Using Machine Learning and AI for credit risk modeling has become a key tactic in the financial sector, revolutionizing how lenders evaluate borrower risk. Credit risk modeling has always depended on statistical methods and historical data, but AI-driven models provide a more accurate and dynamic approach thanks to the development of sophisticated algorithms and computer capacity.

Organizations may find new insights and development prospects while also reducing credit risk by utilizing AI and machine learning. By enabling the integration of disparate data sources, such as social media activity, and transaction histories, these technologies improve risk assessments and increase loan availability for marginalized groups. Furthermore, the AI for credit risk modeling assessment methodology is more scalable and flexible, allowing it to adapt to changing market conditions and regulatory requirements.

In this guide, we will present a complete approach to overcoming the complexities of developing credit risk models with AI and ML techniques. Financial institutions may get deeper insights into borrower creditworthiness, enhance lending choices, and reduce default risk by utilizing sophisticated data analytics, predictive modeling, and algorithmic methodologies. From comprehending the basics of credit risk to examining advanced AI breakthroughs, this article offers readers with a comprehensive overview of the major ideas, approaches, and concerns involved in constructing AI-driven credit risk models.

What is the Credit Risk Model?

Credit risk is the potential loss incurred by an investor or lender as a borrower fails to repay a loan or meet financial obligations. It is a natural element of the loan and investing process, resulting from the uncertainty surrounding borrowers’ capacity or desire to repay their obligations. loan risk is determined by a variety of variables, including economic circumstances, industry trends, borrower profiles, and loan agreement terms.

Credit risk models are important in the financial industry because they assist lenders and investors in accurately assessing and managing credit risk. These models of credit risk use statistical approaches, historical data, and financial indicators to assess the possibility of debtors defaulting or not paying. The significance of credit risk models is stated as follows:

- Risk Assessment: Credit risk models provide useful information about borrowers’ creditworthiness, allowing lenders to make educated decisions about loan extension and financial product investment. By assessing the likelihood of default and associated losses, these models assist lenders and investors in mitigating financial risk.

- Pricing and Risk-Based Choices: Depending on the apparent amount of risk, credit risk analysis models guide pricing methods for bonds, loans, and other credit instruments. To appropriately represent the risk profile of borrowers, lenders have the ability to modify loan terms, interest rates, and collateral requirements. Additionally, these models’ evaluations serve as a basis for risk-based choices such as credit approvals, credit limitations, and loan restructuring.

Read Blog: A Brief Guide to AI in Portfolio Management

- Portfolio Management: Credit risk models help in distributing assets, diversification, and risk optimization, which are all aspects of portfolio management. Financial organizations can successfully manage their risk and return objectives by assessing the credit reliability and efficacy of individual assets or borrowers within a portfolio. This makes it possible to create diverse portfolios that fit the organization’s risk tolerance and legal needs.

- Regulatory Compliance: For financial organizations, especially those in the banking industry, credit risk analysis models are essential to regulatory compliance. The Basel Accords, which demand the use of internal models or standardized methods for determining regulatory capital buffers, are one example of the criteria that regulatory bodies impose for assessing and controlling credit risk. Institutions can improve their risk management procedures and guarantee regulatory compliance by utilizing strong credit risk models.

Types of Credit Risk

There are several ways that credit risk might appear, and each one has different challenges and ramifications for investors and lenders. Understanding the different types of credit risk is vital for proficiently overseeing and alleviating possible damages. Three main categories of credit risk are as follows:

1. Default Risk

Also known as default probability or default hazard, default risk is the likelihood that a borrower would fail to make debt payments as agreed upon, so breaching the terms of the loan. This kind of risk occurs when borrowers are unable or unwilling to pay back their debts, which causes lenders or investors to suffer financial losses. The default risk is influenced by several factors such as unfavorable economic conditions, declining borrower financial stability, and shifts in market dynamics.

2. Credit Spread Risk

Spread risk or credit spread volatility is the possibility of unfavorable changes in the yield difference between credit-sensitive assets (like corporate bonds and credit default swaps) and securities without risk (like government bonds). This risk results from shifts in how the market views the quality of credit, liquidity, and macroeconomic factors that have an impact on credit instrument value. The return on investment and valuation of fixed-income portfolios, especially those that contain credit-sensitive assets, can be impacted by credit spread risk.

3. Concentration Risk

Excessive dependence on a single borrower, industrial sector, geographic area, or asset class within portfolio results in concentration risk, sometimes referred to as exposure risk or portfolio concentration risk. A portfolio’s total risk exposure increases when a sizable number of its assets are concentrated in a single business or industry. This is because the potential impact of unfavorable events on that entity or industry is amplified. Inadequate diversification tactics, market conditions, or investor strategy choices can all lead to concentration risk.

Knowing the various types of credit risk empowers lenders, investors, and financial establishments to establish comprehensive risk mitigation plans, diversify their holdings, and fortify themselves against possible setbacks. In order to maintain long-term financial stability and increase their resistance to unfavorable market conditions, stakeholders should proactively identify and manage credit risk exposures.

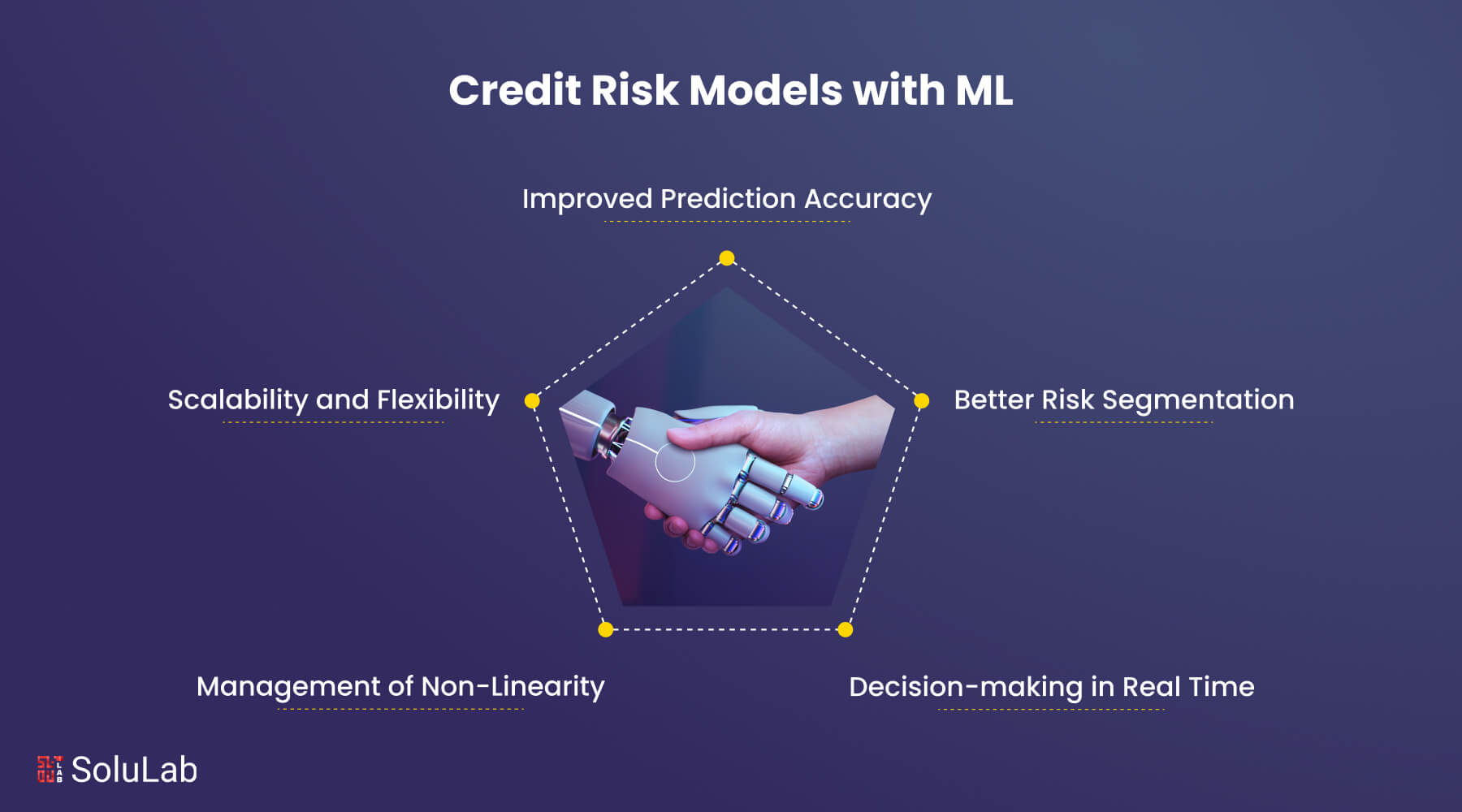

Benefits of Machine Learning for Evaluating Credit Risk

With its superior analytical skills and predictive insights, AI and machine learning (ML) has become a potent tool for credit risk modeling as the financial sector continues to grow. When it comes to credit risk modeling, machine learning has a number of benefits over conventional statistical techniques that enable financial firms to improve risk management procedures and streamline decision-making. The following are some of the main benefits of credit risk machine learning:

1. Improved Prediction Accuracy: Compared to traditional models, machine learning systems are more adept at capturing complex patterns, nonlinear correlations, and exchanges in credit risk data. ML models may achieve improved prediction accuracy and discriminating power by utilizing complex algorithms like gradient boosting machines, random forests, and neural networks. This helps lenders make better credit judgments and reduces the chance of defaults.

2. Better Risk Segmentation: Lenders may better target different customer categories with their pricing and risk assessment methods thanks to machine learning’s ability to provide precise segmentation of borrowers based on their credit risk profiles. Machine learning algorithms have the ability to detect minute changes in risk indicators and tailor credit scoring models or underwriting standards to particular sectors, loan products, or groups of people.

3. Decision-making in Real Time: Machine learning makes it possible to process and analyze enormous volumes of data in real time, which helps lenders make credit decisions quickly and adapt to changing borrower needs or market conditions. Machine learning algorithms have the ability to evaluate credit applications instantly, automate credit approval processes, and identify fraud or abnormalities in credit risk in real time. This improves client satisfaction overall, speeds up processing, and increases operational efficiency.

4. Scalability and Flexibility: Financial institutions may easily update and modify their credit risk models in response to changing market conditions, legal mandates, and new risk variables thanks to the scalability and adaptability of machine learning models. Without the need for human involvement, ML algorithms may absorb new data sources, modify model parameters, and react to shifting risk situations, assuring the continued stability of credit risk models.

5. Management of Non-Linearity: Machine learning is particularly good at managing the non-linear interactions and linkages between variables, which are typical in credit risk modeling. By using strategies like feature engineering, kernel approaches, and deep learning architectures, machine learning (ML) algorithms are able to capture intricate non-linearities and interactions, in contrast to typical linear models that presume linear correlations between predictors and outcomes. With this capacity, machine learning models may find hidden trends and risk variables that could show non-linear associations with credit risk outcomes, producing risk assessments and prediction insights that are more precise.

Use Cases of Machine Learning in Credit Risk Modeling

Machine learning has revolutionized credit risk modeling by providing advanced analytical techniques and predictive abilities. Here are some use cases of machine learning in credit risk modeling:

1. Default Prediction: Machine learning algorithms like logistic regression, random forests, and gradient-boosting machines revolutionize default prediction by leveraging historical loan data, borrower attributes, and economic indicators to estimate the likelihood of borrowers defaulting on their loan obligations. These models excel in identifying high-risk borrowers and flagging potential default events before they occur, enabling financial institutions to assess credit risk more effectively and mitigate potential losses in their loan portfolios.

2. Credit Scoring: In credit scoring, machine learning automates the process of evaluating creditworthiness by analyzing vast amounts of historical credit data. By employing advanced modeling techniques and alternative data sources, ML-based credit scoring models can provide more accurate and fair assessments of borrowers, improving the overall reliability of credit decisions.

3. Risk-Based Pricing: By examining borrower characteristics, market conditions, and rivalries, machine learning makes dynamic risk-based pricing techniques possible. In order to match loan price with risk exposure, maximize profitability, and reduce risks, machine learning algorithms divide borrowers into risk groups, estimate the likelihood of default, and compute risk-adjusted pricing measures.

4. Fraud Detection: Leveraging machine learning algorithms, financial institutions can analyze transaction data in real time to detect unusual patterns or anomalies indicative of fraudulent activities. ML models continuously learn from historical data, improving detection accuracy and enabling proactive measures to mitigate the risks associated with credit fraud.

Related: Machine Learning Use Cases in the Automotive Sector

5. Automation of Credit Decisions: Machine learning expedites the credit approval process by quickly assessing applicant creditworthiness, reducing errors and biases associated with manual decision-making. By minimizing human intervention, ML enhances efficiency and consistency in credit decisions, ultimately improving customer experience and operational workflows.

6. Customer Segmentation: ML algorithms analyze extensive customer data to identify patterns and behaviors indicative of varying risk profiles and credit behaviors. By segmenting customers into distinct groups, financial institutions can tailor products, services, and communication strategies to meet the specific needs and preferences of each segment, enhancing customer satisfaction and fostering loyalty.

7. Dynamic Pricing of Loans: By using the power of data analytics, machine learning enables lenders to dynamically adjust interest rates based on real-time assessments of borrower credit risk and market conditions. This flexibility allows financial institutions to offer fair and customized loan terms, maximizing profitability while meeting the diverse needs of borrowers.

Read Our Blog: AI Use Cases and Applications in Key Industries

8. Early Warning Systems: Machine learning algorithms detect subtle patterns indicative of impending financial distress by analyzing borrower behavior and economic indicators. Early warning systems empower lenders to identify borrowers at risk of default before the situation escalates, facilitating timely intervention measures to prevent losses and preserve borrower-lender relationships.

9. Credit Limit Management: Machine learning dynamically adjusts credit limits based on recent financial behavior, changes in income, and broader economic indicators. This personalized approach optimizes risk management by aligning credit exposure with customer risk profiles, enhancing customer satisfaction, and minimizing credit-related risks for financial institutions.

10. Collections Optimization: By predicting the likelihood of repayment, machine learning enables financial institutions to tailor collection strategies to individual borrower profiles. This nuanced approach optimizes resource allocation within collections departments and enhances the borrower experience by avoiding unnecessarily harsh measures for those in temporary financial distress, ultimately improving loan recovery strategies and safeguarding institutional assets.

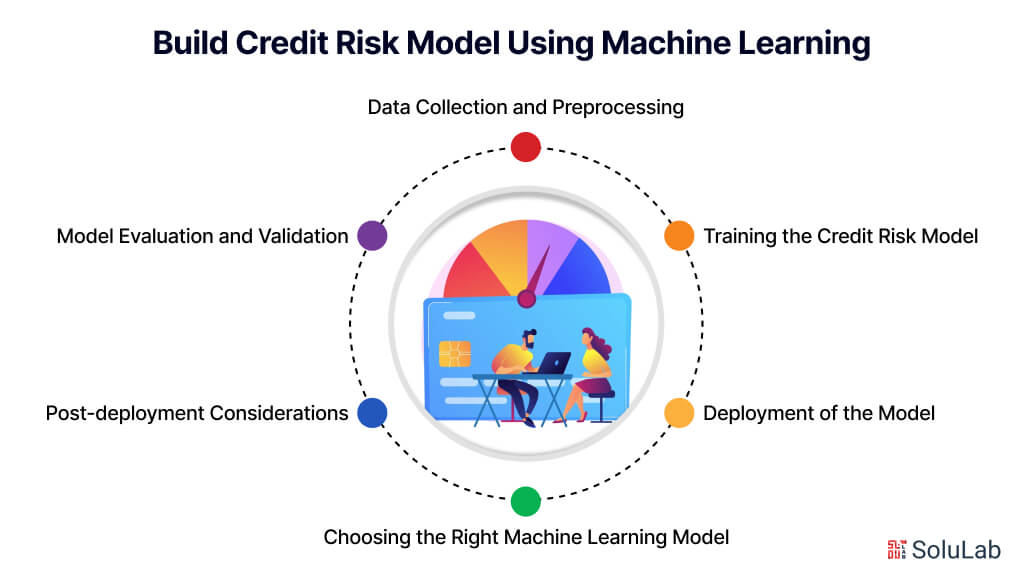

How to Build a Credit Risk Model Using Machine Learning?

Building a credit risk model using machine learning encompasses several critical steps, each vital for ensuring the model’s precision and efficacy. Let’s look into a detailed breakdown of each phase:

A. Data Collection and Preprocessing

- Data Sources: It’s essential to gather comprehensive and relevant data sources for training the model. This includes historical loan performance data, borrower information such as credit scores, income levels, employment history, and demographic details, as well as macroeconomic indicators like GDP growth, unemployment rates, and interest rates. Additionally, alternative data sources such as social media activity, transaction history, or even psychometric assessments can provide additional insights into borrower behavior.

- Preprocessing Techniques: Once the data is collected, preprocessing steps are necessary to ensure data quality and consistency. This involves techniques such as data cleaning to handle missing or erroneous values, outlier detection to identify anomalies that could skew the model, and normalization or standardization of features to bring them to a comparable scale. Categorical variables may need to be encoded using methods like one-hot encoding or label encoding to make them suitable for machine learning algorithms. Feature engineering is also crucial at this stage, involving the creation of new features, transformation of existing ones, or selection of relevant variables to enhance the predictive power of the model.

B. Choosing the Right Machine Learning Model

- Supervised Learning Models: These models are trained on labeled data, where the target variable (e.g., default or non-default) is known. Logistic regression, random forests, support vector machines, and gradient boosting machines are commonly used supervised learning algorithms for credit risk modeling. Each algorithm has its strengths and weaknesses, and the choice depends on factors such as dataset size, complexity, and interpretability requirements.

- Unsupervised Learning Models: While less common in credit risk modeling, unsupervised learning algorithms like clustering can help identify patterns and segments within the data without the need for labeled outcomes. Clustering algorithms can be useful for exploratory analysis and identifying groups of borrowers with similar credit risk profiles.

- Ensemble Methods: Ensemble methods combine multiple base models to improve predictive performance and reduce the risk of overfitting. Techniques such as bagging (e.g., random forests), boosting (e.g., AdaBoost, gradient boosting), and stacking combine the predictions of multiple models to achieve better accuracy and robustness.

C. Training the Credit Risk Model:

- Data Splitting: The dataset is divided into training and testing sets to train the model on historical data and evaluate its performance on unseen data. Common splitting ratios include 70/30 or 80/20 for training and testing, respectively.

- Hyperparameter Tuning: Hyperparameters are parameters that control the learning process of the machine learning algorithm. Techniques such as grid search, random search, or Bayesian optimization are used to search the hyperparameter space and identify the optimal configuration that maximizes a chosen performance metric.

- Cross-Validation: Cross-validation is a robust technique for estimating the performance of a model. It involves splitting the dataset into multiple subsets and training the model on different combinations of these subsets. Stratified k-fold cross-validation, k-fold cross-validation, and leave-one-out cross-validation are frequently used cross-validation techniques.

D. Model Evaluation and Validation

- Performance Metrics: Performance metrics such as ROC-AUC, F1 Score, accuracy, precision, recall, and confusion matrix are used to evaluate the model’s performance. These metrics measure the model’s ability to discriminate between default and non-default cases, balance between false positives and false negatives, and overall predictive accuracy.

- Backtesting and Stress Testing: Backtesting involves evaluating the model’s performance on historical data to assess its predictive accuracy and robustness. Stress testing involves simulating adverse scenarios or extreme market conditions to assess the resilience of the model and the financial institution’s risk exposure.

E. Deployment of the Model

- Integration with Decision Systems: Once the model has been trained and validated, it needs to be integrated into the organization’s decision-making systems or operational workflows. This may involve deploying the model within existing software infrastructure, developing APIs (Application Programming Interfaces) for seamless integration, and establishing governance processes for model deployment and monitoring.

- Real-time Scoring: With real-time scoring, lenders may evaluate a borrower’s credit risk and decide whether to grant a loan or extend credit in actual time. Deploying the model in a real-time scoring environment requires efficient data processing, low-latency model inference, and robust system architecture to handle high volumes of transactional data with minimal latency.

F. Post-deployment Considerations

- Monitoring Model Performance: Continuous monitoring of the model’s performance is essential to detect drifts in accuracy or data quality issues. Key performance indicators (KPIs) such as model calibration, discrimination, and stability should be monitored regularly to assess the model’s ongoing effectiveness and reliability.

- Retraining and Model Updating: As the credit risk environment evolves and new data becomes available, it may be necessary to periodically retrain the model to maintain its predictive accuracy and relevance. Retraining techniques include reconsidering model parameters, adding input from model performance monitoring, and upgrading the model with new data.

- Model Governance and Compliance: Compliance with regulatory standards and industry guidelines is paramount when deploying credit risk models in financial institutions. Regulations pertaining to paperwork, fair lending procedures, verification of models, and transparency should all be followed by model deployment processes. Additionally, organizations must ensure data privacy, security, and ethical considerations in deploying machine learning models for credit risk assessment.

By following these steps meticulously, financial institutions can build robust credit risk models that accurately assess risk and support informed decision-making in lending operations.

Important Things to Think About When Using AI for Credit Risk Modeling

When employing artificial intelligence (AI) for credit risk modeling, several crucial considerations must be addressed to ensure ethical and compliant utilization of these advanced technologies. Here are three key factors:

1. Data Privacy and Ethics: AI-driven credit risk models rely on vast amounts of sensitive borrower data, necessitating robust measures to safeguard privacy and uphold ethical standards. Implementing encryption, access controls, and anonymization techniques is crucial to protect individuals’ privacy rights. Furthermore, ethical principles like fairness, transparency, and accountability should guide model development and deployment to mitigate biases and discrimination in credit decisions.

2. Regulatory Compliance: Financial institutions operating in regulated environments must comply with stringent standards governing credit risk management and data protection. Adhering to relevant regulatory requirements, conducting thorough impact assessments, and establishing governance frameworks are essential when employing AI for credit risk modeling. These measures ensure oversight of AI implementation and monitoring of compliance with regulatory mandates.

3. Interpretability of Models: The interpretability of AI models is pivotal for stakeholders to comprehend credit risk decisions and assess influencing factors. While complex machine learning algorithms offer superior predictive accuracy, their opacity can hinder interpretability, making it challenging to explain model outputs and identify potential biases. Prioritizing transparent modeling techniques and implementing validation processes enhance model interpretability, enabling effective scrutiny by stakeholders, including regulators and consumers, and fostering trust in decision-making processes.

Future Trends and Innovations in Credit Risk Modeling

Credit risk modeling is a dynamic field that is always changing due to market forces, regulatory needs, and technological improvements. In the future, a number of developments and trends have the potential to completely change the credit risk management industry. Three main areas of attention are as follows:

1. Explainable AI

The demand for transparency and interpretability in credit risk modeling is growing alongside the increasing complexity of machine learning algorithms. Explainable AI methods aim to enhance understanding by shedding light on the factors influencing credit risk decisions and identifying potential biases. By providing insights into model predictions and decision-making processes, Explainable AI fosters trust supports regulatory compliance and empowers users to make informed assessments.

2. Federated Learning

Federated Learning is emerging as a promising approach in environments where data sharing is restricted. This method allows multiple institutions to collaboratively train a shared machine learning model while preserving data privacy by keeping sensitive information encrypted and localized. By aggregating model updates instead of raw data, Federated Learning maintains privacy, enables scalability, and facilitates collaborative risk assessment across distributed data sources.

3. Integration of Alternative Data Sources

Credit risk modeling is evolving to incorporate alternative data sources beyond traditional financial metrics. These sources, including social media activity and transactional data, offer valuable insights into consumer behavior and financial health. By leveraging advanced analytics and data fusion techniques, financial institutions can enrich credit risk models with alternative data, improving predictive accuracy, expanding credit access, and enhancing risk differentiation.

Concluding Remarks

Credit risk modeling has a bright future ahead of it because of developments in artificial intelligence, data analytics, and regulatory frameworks. Prioritizing responsible and innovative methods of credit risk management is essential for financial institutions as they negotiate changing market dynamics, technology advancements, and regulatory requirements.

Credit risk modeling may now be improved in ways never before possible thanks to machine learning and artificial intelligence. Financial organizations may create more transparent and robust credit risk models that support informed decision-making, build trust, and promote sustainable development by utilizing complex algorithms, alternate data sources, and explainable AI methodologies.

Are you prepared to redefine your credit risk modeling using AI and machine learning? Collaborate with SoluLab, a top AI development company, to utilize advanced technology and expertise in crafting resilient credit risk models. Our AI consulting and development services are tailored to your requirements, ensuring accuracy, dependability, and regulatory compliance throughout the process. Partner with SoluLab to navigate the evolving landscape of credit risk management with confidence.

FAQs

1. What is a credit risk model, and why is it important?

A credit risk model is a statistical tool used by financial institutions to assess the likelihood of a borrower defaulting on a loan. It analyzes various factors such as borrower characteristics, historical loan performance, and macroeconomic indicators to estimate credit risk. Credit risk models are crucial for financial institutions as they aid in making informed lending decisions, allocating capital efficiently, and mitigating potential losses in loan portfolios.

2. How does machine learning enhance credit risk modeling?

Machine learning algorithms excel in credit risk modeling by analyzing vast amounts of data to identify complex patterns and relationships. Unlike traditional statistical methods, machine learning techniques such as logistic regression, random forests, and gradient boosting machines can handle nonlinear relationships and capture intricate interactions between variables. This enables more accurate predictions of default probability, leading to improved risk assessment and management.

3. What data is used in building credit risk models with machine learning?

Credit risk models leverage a variety of data sources, including historical loan performance data, borrower information (e.g., credit scores, income), macroeconomic indicators (e.g., GDP growth, unemployment rates), and alternative data sources (e.g., social media activity, transaction history). By incorporating diverse datasets, machine learning models can capture a comprehensive view of credit risk and enhance predictive accuracy.

4. How do financial institutions ensure the fairness and transparency of machine learning-based credit risk models?

Financial institutions prioritize fairness and transparency in credit risk modeling by implementing explainable AI techniques and conducting rigorous model validation processes. Explainable AI methods enable stakeholders to understand how credit risk decisions are made and assess the factors influencing these decisions, promoting transparency and accountability. Additionally, model validation ensures that the model is fair, unbiased, and compliant with regulatory standards.

5. What are the key challenges in building credit risk models with machine learning?

Some key challenges in credit risk modeling with machine learning include data quality and availability, model interpretability, regulatory compliance, and the potential for model biases. Ensuring the accuracy and reliability of input data, interpreting complex machine learning models, complying with regulatory requirements, and mitigating biases are critical considerations for building effective credit risk models. However, with proper data governance, model validation, and ethical AI practices, these challenges can be addressed to develop robust and trustworthy credit risk models.