The blockchain space is evolving into a revolutionary space by the day. In today’s dynamic business landscape, it’s become a critical part of business technology – so much so that IBM launched an entire division focused on blockchain and is continuing to invest heavily into the technology. Several other technology companies are also joining the bandwagon or actively exploring options.

Blockchain technology has seen massive growth already; this growth is only limited by the amount of talent. With technology evolving incredibly fast, it’s important for businesses to keep up to the changes. There are multiple startups and enterprises looking to hire remote developers adept at blockchain, pitched as one of the leading cutting-edge technologies today. Better yet, the presence of the distributed ledger adds extra value to each project.

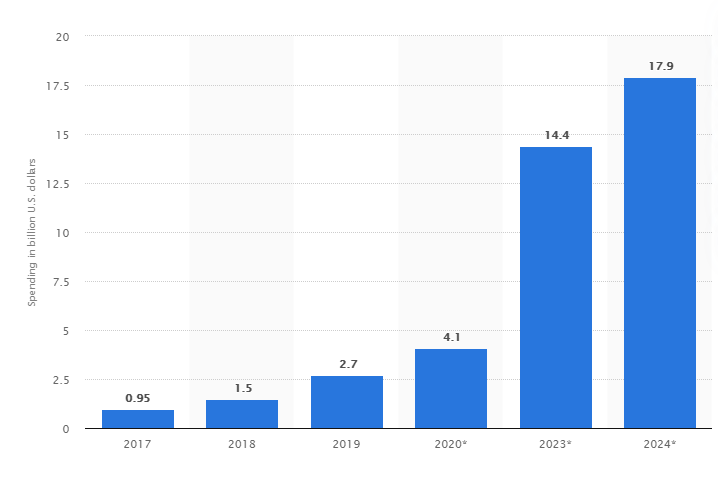

The world is going blockchain. The sheer size of the market isn’t shy of highlighting this. Its market size is projected to touch a staggering $16 billion by 2024, according to a report conducted by Global Market Insights, IBM, FedEx, British Airways, Microsoft, Nestle, Walmart – and these enterprises only sum up a few of the brands venturing into this space.

Worldwide spending on blockchain solutions from 2017 to 2024

(in billion U.S. dollars)

Source: Statistica

Business At Play With Blockchain

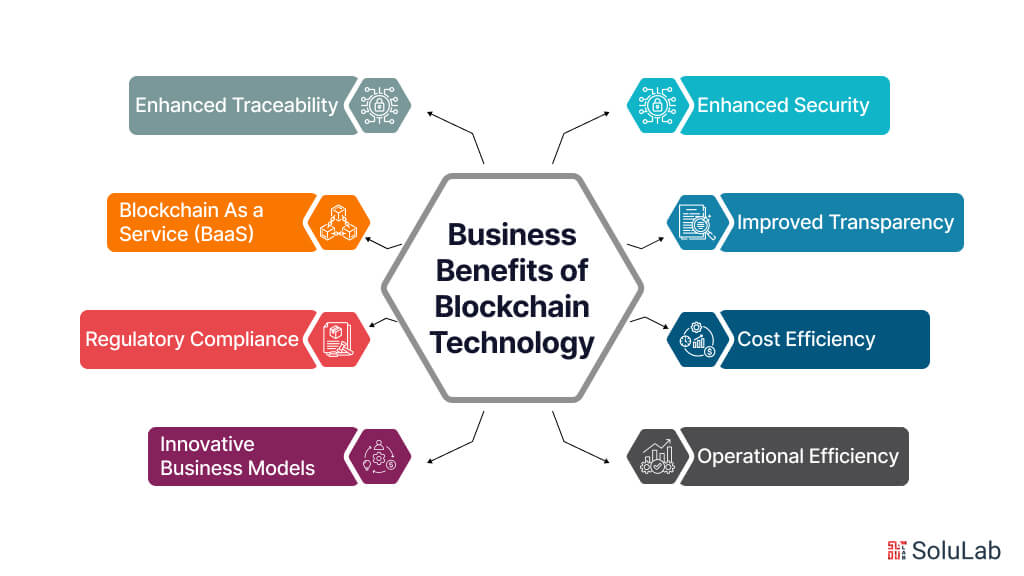

One of the most important benefits of blockchain implementation is the total cost it takes to reach the market. It is significantly cheaper and much more effective to build using blockchain technology than any other platform. Fast incorporation with a number of cryptocurrencies allows it to be a site of choice for companies in all sectors. The use of this sophisticated technology has unbelievably expanded not just the realms of technology and finance, but has also driven changing business needs. In our blog, we look at why it matters.

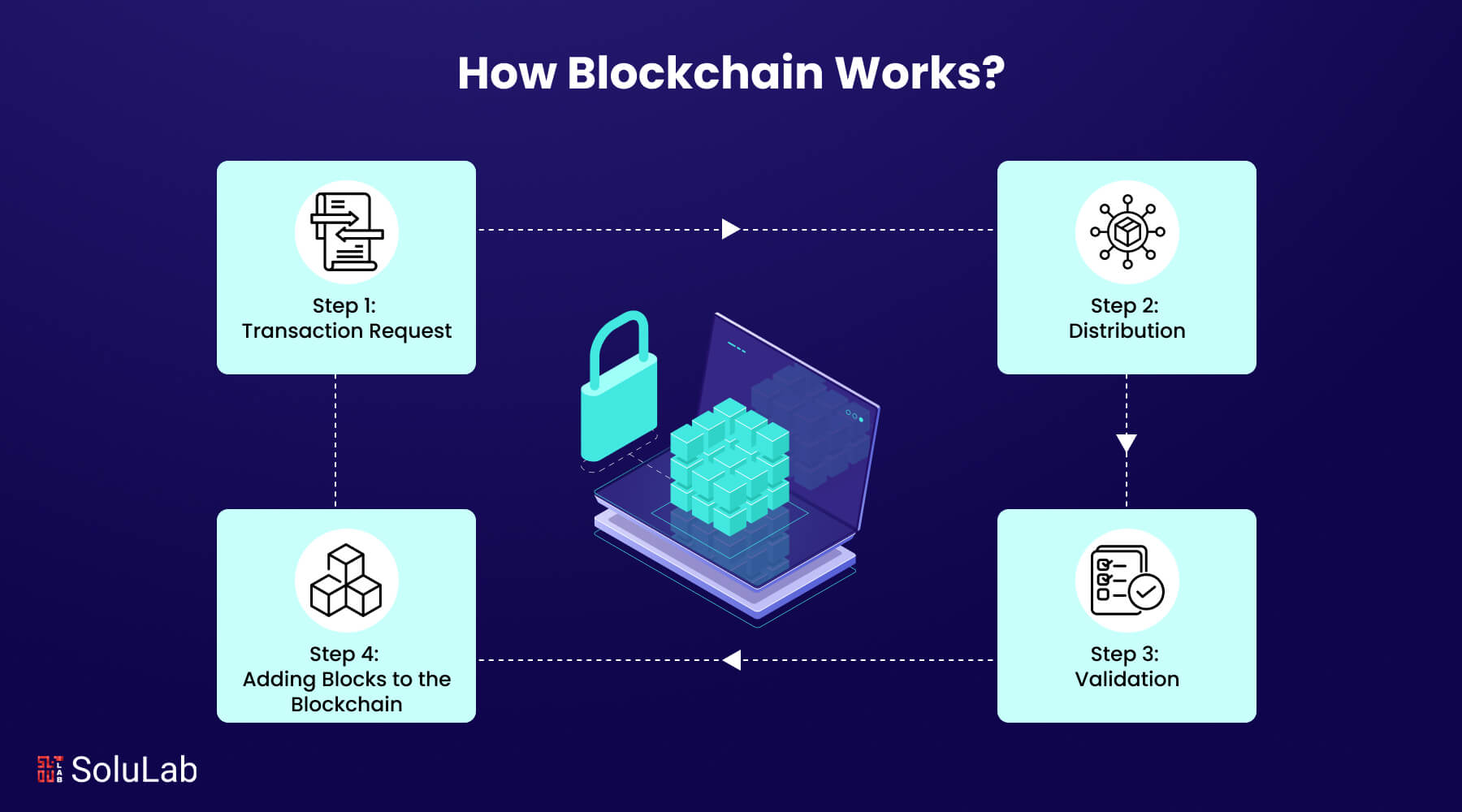

1. Faster, accurate and more efficient processes

Negating the need for intermediaries is one of the key reasons why corporations implement blockchain technology, which not only eliminates costs but also makes the entire process quicker. It’s because by eliminating the inconvenience created by a middleman in a functioning system, you’ll certainly get things done quicker in the overall operating phase.

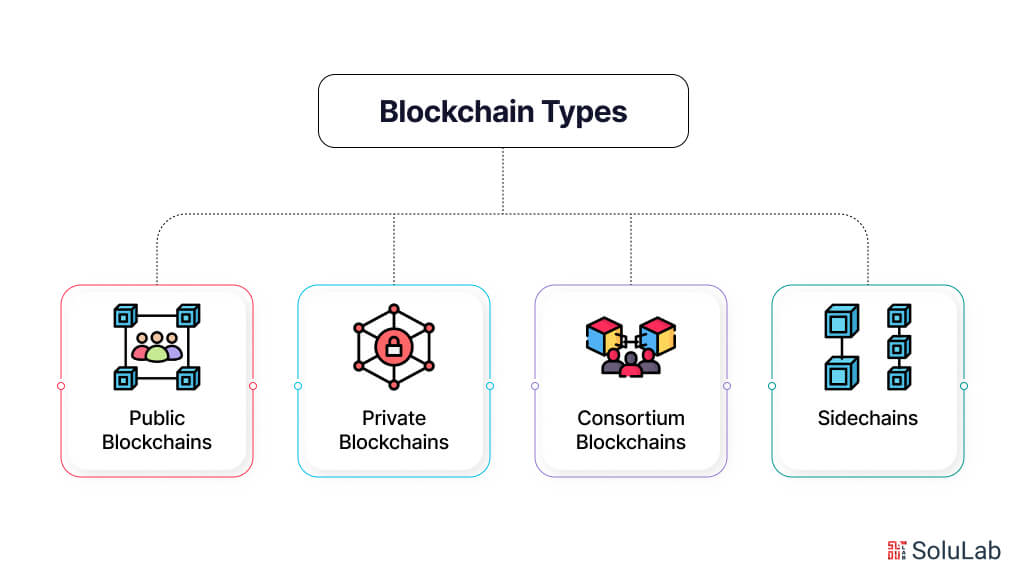

2. Better privacy and encryption for your business data

Blockchain technology prohibits even root users and administrators from tapping into personal or confidential information, thereby ensuring anonymity across the network. Moreover, it also keeps encryption keys that use the highest level of security. This mitigates the risk of hackers penetrating into the platform. By default, the technology is designed to reject all unwanted attempts to access data or even programmes that are within its network.

3. Cost-efficient for your business

We all love the ease of online transactions, but such fees will also limit income. In today’s market, there are various providers such as PayPal and Shopify, which carries costs ranging from 2.9 to 4.4 based on what they do, depending on the location of the purchase inside or outside the USA. Here’s where you have to pay attention to chargebacks or monthly prices. The greatest advantage of blockchain is the elimination of third parties. With blockchain, your business will be better positioned to reduce or avoid counterparty threats.

The perks of leveraging blockchain technology for your business is hard to miss. The challenge arises when you’re looking to hire the right talent to drive a secure blockchain platform. No blockchain development is possible without utilising the skills of experts. Launching a blockchain product or service needs the highest security or expertise – without this, your business could face risks. One of the best ways to solve this is by hiring the right blockchain app development company.

Hiring a blockchain consulting company to drive your business would help you use an open source and secure platform that can be modified to manage everything from quality assurance to financial transactions and smart contracts. Furthermore, It has transformed digital transactions through the use of tokenization of all physical assets. How do you know whether you’re hiring the right blockchain app development company? Hiring sought-after blockchain developers may be a daunting task for both established enterprises and start-ups. Here’s what you need to look out for.

1. How long have they been around? What projects have they worked on?

When you’re looking to hire blockchain app developers, it is important you look at the years of experience the developers have in building blockchain platforms. Details on their domain, founding team and senior management can help you make an informed decision.

In addition to this, it always helps to ask for the achievements and awards they’ve won for their work in this field when hiring remote blockchain developers. Look out for any patents or licenses that they have which could highlight their product’s quality.

One of the other major factors to check is the list of brands or the blockchain app development company’s portfolio. This will give you a picture of what products they have worked on and their performance while developing these platforms. Ask if they have built products for global enterprises or with start-ups as this will give you insights into how they can work with your product idea.

2. Learn more about their team of blockchain developers. What is the domain, skillset and tech stack?

Through this conversation, you will also learn more about the quality of their blockchain developers, where they are based out of, and how you can communicate with them.

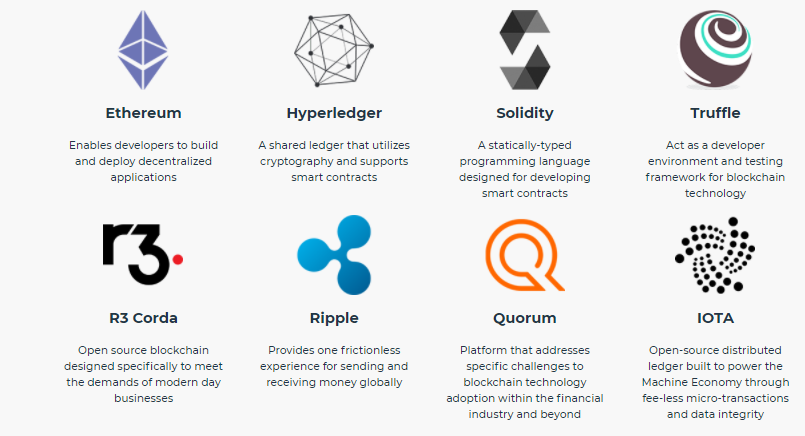

You need to know if their remote blockchain developers understand programming languages like C, C++, Javascript, Node JS, Solidity, Java, Python and Go. A skilled blockchain developer understands the concepts of encryption, data security, decryption and data structures. Apart from the blockchain development process, it’s also important to know if the team is utilising tools that improve efficiency and deployment – be it JIRA, Slack, agile or scrum methods.

While gathering this information, it’s also important to know if the remote blockchain developer can function or work according to your time zone. More often than not, many blockchain developers may be based in different countries to compete with a market that’s driven by price pressure. If this triggers possibilities of quality concerns, you should discuss this with the company.

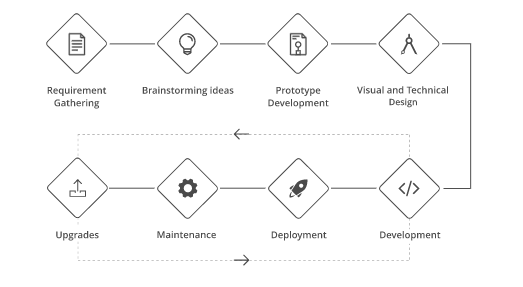

3. Understand the team’s development process and see if it fits your business needs.

Different teams follow different development processes. When hiring a blockchain app development company, you need to ensure what development process is being followed by the team. This is important when it comes to understanding how your product is being designed, developed and implemented.

This also helps you gauge if they have the potential to develop and build a blockchain-based platform. If the team has worked across multiple technology stacks such as cloud, microservices, iOS, Web Apps, Android or mobile app development, they have ample experience to help you navigate blockchain development.

4. Will they support your business with maintenance or service concerns after implementing the platform?

If you’ve managed to hire a blockchain app development company that works as an end-to-end service provider, that’s your one stop shop. They will give you access to product consultation, design, development, maintenance, support and implementation.

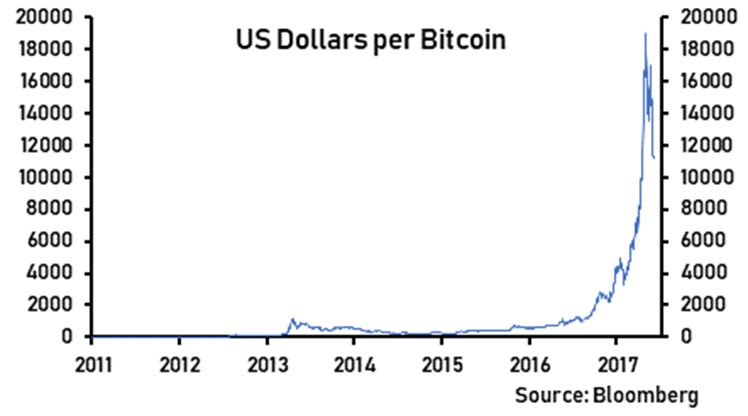

Rising demand for blockchain services

With the industry facing explosive growth, it also highlights the appetite for remote blockchain jobs and hiring remote developers. If you’re looking for a secure blockchain platform, partnering with the right blockchain app development company is critical. If your company needs to get ahead of the blockchain disruption curve, hiring remote developers in the post COVID-19 world may be a challenge, while being a vital necessity. Here’s where we simplify that for you.

Why SoluLab?

Our team of over 25+ experienced blockchain developers with more than 5 years of experience works across projects in the USA, Europe and South Asia, and has proved the capability of developing secure apps that match your business goals. Till date, we have successfully completed more than 50 projects that span blockchain consulting, enterprise blockchain development and crypto-related blockchain development.

If you’re looking to hire a blockchain development company, SoluLab’s team can amplify your business’s technology-driven processes by creating decentralized applications, allowing only authorized personnel to control operations, track real-time data security, development of cryptocurrencies, launch ICOs and HOT wallets. We also help you with training and support migration of your systems to integrate blockchain technology and instant data sharing. Better yet, we also help you implement smart contracts where all personnel can operate in a connected environment to monitor transactions real-time.

Here’s a sketch of our technology stack:

We have partnered with enterprises and hyper-growth startups to develop and design a blockchain readiness program, smart contract audits and more – with the first 15 days completely free, no strings attached. Get started today!