Traditional neo banking platforms still rely heavily on fiat-only infrastructure. And when your users need to move money across borders, volatile FX rates, high remittance fees, and slow settlement times can ruin the experience.

Businesses today expect faster, more cost-efficient global transactions, not complicated bank hops and hidden charges. This shift is already visible in emerging markets. A major trend report projects that stablecoin savings could grow from around USD 173 billion today to USD 1.22 trillion by 2028.

That’s a clear sign that users are actively moving away from traditional bank deposits and into digital dollars that offer more accessibility, speed, and global utility.

If your platform doesn’t support these digital asset rails, users will simply switch to competitors that do. Without dollar-to-stablecoin swap capabilities, neo banks risk losing both customers and international payment revenue. In this blog, you’ll learn:

- Why Stablecoins Matter in Neo Banking?

- Benefits and importance of Dollar-to-Stablecoin Swaps

- How to Integrate Dollar-to-Stablecoin Swaps and more.

Let’s get started!

Why Stablecoins Matter in Neo Banking?

Stablecoins are important to neo banks because they provide the technological framework for offering faster, cheaper, and more internationally accessible financial services than traditional banking services. They enable neobanks to bypass legacy payment systems and offer features that appeal to a global consumer base.

Here are key reasons why stablecoins matter in neo banking:

- Stability and Risk Reduction: Stablecoins are pegged to real-world assets like USD or INR, reducing volatility and protecting customer funds from crypto market swings. This boosts trust in digital banking.

- Liquidity and Instant Transactions: They allow quick settlements anytime, anywhere, without depending on slow banking rails. Liquidity stays available 24/7, helping neo banks provide cross-border and domestic transfers.

- Improved Customer Experience: Users enjoy faster onboarding, cheaper remittances, and transparent payments. For customers and businesses, it means fewer delays and more reliability than traditional banking.

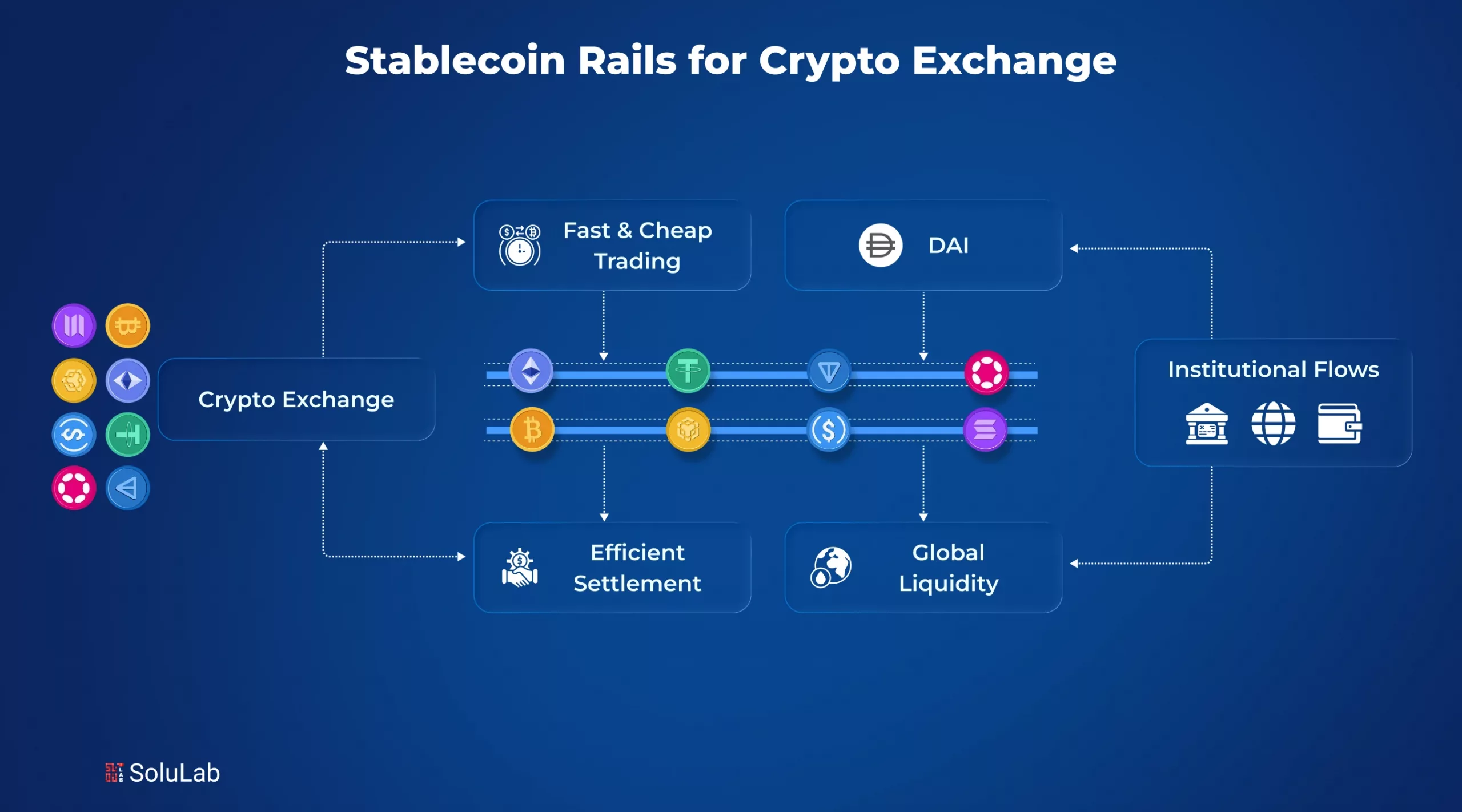

Read Also: Stablecoin Rails for Crypto Exchanges

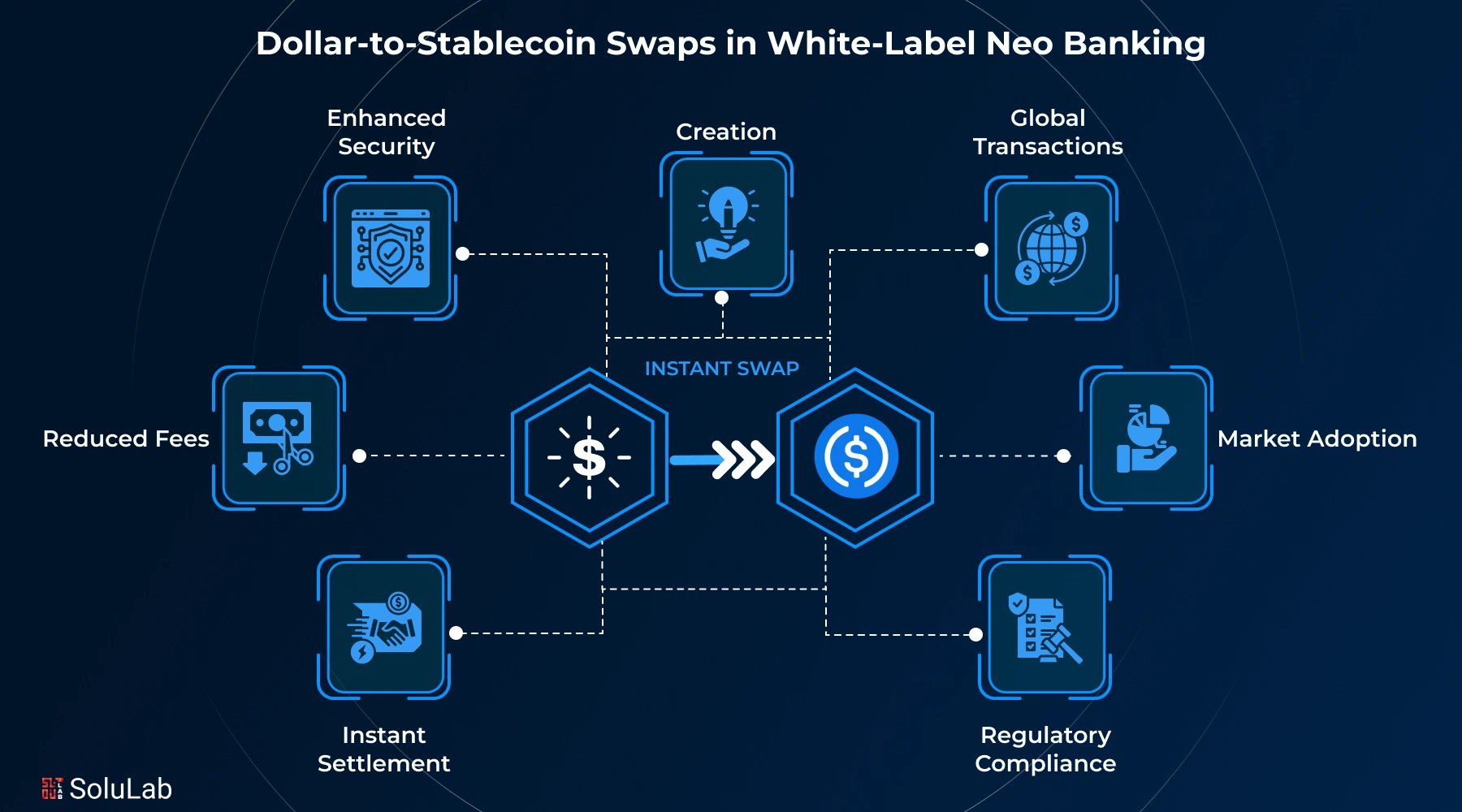

Importance of Dollar-to-Stablecoin Swaps in White-Label Neo Banking

US Dollar stablecoin swaps play a key role in white-label neo banking, helping fintech businesses enable global money movement, reduce currency risks, user trust, and get new revenue opportunities.

Stablecoins let users move money globally within minutes, avoiding high fees and delays. This increases customer satisfaction and makes the neo-bank more competitive in cross-border services.

1. Essential Feature for Global Banking: Businesses can instantly convert USD to digital assets and settle payments worldwide. This ensures smooth international transactions, especially for customers dealing across multiple countries with volatile exchange rates.

2. Revenue Opportunities for B2B Fintechs: Fintechs can earn fees on every swap conversion while offering value-added services like treasury management, making dollar-stablecoin rails a profitable revenue channel for B2B operations.

3. Compliance and Regulatory Alignment: Stablecoin swaps allow easy audit trails and transparency. When paired with KYC/AML controls, this helps fintechs meet regulatory standards and build trust with banks and enterprise partners.

How to Integrate Dollar-to-Stablecoin Swaps in Your White-Label Neo Banking Platform?

Adding dollar-to-stablecoin swap capabilities to your white-label neo banking platform lets users move between fiat and digital assets instantly, enabling smoother cross-border payments, lower fees, and a modern finance experience.

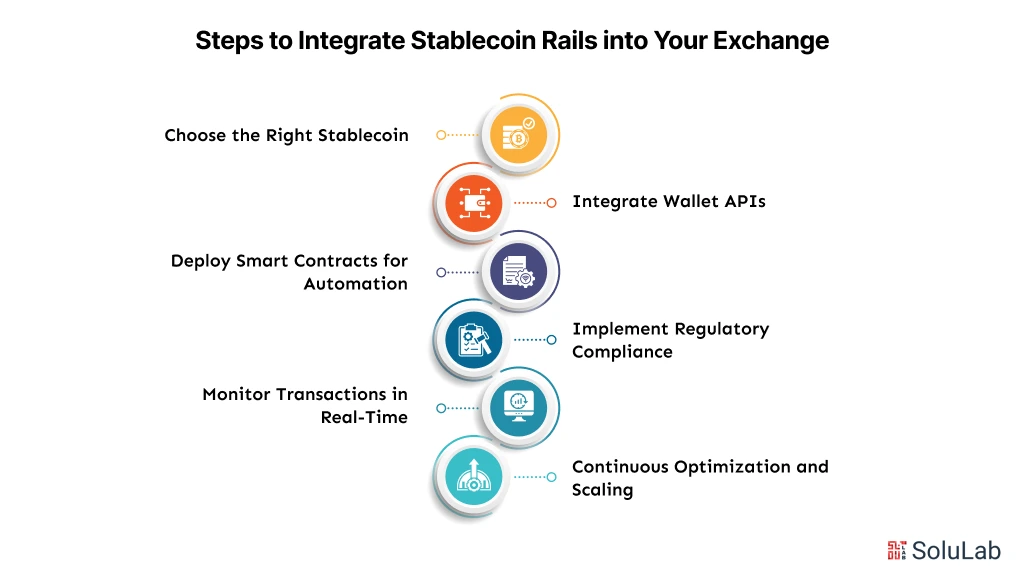

1. Selecting liquidity providers

Choose reliable liquidity partners to ensure fast swaps with minimal slippage. Look for deep liquidity pools, compliance readiness, strong uptime, and competitive pricing to deliver trust and stable conversion experiences for your users.

2. Integrating fiat on/off-ramps

Work with regulated fiat on/off-ramp providers that support major currencies and local payment methods like UPI or bank transfers. This helps customers easily deposit dollars and convert them into stablecoins inside your platform.

3. API and wallet infrastructure setup

Implement secure APIs for real-time swap execution, wallet balances, and transaction management. Integrate self-custody or managed wallets with a smooth UX, syncing user accounts across both fiat and crypto systems without friction.

4. Security, KYC, AML, and risk monitoring

Ensure all swaps follow strict compliance rules. Add automated KYC verification, AML checks, fraud detection, and continuous monitoring tools to protect users, maintain regulatory trust, and avoid service disruptions.

5. Testing swap flow performance

Test the entire conversion flow from deposit to stablecoin delivery under different network loads. Optimize transaction speeds, failure handling, notifications, and user experience before going live in production.

Read Also: Stablecoin Development On Solana

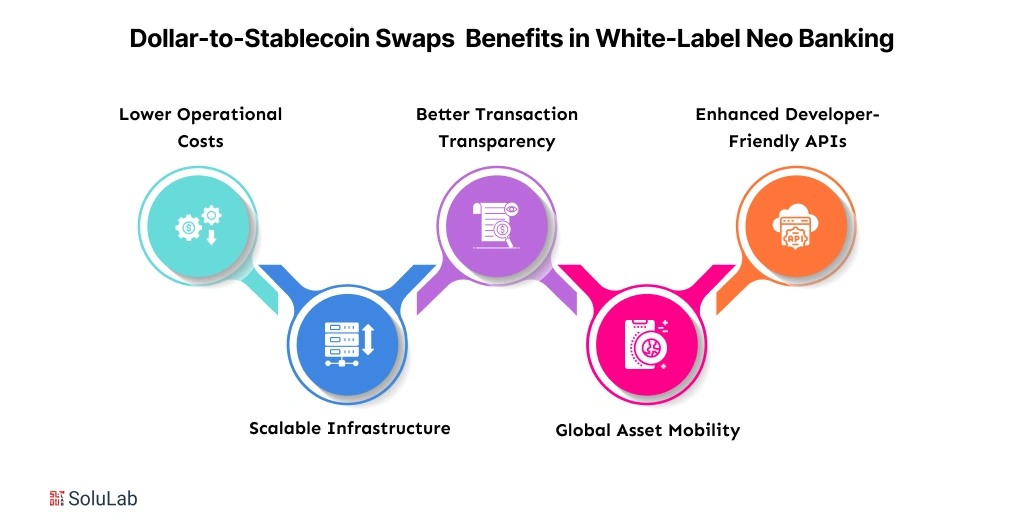

Benefits of Dollar-to-Stablecoin Swaps in White-Label Neo Banking

Dollar-to-stablecoin swaps in white-label neo banking get faster, cheaper financial operations. They help businesses improve cross-border payments, reduce conversion risk, and build scalable global digital banking solutions.

- Lower Operational Costs: Stablecoin-based conversions cut heavy bank fees, reduce FX markups, and remove intermediaries. This allows businesses to run leaner operations while offering competitive pricing to customers at scale.

- Scalable Infrastructure: Blockchain rails handle high transaction volume without performance drops. As user demand grows, neo banks can scale globally without worrying about traditional banking system limits or high expansion costs.

- Better Transaction Transparency: Every stablecoin transaction is recorded on-chain, enabling real-time tracking and auditability. This builds trust, simplifies compliance, and reduces fraud compared to opaque legacy banking processes.

- Global Asset Mobility: Users can transfer value anywhere in the world instantly without relying on local banking networks. It’s ideal for remittances, SAAS payouts, and high-speed cross-border business payments.

- Enhanced Developer-Friendly APIs: White-label providers offer plug-and-play APIs that simplify integration with fintech apps. Teams can quickly deploy digital wallets, payment gateways, and compliance modules with faster time-to-market.

Future of Stablecoin Swaps in Neo Banking

Stablecoin swaps will become the backbone of next-gen digital finance. Neo banks will use instant, low-cost settlement rails to improve payments, lending, and treasury management for businesses and consumers.

1. Tokenized Deposits: Banks will convert customer funds into on-chain tokenized deposits, enabling faster digital settlement, better liquidity, and swapping with stablecoins. This creates more secure, regulated, and efficient banking rails for global payments.

2. CBDC & Stablecoin Hybrid Banking Systems: Neo banks may combine CBDCs with private stablecoins to balance compliance and innovation. Users enjoy trusted government-backed money while still accessing speed, programmability, and 24/7 settlement benefits.

3. Real-time Programmable Payments: Smart contracts will automate recurring and conditional payments, payroll, EMIs, and vendor payouts without manual action. Stablecoin swaps enable instant settlement, removing delays from legacy banking networks.

4. AI-driven Treasury Management: AI solutions and algorithms will optimize liquidity, risk exposure, and yield strategies in real time. Stablecoin swaps enable instant asset rebalancing, boosting returns while maintaining stability and compliance.

Conclusion

Dollar-to-stablecoin swaps are becoming a core capability for modern banking. Businesses that build this feature into their platforms can offer real-time transfers, protect users from currency volatility, and get new revenue models in digital assets.

For providers of neo banking solutions, this is no longer a “nice-to-have”; it’s a competitive advantage that boosts user retention and global reach. By adopting compliant, scalable, and secure integrations within white label BaaS platforms.

SoluLab, a stablecoin development company, can help you integrate secure dollar-to-stablecoin swaps into your white-label neo banking platform. Contact us for leading-edge solutions!

FAQs

1. How does the US stablecoin bill support adoption?

The US stablecoin bill encourages clearer rules for issuing and managing stablecoins, helping banks operate confidently in the digital asset economy.

2. What is a US dollar-backed stablecoin?

A US dollar-backed stablecoin maintains a 1:1 reserve with the US dollar, ensuring stability and trust for users moving value digitally.

3. How do swaps fit within BaaS architecture?

Inside Banking-as-a-service (BaaS) solutions, swap modules can be added like plug-ins, giving fintechs powerful capabilities without owning full infrastructure.

4. How do swaps improve banking user experience?

They allow 24/7 conversions, instant settlements, and global access, enhancing convenience and retention for customers.

5. Can white-label platforms integrate these swaps smoothly?

Yes, via plug-and-play APIs and liquidity integrations, banks avoid heavy blockchain development and go live faster.