As we move towards 2026, the UAE is leading the charge in digital finance innovation with the launch of the Digital Dirham and the AE Coin stablecoin, creating a modern, complementary payments ecosystem. Global stablecoin adoption is accelerating, with the total market surpassing $300 billion in circulation and cross-border stablecoin transactions exceeding $50 billion by the end of 2025.

These numbers highlight the growing role of stablecoins in international trade, remittances, and enterprise payments. Recent regulatory frameworks in the UAE and worldwide are providing clarity and trust, encouraging businesses to explore digital payments. This blog explains what the Dirham-backed stablecoin means for businesses, how it operates, and reduces cost.

Inside the UAE’s Dirham-Backed Stablecoin

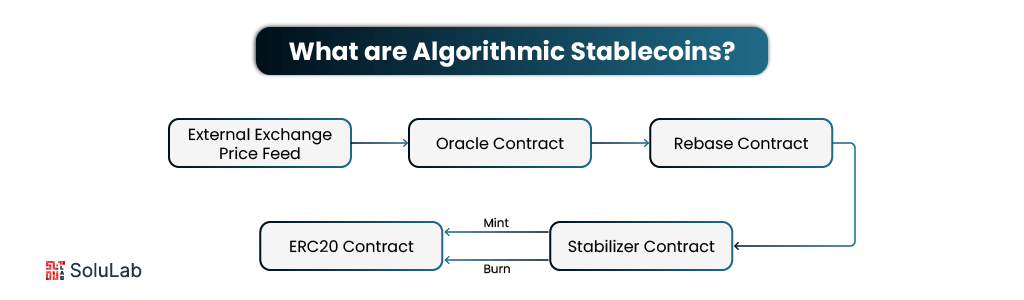

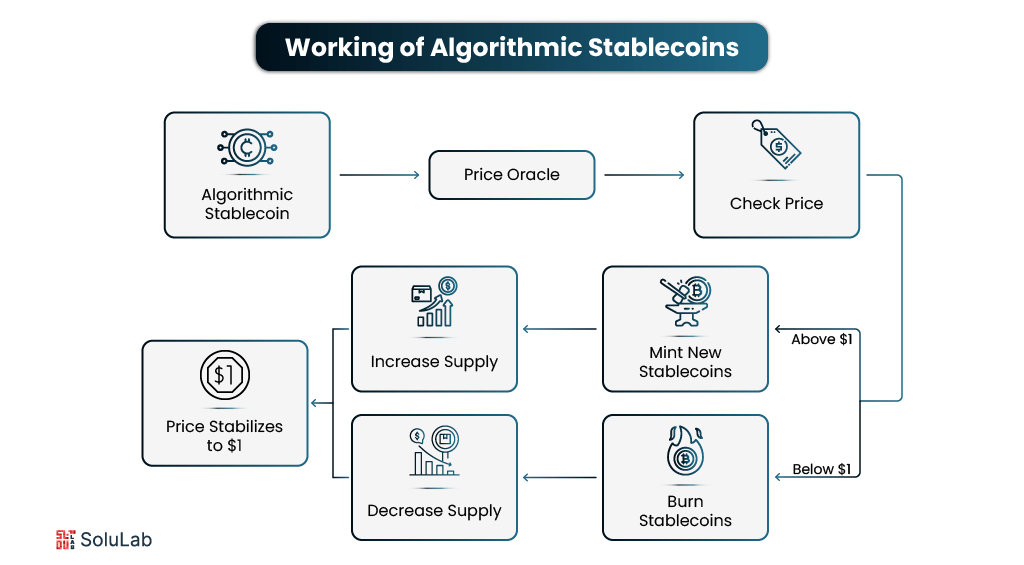

The UAE model pairs a sovereign Central Bank Digital Currency (CBDC) with private stablecoin initiatives. The Digital Dirham will act as legal tender for retail and institutional payments. AE Coin represents a dirham-backed stablecoin issued by First Abu Dhabi Bank (FAB) with IHC and ADQ. The ADI blockchain will support AE Coin distribution and programmable settlement rails.

Federal Decree-Law No. 54 of 2023 gives the Digital Dirham legal backing. Market momentum already exists, with Circle targeting a $47 billion remittance corridor. Regulatory clarity in ADGM and the Virtual Assets Regulatory Authority (VARA) supports rapid enterprise-grade token adoption. Businesses can choose between direct CBDC rails and regulated stablecoin rails.

Digital Dirham Stablecoin: From Compliance Burden to Competitive Edge

Dirham stablecoin is not just a digital asset for transfer; it has many strengths with the right regulations for user security. It can be moulded to many other purposes, let’s check them out.

-

Built-In Compliance Through Smart Contracts

Compliance often requires significant time and resources. The Digital Dirham changes this by embedding KYC and AML checks directly into its infrastructure. Smart contracts enforce compliance automatically before any transaction is completed, reducing the need for manual verification and minimizing errors.

-

Real-Time Audit Trails for Transparency

Every transaction on the blockchain platforms leaves a permanent, tamper-proof record. Businesses gain immediate access to transaction data, making audits faster and easier. This level of transparency builds trust with regulators, reduces the risk of disputes, and lowers the overall cost of compliance.

-

Reducing Settlement Risks for Treasury Teams

Traditional payments often involve settlement delays, creating risks for treasury departments. With the Digital Dirham, transactions settle in real-time, allowing companies to manage liquidity more efficiently. Treasury teams can operate with smaller liquidity buffers, freeing up capital for growth.

-

Turning Compliance into a Business Advantage

Rather than treating compliance as a burden, businesses can position themselves as leaders in transparency and trustworthiness. Companies in sectors such as logistics, supply chain, and trade finance can use the Digital Dirham as a differentiator, attracting clients who value reliable and compliant partners.

How Does the Digital Dirham Stablecoin Differ from Existing Payment Systems?

| Feature | Digital Dirham Stablecoin | Existing Payment Systems |

| Settlement | Direct central bank settlement | Relies on intermediaries like banks and card networks |

| Legal Status | Official legal tender issued by the Central Bank | Private or commercial payment networks |

| Programmability | Supports smart contracts, escrow, and conditional payments | Static fund transfers only |

| Fraud Prevention | On-chain traceability enables real-time monitoring and fraud detection | Limited transparency; higher fraud risk |

| Cross-Border Transfers | Near-instant with CBDC interoperability | Slow; multi-day settlement through correspondent banks |

| Cost Efficiency | Lower fees due to fewer intermediaries | Higher transaction costs and service charges |

| Transparency & Compliance | Fully auditable blockchain records | Opaque and fragmented transaction tracking |

The Digital Dirham offers legal tender status and direct central bank settlement. Card networks and correspondent banking rely on intermediaries and delayed settlement. AE stablecoin will operate on a compliant blockchain with bank-grade reserves. Programmability allows conditional payments, automated FX conversions, and escrow features. Traceability on-chain will improve fraud detection compared with cash and legacy rails.

1. Direct Settlement vs. Intermediary Networks

Current payment systems often involve banks, clearinghouses, and other intermediaries, each adding costs and delays. The Digital Dirham enables direct settlement with central bank oversight, reducing transaction layers and cutting fees.

2. Programmability vs. Static Payments

While traditional payments merely transfer funds, the Digital Dirham is programmable. Businesses can set up conditions such as escrow payments, milestone-based disbursements, or automatic reconciliations. This flexibility streamlines complex financial processes.

3. Enhanced Fraud Prevention

Fraud remains a challenge with cash and legacy transfers. The Digital Dirham leverages blockchain layers for security and traceability. Every payment is encrypted and recorded, making fraud harder to execute and easier to detect.

4. Cross-Border Advantage

International transfers today can take days to settle. By using CBDC interoperability and corridor-specific stablecoins, the Digital Dirham promises near-instant cross-border payments. Global businesses can cut costs, reduce delays, and gain greater control over international cash flows.

How Can Businesses Leverage the Digital Dirham?

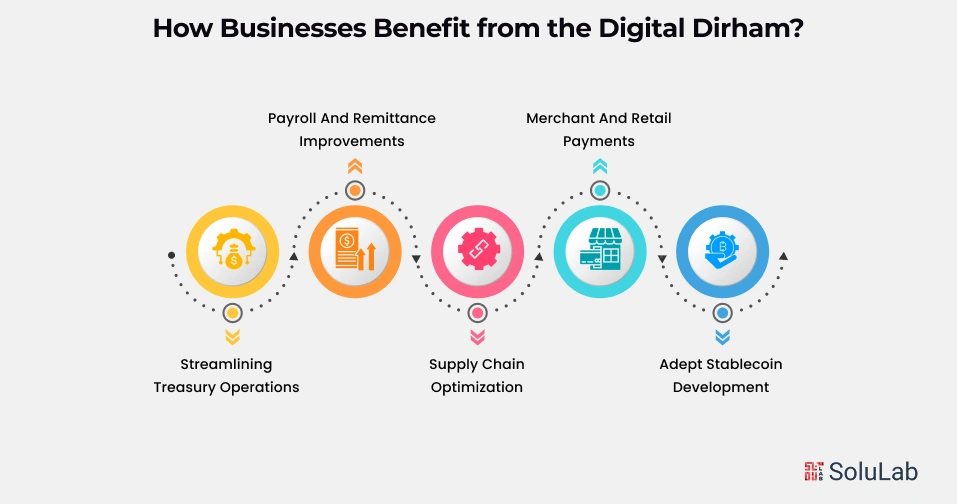

The UAE’s Dirham-backed stablecoin isn’t just a digital currency but a tool businesses can use to streamline operations, cut costs, and enhance security. Here’s how companies can make the most of it:

-

Streamlining Treasury Operations

Enterprises can automate vendor payments with programmable Digital Dirham contracts. These payments can be timed to supplier agreements, reducing disputes, ensuring on-time delivery, and enhancing supplier relationships.

-

Payroll and Remittance Improvements

For companies with large expatriate workforces, the Digital Dirham offers a major advantage. Salaries can be paid directly in the stablecoin, with employees enjoying faster, cheaper stablecoin remittances. Businesses benefit from predictability and reduced administrative overhead in payroll management.

-

Supply Chain Optimization

Suppliers often face liquidity issues while waiting for payments. Businesses can tokenize invoices and settle them instantly using the Digital Dirham. This accelerates working capital cycles and reduces reliance on external financing.

-

Merchant and Retail Payments

Retailers and e-commerce players can integrate Digital Dirham payments into their platforms. Customers benefit from faster checkouts and lower fees, while merchants enjoy instant settlements and reduced chargeback risks.

-

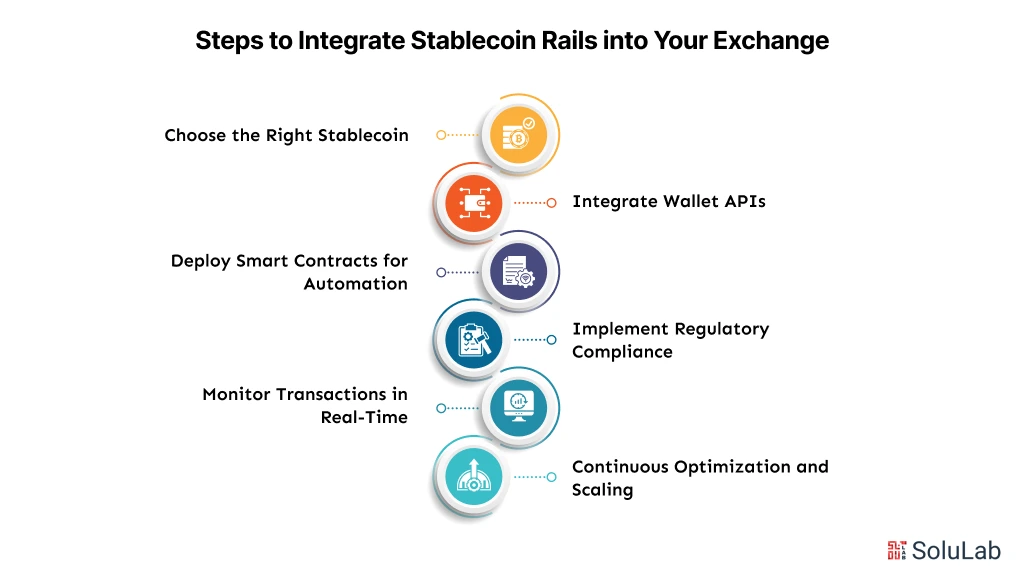

Adept Stablecoin Development

Adopting a CBDC requires technical expertise. Partnering with a company that creates stablecoins ensures seamless integration with existing systems, secure wallet management, and full compliance with all relevant regulations. These collaborations help businesses adopt the Digital Dirham faster while minimizing risks.

Other Global Regulatory Trends Boosting Trust in Stablecoins

The growth of stablecoins is no longer just about technology; it is about regulation. Global efforts are creating frameworks that build confidence, reduce risks, and encourage mainstream adoption. These moves directly support the credibility of the Dirham-backed stablecoin and strengthen its business case.

1. U.S. GENIUS Act (2025)

The GENIUS Act sets clear rules for payment stablecoins in the United States. It requires 1:1 reserve backing in cash or Treasuries, introduces licensing for issuers, and enforces disclosure of reserves. Importantly, it removes stablecoins from being treated as securities or commodities, placing oversight under banking regulators. This clarity makes RWA backed stablecoins safer and more attractive for both businesses and consumers.

2. Hong Kong’s Stablecoin Ordinance

Hong Kong implemented its Stablecoin Ordinance in August 2025, positioning itself as a leader in digital asset regulation. The law requires issuers of fiat-referenced stablecoins to obtain licenses from the Hong Kong Monetary Authority.

It enforces strict reserve rules, redemption rights, custody standards, and regular audits. The law also criminalizes unlicensed promotion, ensuring that only regulated players can operate. These measures make stablecoins more trustworthy in one of the world’s leading financial hubs.

3. EU’s MiCA Regulation

The Markets in Crypto-Assets Regulation (MiCA) came into force in 2024 across the European Union. It sets common rules for crypto-asset issuers and service providers, including stablecoins. MiCA requires issuers of asset-referenced tokens and e-money tokens to maintain sufficient reserves, follow governance standards, and provide transparent disclosures. This regulation blends the European market, making stablecoins safer and more predictable for businesses operating across multiple EU countries.

The Future of Business With the Dirham-Backed Stablecoin

The near future will show wider commercial adoption of dirham-backed stablecoin for public use. Interoperability between the Digital Dirham and AE Coin will enable flexible settlement choice. New products will arise around tokenized assets and real-time treasury liquidity pools.

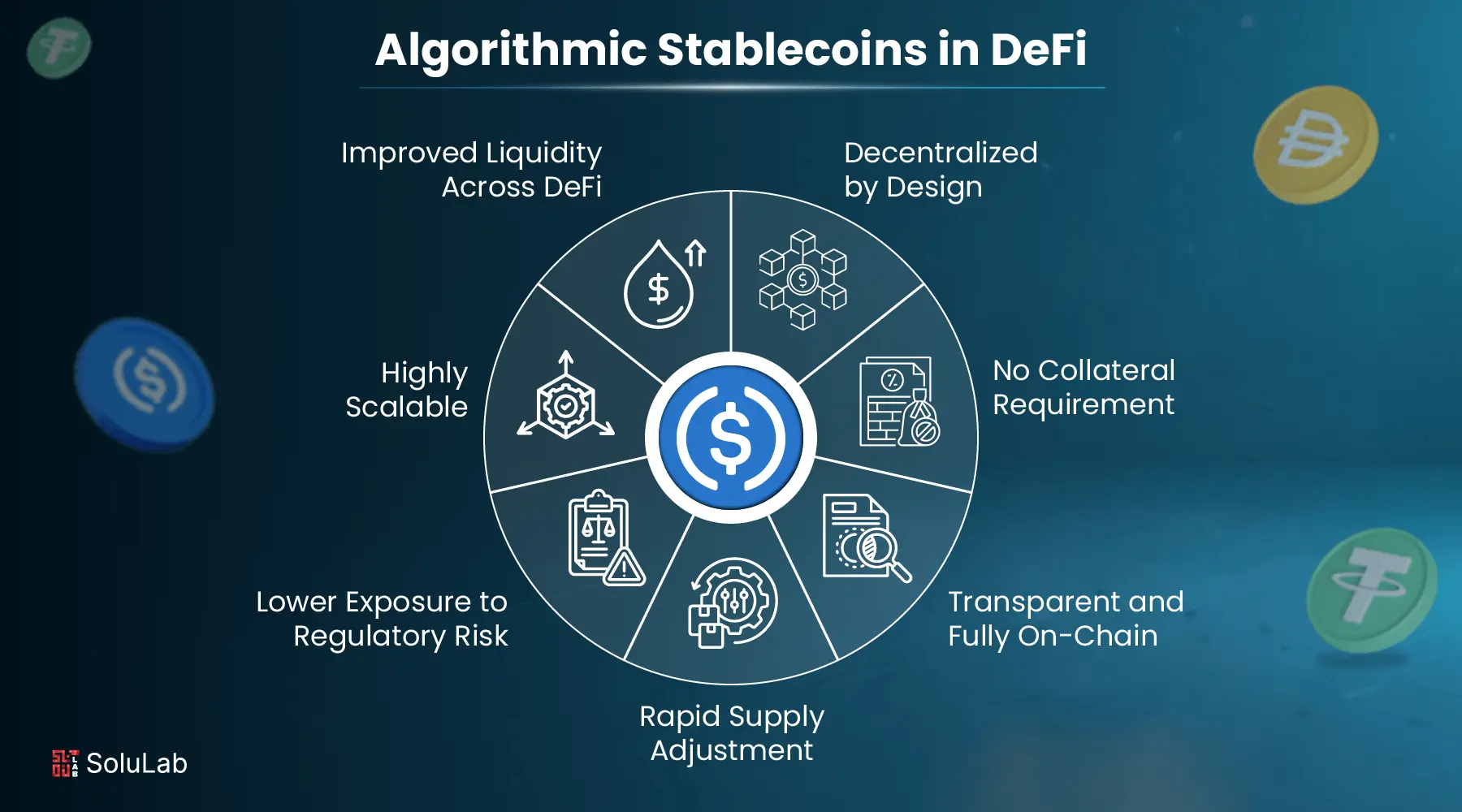

Merchant checkout will evolve to accept programmable payments and instant settlement. DeFi protocols may integrate with regulated stablecoins under strict compliance guardrails. Global developments, including the US stablecoin bill, will influence cross-border rules. Boards and executives should prioritise pilots to avoid strategic and operational lag.

Conclusion

With the above details, you might have understood the Dirham stablecoin growth and futuristic goals. This is not just about transferring; it’s a new era for innovatively simplifying things. If you are also looking for stablecoin development, then SoluLab is here to assist you.

We, at SoluLab, the top stablecoin development company, built custom fiat-pegged and algorithmic tokens that safeguard your ecosystem from volatility. Our expert team also provides multiple services, like token and wallet integrations.

For more information, contact us today!

FAQs

1. Could the Dirham-backed stablecoin change how loyalty programs work?

Yes. Loyalty rewards can be issued as Dirham stablecoins, making them transferable, redeemable across multiple businesses, and programmable for offers. This transforms reward points into liquid assets that hold real, usable value.

2. How will a dirham-backed stablecoin in the UAE help businesses?

It lowers settlement delays, reduces costs, and embeds compliance into transactions. Enterprises can manage liquidity better, automate payments, and benefit from faster, safer cross-border transactions under clear UAE regulatory frameworks.

3. What are the top use cases of stablecoins for enterprises?

Stablecoins enable payroll efficiency, real-time supplier settlements, cheaper remittances, and treasury automation. They also support escrow payments, programmable contracts, and tokenized assets, helping businesses improve cash flow and reduce reliance on traditional banking delays.

4. How can businesses start using the Digital Dirham?

Companies can work with regulated financial institutions and blockchain service providers in the UAE to set up wallets, enable payment processing, and integrate programmable features into their systems.

5. Why choose SoluLab as a stablecoin development company?

SoluLab creates fiat-pegged, algorithmic, and AI-powered stablecoins with a compliance-first design. We provide secure wallet integrations, system upgrades, and smooth enterprise adoption, ensuring businesses launch stablecoins quickly while staying fully aligned with regulatory standards.