How to say crypto is growing? As of 2024, $10.6 trillion plus crypto transactions have happened around the globe. People and institutions are shifting their thoughts and financial system. Countries are adopting crypto while managing the security and tax laws; this change is for future growth.

Nations like Switzerland, Singapore, and El Salvador are building legal frameworks, infrastructure for crypto adoption. The largest crypto-using nation U.S. growing its bitcoin reserve. Today, more than 560 million people are using crypto across the world. This is why investors are looking for the best crypto-friendly countries to invest in.

If you are also one of them or someone who wants to explore worldwide opportunities for crypto-friendly solutions, the blog is for you. Let’s begin!

Why Are Countries Becoming Cryptocurrency-Friendly in 2026?

Globally, countries are adopting crypto to enhance decentralization, innovation, and the economy. In recent years, investors have been eyeing the cryptocurrency-friendly countries due to tax incentives and blockchain infrastructure. Not only these, but the regulations’ clarity and security over customer transactions attract the global traders.

The governments are supporting crypto investment firms by giving them freedom and offering long-term operational certainty. Although security rules remain strict, the entrepreneurship over crypto is highly encouraged. This creates jobs, financial inclusion, blockchain growth, and a digital global economy.

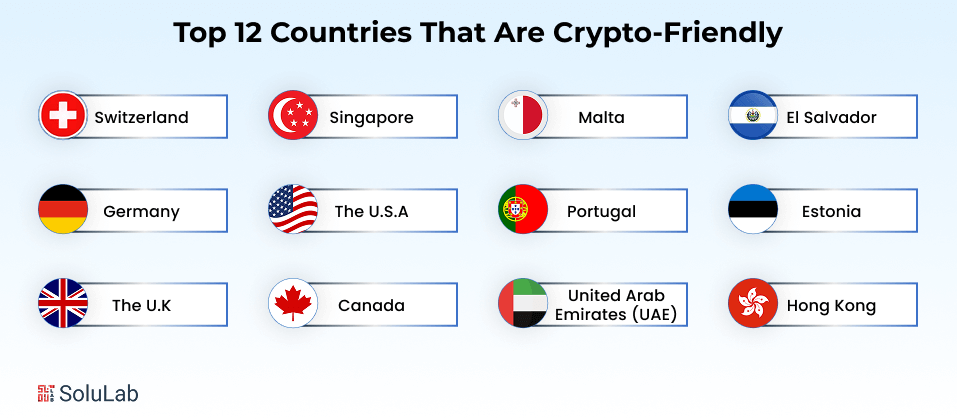

Top 12 Countries That Are Crypto-Friendly in 2026

This article explores twelve standout countries that are crypto-friendly, offering strong foundations for digital assets businesses. Each country has its own strengths and growth strategies.

1. Switzerland

2. Singapore

3. El Salvador

4. United Arab Emirates (UAE)

5. Portugal

6. Estonia

7. Germany

8. Malta

9. The U.S.A

10. The U.K

11. Canada

12. Hong Kong

Switzerland: Europe’s Crypto Valley

Switzerland leads with precision and trust. Its regulations, precise laws, and innovation-centric mindset create secure digital assets for traders. That’s why a good surge in crypto companies in Switzerland is seen lately.

- The Crypto Valley in Zug hosts 1,000+ blockchain startups as of early 2026.

- FINMA provides licensing clarity for ICOs, custody services, and digital exchanges.

- No capital gains tax on personal crypto holdings supports long-term investors.

- Swiss banks have offered integrated crypto trading and wallet services since 2023.

- Switzerland supports Web3 with AI-powered crypto wallet development hubs, attracting crypto investment firms.

Singapore: Asia’s Fintech Beacon

Singapore is known for being one of the crypto-friendly countries with investor protection and secure crypto exchange platforms.

- The Monetary Authority of Singapore (MAS) introduced legal licensing regulations for crypto exchange firms in 2024.

- However, in 2026, MAS made it mandatory for every cryptocurrency dealer.

- Corporate tax remains low at 17%, attracting blockchain startups from across Asia.

- Over 400 fintech firms support flash loan bots and MPC wallet tech in 2026.

- Government-backed sandbox programs help scale AI-integrated crypto wallets.

El Salvador: The Bitcoin Nation

El Salvador is the first country to accept Bitcoin as legal tender. The government has built policies around it to bring stability to the nation’s financial situation.

- Bitcoin has been accepted nationwide since 2021; Chivo Wallet has 4.5 million users in 2026.

- Bitcoin City offers no capital gains, property, or income taxes on crypto earnings.

- Government bonds are backed by Bitcoin, funding infrastructure, and attracting global capital.

- The national blockchain curriculum has been taught in public universities since 2023.

- El Salvador ranks in the top 5 for crypto wallet downloads in Latin America.

United Arab Emirates: The Middle East’s Digital Finance Hub

UAE, particularly Dubai and Abu Dhabi, is leading Web3 adoption through business-friendly policies.

- VARA licenses over 50 crypto firms as of Q1 2026 in Dubai alone.

- DMCC hosts over 600 crypto-related businesses in its free zone.

- Zero income tax and customs duties draw in exchange platforms and wallet developers.

- UAE’s National AI Strategy integrates smart crypto payment systems in public services.

- Blockchain tech is used actively in the property, logistics, and finance sectors.

Portugal: A European Crypto Haven

Portugal’s relaxed tax structure makes it ideal for investors and freelancers dealing with digital assets.

- No VAT or capital gains tax for individual crypto investors (non-professional traders).

- Lisbon’s blockchain community has grown 40% year-over-year by mid-2026.

- Digital nomad visa boosts crypto freelancing and remote blockchain work.

- The government is exploring e-Euro stablecoin pilots through private partnerships.

- Blockchain associations offer education, wallet development support, and investor programs.

Estonia: Digital-First and Blockchain-Ready

Estonia’s e-residency and digital-first approach make it a hotspot for crypto exchange registrations.

- Over 3,500 crypto firms have registered via the e-residency platform since 2020.

- Transparent crypto licenses have been issued under updated AML laws since late 2023.

- Local firms develop AI Copilot tools to assist with crypto compliance.

- National e-wallet ID program supports multicurrency wallet integration.

- Blockchain solutions are used in government e-services, from land records to e-voting.

Germany: Regulated Yet Forward-Looking

Germany offers one of the EU’s most structured yet innovation-friendly crypto ecosystems.

- Long-term crypto holdings (over one year) are exempt from capital gains tax.

- BaFin has licensed banks for digital custody services since 2021.

- Frankfurt is home to multiple blockchain research labs funded by EU grants.

- The national blockchain strategy includes use cases in identity, finance, and logistics.

- Web3 educational programs are now included in 25+ universities across the country.

Malta: The Blockchain Island

Malta’s proactive legal frameworks offer transparency and strong protections for crypto ventures.

- VFAA offers a three-tier licensing system based on service type, including exchanges, custody, and ICOs.

- MDIA supports blockchain platform audits and certifications to reduce fraud.

- Tax exemptions on long-term digital asset holdings promote a holding culture.

- Partnerships with universities help develop talent for crypto wallet security roles.

- Over 100 blockchain and crypto startups registered between 2022 and 2024.

United States of America: Strategic Crypto Reserve

The United States has over 50 million crypto users and a wide investor base. In the US SEC and CFTC take care of market activity while providing clear regulations and guidelines over digital assets.

- States like Texas, New York, and Wyoming are leading in regulatory clarity, crypto reserve, and tax incentives.

- Access to deep venture capital markets boosts the success of crypto exchanges.

- Prominent U.S. crypto exchange companies like Coinbase, Kraken, and Gemini shape global trading trends.

- Advanced AI integration supports smart crypto wallets and arbitrage tools.

- Regulatory frameworks allow ICOs and asset-backed token offerings under SEC oversight.

United Kingdom: Regulatory Framework

Similar to the U.S., the United Kingdom also has the Financial Conduct Authority (FCA) to look after crypto activity. Since 2023, over 250 cryptocurrency firms have registered the digital asset licensing.

- The UK introduced a new rule, from January 1, 2026, crypto companies must collect detailed reports. That should contain the company user’s crypto transaction data.

- The FCA Sandbox enables testing of AI-powered crypto wallets and fintech apps.

- UK initiatives like the Cryptoassets Taskforce focus on long-term blockchain integration.

- Favorable legal conditions allow crypto investment firms to scale securely.

- Firms like eToro, Revolut, and Bitstamp thrive under the UK’s flexible licensing norms.

Canada: Uprising Crypto Country

Canada recently developed the stablecoin reserve and positioned itself as one of the crypto-friendly countries in 2026. Currently, more than 6 crypto ETFs trade publicly while maintaining the regulations and security.

- All crypto exchanges must register with the Canadian Securities Administrators (CSA) and IIROC.

- Crypto transactions are taxed as capital gains, bringing clarity to investors.

- Provinces like British Columbia and Ontario lead in blockchain development and AI wallet innovations.

- Canada’s cold climate and low-cost electricity attract crypto mining firms from across the globe.

- Crypto investment firms actively operate in Toronto and Montreal due to regulatory transparency.

Hong Kong: Asia Crypto Riser

Hong Kong regulates the crypto market with the Securities and Futures Commission (SFC). The cryptocurrency firms’ licensing is handled by Virtual Asset Service Providers (VASPs).

- Hong Kong’s recent stablecoin bill introduced a regulatory framework to enhance the security and growth.

- Low taxation policies and ease of business attract international blockchain startups.

- Strategic location between East and West enhances market access across Asia.

- Initiatives like the FinTech Innovation Hub foster collaboration in crypto R&D.

- Success stories like Bitfinex and ANX International showcase strong operational growth in the region.

How to Choose the Right Crypto-Friendly Country?

Selecting the right base for crypto operations depends on multiple factors. Here’s a quick comparison:

| Factor | Description |

| Regulatory Clarity | Countries like Switzerland, Malta, Singapore, the U.S., and Hong Kong offer well-defined frameworks. |

| Tax Benefits | El Salvador and Portugal offer zero tax on capital gains for individuals. |

| Government Support | UAE, Canada, and Estonia promote crypto through national AI and digital agendas. |

| Business Setup Ease | Estonia allows full remote setup via e-residency. |

| Financial Infrastructure | Germany, Canada, and Switzerland integrate banking with crypto services. |

| Tech Innovation | Singapore, UAE, and Hong Kong push AI-powered wallets and flash bots. |

| Market Potential | El Salvador, the UK, and the UAE offer high adoption rates and institutional interest. |

Final Thoughts

2026 is a turning point for crypto enthusiasts, as many countries are providing tax relaxation and adopting crypto for digital payments. The twelve countries mentioned above are laying a strong foundation for the digital economy through the development of blockchain, AI, and cryptocurrency. However, among the mentioned nations, Switzerland is one of the top crypto countries due to high tax relaxations.

Although the UK and Canada also reserve Bitcoin and include that in employee pensions, they still need a wider strategic plan. Investors must choose the right country to unlock greater profits, opportunities, and potential in the long-term run in the crypto world.

If you are looking to build a long-term Bitcoin strategy, consider consulting with The Bitcoin Way, a trusted Bitcoin consultancy helping individuals and organizations integrate Bitcoin safely and strategically.

SoluLab, the leading cryptocurrency development company, is here to support you. We offer reliable and secure solutions for crypto businesses across the globe, including the U.S. and Europe. If you are interested in crypto-friendly solutions, contact us today!

FAQs

1. What makes a country crypto-friendly in 2026?

Clear regulations, low taxes, strong infrastructure, and open policies make a country crypto-friendly. Governments now support startups and encourage blockchain.

2. Why are crypto investment firms choosing countries like Canada and Singapore?

These countries offer legal clarity, tax relief, and strong digital finance ecosystems. Firms also benefit from innovation grants and infrastructure.

3. Is the U.S. still leading in crypto adoption?

Yes, the U.S. leads in users, innovation, and exchange platforms. States like Wyoming offer tax benefits and regulation clarity.

4. Which countries offer zero tax on crypto gains?

El Salvador and Portugal offer zero tax on individual crypto profits. This attracts investors, traders, and remote blockchain workers.

5. Why is Hong Kong considered a crypto hub in Asia?

Hong Kong combines low tax, business ease, and strong regulation. Strategic location also gives access to global crypto markets.

6. Can anyone start a crypto exchange in these countries?

Yes, with proper licenses and compliance, anyone can. Countries like Estonia and Malta support global founders via digital systems.