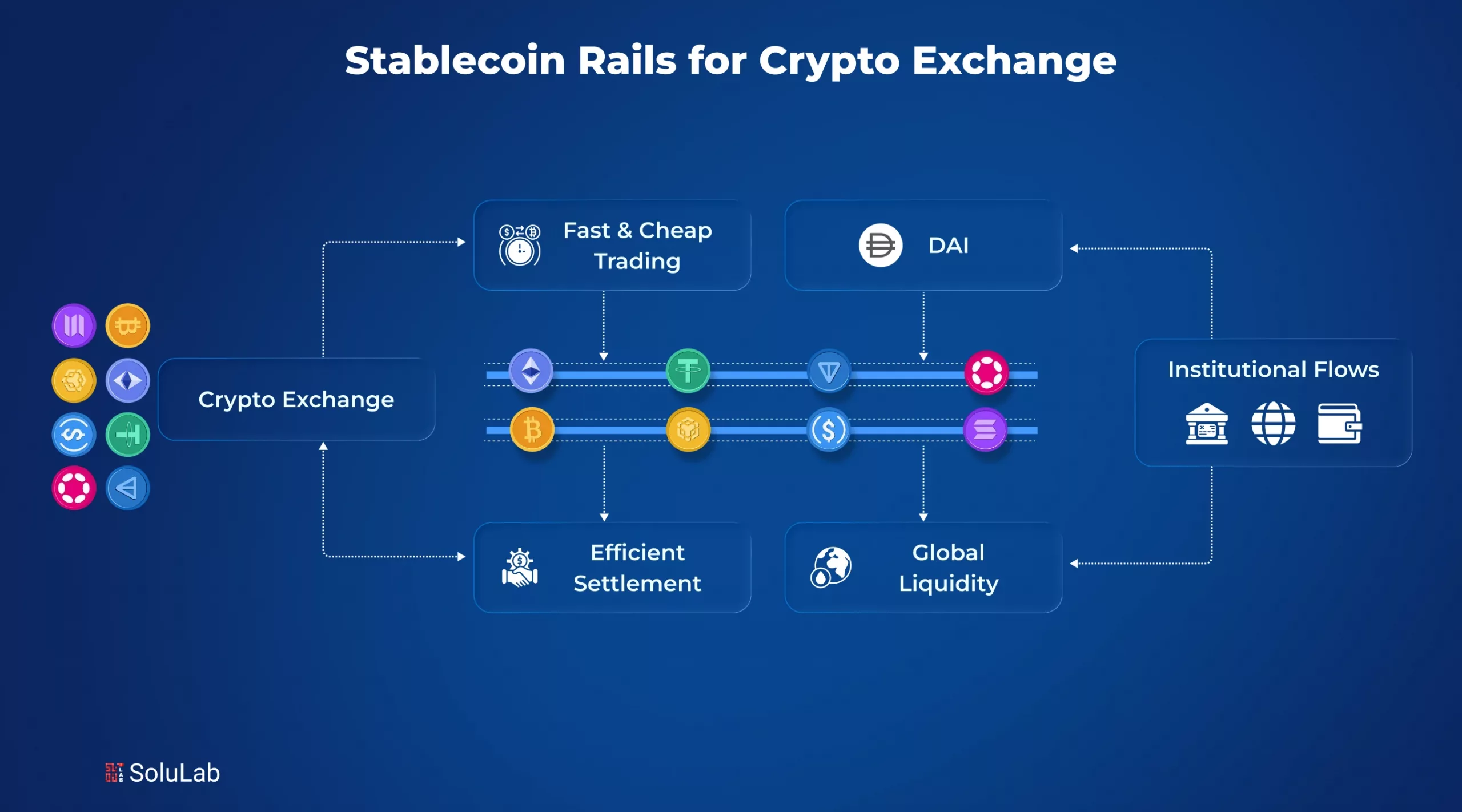

Running a crypto exchange today means handling billions in trades every day. To stay competitive, you need stablecoin rails, the blockchain payment rails that let funds move instantly, 24/7, without banking delays.

For B2B founders, fintech teams, and developers, stablecoins in crypto-fintech systems give three big wins – seamless liquidity, lower volatility risk, and predictable, real-time settlements. Major exchanges now process $20–30 billion daily using these rails.

Adopting stablecoin rails for fintech helps your exchange cut fees, speed transactions, and scale globally, key advantages for attracting institutional partners and high-volume traders.

Why Do Crypto Exchanges Need Stablecoin Payment Rails?

Running a crypto exchange today is challenging. Market volatility, liquidity bottlenecks, and the pressure for instant cross-border settlements are constant hurdles. This is why stablecoin payment rails have become a must-have infrastructure for modern exchanges.

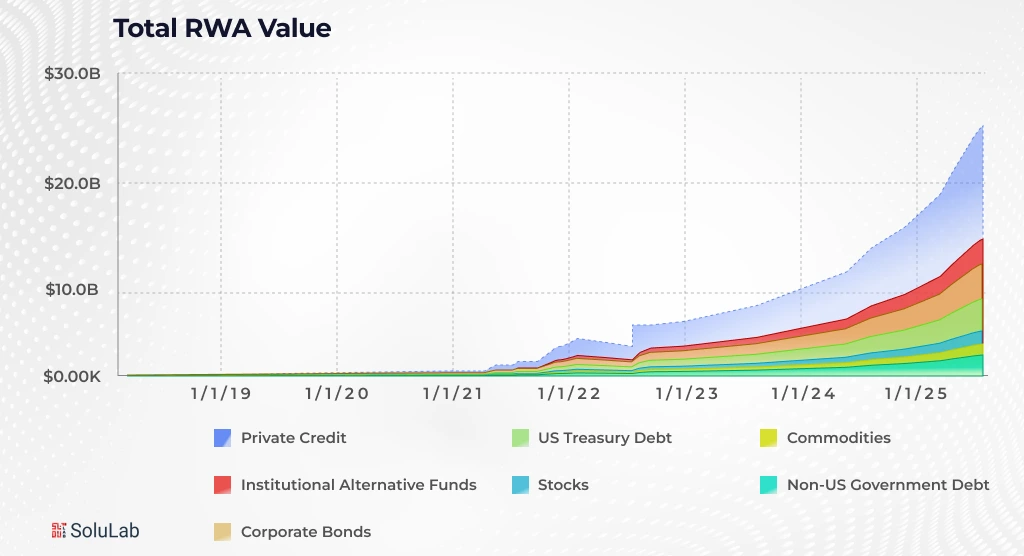

In 2023 alone, $10 trillion total on-chain transaction volume with stablecoins making up 60%, underlining their crucial role in financial operations.

By integrating rail stablecoin systems, exchanges can benefit from:

- Stable trading pairs that reduce slippage and protect users from sudden market swings.

- Automated settlements powered by smart contracts, ensuring faster, transparent, and error-free transactions.

- Reduced dependency on traditional fiat gateways, cutting delays and operational costs.

With stablecoin payment rails, exchanges not only improve operational efficiency but also gain a competitive edge in the fast-evolving crypto ecosystem.

For founders and infrastructure teams, this means faster settlements, lower costs, and a platform ready for global adoption.

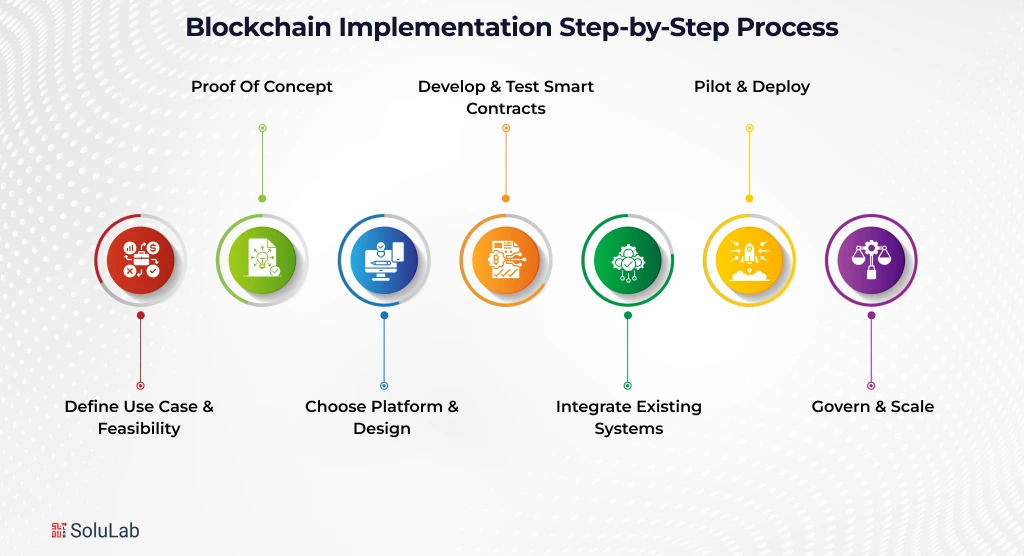

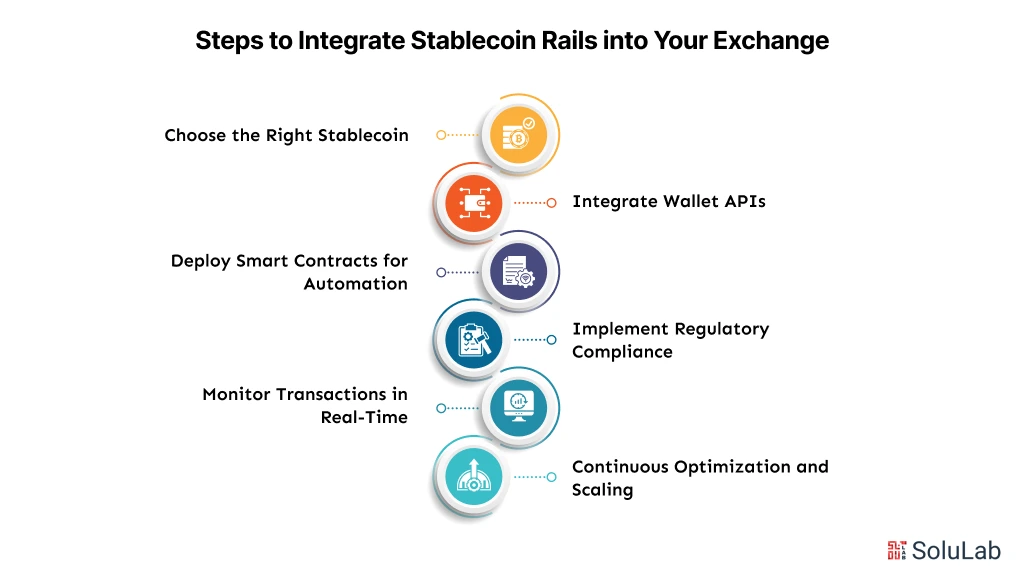

Step-by-Step Guide to Integrating Stablecoin Rails into your Exchange

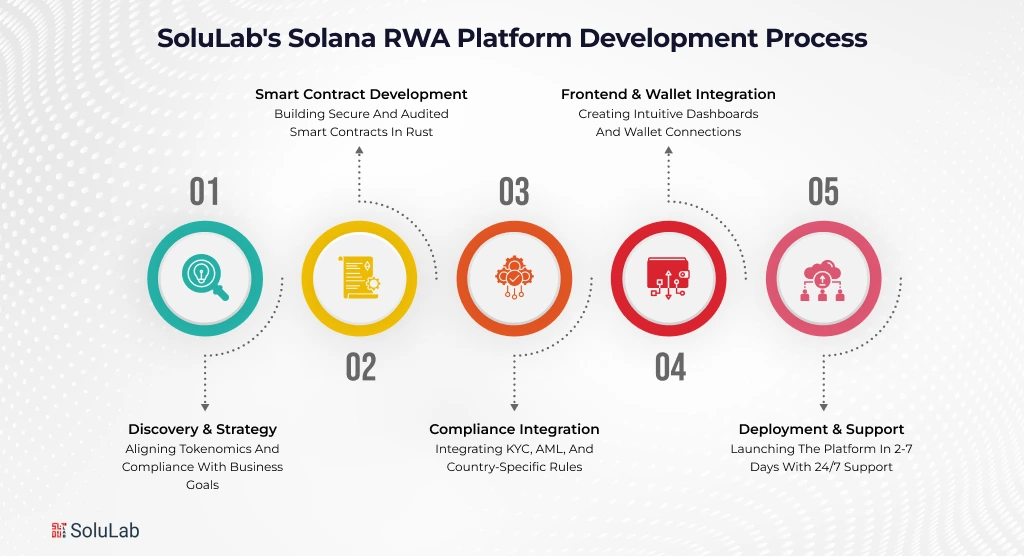

Integrating stablecoins rails for fintech into your crypto exchange or financial platform can significantly enhance liquidity, reduce transaction costs, and improve settlement speed. For B2B clients, understanding and implementing these steps ensures your infrastructure is competitive, secure, and scalable.

1. Choose the Right Stablecoin

Start by evaluating types of stablecoins based on your business needs. Consider factors like liquidity, regulatory compliance, ecosystem compatibility, and transaction efficiency. Popular options include:

- USDT: High liquidity, widely used in exchanges.

- USDC: Institutional-grade transparency with regular audits.

- DAI: Decentralized, crypto-backed stablecoin ideal for DeFi integration.

Selecting the right rail stablecoin ensures smooth cross-border transactions, reliable settlement, and compliance with stablecoin regulations. For B2B fintechs, this step reduces operational risks and ensures your platform can scale with institutional adoption.

2. Integrate Wallet APIs

To connect your platform to stablecoin payment rails, leverage professional wallet APIs. These tools simplify:

- Secure custody of stablecoins.

- Instant transactions across multiple networks.

- Multi-currency support for different stablecoins in crypto-fintech systems.

Integration with stablecoin rails for fintech allows your users to move funds seamlessly between wallets, exchanges, and payment channels. This step is critical for operational efficiency and building trust with corporate clients.

3. Deploy Smart Contracts for Automation

Smart contracts are the backbone of stablecoin rails. Use them to automate critical functions such as:

- Settlement of trades and transactions.

- Margin calls and collateral management.

- Liquidity provisioning for high-frequency trading.

With programmable stablecoin payment rails, these smart contracts ensure that transactions are transparent, auditable, and executed without manual intervention.

4. Implement Regulatory Compliance

Compliance is essential for B2B fintechs working with stablecoins in crypto-fintech systems. Ensure adherence to stablecoin regulations and frameworks such as the GENIUS Act stablecoin. Key actions include:

- Verifying issuer reserves for each stablecoin.

- Implementing AML/KYC procedures.

- Maintaining audit trails for all transactions.

Being compliant not only protects your platform from legal risks but also increases trust among institutional clients looking to leverage your stablecoin rails infrastructure.

5. Monitor Transactions in Real-Time

Once your stablecoin rails are live, continuous monitoring is crucial. Use dashboards and analytic tools to:

- Track how stablecoins work in real-time.

- Identify unusual transactions or network congestion.

- Prepare audit reports for regulatory authorities or clients.

Real-time monitoring ensures transparency and operational control, critical for B2B relationships and for demonstrating your platform’s reliability to investors or enterprise clients.

6. Continuous Optimization and Scaling

After integration, focus on optimization to maximize the benefits of stablecoin rails:

- Adjust liquidity pools according to trading volume.

- Deploy cross-chain bridges for broader network reach.

- Upgrade smart contracts to support new types of stablecoins.

Continuous improvements enhance efficiency, reduce costs, and make your platform a go-to solution for B2B partners seeking robust crypto and fintech services.

How Rail Stablecoin Systems Improve Crypto Exchange Liquidity Management?

For any B2B crypto exchange, strong liquidity is the key to smooth trading and happy institutional clients. A rail stablecoin system provides the infrastructure that keeps funds moving quickly and predictably, even during high-volume trading.

Rail stablecoin networks let exchanges settle trades in real time with stable, dollar-pegged assets like USDC or USDT. This steady value cuts the risk of price swings and reduces slippage in high-frequency trading, where even small delays or price gaps can cost millions.

By adding stablecoin payment rails, exchanges can accept large institutional inflows without relying on slow banks. Funds arrive and clear within minutes, giving market makers and professional traders instant access to liquidity.

For B2B founders and fintech teams, using stablecoins in crypto-fintech systems means:

- Faster settlements across multiple trading pairs

- Lower transaction fees compared to traditional payment rails

- 24/7 liquidity to handle global trading demand

Read Also: UAE’s Dirham-Backed Stablecoin

Optimizing Cross-Border Settlements with Stablecoin Rails for Crypto Exchanges

For B2B operators, using stablecoins rails for fintech means:

- Lower costs: Cross-border transfers that can cost 2–5% through banks often drop to under 0.1% with stablecoins in crypto-fintech systems.

- Instant settlements: Liquidity moves in real time, helping OTC desks close large trades without delays.

- Stable value: Stablecoin use cases like margin trading stay protected from crypto price swings, because coins are pegged to fiat such as USD or EUR.

Top exchanges already process $20–30 billion daily through these rails. By integrating stablecoin payment rails with clear U.S. rules like the GENIUS Act stablecoin framework, a platform gains regulatory confidence and attracts institutional partners.

How Top Exchanges Use Stablecoin Rails?

1. Kraken With Circle

Kraken partnered with Circle to bring more USDC and the euro stablecoin EURC to its platform. This gives Kraken users deeper liquidity, lower conversion costs, and tighter stablecoin rails integration across trading and settlement. Through its work with OpenPayd, Kraken also supports stablecoin on/off ramps as part of a rails-agnostic payments system.

Takeaway for crypto exchanges: Integrating stablecoins in crypto-fintech systems with issuers like Circle can boost liquidity, cut conversion friction, and make stablecoin settlement rails a core part of operations.

2. Binance

Binance Pay lets users make peer-to-peer and merchant payments using stablecoins with instant, fee-free transfers. Binance also added Circle’s USYC yield-bearing stablecoin, allowing institutional users to post collateral and speed up settlements.

Takeaway: Leading exchanges show that stablecoin payment rails are not just for trading. They drive payments, collateral management, and institutional flows, proving that stablecoin rails for fintech are now central to growth, not a side feature.

What is the Future of Stablecoin Rails in Global Trading with Stablecoin Regulations?

The future of stablecoin rails for fintech is highly promising. Analysts project the global market could reach $3.7 trillion by 2030.

Clear stablecoin regulations, including the US stablecoin bill and GENIUS Act stablecoin, provide a secure path for adoption. Crypto exchanges and fintech platforms using these frameworks can scale confidently, diversify revenue streams, and stay competitive.

Many institutions are already exploring stablecoins in crypto-fintech systems for treasury management, cross-border settlements, and B2B payments, making this infrastructure critical for modern financial operations.

Read More: Dollar-to-Stablecoin Swaps In White-Label Neo Banking

Build Your Exchange with a #1 Stablecoin Development Company

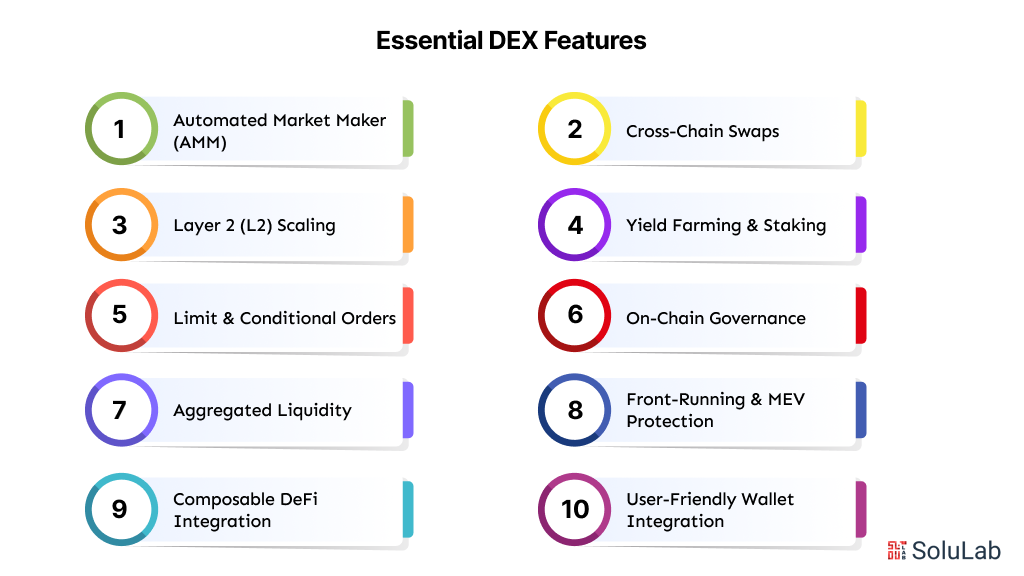

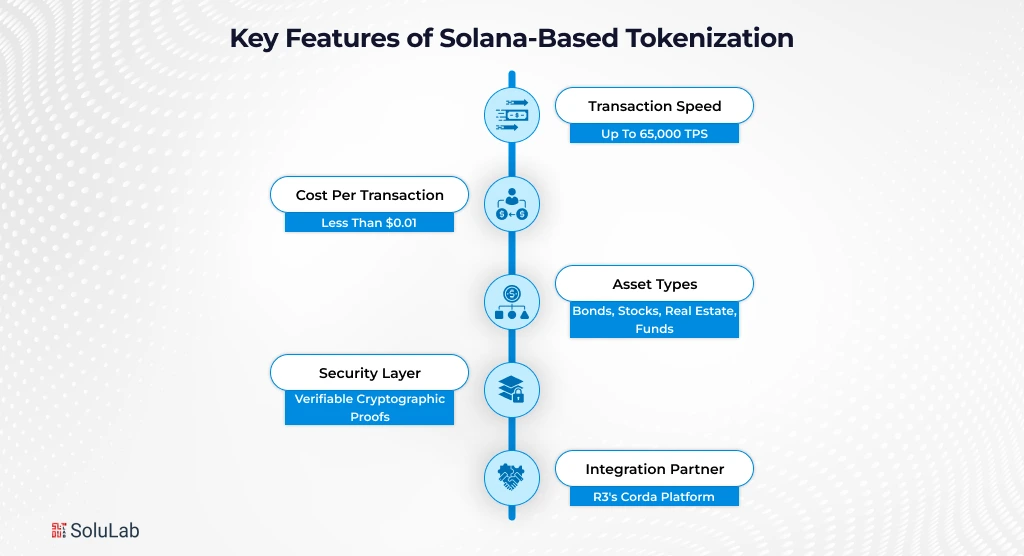

Partnering with a crypto exchange development company ensures your exchange is fast, secure, and compliant. Key benefits for B2B platforms include:

- Regulatory compliance: Align with the US stablecoin bill and the GENIUS Act stablecoin.

- Multi-chain integration: Seamless transfers across Ethereum, Solana, and Layer-2 networks using stablecoins rails for fintech.

- Advanced liquidity management: Deep liquidity via rail stablecoin infrastructure for trading, payments, and cross-border settlements.

- Secure smart contracts: Audited, institutional-grade contracts for automated transactions.

SoluLab offers full B2B solutions, integrating stablecoin payment rails, stablecoins in crypto-fintech systems, and advanced stablecoin use cases.

Conclusion

Stablecoins rails are no longer optional; they are foundational for modern crypto exchanges. By understanding how stablecoins work, navigating stablecoin regulations, and partnering with a stablecoin development company, B2B platforms can reduce operational costs, speed settlements, and scale globally.

With the right infrastructure, your exchange gains:

- Faster transactions via stablecoin payment rails

- Deep liquidity across markets using rail stablecoin mechanisms

- Compliance and security that build trust with institutional users

Integrating stablecoins in crypto-fintech systems allows B2B exchanges to unlock new revenue streams, reduce volatility, and enable innovative stablecoin use cases, all while staying competitive in the global market.

Contact us to grab the best stablecoin solutions!

FAQs

1. What are stablecoin rails?

Stablecoins rails are blockchain-based infrastructure that allows stablecoins to move quickly and securely between exchanges, wallets, and users. They act like payment highways for crypto, enabling real-time transfers without traditional banking delays.

2. Why do crypto exchanges need stablecoins payment rails?

Crypto exchanges rely on stablecoins payment rails to provide low-volatility trading pairs, reduce transaction costs, and attract institutional users. By integrating stablecoins in crypto-fintech systems, exchanges can settle trades instantly, support cross-border transactions, and maintain liquidity 24/7.

3. How can stablecoins in crypto-fintech systems reduce fees?

Stablecoins in crypto-fintech systems cut fees by bypassing traditional banking intermediaries. Cross-border settlements that once cost 2–5% can now settle for just a fraction of a cent. Stablecoins payment rails also allow exchanges to automate settlements, minimize reconciliation errors, and speed up transactions.

4. How does the US stablecoin bill impact operations?

The US stablecoin bill (GENIUS Act) mandates that all regulated stablecoins maintain 1:1 reserves, regular audits, and compliance with AML/KYC regulations. For exchanges, this provides legal clarity, reduces operational risk, and increases institutional confidence.

5. What is the GENIUS Act stablecoin and its role?

The GENIUS Act stablecoin legislation sets federal standards for stablecoin issuance, redemption, and reserve management. Its role is to ensure that stablecoins remain trustworthy and compliant for institutional adoption.

6. How to choose a stablecoin development company for integration?

Choosing a stablecoin development company involves evaluating technical expertise, regulatory experience, and past integrations. SoluLab can be your best partner for all sorts of blockchain and stablecoin solutions, be it development ot integration. Get a custom quote today!

![Top 15 Asset Tokenization Companies in the USA [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Top-Asset-Tokenization-Companies-in-USA-1.webp)