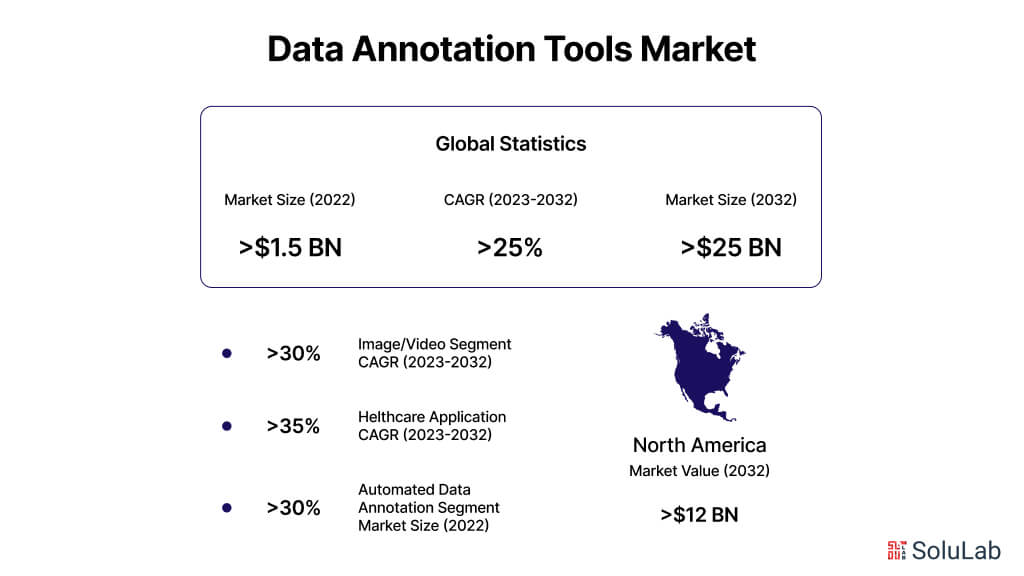

In a modern competitive environment where everyone is talking about the rise of AI and machine learning, the field of data science development is crucial. The global data annotation tools market size was estimated at USD 1.02 billion in 2023 and is anticipated to grow at a CAGR of 26.3% from 2024 to 2030. For a machine learning model to work as expected, quality data from the start to the end must be collected for research and analysis before being put into action. The machine learning model’s success depends on the data gathered from various sources to function and predict outcomes.

This guide is going to be essential for both decision-makers and buyers who believe in turning their thoughts into data implementation for AI and ML Operations. In this article, we will talk about what is data annotation, what it is, the tools used for data annotation, and much more to get you aware of its working and used cases.

What is Data Annotation?

Data annotation simply means marking and categorizing data to help machines, learning algorithms, interpret and modify information. This method is not only required for training AI models, but it also plays an important part in analyzing various sorts of data such as photos, sounds, videos, and texts. In the last five to ten years, data notations have become increasingly important for maintaining performance in machine learning systems. The data notation market is expected to reach twenty-one four dollars billion by 2026.

Without sufficient annotating, these techniques would struggle with structured data, unable to disconnect between the information supplied. This significance of data notation is well appreciated when dealing with structured data, commonly used emails, social media, photographs, text, and other sources. Data notation technology is meaningless without a data mining cycle, especially with the growing relevance of AI machine learning, which uses massive volumes of data collected on a worldwide scale.

What are the Different Types of Data Annotation?

Data Annotation is a vulnerable method that is used across different types of data each of its kind and methods used. The field is mainly divided into Computer Vision and Natural Language Processing types of data annotation. While the NLP Annotation works with text and audio data, on the other hand, Computer vision needs visual data. To better understand the concept of data annotation, here are data annotation types:

1. Text Annotation

This involves labeling and sorting textual data to help machines understand human language and interpret it more accurately. According to WiFi Talents, text annotation holds a significant share in the data annotation market. The most common text annotation operations are crucial for various LLM use cases, enhancing the machine’s ability to process and generate human-like language.

- Sentiment Annotation: Recognizing and Categorizing Emotions and opinions that are conveyed in a text.

- Entity Annotation: Entities such as people, organizations, and places within a text are identified and categorized.

- Relation Annotation: This includes a definition of the connections between different entities and concepts that are being shared using the text.

- Semantic Annotation: The task of connecting the words and phrases concerning their questions and meanings.

2. Image Annotation

The image annotation process involves attaching descriptive labels, tags, or bounding boxes to digital images to assist machine language with compressing visual content. This plays a pivotal role in creating computer vision technologies such as facial recognition, object detection, and image classification. Additionally, this process is crucial for training both large and small language models to interpret and generate descriptions for visual data accurately.

3. Video Annotation

Video annotation goes beyond the scope of image annotation by providing detailed information within video frames, enabling machines to examine the movement of visual content. This type of annotation is crucial for training large vision models, especially in applications such as autonomous vehicles, video surveillance, and gesture recognition.

4. Audio Annotation

Audio Annotation concentrates on tagging and transcribing audio data such as speech, music, and other sounds. Under this annotation, the development of speech recognition systems is made possible along with the development of voice assistants, and audio classification models.

5. LiDAR Annotation

Light Detection and Ranging (LiDAR) annotation involves labeling and categorizing 3D point cloud data produced by LiDAR sensors. This annotation type is becoming increasingly important for applications such as autonomous driving, robotics, 3D mapping, and LLMOps, where precise data labeling is crucial for model accuracy and performance.

What is the Use of Large Language Models in Data Annotation?

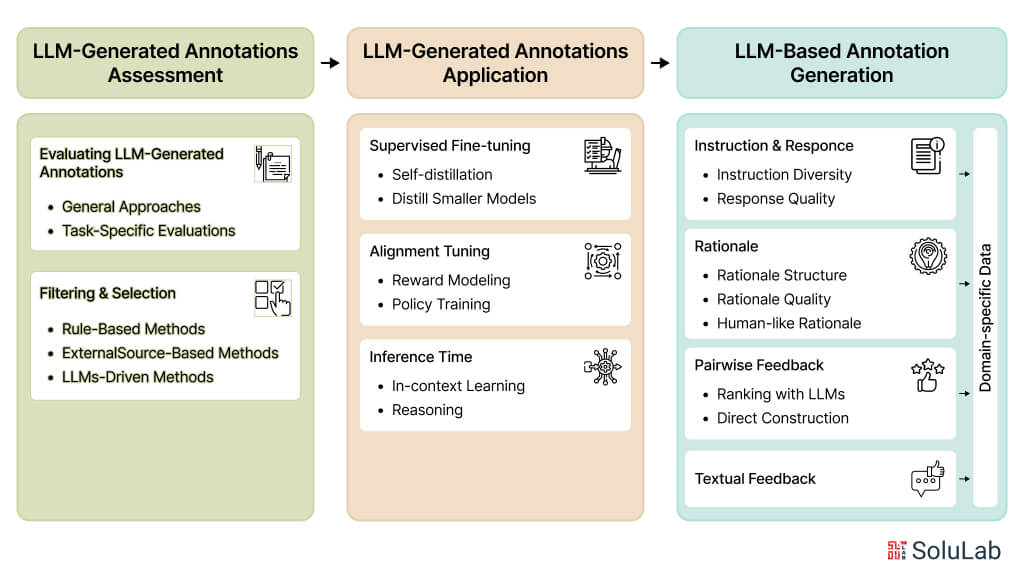

The rise of advanced Large Language Models like GPT-4, provides a unique chance of automating complex tasks within data annotation. The LLM data annotation is divided into three main areas:

- LLM-Based Annotation Generation: This model mainly focuses on how these LLMs are being used to automatically generate annotations for various types of data, streamlining the annotation process by leveraging the capabilities of Generative AI for Data Analysis.

- Evaluation of LLM-Generated Annotations: Large Language Models in Data Annotation includes the evaluation of the quality, accuracy, and effectiveness of annotations generated by Large Language Models. It aims to look after the annotations whether they are produced to meet the required standards and are suitable for applications.

- Application of LLM-Generated Annotations: Under this part annotations are explored based on LLM generation and if they can be used efficiently for practical applications like training, machine learning models, improving data analysis process, and enhancing the performance of AI systems.

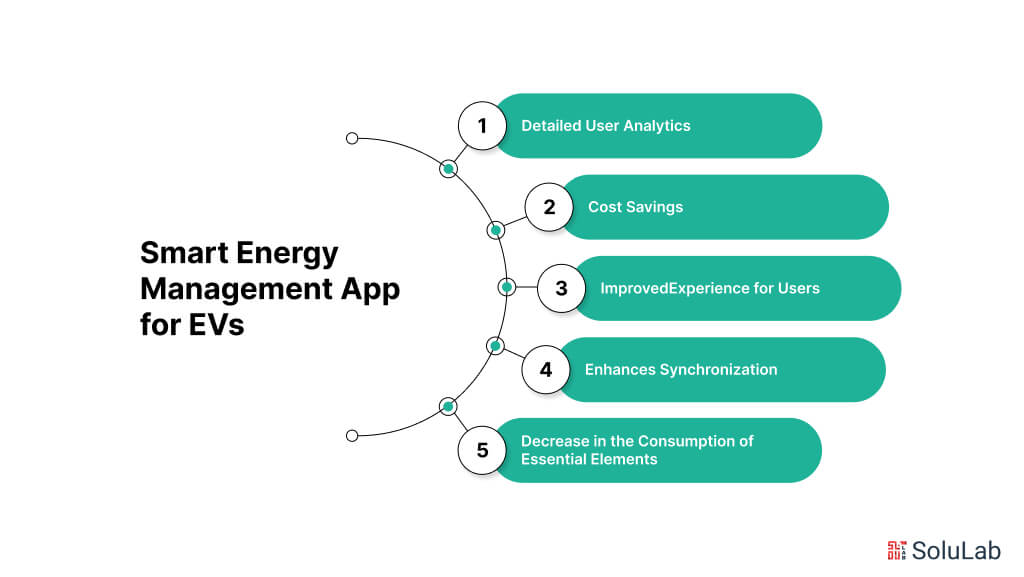

What are Data Annotation Tools?

A data annotation tool can be a cloud-based, on-premise, and a software solution used for annotating production-grade training data for machine learning. Even some organizations opt for a DIY approach and create their own tools, numerous data annotation tools are accessible through open-source or freeware options. The data annotation tools market was valued at $1,355.12 million in 2020 and is now projected to reach $13,696 million by 2030. These data annotation tools are also available commercially for rent or purchase. In a way, data annotation tools are categorized for specific data such as images, videos, text, audio, and spreadsheets. They also provide various deployment options that only include one-premise, container, SaaS Cloud, and Kubernetes. Here are some tools and technologies in Data Annotation:

Manual Automation Tools

These are the software applications that enable human annotators to manually label data. These tools provide the interface for tasks like drawing bounding boxes, segmenting images, and labeling objects within images. Some examples of this are as follows:

- Labellmg: This works as an open-source graphical tool used for annotating images with the use of bounding boxes.

- VGG Image Annotator: A tool that is specifically designed for image annotation which supports various annotation types like points, rectangles, circles, and polygons.

- LableMe: An online web tool interface for image labeling, commonly used for tasks that require detailed annotations such as segmentation.

- Labellerr AI: For teams requiring a scalable, enterprise-grade data annotation tool, Labellerr AI provides an automated platform with a smart feedback loop and ML-assisted labeling to reduce manual effort by up to 80% and accelerate project completion.

Semi-Automated Annotation Tool

- Computer Vision Annotation tools: CVAT tool is an open-source that incorporates automated annotation features features by utilizing pre-trained models for aiding annotation processes.

- MakeSense.AI: This is a no-cost online tool that presents semi-automated annotation functionalities, simplifying the process for different types of data annotation.

Automated Annotation Tools

They are fully automated tools striving to remove the need for human involvement with the employment of advanced AI models to produce annotations. Even though these tools can significantly speed up the annotation process, the efficiency of these tools mostly relies on the complexity of the tasks and the quantity of the existing data.

For example: Proprietary systems developed by AI, are usually customized for particular use cases or datasets.

How to Choose a Data Annotation Tool?

For AI and ML in data integration operations to turn out as expected it is important to choose the right annotation tool. To assist you with an informed decision-making process, here are curated data annotation tools according to their features, user feedback, industry accolades, and versatility across different applications. Now look at a few points to help you decide the best data annotation tools that stand out:

| Factors | Description |

Project’s Requirements |

Before venturing into data annotation tools, one must first have a very clear definition of the tasks and objectives of the project. Identify if the project requires picture classification, object detection, sentiment analysis, or any other kind of task that needs implementing regarding the machine learning project at hand. This will help in choosing a tool that best fits the specific needs of your project. |

Data Formats and Types |

Diverse projects require different forms and types of data. Ensure that the annotation tool you have chosen can support the specific kinds of data, such as text, image, video, or audio data, relevant to your project. Besides that, check if the format used in the annotations is compatible with popular formats like COCO or Pascal VOC, or any other custom-made formats that might be required for your project. |

Accuracy and Quality of the Annotation |

The quality and correctness of your annotations impact directly how accurate your machine-learning model is. To get high-quality annotations, look for tools with cutting-edge features such as pre-labeling methods, quality control methods, and AI-assisted annotation to ensure quality. Tools such as SuperAnnotate and Encord offer strong quality control tools to protect the accuracy of the annotation. |

Consider Collaboration and Scalability |

The larger your project becomes, the more important scalability becomes. Choose a solution that will maintain performance as user bases and volumes of data increase. For large teams, collaborative features such as team management, communication channels, and review pipelines are very critical in maintaining consistency and ease of annotation. |

User-Friendly Interface |

An intuitive interface is important for accurate and efficient annotations. Tools featuring error-prevention tagging, custom workflows, and easy-to-use labeling tools will be recommended. To speed up the process of labeling, a platform like Dataloop or Kili offers powerful UX capabilities and a configurable interface. |

Review license and Cost Models |

There are licenses for several data annotation tools, and they have different price options. Take the time to scrutinize the license agreements and options so that you get the best deal on your project. Apply variables such as usage-based pricing, and subscription fees, among all other latent factors that may impact your budget in the long term. |

Integration Possibilities |

It must be ensured that a change in workflow is smooth with seamless integration into your current machine learning stack. Make sure the products will work with the tools and procedures you already have by looking for products with inclusions of cloud storage integration, SDKs, and APIs. Systems like Kili or Encord come with strong developing features that are easily integrated into your current machine-learning stack. |

Best Data Annotation Tools

- SuperAnnotate: A fully integrated data annotation platform featuring an intuitive interface with comprehensive picture, video, and text capabilities and state-of-the-art AI-assisted features.

- Dataloop: This offers an AI development platform in a user-friendly interface with collaboration, making the entire AI lifecycle from data administration and annotation to model training and deployment very easy.

- Encord: A platform that has customized processes, on-demand labeling services, and effective labeling for the majority of visual modalities; built for AI at scale.

- Kili: It is a powerful data-labeling platform with integrated and easy-to-use tools. Users work with a range of data formats, complex automation and quality control, and very easy integration with pre-existing stacks for machine learning.

Read Also: Robotic Process Automation (RPA)

Benefits of Data Annotation

Besides time and cost savings data annotation offers benefits such as:

-

Enhanced Efficiency

Data labeling enhances the training of machine learning systems, improving their ability to recognize objects, words, sentiment, and intent among other grounds.

-

Increased Precision

Precise and accurate data labeling results in better training for data algorithms, which leads to higher data extraction accuracy in the future.

-

Decreased Human Intervention

Improved data annotation enhances the AI model’s output accuracy, reducing the need for human intervention, thus cutting costs and saving time.

-

Scalability

Automated data annotation allows for the scalability of data annotation projects, enhancing AI and ML models.

-

Easy Labeled Datasets

Data Annotation can streamline data and look after its processing, this is considered the most important step in machine learning. This results in the creation of labeled datasets.

If you want to build strong practical skills in handling datasets, annotation workflows, and AI-driven decision-making, enrolling in a comprehensive Data Analyst Course can help you advance your expertise and prepare for real-world data roles.

How to Secure Data Annotation?

Securing data annotation is crucial for maintaining the integrity and privacy of the information being processed. Here’s how you can ensure secure data annotation:

- Data Encryption: Implement encryption for both data at rest and data in transit to protect sensitive information during the data annotation process.

- Access Control: Limit access to data annotation tools and datasets to authorized personnel only. This reduces the risk of unauthorized access and potential data breaches.

- Anonymization Techniques: Use anonymization methods to strip identifiable information from datasets before starting the data annotation process, ensuring that personal data is protected.

- Regular Audits: Conduct regular security audits of your data annotation tools and practices to identify vulnerabilities and ensure compliance with data protection regulations.

- Training Annotators: Provide thorough training to annotators on data privacy and security best practices. This helps in safeguarding data during the annotation process.

- LLM Data Annotation Practices: When using Large Language Models in Data Annotation, ensure that the models and tools employed are secure and do not inadvertently expose sensitive data.

- Secure Data Annotation Tools: Utilize the best data annotation tools that prioritize security features, such as secure cloud environments and robust access controls, to protect your data.

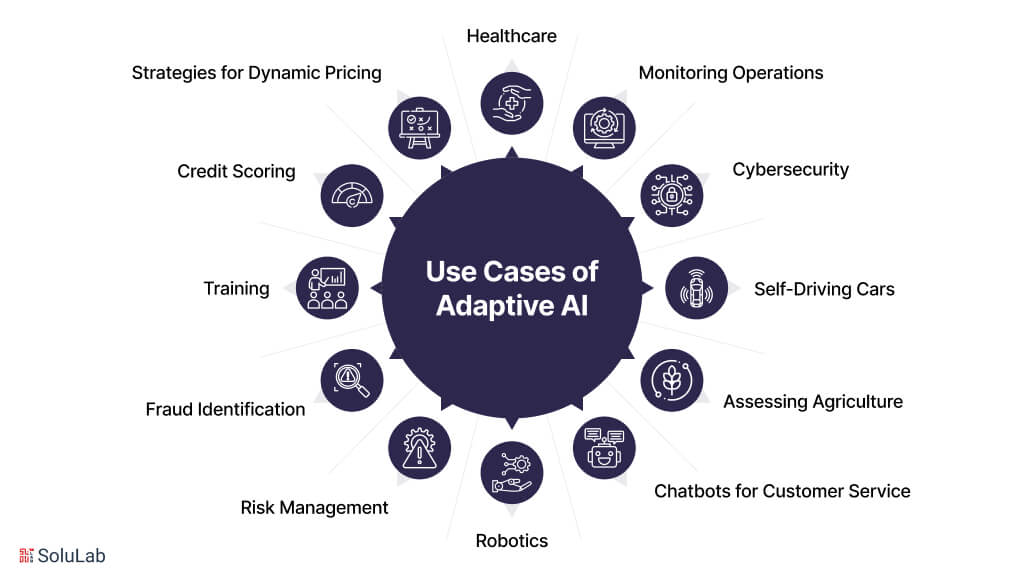

Use Cases of Data Annotation

Data Annotation finds diverse applications across industries. Here are some use cases of data annotation:

1. Autonomous Vehicles

Data Annotation is crucial for training self-driving cars to recognize road elements like traffic lights and pedestrians, aiding in safe navigation.

2. HealthCare

This helps in identifying anomalies in medical images such as X-rays and CT Scans, which results in improved patient care

3. E-Commerce

Analyzing customer behavior enhances personalized recommendations and boosts sales for businesses making use of data annotation.

4. Social Media

Enable businesses to understand customer needs and engage effectively by analyzing content on social media, which allows businesses to detect spam, identify trends, and conduct sentiment analysis.

5. Sports Analytics

Data Annotation is also applied in sports analytics where video footage of games like soccer and basketball is labeled to assess player performance and refine team strategies.

Wrapping Up

Data annotation is the most important procedure in allowing machine learning algorithms to learn from raw data to produce efficient results. Data Annotation is the process of attaching relevant labels, tags, and metadata to datasets to convert unstructured data into a structured, machine-readable form. This is a critical process for making supervised algorithms work because it produces the training data needed for the model to recognize patterns, be able to predict outcomes, and even generate new insights. Companies from every sector and domain have benefitted from this, including healthcare, banking, retail, and transportation.

SoluLab provides end-to-end data annotation services, custom to what their clients require. When you outsource data annotation services from SoluLab, you will free up in-house resources that can be diverted to core business goals. All the back-office operations would be performed by handling professionals.

FAQs

1. Why is Data Annotation becoming a crucial part of processing?

Data Annotation is the process of marking data to make it easier to understand for machines, which makes it a crucial part of data processing specifically for training machine learning models’ purposes to help them keep track of the patterns and provide accurate outcomes.

2. What are the methods for Data Annotation?

There are several different methods data annotation methods which include bounding boxes, polygon annotation, text annotation, keypoint annotation, etc. Each of these methods is suited for different tasks as per the requirements.

3. What are the most commonly used Data Annotation Tools?

There exist various data annotation tools, including Labellmg, LabelBox, and VGG Image Annotator, which are the most commonly used tools for performing data annotation. Techniques such as manual annotation, semi-automated annotation, and crowd annotation play a significant role, especially in developing Credit Risk Models with ML.

4. What are the steps involved in Data Annotation?

The data annotation process starts with collecting relevant data, followed by selecting the right annotation tools. The data is then annotated according to specific criteria, and quality control measures are implemented to ensure accuracy and consistency for training machine learning models.

5. How can SoluLab help with Data Annotation?

SoluLab, an LLM development company, provides expert data annotation services by leveraging advanced tools and techniques for labeling data with precision for machine learning model training. Our team follows stringent annotation guidelines to ensure high-quality results, making us a reliable choice for all your data annotation needs.