As 2025 draws to a close, many investors are exploring ways to turn real-world assets into secure, tradable digital tokens. From real estate and commodities to intellectual property, businesses are seeking smarter methods to enhance transparency and liquidity.

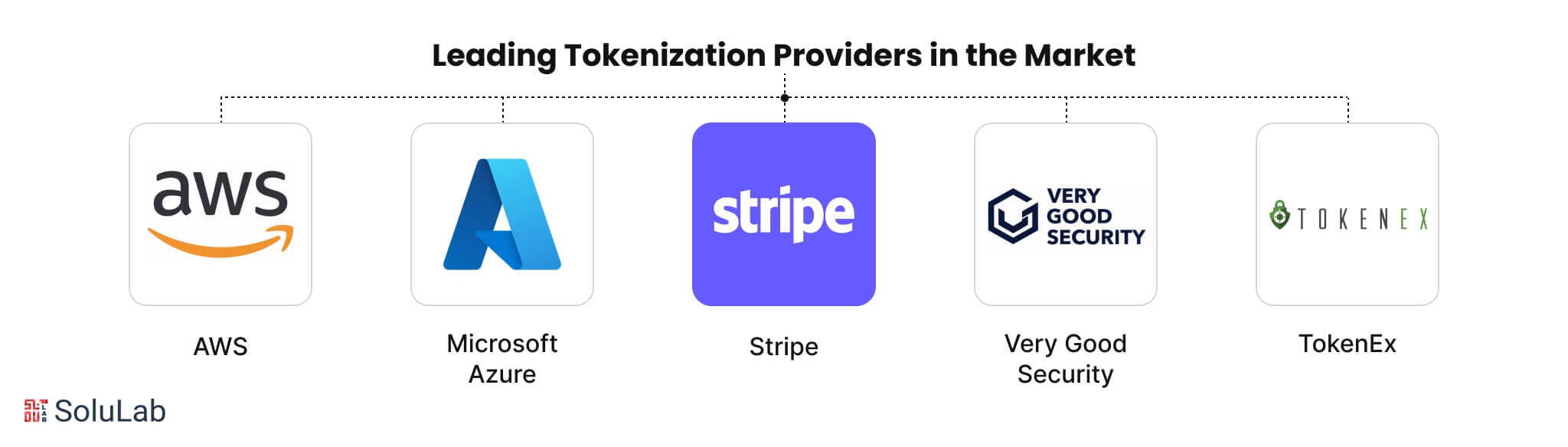

But with numerous tokenization providers in the market, identifying the right partner can be challenging. A wrong choice could lead to compliance risks, unreliable platforms, or even project failures.

Before stepping into 2026, we’ve compiled a list of the top tokenization companies in the United Arab Emirates for 2025, helping you make informed decisions for the year ahead.

How To Choose The Best Tokenization Company in the UAE?

According to Grand View Research, the tokenization market in the UAE is projected to reach $307.3 million by 2030.

It is important to select the appropriate tokenization company in the UAE to manage digital assets safely. The suitable partner will guarantee adherence, creativity, and flawless implementation of your blockchain-based initiatives.

1. Check Industry Experience: Find the firms that have experience in tokenization projects. Best practices teams are aware of regulatory issues, technical factors, and market trends, so your digital assets are under efficient management.

2. Assess Technology Stack: An excellent tokenization firm has solid blockchain infrastructure, smart contracts, and security measures. This ensures security, scalable and future-proof solutions to your assets.

3. Compliance with the regulations: The company should be aware of the UAE financial and crypto regulations. Legal compliance would prevent legal disputes and create trust between investors and other stakeholders.

4. Client References, Case Studies: Previous projects, testimonials and case studies. Positive implementations show stability, technical skills, and capability to achieve business goals.

5. Customization & Support: Select a company that will design solutions to meet your business needs and support you with solutions continuously, maintain, and upgrade to ensure that your tokenization project operates successfully.

Top 10 Tokenization Companies in the United Arab Emirates to Consider in 2026

In the UAE, a hub for fintech and blockchain innovation, several companies stand out for their expertise, reliability, and innovative solutions. Here’s a curated list of the top 10 tokenization companies to consider in 2026:

1. SoluLab

SoluLab is the best tokenization service provider company in UAE with 10+ years of experience, having delivered over 50+ real-world asset tokenization projects for clients worldwide. Key features include secure smart contract development, token modelling, strong compliance (KYC/AML), fractional ownership, traceability, and scalable blockchain integrations (Ethereum, Polygon, BSC, etc.).

SoluLab enables clients to tokenize real estate, art, commodities and intellectual property to increase liquidity, transparency and make high-value assets accessible to a broader investor base.

$25 – $49/ hr

200 – 249

2014

2. DDX Global

DDX Global, with over 8 years of experience in the blockchain space, is a trusted asset tokenization solution provider. The company specializes in RWA tokenization, enabling businesses to tokenize real-world assets like real estate, commodities, and equities.

With secure blockchain infrastructure, compliance-focused services, and customizable tokenization models, DDX Global helps enterprises with liquidity and global investor access. Its innovative approach makes it an ideal partner for businesses seeking scalable tokenization services in the UAE and beyond.

NA

11-50

2023

3. RWA Labs

RWA Labs is a UAE-based asset tokenization company with over 5 years of experience in digitizing real-world assets. They specialize in real estate, private equity, venture capital, fine art, and carbon credits into tradable digital tokens.

The company offers compliant, scalable solutions that integrate traditional markets into decentralized finance (DeFi), enabling fractional ownership and enhancing liquidity for both institutional and retail investors.

$50/ hr

2-20

2024

4. BlockchainX

BlockchainX is an asset tokenization company founded in 2018, specializing in real-world assets like real estate, art, and commodities into blockchain-based digital tokens. Their solutions enable fractional ownership, enhancing liquidity and accessibility for investors.

With a strong focus on security and transparency, BlockchainX offers end-to-end services from token creation to deployment, catering to diverse industries seeking to leverage blockchain technology for asset management.

$50 onwards

100-249

2017

5. Quest Global Technologies

Quest Global Technologies Limited (Quest GLT) is a tokenization development company specializing in Real World Asset (RWA) tokenization. They offer end-to-end services from strategy consulting and asset valuation to smart contract development and compliance advisory.

Notably, Quest GLT has developed blockchain solutions for various sectors, including gaming, where they built a meme token infrastructure for Solana Gods, integrating staking mechanisms and in-game reward systems.

$25-$49/ hr

200-249

2010

6. Tokeny

Tokeny is a tokenization development company founded in 2017, offering enterprise-grade, compliance-first tokenization solutions for financial institutions and asset owners. Using their proprietary T-REX infrastructure and the open-source ERC-3643 standard, Tokeny enables the issuance, transfer, and lifecycle management of tokenized securities with strong regulatory controls.

As part of Apex Group since 2025, Tokeny has tokenized tens of billions of dollars in assets and supports over 120 real-world use cases globally.

$25-$49/ hr

11-50

2017

7. Code Brew Labs

Code Brew Labs has 12 years of experience, specializing in asset tokenization, blockchain, AI, and mobile app development. Their asset tokenization services enable the conversion of physical assets into tradable digital securities, facilitating fractional ownership and enhanced liquidity.

With a track record of successful token launches and a compliance success rate across more than 30 jurisdictions, Code Brew Labs offers comprehensive solutions, from strategy to deployment.

$70/ hr

200

2013

8. Shamla Tech

Shamla Tech is a blockchain development company specializing in the tokenization of Real World Assets (RWAs). With years of experience, they offer comprehensive services to convert physical assets like real estate, gold, and art into secure, tradable digital tokens.

Shamla Tech’s solutions enable fractional ownership, enhancing liquidity and accessibility for investors globally. Their custom consulting services cater to various industries, providing tokenization strategies that align with specific business needs.

$50/ hr

25-50

2015

9. Oodles Blockchain

Oodles Blockchain is a blockchain development company with over a decade of experience, specializing in asset tokenization solutions. They improve real-world assets—such as real estate, art, and commodities—into secure, tradable digital tokens on blockchain platforms like Ethereum and Solana.

Their services enhance liquidity, reduce transaction costs, and enable fractional ownership, making high-value assets more accessible.

NA

200-249

2012

10. Tokyo Techie

Tokyo Techie is a tokenization development company specializing in asset tokenization solutions. With over 5 years of experience, they offer services like Security Token Offering (STO) development, enabling businesses to tokenize real-world assets such as real estate, commodities, and equities.

Ideal for enterprises seeking to bridge traditional finance with blockchain innovation, Tokyo Techie provides tailored solutions to meet diverse asset tokenization needs.

NA

50+

2017

Future of the Asset Tokenization Company in the UAE

The asset tokenization business in the UAE is expanding with the use of blockchain-based solutions as companies are focusing on tokenizing real-world assets and receiving global investment opportunities.

1. RWA Tokenization Businesses in the UAE

The UAE is quickly emerging as a center of RWA Tokenization Companies and allowing businesses to fractionalize valuable assets such as real estate, commodities, and art to draw in investors operating in the global market with openness and liquidity.

2. Increasing Tokenization Services

The UAE is in the process of tokenization that spans across various industries, such as real estate to finance. These services will provide secure and regulatory-compliant platforms that will assist organizations in simplifying transactions and improving investor confidence.

3. Growing Demand to Tokenize Real Assets

The UAE companies are beginning to pursue tokenization of real-world assets, which would provide fractional ownership and enhanced accessibility. This change opens up new areas of investment and improves market participation in the various industries.

Conclusion

From real estate to financial assets, these firms are helping businesses get liquidity, enhance transparency, and secure transactions through blockchain technology. As regulations and adoption grow, a strong market can accelerate adoption, whereas the wrong one can slow you down with compliance requirements.

Choosing the right tokenization partner in the UAE depends on your specific needs—whether it’s asset-backed tokens, security compliance, or blockchain platforms. SoluLab, a leading tokenization company in the UAE, can help you with its blockchain expertise, along with tokenization experience, to assist companies in launching scalable, investor-ready, and compliant platforms.

Contact us today to get a customized quote for your unique business idea!

FAQs

1. Are there any regulatory frameworks for asset tokenization in the UAE?

Yes, the UAE has established regulatory frameworks through VARA and other entities to ensure secure and compliant asset tokenization practices.

2. Can I tokenize real estate properties in the UAE?

Yes, platforms like the Dubai Land Department’s Real Estate Evolution Space Initiative (REES) facilitate the tokenization of real estate properties, enabling fractional ownership.

3. Why is tokenization gaining popularity in the UAE?

Tokenization is gaining popularity in the UAE due to its ability to enhance liquidity, democratize access to investments, and align with the country’s vision of becoming a global blockchain hub.

4. What services do UAE asset tokenization companies offer?

UAE asset tokenization companies provide services such as creating digital tokens representing ownership, ensuring regulatory compliance, and facilitating secure transactions on blockchain platforms.

5. Can I tokenize real estate properties in the UAE?

Yes, platforms like the Dubai Land Department’s Real Estate Evolution Space Initiative (REES) facilitate the tokenization of real estate properties, enabling fractional ownership.

![Top 10 Tokenization Companies in the United Arab Emirates [2026]](https://www.solulab.com/wp-content/uploads/2025/10/Tokenization-Companies-in-the-United-Arab-Emirates.webp)