As of 2025, green asset tokenization is projected to reach $50 billion by year-end showing how fast climate-focused digital assets are scaling. Companies like Bluebird and Arx Veritas have already tokenized $32 billion worth of Emission Reduction Assets (ERAs), preventing 394 million tons of CO₂—equivalent to 105× Iceland’s annual emissions.

This shift is powered by Net-Zero tokenization, a model that brings transparency, liquidity, and verifiable climate impact to global sustainability markets. By converting renewable energy projects, carbon credits, and emission-reducing assets into on-chain tokens, organizations gain real-time traceability and unlock new financing pathways for climate action.

Let’s break down how tokenization for Net Zero is reshaping climate finance and accelerating global sustainability goals.

Key Takeaways

$50B+ market growth: Green asset tokenization is becoming a major financing vehicle for climate-aligned investments.

Verifiable climate impact: Blockchain ensures transparent measurement, reporting, and verification (MRV) for carbon and renewable energy assets.

Global liquidity for sustainability: Tokenization unlocks 24/7 markets, fractional investing, and cross-border climate funding.

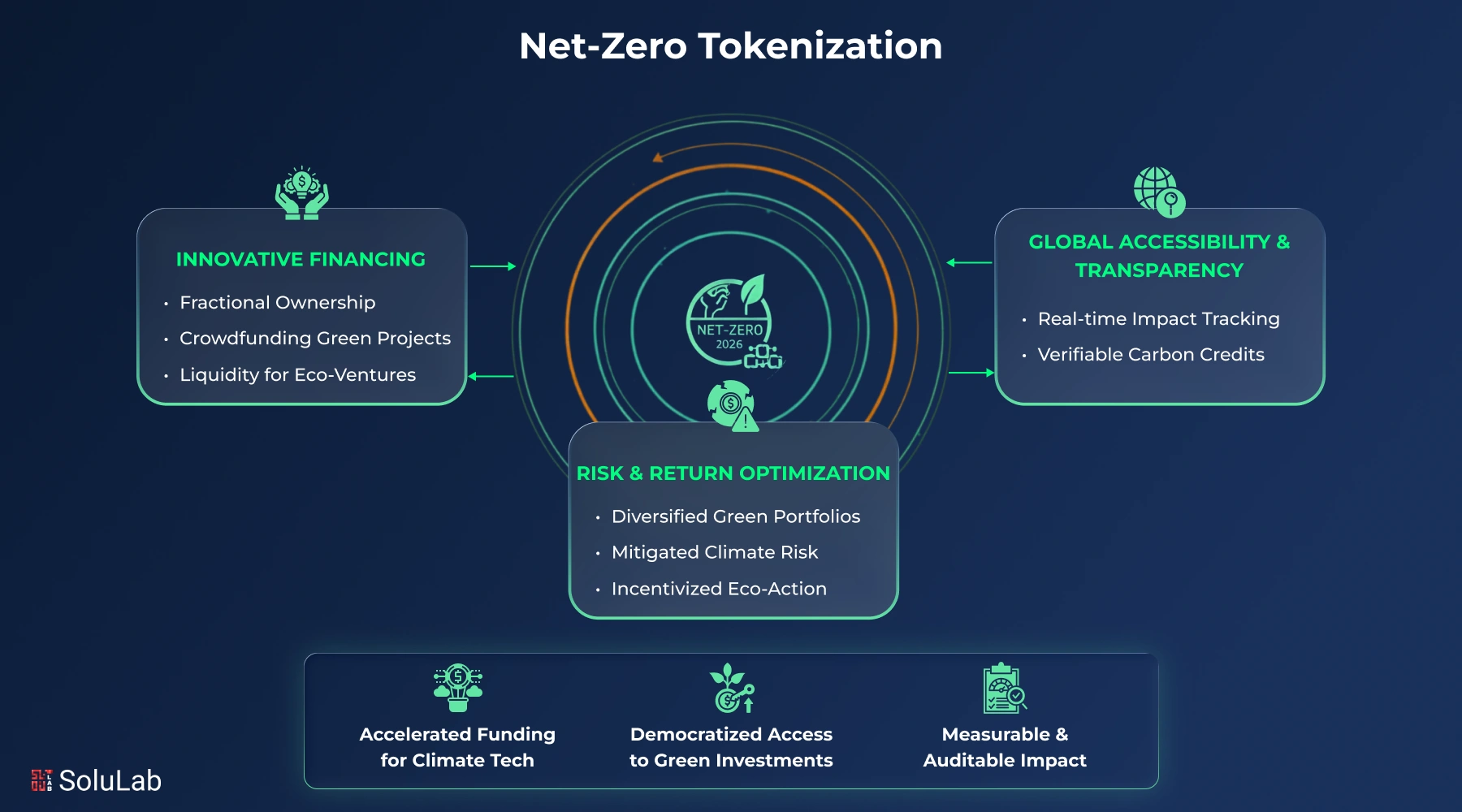

The Main Purpose of Net Zero Tokenization

The main goal of tokenization for Net Zero is to make climate finance accessible, liquid, and transparent. This is to enhance the traditional funding channels through technology. People using traditional funding channels often face delays. Net-zero tokenization converts climate-focused real-world assets into blockchain tokens. Leading to digital representation of renewable energy, carbon credits, or green bonds.

Key Objectives

- Transparency: Blockchain ensures every asset’s impact is traceable, reducing risks of greenwashing.

- Liquidity: Investors can buy, sell, and trade climate assets 24/7 instead of waiting years for returns.

- Inclusivity: Fractional ownership opens the door for small and medium investors to participate in green projects.

In short, Net Zero tokenization democratizes access to climate investments, balancing sustainability goals with financial growth.

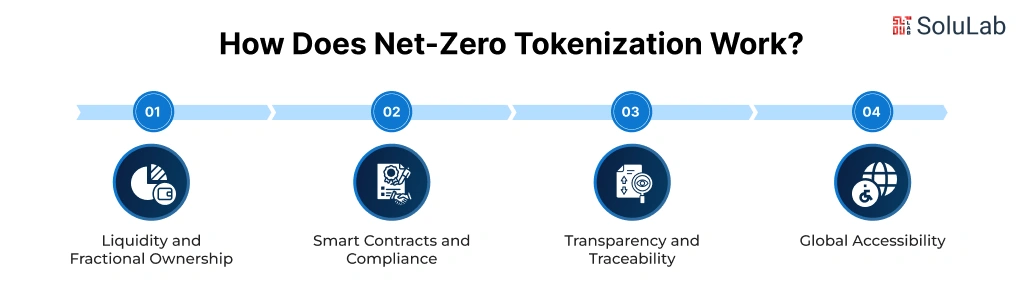

How Net-Zero Tokenization Actually Works?

Tokenization, at its core, converts climate-focused real-world assets into blockchain tokens. These tokens represent verifiable ownership or stake in a project such as a solar farm or reforestation initiative. The process combines smart contracts development, IoT integration, and regulatory frameworks to ensure both trust and compliance.

-

Liquidity and Fractional Ownership

Tokenized assets can be divided into smaller units, enabling wider participation. For instance, a $500 million wind farm project can now be broken into fractional tokens, letting smaller investors participate. Unlike traditional green bonds, these tokens can be traded in real time, ensuring liquidity.

-

Smart Contracts and Compliance

Smart contracts automate investments, compliance checks, and reporting. They align with standards like ISSB and TCFD, eliminating manual errors and delays. Moreover, administrative costs can be reduced by up to 90%, according to EY’s 2023 Blockchain Report.

-

Transparency and Traceability

Every tokenized transaction is recorded on blockchain ledgers. This traceability builds trust, simplifies ESG audits, and offers investors real-time insight into emission reductions.

-

Global Accessibility

Unlike traditional systems restricted by geography, tokenized ESG assets are globally accessible. A renewable energy firm in Asia can raise funds from investors in Europe or Africa seamlessly through an RWA tokenization platform development.

Why Global Net-Zero Goals Depend on Tokenization?

Achieving net-zero emissions by 2050 requires enormous capital. The International Energy Agency estimates $4-6 trillion in annual investments, reaching $125 trillion cumulatively. Current green bonds and loans, while essential, face liquidity constraints and high costs. Fragmented standards slow down reporting and verification, making global decarbonization harder.

Real-World Asset Tokenization as a Catalyst

Tokenization in ESG solves these hurdles by transforming assets into tradable, traceable tokens.

- Liquidity: Tokenized ESG assets can trade freely, unlike rigid green bonds.

- Accessibility: Fractional ownership lets community funds and individuals join high-value projects.

- Automation: Smart contracts streamline compliance with global ESG reporting norms.

In 2025, over $32 billion worth of tokenized ERAs have prevented 394 million tons of CO₂, a clear sign that Tokenization for carbon credits is redefining climate finance.

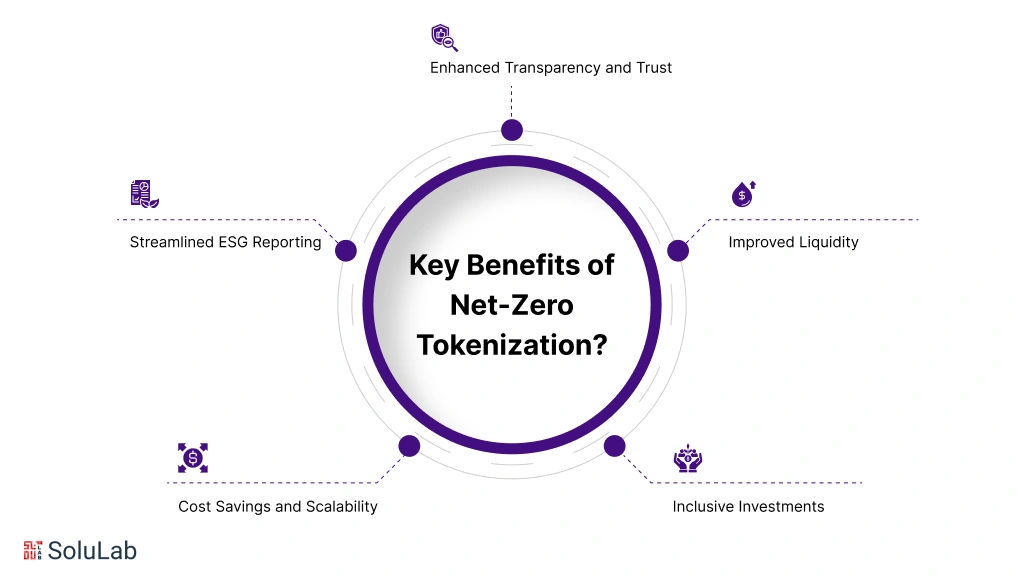

Why Enterprises Are Betting on Net-Zero Tokenization?

Corporations view Net-Zero tokenization not just as a sustainability move but as a strategic business advantage:

-

Enhanced Transparency and Trust

Immutable blockchain records make audits easier and improve investor confidence by 70%. It reduces greenwashing, a concern highlighted in the 2024 UNEP Emissions Gap Report.

-

Improved Liquidity

Tokenized green bonds and carbon credits offer flexible capital movement. Businesses can raise funds faster and investors can exit earlier, ensuring steady capital inflow.

-

Inclusive Investments

Fractional ownership allows small investors to fund clean energy grids or carbon removal systems. A tokenized solar grid in Nigeria, backed by small contributions, now powers rural clinics, proof of tokenized ESG assets driving equitable impact.

-

Cost Savings and Scalability

Smart contracts lower administrative costs while ensuring global scalability. A model proven successful in Colombia for hydroelectric projects can easily be replicated in Africa or Asia through asset tokenization services.

-

Streamlined ESG Reporting

Tokenized RECs and carbon credits offer verifiable data aligned with ISSB and TCFD disclosures. This real-time transparency simplifies global net-zero reporting.

Where RWA Tokenization Is Driving Real ESG Impact?

Environmental, Social, Governance (ESG) is used to evaluate a company’s sustainability. Now, people are eyeing climate finance as a part of it for the greater good. And tokenization is part of it. Let’s check how tokenization is shaping the ESG of companies.

-

Scaling Renewable Energy

Green asset tokenization has already added over 700 megawatts of renewable capacity globally in 2025. In regions like Southeast Asia, tokenized renewables are helping reduce dependence on coal. IoT sensors track every kilowatt-hour, providing real-time verification for investors. Institutional investors are negotiating deals worth $500 million in tokenized renewables, signaling growing confidence in RWA tokenization development.

-

Carbon Credits and Emission Reduction Assets

Each tokenized carbon credit represents one ton of CO₂ avoided. Blockchain tracks its origin — whether from reforestation in Brazil or methane capture in mining zones. Tokenized ERAs worth $32 billion have prevented massive emissions while ensuring transparency and compliance with ISSB and TCFD frameworks.

Read Our Blog: How Tokenizing Solar Assets Is Reshaping Renewable Energy?

-

Green Bonds for Sustainable Infrastructure

Tokenized green bonds have raised over $1.2 billion for renewable infrastructure in 2025. For instance, EDF’s blockchain-enabled green bonds allowed real-time monitoring of energy projects. This method cut costs, improved liquidity, and enabled fractional participation.

-

Sustainable Agriculture and Regenerative Practices

Agriculture plays a major role in emission reduction. In 2025, tokenized farmland projects worth $300 million in Sub-Saharan Africa attracted investors by linking tokens to soil carbon capture and crop yield data. Tokenization in ESG thus promotes sustainable farming and supports food security.

The Future of Net-Zero Tokenization

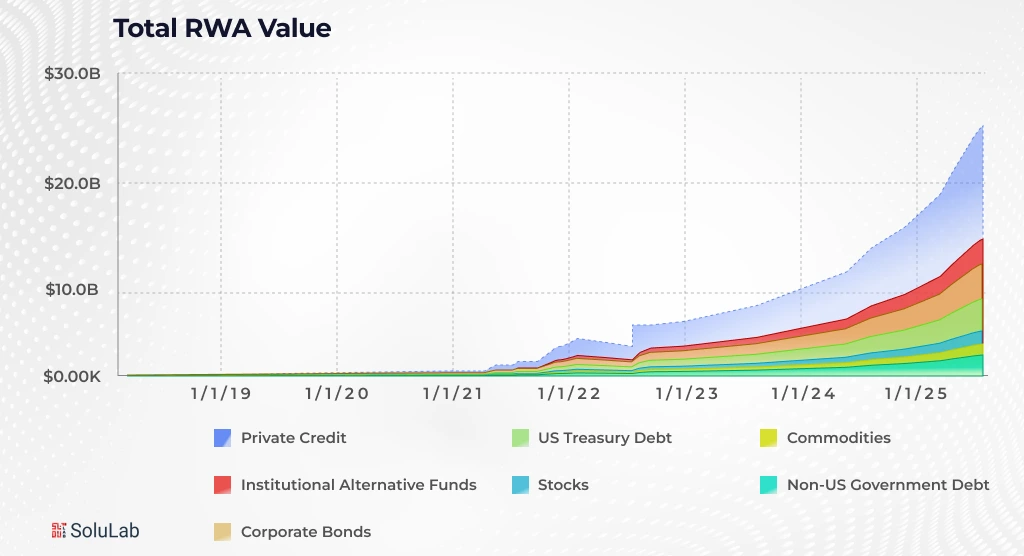

The coming decade promises massive growth for tokenized green bonds and climate-focused real-world assets. Analysts forecast that tokenized RWA markets may reach $19 trillion by 2033, with ESG-focused assets leading the expansion.

Key trends changing the next phase include:

- AI-Driven Forecasting: Advanced AI models are now predicting emission patterns, renewable generation output, and carbon market volatility with far greater accuracy, helping investors deploy capital into the highest-impact climate assets.

- IoT-Enabled Tracking: Smart IoT solutions are enabling real-time monitoring of renewable energy production, carbon sequestration, and project-level performance by bringing unmatched transparency to blockchain-based ESG assets.

- Cross-Chain Interoperability: Modern climate-finance platforms are enabling seamless movement of tokenized ESG assets across multiple blockchains, improving liquidity and accelerating institutional adoption.

- Regulatory Maturity: Countries like Singapore, UAE, and the EU are finalizing robust tokenization and carbon-market frameworks, giving enterprises the compliance confidence needed to scale sustainable finance solutions.

- Enterprise Adoption: Corporations, energy firms, and climate-tech startups are rapidly embracing blockchain in climate finance, positioning themselves at the forefront of a trillion-dollar sustainability transformation.

Conclusion

Achieving climate goals is no longer limited to policy and pledges, tokenization is now turning sustainability into a scalable financial opportunity. If you are exploring Net-Zero tokenization, whether for carbon credits, renewable energy assets, or climate-positive infrastructure, SoluLab is your trusted partner.

As a leading asset tokenization company, we help organizations convert high-value assets, from carbon offsets and renewable projects to real estate, metals, and intellectual property, into secure, compliant digital tokens. Our experts map your business goals, define the right token model, design a future-ready architecture, and build a fully compliant tokenization ecosystem tailored to climate-finance needs, just like we did for Tangible.

If you’re ready to turn climate impact into transparent, verifiable, and investable value, connect with SoluLab today and start building the next wave of sustainable finance innovation!

FAQs

1. How can Net-Zero Tokenization turn sustainability into a revenue stream for enterprises?

By tokenizing ESG assets, businesses monetize carbon credits, renewable projects, and green bonds, unlocking new liquidity channels while aligning profitability with sustainability goals.

2. Why choose SoluLab for Net-Zero Tokenization development?

SoluLab designs scalable RWA tokenization platforms integrating smart contracts, IoT, and compliance frameworks, empowering enterprises to tokenize assets, enhance transparency, and achieve ESG reporting excellence.

3. How does tokenization improve transparency in ESG investments?

Every transaction is recorded on blockchain ledgers, creating immutable proof of ownership, reducing greenwashing, and enabling real-time auditing of carbon offsets and renewable project impacts.

4. What are the business benefits of adopting Net-Zero Tokenization?

It improves liquidity, automates compliance, lowers costs, and enhances investor confidence, helping enterprises efficiently fund sustainable initiatives and achieve measurable climate impact faster.

5. What’s next for Net-Zero Tokenization in global climate finance?

The future lies in AI-driven ESG analytics, IoT-based energy tracking, and cross-chain token interoperability, making climate finance faster, traceable, and globally inclusive.

![Top 15 Asset Tokenization Companies in the USA [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Top-Asset-Tokenization-Companies-in-USA-1.webp)