Dubai’s real estate market is shifting from bold architecture to measurable sustainability. UAE strategies: UAE Vision 2021, the Energy Strategy 2050, and Dubai Clean Energy Strategy 2050 are directing towards green real estate growth.

Also, landmark projects like Masdar City and The Sustainable City demonstrate how blockchain plays a key role in sustainable real estate enhancement.

UAE climate-forward development looks like: energy-efficient design, extensive water recycling, and integrated renewable systems. With blockchain technology support UAE is trying to reduce emissions and build sustainable real estate.

Key Takeaways

- Through green real estate, you can reduce its environmental footprint, especially in a sector responsible for nearly 40% of global CO₂ emissions.

- Blockchain technology strengthens sustainable real estate in the UAE by providing verifiable data to get certificates like LEED and Estidama.

Dubai’s Green Real Estate Market Is Entering Its Next Phase

Dubai is shifting from basic green initiatives to data-driven, digitally monitored, and finance-ready sustainability models. This new phase is powered by technologies like AI-based energy optimization, IoT-driven real-time monitoring, blockchain for water management, and Web3-enabled ESG verification, ensuring every sustainability claim is backed by transparent, tamper-proof data.

- Market evolution emphasizes continuous performance data rather than single-point green features on buildings.

- Investors now reward verified operational savings and transparent ESG reporting when pricing assets and risk.

- Green buildings are becoming essential because the real estate sector is responsible for nearly 40% of global CO₂ emissions. Of this footprint, 70% comes from building operations, and 30% comes from construction activity.

- The UAE aims for net-zero emissions by 2050, increasing pressure on developers and investors to adopt sustainable practices.

- Developers who embed monitoring and measurement early gain certification advantages and faster project approvals.

Why Is Blockchain Becoming a Must-Have for Green Real Estate Platforms?

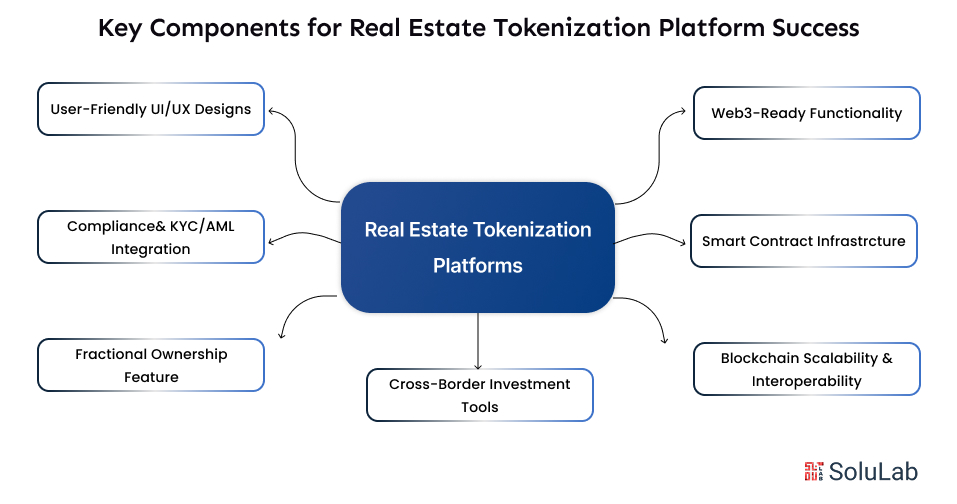

Blockchain combines immutable records, real-time data flows, and programmable rules, a strong match for sustainability needs. And Dubai is not an exception to using blockchain and AI for futuristic growth. With this integration in the green real estate sector verification, automation of tasks, and compliance quickens.

- Buildings with verified green credentials command 7-10% higher rental premiums.

- Verified performance also reduces insurance premiums by 5–15% for compliant buildings.

- Increase the installed clean energy capacity from 14.2 GW to 19.8 GW by 2030

- Efficient blockchain-enabled systems can reduce operational energy costs by 20–30%.

Below are the concrete benefits written as solution-focused statements for business readers.

Ensures transparent tracking of sustainable real estate materials and provenance

Blockchain in supply chain events is immutable; developers can prove origin, certifications, and recycled content.

- Verifiable material origin reduces greenwashing and supports certification audits quickly and reliably for regulators worldwide.

- Immutable supplier records speed up procurement approvals and lower disputes between contractors and buyers.

- On-chain provenance enables faster, clearer claims for recycled or low-carbon construction materials.

Makes compliance and certification straightforward with verifiable evidence

Certifications like LEED and Estidama require proof. Therefore, blockchain integration comes into the picture: to store audit trails and performance data for easy verification.

- On-chain documentation simplifies audits and reduces the administrative time required for certification submission and review.

- Automated evidence pulls lower manual reconciliation and provides assessors with clean, tamper-proof files.

- Continuous performance logs demonstrate compliance over time, improving certification renewal outcomes and investor confidence.

Automates payments and approvals to reduce project delays

Smart contracts execute payments, incentives, and warranty releases automatically when predefined performance or delivery milestones are met.

- Smart contracts reduce payment disputes and accelerate cash flow for real estate contractors and suppliers working on green measures.

- Milestone-based automated disbursements improve trust among stakeholders and shorten project timelines substantially.

- Programmable incentives align subcontractors with sustainability real estate outcomes, improving delivery quality and schedule adherence.

Enables verified carbon accounting and blockchain carbon credits

Immutable energy and emissions records permit credible carbon accounting and creation of tradable, verifiable carbon credits.

- On-chain emissions ledgers create trusted data for carbon credit minting, sale, and retirement processes.

- Verified carbon credits open new revenue lines and funding options for developers and building owners.

- Transparent carbon accounting supports investor due diligence and strengthens environmental claims for assets.

Strengthens investor trust through tamper-proof sustainability performance

Investors need credible, auditable data. Blockchain solutions deliver a single source of truth for operational performance and ESG metrics.

- Tamper-proof performance data reduces perceived investment risk and supports better pricing for green assets.

- Clear audit trails make underwriting simpler and shorten investment committee review cycles.

- Transparent metrics help asset managers report reliably to stakeholders and regulatory requirements.

Applications of Blockchain in Sustainable Real Estate Development, UAE

Blockchain trends can be woven into multiple use cases across design, construction, operations, and finance. Each application drives business outcomes and supports Dubai’s sustainable real estate development targets. Luxury under a safe environment is the main action in the UAE’s Net Zero Emission 2050.

1. Material provenance and supplier certification tracking

Record every supply event on-chain from quarry to site, enabling verifiable material claims and faster approvals.

- Traceable supply chains reduce procurement friction and help validate low-carbon or recycled material claims instantly.

- On-chain supplier ratings encourage sustainable sourcing through market visibility and accountability.

- Integration with certification bodies speeds acceptance of innovative eco-materials in projects.

- Material transparency matters because 30% of real estate emissions come from construction.

2. Energy monitoring, microgrids, and peer-to-peer energy trading

Combine smart meters with blockchain to record production, consumption, and enable direct trading of surplus renewable energy.

- Real-time energy data on-chain enables automated billing, settlement, and renewable energy tracking.

- Microgrid settlements reduce system losses and let owners monetize excess solar generation reliably.

- P2P trading supports local resilience and creates tangible returns from embedded renewables.

3. Water reuse and performance tracking for certifications

Log greywater and rainwater recycling performance to prove water efficiency gains and support Estidama or local regulations.

- On-chain water performance evidence simplifies the demonstration of targeted freshwater reductions during certification.

- Reliable water data supports operational optimization and tenant engagement programs for conservation.

- Measured savings improve asset valuation and unlock water-focused green financing instruments.

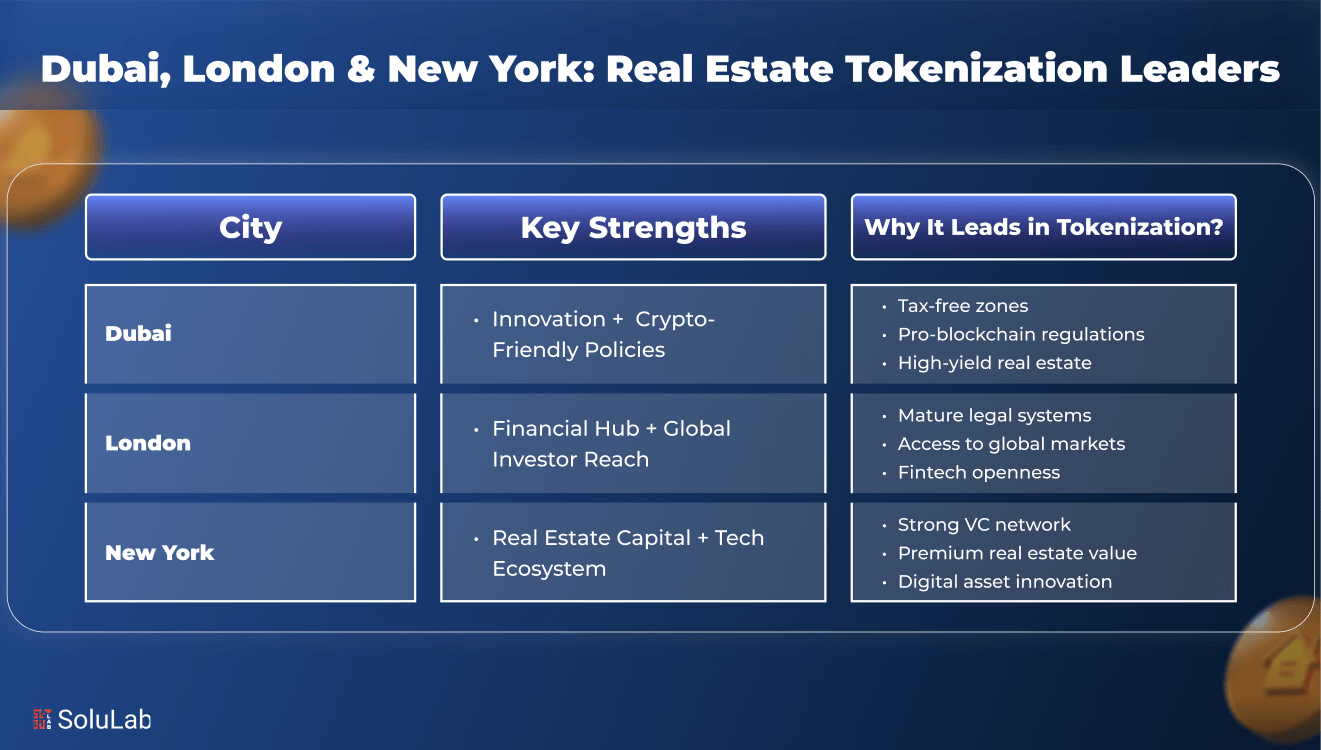

4. Tokenization and green finance instruments

Fractional ownership and tokenized green assets expand investor pools and enable new funding for sustainable development.

- Tokenized assets increase liquidity for green projects and diversify capital sources for developers.

- Blockchain-enabled green bonds or sukuk can deliver automated interest and environmental reporting.

- Fractional ownership attracts smaller investors into high-quality, certified sustainable real estate.

5. Benefits for developers and investors

Blockchain reduces barriers to green building delivery and improves margins through automation and better capital access.

- Verified operational savings of 20–30% increase long-term competitiveness.

- Buildings with verified credentials achieve 7–10% higher rental premiums.

- On-chain data improves financing access due to transparent sustainability performance metrics.

6. Benefits for investors

Investors gain clearer signals on risk, verified sustainability returns, and optional liquidity from tokenized instruments.

- 10 to 15% operational savings increase the predictability of cash flows and support stronger valuation models.

- Transparent ESG records reduce compliance risk and simplify reporting to limited partners or institutions.

- Tokenization creates exit options and fractional exposure to high-quality green assets.

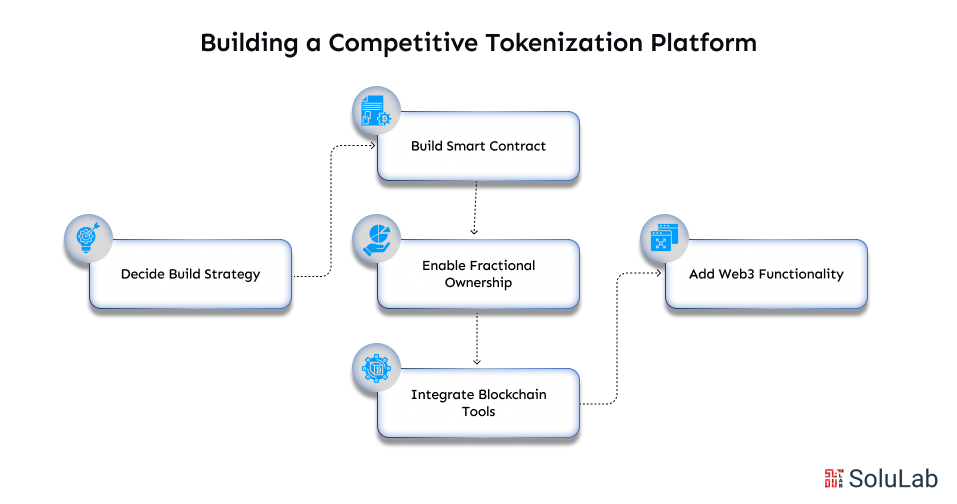

Implementation Roadmap of Blockchain in Green Real Estate in Dubai

Adopt a phased, pragmatic roadmap that aligns policy, certification needs, and operational targets. Start small, prove value, then scale.

Pilot and data foundation

Deploy smart meters, integrate building management systems, and record baseline data on a permissioned chain.

- Pilots show measurable energy and water savings and validate smart contract workflows before wider rollout.

- Establish data governance, privacy controls, and stakeholder access rules to ensure regulatory compliance.

- Use pilot results to refine KPI definitions used for certifications and investor reporting.

Green certification and finance integration

Connect on-chain performance to certification processes and green finance instruments like green sukuk or bonds.

- Link verified performance to finance triggers and automate reporting for lenders and rating agencies.

- Enable tokenization pilots for fractional investment and test secondary market liquidity options.

- Scale supplier onboarding to include provenance data for major building materials across projects.

Sustainable real estate ecosystem scale and marketplace

Open access to a broader set of developers, auditors, and investors to create network effects and liquidity.

- Create standardized on-chain data models and APIs for seamless integration across PropTech platforms.

- Launch a marketplace for verified carbon credits, green certificates, and tokenized assets to attract global capital.

- Embed automated compliance and reporting as standard operating procedure across new developments.

Future of Blockchain-Powered Green Real Estate Development in Dubai

The long-term outcome is a resilient real estate ecosystem where sustainability is measurable, financeable, and valuable. Buildings will be judged by continuous performance, not claims.

Companies that combine design excellence with verified operational data will command premiums and easier financing. Investors will favor assets with immutable sustainability proofs. Dubai, with clear national targets and leading projects, is well-positioned to lead this transition.

- Verified performance will become the baseline for asset valuation and investor decision-making across the UAE.

- Blockchain carbon credits and tokenized assets will unlock new capital and monetize sustainability outcomes.

- Early adopters will gain regulatory headroom, faster certification, and stronger market positioning.

- AI-powered green real estate will take a new shape in the coming days.

Conclusion

Dubai’s real estate sector is entering a new era where sustainability is no longer optional. As mentioned above, blockchain supporting green real estate is adding a long list of benefits to businesses. Tokenization, carbon credits, and real-time ESG reporting will only accelerate the UAE’s moves towards its Net Zero 2050 target.

At SoluLab, we help in developing blockchain platforms for material provenance, smart contracts, certification automation, tokenization, and carbon accounting. Whether you plan to build a green real estate platform, integrate energy monitoring, introduce tokenization, or automate LEED/Estidama reporting. Our expert blockchain developers can build solutions for:

- Up to 40% lower operational and administrative costs by replacing paper-heavy processes with secure blockchain transactions.

- Enterprise-grade blockchain APIs built for real estate, asset management, and green building platforms.

If you are ready to accelerate your sustainable real estate business in the UAE, contact us today to make your vision come true!

FAQs

1. How much does it cost to build a blockchain-powered green real estate platform?

Costs typically start from $10k. Most projects fall between moderate MVP budgets and enterprise-level investments, depending on certification, tracking, and automation needs.

2. How long does it take to develop a blockchain-based green real estate solution?

Most platforms take 2–4 months, depending on complexity, required integrations, certification workflows, smart contracts, and data pipelines.

3. How do carbon credits and green real estate reduce operational costs?

Verified performance improves resource efficiency, enabling 20–30% energy savings while generating revenue through carbon credits, lowering long-term operating expenses.

4. Why should I choose SoluLab for blockchain-enabled green real estate development?

SoluLab offers deep PropTech experience. It has blockchain experts and proven experience with sustainability tracking, tokenization, and certification automation.

5. Is a blockchain-based green real estate platform secure?

Yes. Blockchain ensures tamper-proof data, encrypted transactions, permissioned access, and decentralized verification, providing a highly secure environment for sustainability and compliance workflows.