Traditionally, stablecoins provided an extra layer of security. They maintained their value, pegged with fiat currencies, and ultimately became a necessity for both traders and institutions. However, user expectations have risen with time. They expect these to make money without risky methods.

Yield-bearing stablecoins are transforming the way consumers see digital assets because of their ability to stay pegged while producing passive income. They merit further investigation, whether you are immersed in DeFi or just investigating more intelligent methods of storing value.

According to JPMorgan researchers, yield-bearing stablecoins may rise from 6% to 50% of the stablecoin market size. Its rising market value indicates digital demand for the top yield-bearing stablecoin. Over a year, its market worth rose 5284% from $65 million in February 2024 to $3.5 billion in February 2025.

This blog will go into the topic of yield-bearing stablecoins and how they are changing the game when it comes to digital asset valuation. We’ll explain what they are, how they work, and why they’re becoming more popular among investors looking for stable returns with little risk.

Demystifying Yield-Bearing Stablecoins

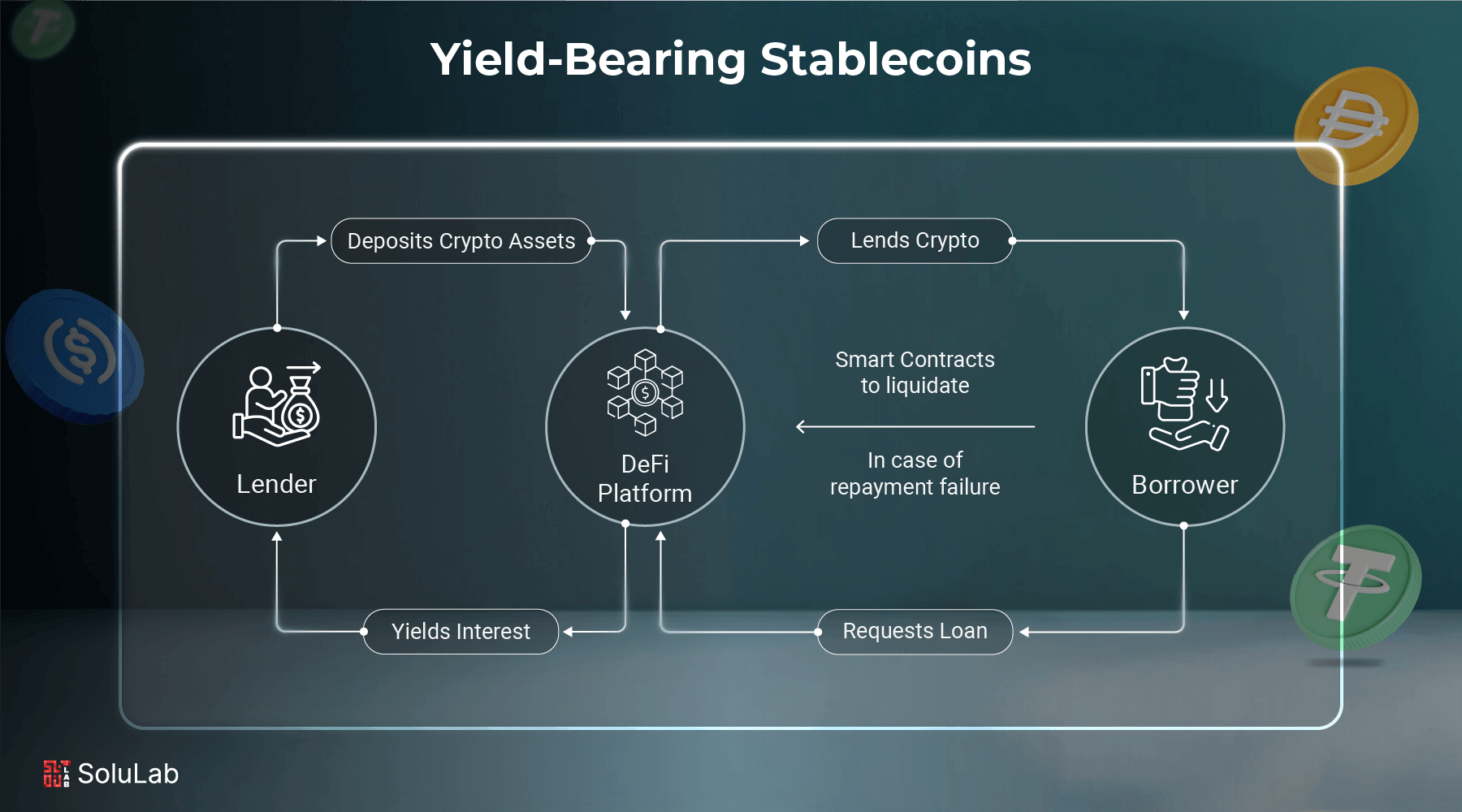

Take your bank account, for example. When you deposit cash, the bank doesn’t just let it sit idle. Instead, it maintains a digital record of your balance while lending the actual funds to borrowers. The interest collected from these loans is partially shared with you as a reward for holding your money there. What you see in your account is essentially a digital claim on real money that’s out in the market generating returns.

Similarly, yield-bearing stablecoins work by having users contribute capital to a protocol, often through deposits in stablecoins like USDC or even major assets like BTC and ETH. Once deposited, the protocol uses these funds in various investment or lending strategies and mints a stablecoin that represents your deposit. Over time, the gains earned are distributed fairly to holders based on the size of their stake. This method generates DeFi native yield without requiring active trading or high-risk speculation.

The mechanisms behind the earnings can differ between projects. Innovations in stablecoin in the DeFi space have opened up a range of options: liquidity mining, staking, or algorithmic rebalancing, that allow users to earn consistent returns in new, decentralized ways.

How Yield-Bearing Stablecoins Differ from Traditional Stablecoins?

Yield-bearing stablecoins take the concept of digital stability a step further by combining value retention with consistent income generation. While traditional stablecoins are typically used for transactions, remittances, and stable storage in crypto portfolios, yield-bearing stablecoins are crafted to provide ongoing returns simply by being held. This reflects some aspects of traditional finance (TradFi) like earning interest on savings, but without the friction of banks or intermediaries.

Below is a comparison to highlight their key differences:

| Feature | Traditional Stablecoins | Yield-Bearing Stablecoins |

| Core Purpose | Mainly used for price stability, facilitating trades, and avoiding volatility in crypto. | Combines stable value with passive yield, making funds productive while retaining a stable peg. |

| Earning Potential | Does not generate any yield unless manually deposited into yield strategies. | Automatically earns interest through protocol-level mechanisms without active management |

| Backing Assets | Typically backed 1:1 by fiat reserves or cash equivalents in a centralized reserve. | Backed by user deposits that are actively deployed in lending, staking, or liquidity pools. |

| User Participation | Users must take extra steps to invest and earn returns. | Yield is built in; simply holding the token accrues earnings proportionally. |

| Protocol Integration | Used across exchanges, wallets, and platforms as a stable unit of account or settlement. | Deeply integrated with DeFi protocols that leverage assets for yield-generating strategies |

| Risk Level | Very low risk, minimal exposure due to reserve-based model. | Slightly higher risk depending on how the underlying capital is invested. |

| TradFi Analogy | Comparable to holding fiat cash or using a debit card without interest returns. | Similar to placing money in high-yield savings or reinvested bonds in TradFi. |

| Examples in Use | USDC (Circle), USDT (Tether), BUSD (Binance) | sDAI (Spark Protocol), aUSDC (Aave), yDAI (Yearn Finance) |

How Do These Stablecoins Generate Yield?

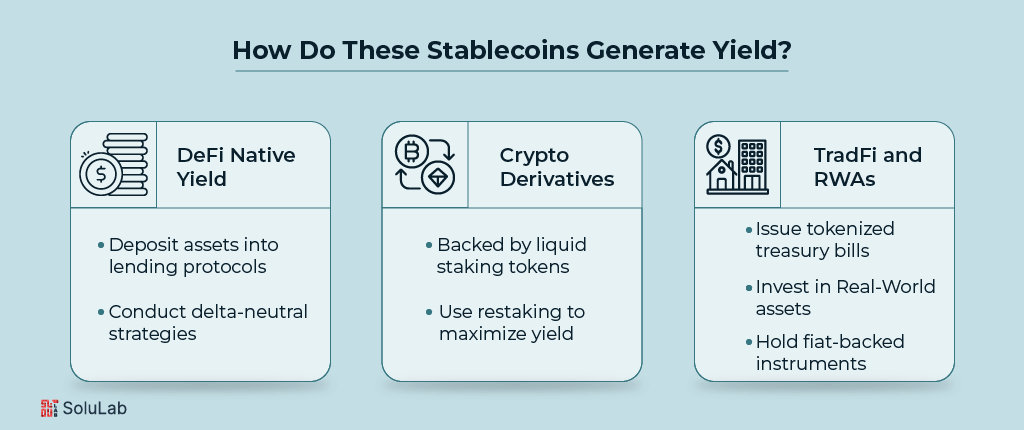

Yield-bearing tokens accumulate passive income through three primary channels: DeFi native yield, crypto derivatives, and traditional finance (also known as TradFi) combined with real-world assets (RWAs). Each source has its structure and logic, offering different levels of risk, return, and decentralization.

1. DeFi Native Yield

These returns originate within decentralized ecosystems and are driven by demand for lending, borrowing, or liquidity.

- Protocols like Aave or Compound allow users to deposit assets such as ETH or DAI, which are lent out to borrowers. The interest earned is shared with depositors via yield-bearing stablecoins.

- MakerDAO’s DSR (Dai Savings Rate) enables holders to lock DAI into a contract and receive sDAI, which earns a variable return depending on supply-demand conditions.

- Ethena Finance employs delta-neutral hedging strategies using ETH to earn DeFi native yield without exposing users to price volatility.

2. Crypto Derivatives

These stablecoins earn from tokens that represent staked or restaked crypto assets, acting like income-generating securities.

- Prisma Finance’s mkUSD is backed by liquid staking tokens (LSTs) that collect rewards from staked ETH and pass them onto stablecoin holders.

- Davos Protocol’s DUSD leverages restaking layers to maximize yield from the same set of staked assets, multiplying reward flows.

- These crypto derivatives offer a way to earn yield without locking funds directly into staking contracts.

3. TradFi and Real-World Assets (RWAs)

Protocols in this category bridge traditional markets and DeFi by tokenizing stable income-generating assets.

- Ondo and Flux Finance issue stablecoins backed by tokenized treasury bills or short-term corporate debt, delivering predictable returns.

- Mountain Protocol and Paxos Lift Dollar invest in diversified RWAs like real estate, government bonds, and ETFs to create secure yield for users.

- stEUR, sUSDT, and eUSDC provide stable returns by holding regulated financial instruments—essentially bringing traditional finance (TradFi) into the on-chain environment.

This multi-pronged approach allows each stablecoin development company to innovate with both blockchain-native and institutional strategies, unlocking new ways to earn while maintaining stability.

How to Earn Passive Income From Yield-Bearing Stablecoins?

Earning from yield-bearing stablecoins is a seamless way to grow your crypto holdings without trading or staking complexity. These tokens are designed to maintain stability while generating income, often backed by real-world assets or DeFi strategies. Here’s how you can start:

Step 1: Select a Reputable Yield Protocol

Start by choosing a trusted DeFi platform that offers yield-bearing versions of stablecoins. Some of the most reliable options include:

- MakerDAO (sDAI): Offers interest through the DAI Savings Rate (DSR).

- Aave (aUSDC): Automatically generates yield from lending activities.

- Spark Protocol: Provides yield via integrated smart DeFi strategies.

These are not just regular tokens; they are asset-backed stablecoins, meaning each one is tied to real collateral, ensuring both yield and price stability.

Step 2: Deposit Your Assets to Mint Yield-Bearing Tokens

Once you’ve selected a platform, you’ll need to deposit compatible assets like DAI, USDC, or ETH into the protocol.

- For example, depositing DAI into MakerDAO will allow you to mint sDAI.

- These deposits are pooled and then used in lending, staking, or hedging strategies to generate returns.

You’re not lending or investing manually; the protocol takes care of that, distributing a share of the earnings to you automatically.

Step 3: Swap on a DEX (If You Prefer Buying Directly)

If you’d rather not deposit directly into a protocol, you can purchase existing yield-bearing stablecoins from a decentralized exchange (DEX) like Uniswap, Curve, or Balancer.

- This is especially helpful if you want to diversify into multiple tokens without going through each protocol.

- It’s fast, flexible, and you gain access to tokens that are already generating returns.

Step 4: Store Them in a Secure, Non-Custodial Wallet

Once acquired, transfer your yield-bearing tokens into a wallet like MetaMask, Ledger, or Trust Wallet.

- These wallets allow you to hold your assets securely while still earning.

- There’s no need to actively stake or lock them—returns are earned passively just by holding.

This step ensures that you retain full control of your funds while enjoying continuous yield generation.

Step 5: Monitor and Manage Your Earnings

Most platforms offer dashboards where you can:

- Track how much you’ve earned over time.

- Check current yield rates and APRs.

- Reinvest or convert your returns as needed.

Many protocols auto-compound your earnings, meaning your balance grows without requiring manual action.

Step 6: Expand to Other Stablecoin Yield Options

Curious about how to earn yield on other stablecoins? Explore platforms like:

- Yearn Finance: Automates the best yield strategies across protocols.

- Angle.money: Offers euro-based and multi-currency stablecoin yield.

- Flux and Ondo Finance: Focus on tokenized real-world assets and TradFi integration.

These platforms accept common stablecoins like USDT or USDC and turn them into yield-bearing forms through automated, optimized strategies.

Read Also: Hong Kong Stablecoin Regulation

3 Popular Yield-Bearing Stablecoins You Should Know

As more users look for safer ways to earn passive income in crypto, yield-bearing stablecoins are gaining serious traction. Built on secure protocols and backed by real assets or lending strategies, they’ve become a go-to for DeFi users who want reliable yield without high risk. Let’s look at three standout options that are reshaping how people think about stable digital assets.

1. sDAI – MakerDAO’s Yield-Earning DAI

sDAI represents a version of DAI that earns interest through the Dai Savings Rate (DSR). When users deposit DAI into the protocol, they receive sDAI, which accrues yield automatically. It’s ideal for anyone who wants to keep their assets stable while quietly earning. The beauty of sDAI is that it can be used across DeFi applications while continuing to generate passive returns in the background.

2. aUSDC – Aave’s Passive Earning Token

aUSDC is Aave’s interest-bearing version of USDC. Once you deposit USDC into Aave, it converts into aUSDC and begins accumulating yield. It doesn’t require staking or complex management—just hold it in a compatible wallet and let the protocol do the work. Aave’s seamless interface makes this one of the easiest entry points for users looking to earn from their stablecoin holdings.

3. stEUR – Angle Protocol’s Euro-Based Stablecoin

For users seeking a Euro-denominated yield option, stEUR by Angle Protocol is an excellent choice. It’s backed by tokenized European money market funds and offers a stable, low-risk yield while maintaining its peg to the Euro. stEUR is especially useful for users in the EU or those who want to diversify beyond dollar-backed assets.

Protocols like these wouldn’t be possible without the expertise of a leading stablecoin development company that understands both blockchain infrastructure and financial compliance. If you’re thinking about how to create a stablecoin that does more than just hold value, studying these successful examples is a smart first step.

Benefits of Yield-Bearing Stablecoins

Yield-bearing stablecoins offer more than just price stability, they unlock a smarter, more efficient way to grow wealth in the digital economy. These assets are ideal for users who want to avoid volatility but still earn consistent returns without active management.

Whether you’re holding assets during a market dip or parking funds between trades, these stablecoins quietly generate yield in the background. Here’s why they’re becoming a favorite among both retail users and institutional players:

- Passive Income Made Simple

You don’t need to trade, time the market, or take on risk-heavy strategies. Just holding a yield-bearing stablecoin in your wallet starts generating income automatically. - Stability Without Sacrificing Growth

Unlike typical crypto assets, these stablecoins are designed to maintain their peg, often to the US dollar or euro, so you earn without worrying about price swings. - Flexible and Liquid

Most yield-bearing stablecoins remain usable across DeFi platforms, meaning you can lend, borrow, or trade them while still earning interest. - Reduced Risk Exposure

Many of these tokens are backed by diversified strategies like lending pools, treasury assets, or staking mechanisms, lowering your exposure compared to volatile tokens. - Ideal for Long-Term Holding

If you’re waiting to re-enter the market or want a low-maintenance savings option, yield-bearing stablecoins give you a way to earn in the meantime.

The Future of Yield-Bearing Stablecoins

Yield-bearing stablecoins are quietly shifting how people think about holding money. What used to be a passive act, just storing value now becoming an active opportunity to earn. As more users look for safer ways to grow their assets without constant market exposure, these stablecoins are finding a real, lasting place in both personal finance and institutional strategy.

Soon, they’ll likely be used for more than just decentralized finance (DeFi). Think payroll in a stablecoin that earns while it sits, or savings tools that reward you. With better infrastructure, clearer rules, and growing trust, yield-bearing stablecoins aren’t just a trend—they’re the next chapter in how we build and hold value.

Conclusion

Yield-bearing stablecoins are changing the way people think about money in the digital world. Instead of just holding value, these tokens offer a way to earn steady returns without diving into high-risk strategies. With more real-world use cases emerging, from everyday savings to cross-border finance, they’re quickly becoming a smarter, safer choice for anyone looking to grow their assets without constant market stress.

At SoluLab, we work closely with companies ready to explore this space, helping them build stablecoin solutions that are secure, scalable, and future-ready. Our focus on AI stablecoin development means we don’t just create tokens, we design systems that are smart, efficient, and easy to use. A great example of this is our recent project, DLCC, which aims to reshape the future of regulated crypto lending. We built a decentralized platform with a custom crypto wallet solution, making asset lending simple and compliant.

If you’re thinking about building your stablecoin or launching a new financial product, let’s talk. Book a free consultation now!

FAQs

1. Are yield-bearing stablecoins safe to use?

Yes, but like any financial product, their safety depends on how the underlying protocol is managed. Many are backed by highly liquid assets or use well-audited smart contracts, but users should still evaluate the team, collateral model, and risk disclosures before investing.

2. Do I need to lock my funds to earn yield from these stablecoins?

Not always. Some yield-bearing stablecoins generate interest just by being held in your wallet, with no lock-up period. Others might offer higher returns if you agree to lock your funds for a set time. It all depends on the platform’s structure.

3. Can I still trade or transfer a yield-bearing stablecoin?

Absolutely. One of the key benefits of many yield-bearing stablecoins is that they remain liquid. You can send, swap, or even use them in other DeFi applications without interrupting the yield you’re earning, though it’s best to double-check if your specific token supports this.

4. How are yields calculated and paid out?

Yields are usually based on the performance of the protocol’s lending or investment strategies. Some pay interest daily or weekly, while others continuously stream small amounts into your wallet. You won’t always see large jumps, but your balance grows over time.

5. Is there any tax implication when holding these tokens?

Yes. In many regions, earnings from yield-bearing stablecoins may be considered taxable income, similar to interest on savings. It’s a good idea to consult a tax advisor familiar with crypto to understand your specific obligations.