RWA-backed stablecoins have grown from a small notion to a powerful competitor in the expansive stablecoin market in 2026. Supported by tangible assets such as U.S. Treasury bills, real estate, and commodities, these digital currencies provide a unique blend of return, transparency, and on-chain stability that is attracting the attention of both institutional investors and individual users.

An analysis by Ripple and Boston Consulting Group (BCG) forecasts that the market for tokenized real-world assets may expand from $0.6 trillion in 2026 to $18.9 trillion by 2033, indicating a compound annual growth rate (CAGR) of 53%.

In this blog post, we’ll walk through the factors why investors worldwide are paying attention to RWA-backed stablecoins in 2026. We’ll also see what’s driving their growth and which platforms are leading the way.

Let’s begin!

What Are RWA-Backed Stablecoins?

RWA-backed stablecoins represent a novel category of digital currency that is secured by real-world assets (RWAs), including U.S. Treasury bonds, real estate, gold, or other physical assets. In contrast to conventional stablecoins that depend on fiat reserves (such as USDT or USDC) or cryptocurrency collateral (like DAI), RWA stablecoins get their value and stability from off-chain, legally acknowledged assets that are tokenized and integrated into the blockchain.

This methodology integrates the trustworthiness and reliability of conventional finance with the efficacy, transparency, and accessibility of decentralized finance (DeFi). By collateralizing a stablecoin with tangible, income-producing, or highly liquid assets, issuers may provide a reliable store of value while also including yield mechanisms—an area where crypto-native solutions sometimes encounter difficulties.

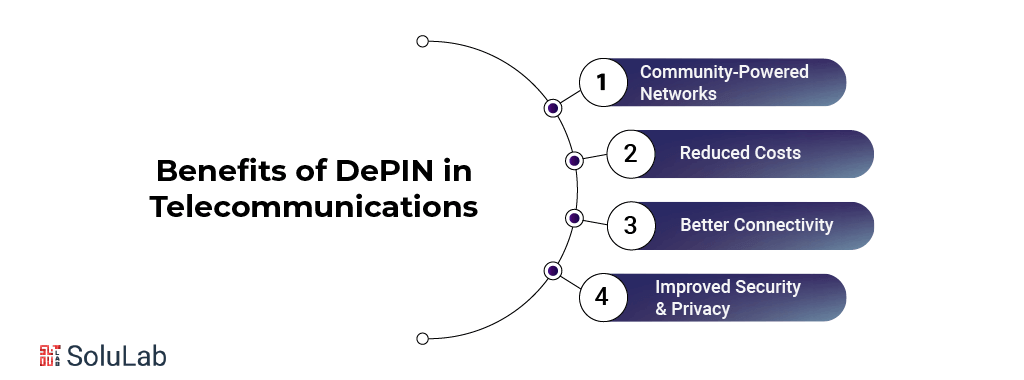

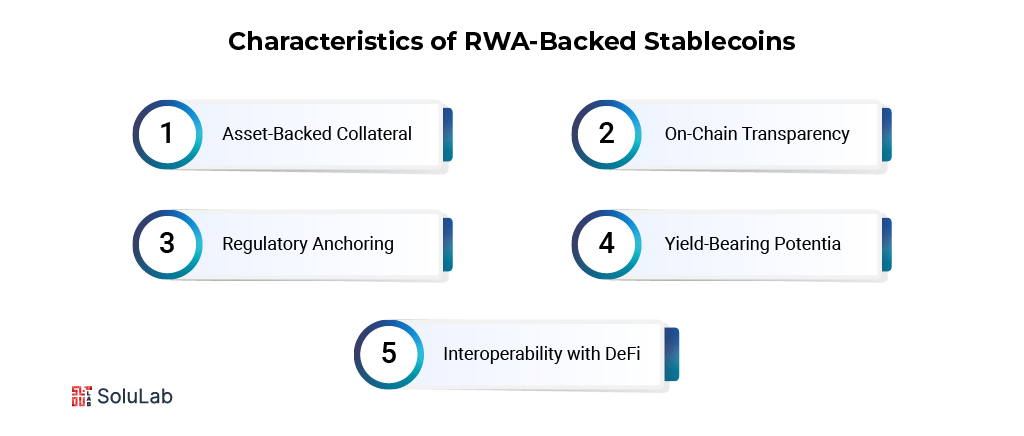

Key Characteristics of RWA-Backed Stablecoins

The key characteristics of the RWA-backed stablecoins are as follows:

- Asset-Backed Collateral: Each token is secured 1:1 (or through diversified portfolios) by physical assets such as government bonds, real estate, or commodities maintained by reputable custodians.

- On-Chain Transparency: RWA stablecoins are produced and monitored on public blockchains, offering immediate visibility into their circulation and reserves.

- Regulatory Anchoring: These stablecoins frequently adhere to financial rules and pass periodic audits, enhancing their attractiveness to institutional users.

- Yield-Bearing Potential: As RWAs can provide passive income (such as interest from Treasury bills or rental income from real estate), holders of RWA stablecoins may gain from yield distribution.

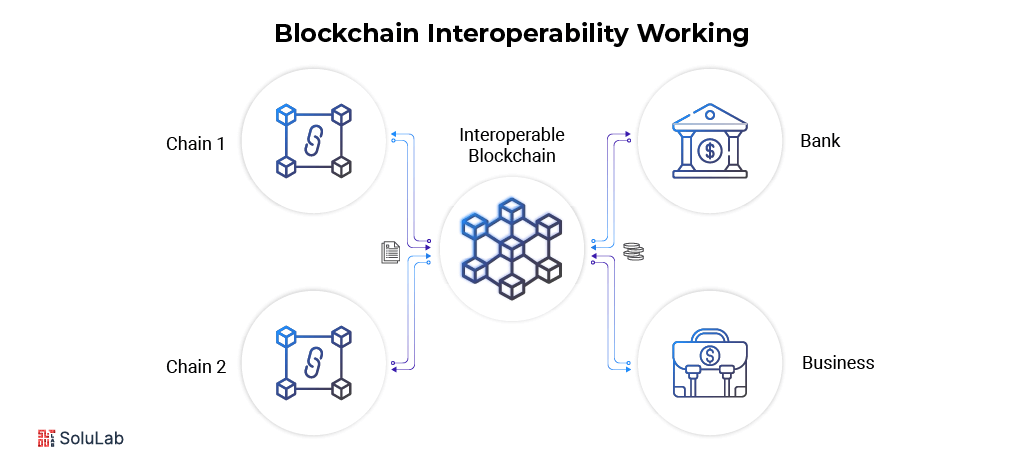

- Interoperability with DeFi: Numerous RWA stablecoins are engineered for easy integration into DeFi ecosystems, utilized in lending, staking, or as stable trading pairs.

The proliferation of RWA-backed stablecoins signifies a major transformation in the digital asset environment. As the cryptocurrency sector develops, users are progressively pursuing reliable, transparent, and yield-generating digital assets. RWA crypto coins are emerging prominently by providing the advantages of both liquidity and programmability inherent in blockchain technology and the dependability of physical, real-world assets.

Read Also: How to Create A Stablecoin?

Why RWA-Backed Stablecoins Are Gaining Momentum in 2026?

RWA-backed stablecoins are increasingly favored by investors seeking benefits beyond mere price stability. They offer access to genuine returns from tangible assets, like as government securities and real estate, while being readily traded on-chain. Institutions, private investors, and DeFi protocols are adopting this emerging trend of asset-backed currencies.

The factors propelling their growth in 2026 are as follows:

- Macroeconomic Tailwinds: As central banks implement tightening measures and conventional markets present limited returns, investors are seeking RWA crypto currencies to have access to real-world yield prospects using blockchain technology.

- On-Chain Yield from Real Assets: In contrast to fiat-backed stablecoins that remain dormant, RWA-backed coins may transmit profits from yield-generating assets, like as U.S. Treasury bills, directly to token holders.

- Institutional Adoption: Financial institutions are progressively embracing tokenized Real-World Asset models. Significantly, entities like as BlackRock, Franklin Templeton, and Ondo Finance have either introduced or supported RWA cryptocurrencies, thus affirming the concept.

- Regulatory Clarity: Nations like as the U.S., Singapore, and the UAE are developing frameworks for RWA tokenization, providing legitimacy and legal structure to these coins—attributes frequently absent in crypto-native assets.

- DeFi Utility and Interoperability: Real-world asset stablecoins are increasingly recognized as collateral inside DeFi protocols, providing users with a reliable on-chain currency characterized by low volatility and consistent returns.

- Global Accessibility: RWA digital currencies facilitate democratized access to formerly elite markets, such as U.S. Treasuries or luxury real estate, allowing everyone with a crypto wallet to take part in global asset classes.

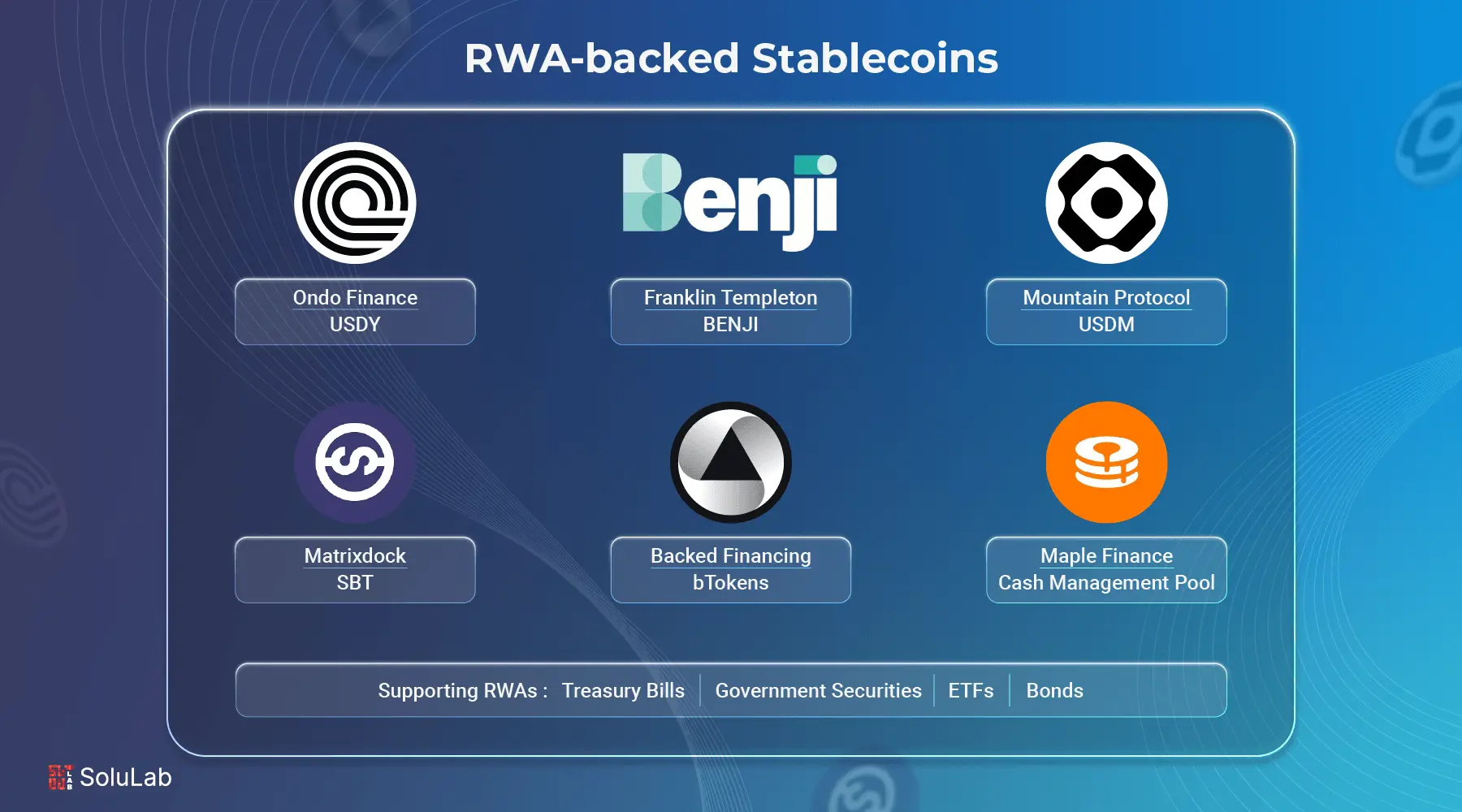

Top RWA-Backed Stablecoins in 2026

The rise of RWA-backed stablecoins in 2026 is transforming user engagement with digital assets by integrating real-world value with blockchain efficiency. Supported by assets such as U.S. Treasuries, real estate, and commodities, these stablecoins provide yield, security, and transparency, making them preferred choices for institutions and DeFi protocols.

Below are a few prominent RWA-backed stablecoins garnering attention in 2026:

-

Ondo Finance – $USDY

Ondo’s $USDY has become one of the most favored yield-generating stablecoins, supported by short-term U.S. Treasuries and bank deposits. Emphasizing transparency and adherence to SEC regulations, $USDY enables investors to generate tangible dividends while preserving on-chain liquidity.

-

Franklin Templeton – BENJI Token

Franklin Templeton’s BENJI token serves as a tokenized version of its U.S. Government Money Fund. This SEC-registered fund has garnered significant attention in 2026 for offering traditional investors a streamlined method to engage with tokenized U.S. government debt, which is fully backed and auditable.

-

Mountain Protocol – USDM

USDM is a regulated risk-weighted asset stablecoin that provides daily income to holders through the tokenization of U.S. Treasury bills. It functions under a license from the Bermuda Monetary Authority and has emerged as a preferred option for cautious investors seeking to engage in the cryptocurrency sector while maintaining compliance.

-

Matrixdock – SBT (Short-term Bond Token)

The SBT token of Matrixdock is intended for professional investors and institutions. It is supported 1:1 by short-term government securities and is issued inside a Hong Kong-regulated framework, providing secure and reliable returns.

-

Backed Financing – bTokens

Backed Finance offers bTokens, which are tokenized representations of tangible financial products such as ETFs and bonds. These coins adhere to European securities regulations and serve institutions seeking diverse real-world asset exposure on-chain.

-

Maple Finance – Cash Management Pool

Maple has launched an RWA-backed stablecoin pool, allowing protocols and DAOs to allocate idle money in premium off-chain assets. These funds yield tangible returns while being administered transparently using smart contracts.

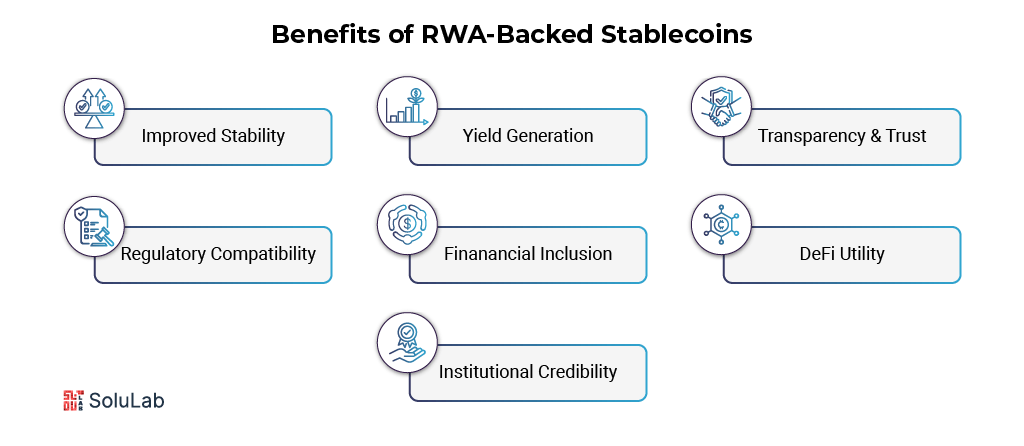

Benefits of RWA-Backed Stablecoins

As the digital asset ecosystem develops, RWA-backed stablecoins are increasingly acknowledged as a safer, compliant, and value-generating option to traditional crypto-collateralized or fiat-backed stablecoins. By tethering digital tokens to genuine assets, such as government bonds, real estate, or commodities, these stablecoins provide a basis of trust and intrinsic value that attracts both institutional and ordinary investors.

Here are the primary benefits that make RWA-backed stablecoins stand out:

1. Improved Stability

In contrast to algorithmic or cryptocurrency-backed stablecoins, which may experience volatility and liquidity shortages, RWA-backed stablecoins are anchored to actual, physical assets. This tangible support serves as a safeguard against market volatility and provides consumers with assurance over the preservation of asset value.

2. Yield Generation

Government bonds and real estate are both solid and income-producing real-world investments. RWA-backed stablecoins allow users to access these yields directly, eliminating the necessity for middlemen, therefore serving as an optimal instrument for generating passive income on-chain.

3. Transparency and Trust

Most RWA-backed models incorporate third-party audits, on-chain monitoring, and comprehensive documentation of the underlying assets. This fosters trust, particularly when compared to non-transparent reserves or unaudited stablecoin frameworks, rendering these tokens more appealing to risk-averse investors.

4. Regulatory Compatibility

RWA stablecoins frequently function under more defined legal frameworks, particularly when linked to regulated securities such as U.S. Treasuries. This legislative congruence is essential for attracting institutional money and avoiding compliance issues that have affected previous stablecoins.

5. Enhanced Financial Inclusion

These stablecoins disassemble conventional obstacles to high-value marketplaces. A user from anywhere in the globe can acquire fractional ownership of tokenized real estate or government debt—an endeavor that was previously practically unfeasible without a reliable middleman or access to local markets.

6. DeFi Utility

RWA-backed stablecoins are swiftly being included in DeFi systems as reliable collateral, liquidity pairings, and savings vehicles. Their diminished volatility and inherent yield render them especially appropriate for lending, borrowing, and staking methods.

7. Institutional-Grade Credibility

Supported by tangible assets, subjected to regular audits, and frequently issued in collaboration with qualified custodians, RWA-backed stablecoins are becoming the favored instrument for institutional use of blockchain technology.

Read Also: Hong Kong Stablecoin Regulation

Use Cases of RWA-Backed Stablecoins

By 2026, the practical uses of RWA-backed stablecoins have become more prevalent as they arise as a favored tool for people and institutions both. These tokens, also known as asset-backed stablecoins, are not only tied to fiat currencies; they are supported by tangible assets like as government bonds, real estate, and commodities. This offers them a distinctive place inside the digital banking ecosystem, providing stability, yield, and tangible significance.

Here are some of the most compelling use cases:

1. Decentralized Lending and Borrowing

On DeFi platforms, these stablecoins serve as reliable collateral owing to their public and audited reserves. This mitigates loan risk and facilitates global financial access.

2. Cross-Border Transactions

Businesses utilize them for rapid, economical overseas transactions, bypassing the delays and charges associated with conventional banking systems.

3. Yield-Generating Savings

As they are frequently supported by interest-bearing assets such as U.S. Treasuries, users can generate passive income by holding or staking them on-chain.

4. DAO & Enterprise Treasury Management

Organizations allocate dormant money in RWA-backed stablecoins to sustain liquidity while generating yield, integrating financial efficiency with blockchain adaptability.

5. Real Estate Tokenization

Utilized for rental agreements, dividends, and acquisitions on tokenized real estate platforms, they facilitate high-value transactions within a completely digital framework.

6. Stability in Emerging Economies

In places affected by inflation, these stablecoins serve as a reliable store of value and means of trade, accessible solely via a cryptocurrency wallet.

The Future of RWA-Backed Stablecoins

Looking forward, RWA-backed stablecoins will continue to serve as the foundation of both decentralized and traditional finance. As legal clarification and tokenization progress, these coins are expected to transform into programmable financial instruments that can automate compliance, taxes, and yield distribution. Innovations such as AI stablecoin development are increasingly contributing to the optimization of risk assessment, real-time asset tracking, and dynamic collateral management, hence enhancing the intelligence and adaptability of these tokens to market circumstances.

The function of stablecoin in DeFi will persist in its expansion. RWA-backed stablecoins, now utilized as collateral, liquidity pairings, and yield-bearing assets, provide a distinctly safe and transparent alternative to algorithmic models. As DeFi protocols evolve and draw institutional investment, these stablecoins are anticipated to prevail in on-chain lending, treasury management, and tokenized trading infrastructure—connecting Web2 value with Web3 execution.

Final Thoughts

RWA-backed stablecoins are rapidly establishing themselves as the foundation of a safer, transparent, and yield-oriented digital economy. With the increasing need for real-world asset integration, these stablecoins provide the market with essential stability grounded in practical value and usefulness across decentralized finance, payments, and treasury administration. In 2026, their momentum represents not only a trend but a transformation in the financial sector.

SoluLab is honored to be leading this shift as a renowned stablecoin development company. We have just launched our new project, Stablecoin Ecosystem, to establish its network from scratch. Our team managed all aspects, including community architecture, growth initiatives, liquidity assistance, and exchange listings. Through our thorough marketing and technological implementation, the client transitioned from complete obscurity to a growing competitor battling major players such as USDT and USDC.

Whether you need a go-to-market strategy, community engine, or end-to-end ecosystem development, we’re here to help. If you’re building the next category-defining stablecoin, let’s talk!

FAQs

1. How are RWA-backed stablecoins different from tokenized real estate or other tokenized assets?

RWA-backed stablecoins are pegged to the value of real-world assets and used primarily as a medium of exchange or store of value, much like traditional stablecoins. In contrast, tokenized assets like real estate or commodities represent direct ownership or shares in specific assets and are typically used for investment or fractional ownership purposes.

2. Can individuals redeem RWA-backed stablecoins for the actual real-world assets?

Redemption depends on the issuing platform. Some RWA stablecoins allow institutional-grade redemption, where verified users can exchange tokens for the underlying assets, while others are strictly on-chain representations meant for trading, saving, or DeFi usage without direct redemption.

3. Are RWA-backed stablecoins more secure than algorithmic stablecoins?

Generally, yes! RWA-backed stablecoins are backed by real, tangible assets and typically undergo regular audits and reserve disclosures. Algorithmic stablecoins, on the other hand, rely on mathematical mechanisms and market incentives, which can be more volatile and prone to failure under stress.

4. What risks are associated with RWA-backed stablecoins?

Key risks include custodial risk (where assets are stored), regulatory uncertainty, and liquidity limitations if the underlying assets can’t be quickly converted to cash. Some also carry centralization risk, depending on the issuer’s control over reserves and minting.

5. Can RWA-backed stablecoins be used for staking or earning yield?

Yes, many platforms now offer staking programs or DeFi integrations for RWA stablecoins. Since these tokens are often backed by yield-generating assets (like Treasury bonds), some protocols pass a portion of that yield back to users holding or staking the stablecoin.