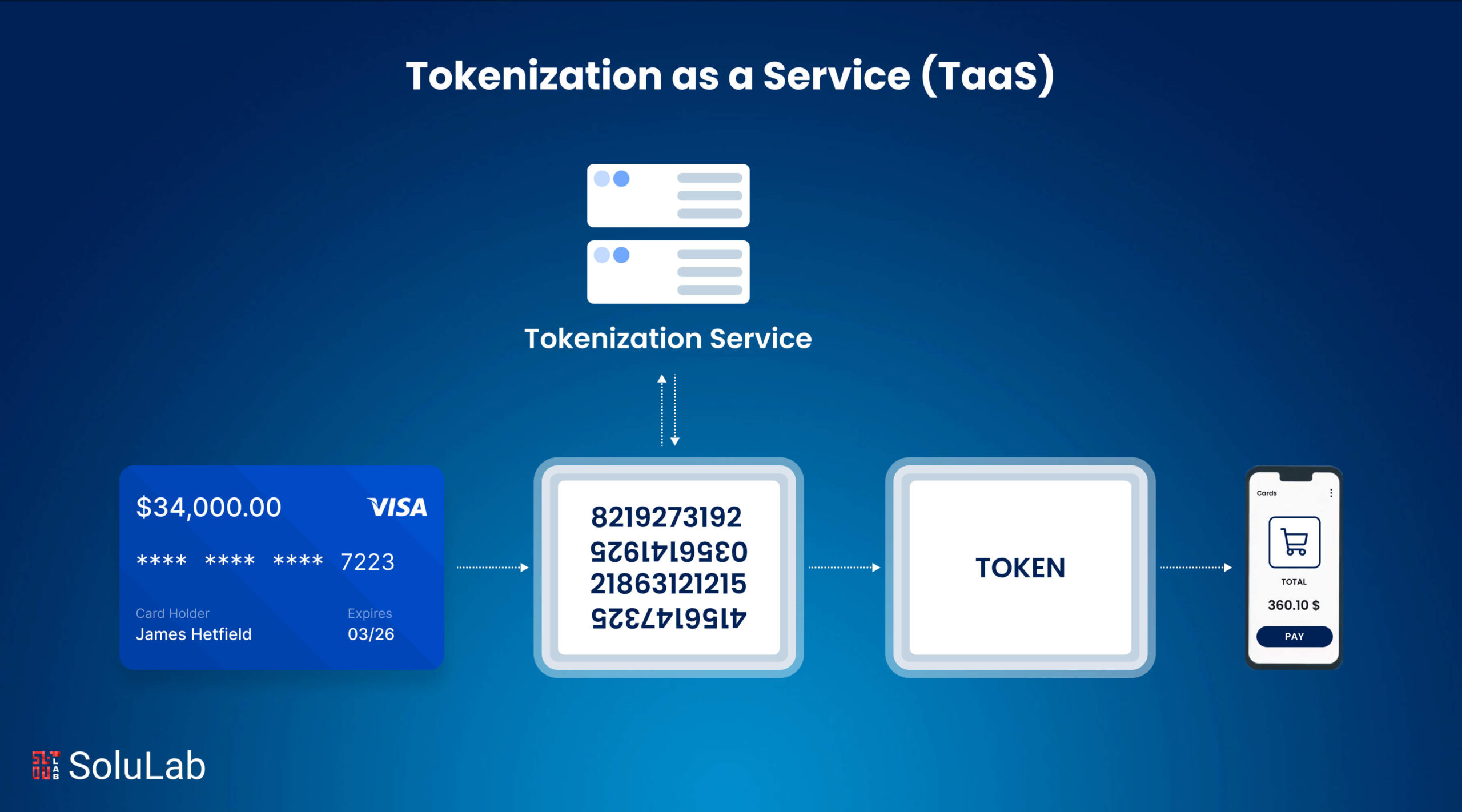

The financial world is changing fast. One of the biggest changes happening right now is tokenization in finance. This means turning real things like property, stocks, or money into digital tokens that live on a blockchain. These tokens represent ownership or rights to a physical or financial asset.

According to Boston Consulting Group, tokenized investment could be worth $16 trillion by 2030. That’s about 10% of the global economy. Why? Because tokenization in financial services solves a lot of the problems that traditional finance has like slow processes, high fees, and limited access.

To make this possible, companies often partner with an asset tokenization development company to build scalable systems backed by blockchain technology. These platforms are at the heart of enabling tokenization of assets safely and efficiently.

Traditional Finance vs. Tokenized Finance

In traditional finance, buying or selling assets can be slow and expensive. You need to go through banks, brokers, and clearinghouses. It can take days to complete a transaction. Also, only a few people often get access to high-value investments.

But tokenized financial assets are changing that.

With tokenization in finance:

- You get real-time settlements.

- Assets become liquid, even if they were hard to trade before

- You can own just a fraction of a large asset (this is called fractional ownership).

- People from anywhere in the world can invest, no matter their location.

Thanks to blockchain technology, this is now possible. It removes the middlemen, adds transparency, and makes the process much faster.

As a result, we are seeing the rise of new solutions in banking, fintech, and investing, many backed by real world asset tokenization strategies and even powered by AI agents in asset tokenization for added automation and intelligence.

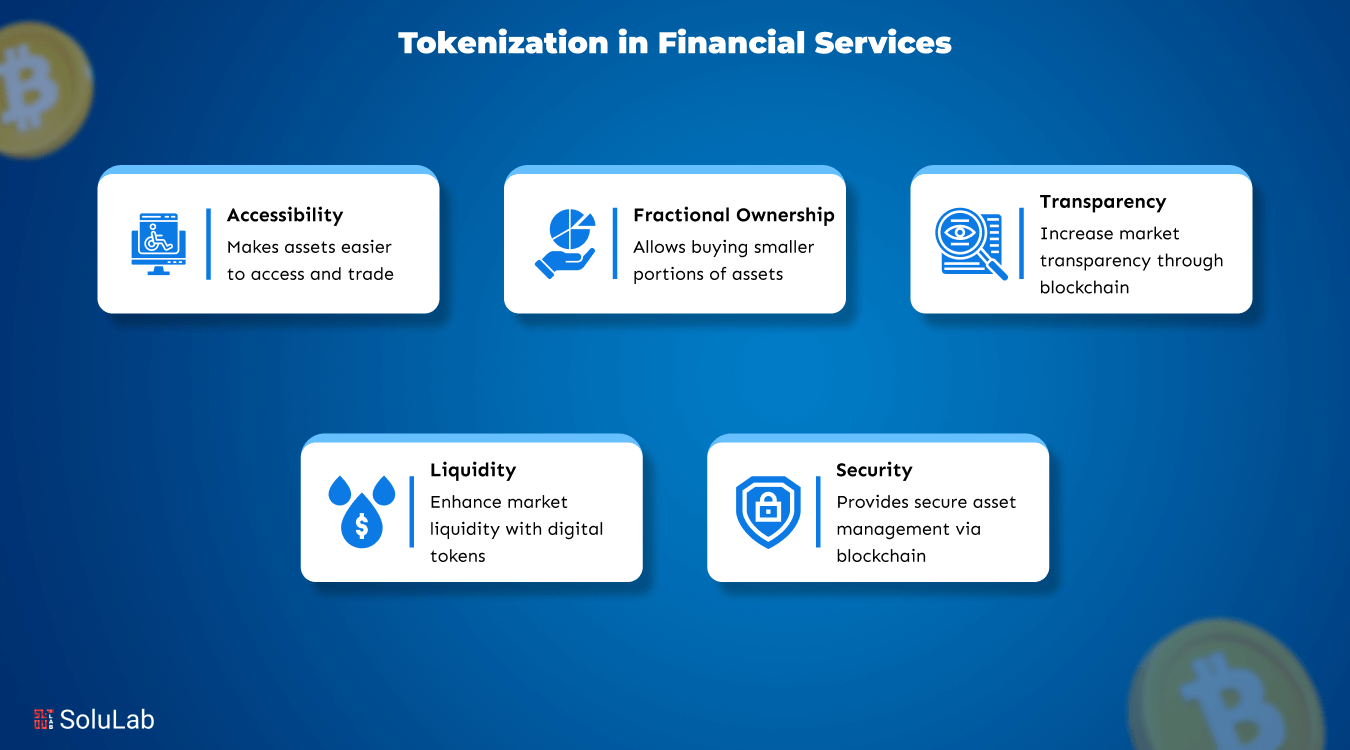

Key Benefits of Tokenization in Finance

More and more companies are choosing finance tokenization because it offers major improvements over traditional finance. Here’s why:

1. Efficiency

With tokenization, smart contracts can automatically handle tasks like transfers, payments, and recordkeeping. This reduces paperwork, lowers errors, and saves time. Businesses working with an asset tokenization development company can quickly set up secure and efficient systems.

2. Security

All transactions are stored on a blockchain, making them tamper-proof. That means no one can change or delete the data, which greatly reduces fraud.

3. Liquidity

Many high-value assets, like real estate or fine art, are hard to sell quickly. But tokenization of assets makes it possible to divide these into smaller parts (tokens) and sell them easily to more investors. This opens up new ways to raise money and trade faster.

4. Transparency

Since every transaction is recorded on the blockchain, both businesses and investors get full visibility into what’s happening. This builds trust and makes compliance easier.

5. Accessibility

Traditionally, investing in assets like real estate or private equity required large amounts of money. With tokenized investment, even small investors can own a fraction of valuable assets. This makes investing more inclusive.

The growing use of tokenization in finance shows how powerful this shift is. Companies are modernizing their operations and using platforms like an asset tokenization platform to handle everything from real estate to bonds.

Read Also: RWA Tokenization In Traditional Banking

Technology Behind Tokenization of Assets

The core technology behind tokenization in finance is blockchain. It is a secure, digital ledger that records every detail about an asset, who owns it, where it came from, and every transaction it’s ever gone through. This makes it reliable, transparent, and tamper-proof.

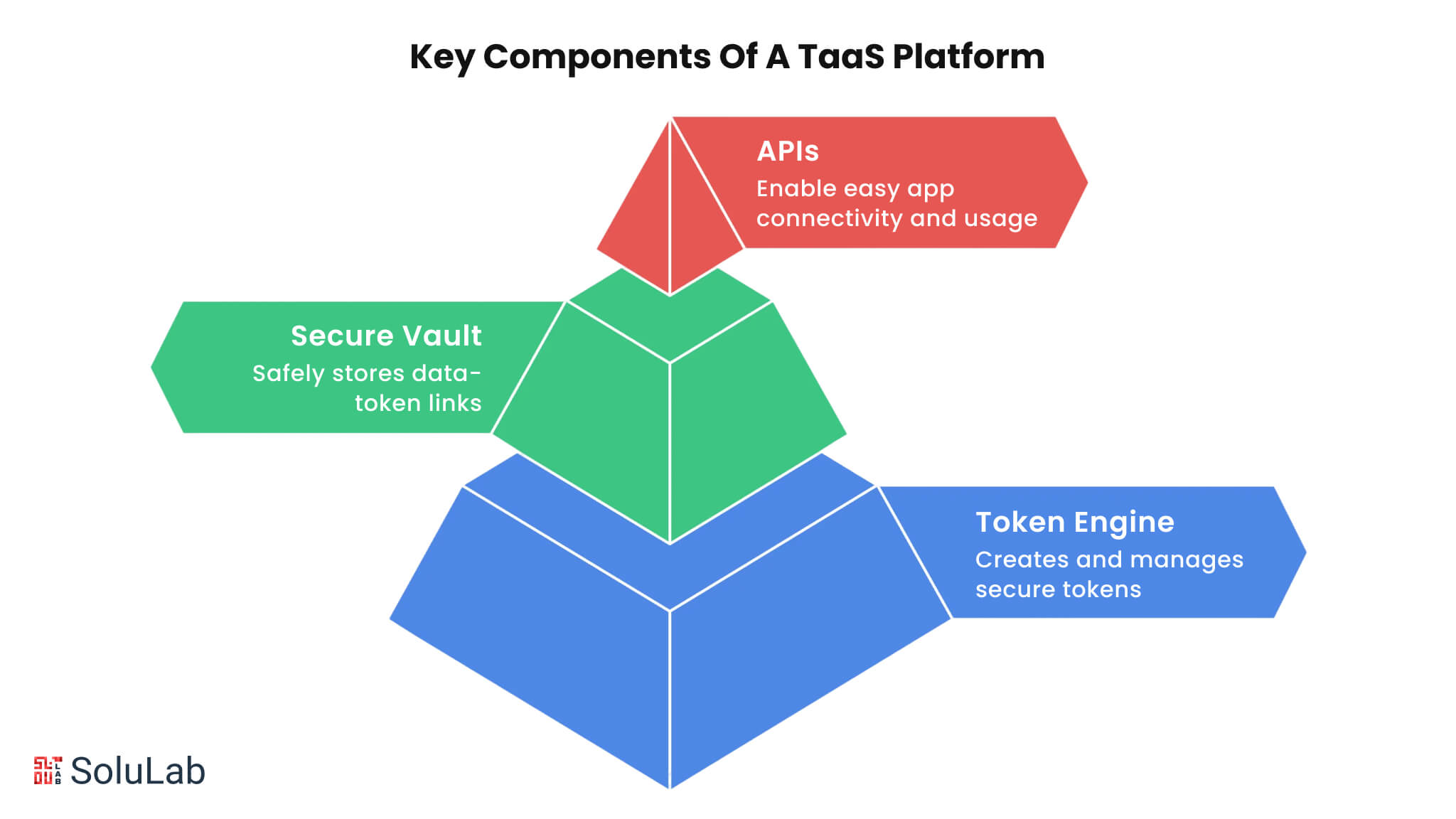

To make this system work smoothly, a few important tech pieces come together:

- Smart contract development helps automate things like compliance checks, payments, or transfers, so there’s less need for middlemen.

- Blockchain-as-a-Service lets companies launch their own blockchain apps quickly, without building everything from scratch.

- Protocol layers, like Layer 1, Layer 2, and Layer 3 blockchain, help improve speed, reduce costs, and make different blockchain systems work together.

Companies that want to create secure and scalable solutions often partner with a blockchain consulting company. If you’re looking to build a reliable solution, it’s smart to work with an asset tokenization development company that already has experience in this space.

Types of Assets Being Tokenized in Financial Services

Now let’s talk about what can be tokenized. Actually, a lot of things!

This is where asset tokenization becomes powerful. You can create digital versions of real-world assets that are easier to buy, sell, and invest in.

Here are some examples:

1. Real estate tokenization: Instead of buying an entire property, investors can buy small shares. This makes investing more affordable and opens up real estate markets to global investors.

2. Equities and Bonds: Tokenization lets you add automation, like instant dividend payouts and faster settlement.

3. Private Equity: Startups and private companies can raise funds more easily and give investors a way to trade their shares.

4. Commodities like Gold or Oil: Storing gold can be expensive. But with gold tokenization, you can own it digitally without worrying about logistics.

5. Collectibles and NFTs: These are gaining popularity, too. Tokenization lets you prove ownership of rare or valuable items online.

Each of these categories improves transparency, reduces costs, and increases investor access. More importantly, they help create more liquid markets using tokenized financial assets.

How Tokenization Enables Fractional Ownership and Global Access?

In the past, investing in big assets like commercial real estate or venture capital was only possible for wealthy individuals. But now, finance tokens have changed that. Investors can put in as little as $10 to own a part of these valuable assets.

This is called fractional ownership, and it offers some important benefits:

- It opens investment opportunities to everyone, not just the rich.

- It lowers the risk of putting all your money in one place.

- It makes it easier to buy and sell shares in assets through secondary markets.

Many asset tokenization platform providers are creating the technology to make fractional ownership simple and accessible worldwide.

Some platforms also use AI agents in asset tokenization to help manage these digital assets better, improving customer service and automation.

Real-World Use Cases of Financial Tokenization

Tokenization is no longer just an idea; it’s actively changing how finance works. Both big companies and startups are using tokenization in financial services to improve asset management.

Some examples:

- The European Investment Bank has issued bonds directly on the blockchain.

- HSBC created a platform to trade tokenized gold, making the precious metal easier to buy and sell.

These examples highlight how real world asset tokenization and tokenization of assets are becoming mainstream. They prove that asset tokenization development companies are building real, working platforms that bring liquidity and transparency to traditional finance.

Best Platforms for Investing in Tokenized Assets

If you want to invest in tokenized investment, you don’t need to be a tech expert or a wealthy investor anymore. Several platforms now make it easy to access real world asset tokenization, including things like real estate, stocks, bonds, and even private equity.

These platforms are designed to lower the entry barrier, increase transparency, and offer more liquidity, allowing everyday investors to benefit from tokenization in finance. Here are some of the best platforms to consider:

1. Token World

Token World is a secure and scalable crypto launchpad platform that simplifies the tokenization of assets, helping blockchain startups raise capital while giving investors access to vetted, high-potential projects. With built-in smart contract security, regulatory compliance support, and multilingual capabilities, it enables real world asset tokenization across sectors like real estate, DeFi, and healthcare. By integrating an AI agent in asset tokenization and leveraging advanced blockchain infrastructure, Token World offers a seamless, transparent, and investor-friendly Web3 experience.

2. RealT

RealT is a leading asset tokenization platform that focuses on tokenization of real estate. It allows users to buy fractional shares of rental properties. This is a perfect example of real world asset tokenization, where physical properties are converted into digital tokens for global investors.

3. tZERO

tZERO is well-known for offering tokenized financial assets like digital stocks. It’s one of the first platforms to follow U.S. SEC guidelines, making it ideal for investors looking for regulated and compliant solutions in tokenization in financial services.

4. Securitize

Securitize works with institutions to help them tokenize bonds, funds, and equity. As an asset tokenization development company, it offers secure infrastructure and helps businesses benefit from the tokenization of assets with ease.

Read Also: AI Tokenization For Asset Ownership

Compliance, Standards & Security in Tokenized Finance

When we talk about tokenization in finance, one thing is clear: trust matters. That trust is built on strong rules, secure systems, and clear global standards. Tokenization doesn’t remove compliance; it helps automate it.

1. Token Standards

In tokenized financial assets, standards are the foundation. Whether you’re dealing with finance tokens or NFTs, most digital assets follow well-known protocols like ERC-20, ERC-721, and ERC-1400. These standards:

- Make sure tokens work across systems

- Help protect investors

- Allow easy integration with wallets and exchanges

They are especially important for companies offering asset tokenization platform services or building tools for the tokenization of assets.

2. Regulatory Considerations

Even though tokenized investment is digital, it must follow real-world laws. Many countries, like Singapore and the UAE, are leading with clear rules for digital assets. The space is getting more mature, especially around things like:

- Security Token Offerings

- The difference between ICO vs. STO

- Rules for who can invest and how tokens are traded

Following these regulations isn’t optional; it’s essential. That’s why many companies work with a blockchain consulting company to stay compliant.

3. Security & Privacy in Tokenized Systems

Keeping data safe is just as important as compliance. That’s where modern blockchain features shine:

- Role-based access: Control who sees or moves digital assets

- Zero-knowledge proofs: Protect private details without revealing them

- End-to-end encryption: Make sure every transaction is secure

Working with experts ensures these tools are built the right way from day one. We offer reliable smart contract development to keep everything secure and automated.

Read Also: Why Dubai, London & New York Lead in Real Estate Tokenization?

The Future of Tokenization in Finance

Tokenization is no longer just an idea; it’s becoming the backbone of finance.

- Decentralized finance tokens will help assets move freely across different blockchains

- An AI agent for finance tools will handle tasks like risk scoring and KYC

- New layers of trust will emerge in the Decentralized Web3 Ecosystem

- Real-time asset tokenization development company services will bring assets online in days, not months

The shift is fast and real. Major institutions are already joining in, using real-world asset tokenization to unlock new markets, reduce costs, and grow faster.

With Tokenization in asset management, people and companies can trade 24/7, send money globally in minutes, and invest with less money upfront. Whether it’s decentralized finance tokens, real estate tokenization, or gold tokenization this isn’t just a trend. It’s changing how the world handles money and investments.

Conclusion

The rise of tokenization in financial services is reshaping how we store, trade, and grow assets. Whether you’re managing real estate, gold, or stocks, tokenization of assets offers more security, faster transactions, and global reach. It also brings transparency and automation through smart contracts, while keeping your business fully compliant.

If you’re a business looking to get started, partner with an expert Tokenization Platform Development Company like SoluLab. We’ve built plug-and-play platforms like Token World to help businesses tokenize assets in just a few days.

Whether you are a well-established business or a startup, we can help you grow your business with technical support. Contact us today!

FAQs

1. What is tokenization in finance?

It means converting assets like stocks or property into digital tokens stored securely on blockchain networks.

2. Are tokenized assets secure?

Yes. With encryption, smart contracts, and strong compliance, digital tokens are often safer than traditional systems.

3. What types of assets can be tokenized?

Everything from real estate, bonds, and company shares to gold and NFTs.

4. How does tokenization benefit investors?

It offers easy access, liquidity, transparency, and the ability to buy small portions of large assets (fractional ownership).

5. How can my company get started?

Partner with a Tokenization Platform Development Company like SoluLab. Our experts help launch secure, regulation-ready platforms fast.