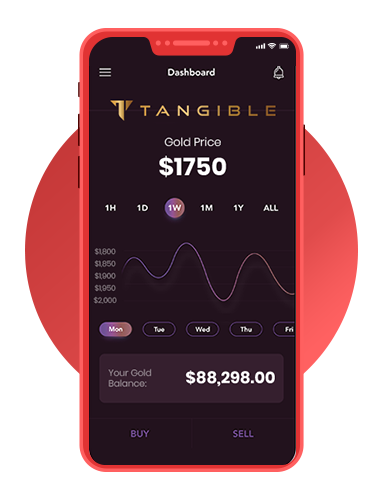

Tangible gold is the first trusted gold and silver investment decentralized exchange platform where users are welcomed to buy, sell or trade these metals. Along with SoluLab, users can use this platform to their benefit with minimum investments.

Business Overview

The Challenge

Our Solution

Project Features

Outcome

Technologies we used

MongoDB

Kubernetes

React

Solidity

NodeJS

Docker