What if your bank could predict fraud before it happens, guide you toward smarter crypto investments, and answer your questions instantly—without human error or long wait times? That’s what AI in crypto banking is making possible in 2026.

With cryptocurrencies moving mainstream and digital finance facing constant risks of fraud, volatility, and compliance challenges, the role of AI is no longer optional—it’s essential. From fraud detection to personalized investment insights and AI-powered compliance checks, the fusion of AI and crypto banking is an opportunity that traditional finance could never achieve.

This blog explores how AI is transforming crypto banking and highlights the new opportunities emerging in 2026 for businesses, investors, and financial institutions. Let’s begin!

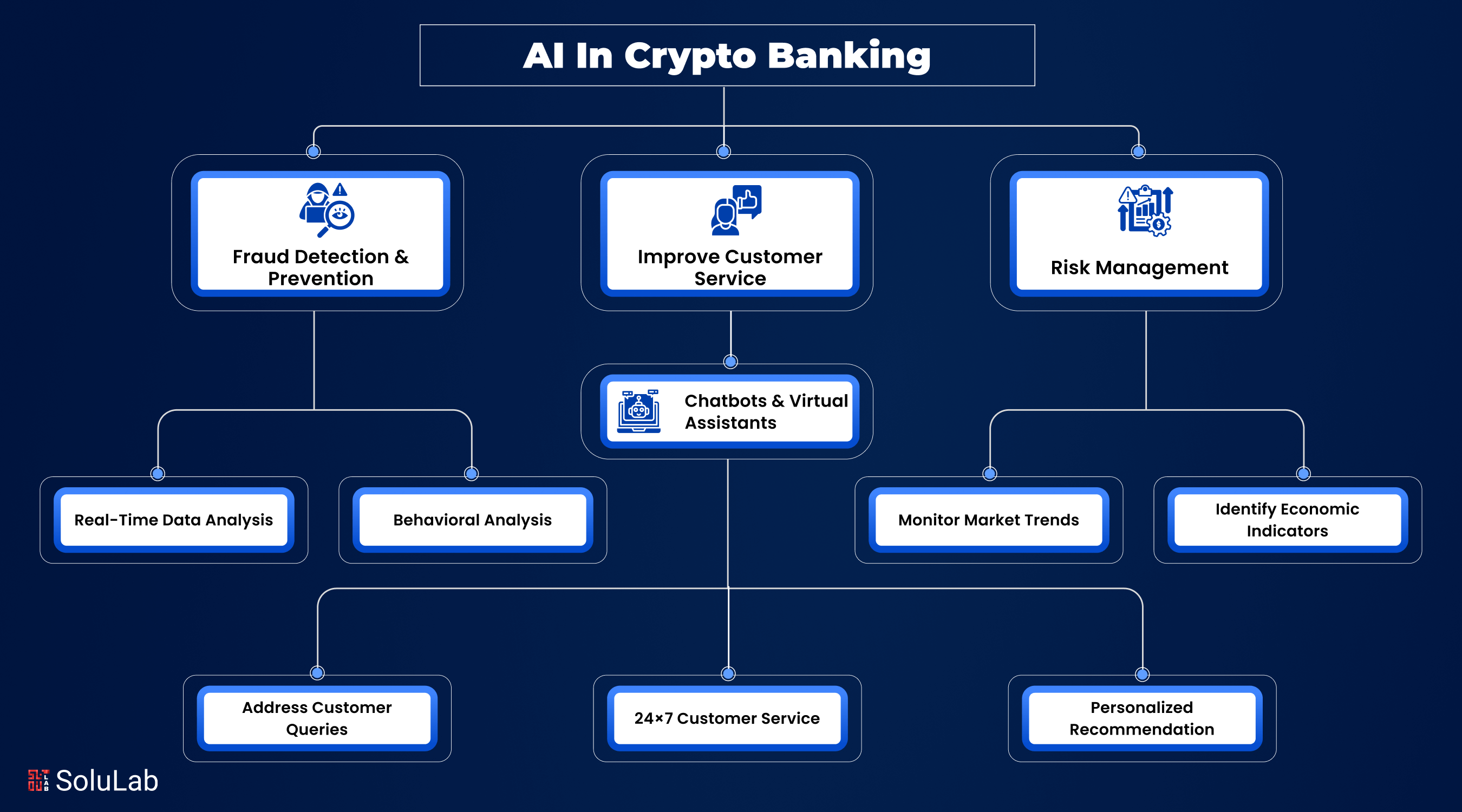

What is AI’s Role in Crypto Banking Operations?

AI in crypto banking goes beyond automation—it acts as the intelligence layer that makes digital financial systems smarter, faster, and more secure. Unlike traditional banking, where processes are rigid and heavily manual, crypto banking requires real-time decision-making, fraud prevention, and global compliance.

Traditional crypto banks rely on static rules and human oversight. They have workflows for onboarding, KYC, and fraud detection, executed manually. These systems work, but often lag and fail to scale.

AI-integrated crypto banks, on the other hand, use machine learning to automate tasks, spot fraud instantly, predict market shifts, and personalize services. In short, AI acts as the engine that powers the efficiency, security, and innovation in crypto banking, bridging the gap between traditional finance expectations and the demands of a decentralized economy.

Difference between Traditional vs. AI-integrated Crypto Banking

As the users and transactions increase, it’s highly possible to keep up with customer requirements. Hence, automation of tasks comes into the picture. This is where AI integration in crypto banking makes things easier.

The table below showcases what are the things that we are unable to perform efficiently with traditional baking and how we can enhance them with AI.

| Aspect | Traditional Crypto Banking | AI-Integrated Crypto Banking |

| Onboarding & Compliance | Manual KYC, slow, prone to mistakes | Instant identity checks, fewer errors, better compliance |

| Security & Fraud Detection | Fixed rules, mostly reactive | Learns patterns, detects fraud in real time |

| Decision-Making & Trading | Human-led, often delayed | Predictive models enable faster and smarter decisions |

| Customer Support | Limited hours, repetitive responses | AI chatbots offer instant, 24/7 natural language support |

Why 2026 Is a Turning Point for AI in Crypto Banking?

The year 2026 marks a tipping point for AI adoption in crypto banking. What was once experimental is now becoming an operational necessity, driven by three major shifts in the financial landscape:

-

Mainstream Adoption of Cryptocurrencies

With more institutions and retail users embracing crypto, the demand for secure, transparent, and user-friendly banking solutions has skyrocketed. AI helps meet these expectations by ensuring trust, speed, and efficiency in every transaction.

-

Regulatory Clarity and Compliance Pressure

Governments across the globe are rolling out clearer crypto regulations. This pushes banks and fintechs to adopt AI-powered compliance systems that can manage dynamic KYC/AML requirements in real time.

-

Advancements in AI Technologies

From generative AI to predictive analytics and natural language processing (NLP), AI has matured significantly. These tools are no longer limited to back-office automation; they are actively shaping customer experiences, investment strategies, and fraud prevention in crypto banking.

-

Rising User Expectations

Today’s customers expect instant, personalized, and secure services. AI-driven chatbots, smart investment advisors, and biometric authentication are no longer “good-to-have” features; they’re becoming standard in 2026.

-

Convergence of AI and DeFi

With decentralized finance (DeFi) gaining traction, AI is acting as the bridge between centralized crypto banks and decentralized ecosystems, opening doors for hybrid models of banking.

All in all, 2026 is the year when AI shifts from being a supportive tool to becoming the backbone of crypto banking operations—driving efficiency, compliance, and innovation across the sector.

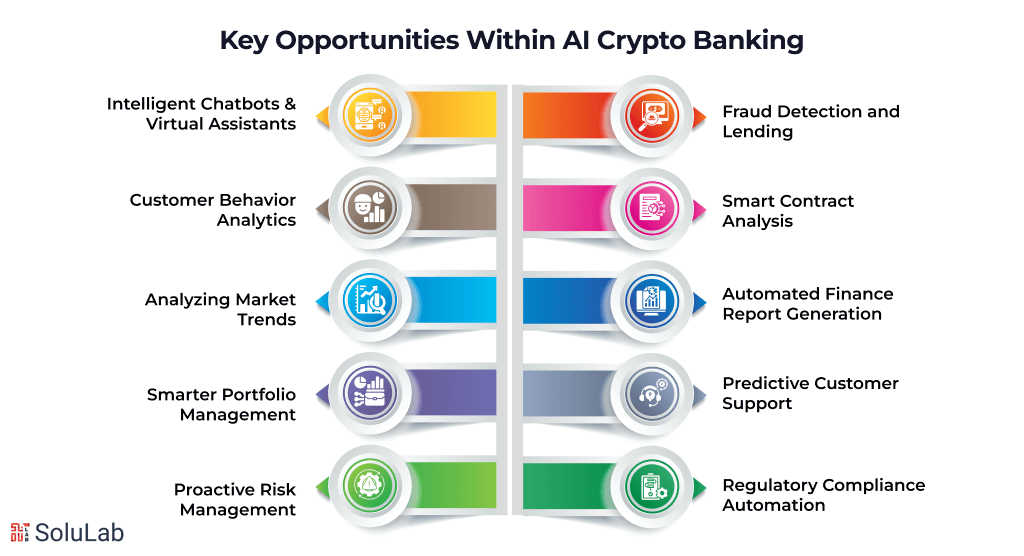

Key Opportunities Emerging with AI in Crypto Banking

AI is no longer just a supportive tool in crypto banking—it’s becoming the driving force behind smarter wallets, safer transactions, and personalized financial experiences. As competition grows and customers demand more speed, transparency, and trust, these are the standout opportunities AI creates for crypto banks in 2026:

-

Intelligent Chatbots & Virtual Assistants

AI chatbots act like always-available digital bankers, guiding users through wallet setups, answering crypto-specific questions (like “What gas fee did I pay?”), and even initiating simple transactions. They reduce support costs while delivering a faster, more engaging customer experience.

-

Customer Behavior Analytics

AI observes how people spend, save, swap, and hold tokens. By recognizing patterns, it creates detailed customer profiles that help banks tailor services. For example, if someone consistently holds stablecoins, AI may suggest yield products or low-risk lending options. Hence, creating a personalized approach instead of a one-size-fits-all banking approach.

-

Analyzing Market Trends

Crypto markets move fast, often influenced by news, blockchain activity, or even memes. AI tools track these signals from social sentiment, trading volumes, and on-chain metrics. With predictive models, crypto banks can manage risk better, adjust loan rates quickly, and launch timely products in response to emerging trends.

-

Smarter Portfolio Management

Managing crypto portfolios manually can be overwhelming. AI for banking simplifies this by recommending rebalancing strategies based on risk profiles and market movements. If a DeFi token surges, AI highlights the opportunity. If exposure becomes risky, it suggests reducing allocation. This gives customers smarter, data-backed portfolio services that adapt instantly.

-

Proactive Risk Management

Volatility defines crypto banking, and AI provides real-time monitoring to control it. By analyzing liquidation risks, macroeconomic shifts, and wallet activity, it flags potential threats early. Crypto banks benefit from reduced default rates, while customers enjoy more stable services. This makes risk management a proactive process rather than a reactive one.

-

Fraud Detection and Lending

Fraudulent activity is rampant in crypto, but AI detects unusual wallet behavior faster than human teams. Beyond fraud, AI helps in lending decisions by analyzing blockchain history, spending patterns, and even social activity. This offers alternative credit scoring for users without traditional financial histories, expanding access to crypto credit.

-

Smart Contract Analysis

Smart contracts power most of crypto banking, but bugs and risks can be costly. AI scans code at scale, flagging vulnerabilities, misconfigurations, or suspicious clauses. Automating audits saves banks significant resources while ensuring safer contract execution, making DeFi products more trustworthy for both institutions and retail users.

-

Automated Finance Report Generation

Reporting is essential in crypto banking for compliance, audits, and transparency. AI automates report creation by pulling transaction data, holdings, and activity into structured documents. These can be generated in seconds, eliminating manual formatting errors. For banks, this improves efficiency and ensures faster response to regulatory or investor demands.

-

Predictive Customer Support

AI doesn’t just answer questions, it anticipates them. By studying user history, it can predict when someone might ask about withdrawals, loan deadlines, or portfolio losses. Crypto banks can then reach out proactively with guidance, reducing customer anxiety and positioning themselves as more supportive, forward-looking institutions.

-

Regulatory Compliance Automation

Compliance is a major challenge in crypto, with rules differing across countries. AI helps crypto banks stay ahead by scanning transactions for AML (Anti-Money Laundering) compliance. That involves flagging suspicious activities and preparing KYC documents automatically. This not only prevents penalties but also builds stronger trust with regulators and customers alike.

These AI development solutions are playing a key role in the growth of your business. Make sure of your goal and reach a reliable partner to integrate AI for your crypto banking services.

Can Predictive Analytics Simplify Crypto Banking Strategies?

Crypto-friendly banks are now getting traction among users through their quick services. AI crunches historical price data, network activity, and on-chain signals to forecast shifts. These insights help banks adjust lending rates or liquidity strategies before the next wave hits.

Crypto banks and startups can use these models to offer products like dynamic yield strategies. Institutions also gain tools to hedge risk or launch algorithmic products confidently.

Real-World Examples of AI in Crypto Banking

While AI in crypto banking is still emerging, several banks and fintech innovators are already showcasing how transformative it can be:

1. JPMorgan Chase – AI for Fraud Detection in Digital Assets

JPMorgan has been leveraging AI-powered systems to monitor blockchain transactions and detect suspicious activity in real time. This helps the bank strengthen compliance while reducing fraud losses in crypto-linked services.

2. Revolut – Personalized Crypto Investment Insights

Revolut, a global fintech, uses AI to deliver personalized investment recommendations based on customer trading behavior. The platform helps users manage crypto portfolios more effectively, enhancing retention and customer satisfaction.

3. Binance – AI-Driven Customer Support

Binance integrated AI-powered chatbots to handle 24/7 customer queries across multiple languages. This has cut response times drastically, reduced support costs, and improved user trust in its platform.

4. PayPal – Risk Management with AI

PayPal uses AI models to analyze transaction patterns and mitigate risks in its crypto services, enabling safer on- and off-ramp services for millions of users.

5. Early Adopters in 2026

Several mid-sized fintechs and regional banks are now piloting AI-based smart contract audits, automated compliance systems, and predictive customer support. Early data suggests up to 40% faster loan approvals and a 25% drop in fraudulent activity compared to traditional methods.

Future of AI in Crypto Banking

Agentic AI will start managing portfolios, loans, and risk autonomously. It’ll still work under human oversight, but the time to act will shrink dramatically. AI will optimize routing, settlement times, and compliance for CBDCs and cross-border crypto. AI-driven smart contracts will make payments faster, seamless, and smarter.

AI in crypto banking needs clear guardrails. In traditional banking, regulators push for transparency and fairness. Crypto banks will follow, with frameworks evolving throughout 2026 and beyond.

Looking ahead, AI will provide real-time financial coaching, guiding users on when to trade, how to diversify portfolios, and which lending options fit their unique risk appetite. This moves crypto banking from transactional to advisory.

Conclusion

AI is no longer just an add-on to crypto banking—it’s becoming the backbone of smarter, safer, and more personalized digital finance. As 2026 unfolds, the banks and fintechs that embrace AI will be the ones setting the pace for innovation in the global financial ecosystem.

At SoluLab, we specialize as a white label crypto bank development company, helping businesses integrate cutting-edge AI solutions into their crypto banking platforms. Recently, we partnered on AmanBank, a generative AI-powered mobile banking platform, showcasing how AI can transform customer experiences in digital finance.

Contact us to become a trusted AI development partner and design and implement next-generation solutions that stay ahead of the curve.

FAQs

1. How is AI changing crypto banking in 2026?

AI is making crypto banks smarter with instant KYC, fraud detection, predictive trading insights, and personalized portfolios, helping both startups and big institutions operate faster and safer than ever.

2. Can AI really predict crypto price swings?

Yes, AI analyzes blockchain data, trading volumes, and even social sentiment. While it can’t guarantee accuracy, it helps banks prepare for market shifts before turbulence actually hits.

3. Is AI safe to use in crypto banking?

AI makes systems safer by spotting fraud in real time and automating compliance. But human oversight and clear regulations are essential to keep it reliable and fair.

4. Can AI help me if I’m just a casual crypto investor?

Absolutely! AI tools can suggest better portfolio allocations, warn you before risky moves, and even explain your fees. It’s like having a friendly financial advisor in your pocket.

5. How can I get started with SoluLab for AI crypto banking development?

Getting started is simple! You can reach out to our team through our website’s contact form or schedule a free discovery workshop. We’ll first understand your business goals, assess your current systems, and then propose a tailored roadmap.