As the crypto market continues to grow, so does the number of tokens entering the space, many with questionable purpose or backing. Some skyrocket overnight, only to vanish just as quickly. For anyone looking to invest wisely, separating noise from substance is more important than ever.

The cryptocurrency space is filled with opportunities, but it’s also full of distractions. Among the most discussed yet misunderstood terms in crypto investing is “shitcoin.” Whether you’re just starting or have dabbled in trading before, understanding the difference between legitimate and speculative tokens is essential.

In this blog, we’ll break down what shitcoins really are, how they differ from real tokens, how people create and trade them, and what you should watch out for as a responsible investor.

What Are Shitcoins?

In cryptocurrency, the term “shitcoin” refers to tokens that have little or no real value, purpose, or development activity. These coins often emerge in large numbers and usually fail to offer any meaningful utility. The term isn’t an official classification but a widely used label for tokens considered to be low quality.

Most shitcoins are created quickly and with minimal effort. Developers may launch them based on internet memes, popular trends, or even as parodies of existing cryptocurrencies. In many cases, these coins are designed to attract attention and speculative investment rather than to solve a genuine problem.

Signs of a Shitcoin

Several characteristics of a shitcoin include:

- No clear use case or roadmap

- Anonymous or unverified development team

- Little to no community engagement

- Unusual token distribution favoring a few wallets

- Extremely low liquidity and trading volume

Recognizing these red flags can help you avoid risky investments.

What Makes a Token Real or Valuable?

Legitimate tokens are tied to practical use cases. They might power decentralized applications (dApps), enable payments within a blockchain ecosystem, or represent assets in financial systems. Their value is linked to their function.

Transparent, well-known development teams lend credibility to a project. Legitimate tokens are usually supported by developers who actively share updates, participate in the community, and maintain a public presence.

Real tokens are backed by active communities. Developers, users, and investors all contribute to the token’s ecosystem, making it stronger over time. This community involvement often indicates long-term viability.

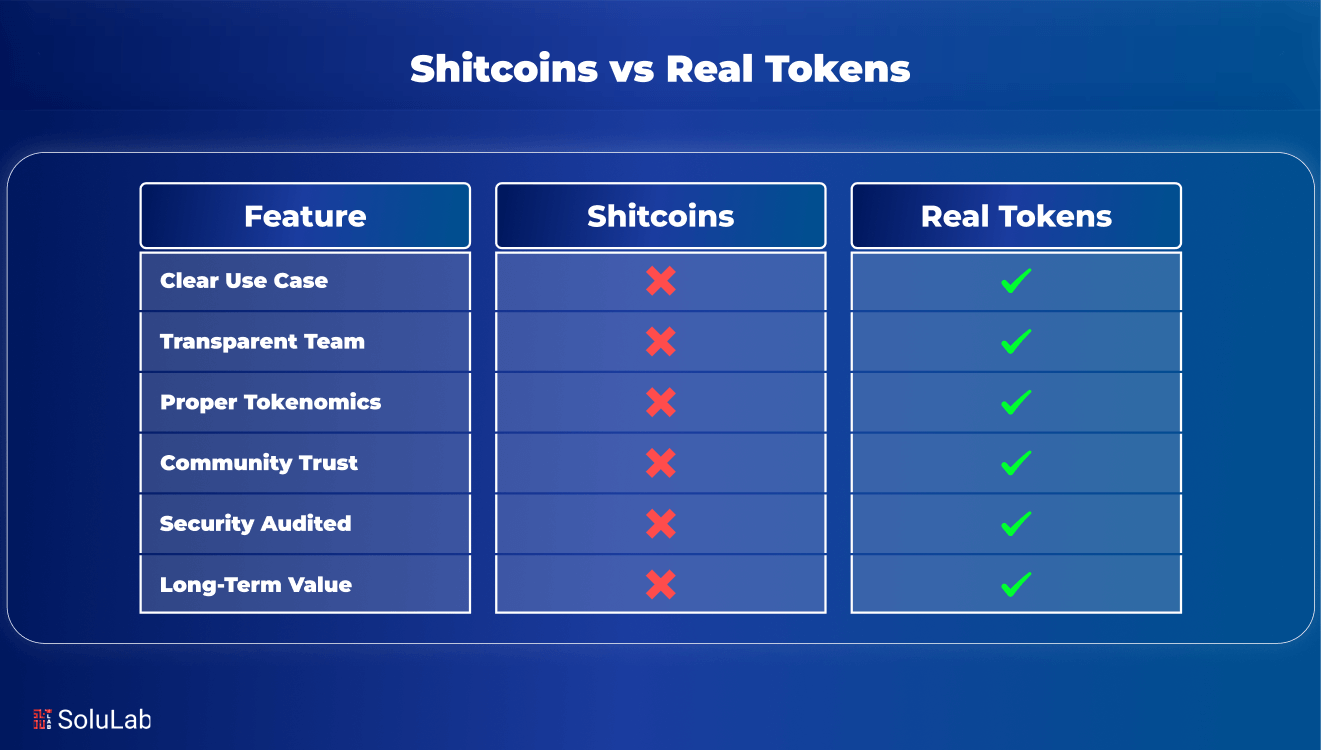

Shitcoins vs Real Tokens: Key Differences

| Aspect | Shitcoins | Real Tokens |

| Purpose & Utility | Often created for hype or speculation | Built to solve real problems or power actual ecosystems |

| Team Transparency | Anonymous or unverified developers | Public, experienced teams with visible track records |

| Community Support | Hype-driven with little long-term engagement | Active developer support, engaged users, ongoing contributions |

| Tokenomics | Poorly structured, often unfairly distributed | Clear models with balanced supply and utility |

| Value Over Time | Prone to short-term spikes and crashes | Steady growth tied to real adoption |

| Security & Trust | High risk of scams and abandonment | Often audited and aligned with best practices |

Why Do People Still Buy Shitcoins?

Despite their questionable value, shitcoins continue to draw in large numbers of investors, especially those new to the crypto space. At first glance, they seem like low-risk, high-reward opportunities. In reality, the appeal of shitcoins is rooted in fast-moving trends, emotional decision-making, and a lack of proper research. Understanding why people buy them is the first step in avoiding the common traps they present.

-

Chasing Big Returns

Shitcoins often promise high returns with very low entry costs. This makes them appealing to those looking to turn a small amount of money into large profits, even if the chance of success is very low.

-

Hype on Social Media

Social platforms amplify buzz around new tokens. Influencers and anonymous promoters create urgency and excitement, encouraging quick investments before people take time to research.

-

Cheap Price Tricks

A token priced at fractions of a cent may seem like a bargain. But price alone doesn’t equal value without solid fundamentals; these tokens are unlikely to gain lasting traction.

-

Risks of Buying Shitcoins

While the upside may seem tempting, shitcoins carry real and often underestimated risks. Many of these risks can lead to financial loss or involvement in questionable projects.

-

Scams and Rug Pulls

Some tokens are launched purely to collect investor funds and disappear. These scams, known as rug pulls, leave investors with worthless coins and no way to recover their money.

-

Hard to Sell Later

Even if the price rises, you might struggle to sell your tokens due to low trading volume. Without active buyers or liquidity, you’re effectively locked into your position.

-

Legal Trouble

Many shitcoins are not compliant with local or international regulations. Investing in them may expose you to legal scrutiny or future bans as governments tighten crypto oversight.

Read Also: Tokenizing TradFi: Real-World Assets & Smart Bonds

How to Check If a Token Is Worth Buying?

With thousands of cryptocurrencies in the market, it can be difficult to know which tokens are actually worth your time and money. Before investing in any project, it’s important to assess its fundamentals. Reliable tokens are usually backed by solid ideas, transparent teams, and fair tokenomics. This section outlines a few practical steps to help you evaluate whether a token is a potential opportunity or a red flag.

Start with the whitepaper or official documentation. This should clearly explain what the token is for, how it works, and how it plans to grow. A good whitepaper will outline the project’s use case, technical architecture, tokenomics (supply, distribution, utility), and roadmap. If these details are missing or vague, that’s a reason to be cautious.

-

Google the Team

A trustworthy project is usually built by a team with a visible, verifiable presence. Look up the founders and developers on platforms like LinkedIn, GitHub, or Twitter. Check whether they’ve worked on other blockchain projects, if they engage with the community, and if they’ve been publicly active since the token launched. A fully anonymous team isn’t always a deal-breaker, but transparency builds confidence.

-

Check How Tokens Are Shared

Examine the token distribution. Are a small number of wallets holding the majority of tokens? This could lead to price manipulation if large holders decide to sell all at once. You can usually find this information on blockchain explorers like Etherscan or BscScan. Ideally, tokens should be distributed across a broad base of wallets with clear allocations for development, marketing, and community growth.

How Shitcoins Affect the Growth of the Crypto Industry?

While shitcoins might seem harmless or even humorous, they can have lasting effects on the broader cryptocurrency ecosystem. Their presence can erode investor trust, slow down legitimate innovation, and attract attention for all the wrong reasons. Understanding their broader impact helps explain why industry leaders, regulators, and long-term investors often warn against these types of projects.

-

Trust Issues

The more scammy or non-serious tokens flood the market, the more difficult it becomes for new investors to separate quality projects from risky ones. This leads to skepticism and fear, especially among people new to the space. As a result, even legitimate projects sometimes struggle to raise funds or gain adoption simply because people have been burned before.

-

Shifts Focus

When large amounts of capital and attention are directed toward short-term trends or joke tokens, fewer resources go toward building blockchain solutions that solve real problems. Developers may choose to launch quick-profit tokens instead of long-term platforms, which slows the pace of genuine progress in areas like decentralized finance, healthcare, or supply chain.

-

Quick Profits

Shitcoins tend to appeal to a mindset focused on speculation rather than innovation. This encourages a culture of gambling over investing, where people chase the next pump instead of supporting projects with real-world impact. As a result, the industry risks becoming known more for volatility than for value.

How to Build a Safer Crypto Portfolio?

Investing in cryptocurrency can be both exciting and rewarding, but it comes with risks, especially if your portfolio is made up of projects without strong fundamentals. A safer, more stable approach focuses on research, diversification, and continuous learning. Whether you’re just starting or refining your strategy, these tips can help you build a portfolio that aligns with your financial goals.

1. Choose Real Projects

Look for tokens that are tied to real products, services, or blockchain ecosystems. These are often found in sectors like decentralized finance (DeFi), NFTs, gaming, and enterprise blockchain. A good starting point is to ask: What problem does this token solve? If the answer is vague or purely speculative, consider moving on.

2. Spread Your Money Wisely

Never put all your funds into a single project, especially if it’s new or untested. Spreading your investments across different asset types (e.g., established cryptocurrencies like Bitcoin or Ethereum, plus a few promising altcoins) can reduce your exposure to sudden losses. Diversification helps absorb market shocks more effectively.

3. Keep Learning

The crypto world is constantly evolving. New regulations, technologies, and use cases appear all the time. Following credible sources, joining online communities, and staying up to date with market trends can help you adapt your strategy over time. Informed investors are less likely to fall for hype and more likely to make smart, long-term decisions.

Final Thoughts

Shitcoins may grab attention, but they rarely hold long-term value. Understanding what defines a “real” token versus a speculative one is essential for anyone serious about cryptocurrency investing. By learning how to spot red flags, verifying token utility, and researching project teams, you can avoid many common pitfalls. Remember, not all that glitters in crypto is gold, and not every coin is built to last.

At SoluLab, a leading cryptocurrency development company, we specialize in developing high-quality blockchain solutions and custom token ecosystems. If you’re looking to explore token creation the right way with strong tokenomics, full compliance, and scalable architecture, we can help you build more than just a coin. We help build lasting value.

Ready to create a real token with real impact? Reach out to SoluLab today and let’s turn your blockchain idea into a solid, sustainable product.

FAQs

1. What is a shitcoin in cryptocurrency?

A shitcoin is a digital token with little to no utility, often created without a clear use case or long-term purpose.

2. How can I tell if a crypto token is legit or not?

Look for a real-world function, transparent team, community support, and a well-structured token distribution.

3. Why do people still invest in shitcoins?

Many are drawn to the possibility of quick returns, especially during hype cycles or viral online promotion.

4. What are the risks of trading shitcoins?

They include scams, rug pulls, lack of liquidity, and potential legal or regulatory complications.

5. Can shitcoins ever become valuable?

Rarely. Most do not have the fundamentals needed for long-term value or growth, despite short-term buzz.