The world of crypto has always been fast, but in 2026, things feel even more explosive. Solana has become one of the most exciting blockchains, with its market cap crossing $129 billion. Alongside, meme tokens are stealing the spotlight with their own booming ecosystem worth over $12.9 billion. Add to this more than 11.4 million active Solana wallets, and you have a recipe for rapid adoption.

Low fees, lightning-fast speed, and nonstop innovation have made Solana the go-to playground for meme coin traders and communities. For enterprises, this is the right time to look at wallet development, as it combines infrastructure strength with massive community energy.

How Solana Wallets Drive Meme Coin Market Growth?

Solana Meme Coin Wallet adoption sits at the center of the meme coin wave. They are no longer just tools to hold tokens. Instead, crypto wallet solutions have become discovery engines, trading dashboards, and even social hubs. Most meme coin transactions start and end with a wallet. This makes wallets a powerful gateway for both retail traders and enterprises.

Wallet adoption is also driving higher liquidity for Solana meme coins. As more users transact through apps like Phantom or Backpack, projects see faster growth and tighter communities. A strong wallet ecosystem is now one of the biggest reasons Solana meme coins continue to thrive.

Current Crypto, Solana, Meme Coins Market Trends

2026 has brought together three big trends:

- Crypto market maturity: With Bitcoin steady at the top, investors are more open to altcoins and meme coins.

- Solana momentum: High trading volumes, $12.1 billion in TVL, and fast confirmations put Solana ahead of rivals.

- Solana Wallet 2025: Over 2.2 million daily active wallets are transacting on the Solana network in Q1 2025.

- Meme coin culture: BONK, PENGU, and others attract millions of traders, making meme coins a daily trend topic.

This mix of serious infrastructure and playful speculation is unusual. That’s why enterprises are now rushing to build wallet solutions on Solana.

Why Are Enterprises Turning to Solana Wallet Development?

Enterprises see crypto wallet development as more than apps. They see them as business opportunities. A well-designed wallet can become the default choice for millions of meme coin traders. With such huge active communities, the potential for user retention and monetization is massive.

Three reasons enterprises are focusing on Solana wallet development in 2026:

- High user demand: Millions of new NFT wallets are being downloaded every month across the globe.

- Network effects: The more wallets integrate Solana meme coins, the stronger the ecosystem grows.

- Business credibility: Early movers in Web3 wallet development can gain trust before the market becomes saturated.

Wallets can be built as consumer apps or as licensed enterprise products. Either way, the market is large and ready.

Key Business Use Cases of Solana Wallets in 2026

Enterprises are exploring Solana crypto wallets not just for storage, but for multiple revenue-driven use cases. Here are the most relevant ones:

1. Airdrop distribution: Simplifying airdrops makes wallets sticky and boosts community loyalty.

2. Trading tools: Meme coin traders rely on wallets for quick swaps, P&L tracking, and whale alerts.

3. NFT access: Many meme coins link with NFTs for rewards and gated communities. Wallets enable seamless access.

4. Risk control: Scam detection and rug-pull prevention protect users and build trust.

5. Cross-chain activity: Multi-chain support makes wallets flexible for meme coin development across Solana, Ethereum, and BSC.

By supporting these use cases, enterprises can turn wallets into long-term growth engines.

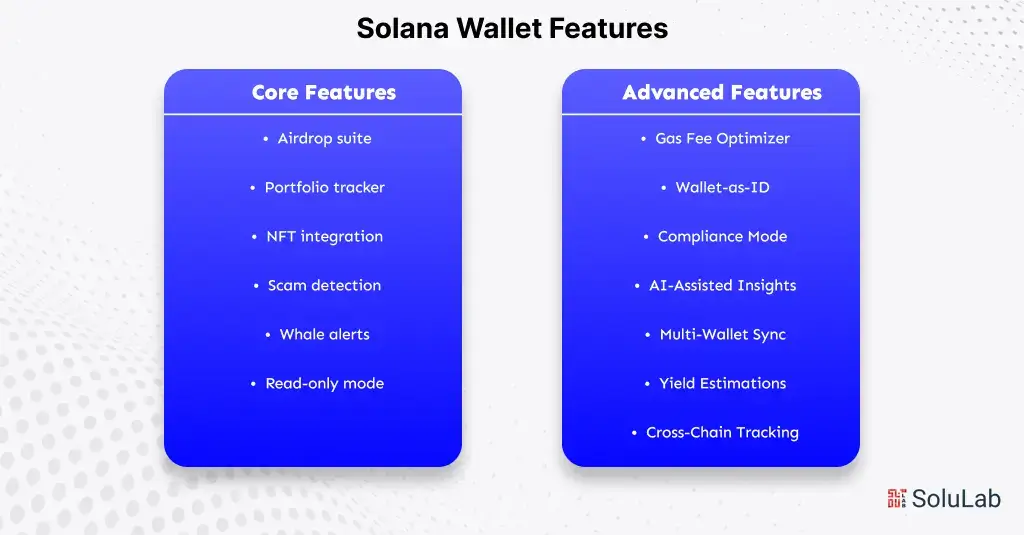

Core Solana Wallet Features That Businesses Must Prioritize

Every wallet starts with the basics. These core features build trust and retention. Without them, no wallet can compete.

- Airdrop suite: Automatic scanning, one-click claiming, and history logs make airdrops safe and engaging.

- Portfolio tracker: Real-time P&L and holder concentration charts help users manage risks in volatile meme markets.

- NFT integration: Combined NFT and token views allow smooth interaction with hybrid meme projects.

- Scam detection: Token risk scores based on liquidity, ownership, and mint rights protect users from rug-pulls.

- Whale alerts: Real-time notifications for big trades keep users engaged and active.

- Read-only mode: Allows wallet research without key connections, increasing privacy and onboarding ease.

These features are non-negotiable for any Solana meme coin wallet today.

Differentiators That Help Your Solana Wallet Win Market Share

Beyond the basics, differentiators give wallets their competitive edge. They help a wallet become the go-to app for communities.

-

On-Chain Meme Coin Analytics

With this, you can see token age, liquidity health, and trading pressure in one view. It helps users move from guesswork to smarter decisions, giving your wallet real credibility in meme coin markets.

-

Liquidity Lock Visibility

This shows how much liquidity is locked and for what. Clear LP data builds trust instantly, helping users feel safer while boosting confidence in the projects they invest in.

-

Social Sentiment Tracking

You can combine Telegram, Discord, and X chat into one hype score. It gives users an early pulse on meme coin buzz, helping them react before the market shifts.

-

Smart Alerts

Not just price pings, smart alerts merge trading volume and social activity. Users get fewer false alarms and faster insights, making your wallet feel like a real trading companion.

-

Community Gamification

Leaderboards, referral rewards, and fun airdrop perks turn wallets into communities. This makes trading engaging, sticky, and social, keeping users coming back daily.

Wallets that offer these differentiators often grow fastest through word-of-mouth.

Advanced Solana Wallet Features For Startups and Enterprises

Advanced modules take wallets from consumer apps to enterprise platforms. These features target professional traders and funds.

-

Gas Fee Optimizer

A gas fee optimizer manages priority fees and timing, ensuring smooth execution during heavy traffic. This feature helps traders gain an advantage in high-volume meme coin drops.

-

Wallet-as-ID

A wallet-as-ID framework attaches loyalty badges and reputation layers. It transforms wallets into identity hubs that strengthen community belonging and long-term user engagement.

-

Compliance Mode

A compliance mode includes tax-ready exports, whitelist tools, and risk classifications. These functions make meme coin investing safer and more reliable for institutional players.

-

AI-Assisted Insights

AI-assisted insights combine on-chain signals with social sentiment data. This feature provides traders with non-financial indicators that support sharper and more confident decisions.

-

Multi-Wallet Sync

A multi-wallet sync function consolidates holdings across multiple addresses. It provides enterprise-grade visibility with unified portfolio analysis and P&L reporting.

-

Yield Estimations

A yield estimation tool projects APRs for staking and farming meme coins. It helps users make better-informed decisions before locking capital.

-

Cross-Chain Tracking

A cross-chain tracking module manages meme coin positions across Solana, Ethereum, and Base. It offers traders a single, unified view of all holdings.

These advanced features are optional for casual users, but critical for businesses and serious traders.

The Future of Solana Meme Coin Wallets

The future of Solana wallets is more than storage. They will evolve into full-stack community engines. Wallets will merge social engagement, AI insights, compliance, and yield farming into one seamless user experience.

We can expect three big shifts:

1. Deeper integration with communities: Solana meme coin wallets will embed GenAI-driven chatbots, NFT community hubs, and on-chain social scoring systems, making wallets function as decentralized social platforms.

2. Cross-chain dominance: AI-powered bridges will enable unified meme coin trading across Ethereum, BNB Chain, Solana, and Layer-2 rollups, reducing latency and slippage.

3. Smart compliance and security: Wallets will feature automated KYC modules, AI-driven fraud detection, and zero-knowledge proof (ZKP) verification, balancing privacy with regulation.

In 2026 and beyond, wallets are the key to unlocking Solana’s full potential. Enterprises that build now will not just capture users; they will define how the next wave of meme coin culture evolves.

Conclusion

You may already have a clear ideology on the Solana wallet and what factors make it a key solution in the meme and crypto tokens space. If you are also looking for a reliable partner to make your idea come true, then SoluLab is here to aid you in every step.

We at SoluLab, a top crypto wallet development company, help you to build secure, stable and and scalable payment integration solutions. This makes your business reliable and user-friendly. Our expert team specializes in crafting ultra-secure cryptocurrency wallets, empowering you to earn, transfer, and monitor virtual currencies with confidence.

Contact us today to uplift your crypto or meme platform to new heights!

FAQs

1. Can Solana meme coin wallets integrate AI for smarter trading?

Yes, modern Solana crypto wallets use AI for sentiment tracking, predictive trading, and fraud detection, giving meme coin investors smarter tools beyond simple storage and transfers.

2. How do Solana wallets help businesses stand out in 2026?

By offering unique features like NFT access, cross-chain swaps, and social engagement tools, Solana Wallet development allows businesses to attract, retain, and monetize engaged crypto communities.

3. What features of crypto wallets are most important for enterprises today?

Enterprises prioritize security, scalability, compliance, and community-driven tools. Advanced cryptocurrency wallet solutions must balance trading performance with features like airdrop support, whale alerts, and cross-chain activity tracking.

4. Why should businesses choose SoluLab for Solana Wallet development?

SoluLab offers end-to-end crypto wallet development with advanced features, enterprise security, and user-friendly design, making it a trusted partner for businesses entering meme coin development and Web3 solutions.

5. Could Solana wallets eventually replace standalone meme coin exchanges?

Possibly. With Web3 wallet development evolving into trading dashboards, analytics hubs, and community platforms, wallets might reduce reliance on centralized exchanges for meme coin investors and enterprises alike.