If you’re planning to launch a stablecoin, you already know the goal to build something fast, secure, and scalable without wasting time or money. Solana has become a top choice because it handles real payments and high traffic with ease, which is perfect for teams that want to launch quickly and grow confidently. And the market shift is real.

Solana’s stablecoin ecosystem jumped from $1.83B in early 2025 to $9.3B by Q3 2025, a huge surge. The global stablecoin market is now over $300B, and companies like Visa, Western Union, and Cash App are already building on Solana.

With clearer regulations like MiCA, GENIUS Act, and rising RWA tokenization, stablecoins are becoming core financial tools, not experiments. We build compliant, secure, audit-ready stablecoins designed for real business use cases.

In this guide, you’ll learn everything you need to launch a stablecoin on Solana in 2026, from choosing your model to the tech, security, costs, and full go-to-market plan.

Where the Global Stablecoin Market Stands Today?

The stablecoin market is exploding. What started as a crypto side product has now become a serious part of global finance. In 2025, the total stablecoin market crossed $303 billion, rising 47% in just one year.

Here’s what the numbers look like today:

- $303B+ total stablecoin market cap

- $13.04B stablecoin supply on Solana

- $165B stablecoin supply on Ethereum

- $2.2T+ stablecoin transfer volume in just 30 days

- 5%+ merchants now accept stablecoins for real payments

These numbers show something very clear that Stablecoins are no longer a crypto token; they’re becoming everyday financial tools used for payments, settlements, cross-border transfers, and business operations.

Why Solana for Stablecoin Development?

If you’re planning to build a stablecoin in 2026, Solana is one of the strongest platforms to choose from. It gives you something every founder wants: speed, low cost, and real scalability. But the real reason Solana blockchain stands out is simple: it is built for high-volume money movement, not slow, expensive transactions, and here is why.

Solana works differently from blockchains like Ethereum. It uses a design called Proof of History (PoH), which lets the network order transactions in advance. This is why Solana is extremely fast and stable under heavy load. Here’s what that means in real life:

| Feature | Solana | Ethereum | Why It Matters for Stablecoins |

| Throughput | 65,000+ TPS | 12–15 TPS | No delays, no queues |

| Confirmation Time | 400 ms | 12+ sec | Instant payments |

| Transaction Fee | $0.00025 | $1–$50 | Cheap for millions of daily users |

| Liquidity | Single chain | L1 & L2 fragments | No bridging headaches |

| Consensus | PoH | PoS | Predictable cost & ordering |

For stablecoins, which often power payments, stablecoin remittances, trading, and settlements, this kind of structure is ideal. Also, for the stablecoin developers, two major upgrades are arriving. This is where Solana becomes a real powerhouse for stablecoin builders:

1. Firedancer (2025 – 2026)

A new independent validator client made by Jump Crypto.

- Doubles Solana’s block space by late 2025

- 25% more compute units per block

- Built to process the load of large financial systems

- Expected: sub-millisecond finality

- Almost-zero fees, even when millions of people transact

This means your stablecoin will run smoothly even if your daily volume explodes.

2. Alpenglow Consensus (2026)

A consensus upgrade focused on precision finality.

- Reduces finality to under 150 ms

- Removes ordering issues

- Perfect for high-frequency transactions

- Enables real-time settlement for payments & trading apps

This is a huge win as your stablecoin won’t get stuck, delayed, or reordered, and if you care about reliability and long-term costs, Solana clearly gives more value than networks where fees spike, block space fills up, and transactions slow down.

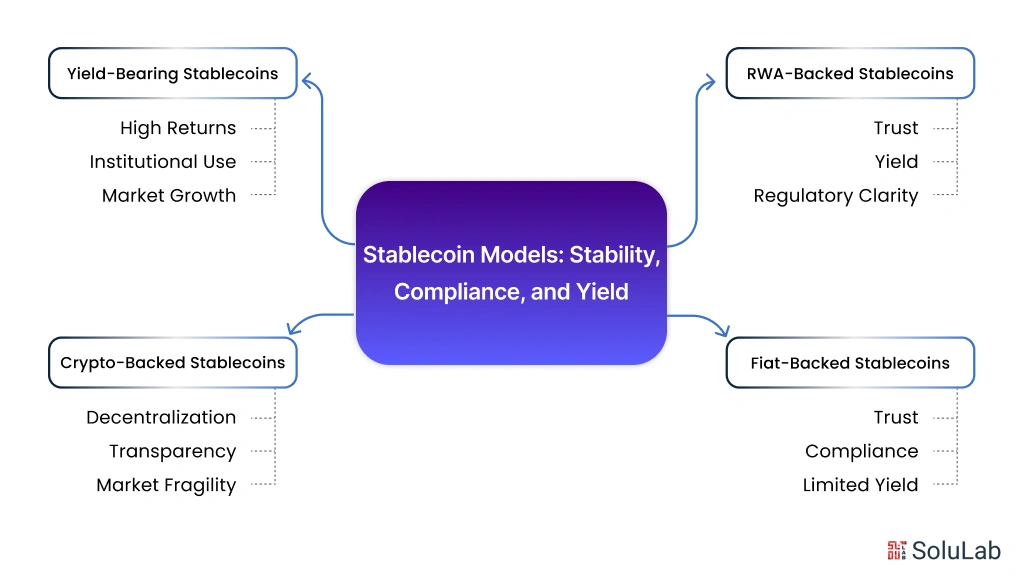

Which Stablecoin Type Is Right for You?

Picking the right stablecoin model decides how fast you can launch, how stable your asset stays, and how confidently users will trust your product. Each model comes with different levels of stability, compliance, yield, and complexity, and the right choice depends heavily on what you’re trying to build.

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins are the most trusted and easiest for users to understand. You hold real money like USD or EUR in a regulated bank account, and you issue one token for every dollar stored. It’s clean, simple, and the peg stays strong because audits and reserves are transparent.

This is the model behind USDC, USDT, and PYUSD. It shines in payments, settlements, and fintech use cases, anywhere trust comes first. The only downsides are bank dependencies, heavy compliance, and limited yield on reserves.

Read Also: USDC vs. USDT

With the GENIUS Act now live, smaller issuers fall under state regulation and larger issuers under federal oversight, giving founders a clear path to launch.

2. Crypto-Backed Stablecoins

Crypto-backed models use assets like ETH instead of banks. Users deposit more value than they mint, often two dollars of crypto for every one dollar of stablecoin, because the market moves quickly. Smart contracts handle everything: minting, burning, and liquidations.

This makes the system transparent and decentralized, without relying on traditional banks. It’s great for DeFi ecosystems, DAOs, and decentralized treasuries. But it does grow more slowly since over-collateralization limits supply, and it can become fragile during major market crashes.

3. RWA-Backed Stablecoins

RWA-backed stablecoin models power the fastest-growing stablecoin segment. Here, your token is backed by real-world assets like T-bills, gold, money market funds, or real estate, all stored with regulated custodians and verified through independent audits.

Projects like USDY, BUIDL, and Solayer’s sUSD follow this approach. It is a good choice as it blends trust, yield, and regulatory clarity across the U.S., EU, and Asia. The challenge is that setup takes more legal work, custody partners cost more, and global liquidity is still developing. But for enterprises, fintech apps, and institutional products, this model offers the strongest foundation.

4. Yield-Bearing Stablecoins

Yield-bearing stablecoin models stay pegged to $1 but automatically generate yield through staking, treasury returns, perp funding, or protocol fees. This segment exploded from $1.5B to $11B+ in just 18 months, and big institutions expect it to take over a major share of the stablecoin market.

Assets like USDe, USDC+, and yield-enabled sUSD are built for institutional treasuries, corporate cash management, and advanced DeFi systems. The upside is obvious; returns can land between 4% and 18% depending on the strategy. The trade-off is greater complexity, more risk layers, and retail restrictions in some regions.

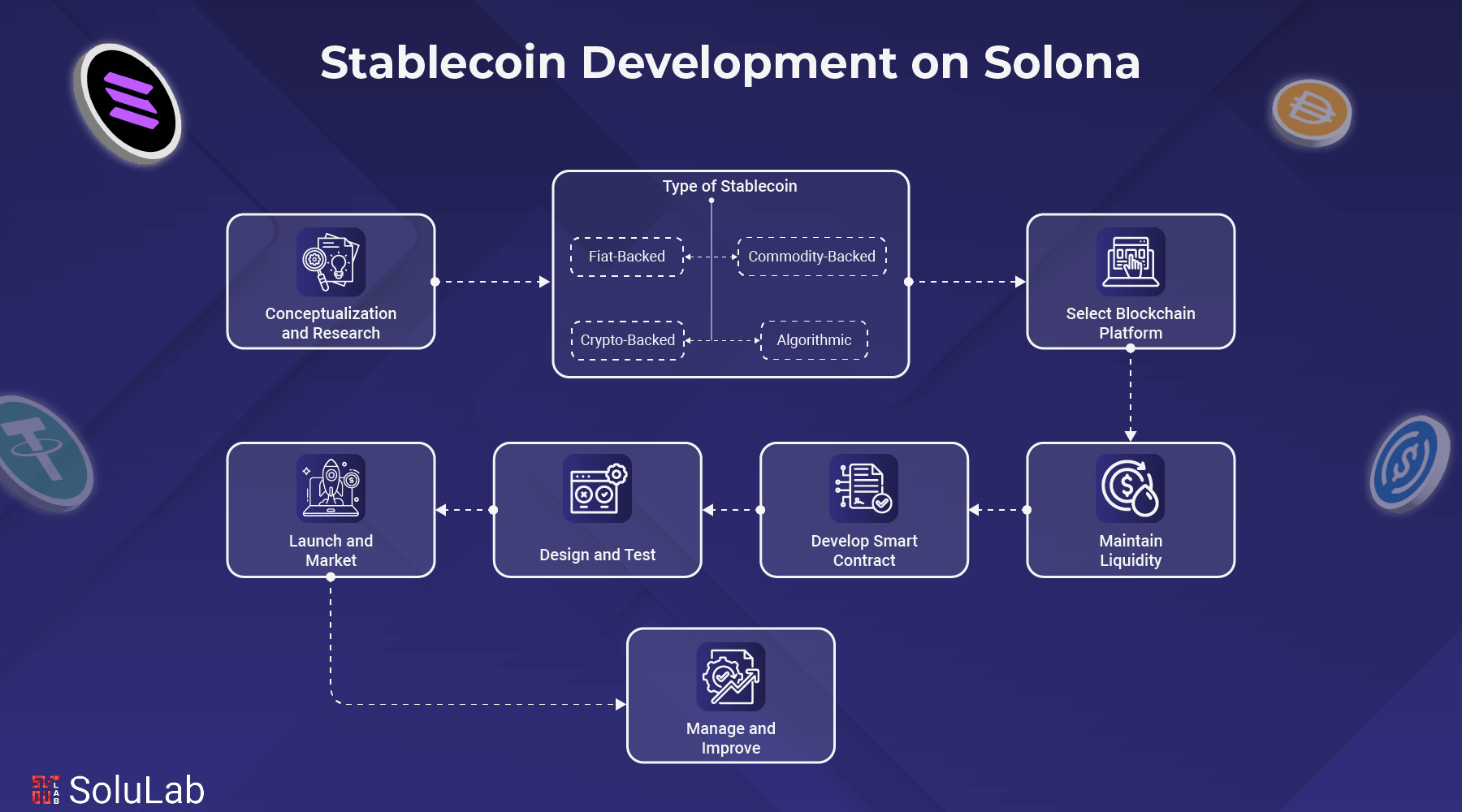

A Simple Framework to Build a Stablecoin on Solana

Building a stablecoin on Solana doesn’t have to feel complex. Here’s a clear, simple framework that founders can follow. It covers strategy, tech, audits, timelines, and costs, everything you need before hiring a stablecoin development company, and here is how we do it at SoluLab:

1. Pre-Development: Foundation & Market Research

This stage is about planning your project the right way, so you don’t waste time or money later.

Define Your Stablecoin Idea

Ask simple but important questions:

- Who will use your stablecoin? (DeFi users? Enterprises? Retail payments?)

- What does your stablecoin solve that USDC/USDT don’t?

- Which countries will you focus on first?

Study the Market

- Check what stablecoins already exist on Solana or your target chain.

- Look at liquidity, trading volume, and adoption.

- Find what you can do better (speed, cost, asset-backing, compliance, etc.).

Size the Opportunity

- Example: If you target enterprise treasury, the market size can be $500B+ in idle cash.

Design Your Token Economics

- Choose your peg (fiat, RWA, crypto-backed, algorithmic).

- Decide reserve ratio (1:1 for fiat-backed, 150–200% for crypto-backed).

- Plan fees, mint/burn rules, and governance setup.

2. Technical Design & Architecture

This stage defines how your stablecoin will work on the Solana blockchain.

Design the Core Contract

Plan for:

- Mint authority: Who is allowed to create or destroy tokens?

- Reserves: How collateral will be stored (custodian, multisig, or on-chain vault).

- Redemption flow: How users get back fiat or collateral.

- Oracle feeds: Which price data sources will you use (Chainlink, Pyth, Switchboard).

- Fees: Mint, burn, or transfer fees.

Solana-Specific Design

- All stablecoins on Solana use the SPL Token Standard.

- Use Rust and Anchor for smart contracts; it reduces bugs and makes audits easier.

- Solana separates code and data, so you need to design your account structure carefully.

- Estimate compute costs (CUs). Solana fees are tiny, but compute limits matter.

Build a State Machine

List all possible states like idle, Minting, redeeming, paused, and emergency mode. So, plan safe transitions between each state.

Read More: Dollar-to-Stablecoin Swaps In White-Label Neo Banking

3. Smart Contract Development

Now the solana developers and stablecoin development team collaboratively write and test the stablecoin logic.

Mint & Burn Logic

- Mint: User deposits collateral, then the contract mints stablecoin.

- Burn: User returns stablecoin, then contract releases collateral.

- Check permissions, reserve amounts, and limits.

Peg-Stability Logic

- Pull fresh prices from Oracle every few seconds.

- If the price goes above $1.01, offer lower burn fees (encourages burns).

- If the price goes below $0.99, discount mint fees (encourages mints).

- Add emergency functions if the oracle fails.

Reserve Management

- Track collateral balances in real time.

- Ensure reserves always match supply and reserve ratio.

- Allow emergency withdrawals for authorized parties.

- Emit logs for audits.

Anchor and SPL Token

- Create mint accounts, set decimals (usually 6).

- Use the SPL Token Program for transfers for better compatibility.

- Anchor helps validate accounts and prevent common bugs.

Testing

- Unit tests for edge cases.

- Integration tests for full flows (mint, swap, then redeem).

- Stress tests with 10,000+ simulated users.

- Fuzzing to catch hidden issues.

4. Security Audit & Compliance

A stablecoin must be secure, compliant, and audit-ready.

Pre-Audit Checklist

- Clean the code and documentation.

- Document all flows and states.

- Prepare your test suite.

- Set up an incident-response playbook.

Audit Process

- Automated scans for common vulnerabilities.

- Manual review by auditors.

- Attack simulations (oracle attacks, unauthorized minting, etc.).

- Optional: Formal verification for mission-critical logic.

Common Solana Bugs to Fix

- Missing signer checks

- Wrong account ownership

- Integer overflow

- Faulty state transitions

- Oracle manipulation

Post-Audit

- Fix all issues.

- Re-audit if major changes were made.

- Launch a bug bounty program.

5. Deployment & Launch

At this stage, your stablecoin goes live on the Solana mainnet.

Pre-Launch Checklist

- All audit issues fixed

- Multisig authority (3-of-5 recommended)

- Liquidity secured (Jupiter, Raydium, Orca)

- Exchange integrations

- Legal filings completed

- KYC/AML system ready

- Emergency pause mode tested

Deployment Flow

- Deploy SPL token mint

- Deploy vault/reserve program

- Deploy the Oracle program

- Set a time lock for upgrades

- Mint initial supply

- Add liquidity to pools

- Monitor for 24–48 hours

Liquidity Bootstrapping

- Launch with at least $5M liquidity on Jupiter.

- Add stablecoin ↔ USDC and stablecoin ↔ SOL pairs.

- Watch price daily; adjust incentives if slippage crosses 0.1%.

Marketing & GTM

- Day 1: Global announcement and DEX listing

- Week 1: CEX listings

- Week 2: Enterprise partnerships

- Month 1: DeFi integrations

Read Also: Top Crypto Stablecoin Wallets

How to Stay Compliant When Launching a Stablecoin in 2026?

If you are planning to build a stablecoin, compliance is not optional, and founders need a clear plan before going live.

Today, stablecoin rules are more defined than ever. By 2026, most major regions will have set proper licensing, reserve, and audit requirements. Here’s a quick view of the global landscape so you know what to expect:

| Region | Rule | Status | What You Must Do |

| United States | GENIUS Act (2025) | Live | 1:1 reserves, federal/state license, quarterly audits, AML/KYC, travel rule |

| European Union | MiCA (2024–2025) | Fully enforced | NCA license, reserve transparency, consumer protection, liquidity buffers |

| Singapore | MAS Guidelines (2025) | Live | Payment Token Service Provider license, reserve audits, risk controls |

| Hong Kong | SFC Guidance (2024–2025) | Operational | Payment token issuer license, segregated accounts, regular audits |

| UAE/Dubai | DFSA/ADGM | Developing | Stablecoin-friendly pathways, flexible licensing, and strong compliance focus |

What Makes Your Stablecoin Different From the Rest?

The stablecoin market on Solana is growing fast, and any new stablecoin will compete with strong players. As a founder, you must know who you’re competing with and what gaps you can fill. Below is a simple view of today’s market and where new stablecoins can still win.

| Stablecoin | Type | Issuer | Current Supply | Market Position |

| USDC | Fiat-backed | Circle | $5B+ | Most liquid & trusted |

| USDT | Fiat-backed | Tether | $8B+ | Global market leader |

| USDe | Yield-bearing | Ethena | $1.5B on Solana | Fastest-growing; institutional focus |

| PYUSD | Fiat-backed | PayPal/Paxos | < $500M | Payments-focused coin |

| USDY | RWA-backed (Treasuries) | Ondo Finance | < $100M | Institutional yield product |

| sUSD | RWA-backed (T-bills) | Solayer | < $200M | High-yield emerging player |

| USD1 | Act-compliant | GENIUS Act Issuer | < $50M | New entrant |

Based on SoluLab Analysis. The big players still leave open space for new ideas.

- USDC and USDT have scale but lack strong transparency and modern features.

- Yield coins like USDe grow quickly but come with higher risk, while RWA-backed options like USDY and sUSD are still small and mostly serve institutions.

This creates a clear opportunity: a stablecoin that blends Solana’s speed, full compliance, and safe, transparent reserves. A GENIUS Act–ready stablecoin with real on-chain use cases like stablecoin payment rails, remittances, treasury, and emerging-market adoption can easily stand out.

The next winning stablecoin in 2026 won’t chase risky yields; it will focus on trust, speed, and real-world utility that the current leaders don’t fully offer.

Startups Already Winning With Solana-Based Stablecoins

When founders look at Solana development companies, the best way to understand the value is to study why and how big enterprises explore them for services. Here are clear case studies that show why brands choose Solana and why it’s becoming the top choice for stablecoin development on Solana.

1. Western Union – USDPT Stablecoin on Solana

Western Union is one of the biggest money transfer companies in the world, moving more than $150 billion every year. They are now launching their own stablecoin, USDPT, built on Solana.

Western Union’s plan is simple:

- Let people send money instantly with Solana

- Keep transfer fees low

- Connect real cash (cash-in/cash-out) with digital money

- Use Solana’s speed to improve settlement time

Solana won after Western Union compared many blockchains. It scored highest in compliance, cost, and scalability, three things that matter most to global payment companies.

2. Ondo Finance – USDY on Solana

Ondo Finance launched USDY, a yield-bearing, real-world asset stablecoin backed by U.S. Treasury bills. It gives users around 5.2% APY, making it more than just a stable token; it’s also an income tool.

Why does USDY work so well on Solana?

- It connects easily with Solana’s big DeFi apps (Jupiter, Raydium, Orca).

- It lets users swap and earn instantly.

- Solana’s low fees make high-volume trading smooth.

Ondo also uses:

- Switchboard oracles for price data

- Squads multisig for secure governance

- Cross-chain bridges to bring dollars from Ethereum to Solana

3. PayPal – PYUSD on Solana

PayPal launch of PYUSD on Solana was a big moment for stablecoins. It proved that major global brands trust Solana’s SPL token and Token Extension technology.

Here’s what makes PYUSD on Solana interesting:

- PayPal users can buy PYUSD from their own PayPal accounts

- Monthly KPMG audits (trusted by institutions)

- Built-in compliance rules using transfer hooks and token delegates

- Millions of users can now access a Solana-based stablecoin instantly

This shows that Solana stablecoin development guide patterns are already working at a global scale, even for companies with strict compliance requirements.

Conclusion

Stablecoin development on Solana in 2026 has moved past the hype stage. It’s now a real, stable, and trusted path for companies that want to launch digital money at scale. Regulations are clearer, big institutions are joining in, and Solana’s tech has already been tested in real-world use.

The good news that if you build with the right strategy, solid tech, strong audits, clear communication, and a real business model, you can win big, and SoluLab, a Stablecoin development company, can help you.

The global payments and corporate treasury market is massive, and Solana gives you the speed and scale to compete. If you’ve been thinking about launching your own stablecoin, now is the time.

FAQs

1. How long does stablecoin development take?

Most stablecoins on Solana take around three to five months to build. The planning, development, audits, and compliance work all move together so the timeline stays tight. If you’re applying for federal licensing under the GENIUS Act, it can add a few more weeks, but the core build still moves fast on Solana.

2. What’s the minimum capital needed to launch?

Most founders spend between $50K and $100K to get their stablecoin ready for launch. This includes the SPL token work, smart contracts audits, legal checks, and the final deployment. After that, you’ll need reserve capital, usually starting from $10M depending on the amount of stablecoins you want to issue.

3. Is Solana the best chain for stablecoins?

Solana is great for payments because it’s fast, cheap, and handles huge volumes. Ethereum works better for deep liquidity and enterprise use. Tron is strong for remittances. In 2026, Solana is growing the fastest for consumer and payment use cases, making it a strong choice for founders, but going multi-chain is still the safest long-term option.

4. How do I keep my stablecoin pegged?

You keep the peg stable by backing every token with real reserves and using oracles to watch the price. If the price moves, arbitrage traders help bring it back to normal. You can also pause minting or burning during emergencies, and clear governance rules help keep everything stable as your supply grows.

5. What’s the regulatory status in 2026?

Regulations are much clearer now. The US runs under the GENIUS Act, the EU has full MiCA guidelines, and places like Singapore, Hong Kong, and the UAE offer strong frameworks for stablecoins. The core rules everywhere stay the same: full reserves, audits, proper KYC/AML, and transparent reporting.

6. How much yield can a yield-bearing stablecoin generate?

It depends on what backs it. T-bills earn around 4–5%. Private credit gives 7–9%. Some mixed models can go above 15%, but these come with a higher risk and a more complex design. Safer models stick to simple, regulated assets like treasuries.