Enterprises are under immense pressure to stay competitive, efficient, and transparent. But with rising data, slow transactions, and outdated legacy systems, many businesses are facing troubles in scaling their operations securely.

The enterprise blockchain market is expected to reach USD 145.9 billion by 2030, growing at a CAGR of 47.4% from 2024 to 2030.

This lack of trust, especially in sectors like finance, supply chain, and healthcare, is costing companies not just money but credibility. And while everyone’s talking about blockchain, the real challenge is figuring out which platforms are enterprise-ready, scalable, and future-proof in 2026.

In this blog, we’ll explore the top 5 enterprise blockchain platforms, the criteria to select the best platform, and more. Let’s get started!

Read Our Blog: Top 10 Blockchain Development Companies in 2026

How Blockchain Is Transforming Enterprises?

Here’s how blockchain is impacting enterprises across industries:

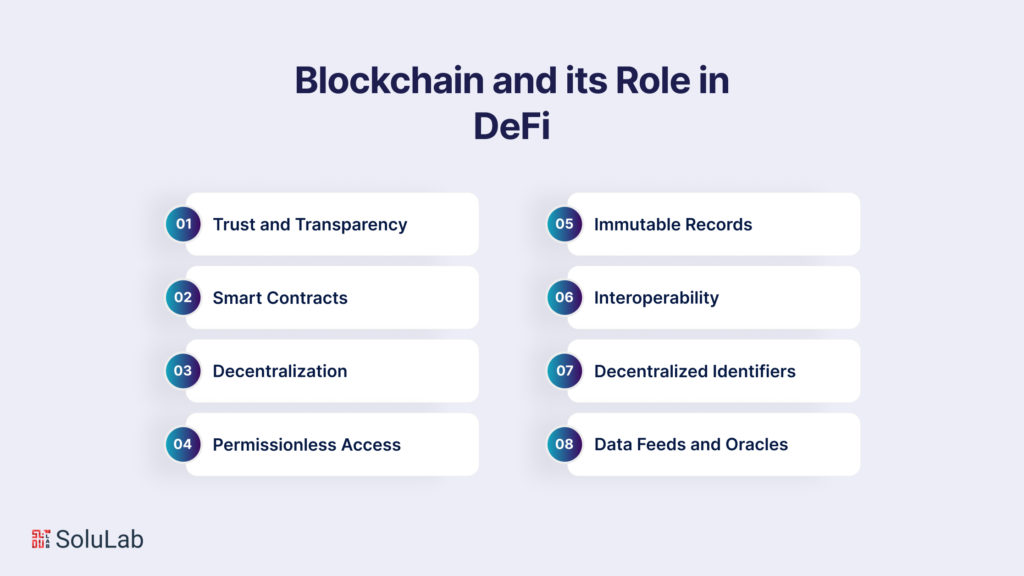

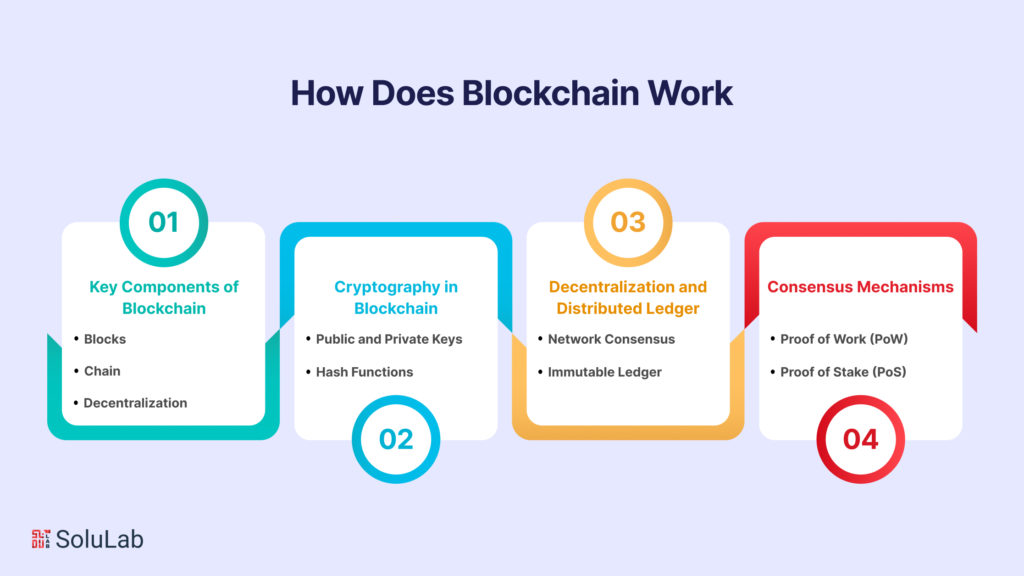

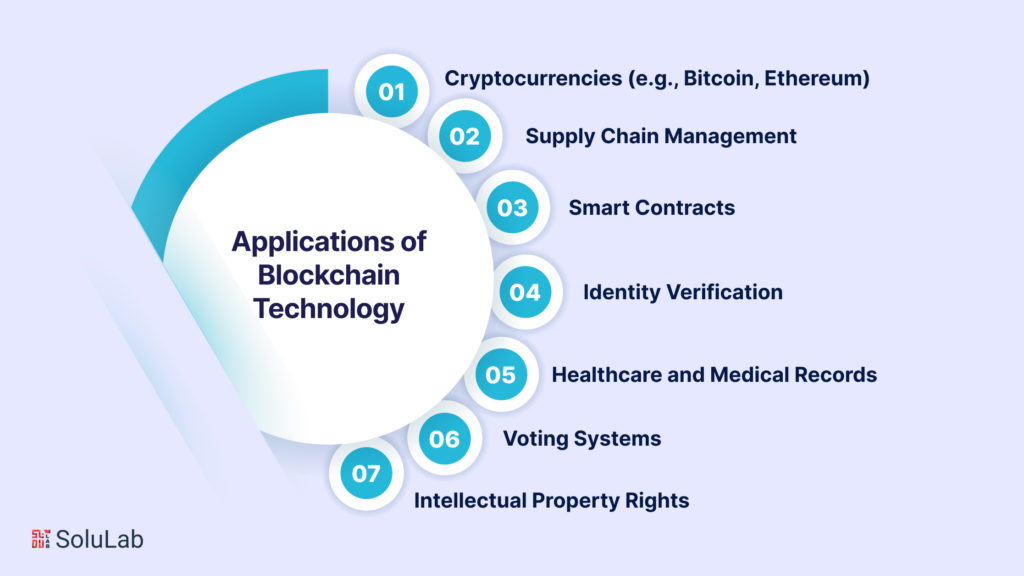

1. Trust Without Middlemen: Blockchain enables secure, verifiable transactions without intermediaries. That means faster processes and fewer costs.

2. Supply Chain Transparency: Every step can be tracked from farm to fork. Enterprises can now trace product origins, reduce fraud, and ensure compliance. This is perfect for FMCG, pharma, and agriculture.

3. Smart Contracts: No more manual checks. Smart contracts automate tasks when conditions are met. Great for legal, finance, and logistics.

4. Better Payments & Settlements: Faster cross-border payments with reduced transaction fees. Especially useful for export-import businesses in India.

5. Audit & Compliance Made Easy: Audits become simpler since every change is recorded. Blockchain makes financial data tamper-proof and regulator-friendly.

Read Our Blog: Top Blockchain Technology Companies

Criteria for Selecting the Top Enterprise Blockchain Platforms

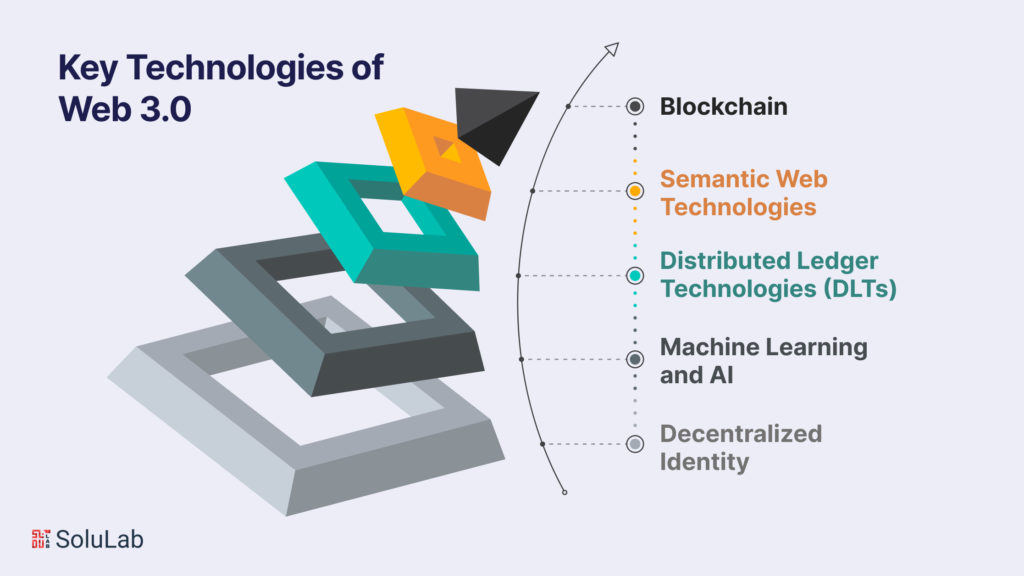

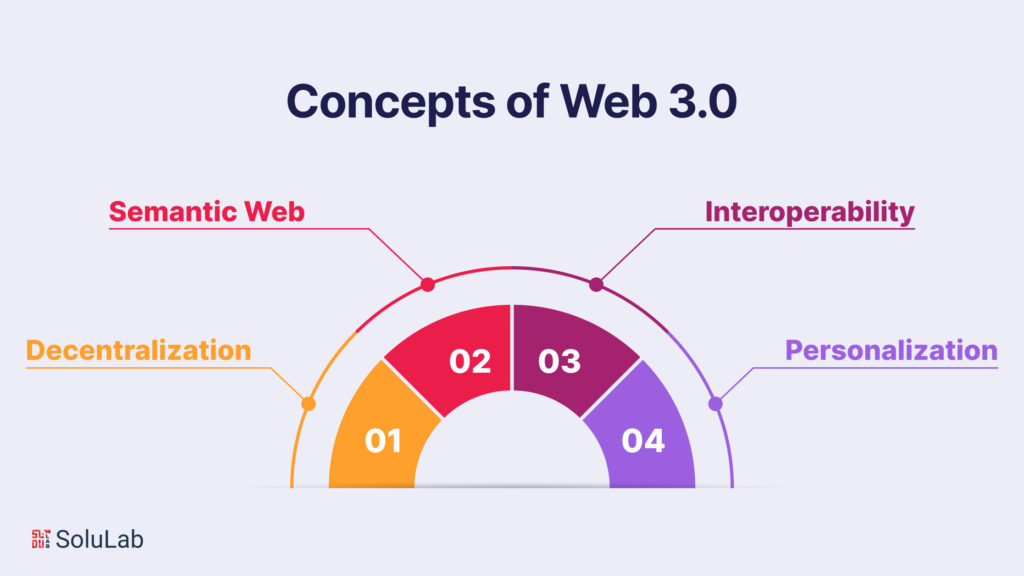

With the proliferation of blockchain platforms catering to enterprise needs, it’s essential to establish a set of criteria to evaluate and select the most suitable options. Each platform comes with its strengths and weaknesses, making the selection process a nuanced task. Here are the key criteria to consider when selecting the top enterprise blockchain platforms of 2026:

- Scalability and Performance: Scalability is crucial for enterprise applications that demand high transaction throughput. Platforms must demonstrate the ability to handle a large number of transactions per second while maintaining low latency. Considerations include the platform’s consensus mechanism, sharding techniques, and approaches to optimizing network performance as the user base expands.

- Security and Data Privacy: Enterprises handle sensitive data, and security is paramount. Blockchain platforms must employ robust encryption, hashing, and access control mechanisms to safeguard data from unauthorized access. Privacy features, such as zero-knowledge proofs and private transactions, allow enterprises to share information selectively while preserving confidentiality.

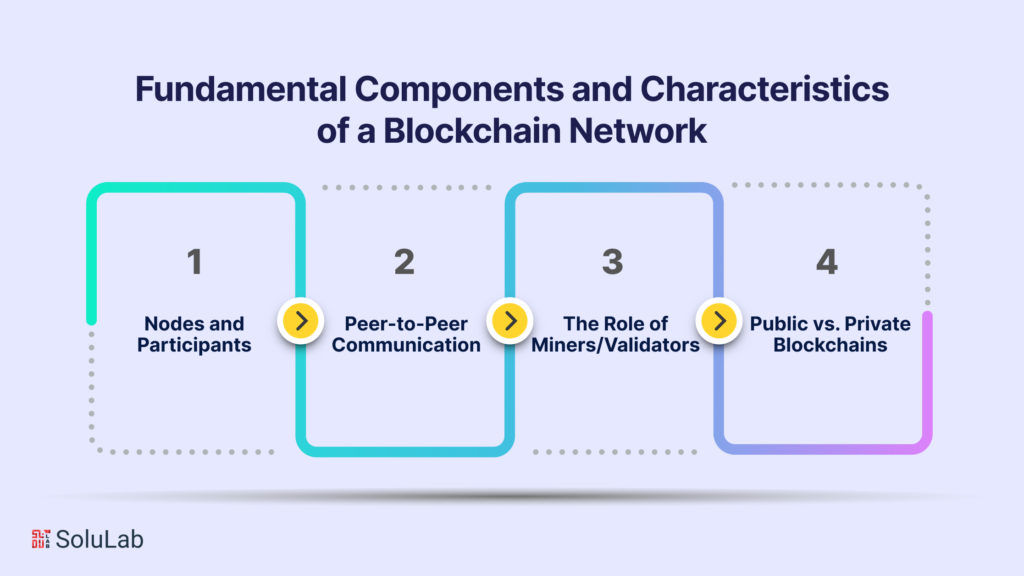

- Interoperability and Integration: In an ecosystem with multiple blockchain networks and existing IT infrastructure, interoperability is essential. Platforms should support seamless integration with legacy systems and other blockchain networks. Standards like cross-chain communication protocols enhance interoperability and facilitate data exchange between different platforms.

- Smart Contract Capabilities: Smart contracts automate business processes, but their complexity varies between platforms. Evaluate the programming languages supported, the ease of writing and deploying smart contracts, and the platform’s support for oracles (external data sources).

- Community and Support: A vibrant and active community indicates a platform’s vitality and ongoing development. Robust community support ensures quick issue resolution and a wealth of resources for developers. Platform documentation, developer tools, and user-friendly interfaces contribute to a positive user experience.

Read Also: Best Companies to Hire Blockchain Developers

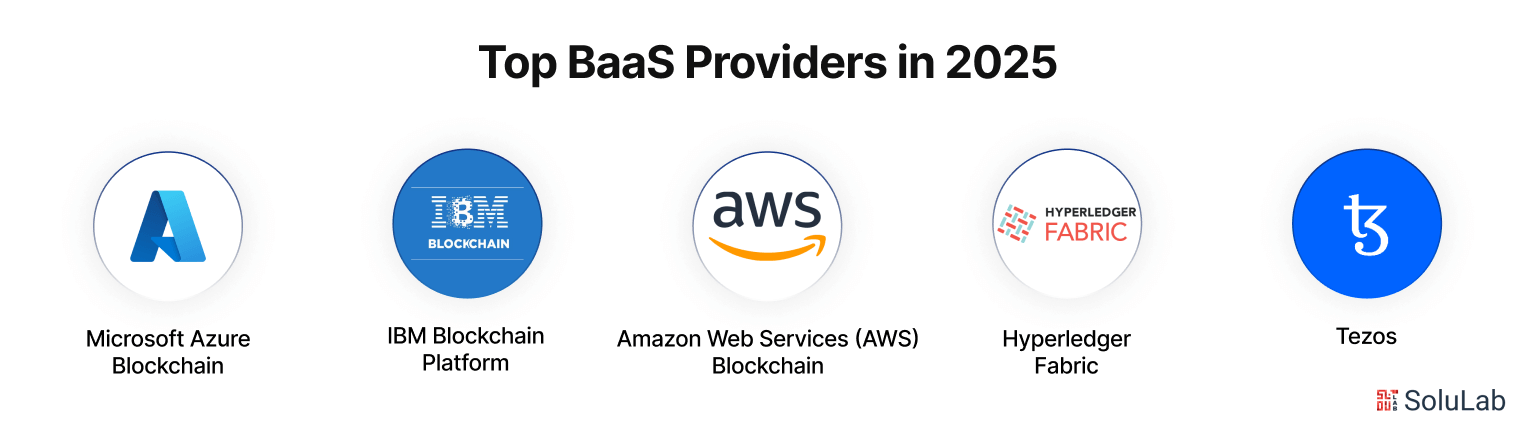

Top 5 Enterprise Blockchain Platforms

1. Ethereum

Ethereum, founded in 2015, is one of the most widely adopted blockchain platforms, known for its smart contract functionality, decentralized applications (dApps), and a robust developer community.

While originally public, Ethereum also offers enterprise-grade solutions through frameworks like the Enterprise Ethereum Alliance (EEA). It’s ideal for businesses looking to build transparent and automated systems.

2. R3 Corda

R3 Corda, launched in 2016, is a blockchain platform designed for regulated industries like finance, healthcare, and supply chain. Unlike public blockchains, Corda focuses on privacy, scalability, and interoperability by enabling only the involved parties to access transaction data.

It supports smart contracts and offers robust identity management, making it ideal for enterprise use cases. Its unique architecture ensures compliance and efficiency for complex workflows.

3. Hyperledger Fabric

Hyperledger Fabric, launched in 2015 by the Linux Foundation, is a modular and permissioned blockchain platform designed for enterprise use. It supports pluggable consensus mechanisms, private channels for confidential transactions, and chaincode (smart contracts) written in general-purpose programming languages like Go and Java.

Its architecture is ideal for businesses needing secure, scalable, and customizable solutions across sectors like supply chain, finance, and healthcare.

4. Hedera Hashgraph

Hedera Hashgraph, founded in 2018, is a high-performance public distributed ledger designed for enterprises. Unlike traditional blockchains, it uses a unique hashgraph consensus algorithm, making it faster and more energy-efficient.

Key features include fair transaction ordering, low fees, and high throughput, making it ideal for use cases like supply chain, identity management, and payments. Its governing council includes global giants like Google and IBM, ensuring robust governance.

5. IBM Blockchain

IBM Blockchain (launched in 2017) is a robust enterprise-ready platform built on Hyperledger Fabric, designed to help businesses securely share data and streamline workflows. Known for its modular architecture, it supports permissioned networks, ensuring high privacy and scalability.

It also integrates with existing systems, making it ideal for sectors like supply chain, finance, and healthcare. IBM offers tools, templates, and support to help enterprises build and scale blockchain solutions efficiently.

Conclusion

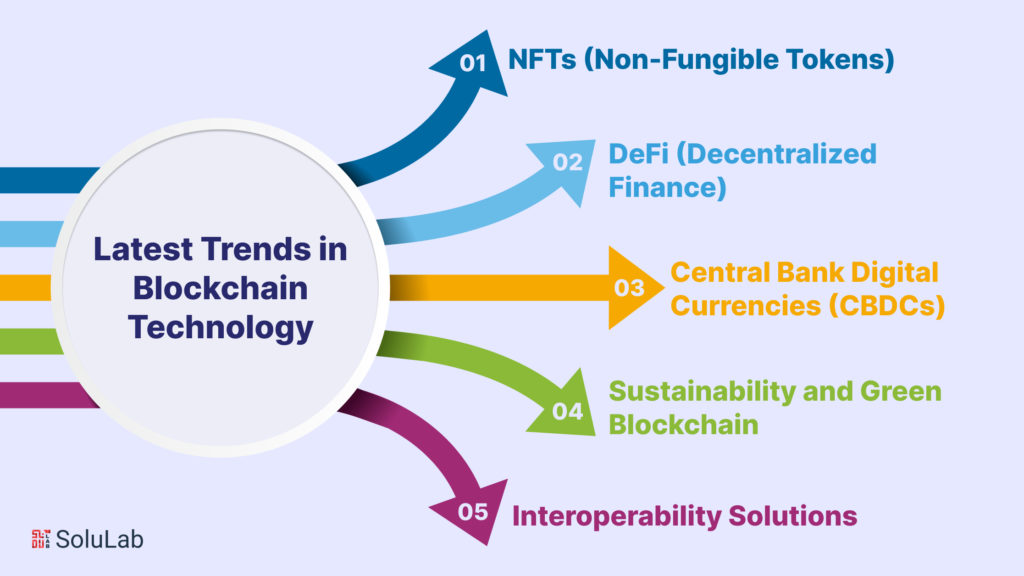

In 2026, enterprise blockchain platforms will no longer be optional — they’re a strategic necessity. Whether it’s improving operations, security, or transparency. Platforms like Hyperledger Fabric, Ethereum Enterprise, and others are redefining how businesses function.

Each offers unique features tailored to different enterprise needs, from smart contracts to permissioned networks. As businesses continue to grow, choosing the right blockchain platform and hiring a blockchain developer can provide a competitive edge in the market. The key is to align technology with business goals.

Token World, a crypto launchpad platform, partnered with SoluLab to enhance smart contract security, scalability, and regulatory compliance. We built robust tokenomics, investor dashboards, and multilingual support. Our blockchain integration and community strategies empowered Token World to deliver secure, user-friendly token launches and drive global investor engagement.

SoluLab, a blockchain development company, can help you pick the best platform as per your business requirements.

FAQs

1. How is enterprise blockchain different from public blockchain?

Enterprise blockchains are usually permissioned, meaning only authorized participants can access or validate transactions, ensuring privacy and control. Public blockchains like Bitcoin and Ethereum are open to everyone, and transactions are fully transparent.

2. Is it expensive to build on an enterprise blockchain platform?

Costs vary depending on the platform, complexity of the solution, development time, and compliance needs. While some platforms are open-source and free to use, enterprise-level support or custom integrations can increase expenses. However, the long-term ROI often outweighs the initial investment.

3. Can enterprise blockchains support AI and IoT integrations?

Yes, many modern enterprise blockchain platforms support integration with AI, IoT, and cloud computing. This allows for powerful use cases like predictive maintenance, smart manufacturing, automated logistics, and real-time asset tracking with secure data layers.

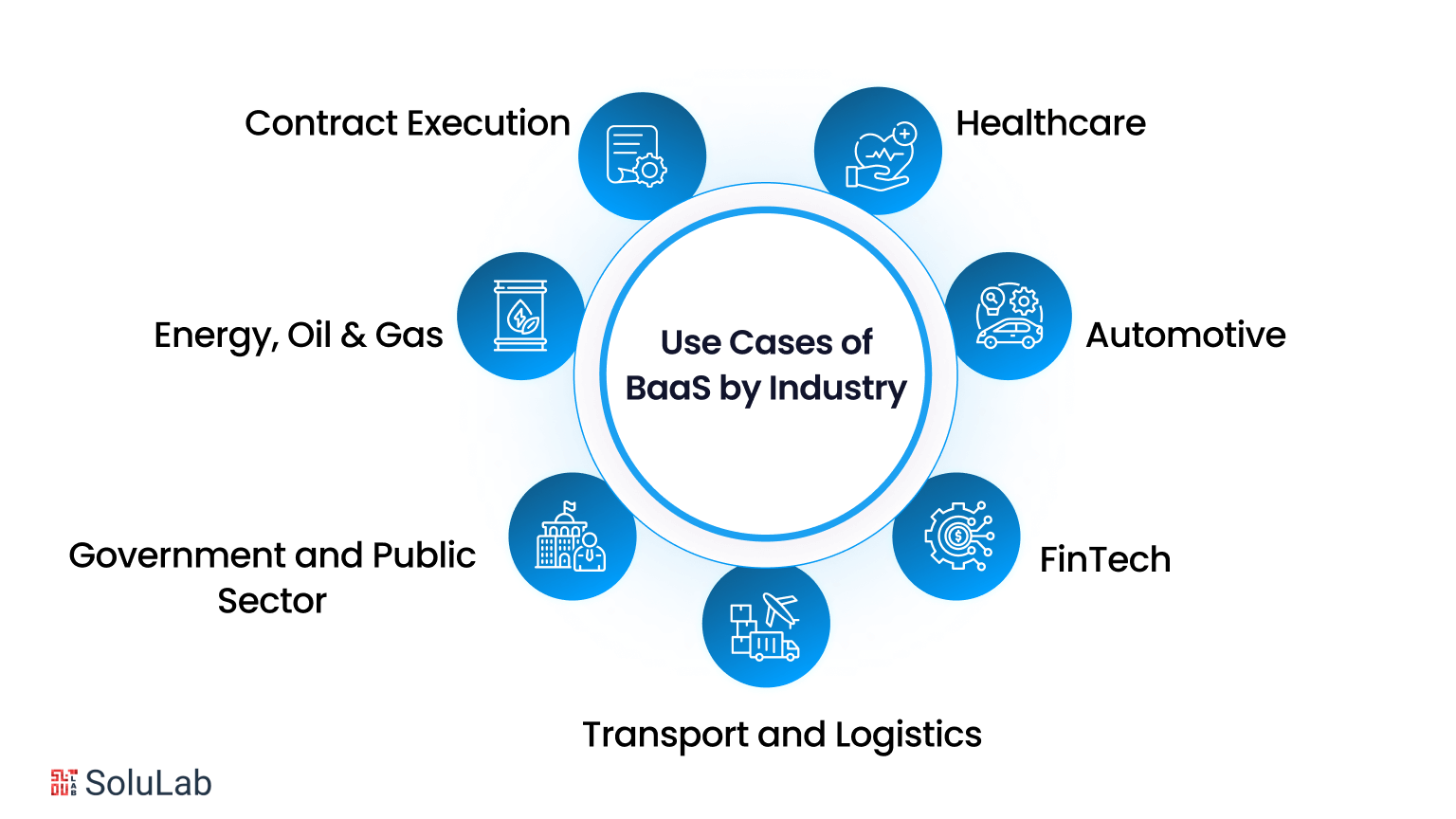

4. Which industries are adopting enterprise blockchain platforms the most?

Major industries using enterprise blockchain solutions include finance and banking, supply chain and logistics, healthcare, insurance, government, energy, and real estate. These sectors benefit from enhanced transparency, data integrity, and automation.

5. How long does it take to build an enterprise blockchain solution with SoluLab?

Timelines vary based on complexity, but SoluLab typically delivers MVPs within a few weeks and full-scale enterprise-grade platforms in a few months. Their agile development process ensures fast iterations and transparent progress tracking.

![Top 5 Enterprise Blockchain Platforms to Consider [2026]](https://www.solulab.com/wp-content/uploads/2025/04/Top-Enterprise-Blockchain-Platforms.png)