Web3 banking in Europe just got real and regulated. With the introduction of Europe’s Markets in Crypto-Assets Regulation (MiCA), the EU now has a single rulebook for digital assets. This is big: MiCA will apply to over 450 million users across 27 countries, giving enterprises a clear, stable foundation to launch compliant financial products.

For fintech companies, enterprises, and financial institutions, this isn’t just a law; it’s a massive opportunity. Now, businesses can confidently build and launch MiCA-compliant platforms like crypto wallets, stablecoin payment rails, and White Label Neo Banking Apps, all backed by regulatory clarity.

This article is for B2B leaders who want to understand how to design, build, and deploy MiCA-compliant Neo Banking solutions in a fast-changing digital economy. Whether you’re scaling a fintech product or entering the EU market, missing this moment could cost you your first-mover advantage.

Let’s break down what MiCA means, why timing matters, and how to start building today.

What Is MiCA and Why Does It Matter for Web3 Banking in Europe?

The European Markets in Crypto-Assets Regulation, or MiCA, was introduced to solve a major problem: inconsistent crypto laws across EU countries. Before MiCA, launching a white label crypto banking service in Europe was complicated. Each country had its own rules, making it difficult for businesses to stay compliant.

MiCA changes that. It creates a single, clear framework that applies across all EU member states. It covers:

- Utility tokens

- Asset-backed tokens

- Stablecoins

- Crypto-asset service providers (CASPs)

This matters for businesses building Neo banking solutions because now there’s one rulebook instead of many. That reduces legal risks, lowers go-to-market time, and makes it easier to scale.

With MiCA, launching a MiCA-compliant platform or a white-label neo bank solution is now more predictable and faster. This gives first movers a real advantage in Europe’s fast-evolving Web3 finance space.

Why Are Enterprises Launching Neo Banks in Europe Now?

There’s never been a better time to build a MiCA-compliant neo bank in Europe. Three major forces are driving this rapid shift:

1. Clear Regulations Are Finally in Place

Europe’s Markets in Crypto-Assets Regulation (MiCA) is now active, offering much-needed legal clarity. This allows enterprises to launch Web3 banking products with confidence, knowing exactly what’s required to stay compliant.

2. Faster Time to Market with White-Label Solutions

Using a white-label crypto banking service, companies can go from idea to launch in just a few months. This drastically reduces the time, cost, and risk compared to building from scratch. With the right neo banking solutions, financial institutions can stay ahead of competitors.

3. Demand for Web3 Banking Is Growing Across the EU

European users, both retail and business, are looking for next-gen financial tools. From DeFi integrations to stablecoin-based payments, the shift is happening fast. Enterprises that offer MiCA-compliant platforms now can gain a strong early-mover advantage.

If you’re a Blockchain company or a financial product builder, this is the right moment to enter the market with a MiCA-compliant white label neo banking app. Fast movers will earn the trust of early adopters and regulators alike.

Read Also: Build a Crypto-Friendly Bank Like JP Morgan in 2025

What Is a MiCA-Compliant White-Label Neo Bank?

A MiCA-compliant platform is a ready-to-launch digital banking solution that follows the rules set by Europe’s Markets in Crypto-Assets (MiCA) regulation. A white-label neo bank solution allows any FinTech company to offer its own branded bank without building everything from scratch.

With a white-label setup, your business can quickly enter the Web3 banking space by using:

- Pre-built neo-banking app development tools

- Support for a top-notch smart contract

- Secure infrastructure for crypto payments, lending, and digital asset custody

- Built-in features of stablecoins and multi-currency support

In short, a MiCA-compliant white-label neo bank makes it faster, safer, and cheaper for companies to offer digital banking in line with European laws, without the complexity of full in-house builds.

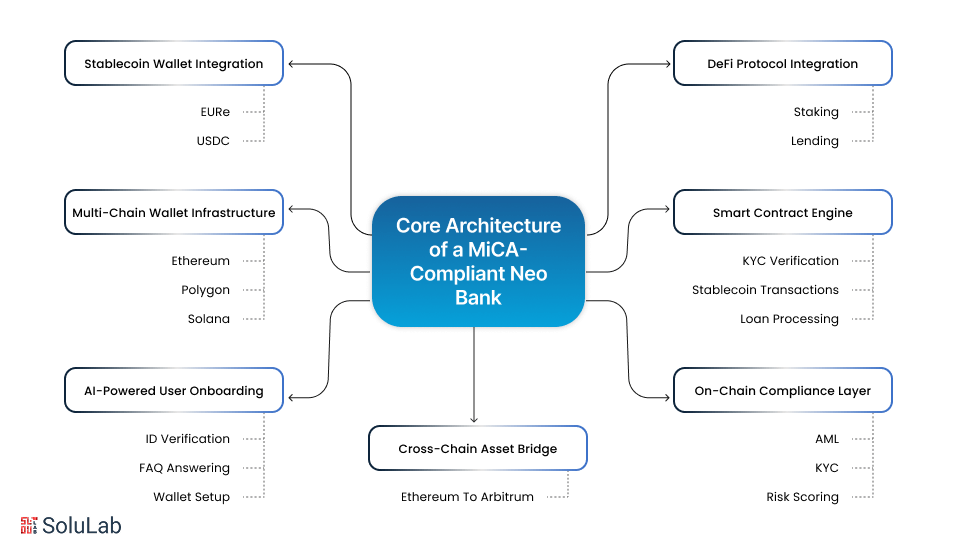

What Does the Core Architecture of a MiCA Neo Bank Look Like?

A MiCA-compliant Neo bank must be built for security, compliance, and scalability from the ground up. The architecture typically combines blockchain infrastructure with modular, plug-and-play components to meet both user demands and European regulatory standards.

Here’s what the core technical architecture looks like:

1. Multi-Chain Wallet Infrastructure

Your users should be able to hold and transact with multiple digital assets. This is achieved through multi-chain wallet integration, enabling smooth access to Ethereum, Polygon, or even Solana-based assets.

2. Smart Contract Engine

A key part of the backend, smart contracts automate everything, from KYC verification to stablecoin transactions and loan processing. Working with a smart contract development company ensures these contracts are secure, upgradeable, and compliant with MiCA norms.

3. On-Chain Compliance Layer

This includes MiCA-mandated modules for AML, KYC, risk scoring, and transaction monitoring. These compliance protocols are often embedded directly into smart contracts or plugged into a rules engine via APIs. White label crypto banking services need these for real-time legal adherence.

4. AI-Powered User Onboarding

Leveraging AI agents streamlines onboarding and customer support. From verifying ID documents to answering FAQs and setting up user wallets, AI agents can dramatically cut costs and speed up registration.

5. Stablecoin Wallet Integration

Every MiCA-compliant platform must support regulated stablecoins like MiCA-registered EURe or USDC. These are embedded via APIs and must comply with capital reserve standards. Collaborating with a stablecoin development company ensures smooth integration and token handling across your ecosystem.

6. Cross-Chain Asset Bridge

Modern banks can’t operate on one chain alone. Cross-chain bridges enable asset movement between blockchains (e.g., transferring from Ethereum to Arbitrum), allowing users flexibility while staying compliant.

7. DeFi Protocol Integration

For banks that want to offer staking, lending, or yield generation, working with a DeFi development company ensures proper integration of popular DeFi tools. These services must be modular and configurable to stay within MiCA rules.

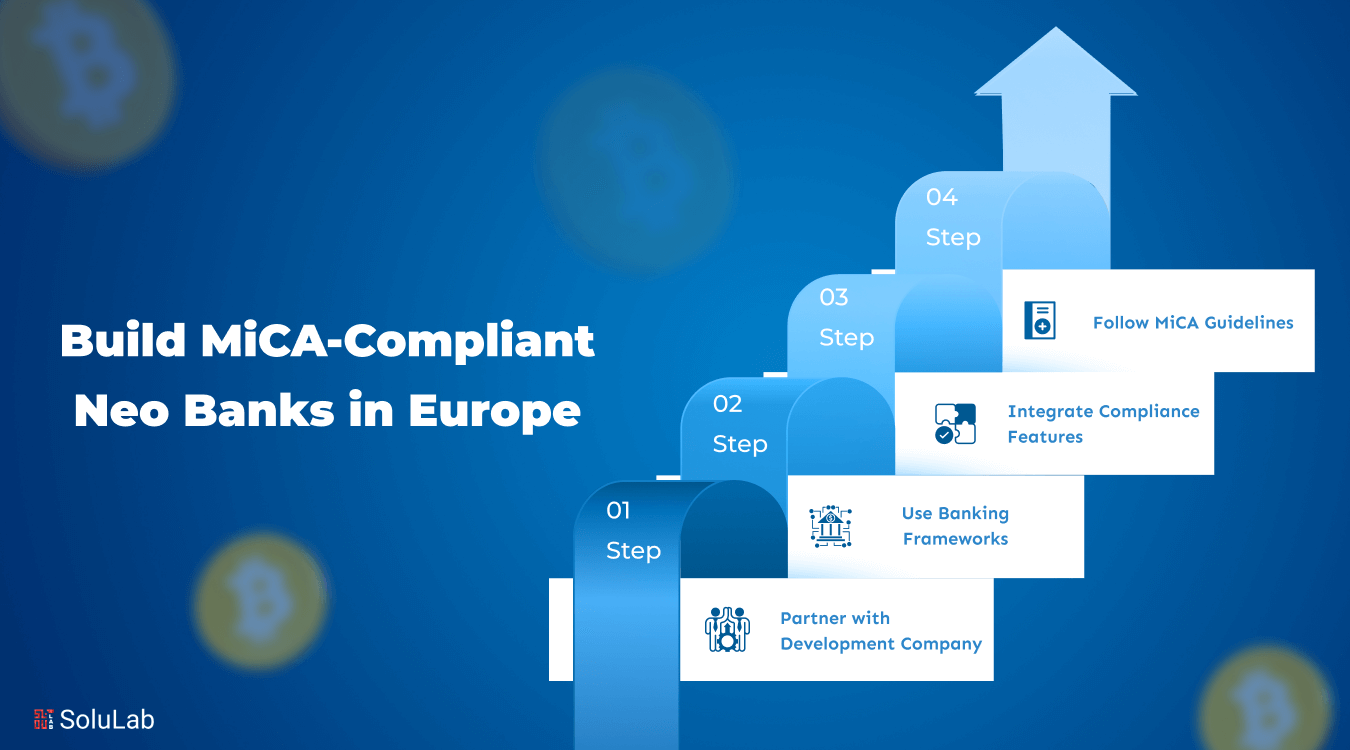

How Do You Build a MiCA-Compliant White Label Neo Bank?

Building a MiCA-compliant platform is not just about writing code; it’s about making sure your banking app follows Europe’s new rules for crypto and digital assets. Here’s how you can do it the right way:

1. Partner with the Right Development Company

Start by choosing a trusted Blockchain development company that understands both fintech and regulatory compliance. They’ll help you avoid delays and build fast, secure systems.

2. Use Proven Banking Frameworks

Choose a strong Neo-banking app development stack that supports fast onboarding, flexible modules, and scalable architecture.

3. Integrate Key Compliance Features

Add secure identity checks (KYC/AML), transaction monitoring, and plug-in features like:

- AI tools for automated fraud detection and support

- Modules for asset-backed services

- Smart contract solutions for secure on-chain automation

4. Follow MiCA Guidelines from Day One

Make sure your platform meets MiCA standards for:

- User protection (transparency, data handling)

- Custody of digital assets

- Clear reporting and licensing requirements

With an experienced tech partner, your MiCA-compliant Neo‑Banking solution can go from idea to pilot launch in 10–12 weeks. That gives you a serious first-mover advantage across Europe.

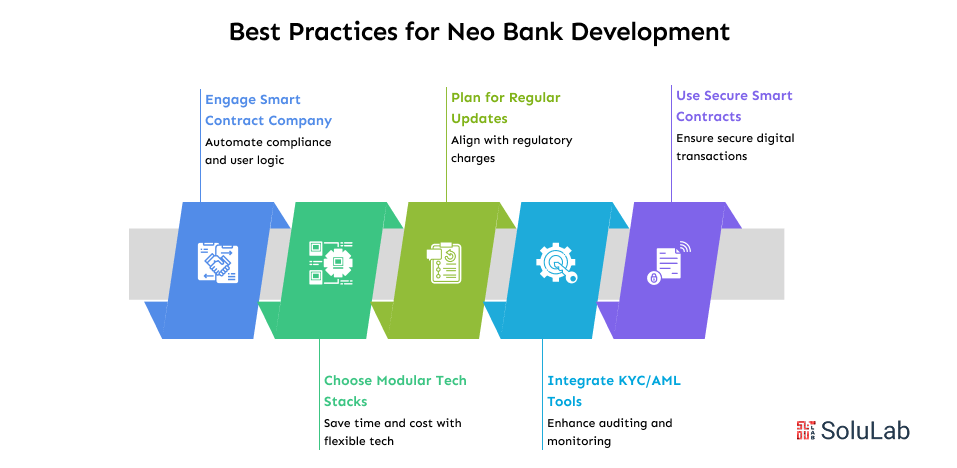

What Are the Best Practices for Neo Bank Development?

To build a scalable and MiCA‑compliant white-label neo bank, you need more than just speed; you need strategy. Here are some proven practices to help enterprises launch successfully:

- Work with a trusted smart contract development company to automate compliance, onboarding, and user logic.

- Choose modular and flexible tech stacks for top-class blockchain development to save time and cost.

- Plan for regular updates to align with ongoing changes in Europe’s Markets in Crypto-Assets Regulation

- Integrate advanced KYC, AML, and analytics tools right from the start for easier auditing and monitoring.

- Use secure, audited smart contracts for digital wallets, transactions, and stablecoin integrations.

Building a MiCA‑compliant Neo‑Banking solution is not just about meeting legal requirements; it’s about creating a future-ready, regulation-first product that can grow with your customers.

Why Should You Start Building Now?

Delaying your entry into the European Web3 banking space means missing out on key opportunities. Here’s why it’s smart to start building today:

- First-mover advantage: Be among the first to launch a fully MiCA-compliant banking platform. This gives you early access to regulated markets across Europe.

- Regulatory alignment: MiCA is now law. Acting now ensures you’re not playing catch-up when enforcement tightens.

- Brand trust: Early compliance with MiCA builds credibility with both users and regulators. Customers are more likely to trust and onboard with a regulated product.

At SoluLab, a leading white label bank development company in the USA, we’ve helped multiple financial and fintech leaders build MiCA-compliant Neo‑Banking solutions that are secure, scalable, and ready for audits.

Whether you’re an established finance player, a growing DeFi platform, or an eCommerce company exploring embedded finance, a white-label neo bank solution lets you:

- Launch quickly without starting from scratch

- Focus on your core business while we handle the tech

- Expand across borders with full MiCA alignment

Now is the best time to move. The market is growing. Regulation is clear. And with the right partner, you’re just weeks away from launching your own branded Web3 neo bank. Contact us today!

FAQs

1. How does a White Label Neo Banking App work for Web3 businesses?

A White Label Neo Banking App is a ready-made fintech product that businesses can brand and launch quickly. It includes banking features like KYC, wallets, and payments, while staying compliant with MiCA and EU regulations.

2. Why are Neo banking solutions gaining traction in the European Web3 market?

Neo banking solutions combine modern UX with crypto-friendly features. As MiCA comes into force, it helps companies offer digital wallets, stablecoin rails, and DeFi access within a legal framework.

3. What does Europe’s Markets in Crypto-Assets Regulation mean for startups?

The Europe’s Markets in Crypto-Assets Regulation (MiCA) sets clear rules for stablecoins, custody, and crypto services. Startups now need legal clarity before launching, which helps build trust with users and regulators.

4. How do white label crypto banking services save time and cost in launching a Web3 bank?

White label crypto banking services let you skip building from scratch. You get a full-stack bank setup, compliant and ready to deploy in weeks, saving hundreds of development hours and costs.

5. What should I know before building a MiCA-compliant Neo bank?

Before building a MiCA-compliant Neo bank, assess licensing needs, select the right white-label partner, and ensure modular support for features like tokenization, AI agents, and stablecoin onboarding.

6. How does a white-label neo bank solution help launch faster in Europe?

A white-label neo bank solution offers pre-built modules for core banking, custody, compliance, and payments. It helps launch in 10–12 weeks with fewer legal risks and faster market entry.