By 2030, tokenized assets are predicted to have a $16 trillion worldwide market capitalization. Real-world asset tokenization has the potential to transform several sectors, including carbon credits, real estate, equities, and the arts. With the invention, the potential applications of blockchain technology in several industries have advanced significantly.

Creative ways to support environmental sustainability are emerging as the globe struggles with the pressing issues of climate change. One of the most promising of these is the tokenization of carbon credits, which uses blockchain technology to make the carbon market more open, effective, and accessible. This blog explores everything you need to know about carbon credit tokenization including how it works, its advantages, fundamentals, and use cases.

What are Carbon Credits?

Before we talk about tokenizing, let’s have a better knowledge of what are carbon credits. Permits known as carbon offsets or carbon credits allow companies to release a specific quantity of greenhouse gases, or carbon dioxide. One ton of carbon dioxide (CO2) is equal to one carbon credit. As per the report provided by Ecosystem’s marketplace annual report, the voluntary carbon credit market reached a valuation of over $2 billion by 2022.

By giving businesses financial incentives to decrease their carbon footprint, the carbon credit system seeks to lower greenhouse gas (GHG) emissions. Businesses are given a fixed quantity of credits under this system, which gradually diminishes, and they are free to sell any extra credits to third parties. The cap-and-trade concept which was effectively employed to reduce sulfur pollution in the 1990s, is the foundation of this system. The framework’s worldwide applicability was further strengthened in November 2021 when negotiations decided to create an offset trading market for global credit carbons at the Glasgow COP26 climate summit.

What is the Role of Banks in Carbon Credit Tokenization?

Banks have a big part to play in the new market for tokenizing carbon credits, and moving quickly, they can become disruptive forces when it comes to virtual asset markets. Here are the major features of banks in carbon credit tokenization:

-

Technology and Market Leadership

Leading this modern technology businesses set an example for others to look up to and depict a dedicated environment leading towards enhanced responsibilities

-

Increasing Consumer Demand

Early adoption of carbon credit tokenization by banks would enable them to meet this demand and draw in a new market of customers who are economically aware.

-

Dedication to Addressing Climate Change

By actively participating in the creation of carbon credit tokenization methods, banks may show their dedication to addressing climate change in line with international imperatives.

-

Tokenized Securities for New Income Source

Banks can develop new tokenized securities, such as green bonds or structured products linked to the tokenized carbon credits, and gain from improved branding and reputation, particularly if concerns about climate change gain traction.

Read Blog: What Makes Germany a Natural Fit for Carbon Credit Tokenization?

Top 5 Use Cases of Carbon Credit Tokenization

The potential of tokenized credit carbons in practical applications is being demonstrated by these top 5 real-world use cases of carbon credit tokenization:

-

Verra

Leading worldwide carbon standard organization Verra has been at the forefront of the tokenization of carbon credits. Verra is streamlining its Verified Carbon Standard (VCS) credits by collaborating with blockchain platforms. To make it simpler for companies and individuals to trade carbon credits and offer their emissions, this effort seeks to improve the carbon market’s transparency, accessibility, and liquidity.

-

Flow Carbon

A platform for buying and retiring carbon credits is provided by Flow Carbon to both individuals and organizations. Additionally, its platform offers tools for monitoring and validating the effects of such credits, and initiatives. Through easily accessible and traceable carbon credit exchanges, Flow Carbon is dedicated to advancing climate action.

-

Moss

Moss works to protect Brazilian rainforests, especially the Amazon. Moss has made it possible for people and organizations to contribute to the conservation of the rainforest by tokenizing carbon credits that are produced from the maintenance of this important environment. They immediately support the preservation of the most important environmental resources in the world by using Moss tokens.

-

Klima DAO

The decentralized autonomous organization (DAO) dedicated to climate action is Klima DAO. By minting Klima tokens and buying carbon credits, Klima DAO establishes a direct connection between the cryptocurrency community and the carbon market. This strategy combines the realms of blockchain technology and environmental sustainability by encouraging people and businesses to invest in carbon credits along with promoting climate-positive initiatives.

-

Celo

Celo’s mobile-first blockchain infrastructure is being used to investigate the possibility of tokenizing carbon credits. Celo hopes to increase accessibility and inclusivity of climate action by including carbon credit tokenization within its platforms, particularly for people and communities in countries that are developing who might not otherwise have access to carbon trading.

Tokenized Carbon Credits: A New Asset Class for Climate Action

Tokenized carbon credits represent verified greenhouse gas reductions on the blockchain. Each token denotes one metric ton of carbon dioxide avoided or removed from the atmosphere.

These credits are created by bridging existing credits from carbon registries into crypto tokens. Rigorous verification ensures the environmental integrity of each tokenized credit.

For organizations, tokenized credits offer a blockchain-based tool to offset residual emissions and meet sustainability goals. They also allow individuals to compensate for their personal carbon footprints.

Trading these tokens unlocks liquidity, transparency and standardization in carbon markets plagued by fragmented trading and data inconsistencies.

On blockchain platforms, tokenized credits become a fluid digital asset class enabling seamless transactions. This gives corporations, governments and individuals equal access to carbon as an investable commodity.

Tokenizing Carbon Credit: The Process

Carbon credit tokenization converts real-world carbon credits into digital tokens using blockchain technology. This unlocks new potential for carbon markets. The tokenization process involves:

- Verifying the carbon reductions of projects like renewable energy or reforestation. Audits rigorously quantify the emissions avoided.

- Recording the verified impacts on a blockchain. This immutable ledger in blockchain provides permanent transparency.

- Issuing tokens representing carbon credits via smart contracts. These automate minting and transferring the tokens.

Once tokenized, the credits become digital assets that can be freely bought, sold, and traded. Participants across the carbon markets can purchase the tokens to offset emissions or trade them on decentralized exchanges.

In this way, tokenization provides open access to carbon markets for a wider range of stakeholders. It allows more individuals and organizations to engage in sustainable practices and contribute to reducing global greenhouse gas emissions.

The automation and transparency of blockchain technology also streamlines carbon credit transactions. This democratizes participation and enhances efficiency in mitigating climate change.

Benefits of Tokenized Carbon Credits

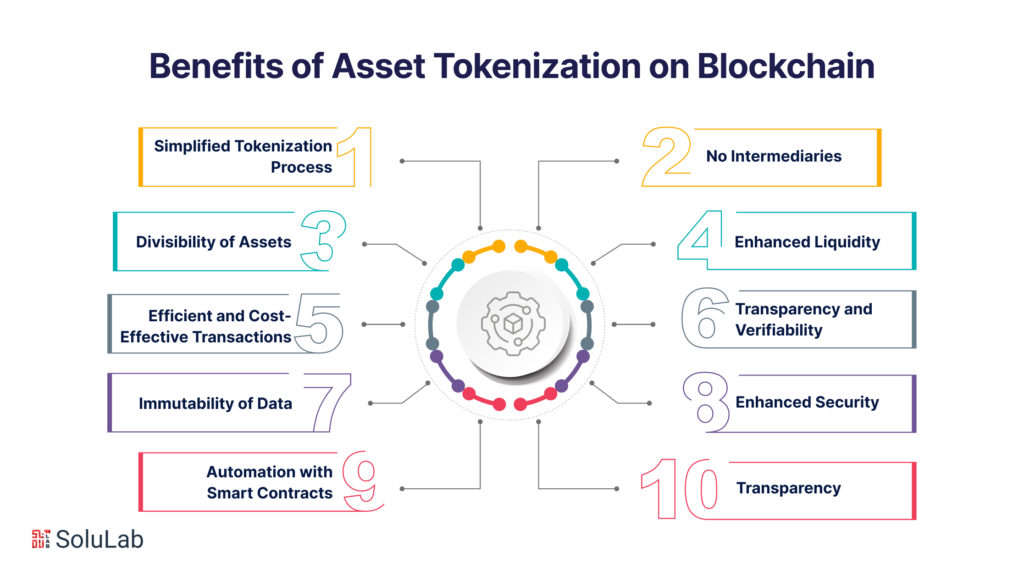

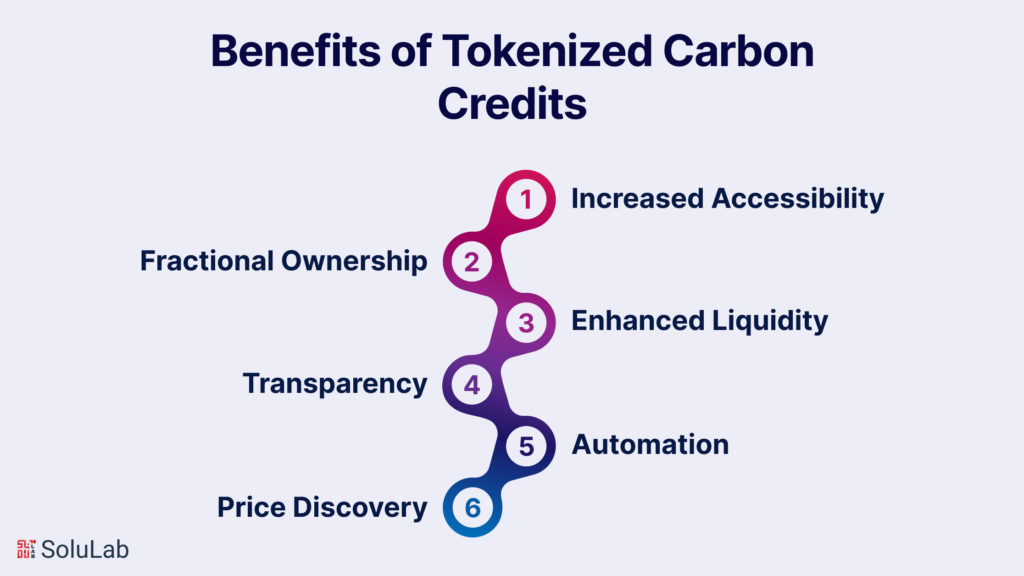

Tokenization unlocks several key benefits:

-

Increased Accessibility

Carbon markets become more accessible as tokenization removes geographical restrictions. Anyone across the world can purchase, trade, and retire tokenized carbon credits through digital platforms.

-

Fractional Ownership

Each credit can be split into smaller tokenized units, allowing individuals with limited budgets to offset their footprint.

-

Enhanced Liquidity

Tokens can be seamlessly traded on decentralized exchanges, eliminating intermediaries and reducing costs.

-

Transparency

The blockchain provides an immutable record of a credit’s origins and ownership history, preventing double-counting or other fraud.

-

Automation

Smart contracts automate credit issuance, payments, transfers, and retirement, streamlining the process.

-

Price Discovery

Tokenization provides transparent pricing data, increasing market efficiency and competition.

The Future of Tokenized Carbon Markets

By harnessing blockchain technology, tokenized carbon markets have the potential to engage a broader range of stakeholders in emissions reduction. Individuals can measure and offset their personal footprints, while companies large and small can more efficiently manage their climate impact.

Standardization and mainstream adoption of tokenized credits could significantly scale voluntary carbon markets. This would catalyze progress on global emissions goals, ultimately accelerating the worldwide transition to a low-carbon economy.

Check Our Blog Post: The Ultimate Guide To Creating a Carbon Credit Marketplace

Launching an Impactful Carbon Credit Tokenization Project

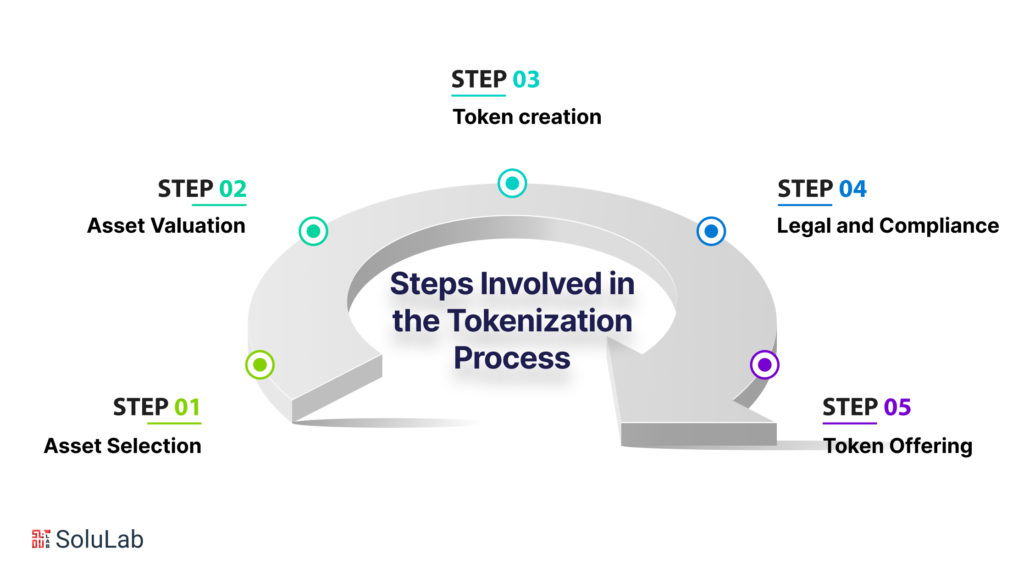

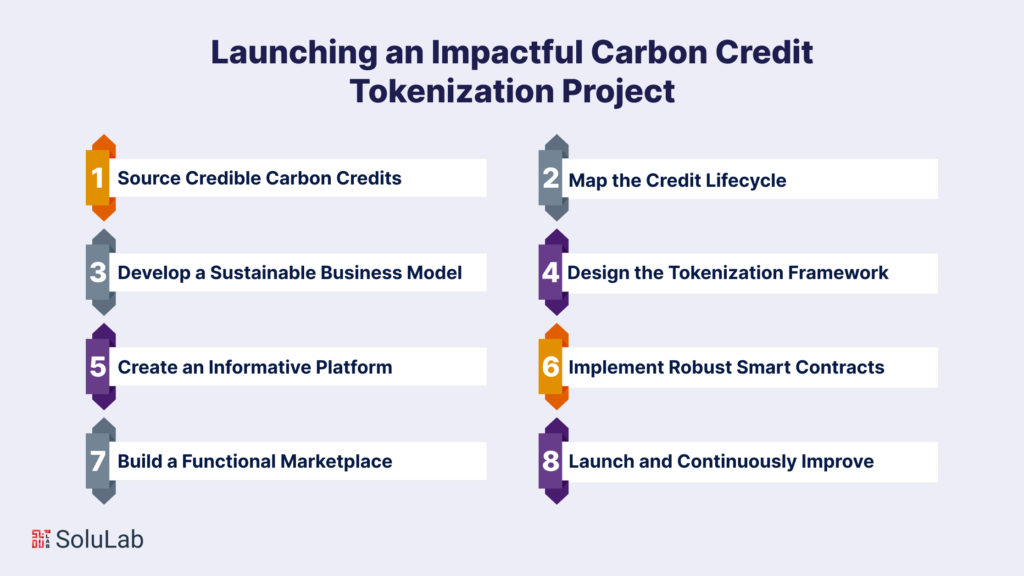

Tokenizing carbon credits can drive transparency and efficiency in carbon markets. But executing an effective project requires strategic planning across many fronts. Here is a step-by-step guide:

1. Source Credible Carbon Credits

First, determine where your carbon credits will originate. If you run a company with internal offsets, tokenize those. If operating a market platform, carefully select reputable partner projects. Start small and local before expanding globally.

2. Map the Credit Lifecycle

Plan how credits will be generated, verified, listed, purchased, tokenized, and retired. Select standard-setters to ensure credibility. Outline how data flows through each stage.

3. Develop a Sustainable Business Model

Consider transaction fees, subscriptions, commissions, and consulting services. Combine approaches to generate revenues sustainably. Provide ongoing value to users.

4. Design the Tokenization Framework

Choose the optimal blockchain, token standard, minting approach, and accepted currencies. Prioritize security and energy efficiency.

Read Our Blog Post: A Guide to Asset Tokenization

5. Create an Informative Platform

Develop a user-friendly site and compelling content that educates audiences on your vision. Integrate marketing to attract early adopters.

6. Implement Robust Smart Contracts

Work with experienced developers to program airtight smart contracts. Conduct meticulous auditing to identify vulnerabilities.

7. Build a Functional Marketplace

Allow seamless credit listings, purchases, payments, and transfers. Make registering and transacting intuitive for users.

8. Launch and Continuously Improve

Deploy after rigorous testing. Get user feedback. Regularly add features and upgrades to increase value. With proper planning, carbon credit tokenization can enable transparent and democratized climate action. By following best practices, your project can empower markets to drive impact.

Conclusion

In conclusion, the concept of carbon credit tokenization presents a promising pathway toward a more sustainable and environmentally conscious future. As we grapple with the pressing issues of climate change and the urgent need to reduce greenhouse gas emissions, this innovative approach allows us to harness the power of blockchain technology to efficiently trade and track carbon credits. By tokenizing these credits, we unlock the potential for a more transparent and accessible carbon market, making it easier for businesses and individuals to contribute to global efforts in reducing carbon footprints. It is a significant step forward in the fight against climate change, offering a scalable solution that can help us achieve our collective environmental goals.

With blockchain emerging as a game-changer for carbon markets, SoluLab brings unmatched experience in tokenizing climate solutions. Having delivered sustainability applications on major protocols like Ethereum and Polygon, SoluLab provides comprehensive services from designing high-impact programs to developing robust smart contracts for transparent credit issuance. Their full-stack developers help seamlessly integrate tokenized credits into DeFi ecosystems for enhanced liquidity. For any organization pursuing tokenized carbon markets, SoluLab is the partner of choice to architect end-to-end technical solutions that unlock the vast potential of blockchain for planetary impact. Contact SoluLab today to explore how we can help your organization leverage blockchain for sustainable success.

FAQs

1. What is carbon credit tokenization, and how does it work?

Carbon credit tokenization is a process of representing and trading carbon credits using blockchain technology. It involves converting carbon credits, which are essentially certificates representing a reduction in greenhouse gas emissions, into digital tokens. These tokens are then recorded on a blockchain, creating a transparent and immutable ledger of carbon credit transactions. This technology allows for the efficient and secure trading of carbon credits, making it easier for businesses and individuals to buy, sell, and transfer these credits.

2. What are the benefits of using carbon credit tokens?

Carbon credit tokenization offers several key benefits. It enhances transparency by providing a tamper-proof record of carbon credit transactions, making it easier to verify the legitimacy of credits. It also increases accessibility, allowing a wider range of participants to engage in carbon credit trading. Additionally, it improves efficiency by reducing administrative costs associated with traditional carbon credit markets. Ultimately, this technology encourages greater participation in the fight against climate change by simplifying the process of offsetting emissions.

3. Are carbon credit tokens a viable solution for combating climate change?

Carbon credit tokenization is a promising tool in the fight against climate change. By streamlining the carbon credit market and making it more accessible, it can encourage businesses and individuals to offset their carbon emissions more effectively. While it’s not a standalone solution, it is a valuable component of broader efforts to reduce greenhouse gas emissions and transition to a more sustainable future.

4. How can I get involved in carbon credit tokenization as an individual or a business?

Individuals and businesses interested in carbon credit tokenization can start by researching blockchain platforms and organizations that facilitate carbon credit token trading. You can also reach out to accredited carbon credit project developers to purchase or invest in carbon credits. Engaging with carbon offset initiatives and seeking out platforms that support carbon credit tokenization is a great way to get started and contribute to environmental sustainability.

5. What challenges and regulatory concerns exist in the world of carbon credit tokenization?

Carbon credit tokenization faces challenges related to the credibility of carbon credit projects, potential issues with double counting of emissions reductions, and the need for comprehensive regulatory frameworks. To address these concerns, it’s essential for governments, organizations, and the blockchain community to work collaboratively in setting industry standards and ensuring that carbon credit tokenization adheres to best practices in the field. This ongoing effort is crucial to maintain the integrity of carbon credit markets and achieve meaningful environmental impact.