Web2 brands are struggling to truly connect with their audiences. Social media algorithms change constantly, data privacy is a growing concern, and engagement often feels one-sided. Fans want more than likes and comments.

Here’s where the frustration kicks in. Traditional platforms limit interaction. Even the most loyal fans are reduced to passive spectators. For brands, this means lost opportunities for deeper loyalty and community-building.

But what if we tell you, that fans can own a piece of the brand experience? That’s exactly what fan tokens in Web3 offer. They’re not just digital coins—they’re keys to access, influence, and connection.

From sports teams to global fashion houses, major Web2 brands are stepping into Web3 to build vibrant, decentralized communities where fans don’t just follow—they participate. In this blog, we’ll break down why this shift is happening and what it means for the future of engagement.

What Are Fan Tokens?

Fans can purchase, possess, and utilize fan tokens, which are essentially digital badges or special passes, to strengthen their bonds with their preferred brands, sports teams, or celebrities. These tokens are safe, transparent, and may even have actual value because they are based on blockchain technology, unlike standard loyalty points or fan clubs.

Fans now have a new method to express their support, receive special benefits, and occasionally even vote on brand decisions, such as selecting the music for a major event or designing a jersey. They have more power over their digital assets due to these tokens, which are part of a larger movement towards decentralized digital ownership.

Over 70 major sports teams have integrated these, including FC Barcelona, Paris Saint-Germain, and Manchester City.

A number of fan tokens have stood out in terms of user interaction and market valuation as of April 2025:

Why Fan Tokens Are Getting Popular?

Fan tokens are recently changing the game for brands since they bring additional advantages to interacting with fans. Fan tokens are widely considered important for several reasons.

- Direct Interaction with Fans: Fan tokens allow brands to connect to their audience personally, without relying on intermediaries. As a result, fans and the brand can have instant exchanges, feel supported, and feel more connected.

- High Brand Loyalty and Retention: Having tokens makes fans feel connected to the brand and stick with it. There is a bigger chance they will stay, and often engage and endorse the brand.

- Marketing and Promotion Opportunities: Brands can use fan tokens to design contests and special drops, and give voting powers to fans, all of which help make marketing more lively and productive.

- Data Ownership and Privacy Benefits: With fan tokens, fans are made owners of their data, which helps earn their trust and shows respect for their privacy.

- Global Fanbase Expansion: Anyone, anywhere, can use fan tokens because they are stored on the blockchain. By using digital tools, brands can connect with and interact with fans in every part of the world.

- Fan Tokens Support Community: Fans can take part in community-run discussions through fan tokens, which ensures the fans are part of the process.

- New Revenue Streams: Aside from merchandise or services, fan tokens let teams and leagues secure more earnings through selling tokens, giving unique experiences, and entering partnerships in Web3.

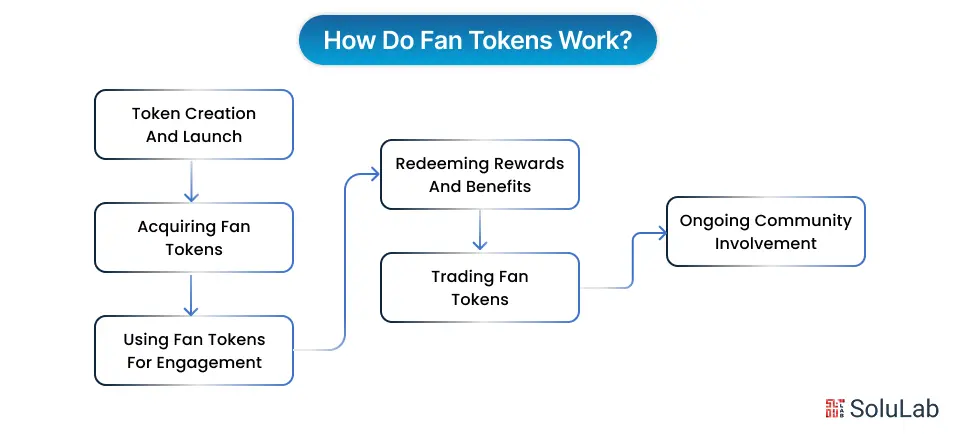

How Do Fan Tokens Work?

Here’s a simple way to understand how they work and bring value to both fans and brands:

Step #1. Token Creation and Launch

- A sports club, artist, or organization partners with a blockchain platform to create its own fan tokens.

- These tokens are minted (created) as digital assets on a blockchain, making them secure, transparent, and easy to trade.

- The tokens are usually released through a sale or distribution event where fans can buy or earn them.

Step #2. Acquiring Fan Tokens

- Fans purchase fan tokens using cryptocurrency or fiat currency on supported exchanges or platforms.

- Sometimes, tokens are distributed as rewards for loyalty, participation in contests, or promotional events.

- Once acquired, tokens are stored securely in a digital wallet owned by the fan.

Step #3. Using Fan Tokens for Engagement

- Fans use their tokens to participate in exclusive polls, votes, and decisions related to their favorite team or artist.

- Examples include voting on jersey designs, choosing songs for concerts, or selecting matchday experiences.

- This voting power gives fans a voice and a sense of influence, creating a more interactive community.

Step #4. Redeeming Rewards and Benefits

- Holding fan tokens can unlock access to special perks like VIP tickets, meet-and-greet opportunities, merchandise discounts, and exclusive content.

- Some fan tokens provide access to private chats, behind-the-scenes updates, or early access to events.

Step #5. Trading Fan Tokens

- Since fan tokens are digital assets on the blockchain, they can be bought, sold, or traded on cryptocurrency exchanges.

- The value of fan tokens fluctuates based on demand, team performance, and fan engagement.

- This trading aspect creates a marketplace where fans can potentially profit or invest more in their passion.

Step #6. Ongoing Community Involvement

- Fan token holders form a loyal, engaged community that continuously interacts with the team or brand.

- Teams often release new tokens, run special campaigns, or update benefits based on community feedback.

- The ecosystem grows as more fans join, increasing the token’s utility and value.

The Future of Fan Tokens

As more brands and sports teams explore Web3, fan token platforms are set to become a key tool for deeper, more interactive fan engagement.

Looking ahead, fan tokens are expected to offer fans more than just voting rights—they’ll provide access to exclusive experiences like VIP events, personalized content, and even augmented reality interactions. With advancements in AI and blockchain technology, these tokens will enable fans to have tailored experiences based on their preferences and past interactions.

Moreover, the integration of Web3 fan tokens into official club apps is on the rise, making it easier for fans to engage with their favorite teams. This integration improves the overall fan experience, allowing for real-time interactions and rewards.

However, the future isn’t without challenges. Market volatility and regulatory uncertainties remain concerns that need addressing. Despite these hurdles, the potential for fan tokens to improve fan engagement is immense.

Conclusion

Fans want connection, and brands seek loyalty; fan tokens are proving to be a powerful bridge. Major Web2 brands are using this Web3 innovation not just for hype, but because it genuinely changes how they engage with their audience.

From creating stronger communities to new revenue streams, fan tokens offer a win-win for both sides. As technology continues to grow, we’re likely to see even more creative and meaningful ways these tokens shape brand-fan relationships. If you’re a brand still watching from the sidelines, now might be the perfect time to jump in.

SoluLab, a token development company, can help you create a fan token and offer expert guidance on it. Contact us today to discuss further!

FAQs

1. Are fan tokens the same as NFTs?

Not exactly. While both are blockchain-based, fan tokens usually have utility like voting or access, whereas NFTs are unique digital assets used mostly for collectibles and media.

2. Are fan tokens safe to use?

Fan tokens are generally safe when issued by credible platforms using secure blockchain technology and backed by reliable crypto token development services. However, users should be cautious and do research before purchasing.

3. Can small brands also use fan tokens?

Fan tokens aren’t just for big names—small or niche brands can also leverage a token development solution to build tight-knit communities and increase fan engagement.

4. Which industries are leading in fan token use?

Sports and entertainment industries are leading the charge, but other sectors like fashion, gaming, and lifestyle are quickly catching up.

5. Can fan tokens help brands go global?

Yes, because fan tokens are digital and borderless, they allow brands to reach and engage a global audience more efficiently than traditional methods.