The worldwide generative AI market in banking and finance is expected to be worth USD 712.4 million in 2022. It is predicted to expand at a CAGR of 33% from 2023 to 2032, reaching roughly USD 12,337.87 million by 2032. With rapid technological advancement, the financial industry finds itself at the intersection of innovation and necessity. As financial institutions grapple with evolving customer expectations, increasing data complexities, and the perpetual quest for heightened security, the integration of modern technologies becomes not just a choice but a strategic imperative. Among the myriad breakthroughs, one technology stands out as a catalyst for transformative change — Generative Artificial Intelligence (Generative AI). This blog explores the profound impact of Generative AI in banking and finance, unraveling the potential it holds to revolutionize core functions such as fraud detection, customer service, risk management, and algorithmic trading.

In this blog, we aim to discover how Generative AI is reshaping traditional financial paradigms and propelling the banking and finance industry into a new era of efficiency, responsiveness, and unparalleled innovation. As we delve into the applications, challenges, and future possibilities of Generative AI in banking, we will unravel the layers of this transformative technology, shedding light on how it is reshaping the financial sector’s traditional modus operandi.

So, let’s get started!

What Exactly is Generative AI?

Generative Artificial Intelligence (Generative AI) is an advanced subset of artificial intelligence designed to enable machines not just to analyze data but to autonomously generate new content, responses, or outputs. Unlike traditional AI models that are task-specific and follow pre-programmed rules, generative models, often built upon deep neural networks, have the ability to produce creative and contextually relevant outputs. In the realm of finance, Generative AI utilizes complex algorithms to understand patterns, generate insights, and create content, offering a dynamic approach to problem-solving and decision-making.

1. Distinction Between Generative and Traditional AI in Banking

In the context of banking and finance, understanding the distinctions between Generative AI and traditional AI is crucial for appreciating the transformative impact of the former. Traditional AI, characterized by rule-based systems and structured data processing, excels in tasks with clear guidelines and well-defined outcomes. Generative AI, on the other hand, introduces an element of autonomy and creativity, allowing systems to generate novel solutions and responses based on learned patterns. This section will provide a detailed exploration of how Generative AI in finance differs from traditional AI approaches, emphasizing its role in handling unstructured data, fostering innovation in customer interactions, and redefining the limits of data-driven decision-making in the financial sector.

2. The Influence of Generative AI in Financial Services

The integration of Generative AI into the fabric of financial services signifies a seismic shift in the industry’s landscape, offering a spectrum of transformative impacts. At its core, Generative AI possesses the capacity to redefine traditional operational paradigms, ushering in a new era marked by heightened efficiency, superior decision-making processes, elevated compliance standards, enriched customer service experiences, and a culture of continuous innovation. In the realm of financial services, where data is a cornerstone, technology investments are paramount, customer interactions are pivotal, regulatory frameworks are stringent, and a substantial white-collar workforce drives operations, Generative AI emerges as a potent force poised to optimize and propel the industry forward.

This technology’s profound potential is particularly pronounced in the financial sector, where the sheer volume and complexity of data demand sophisticated analytical tools. Generative AI, with its ability to sift through vast datasets, identify patterns, and generate actionable insights, stands as a catalyst for productivity gains. Its integration into decision-making processes enhances precision and agility, empowering financial institutions to navigate complexities with unparalleled finesse. Moreover, in an industry where regulatory adherence is non-negotiable, Generative AI’s capacity to streamline compliance procedures becomes a strategic advantage, ensuring that financial services providers can not only meet but exceed the rigorous standards set by regulatory bodies. As financial institutions embrace this transformative technology, they embark on a journey that transcends mere automation, unlocking a realm of possibilities that promise to reshape the very essence of financial services.

Applications of Generative AI in Finance

AI and RPA in banking have a wide range of applications, changing formerly time-consuming operations. These include revolutionizing customer service with AI-powered Chatbots like ChatGPT, using AI for better fraud detection, using machine learning to anticipate financial trends, and personalizing banking services to individual tastes.

According to an Accenture study, the banking industry will experience 30% increases in staff productivity from front-office to back-office banking activities by 2028. Some examples of application of Generative AI in banking and finance include:

1. Fraud Detection

The banking sector relies significantly on AI to combat fraud, especially as the global cost of cybercrime surged to $6 trillion in 2021 and is projected to escalate to $10.5 trillion by 2025. Given the escalating threat landscape, data security has emerged as a paramount concern for financial institutions. Traditionally, banks have maintained sizable fraud detection departments, incurring substantial operational costs that may not always yield optimal results. However, Generative AI introduces a transformative approach by scrutinizing transaction details like location, device, and operating system, identifying any unusual patterns or deviations from the norm. This automated process mitigates the necessity for manual transaction scrutiny, saving time and minimizing the potential for errors.

Furthermore, Generative AI’s capability to continuously analyze synthetic data allows it to adapt and enhance its detection algorithms in response to evolving fraud schemes. This proactive stance empowers banks to predict and thwart fraudulent activities before they materialize. Additionally, Generative AI can be leveraged to implement additional verification measures for user account access. For instance, an AI chatbot can prompt users to respond to security questions or undergo multi-factor authentication (MFA), reinforcing overall security measures. As the banking industry grapples with the escalating challenges of fraud, Generative AI emerges as a dynamic solution, revolutionizing traditional fraud detection methodologies.

2. Risk Management

Banks recognize the critical importance of a robust risk management plan to maintain an optimal risk exposure level and safeguard profitability. Inadequate handling of liquidity, credit, operational, and other risks can result in significant financial losses. The Integration of Generative AI emerges as a potential solution, complementing traditional risk mitigation software systems. By leveraging historical data, Generative AI has the capability to proactively detect and recognize potential financial risks, providing early alerts on fraud and empowering banks to adapt and prevent or minimize potential losses.

3. Credit Analysis

Generative AI presents banking agents with a potent tool to revolutionize credit analysis, surpassing conventional methods. Through a comprehensive examination of customer credit scores and financial history, it assesses creditworthiness. Additionally, Generative AI scrutinizes loan applications by analyzing data from diverse sources, including credit reports, income statements, tax returns, and other financial information. The technology goes beyond static assessments, examining borrower behavior, bank statements, and account activity to identify shifts in financial circumstances that may indicate potential default or delinquency risks. Particularly notable is its impact on retail and small-ticket-size loans, where Generative AI facilitates real-time decision-making, streamlining processes and significantly reducing the time and costs associated with traditional methods.

4. Financial Projections

Training AI on historical financial data provides banks with two important benefits: financial forecasting and synthetic data production.

Generative AI can recognize patterns and connections in data, allowing for simulations based on hypothetical scenarios. This skill enables banks to examine a range of potential outcomes and make educated decisions as a result.

Read Blog: AI in Finance: The Future of Smart Investments and Risk Management

5. Data Security

The use of synthetic data appears to be a viable answer to the difficulties of data privacy in the banking business. When it is not possible to share consumer data owing to privacy concerns and data protection rules, synthetic data might be a feasible option for developing shareable datasets. Furthermore, synthetic customer data is extremely useful in training machine learning models to assist banks in establishing a client’s eligibility for credit or mortgage loans as well as calculating the proper loan amount.

6. Underwriting

Loan underwriters can benefit from generative AI in their decision-making process. The system may deliver individualized risk evaluations and tailored suggestions by evaluating consumer data. Notably, generative AI may automate key elements of credit memoranda, such as the executive summary, firm description, and sector analysis, hence reducing underwriting time.

7. Lead Generation & Marketing

Banks must spend on focused marketing to make themselves stand out in a competitive marketplace and attract new clients. This approach, however, frequently entails considerable consumer study and creative efforts, which may be both costly and time-consuming.

Fortunately, Artificial Intelligence can help by speeding up marketing efforts. This is accomplished by assessing customer preferences and online activity, categorizing leads into unique groups, and allowing the production of specific advertising initiatives for each segment.

Generative AI Use Cases in Banking and Finance

Generative AI has ushered in a new era of possibilities for the banking industry, transforming the way financial institutions operate and serve their customers. Below are detailed use cases that highlight the diverse generative AI use cases in finance and banking:

1. Algorithmic Trading: Generative AI is increasingly integrated into algorithmic trading strategies, providing financial institutions with a competitive edge in the dynamic and fast-paced world of financial markets. By analyzing vast datasets and identifying subtle market patterns, Generative AI optimizes trading algorithms for better performance. This application empowers banks to execute trades with precision, capitalize on market opportunities, and adapt to changing conditions in real time.

2. Customer Service and Engagement: Generative AI transforms customer service in banking by enabling the development of intelligent chatbots and virtual assistants. These AI-driven interfaces use natural language processing to interact conversationally with customers. They can handle routine inquiries, guide users through transactions, and even provide personalized financial advice. The result is an enriched customer experience, improved satisfaction levels, and the ability for financial institutions to scale their customer service operations effectively.

3. Personalized Financial Planning: Generative AI use cases leverage customer data to offer personalized financial planning services. By analyzing individual spending patterns, investment behaviors, and life events, Generative AI algorithms can generate tailored financial plans for customers. This fosters a more engaging and customized relationship between the bank and its clients, ultimately leading to improved financial well-being for customers.

4. Anti-Money Laundering (AML) Compliance: Generative AI contributes significantly to AML efforts by enhancing the detection of suspicious activities and transactions. Its continuous learning and pattern recognition capabilities allow it to identify complex money laundering schemes that may evade traditional rule-based systems. This application ensures a more robust defense against financial crimes, aligning with the industry’s commitment to maintaining the integrity of the financial system.

5. Loan Decision Automation: For retail and small-ticket-size loans, Generative AI enables real-time loan decisions. By analyzing a multitude of factors, including credit scores, financial history, and real-time data, Generative AI streamlines the loan approval process. This not only enhances efficiency but also reduces the time and costs typically associated with traditional loan approval methods.

6. Regulatory Compliance and Reporting: Generative AI assists banks in navigating the complex landscape of regulatory compliance. It can analyze and interpret regulatory changes, ensuring that the bank’s operations adhere to the latest standards. By automating compliance processes, Generative AI not only enhances efficiency but also reduces the risk of non-compliance and associated penalties. This is particularly crucial in an industry where regulatory adherence is non-negotiable.

7. Chatbot-based Account Access Security: Generative AI enhances account access security by enabling the deployment of intelligent chatbots. These chatbots can prompt users for additional verification measures, such as answering security questions or undergoing multi-factor authentication (MFA). This adds an extra layer of security to user accounts, mitigating the risk of unauthorized access and fraudulent activities.

8. Automated Financial Reporting: Generative AI streamlines the process of financial reporting by automating the generation of reports. It can analyze vast sets of financial data, identify key insights, and present them in a comprehensible format. This not only saves time but also reduces the likelihood of errors associated with manual reporting processes.

9. Dynamic Pricing Strategies: In the lending and financial product offerings, Generative AI enables banks to implement dynamic pricing strategies. By analyzing customer behavior, market trends, and other relevant factors, Generative AI can optimize pricing structures in real time. This ensures that the bank remains competitive in the market while maximizing revenue and profitability.

10. Enhanced Cybersecurity Measures: Generative AI contributes to cybersecurity by identifying and addressing vulnerabilities in a bank’s digital infrastructure. It can analyze patterns of cyber threats, predict potential security breaches, and recommend proactive measures to fortify the bank’s cybersecurity defenses. This is crucial in an era where cyber threats pose a constant risk to financial institutions and their customers.

Related: Generative AI in Cybersecurity

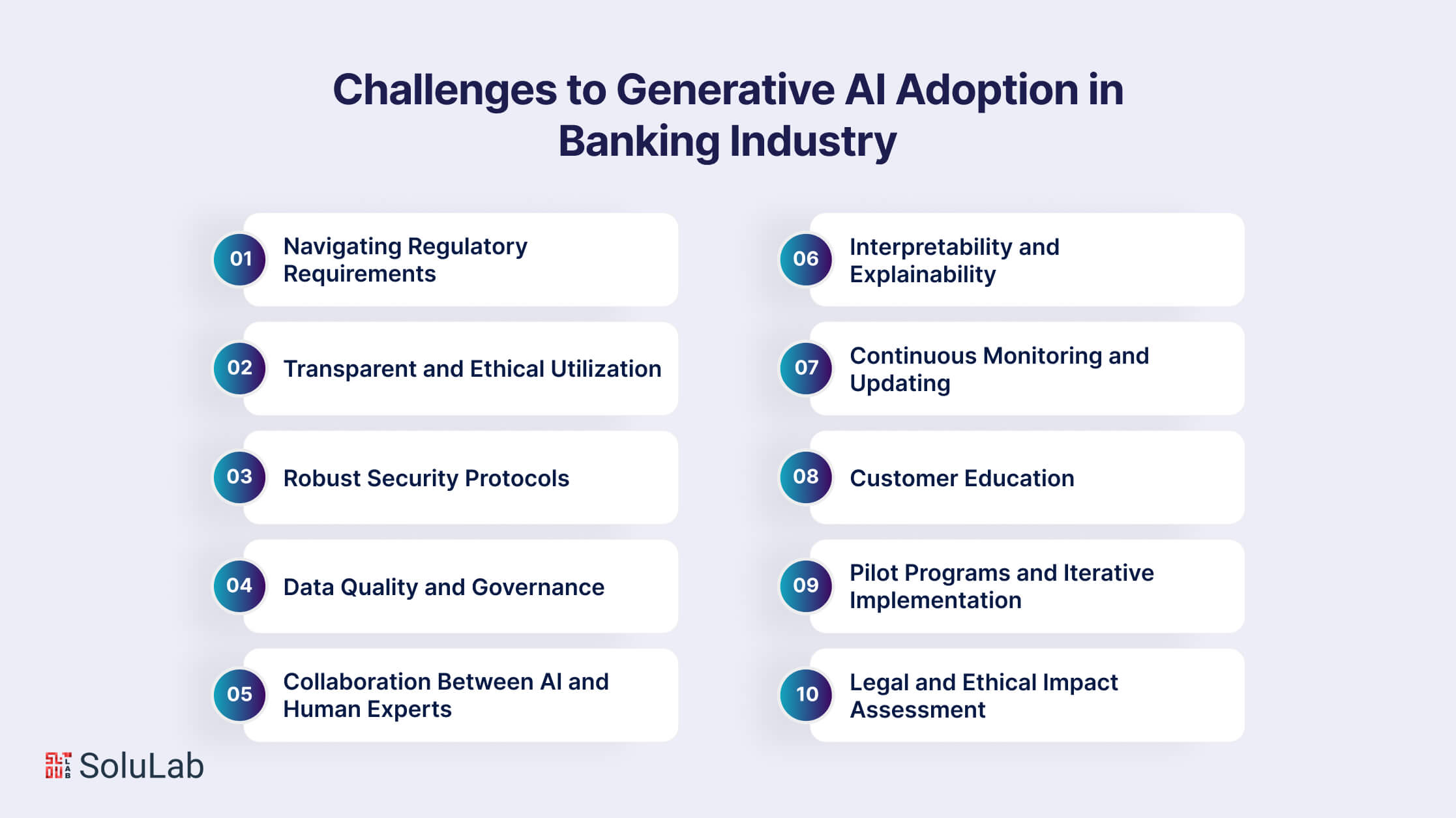

Challenges to Generative AI Adoption in the Banking Industry

The integration of Generative AI in the banking sector confronts several challenges that demand careful consideration for successful implementation.

1. Navigating Regulatory Requirements

To adhere to regulations, a comprehensive understanding of financial and data protection laws is imperative. Awareness of how these regulations impact the use of Artificial Intelligence (AI) in banking, particularly concerning customer data privacy and security, is essential.

2. Transparent and Ethical Utilization

Ensuring transparency with customers regarding the integration of AI in banking operations is critical. Organizations must communicate the purpose and intricacies of AI utilization, detailing the types of data collected and elucidating measures to safeguard this information. Maintaining ethical standards and removing biases in decision-making systems are critical components of responsible AI applications.

3. Robust Security Protocols

The implementation of strong cybersecurity measures is crucial to safeguard AI systems and the sensitive data they handle.To enhance defenses against possible attacks, regular upgrades to security processes, frequent vulnerability assessments, and adherence to industry standards are required.

4. Data Quality and Governance

Providing high-quality data inputs for AI algorithms is foundational to their efficacy. Building strong data governance frameworks becomes critical for ensuring data integrity, correctness, and privacy. Regular audits and dataset cleansing are critical techniques for improving the performance and dependability of Generative AI models.

5. Collaboration Between AI and Human Experts

Interaction between AI systems and human specialists is critical to achieving harmonic integration. AI should be perceived as a tool to augment human capabilities rather than a replacement. Human oversight is still required for complex decision-making processes, interpreting results, and dealing with unexpected obstacles.

6. Interpretability and Explainability

The selection of AI models offering interpretability and explainability is crucial. Transparent decision-making procedures become critical, particularly when regulatory compliance or consumer trust requires clarification on specific judgments made by AI systems.

7. Continuous Monitoring and Updating

It is critical to provide systems for continuous monitoring and upgrading of AI models. Because financial landscapes and client behaviors are dynamic, artificial intelligence must adjust in real time. Frequent updates, algorithm training, and staying up to current on AI technology breakthroughs are all necessary procedures.

8. Customer Education

Proactively educating customers about the benefits and limitations of AI in banking is crucial. Providing detailed information on how AI improves services, guarantees security, and offers tailored experiences helps to create consumer trust. Addressing customers’ concerns or misconceptions about AI is crucial for fostering trust.

9. Pilot Programs and Iterative Implementation

Commencing with pilot programs allows for meticulous testing of AI applications in controlled environments. Before scaling out AI projects across the whole financial ecosystem, gather feedback, identify areas for enhancement, and iteratively refine the deployment plan.

10. Legal and Ethical Impact Assessment

To analyze the legal and ethical consequences of employing AI in banking, a complete impact assessment is required. Assessing possible risks, recognizing biases, and predicting unexpected outcomes are all part of this process. A responsible AI deployment plan includes developing mitigation methods and assuring compliance with the organization’s ethical standards.

Future Trends and Opportunities in the Banking and Finance Industry

As we look ahead to the future of Generative AI, the industry stands on the brink of a technological renaissance. The convergence of innovative trends, potential applications, and collaborative opportunities creates a dynamic ecosystem ripe for exploration and advancement. Now, let’s delve into specific points that illuminate the roadmap for this transformative journey in finance.

1. Emerging Trends in Generative AI for Banking and Finance

The future landscape of Generative AI in banking and finance is poised to witness several transformative trends. One notable trend is the increasing emphasis on federated learning, enabling financial institutions to train machine learning models collaboratively without sharing sensitive data. This approach aligns with the industry’s commitment to privacy and security. Additionally, the integration of reinforcement learning in Generative AI models is gaining traction, allowing systems to learn from dynamic environments and adapt in real time. Explainable AI is another emerging trend, ensuring transparency in decision-making processes and addressing the interpretability concerns associated with complex AI algorithms. As financial institutions continue to explore these trends, the convergence of Generative AI with blockchain technology for enhanced security and decentralized finance (DeFi) applications is also anticipated.

2. Potential New Applications on the Horizon

The horizon for Generative AI applications in banking and finance is expansive, with potential innovations set to redefine industry standards. Predictive banking analytics is one such application, where Generative AI will play a crucial role in forecasting market trends, customer behaviors, and economic indicators, empowering financial institutions to make proactive and strategic decisions. Quantum computing, with its ability to process vast amounts of data at unprecedented speeds, holds the potential to revolutionize risk management and optimization tasks in banking. Moreover, Generative AI may find applications in the creation of decentralized autonomous organizations (DAOs) for community-driven financial initiatives. Exploring the integration of Generative AI with augmented reality (AR) and virtual reality (VR) could also pave the way for immersive and personalized financial experiences.

3. Opportunities for Collaboration and Innovation in the Industry

The evolving landscape of Generative AI in banking presents numerous opportunities for collaboration and innovation within the industry. Financial institutions can collaborate with FinTech startups specializing in Generative AI solutions to co-create tailored applications addressing specific industry challenges. Partnerships with academic institutions and research centers can foster innovation by leveraging the latest advancements in Generative AI research. Moreover, cross-industry collaborations, such as teaming up with technology firms specializing in cybersecurity, can enhance the security infrastructure surrounding Generative AI applications. Collaborative initiatives for creating industry-wide standards and best practices will be crucial for ensuring the responsible and ethical use of Generative AI in the financial sector. By embracing these collaborative opportunities, the banking industry can harness the full potential of Generative AI, driving innovation and shaping the future of finance.

Final Words

In conclusion, the integration of Generative AI in the banking industry holds immense promise, revolutionizing operations and customer experiences. While the potential benefits are substantial, it is crucial for financial institutions to navigate and address the inherent challenges diligently. From ensuring regulatory compliance and transparent AI utilization to robust security measures, data governance, and ongoing collaboration between AI and human expertise, the path to successful Generative AI adoption demands a strategic and ethical approach. Continuous monitoring, customer education, and iterative implementation further underscore the dynamic nature of this transformative technology, emphasizing the need for adaptability and responsible deployment.

As financial institutions embark on the journey of incorporating Generative AI, SoluLab- a Generative AI development company stands as a strategic partner in navigating this technological frontier. With expertise in AI solutions, SoluLab offers tailored approaches to Generative AI adoption, addressing challenges and maximizing the potential for innovation. From pilot programs to full-scale implementations, SoluLab provides comprehensive support, ensuring that financial institutions harness the power of Generative AI effectively. For seamless integration into the future of banking, contact us today to learn how SoluLab’s Generative AI development services can elevate your institution’s capabilities.

FAQs

1. How does Generative AI enhance fraud detection in banking?

Generative AI enhances fraud detection by analyzing transaction details such as location, device, and operating system, flagging unusual patterns. Its continuous learning capability allows it to adapt to new fraud schemes, providing early alerts to help banks anticipate and thwart fraudulent activities before they occur.

2. What role do Generative AI developers play in credit analysis and risk management?

Generative AI developers revolutionize credit analysis by assessing creditworthiness through an in-depth examination of customer credit scores and financial history. It scrutinizes loan applications, analyzes data from various sources, and considers borrower behavior, enabling more accurate risk assessments and proactive risk management strategies.

3. How can Generative AI contribute to customer service in banking?

Generative AI transforms customer service by enabling the development of intelligent chatbots and virtual assistants. These AI-driven interfaces use natural language processing to interact conversationally, handling routine inquiries, guiding users through transactions, and providing personalized financial advice, thereby enriching the overall customer experience.

4. In what ways can Generative AI be applied to algorithmic trading in financial markets?

Generative AI is increasingly integrated into algorithmic trading strategies, offering a competitive edge in financial markets. By analyzing vast datasets and identifying market patterns, Generative AI optimizes trading algorithms for better performance, allowing financial institutions to execute trades with precision, capitalize on market opportunities, and adapt to changing conditions in real-time.

5. What challenges does the adoption of Generative AI in banking face?

Challenges in Generative AI adoption include navigating regulatory requirements, maintaining transparency and ethical use, implementing robust security measures, ensuring data quality and governance, fostering collaboration between Generative AI and human experts, achieving interpretability, continuous monitoring, customer education, pilot programs, and conducting legal and ethical impact assessments. Overcoming these challenges is crucial for the successful and responsible integration of Generative AI in banking operations.