Silver tokenization is changing how real assets are owned and traded in today’s digital economy. Businesses are now digitizing silver holdings to create blockchain-based investment products with global reach.

The tokenized precious metals market crossed $1 billion in value, with silver-backed tokens contributing a fast-growing share. Silver climbed above $48.3 per ounce on 06.10.2025, its highest level since April 2011.

For startups and enterprises, the opportunity lies in developing regulated platforms that connect physical vaults with blockchain systems. As digital finance evolves, silver tokenization platforms are set to redefine how precious metals are issued, traded, and monetized across decentralized ecosystems.

What is Silver Tokenization?

Silver tokenization is converting the ownership of physical silver into blockchain-based digital tokens. Each token directly corresponds to a measurable quantity of silver, often a gram or ounce, stored securely in a licensed vault.

- CoinLaw also states that the overall RWA token market value (tokenized real-world assets) grew ~85% year-on-year to $15.2 billion in early 2025.

- The DamRev article notes that tokenization “significantly enhances liquidity” for silver, making buying, selling, and trading easier.

The tokenization of precious metals, particularly silver, democratizes investment and opens access to a once-exclusive market. Businesses and issuers use tokenized silver to raise funds, enhance transparency, and reach a global audience through regulated blockchain platforms.

Why Silver Tokenization Matters for Precious Metal Investments?

Silver is both an industrial and investment metal. Hence, it appeals to a diverse investor base. Tokenized precious metal systems simplify the buying, selling, and trading of silver while eliminating intermediaries.

- Direct ownership of silver-backed digital assets

- Transparent and verifiable transactions

- 24/7 trading through blockchain platforms

- Lower entry barriers for global investors

Silver’s industrial use in electronics, renewable energy, and healthcare makes its demand stable, providing a strong foundation for tokenized versions to gain traction.

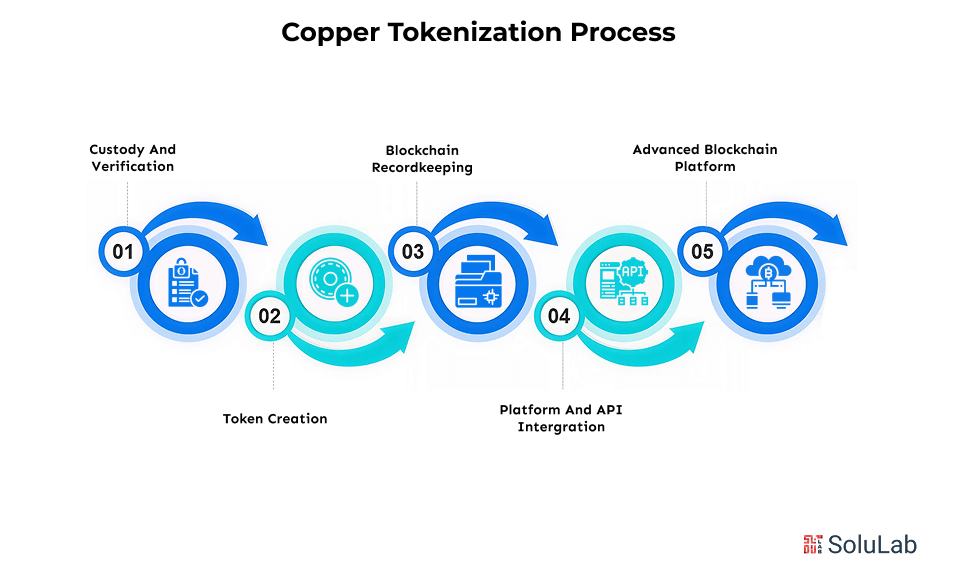

Step-by-Step Process for Silver Tokenization Platform Development

Developing a silver-backed token platform involves integrating blockchain, legal, and financial infrastructure. Each stage ensures compliance, security, and investor confidence. Let’s check the roadmap in detail:

-

Asset Selection and Custody

Silver assets are stored in secure, regulated vaults managed by trusted custodians. Before token creation, each batch of silver undergoes documentation and third-party verification to ensure legitimacy.

-

Legal Structuring and Compliance

A regulatory framework defines how ownership is represented through digital tokens. Developers must integrate compliance protocols covering KYC/AML, jurisdictional licensing, and investor protection standards.

-

Token Creation

After verification, silver ownership data is converted into blockchain-based RWA tokens. Smart contracts automate ownership transfer, redemption, and revenue-sharing mechanisms.

-

Primary Offering and Investor Access

Companies launch the silver-backed token through an STO (Security Token Offering) or private issuance. The process enables direct capital raising while maintaining compliance.

-

Secondary Market Trading

Once listed, tokens trade on licensed RWA exchanges or decentralized platforms. This step increases liquidity, allowing investors to buy or sell their holdings instantly.

-

Redemption & Liquidity Management

Investors can redeem tokens for physical silver or receive settlement in fiat/crypto. Vault integration and transparent audits maintain investor trust.

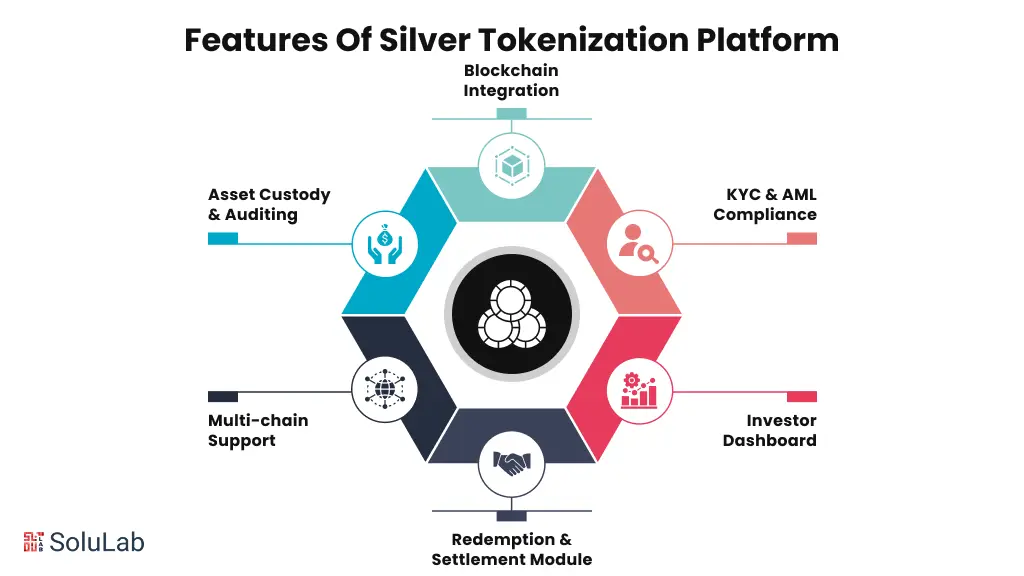

Must-Have Features in Silver Tokenization Platform

A successful silver asset tokenization platform requires secure architecture, transparency tools, and smooth investor experiences. Some of the key features that the platform should include are:

-

Blockchain Integration

Blockchain ensures real-time verification of ownership, audit trails, and traceability. Smart contracts automate the creation, transfer, and redemption of tokens.

-

KYC & AML Compliance

A built-in compliance module helps issuers verify investor identity and meet regulatory norms. Automated KYC ensures safe onboarding and transparent operations.

-

Asset Custody & Auditing

The platform must integrate with certified custodians and support real-time auditing. Custodial data links directly with token supply, ensuring every token represents actual silver.

-

Investor Dashboard

A user-friendly dashboard provides portfolio tracking, transaction history, and live metal valuation. It enhances transparency and user trust.

-

Multi-chain Support

Supporting multiple blockchains such as Ethereum, Polygon, or BNB Chain increases interoperability and flexibility for businesses targeting global investors.

-

Redemption & Settlement Module

This feature enables investors to redeem tokens for physical silver or equivalent fiat value. It guarantees asset convertibility and market confidence.

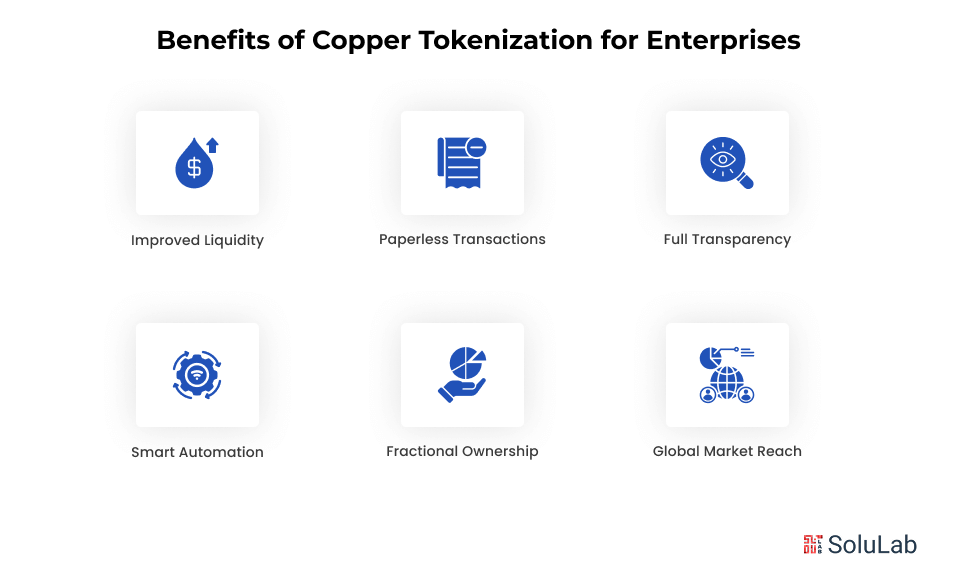

Investors & Issuers: Benefits of Silver Tokenization in Modern Finance

Tokenized precious metals redefine traditional investment by providing equal advantages for investors and issuers.

Benefits for Investors

- Fractional Ownership: Investors can own small quantities of silver without physical storage concerns.

- Liquidity: Tokenized silver can be traded across platforms, offering instant access and flexible exit options.

- Transparency: Blockchain ensures every transaction and ownership record remains verifiable.

- Lower Costs: The elimination of intermediaries reduces overall transaction expenses.

Benefits for Issuers

- Capital Raising: Issuers can attract global investors through regulated token sales.

- Operational Efficiency: Automated processes reduce manual verification and settlement delays.

- Regulatory Compliance: Built-in legal structuring maintains trust among institutional investors.

- Brand Credibility: Offering tokenized silver enhances corporate reputation as a tech-forward asset issuer.

Real-World Examples of Silver Tokenization

Real-world projects highlight how silver tokenization is evolving into a scalable financial solution.

-

tSILVER (tXAG)

tSILVER is a silver-backed token fully collateralized by 99.9% LBMA-accredited silver stored in insured vaults. Each token equals one gram of physical silver and can be redeemed upon request.

-

Other Precious Metal Tokenization Projects

Projects like Paxos Gold (PAXG) and Matrixdock’s XAUm paved the way for similar silver-based tokens. Companies developing gold tokenization platforms can replicate these proven models with enhanced automation, DeFi integration, and NFT-linked ownership tracking to create silver tokenization platforms.

-

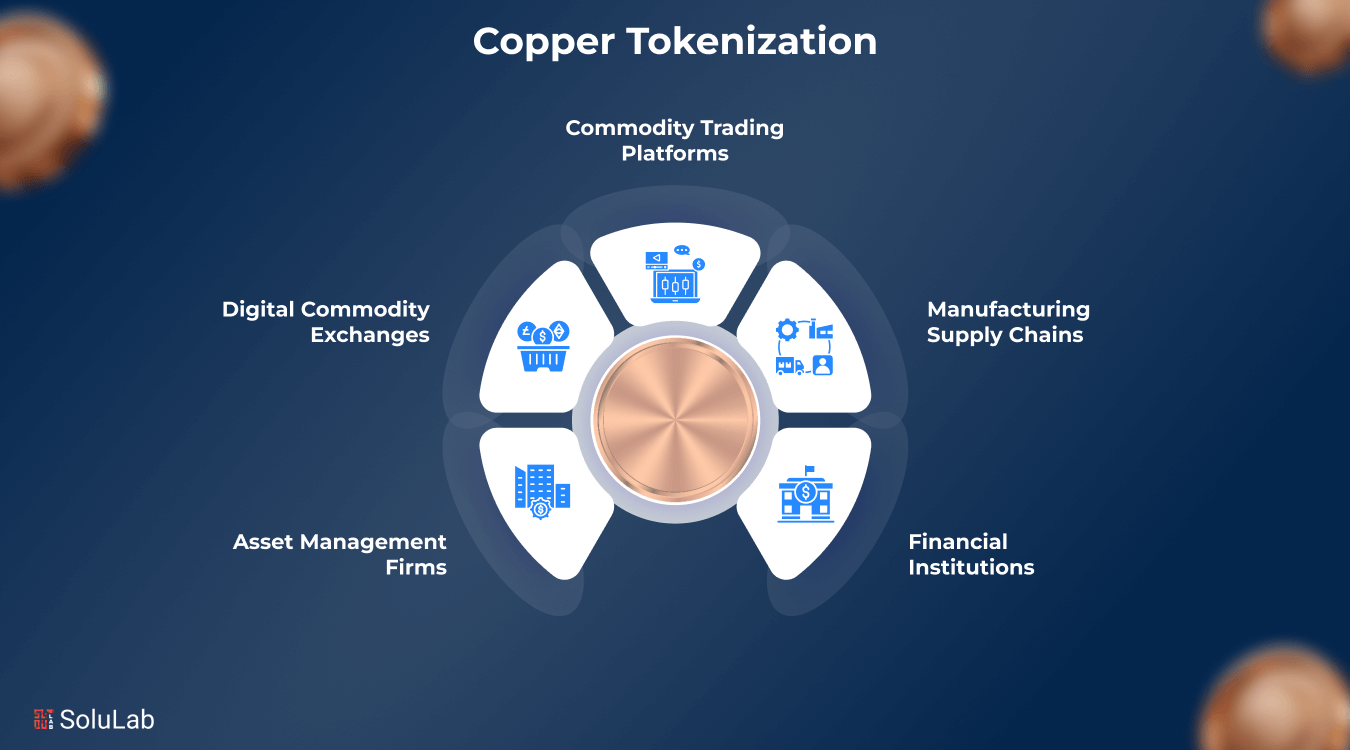

Expanding to Other Commodities

Beyond silver, new initiatives now focus on diamond tokenization, copper tokenization, and other metals. A real-world asset tokenization development company can create multi-asset frameworks enabling investors to diversify across various commodities.

Silver Tokenization Future Trends & Outlook

The silver-backed token market is rapidly expanding, attracting both institutional and retail interest. Current market capitalization stands around $186 million, reflecting early-stage yet promising adoption.

- Integration with DeFi Platforms: Tokenized silver will serve as collateral for decentralized lending, staking, and yield generation.

- AI-Powered Auditing Tools: Automated verification ensures every token is fully backed by real assets.

- Multi-Metal Tokenization Models: Platforms will merge gold, silver, diamond, and copper tokenization under unified ecosystems.

- Stablecoin Pairing: Silver-backed tokens may soon be paired with stablecoins for instant swaps and settlement.

As regulations mature, businesses offering silver-backed token development services will benefit from early adoption, transparency frameworks, and scalable smart contract models.

Companies building such platforms today stand at the intersection of digital innovation and real-asset economics, a position that can redefine modern finance.

Conclusion

Now you might have understood the silver tokenization benefits and what it can offer in the future. So, if you are also planning on a silver tokenization platform development, then SoluLab is here to aid you.

We, at SoluLab, the top real-world asset tokenization development company, specialize in converting RWAs into digital tokens. Making them more accessible and secure for trading. With tokenization, assets such as real estate, artwork, precious metals, and company shares are represented on the blockchain. Our expert is always there for you to aid in the latest integrations and build new applications based on the latest compliance.

Contact us today to get more details on RWA tokenization!

FAQs

1. What makes silver tokenization different from traditional silver investment?

Unlike traditional silver ownership, tokenization lets investors buy fractional shares digitally, trade instantly, and verify holdings on the blockchain, without worrying about storage, logistics, or middlemen.

2. How secure are silver-backed tokens for investors?

Each token is backed by verified silver stored in insured, regulated vaults. Blockchain records ensure transparency and traceability, minimizing fraud and guaranteeing every token represents real-world silver.

3. Can silver tokenization work for industrial use, not just investment?

Yes! Industries can tokenize silver reserves to manage inventory, hedge against price volatility, or enable automated supply chain settlements through smart contracts, blending finance with real-world utility.

4. Why choose SoluLab for silver tokenization platform development?

SoluLab combines blockchain expertise, compliance knowledge, and custom RWA frameworks to build secure, scalable silver tokenization platforms, helping businesses connect physical assets with digital markets efficiently.

5. Could silver tokenization lead to a new kind of digital economy?

Absolutely. As more commodities like silver, copper, and diamonds go on-chain, we’re moving toward an economy where physical assets flow seamlessly across global digital ecosystems, backed by transparency and trust.