In a world where most things are now digital, proving who you are online has become more important and more difficult than ever before. The process of Know Your Customer (KYC) helps banks, fintechs, and other businesses verify identities to stop fraud, follow the law, and build trust with their users.

But let’s be honest, traditional KYC methods can be slow, expensive, and even unsafe. That’s where Blockchain KYC comes in. It uses blockchain technology to make identity checks faster, safer, and more transparent. And the timing couldn’t be better.

| According to Statista, The digital identity verification market is projected to reach $18 billion by 2027 and The blockchain market is expected to hit $39.7 billion globally by 2025. |

These numbers show that KYC blockchain isn’t just a trend; it’s the future of identity verification. Businesses around the world are already working with blockchain KYC companies in the USA to improve security, cut costs, and stay compliant with ever-changing regulations.

What Is Blockchain-Based KYC?

Blockchain KYC is a smarter, decentralized way to handle identity checks. Instead of keeping customer data in private systems owned by banks or financial platforms, KYC blockchain uses blockchain technology to store information safely. This data is encrypted, can’t be changed, and is only shared when the user agrees.

The key to this system is the use of blockchain smart contracts. These are automated programs that help businesses quickly and safely check customer identities, follow regulations, and keep a full history of all actions. Everything happens in real-time, making the KYC/AML process faster, more secure, and less expensive.

Why KYC Needs Innovation?

The traditional Know Your Customer (KYC) process is outdated and full of problems that slow down businesses and frustrate users.

Here’s what’s wrong with the old way:

- It can take up to 30 days just to verify one customer.

- Users often have to submit the same documents again and again on different platforms.

- Businesses spend $60–$80 or more per user on KYC checks.

- There’s a high risk of data leaks and identity theft, since personal information is stored in centralized systems.

That’s why companies are now turning to blockchain technology for KYC. With blockchain KYC verification, the entire process becomes faster, cheaper, and safer.

Instead of storing sensitive data in one place, blockchain KYC companies use decentralized networks. This allows users to own and reuse their identity securely across platforms without repeating the process each time.

This isn’t just a small improvement, it’s a complete shift in how we manage identity. With the power of blockchain based KYC, it becomes smarter, safer, and far more user-friendly.

How Does Blockchain Improve KYC Processes?

Using blockchain in KYC/ AML process solves many problems found in traditional identity verification systems. Here’s how:

1. Immutability

Once information is added to the blockchain KYC system, it cannot be changed or deleted. This creates a secure, tamper-proof record of customer data. It helps prevent fraud and makes the data highly reliable for regulators and businesses. Immutability is one of the strongest benefits of using a KYC DLT System.

2. Transparency for Regulators

All customer verifications are recorded in a way that regulators can easily track. If needed, they can quickly review compliance records. This builds trust with authorities and ensures that blockchain KYC systems meet legal standards.

3. User Ownership of Data

In a traditional system, your data is held by multiple institutions. With blockchain based KYC platform, the customer controls who can access their identity documents through private keys and permissions. This improves privacy and reduces data misuse. This is especially useful in sectors like finance and healthcare, where data sensitivity is high.

4. Automation Using Smart Contracts

With blockchain smart contracts, most of the identity checks can be automated. For example, when a user submits documents, smart contracts can instantly validate the data, reducing the need for manual checks. This reduces time, human error, and cost and it also supports scalability, especially for blockchain KYC companies working with thousands of users.

5. Higher Security with Cryptography

Each identity is stored in encrypted form on the blockchain based KYC platform.. This makes it very hard for hackers to steal or alter sensitive data. Compared to traditional KYC databases, KYC blockchain platforms offer much better protection. This is why more blockchain development companies in USA are now focusing on secure identity management solutions.

Key Features of Blockchain KYC Systems

Blockchain KYC systems are changing the way businesses verify identities. Here are the main features that make them powerful, secure, and ready for the future:

1. Reusable Digital Identity

Users don’t need to submit the same documents over and over again. Once verified, a person’s digital identity can be securely shared with other approved institutions. This reduces onboarding time and improves user experience.

2. Permissioned Access

With blockchain technology, data is not stored in one place; it’s decentralized. Users have control over who can view or access their personal information. Only trusted parties, such as a blockchain consulting company in the USA or financial institutions, can access the data through permissioned layers.

3. Fraud Detection with AI Agents

Thanks to AI and blockchain integrations, unusual behavior or suspicious activity can be flagged instantly. These intelligent tools work in real time to detect fraud, enhancing the security of KYC workflows.

4. Global Regulatory Compliance

Whether it’s a bank in Europe or an insurance company in Asia, orthe UAE, blockchain KYC systems are built to follow local and international KYC/AML processes. They help companies stay compliant with cross-border regulations, which is especially helpful for global businesses.

Many of these advanced features are already being used by top blockchain development companies in industries like finance, insurance, and healthcare blockchain solutions.

These systems not only boost efficiency but also lower costs and help companies stay ahead of compliance risks, all while offering better protection for customer data.

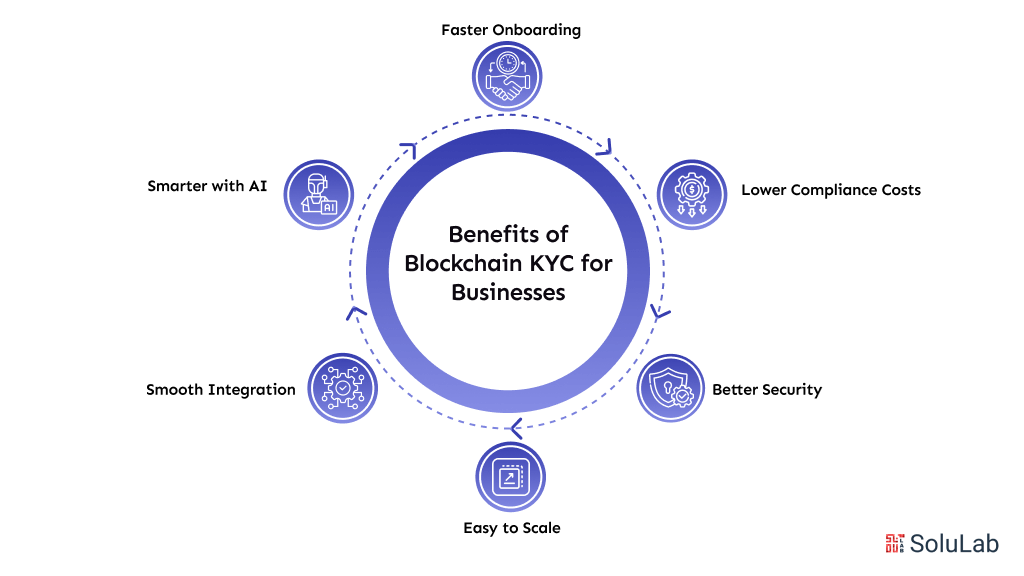

Top Benefits of Blockchain KYC for Businesses

Adopting blockchain KYC systems brings clear, measurable improvements for businesses and users alike:

1. Faster Onboarding

With a decentralized system, verifying customer identity becomes quicker. Companies can reduce user onboarding time by up to 90%, which helps improve customer experience significantly.

2. Lower Compliance Costs

Traditional KYC processes are expensive and time-consuming. Switching to a Blockchain as a Solution for KYC can cut compliance costs by 40–50%, making it ideal for financial services, crypto exchanges, and e-commerce platforms.

3. Better Security

Since data is stored on a decentralized blockchain network, the risk of hacking, leaks, or tampering is greatly reduced. It’s one of the safest ways to manage sensitive customer information today.

4. Easy to Scale

As businesses grow or expand into new regions, blockchain KYC companies USA can easily update and adjust to new regulations or requirements. It’s a future-proof solution that supports global scalability.

5. Smooth Integration Across Platforms

Blockchain smart contract and Layer 1, Layer 2 systems work together seamlessly. This means data can move securely across different platforms without repeating verification steps.

7. Smarter with AI

Adding technologies like AI in finance and AI workflow automation makes the process even more efficient. These systems can predict and automate tasks like fraud detection, reducing manual work and increasing trust.

Top 5 Companies Developing Blockchain KYC Solutions

Here are five top companies leading innovation in blockchain KYC and digital identity verification:

1. SoluLab

SoluLab is a top-rated blockchain development company in the USA known for building powerful solutions that combine KYC blockchain and AI agent technologies. Their products are designed for industries like e-commerce and finance, helping businesses stay compliant while improving customer onboarding.

2. Civic

Civic offers a secure identity verification platform through easy-to-use mobile apps. It uses blockchain-based KYC to give users full control of their data while meeting KYC requirements.

3. SelfKey

SelfKey is a decentralized KYC identity system that allows individuals and businesses to manage, control, and share personal information securely. It’s designed to work across multiple platforms and services.

4. Bloom

Bloom focuses on creating secure and privacy-first solutions for credit scoring and digital identity. It uses AI and blockchain smart contract features to keep user data safe while offering instant verifications.

5. uPort

uPort is an open-source identity platform built on Ethereum. It gives users the ability to manage and verify their identity directly through the blockchain, eliminating the need for centralized systems.

These companies are often supported by expert services like a smart contract development company to help bring these identity products to life.

Key Use Cases Across Industries

1. Banking

Banks are now using blockchain KYC to run real-time identity checks without depending on slow third-party verification. This not only improves speed but also helps with regulatory compliance. With blockchain technology, banks can safely store and share verified customer data across branches and systems.

2. Healthcare

Healthcare blockchain companies are applying blockchain KYC systems to verify patient identities more securely. Medical records can be linked to verified identities using blockchain smart contracts, reducing errors and fraud in patient data.

3. E-commerce

Online platforms are turning to AI-powered chatbots to onboard new sellers and buyers quickly. These automate identity onboarding using blockchain KYC utility. These bots automate identity verification using blockchain KYC companies solutions, helping marketplaces speed up operations while staying compliant.

4. Insurance

Insurance companies now combine AI in finance with KYC blockchain systems to simplify claims processing. Verified customer data can be accessed instantly, reducing paperwork, cutting fraud, and improving user experience. Automation also makes onboarding new policyholders faster and more secure using a KYC with AI and blockchain.

5. Crypto

In the crypto space, those who want to start a cryptocurrency exchange benefit greatly from blockchain based KYC platform. It allows instant verification of users with tamper-proof records. This builds trust, helps meet global compliance standards, and supports safe trading environments.

Token-based identity models are becoming more popular too. These are powered by asset tokenization and supported by secure blockchain based KYC platforms. They offer a new way to manage digital identities across finance, healthcare, e-commerce, and more.

The Future of Blockchain KYC solutions

The future of blockchain KYC looks bright, with powerful innovations already reshaping how identity verification works. Here’s what to expect:

1. Smarter KYC with AI agents

Advanced AI agents and Blockchain will handle customer verification in real time, reducing delays and improving accuracy. They’ll make KYC faster, more secure, and more automated.

2. Cross-Chain Identity Systems

With the rise of multi-chain vs. cross-chain technology, user identities can be verified across multiple blockchain platforms without repeating the KYC DLT systems for each one.

3. Web3 Integration

Web3 development companies are helping bring KYC blockchain systems into the decentralized internet, giving users more privacy and control over their data providing a Web3-ready blockchain KYC utility.

4. Self-Sovereign Identity (SSI)

This means users will fully own their digital identity, without needing a middleman. It’s a key goal of many blockchain KYC companies, and it’s already becoming a reality.

5. Regulatory-Ready Blockchain KYC

As governments adapt, AI development companies and blockchain companies in USA are working together to build KYC solutions that are secure, scalable, and compliant.

With the help of all these, the future of KYC will be decentralized, efficient, and fully digital.

Final Thoughts

Blockchain KYC is no longer just a trend; it’s becoming the future of digital identity. As KYC blockchain solutions grow, businesses now have smarter, safer, and faster ways to verify users while staying compliant with global regulations.

If you’re exploring decentralized KYC solutions or want to build a trusted onboarding process with AI, SoluLab, top blockchain development company, can help. We specialize in developing smart, secure platforms with advanced AI agent integration.

Book a free consultation with us today to explore how we can build your next-gen blockchain-based KYC Platform.

FAQs

1. What is KYC on blockchain?

KYC on blockchain is a way to verify customer identities using a decentralized and secure system. Instead of relying on a central database, data is stored across multiple blockchain nodes, making it more transparent and tamper-proof. It’s faster, safer, and ideal for digital identity verification.

2. Is blockchain KYC secure?

Yes, blockchain KYC is highly secure. It uses cryptographic encryption and smart contracts to protect sensitive user data. Unlike traditional systems, data isn’t stored in one place, which reduces the risk of hacks or leaks.

3. Can AI improve blockchain KYC?

Absolutely. AI Workflow Automation and AI agents can speed up identity checks, flag risks in real-time, and reduce manual errors. Combining AI with KYC blockchain helps businesses meet compliance faster and more efficiently.

4. How does it save money?

Blockchain KYC reduces costs by cutting out middlemen and automating repetitive tasks. With fewer human touchpoints, companies spend less on labor, audits, and third-party services.

5. Which industries are adopting this?

Many sectors now use KYC blockchain, including finance, cryptocurrency exchanges, insurance, healthcare, and e-commerce. It’s especially useful in areas where secure identity verification is critical and regulations are strict.