Ever wondered how someone invests in a $20 million real estate deal with just a few hundred dollars? That’s the magic of Special Purpose Vehicles (SPVs) in asset tokenization.

SPVs have emerged as critical tools in the world of asset tokenization. As businesses adopt blockchain and decentralized finance, SPVs help structure investments, mitigate risks, and ensure regulatory compliance. They act as legally separate entities, often used to represent ownership of tokenized real-world assets like real estate or fine art.

This blog examines the role of SPVs in asset tokenization, their significance, and the benefits they offer to businesses and investors.

What Is a Special Purpose Vehicle (SPV)?

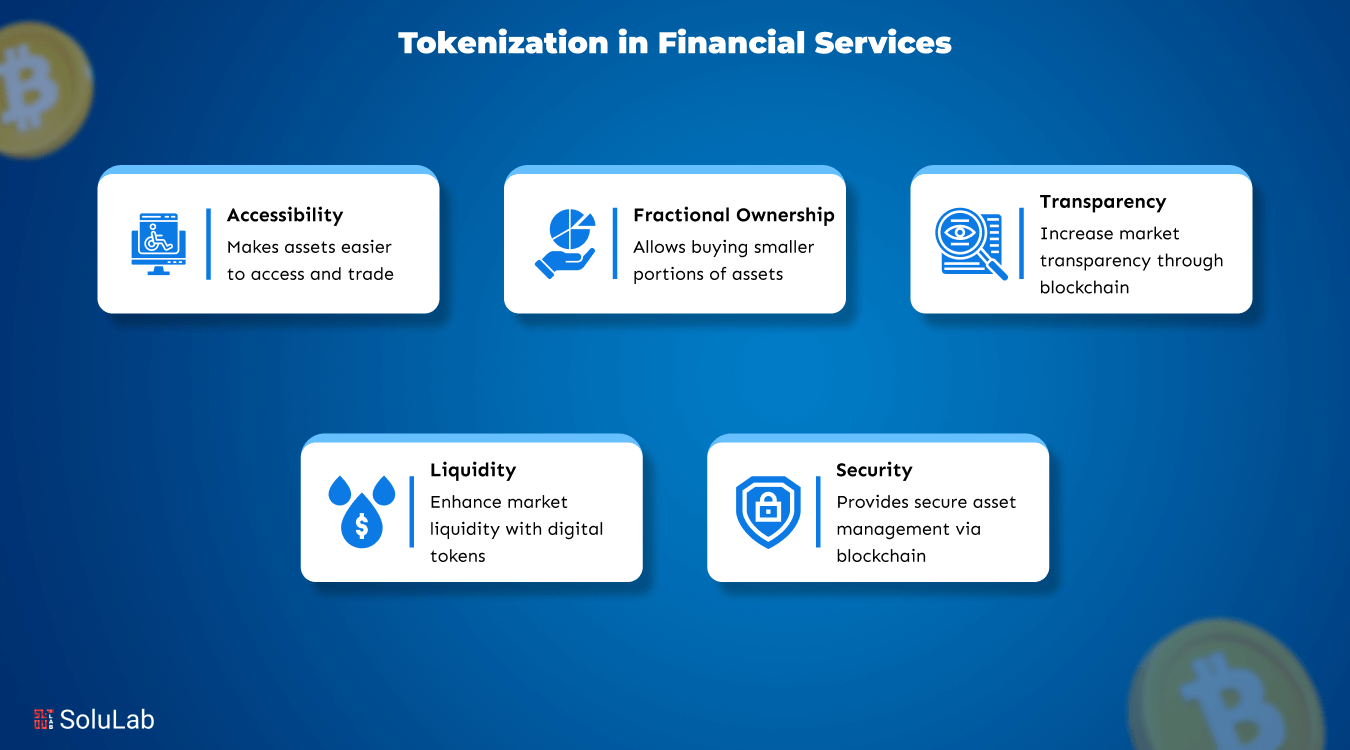

A Special Purpose Vehicle is a legal entity created by a parent company to isolate financial risk. It is also called a Special Purpose Entity (SPE). SPVs improve liquidity, create access for smaller investors, and allow fractional ownership of high-value assets. When combined with smart contracts and blockchain, SPVs reduce manual intervention and increase transparency.

- SPVs operate independently and maintain their own balance sheets.

- They protect the parent company from financial exposure or bankruptcy.

- SPVs can hold assets, issue debt, and participate in risk-heavy ventures.

Key Functions of SPVs

-

Separate Risk Without Impacting the Parent Company

SPVs act like protective shells around risky investments. If something goes wrong inside the SPV, the parent company isn’t dragged down financially or legally. This helps companies take bold steps without risking everything.

-

Make Debt More Attractive and Manageable

When companies package their debt into an SPV, it becomes easier to manage and more appealing to investors. The SPV handles repayments, while the parent enjoys a cleaner balance sheet and better credit terms.

-

Pool Investor Capital for Targeted Projects

SPVs allow companies to gather funds from multiple investors and direct them toward a specific purpose. Those include launching a startup or building a property, without mixing it with the company’s other finances.

-

Ensure Legal Protection in Case of Bankruptcy

Since SPVs are legally separate, even if the parent company faces bankruptcy, the SPV and its assets are usually protected. This legal wall keeps investor funds safer and better managed.

-

Simplify Complex Investments into Structured Deals

SPVs break down big, complicated investments, like real estate or infrastructure, into smaller, digestible units. This structured approach makes it easier to tokenize assets and invite participation from a wider pool of investors.

-

Help in Complying with Global Financial Regulations

Creating an SPV helps businesses follow strict rules in different countries. Whether it’s for taxation, securities compliance, or KYC, the SPV ensures the investment stays legally sound and transparent.

-

Enable Smart Contract Integration and Tokenization

SPVs work well with blockchain-based systems. They act as the legal wrapper around smart contracts. These automate things like dividend payments, ownership transfers, and investor eligibility without manual oversight.

Read Blog: Daos in Real Estate Tokenization

Common Legal Forms of SPVs:

| Structure Type | Description |

| LLC | Limited Liability Company offering flexible rules |

| Limited Partnership | Often used in private equity and real estate |

| Trust | Common in financial structuring and estate use |

| Corporation | Standard setup for many large-scale SPVs |

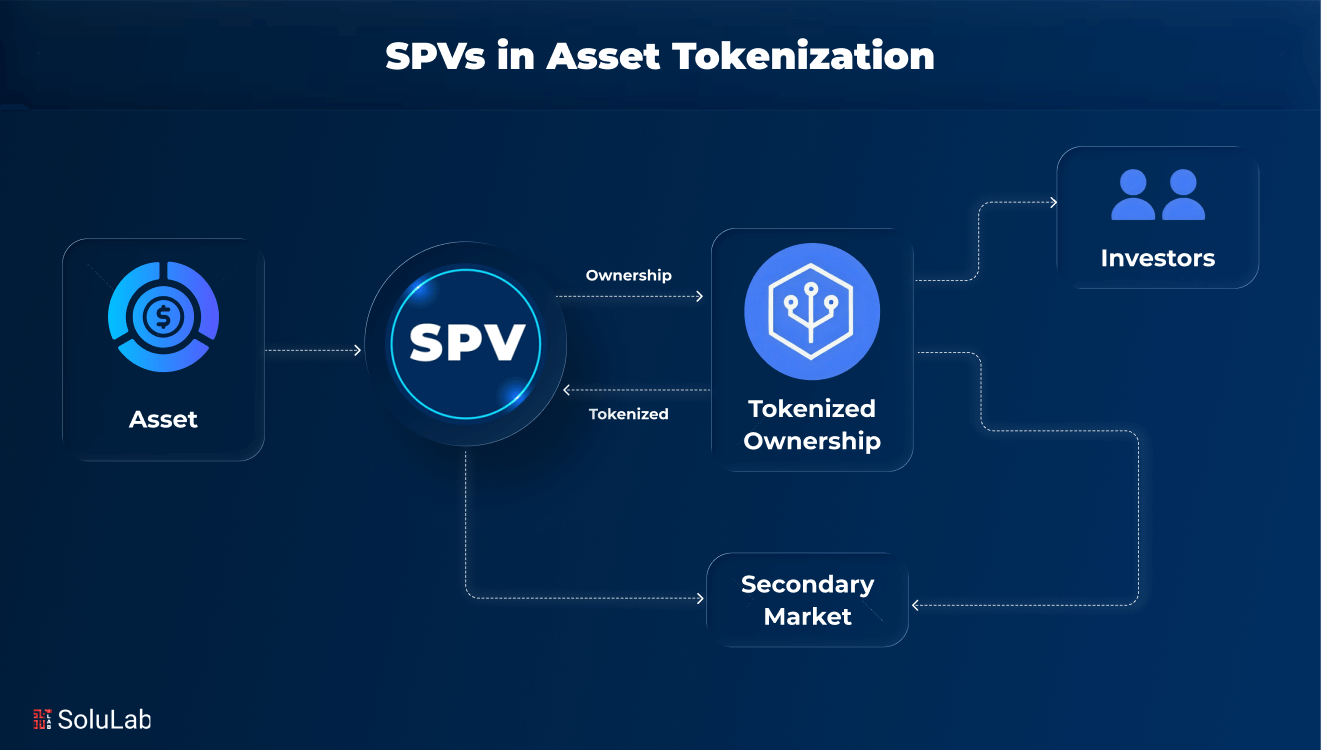

Role of SPVs in Asset Tokenization

The modern digital economy’s changes are pushing businesses to seek capital raises, and that’s where SPVs in tokenization come into play. With a clear legal entity, companies could issue digital tokens under their ownership. This move makes it easier for investors while lowering the traditional barriers. This also opens wide doors for innovative businesses and investors under a secure framework. Tokens issued through SPV can be traded on blockchain platforms that aid in increasing liquidity.

For example, take real estate, developers use SPVs in the tokenization of large investments. This helps in breaking them into small units, which makes retail investors take part. This move’s main focus is to bring capital without overloading the main company’s balance sheet. Finally, SPVs in asset tokenization blend the traditional finance system with modern technology to provide reliable and scalable capital.

Significance of SPVs in Real-World Asset Tokenization

SPVs play a vital role by acting as separate legal entities for asset tokenization. Their primary role includes:

- Issuing digital tokens backed by physical or financial assets.

- Recording asset ownership transparently on the blockchain.

- Ensuring asset rights are clear and legally protected.

For Investors:

- Small investors can access premium assets at lower costs.

- They gain higher liquidity and diversified investment options.

- They benefit from clear legal rights and a transparent structure.

For Business:

- Access to capital without issuing new stock.

- Reduced dilution of existing shareholders’ equity.

- Structured compliance and global investor access.

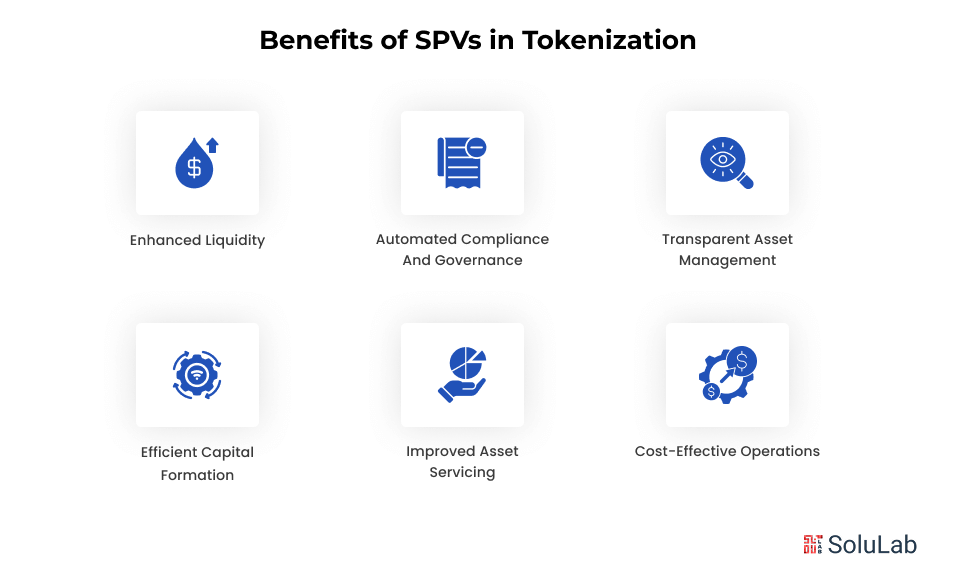

Benefits of SPVs in Tokenization

SPVs offer clear legal, operational, and technological benefits. Below are the key advantages:

-

Enhanced Liquidity

Tokenized SPVs break down large assets into smaller digital tokens that can be traded on blockchain platforms. This allows investors to enter with much smaller capital, making high-value assets like real estate or art more accessible and liquid. With lower investment barriers, broader participation becomes possible, even for retail investors.

-

Automated Compliance and Governance

Smart contracts built into the SPV structure help enforce all legal and regulatory rules automatically. These contracts verify investor eligibility, apply transfer restrictions, and manage compliance without manual paperwork. It reduces the risk of human error while saving time and money on regulatory processes.

-

Transparent Asset Management

Every transaction and ownership update is recorded on the blockchain in real time. This transparency allows investors to monitor their holdings, income distributions, and governance rights from a secure dashboard. Asset managers can also access detailed performance data for better oversight and control.

-

Efficient Capital Formation

Raising capital becomes faster and cheaper with tokenized SPVs. Smart contracts eliminate the need for intermediaries like brokers or underwriters, cutting fundraising costs significantly. Global investors can participate more easily, while token offerings ensure regulatory compliance from the start.

-

Improved Asset Servicing

Dividends, interest, and other financial benefits are distributed automatically using smart contracts. There’s no need for manual processing or reconciliation. Investors receive their payments accurately and on time, with all activities logged transparently on-chain.

-

Cost-Effective Operations

Tokenized SPVs minimize administrative overhead by digitizing operations. Legal and accounting costs drop with the use of blockchain-based reporting tools. Digital documentation streamlines the overall process, making the structure efficient for both issuers and investors.

Real-World Case Studies of SPV Application

1. Harbor’s $20 Million Tokenized Student Housing Project (2023)

In 2023, Harbor took a major step in real estate innovation by using an SPV to tokenize a student housing project valued at $20 million. This move allowed small and retail investors, who usually can’t afford such large investments, to purchase fractional shares through digital tokens.

By structuring the offering via an SPV, Harbor ensured the investment complied with U.S. securities regulations while also boosting liquidity. Investors could easily trade their shares on a blockchain-based platform, making entry and exit from the investment more flexible. This example highlights how SPV-backed tokenization can break traditional real estate barriers and offer regulated, digital investment opportunities to a wider audience.

2. CitaDAO’s Tokenization of Industrial Units in Singapore

CitaDAO, a Web3 real estate platform, successfully tokenized two industrial properties worth over $1.2 million in Singapore using an SPV structure. Investors could purchase tokens representing fractional ownership, with one key feature being the ability to redeem the actual property deed with a 30% ownership stake.

Built on the Ethereum blockchain, this model enabled secure secondary trading while ensuring investor transparency and asset traceability. The SPV model provided legal separation and compliance, while blockchain ensured every transaction and ownership transfer was clearly logged. CitaDAO’s project is solid proof of how asset tokenization, when combined with SPVs, opens up previously illiquid real estate to smaller, tech-savvy investors globally.

Step-by-Step Guide: Creating a Tokenized SPV

The following are some crucial steps while creating a Tokenized SPV:

1. Strategic Planning and Market Analysis: Define goals, capital needed, and investor types, and research demand for tokenized versions of your asset.

2. Form the Legal Structure: Establish an SPV (LLC or Limited Partnership) and ensure full legal documentation and regulatory compliance.

3. Smart Contract and Blockchain Setup: Develop smart contracts for issuing and managing tokens and choose suitable standards like ERC-20 or ERC-3643.

4. Design Token Economics: Structure token utilities, rights, and distribution mechanisms, and include rules for dividends, governance, and trading limits.

5. Launch the Offering: Onboard investors via KYC and AML checks, issue tokens, and manage compliance with smart contract tools.

Legal Models: Bearer vs. Registry-Based Ownership

Two ownership models affect how tokenized assets function:

| Ownership Model | Bearer Ownership | Registry-Based Ownership |

| Definition | Ownership is tied to possession, like holding physical cash or crypto private keys. | Ownership is recorded in legal registries such as property or vehicle records. |

| Control | Whoever holds the asset (or key) controls it. | Only the person listed in the registry has legal control. |

| Risk | Losing access (e.g., private key) means losing ownership permanently. | Ownership can be restored or updated through legal means. |

| Example | Cryptocurrencies, bearer bonds. | Real estate titles, car ownership, and shareholding records. |

| Transfer Process | Simple, transfer possession. | Requires legal steps and approval to update official ownership records. |

| Legal Recognition | Not always recognized by law in case of disputes. | Strong legal backing and enforceability in most jurisdictions. |

| Use in Tokenization | Common in permissionless tokens and decentralized finance. | Used in regulated assets requiring formal legal ownership records. |

Blockchain integrates both models, but legal adaptation is ongoing. Token ownership often reflects contractual rights over actual possession.

Addressing Regulatory and Jurisdictional Complexity

Tokenizing digital assets brings challenges like regulations, security, and licensing, which businesses must handle carefully. Each country has its own rules and monetary teams to clarify tax, assets, and token exchange regulations. Trading tokenized assets triggers income tax and capital gains. These are mainly dependent on location and investors’ interest.

Privacy tools like Zero Knowledge (ZK) proof technology are used to protect user data. However, businesses must comply with KYC and AML regulations. Jurisdictions such as Luxembourg and Ireland are robust towards asset-backed tokens. This makes them global investor-friendly countries.

Final Thoughts: The Future of Tokenized SPVs

SPVs will continue to drive asset tokenization. Their role in risk reduction, legal clarity, and investor access is unmatched. Businesses can raise capital quickly and globally, along with transparent, regulated, and liquid asset options. Legal teams must adapt to new standards and jurisdictions. Collaboration between technologists, lawyers, regulators, and investors is key.

With proper planning and compliance, SPVs can unlock the full potential of tokenized real-world assets. SoluLab is one of the best asset tokenization development company. If you are ready to build the project, our expert team is here to assist you in every step.

Contact us today to make your goal a reality!

FAQs

1. Why do companies use SPVs for tokenization?

Companies use SPVs to raise money without affecting their main business. It creates a safe, separate setup that attracts investors, offers legal protection, and makes the whole process more organized and trustworthy for everyone involved.

2. How does an SPV make real estate investing easier?

SPVs break down big property projects into small, affordable tokens. This way, regular people can invest in real estate with less money and enjoy benefits that were previously limited to big investors or large institutions.

3. Are tokenized SPVs regulated by law?

Yes, tokenized SPVs must follow the rules set by financial authorities. These include investor checks, trading limits, and tax laws, so investors can trust that everything is handled in a legal and proper way.

4. What does blockchain do in SPV-based tokenization?

Blockchain helps record and track every transaction clearly and securely. It also automates many legal steps, reduces paperwork, and ensures both investors and businesses stay updated with real-time information.

5. Do token holders actually own the real asset?

Not directly. Token holders own rights through the SPV that represents the asset, not the asset itself. It’s like holding a legal agreement backed by the asset, which still gives control and value but not physical ownership.