, you name it. There are challenges with scale and regulation, but the momentum is already here. Enterprises aren’t waiting around, they’re using blockchain to fix real problems and stay competitive.