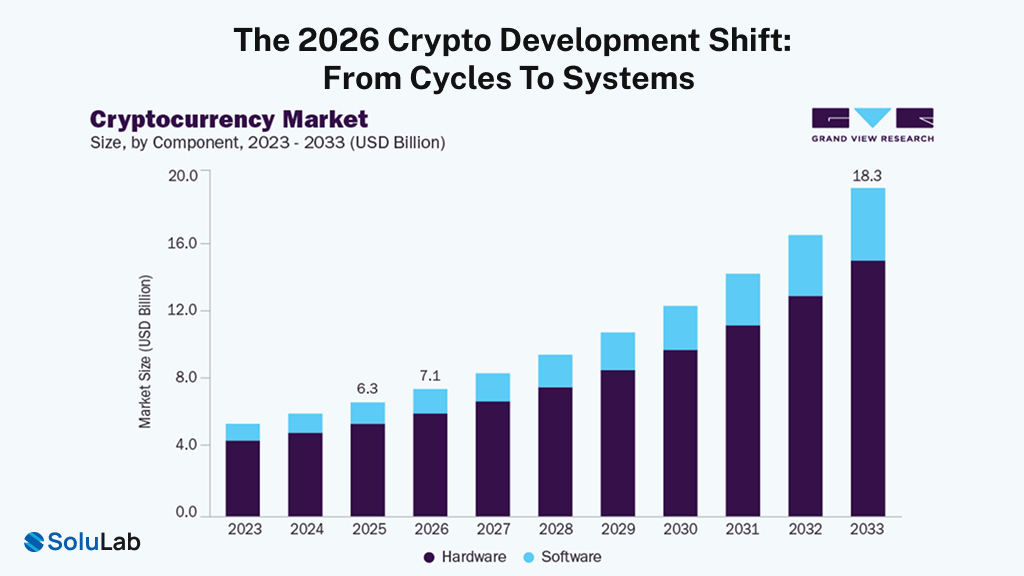

Look, the crypto banking solutions landscape has shifted dramatically in the last 18 months. What used to be the domain of crypto startups is now the domain of enterprise banks, which are seriously getting in. And the market’s telling us something important – crypto banking services aren’t a niche anymore.

| As the stablecoin market hit $33T in 2025, up 72% increse from 2024, and even JPMorgan’s research shows institutions are allocating 8-12% of transaction volumes to on-chain settlement by 2026. This creates immediate demand for regulated crypto banking platforms |

So, let me walk you through what you need to know if you’re thinking about building a crypto banking solution. Whether you’re a founder or executive at a bank wanted to stay competitive, this guide will break down everything from architecture to go-to-market.

Key Takeaways

- Building a production-grade crypto banking solution costs $500k-750k on custom builds.

- The crypto banking sector licensing in the EU/UK/UAE is tightening.

- Team expertise matters more than capital, as most failures aren’t tech problems; they’re regulatory and security missteps.

- Security and custody architecture account for 30-40% of total development cost.

What is a Crypto-Friendly Bank?

Let me clarify something first. A crypto banking solution isn’t just a bank on the blockchain. That’s a misconception that kills projects before they start.

What we’re actually talking about is a regulated or regulated-equivalent financial institution that moves money on both traditional rails and blockchain networks simultaneously. Think Nexo, Kraken, or how legacy banks are now integrating with USDC rails – they’re moving value across both systems, capturing the advantages of each.

Here’s the practical difference:

1. Traditional banking: you wire money on Monday, it arrives on Wednesday, and you pay 2-3% in fees.

2. Crypto banking services: you settle in 15 seconds, costs are cents, and you have cryptographic proof of the transaction. That gap is why enterprises are paying attention.

The types of crypto banks vary significantly, and picking the wrong model early will cost you 12 months and hundreds of thousands:

| Model | Reference Examples | Core Concept | Regulatory Complexity | Key Requirements | Primary Trade-Off | Time to Market |

| Traditional Bank + Crypto License | Santander, BBVA | Existing bank adds crypto services on top of a licensed core | Very High | Banking charter, established customer base, deep regulatory relationships | Slow execution but strong institutional trust | 6–12 months |

| Crypto-Native Bank | Nebeus, BlockFi (pre-collapse) | Built ground-up for digital assets | Extreme | Deep crypto expertise, licensing resilience, institutional-grade security | High upside, high regulatory and operational risk | 12–18 months |

| Hybrid Neo-Bank | Revolut, Wise | EMI license first, crypto layered second | Medium | EMI license, compliance ops, crypto integrations | Faster launch, limited product depth | 8–12 months |

| Settlement Layer (B2B Rails) | BVNK, Alchemy Pay | Infrastructure layer enabling crypto–fiat settlement | Low | B2B integrations, liquidity management, enterprise trust | Not consumer-facing; scale via partners | 6–9 months |

| Self-Custodial + Wrapped Services | Coinbase, Kraken | Users hold keys; platform layers services | High | Strong compliance, wallet infra, service monetization | Lower custody risk, heavier compliance overhead | 9–14 months |

Which one fits you, it depends on your capital, team, and target customer. If you’re a startup with $1-2M and want to launch fast, Model 3 or Model 5 works. If you’re an enterprise with $10M+ and a 12+ month runway, Model 1 or 2 makes sense.

Why Is Timing Critical to Launch Crypto Banking Solutions Before the Market Saturates?

The numbers are compelling, and they’re real. Stablecoin transaction volume hit $2.1 trillion in 2025, compared to $1.2 trillion in 2023. That’s institutions and treasury departments actually moving money on blockchain rails.

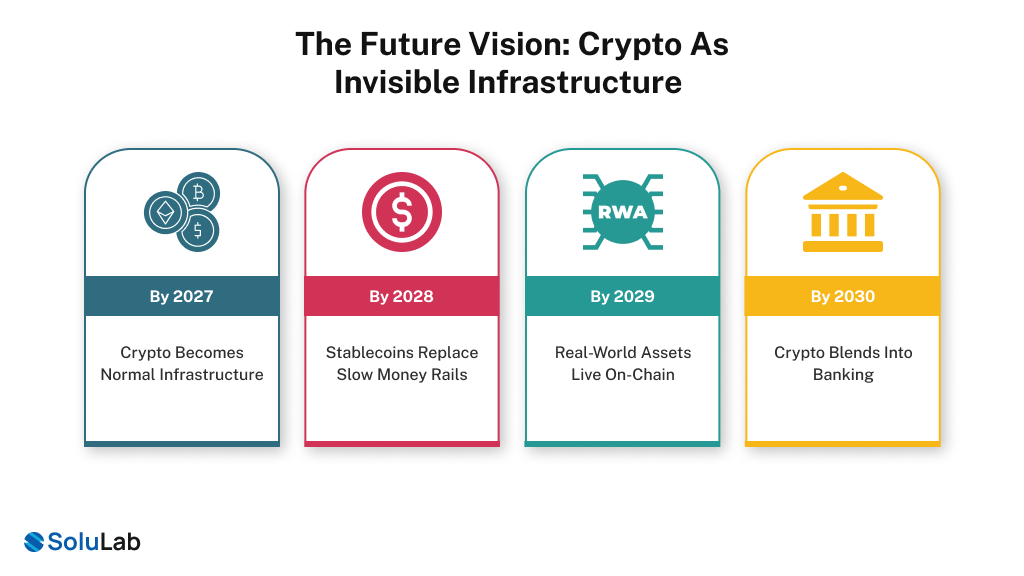

Here’s what triggered the shift: the Fed essentially accepted stablecoins as settlement infrastructure. No formal announcement; just quiet integration into thinking. When JPMorgan runs $1 trillion through its private blockchain and SWIFT consortium banks start experimenting with CBDC rails, it signals regulatory acceptance.

On the enterprise side, CTO budgets for blockchain infrastructure jumped 340% year-over-year. Companies like Tesla, Meta, and traditional corporations are building crypto treasuries. They need banking infrastructure that understands both worlds, regulated banking and crypto operations.

That’s your wedge. The regulatory tailwind matters too:

- EU’s MiCA (Markets in Crypto-Assets) gave VASPs clear licensing pathways. Yes, there are requirements, but at least there’s a pathway. That clarity created 80+ licensed operators in 2025 alone.

- The UK’s FCA regime moved from figure it out to here’s the rulebook. Operational resilience standards, crypto-specific capital requirements, it’s heavy, but predictable.

- The US is fragmented (state-by-state), but Wyoming, Texas, and New York have crypto-friendly frameworks now. Not easy, but possible.

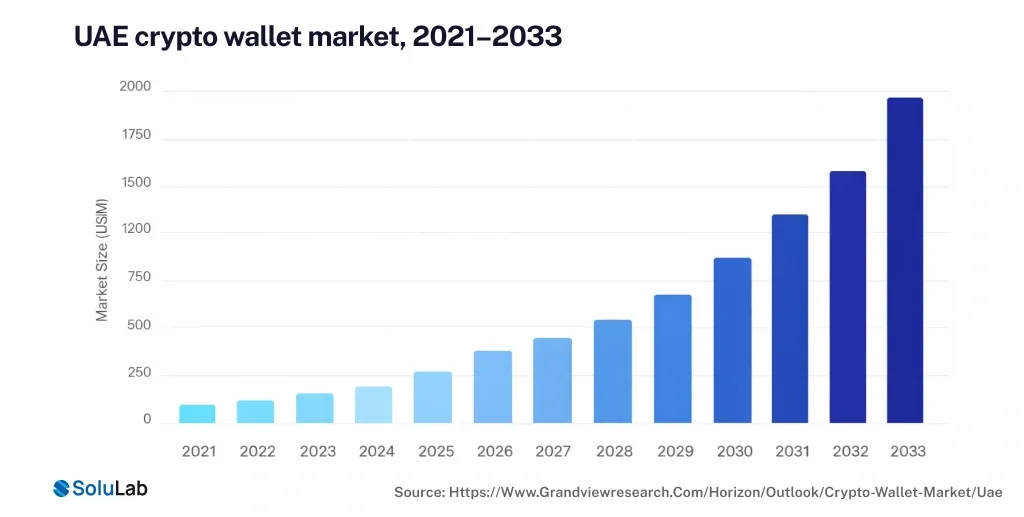

- UAE/Dubai fast-tracked crypto licensing specifically to attract builders. 30-60 day approval timelines if you’re institutional-grade.

That regulatory clarity is temporary, and the Governments are still figuring this out. The window for favorable treatment? It closes in 12-18 months as regulators tighten up post-incident reviews. Early movers get grandfather clauses, and late entrants get 6-month delays minimum.

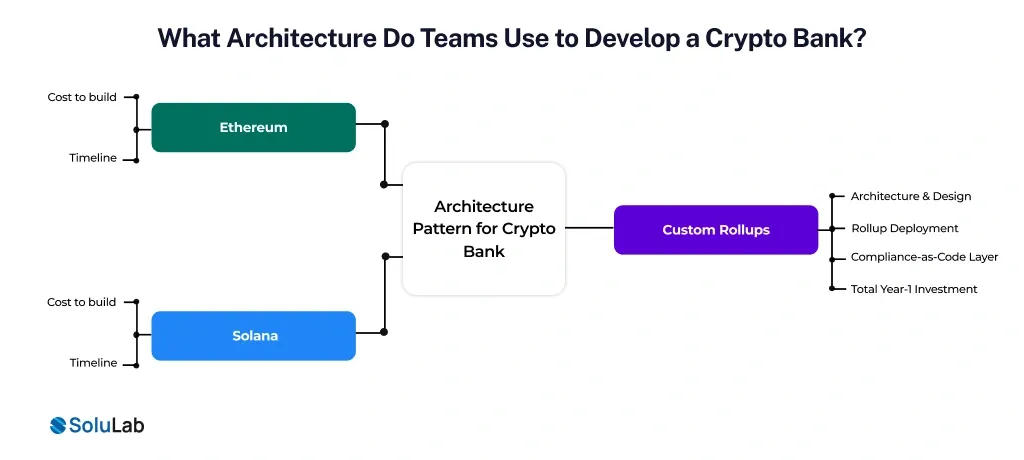

What Architecture Do Teams Use to Develop a Crypto Bank?

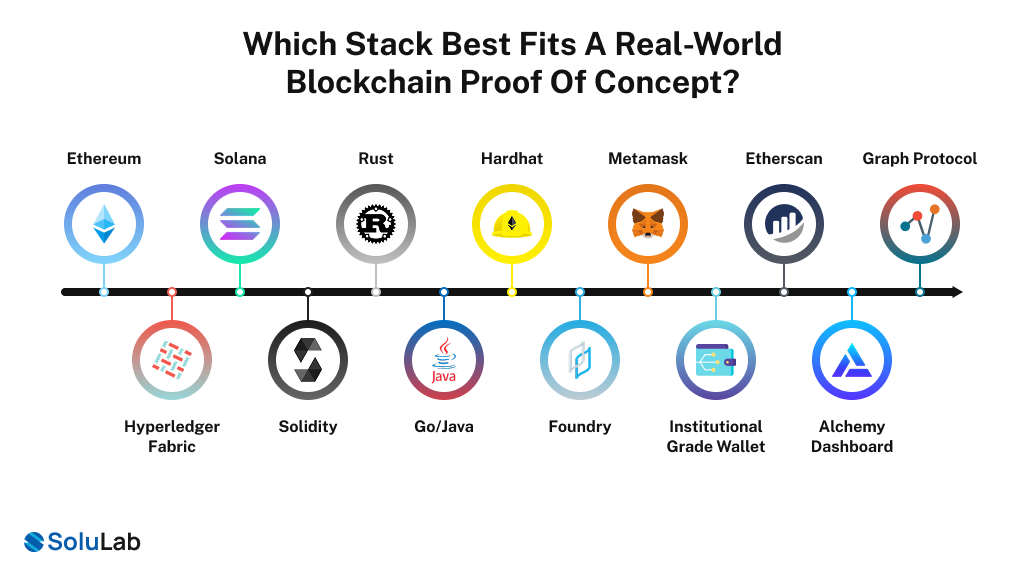

This is where most projects get it wrong. Teams build crypto development solutions on whatever blockchain is popular at the moment. Ethereum because it has liquidity, or Solana because it’s fast. Neither question is the actual question: which blockchain lets you build what you need for your customers?

it’s fast. Neither question is the actual question: which blockchain lets you build what you need for your customers?

1. Ethereum

Honestly, if your customers are institutional, trading volumes matter, and you can absorb gas fees, Ethereum solutions win. USDC has $39B in liquidity on Ethereum alone. Every custody provider integrates with Ethereum first. Regulatory guidance assumes Ethereum.

But the trade-off is Gas fees. During periods of network congestion, which happen 40% of the time, you’re looking at $15-50 per transaction. That’s real money when you’re processing thousands of transfers.

- Cost to build: Essentially free. It’s a public network. Your infrastructure cost is cloud compute ($2-5K/month for reliable node access).

- Timeline: 4-6 weeks to integrate if you use managed RPC providers (Alchemy, Infura, QuickNode).

2. Solana

Solana offers sub-second finality and $0.00025 transaction costs. So, if you’re building a B2C consumer app or focusing on emerging markets where every basis point matters, Solana’s development architecture is genuinely better.

But the issue is Ecosystem maturity. Fewer custody providers, less regulatory clarity, and smaller institutional presence. Plus, Solana’s validator set is still consolidating, and long-term finality assurances are less certain than Ethereum’s.

- Cost to build: Again, free network. But infrastructure costs are similar ($2-5K/month).

- Timeline: 4-6 weeks of integration.

3. Custom Rollups

Here’s what nobody talks about but should. A custom crypto banking platform, built on an Ethereum rollup, gives you something neither L1 offers: operational sovereignty. You control the sequencer, which means you control transaction ordering. You can embed regulatory logic at the protocol layer – transactions automatically reject if addresses hit sanctions lists. You get throughput (10,000+ TPS), cost (sub-cent per transaction), and full audit trails.

Because you use rollup-as-a-service platforms like Gateway.fm, Conduit, or Gelato to launch a dedicated execution environment in weeks.

And here is why banks are choosing this: You’re not dependent on a public network’s politics or validator incentives. You run the rules. And when regulators ask how do you ensure no sanctioned entities touch your system? You show them protocol-level enforcement. That’s institutional credibility. Here is the cost breakdown:

| Component | Scope Covered | Cost Range (USD) | Time Impact | Why It Matters |

| Architecture & Design | System design, threat modeling, scalability planning | $50K–$100K | ~4 weeks | Prevents rewrites, audit failures, and scaling bottlenecks |

| Rollup Deployment | Rollup setup + sequencer infrastructure (Year 1) | $100K–$200K | Parallel | Enables lower fees, higher throughput, and protocol-level differentiation |

| Compliance-as-Code Layer | Automated controls, monitoring, and reporting | $150K–$300K | Parallel | Reduces regulatory risk while enabling enterprise adoption |

| Total Year-1 Investment | Production-grade rollup stack | $300K–$600K | 8–16 weeks | Cost-competitive vs L1 + separate custody over time |

What Security Framework Separates Production-Grade Crypto Banking Software From MVP Experiments?

Here’s what I need to be direct about – if you’re holding other people’s assets, and you are, if you’re building crypto banking features, security isn’t a product feature. It’s the product.

Bad security news kills crypto companies faster than anything else. FTX, Celsius, Voyager Digital – the assets weren’t the issue (though they mattered). It was then that things broke; nobody knew what happened. That opaqueness is what destroyed trust.

So let’s talk about institutional-grade security architecture.

The 4-Layer Model

Layer 1: Cryptographic Foundation

- AES-256 encryption for data at rest

- TLS 1.3 for data in transit

- Hardware Security Modules (HSMs) for key storage

- Regular key rotation (monthly for hot operations)

- This is table stakes. Not interesting, but non-negotiable.

Layer 2: Operational Security

- Multi-Party Computation (MPC) for any withdrawal >$100K

- Segregation of duties (no single person approves a large transfer)

- Time-locked releases (24-48 hour delay from approval to execution)

- Withdrawal whitelists (funds only to pre-approved addresses)

MPC is the game-changer here. Instead of storing a private key as a file (single point of failure), MPC splits it into encrypted fragments distributed across parties. You need at least 2 of the 3 fragments to sign a transaction.

So if an attacker compromises your infrastructure, they get one fragment. Worthless. They’d need to compromise an external custody provider, your systems, and a user’s hardware. That’s exponentially harder.

Layer 3: Infrastructure Security

- DDoS protection (Cloudflare or AWS Shield)

- Web Application Firewall (OWASP Top 10 coverage)

- Database encryption (AWS KMS or HashiCorp Vault)

- Network segmentation (crypto operations isolated)

Layer 4: Monitoring & Incident Response

- 24/7 Security Operations Center (SOC)

- Real-time transaction monitoring (flag any movement >$5M)

- Anomaly detection (unusual geography access, velocity checks)

- Tested the incident response plan

Let’s take an example: Assume you’re managing $500M in customer assets. Here’s how it actually works:

- Cold Storage (70%: $350M): Multisig wallets in 3 geographic locations (NYC, London, Singapore). 3-of-5 threshold. Transfers take 24-48 hours intentionally, giving you time to catch issues before they’re permanent.

- MPC Hot Wallet (20%: $100M): Fireblocks-managed custody with fragments split between you, Fireblocks, and a hardware device. Per-transaction limit of $5M. Refill from cold storage every 4 hours.

- Staking/Yield (10%: $50M): Lido staking (ETH), Aave lending (USDC), monitored closely.

Annual security cost for this setup:

- Fireblocks custody: $4,500 + $0.02 per transaction (assume 500K transactions/year = $10K)

- Cyber insurance: $30-50K/year

- Annual security audits: $50-100K

- SOC monitoring: $100-150K/year

- Cold storage rental & backup: $15-30K/year

Total: $210-360K annually. That sounds expensive. For $500M in assets, it’s actually cheap. 0.04-0.07% of AUM. Institutions expect that cost structure.

How Do Compliance Requirements Differ Across Types of Crypto Banks Globally?

This is the part that separates builders who ship from builders who spend 18 months in legal limbo.

1. Europe: MiCA-Based Licensing Path

MiCA went live in December 2023, and it actually works – there’s a framework. VASP licensing is jurisdiction-specific, but follows the same playbook.

| Jurisdiction | Regulator | Approval Timeline | Key Requirements | Legal Setup Cost | Strategic Use |

| Germany | BaFin | 2–3 months | €100K capital, AML program, crypto-experienced directors | ~€150K | Best testing ground; fastest EU approval |

| France | AMF | 4–6 months | Institutional-grade custody, separate custodian | ~€200K | Higher credibility, stricter oversight |

| Lithuania | BVD | ~2 months | Crypto-focused regulator, lighter process | ~€100K | Fast-track launch option |

You don’t need to operate in all EU countries initially. Get one license (Germany makes sense), then passport into other EU countries under mutual recognition.

Total cost for EU launch: €400-600K legal/compliance setup + €200-300K annual compliance team.

2. United States:

No federal crypto bank license exists. Instead, Money Transmitter Licensing, state by state.

| State | Regulatory Posture | Approval Timeline | Complexity Level | Strategic Role |

| Wyoming | Most crypto-friendly | 4–6 weeks | Low | Proof-of-model entry state |

| Texas | Pro-crypto, serious oversight | 2–4 months | Medium | Scalable growth market |

| California | Largest volume market | 3–5 months | High | Commercial scale |

| New York | BitLicense regime | 6–9+ months | Very High | Do last, only if required |

Cost per state: $50-100K legal + $20-50K surety bond + state filing fees ($2.5-10K).

So, US expansion takes 18+ months and $1-2M if you’re doing it right. Consider the partnership model first, rent liquidity from licensed operators (Coinbase Prime, Kraken), validate market fit, then pursue licensing.

3. Asia:

| Jurisdiction | Regulator | Approval Timeline | Legal Setup Cost | Best For | Notes |

| Dubai | DMCC / DFSA | 30–60 days | $150K–$250K | Speed + regional credibility | Middle East / Asia foothold |

| Singapore | MAS | 3–4 months | $300K–$500K | Institutional products | Strong regulatory reputation |

| Hong Kong | SFC | 6+ months | $500K+ | Specific HK presence | Restrictive; optional |

Recommended sequence: Dubai (speed + credibility) to Singapore (institutional depth), then Hong Kong (if needed).

Read Our Blog: UAE Leads in Crypto Neo Banking Development

Which Crypto Banking Services Must Be Live Before You Launch A Crypto Bank?

When you’re building a crypto product, feature prioritization kills most projects. Teams load on bells and whistles before nailing basics.

Tier 1 (Do This or Don’t Launch):

| Feature | Estimated Cost (USD) | Timeline | Why It’s Mandatory |

| User Registration + KYC | $60K–$100K | 4–6 weeks | Regulatory entry point and user trust |

| Wallet Creation | $20K–$40K | 2–3 weeks | Core custody or self-custody functionality |

| Send / Receive Crypto | $40K–$80K | 3–4 weeks | Primary user value loop |

| Real-Time Balance Updates | $30K–$60K | 2–3 weeks | UX credibility and accuracy |

| Transaction History | $40K–$80K | 3–4 weeks | Compliance, audits, and user transparency |

| Multi-Asset Support | $20K–$50K | ~2 weeks | Avoids early platform lock-in |

| 2FA Security | $15K–$30K | 1–2 weeks | Baseline security expectation |

| KYC / AML Monitoring | $80K–$150K | 6–8 weeks | Ongoing regulatory compliance |

Cost: $275-590K. Timeline: 8-12 weeks.

This is your MVP. This is what gets you to launch and lets you validate with real users.

Tier 2 (Year 1 Additions):

| Feature | Estimated Cost (USD) | Timeline | Strategic Value |

| Debit Card Integration | $80K–$150K | 6–8 weeks | Increases daily usage and retention |

| Fiat On/Off-Ramps | $40K–$80K (each) | 4–6 weeks | Improves conversion and accessibility |

| Staking Integration | $50K–$100K | 5–8 weeks | Revenue + user stickiness |

| Portfolio Dashboard | $40K–$80K | 4–6 weeks | Improves engagement and visibility |

| Admin Controls | $60K–$120K | 6–8 weeks | Operational scale and risk control |

These differentiate you from basic crypto payment apps and create moats.

Tier 3 (Year 2+):

| Capability | Purpose | Strategic Impact |

| DeFi Integrations | Swaps, lending, yield access | Expands financial use cases |

| Smart Contract Interaction | Governance, protocol actions | Power-user and DAO adoption |

| Tax Reporting | Compliance automation | Enterprise and jurisdictional readiness |

| Business Accounts | Multi-sig, DAO wallets | B2B and institutional onboarding |

| Merchant APIs | Payments, integrations | Platform ecosystem growth |

What Launch Strategy Separates Profitable Crypto Banking Solutions from Failed MVPs?

Phase 1: Closed Beta (Months 12-14)

You launch to 100-500 trusted users with Real crypto natives, advisors, and select enterprise customers. The goal here isn’t scale; it’s learning without public pressure.

Questions you’re answering:

- Can users register without support?

- Does KYC actually work at scale?

- Can your infrastructure handle real transaction load?

Problems you find here get fixed before anyone cares, and that’s the whole point.

Phase 2: Regulated Launch (Months 14-18)

Your license approves, you migrate beta users to production, and you onboard actual customers, which is a careful ramp-up.

Week 1: 100 users. Week 4: 1K. Week 8: 5K. By month 4, 20K users.

This phasing matters. You’re not trying to handle hockey-stick growth, as you’re onboarding steadily, stress-testing at each level, fixing issues as you discover them. Your marketing here is hyper-targeted – crypto-native audiences (Twitter/X, Discord, specific subreddits), enterprise outreach (LinkedIn, direct), and fintech partnerships.

Phase 3: Scale (Months 18+)

You’ve proven product-market fit. Now it’s about expansion– geographic markets, new features, institutional products, and partnerships. In this, hiring accelerates, the operations team doubles, and you’re running a real business now.

Conclusion

Building a white label crypto banking solution isn’t about being cutting-edge technology people, it’s about being boring infrastructure that doesn’t fail. Your customers don’t care about your tech stack. They care about speed, security, and regulatory clarity. Build those three things well, and everything else follows.

The market window is real and closing, as Institutions are moving fast. The teams that move faster with proper security and compliance diligence will own 2026 and beyond, which can be taken care of with ease if you work with SoluLab as a Blockchain Development Company. The builders who overthink it, underestimate regulatory complexity, or skip security will disappear.

FAQs

Yes. With the rising institutional adoption of crypto, tokenized assets, and digital payments, crypto-friendly banks are well-positioned for strong growth. Regions like the UAE, Singapore, and Europe continue to attract crypto businesses seeking compliant banking partners.

In 2026, the UAE, Singapore, Switzerland, and select EU jurisdictions are considered among the best locations to launch a crypto-friendly bank. The UAE stands out due to its clear crypto regulations, strong fintech ecosystem, and government-backed innovation hubs like DIFC and ADGM, making it a preferred choice for MENA-focused crypto banking platforms.

The licenses required depend on the business model and jurisdiction. A crypto bank may need–

a digital banking or EMI license, virtual asset service provider (VASP) registration, crypto custody approval, and AML and KYC compliance certification.

In the UAE, approvals may involve VARA, ADGM, or the Central Bank, depending on the services offered.

On average, launching a crypto-friendly bank takes 6–12 months, depending on jurisdiction, licensing complexity, and technology readiness. Using a modular banking platform and early compliance planning can significantly reduce timelines.

The cost to develop a crypto-friendly bank typically ranges from $250,000 to $1 million+, depending on features, compliance complexity, security architecture, and geographic coverage. Expenses include core banking integration, blockchain infrastructure, regulatory approvals, and ongoing compliance management.

Most crypto-friendly banks support both fiat currencies and digital assets. This includes services like fiat accounts, best crypto wallets, instant on/off ramps, stablecoin payments, and cross-border transfers, enabling users to manage traditional and digital finances in one platform.