Running a startup today means managing rapid growth, global clients, and complex cash flows. Traditional treasuries, such as fiat, bonds, or cash, are no longer enough. A digital asset treasury provides a practical and compliant way to manage cryptocurrencies, stablecoins, and tokenized assets as part of your corporate finances, transforming digital holdings into a strategic, risk-managed tool.

With 30% crypto adoption and 500,000 daily traders generating US$34 billion in transactions by mid-2024, companies in UAE need a solid digital asset treasury strategy.

Whether in fintech, logistics, or e-commerce, startups in the UAE can leverage these solutions to strengthen partnerships, attract investors, and signal innovation. In this guide, we explore how UAE digital asset treasury works, its benefits, and the practical steps for implementing a compliant, scalable system.

What is Digital Asset Treasury?

A digital asset treasury is all about managing and organizing your company’s cryptocurrencies, like Bitcoin and Ethereum, along with stablecoins such as USDC or USDT. Unlike traditional treasuries that work with cash or bonds, a digital asset treasury operates 24/7 across borders, giving you real-time control and visibility over your holdings.

Having a clear digital asset treasury strategy ensures your operations follow UAE regulations like VARA, ADGM, and DIFC. For businesses, digital assets treasury management solutions make it easier to handle market fluctuations. You can diversify your portfolio, earn staking rewards, or use DeFi tools to generate returns.

Why UAE Businesses Must Implement Digital Asset Treasury?

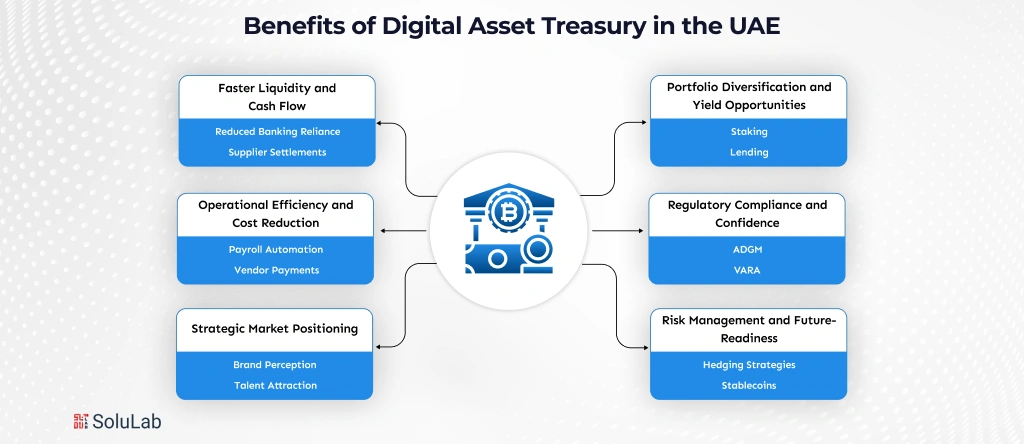

It is a strategic business decision to implement a digital asset treasury strategy in the United Arab Emirates. Startups that adopt it gain multiple advantages that directly impact growth, efficiency, and market credibility:

1. Faster Liquidity and Cash Flow

Using treasury digital assets allows businesses to make cross-border payments in minutes instead of days. This speeds up supplier settlements, reduces reliance on traditional banking intermediaries, and ensures your company always has the right cash available for operations. For a startup, faster liquidity directly translates into stronger relationships and smoother workflows.

2. Portfolio Diversification and Yield Opportunities

By holding stablecoins and tokenized assets, startups can earn additional revenue streams through staking, lending, or decentralized finance (DeFi) protocols. Moreover, diversifying your treasury with digital assets reduces exposure to local currency volatility, giving startups an edge against economic fluctuations while keeping funds productive.

3. Regulatory Compliance

The UAE has developed progressive regulations through ADGM and VARA. Startups following these frameworks gain credibility with investors, financial institutions, and business partners. Demonstrating adherence to regulatory standards positions your company as trustworthy.

4. Operational Efficiency and Cost Reduction

Using digital assets minimizes FX conversion fees, reduces manual reconciliation, and allows finance teams to focus on strategic tasks instead of routine transactions. This efficiency is especially critical for startups scaling operations across multiple markets.

5. Strategic Market Positioning

Maintaining a forward-looking treasury with digital assets signals innovation to clients, investors, and talent. For startups, this translates into stronger brand perception, easier access to partnerships, and the ability to attract tech-savvy employees who value modern, agile companies.

6. Risk Management and Future-Readiness

By combining hedging strategies, stablecoins, and diversified holdings, businesses can protect against sudden market swings while keeping treasury operations flexible. This ensures resilience, even in uncertain economic conditions.

By leveraging these advantages, UAE startups can turn their treasury into a strategic growth engine, improving efficiency, compliance, and innovation.

Core Components of a Digital Asset Treasury Solution

A digital asset treasury solution is a structured system that helps UAE startups manage their digital assets safely, efficiently, and in compliance with local regulations. For companies, a robust treasury ensures liquidity, reduces risk, and enables better financial decision-making. Here’s what makes an effective solution:

1. Secure Custody

Institutional-grade wallets with multi-party computation (MPC) and insurance ensure no single point of failure. Partnering with the best company for digital asset treasury management ensures your assets are protected and compliant.

2. Liquidity and Trading Access

A treasury works best when assets can move freely. Integration with exchanges and OTC desks allows real-time trading and quick access to funds. This supports a digital asset treasury strategy that keeps your business agile and responsive to market changes.

3. Compliance Tools

UAE regulations, including VARA and ADGM frameworks, require careful monitoring. Automated AML and transaction tracking tools help companies stay compliant, reduce risk, and maintain credibility with investors.

4. Analytics & Reporting

Dashboards provide visibility into portfolio performance, risk exposure, and returns. For companies, these insights make reporting to stakeholders straightforward and help guide strategic decisions.

5. System Integration

Modern treasury solutions should connect seamlessly with ERP, accounting, and business systems. APIs automate payments, reconciliations, and reporting, making management of digital assets simpler and more efficient.

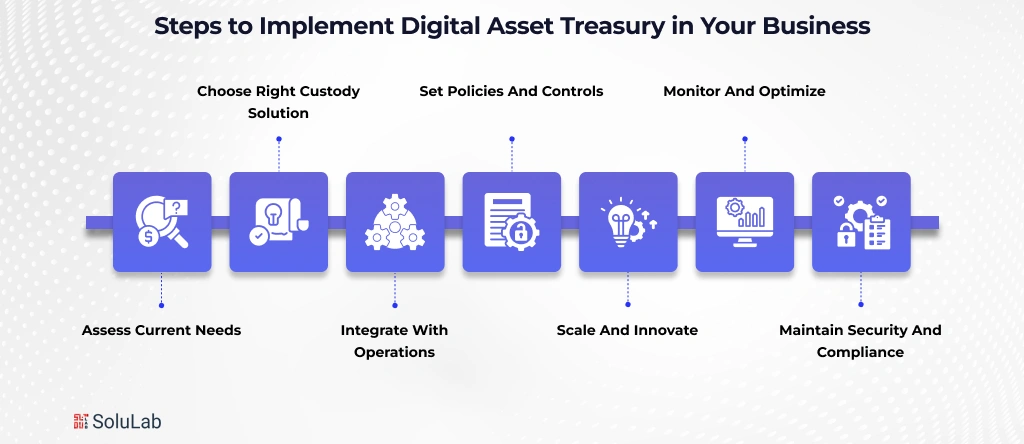

How to Implement a Digital Asset Treasury in Your Business Operations?

A well-structured digital treasury not only improves liquidity but also reduces dependence on traditional banking systems while opening doors to global financial opportunities. Here’s a step-by-step guide on how to implement it effectively:

1. Assess Your Current Needs

Before adding crypto to your treasury, evaluate what you already hold. Look at your cash flow, existing investments, and payment processes. Decide which digital assets, like Bitcoin, Ethereum, or any popular stablecoins, fit your business goals. This step is about understanding your exposure and defining your digital asset treasury strategy.

2. Choose the Right Custody Solution

Decide between self-custody (where you manage private keys in-house) and third-party custody (using regulated custodians or institutional-grade wallets). Verify the presence of secure multi-sig wallets, real-time reporting, and API integration with your existing systems.

3. Set Policies and Controls

Ensure compliance with VARA, ADGM, and DIFC regulations. These policies ensure compliance and security, making your treasury digital assets safe from unauthorized access. Partner with legal and audit firms familiar with digital asset reporting.

4. Integrate with Operations

Connect the treasury to your business systems like ERP, accounting, and payroll platforms. Automate payments, track asset performance, and reconcile with fiat accounts. Integration ensures that UAE digital asset treasury functions smoothly across your operations, turning it into a strategic business tool.

5. Monitor and Optimize

Use dashboards and analytics to track holdings, performance, and risks. Explore staking or lending opportunities to generate additional yield from stablecoins or other digital assets. This step helps your digital asset treasury strategy stay agile and profitable.

6. Scale and Innovate

Once established, you can expand by tokenizing assets, integrating DeFi tools, or exploring cross-border treasury operations. High-growth startups can even adapt US Treasury platform development practices to their UAE operations for advanced portfolio management.

7. Maintain Security and Compliance

Regularly audit wallets, monitor regulatory changes, and update policies. Stay aligned with the standards of VARA, ADGM, and DIFC. Security isn’t a one-time setup; it’s continuous. Following these practices ensures that your company’s digital asset treasury management remains trustworthy and business-ready.

Best Practices for Managing a Digital Asset Treasury

Managing a digital asset treasury requires a strong focus on security. Businesses handling crypto or tokenized assets must protect their funds from cyber threats, internal errors, and system failures. A single mistake can cost millions, so security is fundamental.

Here’s how to build a secure and compliant treasury setup in the UAE:

- Use Multi-Signature Wallets: Every high-value transaction should require multiple approvals. This ensures no single individual can move funds independently, reducing fraud and internal risk.

- Separate Cold and Hot Wallets: Keep cold wallets offline for long-term asset storage and use hot wallets online for daily transactions. This balance limits exposure while maintaining operational flexibility.

- Add Hardware Encryption: Use hardware-based security keys or devices to encrypt wallet data. It adds a physical layer of protection that’s difficult to compromise.

- Conduct Regular Audits: Schedule independent security audits and simulate attacks to find vulnerabilities before hackers do. Continuous testing keeps your system resilient.

- UAE Compliance Standards (FSRA, VARA, SCA): Ensure your setup complies with local regulations. These frameworks are designed to make sure treasury digital assets are managed transparently and securely.

- Build Investor and Client Trust: A secure treasury doesn’t just protect funds, it enhances your company’s credibility with partners, clients, and investors, showing that your business operates with professional financial governance.

Integrating Digital Asset Treasury Solutions with Business Operations

A well-integrated digital asset treasury isn’t just about holding crypto; it’s a growth engine for modern businesses. Here’s how integration can transform your operations:

-

Enable Seamless System Connectivity:

Link your treasury directly with your ERP and accounting software to automate entries, reconciliation, and financial reporting. This reduces manual work and improves accuracy.

-

Use Crypto for Cross-Border Payroll:

Pay international employees or contractors using digital assets, cutting down foreign exchange (FX) fees and improving payment timelines, especially useful for global startups and remote teams.

-

Tokenize Invoices for Faster Settlements:

Convert invoices into tokenized assets to enable instant settlements using smart contracts. This is especially effective in logistics, trade, and supply chain industries where delays can impact operations.

-

Partner with Crypto Treasury Companies:

Work with top crypto treasury companies in the UAE that specialize in secure, compliant setups. They ensure your treasury follows VARA and FSRA standards from the start.

-

Improve Cash Flow Visibility:

Integrated dashboards provide real-time visibility into your company’s digital asset balances, transactions, and performance, giving you better control over liquidity and decision-making.

-

Enhance Operational Efficiency:

Automation reduces errors, saves time, and streamlines complex financial processes, helping teams focus on growth instead of manual financial management.

-

Build Global Scalability:

Integration makes your business ready to scale globally, offering smoother international transactions and a modern reputation that attracts investors and partners.

By integrating digital asset treasury solutions into your daily operations, you’re not just improving finance, you’re future-proofing your business.

Real Life Examples of Digital Asset Treasury Solutions

1. M2 Crypto Exchange & Haruko

Problem: Fragmented crypto holdings across crypto exchanges, OTC desks, and wallets, and a Lack of real-time visibility and slow compliance reporting.

Solution:

- Partnered with Haruko, an institutional digital asset treasury platform.

- Integrated on-chain, OTC, and exchange data into one unified dashboard.

Impact:

- 75% faster response to market shifts.

- Improved liquidity and compliance visibility.

- Stronger digital asset treasury strategy for long-term scalability.

2. Onesafe’s Corporate Adoption Surge

Problem: Startups struggled with manual tracking, high cross-border payment costs, and slow settlements.

Solution:

- Adopted a digital asset treasury solution using stablecoins like USDC for payroll and B2B payments.

Impact:

- UAE companies using Onesafe’s model grew from 70 to 200 within a year.

- Instant settlements, lower fees, and better liquidity control.

- Proven demand for treasury digital assets in UAE startups.

Conclusion

By working with leading digital asset treasury companies in the UAE and following structured steps, startups can turn crypto holdings into strategic business assets that power real operations, not just speculation. The goal is to start small, stay compliant, and scale wisely while building a treasury system that supports everyday business needs.

SoluLab, a leading asset tokenization company in UAE, can help build custom digital asset treasury management solutions tailored to your business. From integrating blockchain solutions to automating compliance workflows, we ensure your treasury operations stay secure, efficient, and ready for scale, aligning with both the UAE’s crypto regulations and global financial standards.

If you are looking for top tokenization solutions, contact us right now!

FAQs

1. What types of digital assets can UAE businesses manage with a treasury solution?

Covers cryptocurrencies, stablecoins, tokenized assets, and other digital holdings that enterprises typically handle.

2. How does a digital asset treasury work in the UAE?

It runs under the VARA and ADGM frameworks, providing secure crypto custody, automated compliance reporting, and easy integration with your existing accounting or ERP systems.

3. How can a digital asset treasury improve financial reporting and compliance for UAE companies?

Focuses on transparency, audit readiness, and alignment with UAE regulatory standards like ADGM and DIFC guidelines.

4. How can a digital asset treasury help with cross-border payments?

With stablecoins and on-chain settlements, UAE startups can send or receive international payments in minutes, avoiding long banking delays and high FX fees. This helps businesses improve cash flow and strengthen global partnerships.

5. What’s the future of digital asset treasuries in the UAE?

The UAE is rapidly becoming a global crypto hub, and businesses that adopt digital asset treasury solutions early will gain a major competitive edge. As regulations mature and more US treasury platform development parallels emerge in the crypto space, UAE startups will have access to world-class tools for secure and scalable treasury management.